We Make $10k Per Month And Are In Our 50s. Should We Sell Our 4-Room HDB To Upgrade To A Condo Or EC?

March 3, 2023

Hello,

Thank you for all the insightful articles. We are in a dilemma with some property decision and hope you can advise us.

We live in a 4-room resale HDB which we bought for $388k. Husband is 51 years old and I am 52. Only my husband is working with $10k gross a month, while I’m a sole proprietor selling stuff online. We have 1 kid currently studying in University.

No outstanding loan, CPF used plus accrued interest – $190k from husband and $274k from wife. Husband current OA has $330k (FRS fulfilled); Wife current OA $30k (FRS not fulfil). We have $200k in cash that we can put toward the purchase.

Our goal is to have a retirement nest egg but we’re not sure what the next move is?

1) Sell current HDB and upgrade to a freehold condo

– for growth and eventually leave to our only kid

2) Retain current HDB and buy another small sized freehold condo for rental

– problem is the ABSD

3) Retain current HDB and buy another small sized freehold condo for rental

– using 99-1 ownership (husband + kid) to reduce ABSD

4) Buy 2nd BTO under Essential Occupier; after MOP can get another condo for rental

– problem is age cause selling current HDB need to put to wife’s FRS when reach age 55?

5) How about the option of EC? We are currently thinking of North Gaia, is it a good option?

Hope to hear from you. Thank you for your time and advice.

Hello,

Thanks for writing to us.

