We Make $14k Per Month And Have $350k Cash. Should We Buy Another Resale HDB Or Wait To Purchase A 2-Bedder Condo?

January 5, 2024

Help! We need advise!

My husband and I bought our resale in April 2021.

Some things to note here would be.

- we still have 2.5 years to go before reaching MOP.

- we bought the resale under owner-essential occupier scheme.

- owner is the wife (who had a higher income)

- We both have a combined income of $14,000. (husband – 4,000 & wife – 10,000)

- Total savings combined cash savings would be 350k

- combined cpf 370k (husband – 170k, wife -200k). This is after considering selling the resale. Hence all cpf had been returned to the cpf account.

- husband 32 years old, wife, 30 years old.

To avoid absd and our eventual goal of 1 hdb + 1 private (of at least 2 bedder).

We are looking to plan ahead. However, due to a lower income from my husband (4K, with a forecast income of 6,000 in 2026 when the MOP happens). We are thinking if there is any way we could achieve our goal?

On a side note, my husband parents don’t have any housing in Singapore, with only 1 malaysia property fully paid.

Would it be best to

- re-purchase a resale HDB after this MOP, under my husband’s name. And wait out another 5 years period?

- transfer the current hdb flat to husband father, then for them to dispose the overseas property by transfer to my husband?

- wait for husband income to rise and be able to purchase at least 2 bedder condo unit?

Thank you for reading and hope to gain some advise!

Kind regards

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hi there!

Thank you for writing in.

Opting for the owner-occupier scheme when purchasing your current HDB was a wise decision, especially considering your intention to eventually acquire a second property. To begin, let’s assess your affordability before exploring the various options you’re considering.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

Let’s look at both your affordability when buying an HDB and buying a private property.

In our calculations, we will allocate a larger share of your cash reserves for the acquisition of the private property. Considering your significant cash savings, you have the flexibility to modify your individual affordability by reorganising your available funds.

Husband’s affordability

Buying an HDB

| Description | Amount |

| Maximum loan based on the age of 35 with a monthly income of $6,000 at a 4.6% interest* | $320,556 (25-year tenure) |

| CPF funds | $170,000 |

| Cash | $100,000 |

| Total loan + CPF + cash | $590,556 |

| BSD based on $590,556 | $12,316 |

| Estimated affordability | $578,240 |

*Do note that we are using the current interest rates which may be different 3 years later so the loan amount may vary. As your household income is above the $14,000 ceiling, you will not be eligible for an HDB loan.

Buying a private property

| Description | Amount |

| Maximum loan based on the age of 35 with a monthly income of $6,000 at a 4.6% interest* | $643,721 (30-year tenure) |

| CPF funds | $170,000 |

| Cash | $250,000 |

| Total loan + CPF + cash | $1,063,721 |

| BSD based on $1,063,721 | $27,148 |

| Estimated affordability | $1,036,573 |

*Do note that we are using the current interest rates which may be different 3 years later so the loan amount may vary

Wife’s affordability

Buying an HDB

| Description | Amount |

| Maximum loan based on the age of 33 with a monthly income of $10,000 at a 4.6% interest* | $534,261 (25 years) |

| CPF funds | $200,000 |

| Cash | $100,000 |

| Total loan + CPF + cash | $834,261 |

| BSD based on $843,261 | $19,627 |

| Estimated affordability | $814,634 |

*Do note that we are using the current interest rates which may be different 3 years later so the loan amount may vary. As your household income is above the $14,000 ceiling, you will not be eligible for an HDB loan.

Buying a private property

| Description | Amount |

| Maximum loan based on the age of 33 with a monthly income of $10,000 at a 4.6% interest* | $1,072,869 (30-year tenure) |

| CPF funds | $200,000 |

| Cash | $250,000 |

| Total loan + CPF + cash | $1,522,869 |

| BSD based on $1,522,869 | $45,743 |

| Estimated affordability | $1,477,126 |

*Do note that we are using the current interest rates which may be different 3 years later so the loan amount may vary

Based on these numbers, you will be able to purchase an HDB and a private property that is at least a 2-bedder. However, it is also dependent on the specific unit and developments that you are looking at.

Now that we have a better understanding of your financial standing, let’s run through the various routes you are considering.

