What I Look At In An Overseas Property Investment: Reviewing 3 One Bedroom Properties In New York

June 15, 2022

Investing in overseas property can be a tricky thing. But one thing to err on the safer side is to look out for gateway cities. Or rather, places that are on their way to becoming gateway cities – to capitalise on the upside in the future.

The other safe way is to invest in global cities. These are places that are internationally recognised, where hordes of foreign investors pour money in as they are the most well-known, and well-connected (Singapore happens to be one of them as well).

And so in this piece, I’ll be looking at a city overseas and picking 3 properties there to review. Think of it as an introductory series to whet your appetite for overseas investment. It’s not going to be too heavy like some of our Singapore reviews, but instead, give you a better idea of what to look out for, and how to approach doing your due diligence.

Let’s start with New York City.

It is well known for its iconic skyline, colossal skyscrapers and crazy real estate prices. It has something special for everyone – Broadway for theatre, Wall Street for finance, Chelsea for Arts, Fifth Avenue (aka Millionaire’s Row) for shopping and Madison Square for sports.

Save for the sometimes peculiar people you might meet there, I have to admit that its architecture, lifestyle, food and the number of billionaires (107 of them, you never know when you’re gonna bump into one on your next trip to the supermarket) makes it a really cool place to call home.

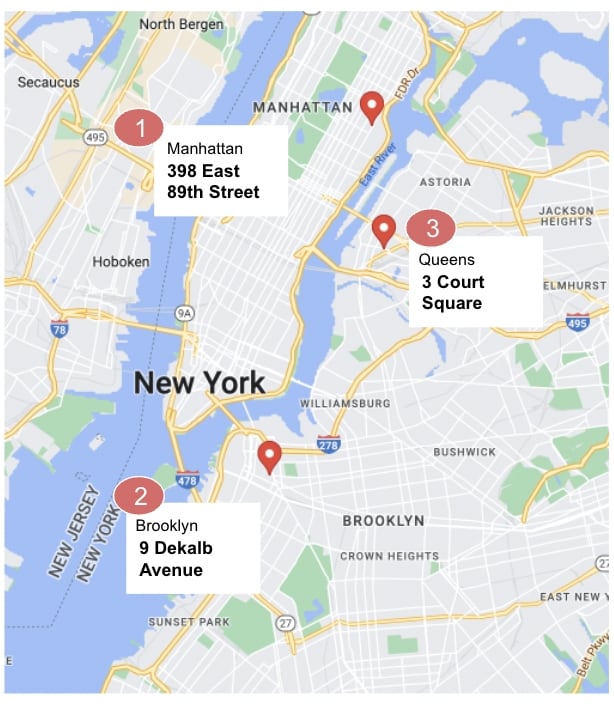

The city is divided into five boroughs – Manhattan, The Bronx, Staten Island, Brooklyn and of course Spider-Man’s home – Queens. Each of them has its own characteristics and flavour.

I might also add that it is one of the densest cities in the country, with about 38,000 people per square kilometre. In comparison Singapore’s density is 8,358 people per square kilometre, so you can just imagine how much busier it can get. I guess that explains why the skyscrapers have to go up so high and why it’s so noisy there. If you have been complaining about how dense Singapore is, New York would clearly not be for you.

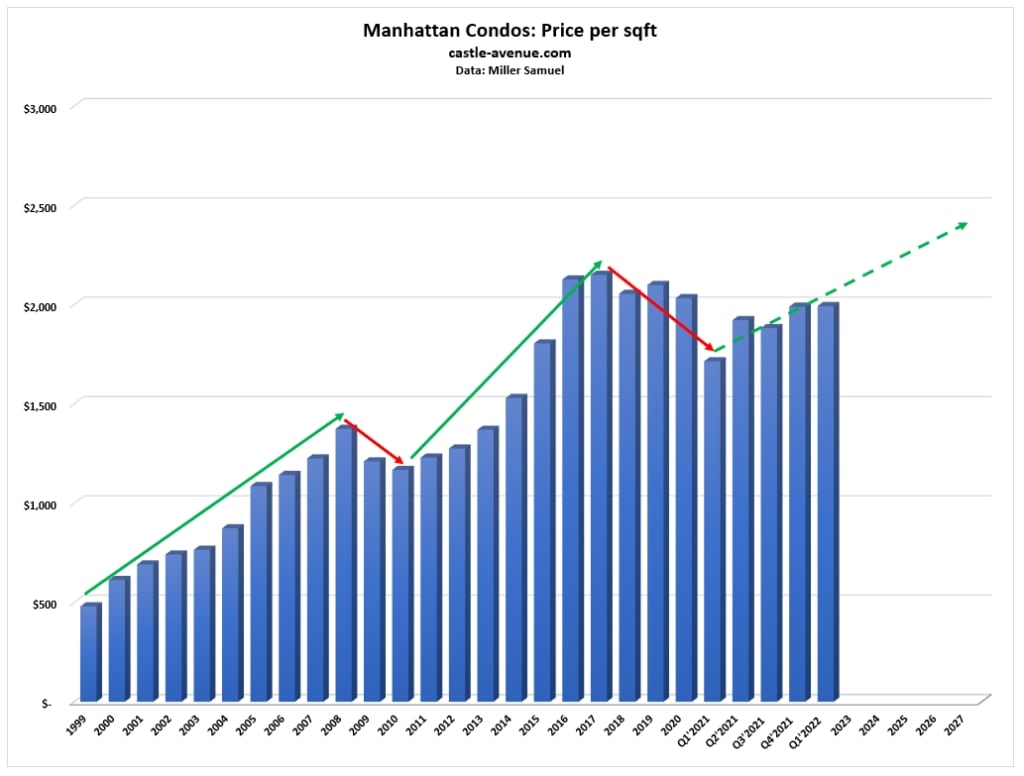

Due to the pandemic, some people have termed the city to be ‘dead’ but honestly, I think that claim is far from the truth. As far as real estate goes, Manhattan posted its best year to date, rebounding from the pandemic with $30B in real estate sales. Does that sound like a dead city to you?

You should know though, that this wasn’t always the case for this city. Global money pouring from all around the world over the past decades played its fair share in transforming and building up to the demand in its real estate that it has today.

Here’s a fun fact: New York City has always been a favourite of the rich to buy real estate as they were able to use shell companies and trusts to buy big bulks of anonymous purchases, hiding their identity and assets from the government. This has been quickly clamped down with new regulations recently, but it definitely played its part in contributing to the city’s incredulous property prices that we know of today.