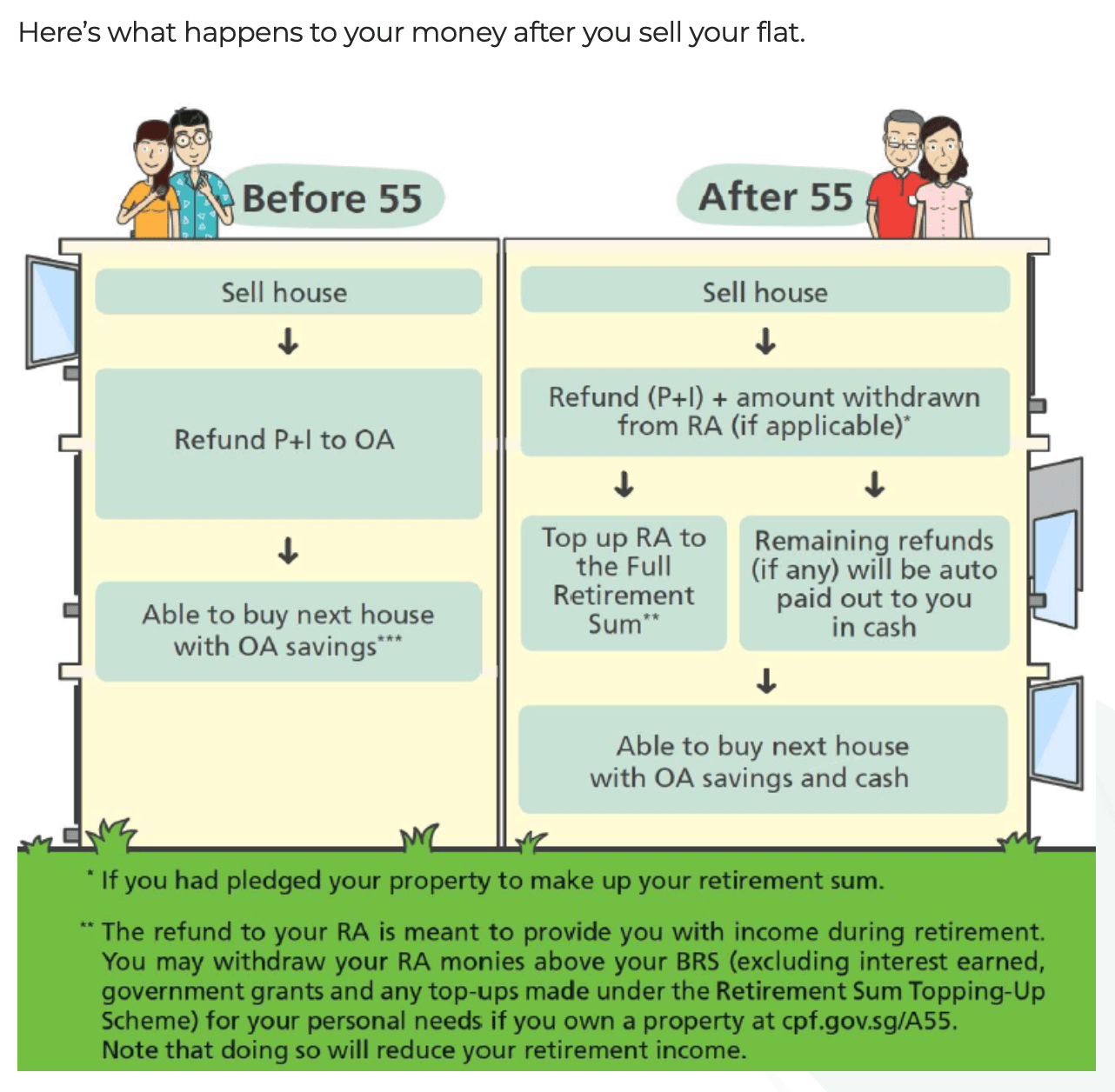

Planning for retirement by switching up your property portfolio can be a stressful process, especially when approaching the age of 55, where a huge chunk of your CPF funds will be locked up in your retirement account. This makes a significant difference in your affordability!

Thankfully, you still have 3 years to play around with.

Here’s how we will structure our answers:

- Running through your affordability should you decide to sell or retain the HDB and thereafter

- Look at the different pathways you’re considering.

- Making our recommendation on what is the best pathway to consider

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability (if you were to sell your current HDB)

Recent 4-room transactions in the area:

| Date | Block | Level | Size (sqm) | Price |

| Jan 2023 | 517 | 10 to 12 | 104 | $510,000 |

| Jan 2023 | 521 | 10 to 12 | 104 | $525,000 |

| Jan 2023 | 522 | 04 to 06 | 104 | $490,000 |

| Jan 2023 | 523 | 10 to 12 | 102 | $523,000 |

| Dec 2022 | 526 | 01 to 03 | 103 | $475,000 |

| Nov 2022 | 519 | 04 to 06 | 105 | $495,000 |

| Nov 2022 | 524 | 10 to 12 | 104 | $530,888 |

We will use the average price of $506,984 for calculation purposes.

| Description | Amount |

| Sale price | $506,984 |

| CPF used plus accrued interest | $464,000 |

| Estimated cash proceeds | $42,984 |

| Description | Amount |

| Maximum loan based on a fixed monthly income of $10,000 and ages 51 and 52 | $706,627 (14-year tenure) |

| Combined CPF funds | $824,000 |

| Cash | $242,984 |

| Total loan + CPF + cash | $1,773,611 |

| BSD based on $1,773,611 | $58,280 |

| Estimated affordability | $1,715,331 |

Affordability (if you were to keep your current HDB)

| Description | Amount |

| Maximum loan based on a fixed monthly income of $10,000 and ages 51 and 52 | $706,627 (14-year tenure) |

| Combined CPF funds | $360,000 |

| Cash | $200,000 |

| Total loan + CPF + cash | $1,266,627 |

| BSD based on $1,266,627 | $35,265 |

| ABSD based on $1,266,627 | $215,327 |

| Estimated affordability | $1,016,035 |

Now that we have a clearer idea of your affordability, let’s take a look at the options you’re considering!

Sell HDB and upgrade to a freehold condominium

We can definitely understand the draw of purchasing a freehold property for legacy planning. One of the most significant advantages of owning a freehold property is its value preservation and growth potential in the long run given there are no lease decay concerns.