Potential pathways

Option 1. Sell existing HDB, purchase another HDB and a private property after MOP

Taking this route will give you more options for your investment property since you have a higher affordability. Nevertheless, when considering an HDB, the adequacy of your husband’s budget of $578,240 largely depends on the specific location and the age of the flat you’re eyeing.

| Towns | 3-Room | 4-Room | 5-Room |

| Ang Mo Kio | $385,000 | $538,000 | $725,500 |

| Bedok | $370,000 | $523,000 | $684,000 |

| Bishan | * | $715,000 | $929,000 |

| Bukit Batok | $385,000 | $595,000 | $758,000 |

| Bukit Merah | $439,500 | $860,000 | $928,000 |

| Bukit Panjang | $400,000 | $508,000 | $615,000 |

| Bukit Timah | * | * | * |

| Central | $470,000 | * | * |

| Choa Chu Kang | $391,500 | $500,000 | $579,000 |

| Clementi | $397,500 | $607,400 | * |

| Geylang | $330,000 | $610,000 | $750,000 |

| Hougang | $390,000 | $532,500 | $690,000 |

| Jurong East | $380,000 | $473,000 | $625,000 |

| Jurong West | $360,000 | $500,000 | $580,000 |

| Kallang/Whampoa | $385,000 | $790,400 | $907,900 |

| Marine Parade | * | * | * |

| Pasir Ris | * | $554,000 | $658,000 |

| Punggol | $470,000 | $600,000 | $677,500 |

| Queenstown | $389,400 | $928,000 | * |

| Sembawang | $447,500 | $556,900 | $580,000 |

| Sengkang | $465,000 | $558,000 | $630,000 |

| Serangoon | $420,000 | $575,000 | $731,500 |

| Tampines | $420,000 | $569,000 | $678,000 |

| Toa Payoh | $350,000 | $780,000 | $900,000 |

| Woodlands | $374,000 | $498,000 | $590,000 |

| Yishun | $385,000 | $500,000 | $650,000 |

Looking at the average prices of the different HDB types in Q3, a 3-room flat is viable, but if you are looking at a 4 or 5-room flat, you will likely have to find something in the outskirts.

This option is a bit of a double-edged sword as the downside primarily lies in the extended waiting period. With approximately 2.5 years left before your existing flat hits the MOP, followed by an additional 5-year wait before the acquisition of the investment property, the total duration spans nearly 8 years. While your current age of 30 is still fine, it’s essential to note that time plays a critical role, particularly in investment scenarios.

Let’s take a look at how the loan quantum will be impacted if the purchase occurs when you’re 38 years old.

| Description | Amount |

| Maximum loan based on the age of 33 with a monthly income of $10,000 at a 4.6% interest | $1,072,869 (30-year tenure) |

| Maximum loan based on the age of 38 with a monthly income of $10,000 at a 4.6% interest | $1,019,424 (27-year tenure) |

| Difference in loan quantum | $53,445 |

In the grand scheme of things, a difference of $50,000 is not that great.

An advantage of this approach is that within the 8 years, there’s potential for salary increases and the accumulation of additional savings, which can be directed towards the investment property purchase.

This strategy allows for allocating a larger portion of your cash reserves towards the HDB purchase, thereby broadening your options.

To quantify this, we’ll assess the potential costs and gains over 10 years (commencing from the present, involving the 2.5 years wait until MOP, a 7-year holding period for the next HDB and a 2-year holding period for the private property).

Let’s say your husband purchases an HDB at $570,000 as your residence.

| Description | Amount |

| Purchase price | $570,000 |

| BSD | $11,700 |

| CPF + cash | $270,000 |

| Loan required | $311,700 |

Costs incurred

| Description | Amount |

| BSD | $11,700 |

| Interest expenses (Assuming a 4% interest) | $79,544 |

| Town council service & conservancy fees (Assuming $80/month) | $6,720 |

| Property tax | $2,548 |

| Total costs | $100,512 |

Potential gains

To do a simple projection, we will use the annualised growth rate of HDBs over the last decade at 1.42%.

| Time period | Price | Gains |

| Starting point | $570,000 | $0 |

| Year 1 | $578,094 | $8,094 |

| Year 2 | $586,303 | $16,303 |

| Year 3 | $594,628 | $24,628 |

| Year 4 | $603,072 | $33,072 |

| Year 5 | $611,636 | $41,636 |

| Year 6 | $620,321 | $50,321 |

| Year 7 | $629,130 | $59,130 |

Total cost of buying an HDB: $100,512 – $59,130 = $41,382

As for the investment property, we’ll presume you purchase a private property at $1.4M, with a rental yield of 3%.

| Description | Amount |

| Purchase price | $1,400,000 |

| BSD | $40,600 |

| CPF + cash | $450,000 |

| Loan required | $990,600 |

Costs incurred

| Description | Amount |

| BSD | $40,600 |

| Interest expenses (Assuming a 4% interest) | $77,643 |

| Maintenance fees (Assuming $300/month) | $7,200 |

| Property tax | $12,000 |

| Rental income (Assuming $3,500/month) | $84,000 |

| Agency fees (Payable once every 2 years) | $3,780 |

| Total costs | $57,223 |

Potential gains

We will also do a simple projection using the annualised growth rate of private properties over the last decade at 2.21%.