Demographics & Context

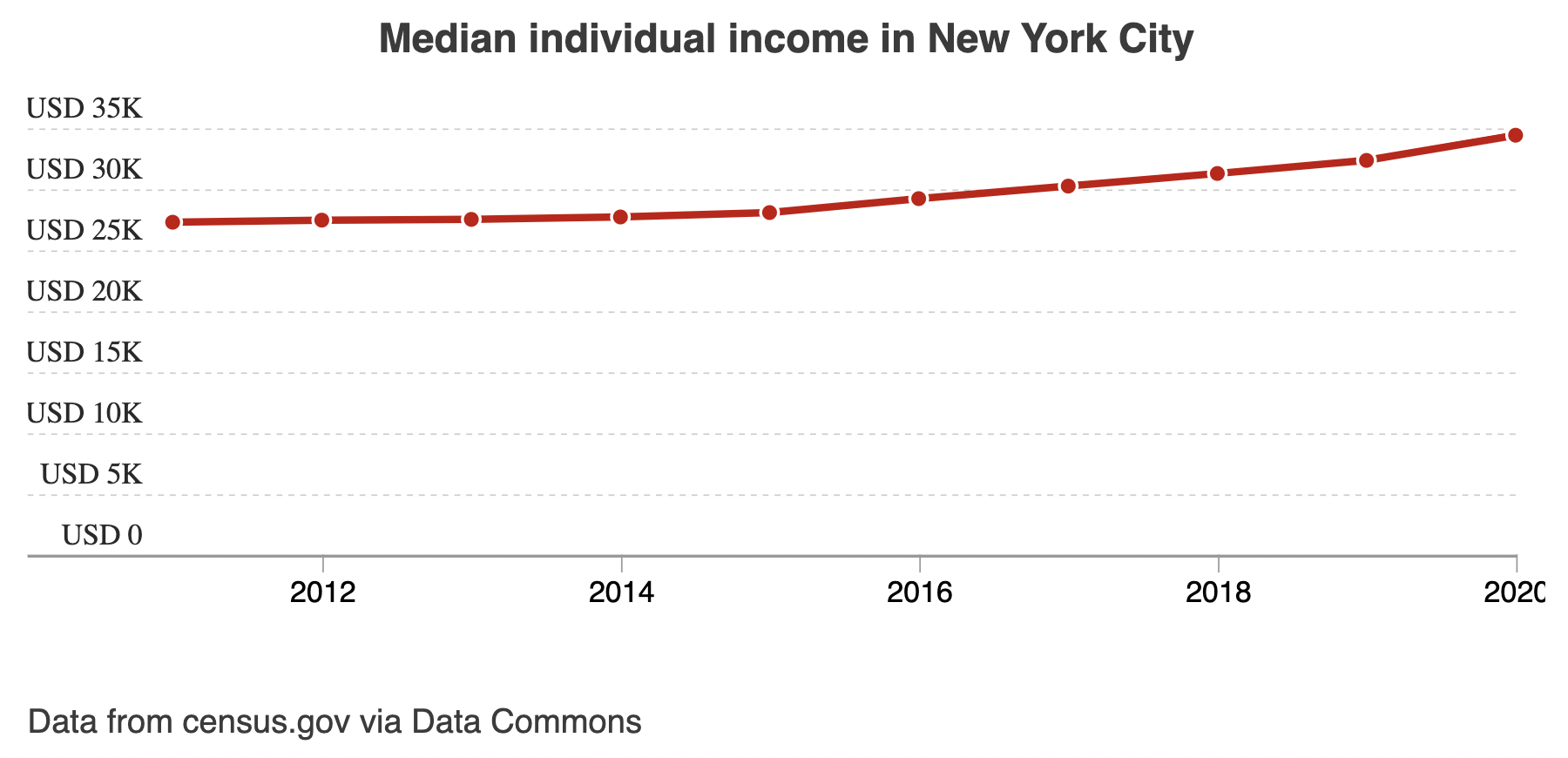

Not only are real estate prices expensive, the costs of living in the Big Apple is known as the most expensive as compared to other cities in the USA. With a median individual income of $32,320, NYC’s residents earn slightly higher than the national average.

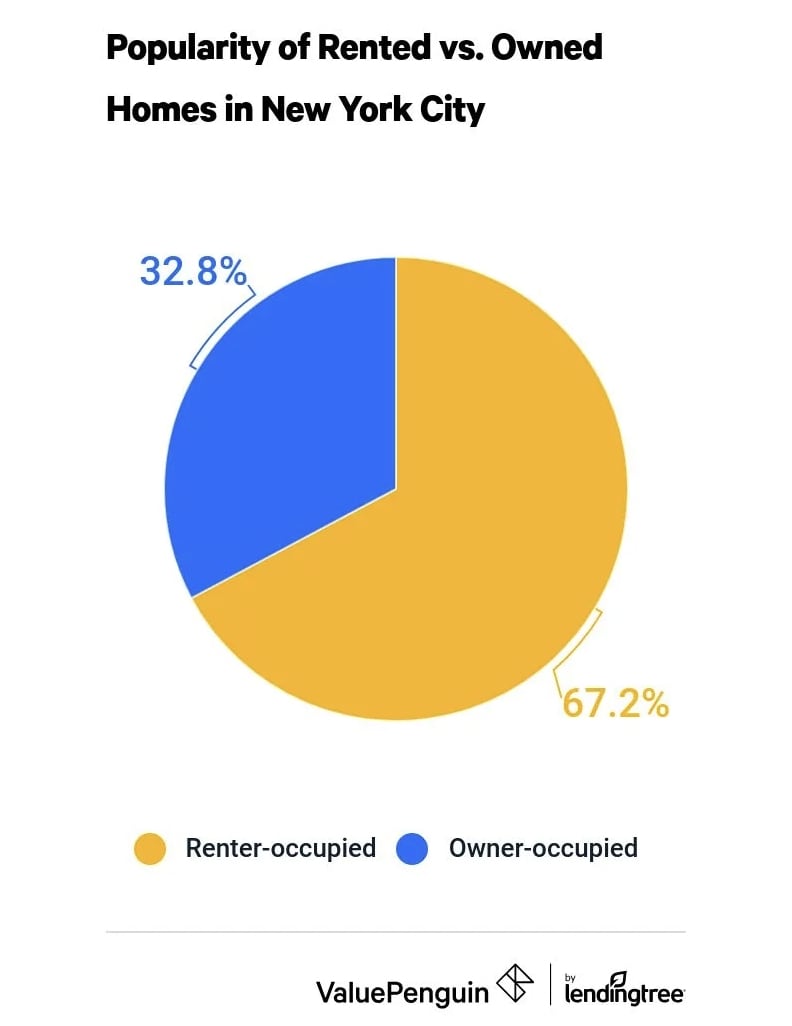

The majority of the folks living there are aged between 25 to 34 and are mainly White. Out of all the residents, nearly 40% are foreign born (that’s as international as it gets!). Renting is vastly much more popular in NYC, with ⅔ of 3,191,691 occupied housing units being rentals.

On top of that, rented homes in NYC have fewer people living in them as compared to occupied homes – this translates to people there preferring to live by themselves or with lesser roommates. Or that the family nucleus there is smaller.

Why is this important you ask? That’s because it gives you an idea of what unit type you should acquire for it to have consistently good rental demand.