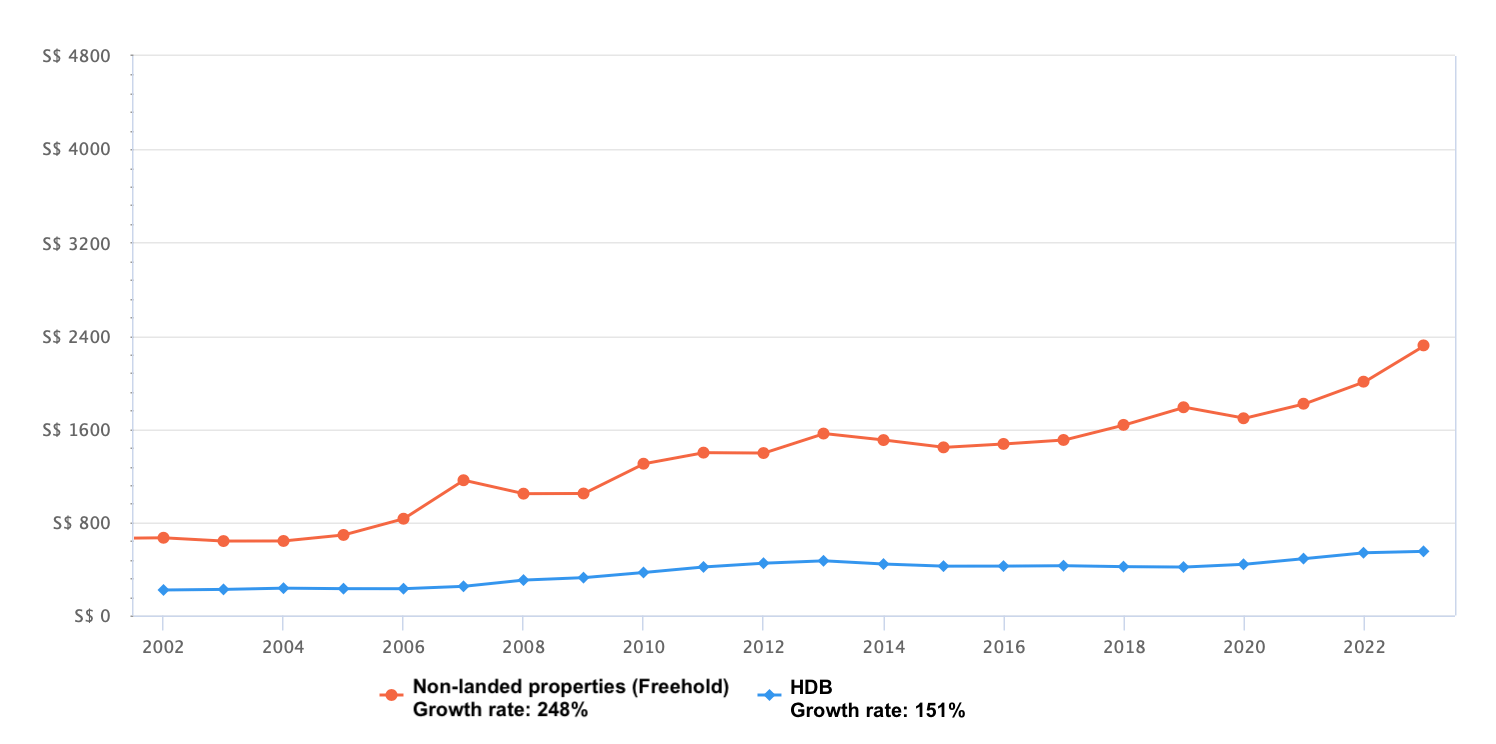

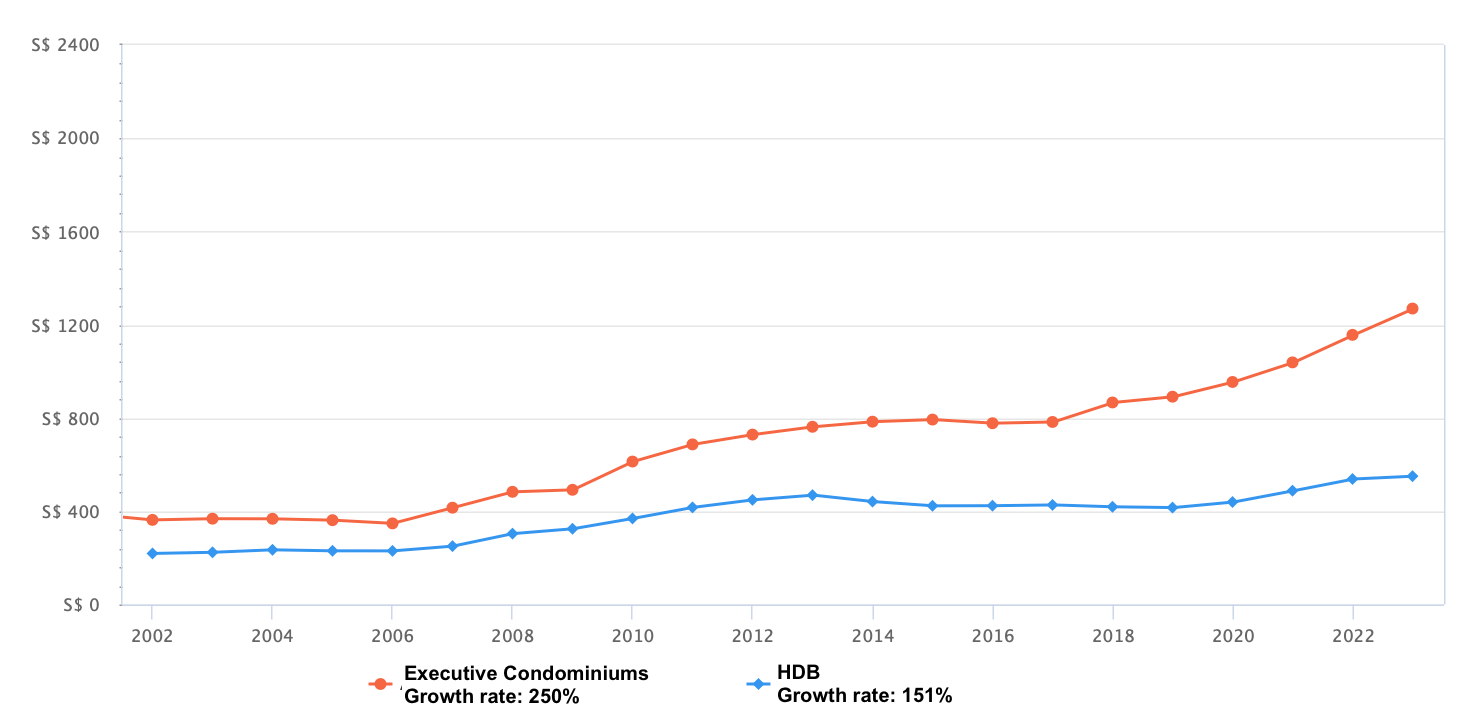

If we were to compare the performance of freehold condominiums versus HDBs over the last 20 years, we can see that the growth rate of freehold condominiums is notably higher than that of HDBs.