| Time period | Price | Gains |

| Starting point | $1,400,000 | $0 |

| Year 1 | $1,430,940 | $30,940 |

| Year 2 | $1,462,564 | $62,564 |

Total gains of buying a private property: $62,564 – $57,223 = $5,341

Total cost incurred if you were to take this route: $41,382 – $5,341 = $36,042

Option 2. Change of HDB ownership

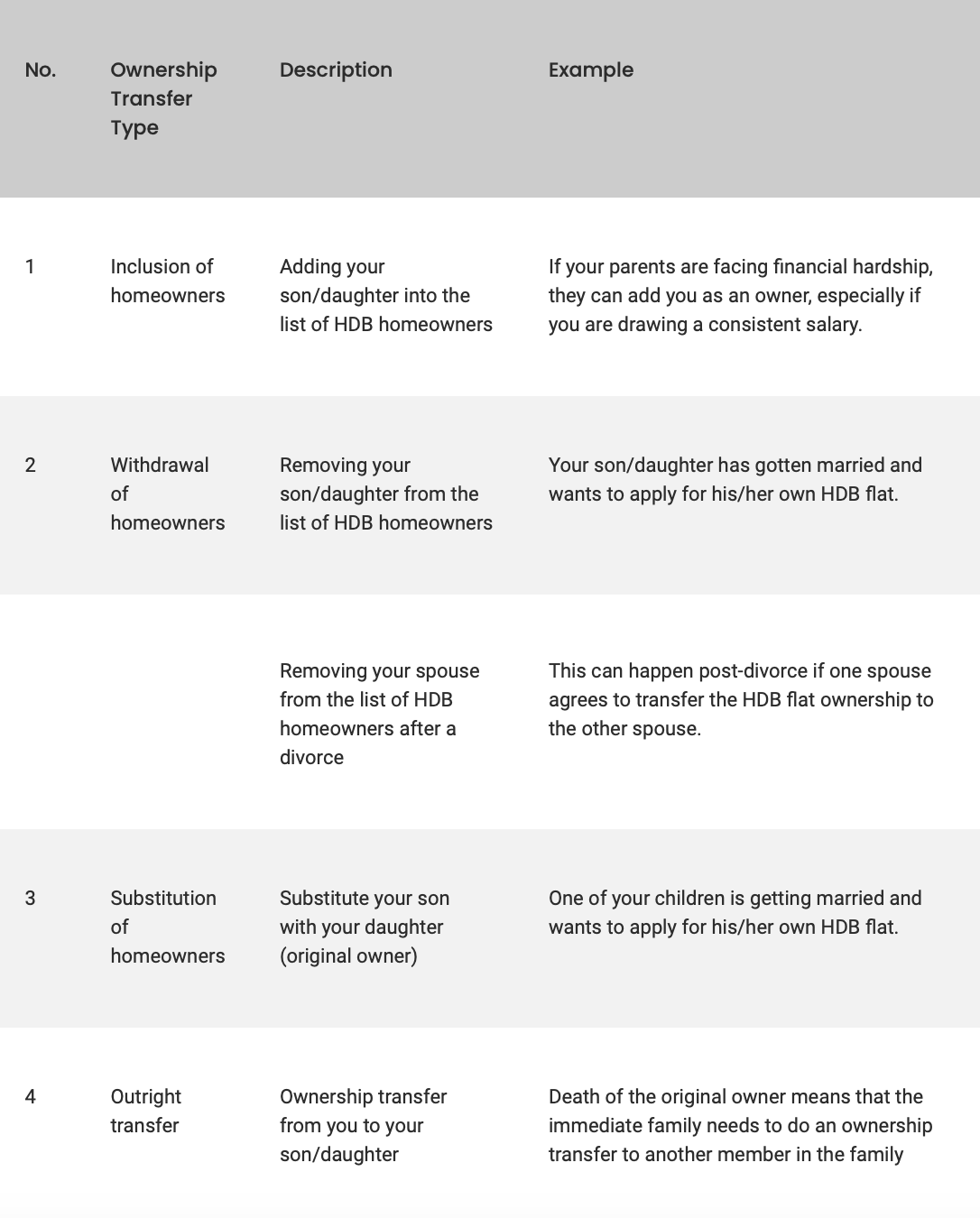

Prior to April 2016, HDB owners could freely transfer ownership to family members. However, due to cases where this was done to buy a second property without incurring Additional Buyer’s Stamp Duty (ABSD), the government revised these rules. Now, ownership transfers are restricted to immediate family members and allowed only under specific circumstances.

There are two options to alter the ownership of HDB flats, either through a part-sale transaction or a transfer without any sale involved. (Do note that the buyers have to fulfil HDB’s eligibility criteria).