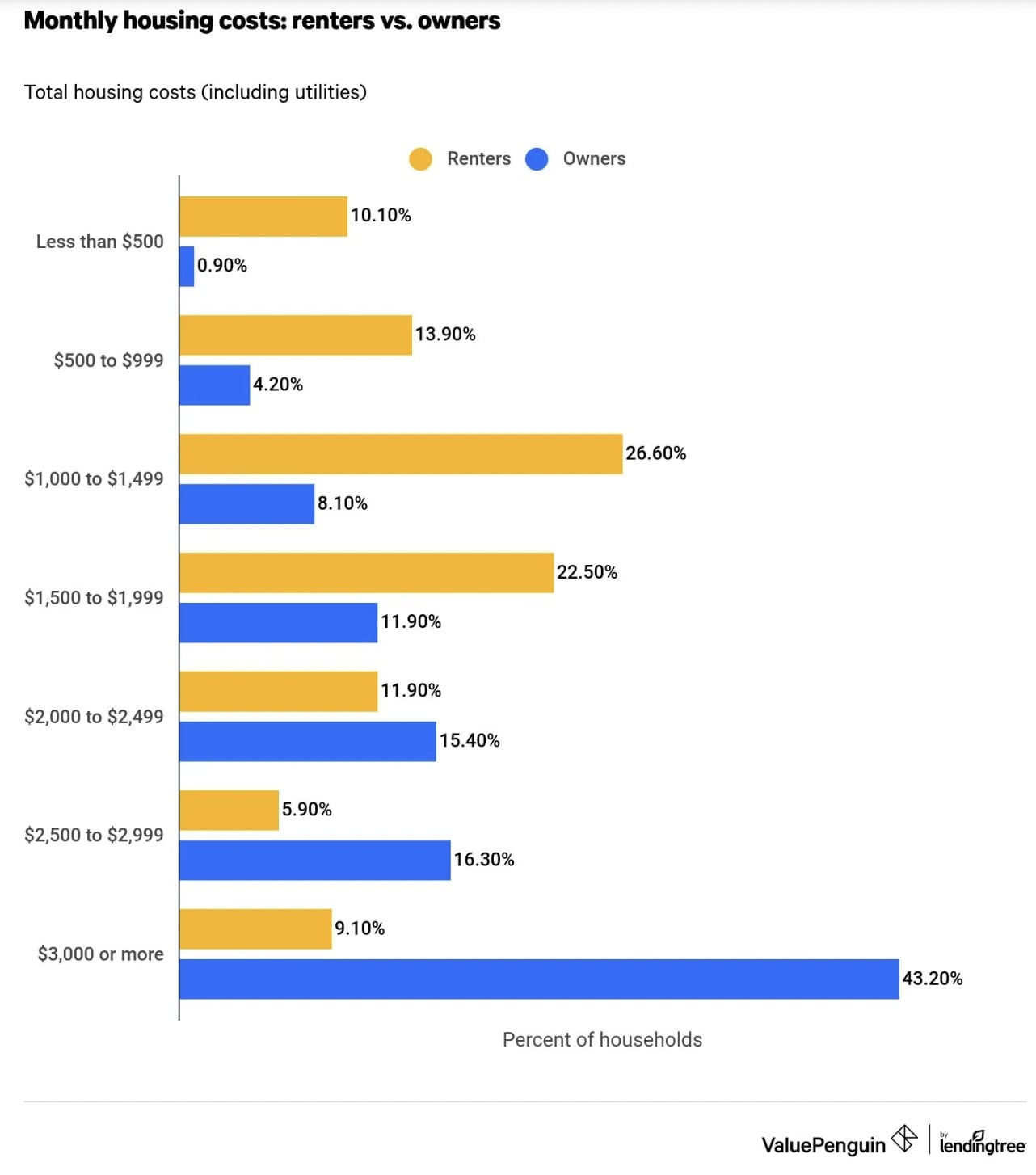

On the matter of costs when it comes to renting vs owning, it seems that typical homeowners spend more than US$3,000 per month, whereas the average cost of renting a unit ranges from US$1K to $1,499. Though, renters typically spend a higher proportion of their overall income on renting homes as compared to homeowners.

Another point I thought would be important to know is the majority unit type there since it sheds a really great insight as to how New Yorkers live. I wasn’t surprised to find out that 69.9% of all units in NYC are either 2 bedrooms or smaller, as it is a trend in most denser cities.

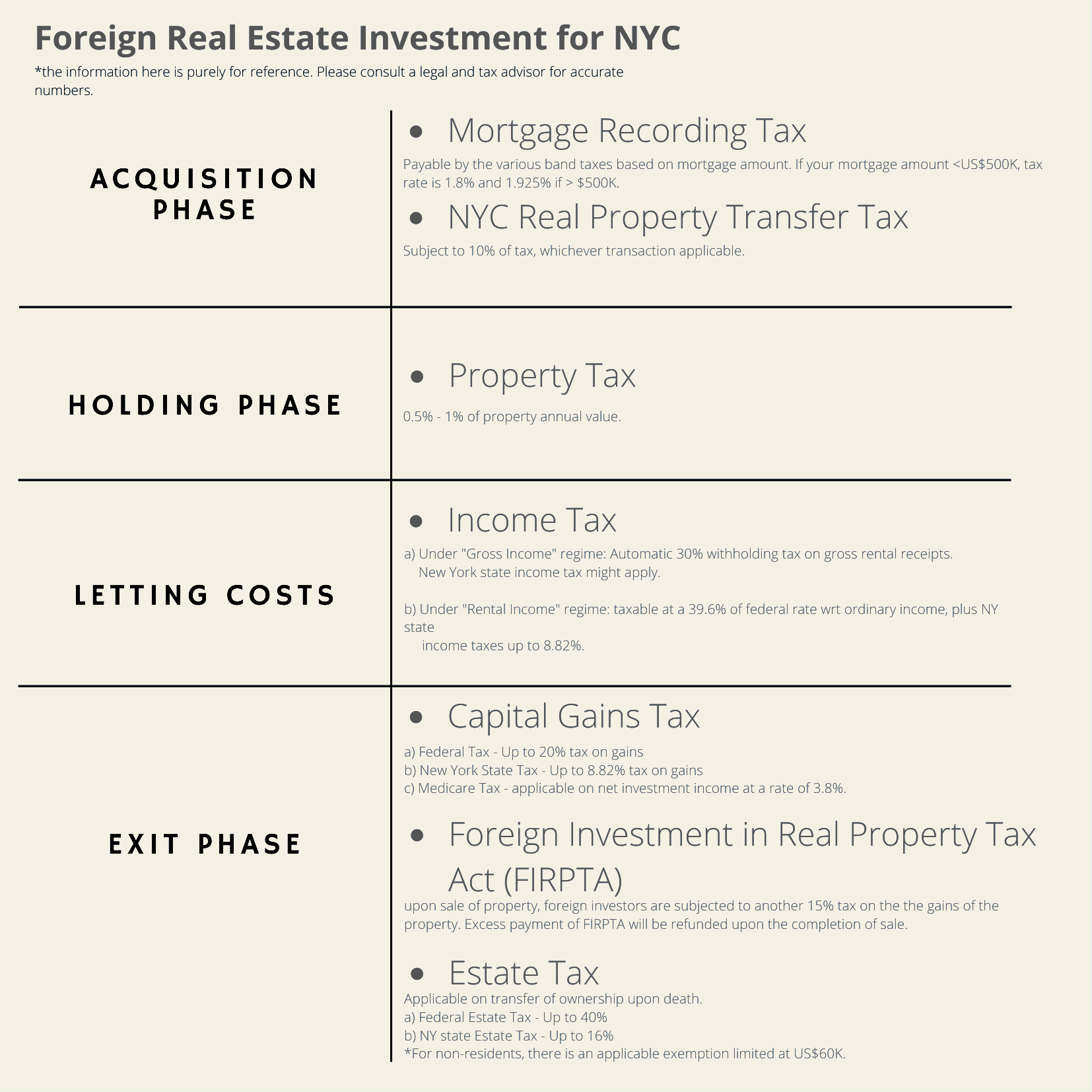

I guess this would really matter for us Singaporeans when it comes to the costs and taxes to acquire property there. Take a look at this table of costs and taxes that I’ve done up for my previous piece on a friend that owns 47 properties around the world.

Now that you have a better introduction to New York, I’ll be reviewing 3 different 1 bedders across NYC and will show you my pick of the bunch at the end.

I’ll be assessing each of them with these 7 variables:

- Costs & Price per Sqft

- Neighbourhood & Amenities

- Unit Layout

- Downpayment & Monthly Taxes

- Rental Demand & Yield

- Potential for Value Appreciation

- Pros & Cons of the space

Just want to be fair and cover as many boroughs as possible – I’ve picked out 1 each from Manhattan, Brooklyn and Queens.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Option 1: Manhattan, 398 East 89th Street #15A