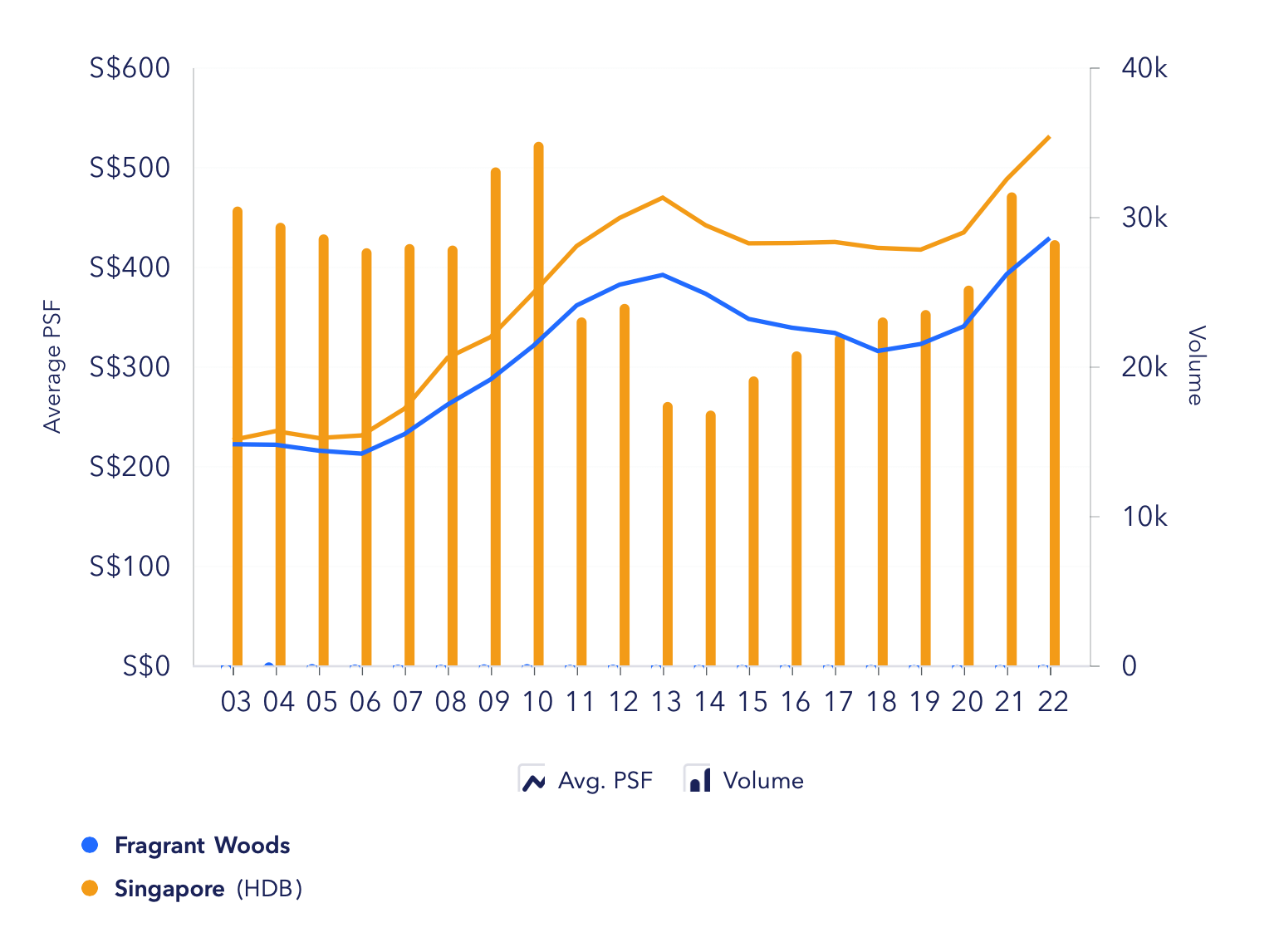

Even though prices of your HDB cluster (Fragrant Woods) are still moving in tandem with the overall HDB market, it might be a wise move to consider selling in the near future seeing as the cluster next to the MRT station (which obtained its MOP last year) is not transacting at a considerably higher price.

Buyers naturally tend to flock towards newer developments if it’s within their means. Based on the recent 4-room transactions, a 6-year-old unit costs $10-$90K more than a 23-year-old unit. With such a slim gap in prices, demand and in turn, prices for older blocks may go down.

These are some of the freehold condominiums within your affordability of $1.7M:

| Project | District | No. of bedrooms | Size (sqft) | Completion year | Asking price |

| Park East | 15 | 2 | 893 | 1994 | $1,650,000 |

| Symphony Heights | 21 | 2 | 926 | 1998 | $1,680,000 |

| Signature Park | 21 | 2 | 1022 | 1998 | $1,650,000 |

| The Blossomvale | 21 | 2 | 840 | 1999 | $1,700,000 |

| Glendale Park | 23 | 2 | 1033 | 2000 | $1,690,000 |

These developments are picked out purely based on the fact that they fit a family of 3 and fall under your affordability, more analysis will have to be done to see if they would be the right fit for you.

Retain current HDB and buy another small freehold condominium for rental

As you have mentioned, the ABSD might pose a challenge if you were to purchase a second property.

If you purchase a resale property, the BSD and ABSD will have to be paid within 14 days of exercising the OTP and this will have to be paid in cash first as there is insufficient time to apply and withdraw the funds from your CPF accounts.