A part-sale involves the partial sale/purchase of the HDB among family members at a mutually agreed-upon price. However, it isn’t permissible for married couples to utilise this method to transfer ownership to one another.

Ownership transfer without a sale occurs when there’s a change in the existing family structure, such as due to divorce, marriage, or the passing of an owner. This also encompasses instances where the current owner needs to modify ownership to maintain the flat.

There are 4 scenarios in which an ownership transfer is possible:

Source: Propertyguru

So since there is no change in your family structure, unfortunately, you will not be eligible to transfer the ownership of the flat to your husband’s father.

Option 3. Wait for an increase in husband’s income

Based on the projection that your husband’s monthly income will be $6,000 in 2026, and taking into account your cash savings of $350,000 (excluding any proceeds from selling your current HDB), he could likely afford a 2-bedroom condo. This, of course, depends on the particular development selected.

In our previous calculations, we only allocated $250,000 of cash for the acquisition of the investment property. However, in this scenario where you retain the current HDB, let’s recalibrate his affordability by considering the utilisation of the entire $350,000 cash savings. As the occupier of the existing HDB flat, his CPF funds wouldn’t have been utilised for the purchase.

| Description | Amount |

| Maximum loan based on age of 35 with a monthly income of $6,000 at a 4.6% interest | $643,721 |

| CPF funds | $170,000 |

| Cash | $350,000 |

| Total loan + CPF + cash | $1,163,721 |

| BSD based on $1,163,721 | $31,148 |

| Estimated affordability | $1,132,573 |

As this purchase will only happen 3 years later, we will not look at what are the available units currently on the market since it will not be relevant.

Although with this option you may have slightly fewer choices as compared to Option 1 where you purchase the investment property instead, the waiting time is greatly reduced as your husband can purchase the property once your existing flat hits its MOP.

Let’s say he purchases a unit at $1.1M, with a rental yield of 3%. Looking at the same 10-year period, he will hold the private property for 7 years.

| Description | Amount |

| Purchase price | $1,100,000 |

| BSD | $28,600 |

| CPF + cash | $520,000 |

| Loan required | $608,600 |

Costs incurred

| Description | Amount |

| BSD | $28,600 |

| Interest expenses (Assuming a 4% interest) | $159,224 |

| Maintenance fees (Assuming $300/month) | $25,200 |

| Property tax | $29,400 |

| Rental income (Assuming $2,750/month) | $231,000 |

| Agency fees (Payable once every 2 years) | $11,880 |

| Total costs | $23,304 |

Potential gains

As before, we will use the annualised growth rate of private properties over the last decade at 2.21% to do a simple projection.

| Time period | Price | Gains |

| Starting point | $1,100,000 | $0 |

| Year 1 | $1,124,310 | $24,310 |

| Year 2 | $1,149,157 | $49,157 |

| Year 3 | $1,174,554 | $74,554 |

| Year 4 | $1,200,511 | $100,511 |

| Year 5 | $1,227,043 | $127,043 |

| Year 6 | $1,254,160 | $154,160 |

| Year 7 | $1,281,877 | $181,877 |

Total gains of buying a private property: $181,887 – $23,304 = $158,573

As the value of your current HDB is undisclosed, we’re unable to project potential gains. However, looking at the above calculations, selecting the appropriate investment property could potentially yield gains through capital appreciation. Additionally, the rental income would partially offset some expenses, consequently reducing monthly costs. Given that the holding period for the investment property is longer than in Option 1, the gains are higher.

To conclude

Considering your individual affordability, you are in a position to eventually own one HDB and one private property. The question is just which option yields the best outcome for you.

Looking at the calculations and from a logical standpoint, the most favourable choice appears to be the last option of acquiring the private property once your HDB fulfils its MOP, since this only entails a wait of 2.5 years.

However, this option hinges on the condition that your husband’s expected salary increase materialises and your cash savings of $350,000 don’t include the sales proceeds from your current HDB. Should these two figures decrease, this option might become unfeasible, depending on the extent of the reduction.

The alternative to this is solely Option 1 which is to sell the HDB and purchase another under the owner-occupier arrangement, necessitating a 5-year wait before acquiring the investment property.

In pursuing this route, it becomes crucial to assess whether suitable HDB options are available within your husband’s budget. Given the 5-year waiting period for the investment property, allocating a larger portion of your cash savings toward the HDB purchase might expand your choices, considering you have time to accumulate additional funds before acquiring the investment property.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice Should I Pay $500K More For A New Launch — Or Buy A Resale Condo Instead?

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Latest Posts

Singapore Property News This New 588-Unit Tampines Condo Will Launch From $1.486M — With A Mall And MRT Link

Singapore Property News A Rare Freehold CBD Office Unit Is Up For Sale At $20.5M — And Foreigners Can Buy It

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

0 Comments