| Type | Detail |

| Offered Price | US$1,495,000 |

| Size | 855 sqft – 1 Room, 1 Bed, 1 Bath |

| Price Per Square Foot | US$1,748 psf |

| Floor | 15 |

| Price Point | $$$ |

| Developer | Magnum Real Estate Group |

| Building Key Facts | 156 Units, 33 Stories, Built in 2002 |

| Key Points | Walking distance to Central Park and the Guggenheim Museum |

Neighbourhood & Amenities

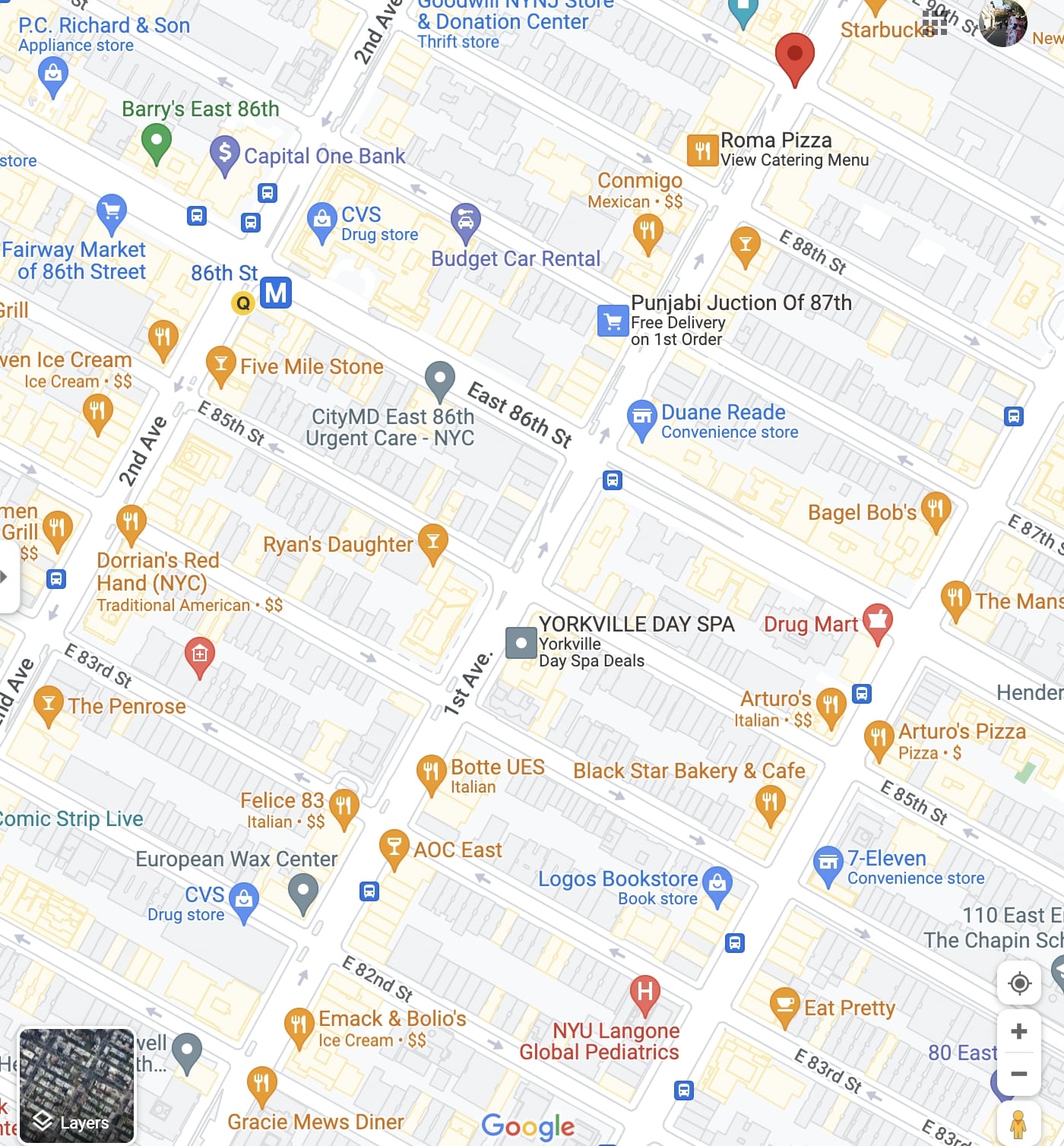

Right off the bat and just looking at the map, I already love the fact that this property is located in the beautiful Upper East Side near the breathtaking Central Park and has amazing amenities nearby. Taking a walk along the world-class park after work hours would be really nice. I can also imagine it would be really aesthetically pleasing to walk along with your neighbours that are well known for their adored architecture.

Just right around the block within a 7-minute walk away is a Wholefoods Supermarket, and a 4-minute walk brings you to 86th Street Metro Station. To get to NYC’S CBD (which is Midtown Manhattan), it’ll only take you a short 20-minutes train ride on the Q Train. Talk about convenience.

You’d also find yourself spoilt for choice in terms of food & beverages, just take a look at the map. There are cafes, restaurants, gyms, beauty parlours, drug stores and departmental stores within a 10-minutes radius walk. Not to mention, my personal favourite Levain Bakery is just there (I’m sold).

Many schools are also nearby, so the location would be perfect for families. Although this 1-bedder would not be too suitable for that demographic, it is still a useful point to note. Some schools include The Chapin School, Brealey School The Dalton School and Regis High School.

Within the development itself, I would say that the services provided are much more comprehensive as compared to a typical Singaporean condominium. There is a 24-hour private residential lobby, a residents’ lounge, children’s playroom, bike room, package room, fitness centre and (my favourite) a roof deck with 360-degree views of the Manhattan skyline. I’d also say that the finishing of each unit is really great. Wood floors, Italian kitchen Cabinetry and Miele appliances are provided. However, it has been lived in since 2002, so I’d assume a certain extent of renovation would be required.

Layout

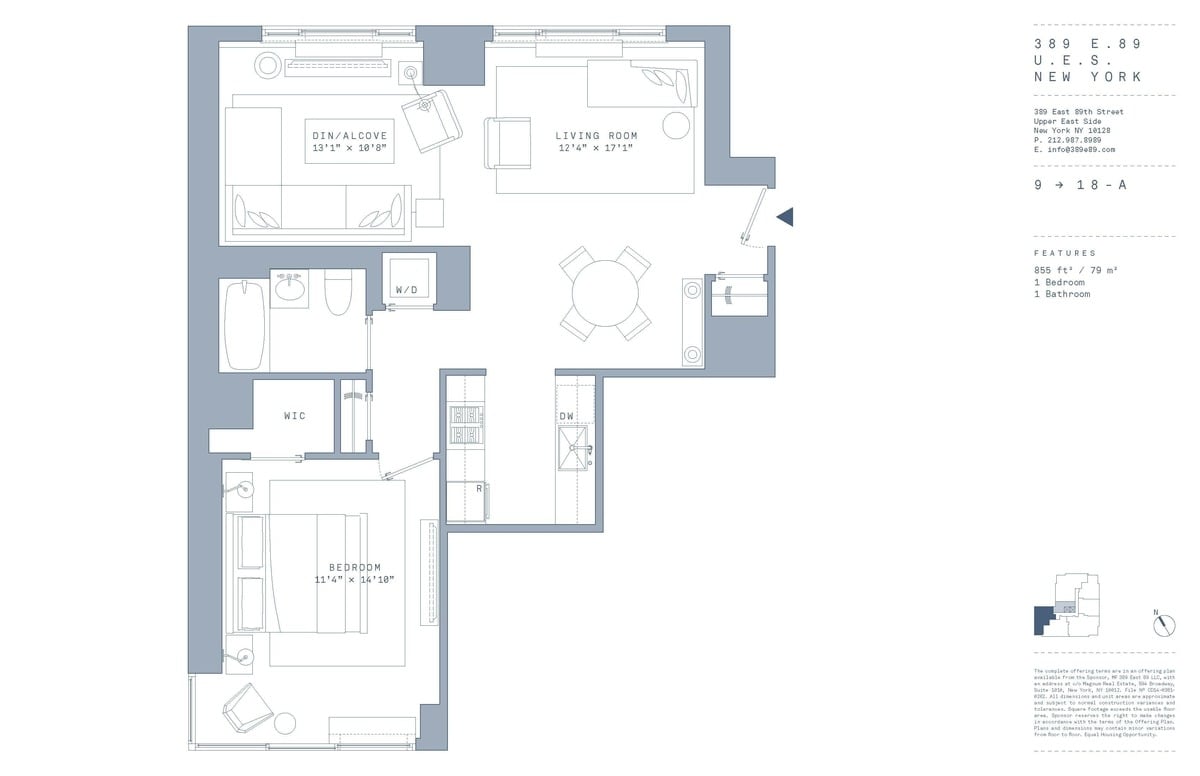

Although it is just a 1-bedder, I’d say 814 sq ft is pretty generous in Uptown Manhattan’s context. Also, every space in this unit is squarish and well-divided to give a clear sense of purpose and privacy for each space. The best thing is that there is a convertible alcove which can be used for study or just about anything.

I like how the kitchen has its own corner which you can enclose and that there is ample space for living, cooking and sleeping. It’s a good size for any single or couple living together, so definitely rentability would be great.

I would say the airflow in the apartment wouldn’t be too great as both the kitchen and bathroom here have no windows. And because of how it’s laid out, you aren’t going to get much air coming through.

Downpayment & Monthly Taxes

Coming down to the nitty gritty and the numbers part of this deal, I’d assume that an average investor will make a downpayment of 30%. The calculation below is also a generalisation – please consult a professional agent and solicitor for your final numbers!

- Downpayment = 30% x US$1,495,000 = US$448,500

- Monthly Costs = Mortgage Payment + Common Charges + Monthly Taxes = $8,068

- Mortgage Payment = 5.37%, 30 Years = $5,857 per month

- Common Charge = $977

- Monthly Taxes = $1,234

Average Rent, Rental Demand & Yield

Manhattan is notorious for its high rents, with the recent average monthly rent recorded in February 2022 to be around $4.3K (national US’ is recorded at $1.6K). Rents have bounced up back in NYC and vacancy rates have dropped from 12% a year ago to 1.32% in February 2022. All signalling a good return for the city that never sleeps.