If you do have sufficient funds in your CPF to pay for it, the cash will be reimbursed back to you at a later date. For new launches, you can utilise your CPF funds for the payment of the BSD and ABSD without first having to pay in cash.

Let’s say you were to purchase a $1M property, the BSD ($24,600) and ABSD ($170,000) will amount to $194,600 which is almost all the cash you have on hand. You will then have to top up another $45K for the 5% cash downpayment ($50K – $5K remaining after paying BSD and ABSD).

Another thing to consider would be the time it’ll take to break even on the substantial amount of ABSD that you’ll be paying. Using a rental yield of 3% for a $1M property, it will take 68 months which is 5 years and 8 months just to break even on the ABSD alone (although to be fair, the rental yields are higher today, but just as a conservative measure).

With a $1M budget, the options for a freehold property are limited. If you do a quick search on the property portals, you’ll realise that most of the developments that fall under this search are boutique projects which we do have some apprehensions about. You can read more on that here.

As with 99-year leasehold properties in general, we can expect the price of the HDB to gradually decline as it ages. As we have brought up earlier, with such a narrow price gap between a much newer cluster and your unit that is 23 years old, demand for your HDB may dwindle which will affect prices so we will not advise holding on to the HDB for the long term.

Retain current HDB and buy another small freehold condominium for rental using 99-1 ownership

The 99-1 ownership method will not actually reduce the ABSD amount as your husband is still purchasing a second property. So in this case, it will be similar to the above pathway. Another important thing to note is that your son will need to be eligible to take on the full loan for the property if he buys it over.

Buy a second BTO with one party as an Essential Occupier and get another condo for rental after MOP

As you’ve rightly pointed out, the issue with buying a second BTO is that by the time it’s complete, it will be 3 – 5 years down the road which means you would have turned 55.

Let’s say you manage to get a BTO that completes in 2026 which is also the year you turn 55. The FRS then will be $220,400 and the BRS will be $110,200. Let’s take a look at your affordability then.

For calculation purposes, we will assume that your current HDB price stays the same for the next 3 years:

| Description | Amount |

| Sale price | $506,984 |

| CPF used plus accrued interest (Husband) | $204,609 |

| CPF used plus accrued interest (Wife) | $295,068 |

| Estimated cash proceeds | $7,307 |

| Description | Amount |

| Existing OA (Husband) | $355,374 |

| CPF refund after sale that can be used for next property (Husband) | $204,609 |

| Existing OA (Wife) | $32,307 |

| CPF refund after sale that can be used for next property (Wife) | $184,868 |

We’re assuming your plan is for you to be the owner of the HDB and your husband the essential occupier who will go on to purchase the second property after the HDB obtains its MOP. This may not be feasible as you are not drawing an income and will not be eligible for a loan.

Even though there is a substantial amount of CPF funds after setting aside the BRS, it is most likely that you will still require a loan to make up for the shortfall. As an essential occupier, your husband’s income will not be taken into consideration for the loan and his CPF funds cannot be utilised. Even if we were to do the reverse, with your husband as the owner and you as the essential occupier, you will not be able to purchase the second property. For this to work, you will have to secure a job so that you’re able to apply for a loan.

In the event you manage to take a loan, your husband will only be able to purchase the second property in 2031 and he’ll be 59 by then. His loan amount will be reduced due to a shorter tenure. Presuming he continues to make $10K a month, the maximum loan will be $351,546 for a 6-year tenure.

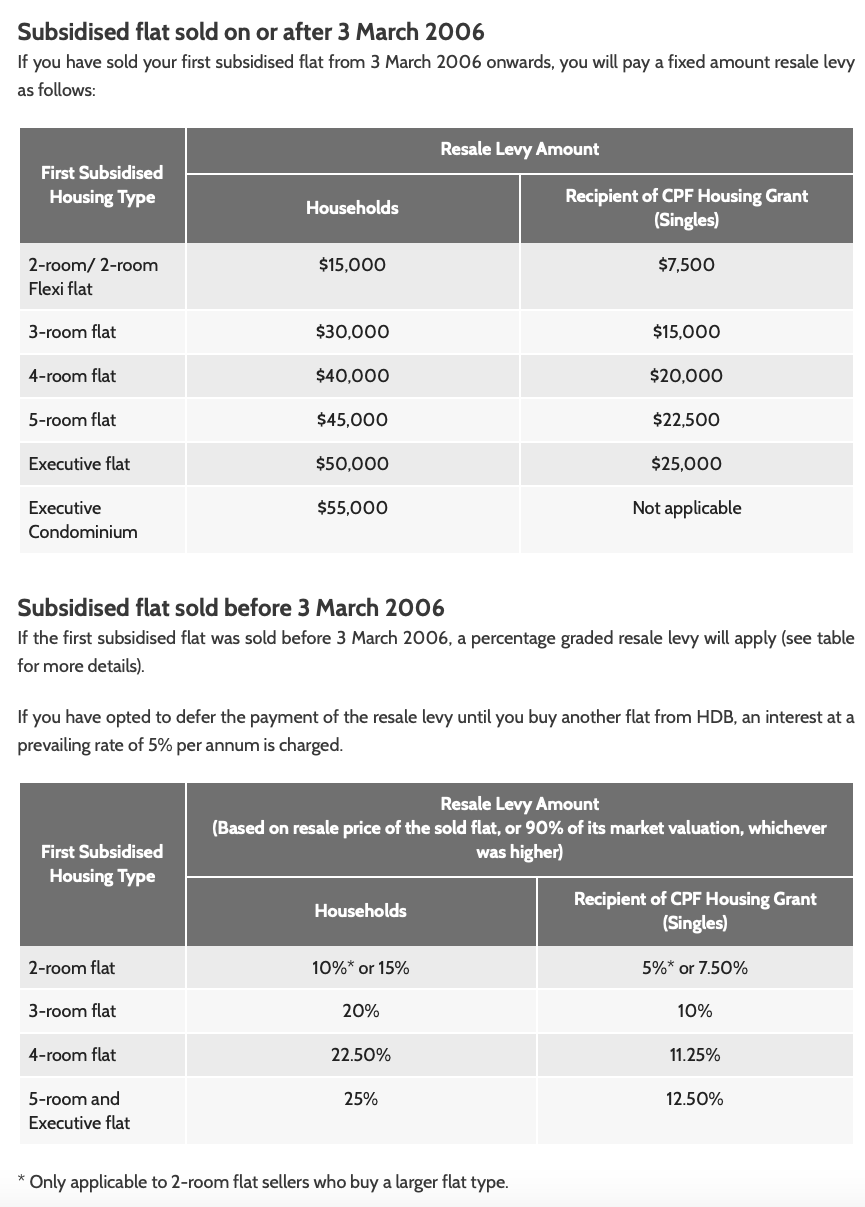

Another thing to note with buying a second BTO is the resale levy. Depending on the unit type and when you sold your first subsidised flat, the amount payable will vary. Plus, this resale levy has to be paid in cash.

Sell HDB and upgrade to a new EC

Executive Condominiums (ECs) are designed to cater to the needs of the sandwiched class and not everyone is eligible to purchase one. New ECs are subsidised and still come with full condo facilities which makes them especially attractive for buyers. There are also special rules that allow you to avoid having to pay the ABSD if you buy an EC from a developer.

We can see from the graph above that ECs have been growing at a notably higher rate than HDBs over the last 20 years.

If you were to purchase a brand new EC from a developer, do note that your loan amount will be reduced as the loan calculation is based on the Mortgage Servicing Ratio (MSR) and a resale levy is also payable. Your maximum loan for a brand new EC is $385,433 for a 14 year tenure.