Considering the local resale prices (which is at a median of $1,864,075), taxes and utilities, landlords can receive an approximate range of 5.22% to 5.57% in annual gross yield. That’s pretty solid, in my opinion. But you do have to consider the higher maintenance costs and higher purchase prices.

More from Stacked

Where 2024’s Most Profitable Resale Property Deals Were In Singapore (One Made $36 Million!)

While new launches stole the limelight for 2024 (and might for the coming year as well), the resale market has…

Potential for Value Appreciation

People have returned and are returning to NYC, and Manhattan’s real estate has peaked higher than it has been in more than three decades. It has swung an average appreciation rate of 26% since 2021 and predictions expect it to go higher.

Summary: Pros & Cons of the Property

| Pros | Cons |

| Great Amenities nearby | Noise on Busy Streets |

| Great North & South Skyline of Manhattan | Older building |

| Accessible and Convenient Location | High monthly charges |

| Lifestyle Offerings 10/10 | Requires A&A |

| Nearby to many pockets of green spaces | Low level in NYC’s context |

| Squarish layout of apartment & Generous with Space | |

| Great fittings | |

| Great rental market |

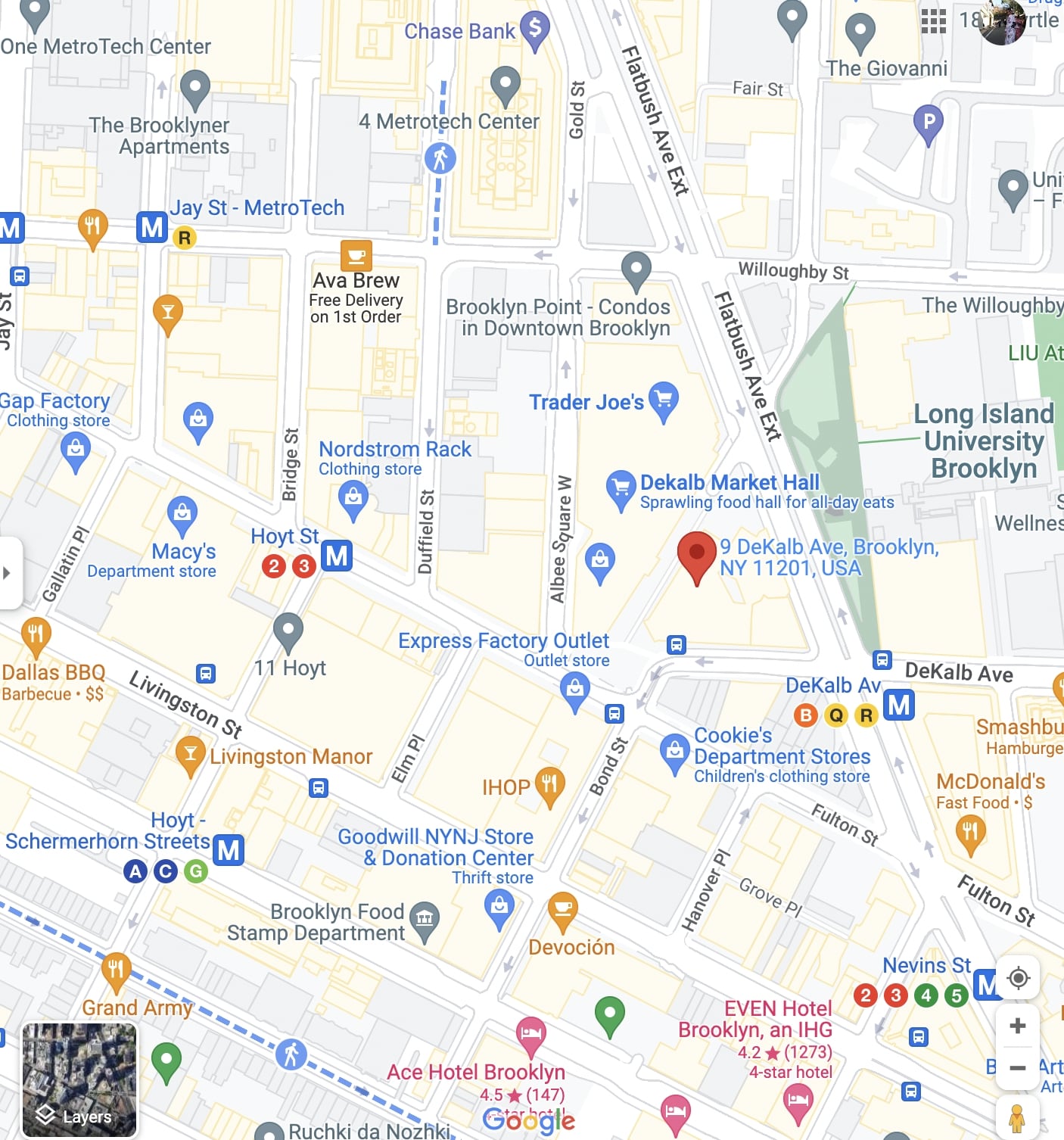

Option 2: Brooklyn, 9 Dekalb Avenue, 71A

| Type | Detail |

| Offered Price | US$905,000 |

| Size | 438 sqft – Studio, 1 Bed, 1 Bath |

| Price Per Square Foot | US$2,066 psf |

| Floor | 71 |

| Price Point | $$$$ |

| Developer | JDS Development |

| Building Key Facts | 547 Units, 92 Stories, Built in 2022 |

| Key Points | Vantage Points and Views of Verrazano Bridge |

Neighbourhood & Amenities

Well known for its boundary-breaking cuisines, Brooklyn is famous for its nightlife and restaurants.

The romantic and quaint Gage and Tollner in Brooklyn

An up-and-coming neighbourhood, 9 Dekalb’s neighbourhood might not be as fancy as Uptown Manhattan but it has all one might need. A Trader Joe’s to do your grocery shopping, Macy’s for departmental shopping and iHOP for a quick bite.

One thing that truly stood out to me was the number of metro stations around the development. The nearest one is Dekalb Avenue Station which carries trains Q, B and R in just a minute’s walk. The next nearest on is Nevins Street which is a 3-minute walk away.

Although it pales in comparison in terms of amenities offerings, I believe it is more of a ‘transit’ neighbourhood. Residents there would find it accessible to travel to all parts of NYC to get whatever they’d need. A direct train D will get you from the condo to NYC’s CBD in 21 minutes. Really convenient.

Long Island University Brooklyn, New York University Tandon School of Engineering and New York City College of Technology are nearby. Downtown Brooklyn, known as NYC’s Civic centre, is also nearby.

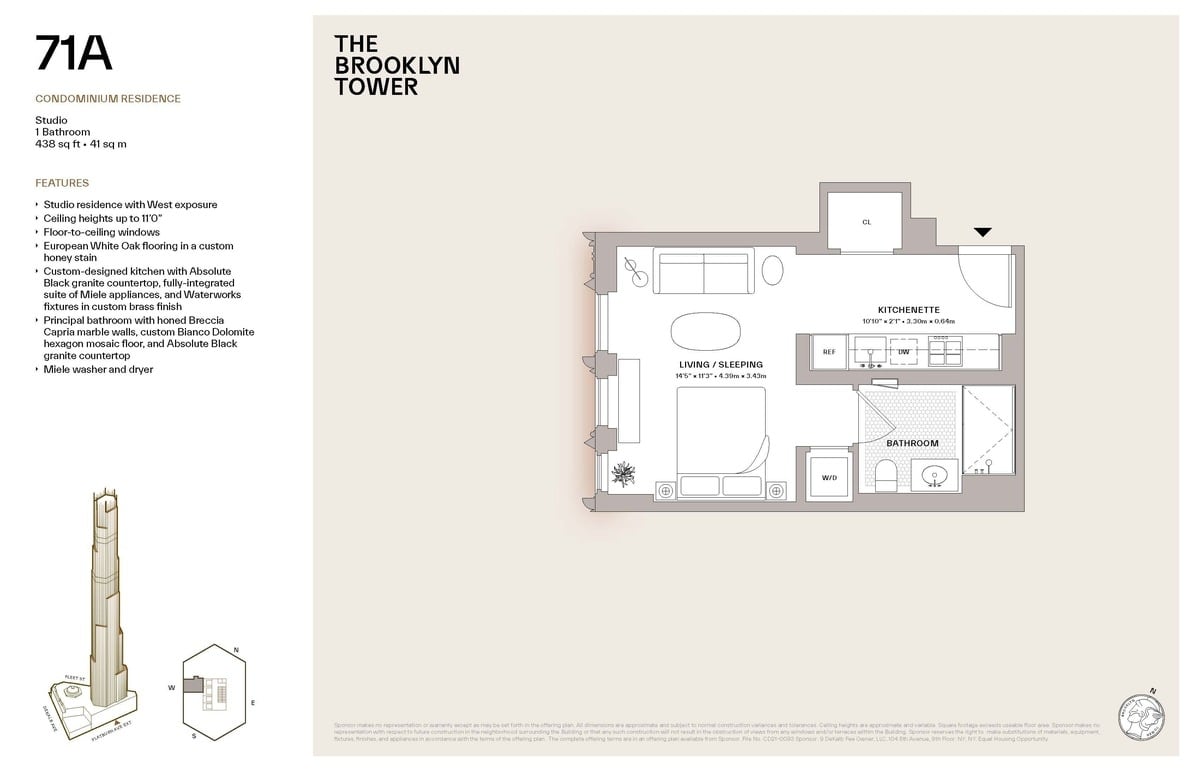

Unit Layout

This unit would definitely only be most suitable for a single to live in and will be a squeeze for a couple. With that being said, the living space and sleeping area have no division and the window faces the West exposure. It is as compact as they come, with little space for even a dedicated dining area.

There is a general kitchenette space that is visible upon entry, which is a pretty common design even in Singapore condominiums.

Downpayment & Monthly Taxes

Similar to 398 East, assuming that an average Singaporean will also place a 30% deposit for this investment. These numbers are a generalisation, please consult a professional advisor for your personalised numbers.

- Downpayment = 30% x US$ 905,000 = US$271,500

- Monthly Costs = Mortgage Payment + Common Charges + Monthly Taxes = $4,713

- Mortgage Payment = 5.37%, 30 Years = $3,545 per month

- Common Charges = $691

- Monthly Taxes = $477

It’s definitely much more affordable as compared to 398 East, though the differences in location and amenities should be considered!

Average Rent, Rental Demand & Yield

The average rent in Brooklyn is recorded $3,124 a month in February 2022, and the average apartment size is 654 sq ft.

One difference I found really interesting between Brooklyn and Manhattan is that the majority of people living in Brooklyn are owner-occupied (about 61%!). With that being said, I’d say the demand for an apartment in 9 Dekalb would be decent due to its convenience and lack of supply in the area.

Depending on your location in Brooklyn, the gross rental yield ranges from 4.62% to 5.10%. In 9 Dekalb’s case, I’d estimate around a US$42,000 annual gross yield.

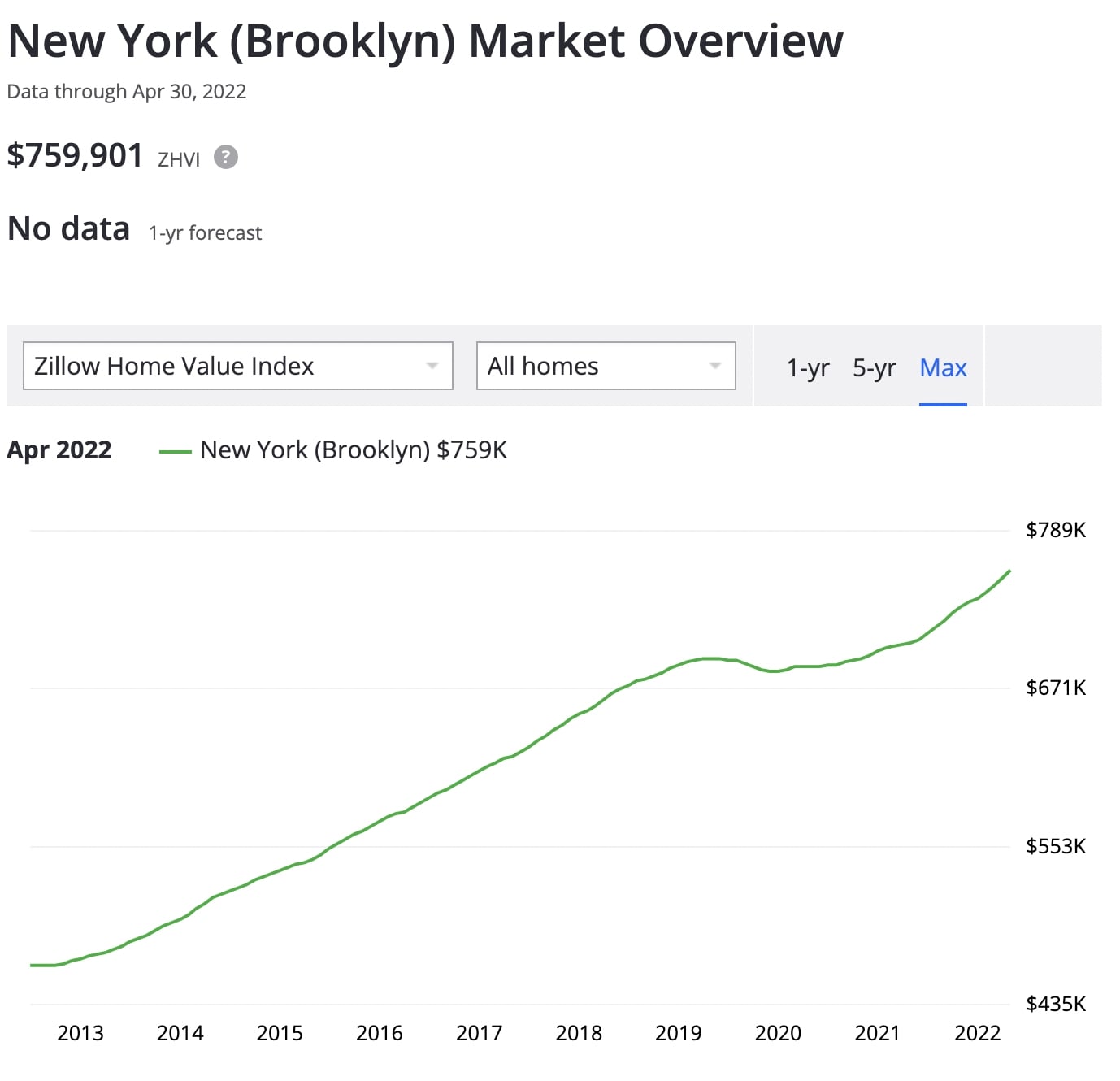

Potential for Value Appreciation

It’s mad to think that just in the past decade, Brooklyn’s real estate appreciated 95.16% (that’s around 6.92% per annum!). In the past year, there has been an uptick of 7.7%, which is great compared to Manhattan.

Pros & Cons of the space

| Pros | Cons |

| High Ceilings of up to 11ft Squarish | Small in comparison to other studio apartments |

| Squarish Layout | Dense Apartment building – 92 Stories & 547 Units |

| High Levels with Unblocked views of Brooklyn on the 71st floor | Higher per square foot cost |

| Parking available and great development amenities | Lack of neighbouring amenities |

| Ready-to-move-in condition, where most Brooklyn properties will require A&A Beautiful finish and quality appliances | Noise pollution |

| Lower monthly payment costs | Not many amenities within 500m radius |

| Great connectivity |

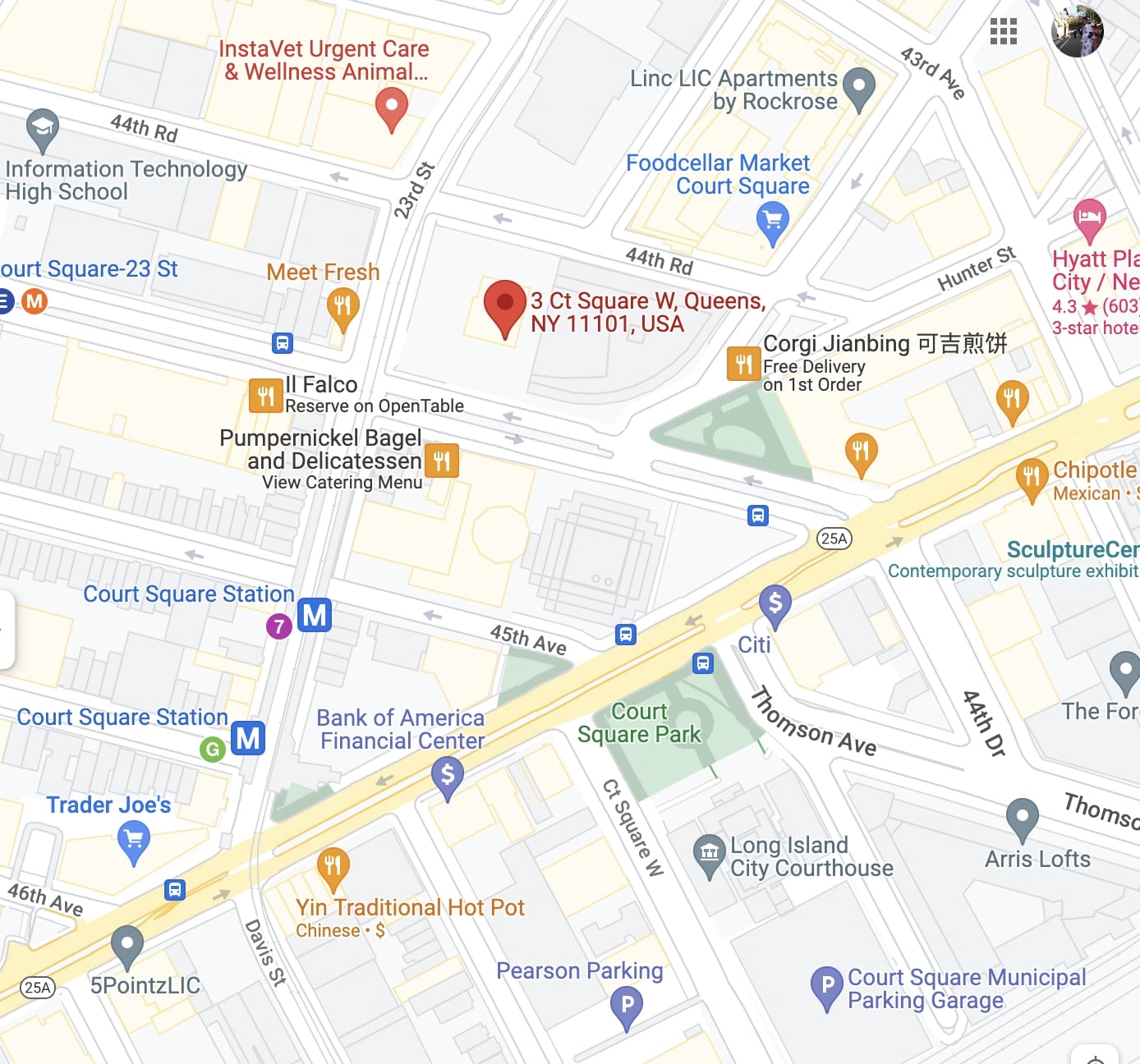

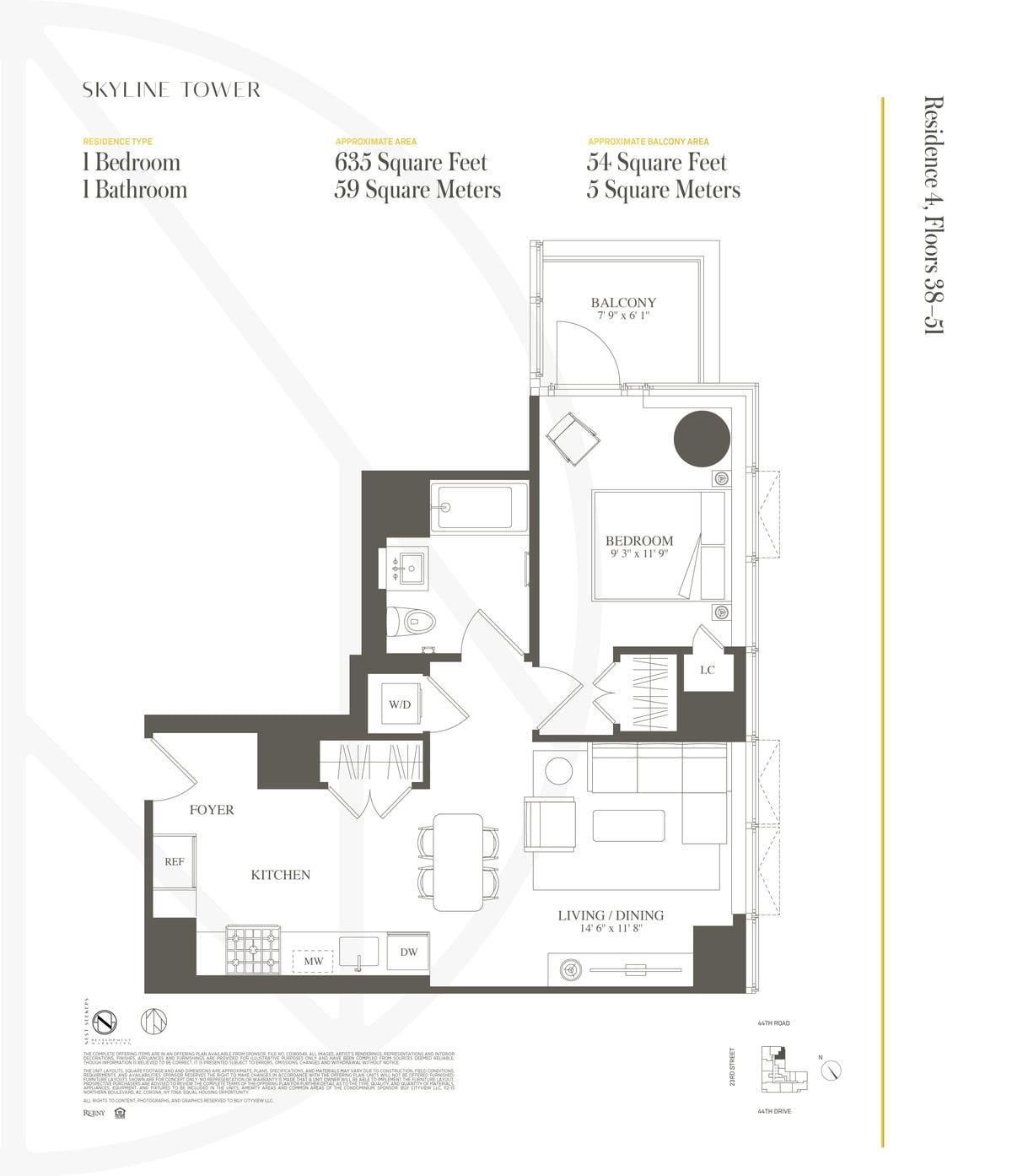

Option 3: Queens, 3 Court Square, Skyline Tower #3904

| Type | Detail |

| Offered Price | US$1,033,110 |

| Size | 635 sqft – 1 Room, 1 Bed, 1 Bath |

| Price Per Square Foot | US$1,626 psf |

| Floor | 67 |

| Price Point | $$$ |

| Developer | Risland US Holdings |

| Building Key Facts | 802 Units, 67 Stories, Built in 2021 |

| Key Points | Tallest Condominium in Queens and Easy Access to 8 Subway Lines |

Neighbourhood & Amenities

Many locals would argue that Queens is the best place to live in NYC. Not only is it one of the safest boroughs in NYC, but it also allows residents to be near the bustle of Manhattan without having to pay the sky-high rents, more trees and easy commuting.

What’s more, it even offers great food and nightlife. Known as NYC’s most diverse borough, you can find a plethora of food from various cultures and meet people from all parts of the world.

Known as the tallest residential building in Queens, 3 Court Square overlooks the stunning East River and the glittery Manhattan skyline. MoMA, Gantry Plaza State Park and Hunter’s Point South Park is nearby too.

There are food offerings like the famous Pumpernickel Bagel and Chinese cuisines like Hot Pot around the neighbourhood, complemented by Trader Joe’s for grocery shopping. It also has pockets of green spaces at Court Square Park for quick walks and mini picnics.

Transportation is also convenient, with several metro lines serving the area. Being only 1 minute away, Court Square station serves the G and 7 Train, while Court Square-23 St Station (also 1 minute away) serves the E and M trains. If land transportation isn’t for you, there are three ferry lines available too. Heading to the CBD only takes a quick 17 minutes – truly offers a much more quaint neighbourhood with the convenience of travelling to anywhere important.

Looking at the amenities within the development, it looks very classy and luxurious. I think it’s a combination of the colour scheme and the high ceilings here. It also offers great amenities like a pet spa, parking, a business centre, a gym, a Yoga/Pilates room, a sauna, a steam room, a 75 ft pool and a 24-hour concierge.

The unit offers elegant and luxurious finishing, such as white oak flooring, a quartz slab for the kitchen countertop and backsplash and Bosch appliances.

Unit Layout

Also in a squarish layout, this stands out a little differently because of the balcony that can be accessed via the bedroom. Especially from the effects of the pandemic, green and open spaces are highly prioritised by homeowners and this balcony would be a great addition when it comes to analysing its selling points.

I also like the open concept kitchen which would elongate the entire living and kitchen space. Overall, really nice and flexible layout for renters to make home.

One difference from 389 East is that this unit doesn’t have an alcove. Folks might need to find an alternative for a study space, or get creative with how the area is designed.

Downpayment & Monthly Taxes

Also assuming that a 30% downpayment will be made, here are its general calculations.

- Downpayment = 30% x US$1,033,110 = US$309,933

- Monthly Costs = Mortgage Payment + Common Charges + Monthly Taxes = $4,972

- Mortgage Payment = 5.37%, 30 Years = $4,047 per month

- Common Charges = $459

- Monthly Taxes = $466

I love how the common charges and monthly taxes cost more affordable than the previous 2 units, which brings down its expenses. I’d say that most should be able to consider this monthly cost.

Average Rent, Rental Demand & Yield

On average, the rent recorded in Queens is $2,769 in February 2022. That’s much lower than the other two apartments. Its average apartment size is 710 sq ft.

Similar to Brooklyn, most of the housing units are owner-occupied (a whopping 67%!), which might mean that they take better care of their neighbourhoods. Queens might be a great location, especially for those who want to live away from the hustle and bustle.

The gross rental yield for Queens ranges from 2.71% to 3.60%. That’s probably the worst performing out of all 3 properties.

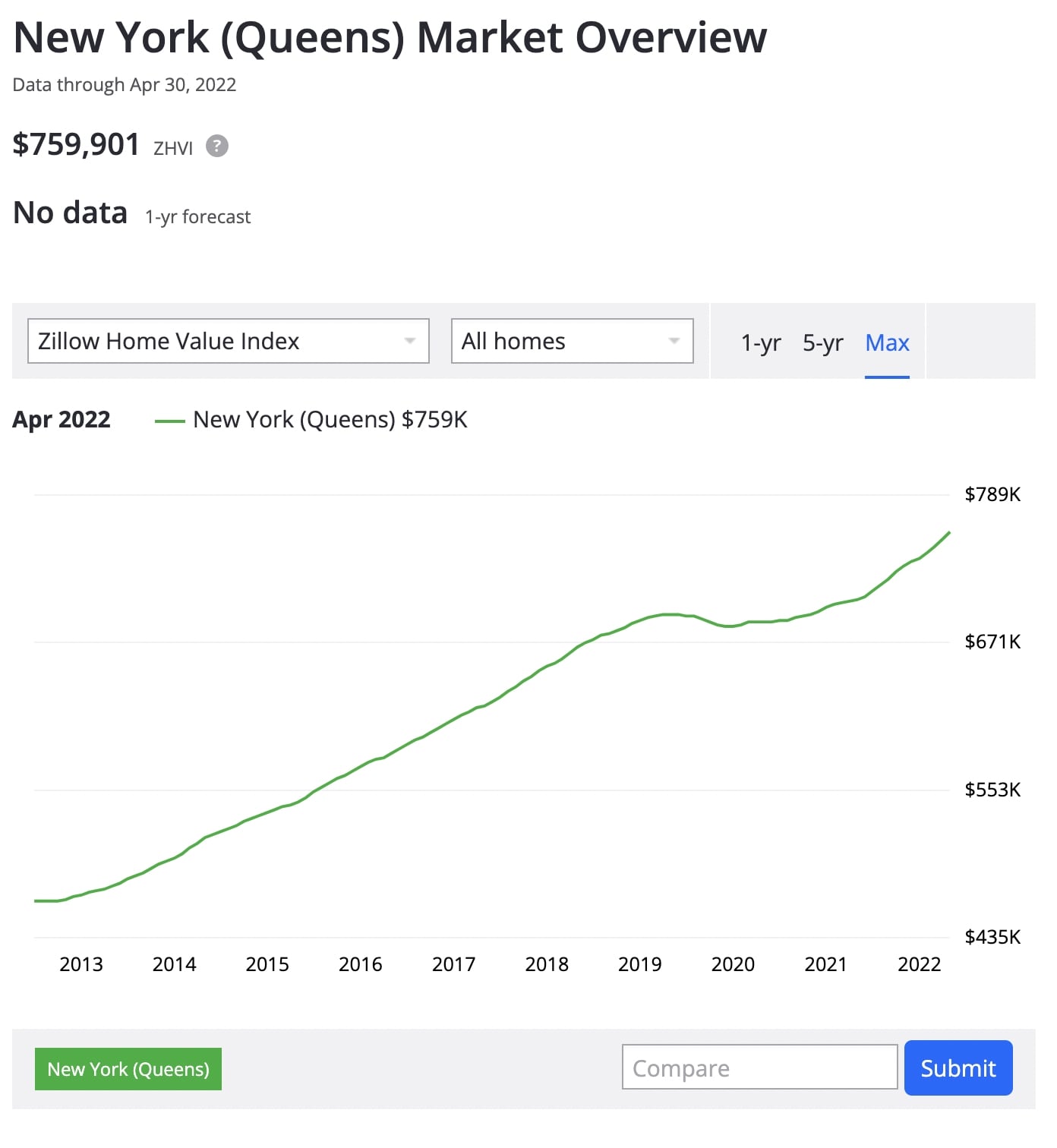

Potential for Value Appreciation

In terms of value appreciation, Queens has seen a 7.7% uptick from 2021 till now. There is also a generally positive value growth for the borough.

Pros & Cons of the space

| Pros | Cons |

| Reputation of the Tallest Condominium in Queens | Extremely dense with 802 units in the development |

| 360-degree vantage views of NYC | Not many amenities within 500m radius |

| Low Monthly Costs | |

| Great connectivity to 8 subway lines | |

| Great In-House Amenities | |

| Luxurious, good-quality fittings | |

| Ready-to-move-in condition |

Final Thoughts

Now, I’m truly interested to know what you, the readers, would pick after reading this summary.

For me, I’m swaying more towards 389 East 89th Street in Manhattan. Mainly because I think the layout of the unit is perfect for any young professional looking to rent an apartment in the city. It is convenient, it is probably higher in demand and also I’d expect a capital uptick. Overall, I think it is a great medium for storing and growing wealth. I mean, how many more condominiums can be fit near the iconic Central Park?

One thing I’d take note of is the monthly costs to maintain this unit. It’s steep and it might be a big pitfall for any investor. I’d scout around the neighbourhood to see if there’d be a better deal before I do sign any papers.

Let me know which one you’d pick! Till then, please look forward to our next content.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What should I consider when investing in New York City real estate as a foreigner?

Is New York City a good place for property investment right now?

What are the typical costs involved in buying a property in New York City?

Which neighborhoods in New York are reviewed for property investment in the article?

What are the key factors to look at when reviewing an overseas property, according to the article?

Cheryl Teo

Cheryl has been writing about international property investments for the past two years since she has graduated from NUS with a bachelors in Real Estate. As an avid investor herself, she mainly invests in cryptocurrency and stocks, with goals to include real estate, virtual and physical, into her portfolio in the future. Her aim as a writer at Stacked is to guide readers when it comes to real estate investments through her insights.Need help with a property decision?

Speak to our team →Read next from Overseas Property Investing

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Overseas Property Investing What Under $200K Buys In Malaysia Today — From Freehold Apartments to Beachfront Suites

Overseas Property Investing A London Landmark Is Turning Into 975-Year Lease Homes — And The Entry Price May Surprise Singapore Buyers

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

0 Comments