Affordability if you were to purchase a brand new EC without first selling your HDB:

| Description | Amount |

| Maximum loan based on fixed monthly income of $10,000 and ages 51 and 52 | $385,433 (14 year tenure) |

| Combined CPF funds | $360,000 |

| Cash | $200,000 |

| Total loan + CPF + cash | $945,433 |

| BSD based on $945,433 | $22,962 |

| Estimated affordability | $922,471 |

Affordability if you were to sell your HDB before purchasing a brand new EC:

| Description | Amount |

| Maximum loan based on fixed monthly income of $10,000 and ages 51 and 52 | $385,433 (14 year tenure) |

| Combined CPF funds | $824,000 |

| Cash | $242,984 |

| Total loan + CPF + cash | $1,452,417 |

| BSD based on $1,452,417 | $42,696 |

| Estimated affordability | $1,409,721 |

Unfortunately, there are no available units that fall within either price range for the existing EC launches. You could consider waiting for the upcoming launches but based on one of the latest EC developments, Copen Grand, prices for the 2 bedroom units were starting from $1.09M. This would mean you’ll likely have to sell your HDB before purchasing and will have to rent in the meantime. That may not be the best option as the project could take 3 – 4 years to build and the accumulated rental will be pretty substantial.

Alternatively, you can also consider looking at some of the younger resale ECs. In this case, the loan will be based on the Total Debt Servicing Ratio (TDSR) so your affordability will be at $1.7M and the resale levy will not be payable. These are a couple that is available on the market:

| Project | District | No. of bedrooms | Size (sqft) | Completion year | Asking price |

| The Terrace | 19 | 3 | 1076 | 2018 | $1,380,000 |

| Westwood Residences | 22 | 3 | 1033 | 2018 | $1,200,000 |

| Wandervale | 23 | 3 | 1130 | 2019 | Starting from $1,400,000 |

| Sol Acres | 23 | 3 | 1098 | 2019 | $1,480,000 |

| Parc Life | 27 | 3 | 936 | 2018 | Starting from $1,288,000 |

Similarly, these projects are picked out purely based on the fact that they fit a family of 3 and fall within your affordability so it is advisable to consult an agent for further analysis.

After crunching all the numbers, there’s one glaring fact that’s not yet mentioned…

Being in the early 50s isn’t considered old, but in the context of buying a property and taking on a loan, it’s definitely something to really mull over.

Given your situation, it seems that relying on a single stable income of $10,000 is quite risky. Your affordability largely depends on this income – and should this source of income disappear, you’d be left in a very difficult situation of having to service a monthly loan without some sort of safety net.

In this situation, you’d be forced to drastically change your lifestyle, dip into your savings or sell your home. All of this incurs cost, and you may have to sell at a lower price than where you bought at.

You did mention that you’re a sole proprietor of an online shop, however, we don’t have any visibility on this nor can we say that it’ll continue to do well enough to service your loan.

As such, making any steps to upgrade is a risky move, in our opinion, and should really only be considered if you have a large amount of liquid cash you can rely on or if you are very certain of the stability of your job till 65 when the loan is paid off.

Conclusion

Since legacy planning is something that you’re taking into consideration, an HDB may not be the best type of property to leave behind as your son will have to meet certain eligibility requirements in order to inherit the house. For example, if he gets married further down the road and buys an HDB, he will need to dispose of one of the HDBs.

Holding on to the HDB and purchasing a second property for rental may not be ideal since there is the hurdle of the hefty ABSD and the amount of time it’ll take to just break even on that.

Purchasing a second BTO with one party as the essential occupier and going on to buy a second property after the HDB obtains its MOP will not be feasible unless both parties are individually eligible for a mortgage loan. Even so, it will take at least 8 – 10 years before the essential occupier can purchase the second property, and the loan tenure will be very much shortened, reducing the loan amount. While your husband could be earning $10K now, it’s hard to predict how long this income can be sustained with the number of years you’ll need to wait.

Also, seeing as how the price gap between your unit and the neighbouring newly MOP-ed cluster is rather slim, demand and prices for older units like yours may go down in the future. From the calculations above, we can see that in just three years, your cash proceeds will significantly reduce due to the CPF accrued interest and this is if prices remain as it is.

As such, it does make sense to sell the HDB while it’s a positive sale now and upgrade to either a freehold property or an EC which has better value retention and possibly growth potential. However, we would only do so on the pretext that you have a large enough cash (or cash equivalent) invested elsewhere or if you have great certainty that the job can be kept till the loan is paid off.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments