Top 5 Selling New Launches Of Q2 2020: What Makes Them Stand Out?

September 4, 2020

The top selling new launches of Q2 2020 should be interesting to any buyer right now, for one reason: it was the period in which the Circuit Breaker was in full swing.

But even with the show flats closed, and most property agents unable to meet in person, these properties managed to draw buyers; some of whom made purchases just based on brochures and virtual tours.

These are the developments that not only survived but thrived during the dark times of Q2 2020, according to Property Guru’s latest market report:

1. Treasure at Tampines (185 units sold)

2. Parc Clematis (154 units sold)

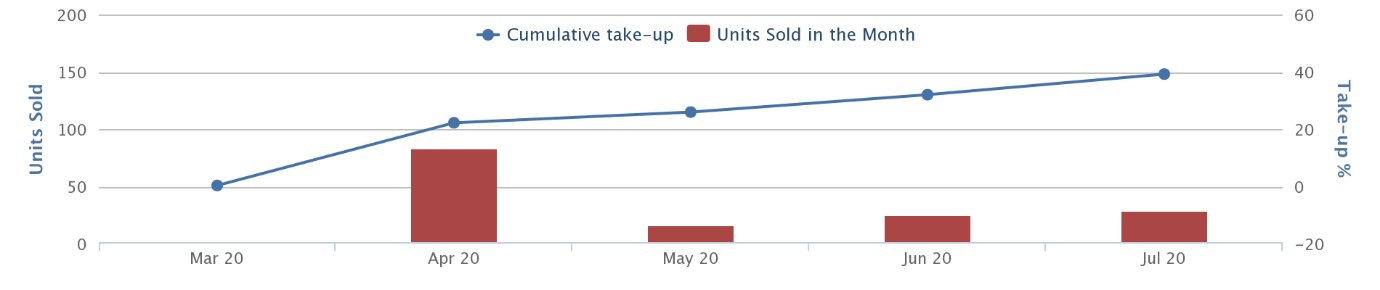

3. The Florence Residences (150 units sold)

4. Parc Esta (137 units sold)

5. Kopar at Newton (121 units sold)

It’s worth noting that these aren’t ranked by a fancy algorithm that takes into account the size of the development – so naturally (with the exception of Kopar at Newton), the top 4 spots are all occupied by the current mega new launches.

Anyhow, here’s a look at why these projects seem to stay in demand, despite the Circuit Breaker and subsequent downturn:

1. Treasure at Tampines

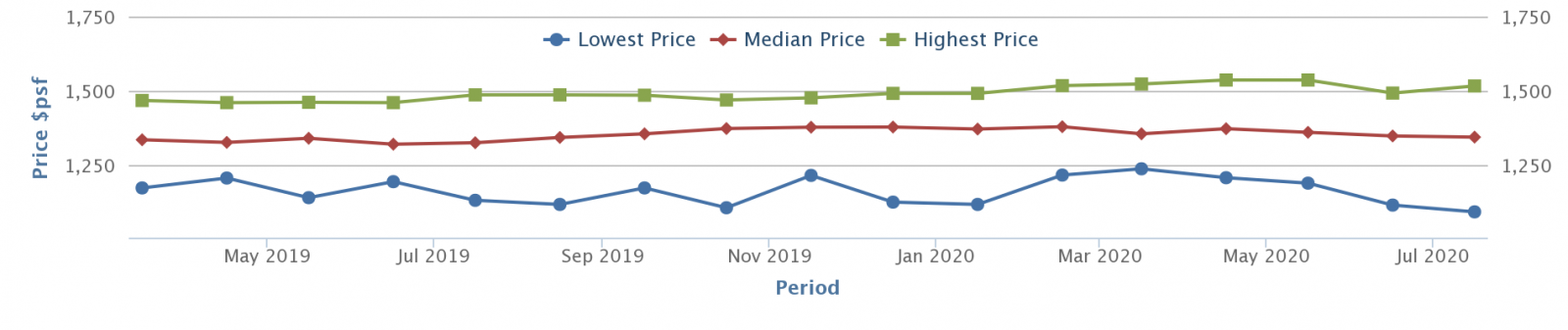

At present, the median developer’s price for Treasure at Tampines averages $1,344 psf. The current highest price is $1,516 psf, while the current lowest price is $1,092 psf.

The average recorded transaction price is $1,355 psf.

The cumulative take-up rate stands at 62.3 per cent – this means it has sold a staggering 1,372 units so far.

Key factors to note:

- Treasure at Tampines is a mega-project, and the largest development to date with 2,203 units.

- This is likely to be one of the most populated developments in Singapore, upon completion

- Some buyers are keeping an eye on the five-year ABSD time limit, given the size of the development

It’s unsurprising that this project tops the list, as it’s one of the most talked-about developments. Treasure at Tampines is possibly the largest condo we’ve ever seen in Singapore.

We have a more in-depth review of Treasure at Tampines. But to summarise, the main appeal of this project is the price given its location.

Tampines is one of the regional centres of Singapore. Tampines saw home prices more than double, from around $660 psf to about $1,370 psf between 2009 and 2018 alone; so you can see why market watchers would be surprised at this condo’s present average of just $1,355 psf.

(It’s even a new launch too).

On the other hand, detractors will point out that the large number of units is a concern. This is likely to be the most populated private development in Singapore once it’s done. That can pose rental and resale challenges, with so much potential competition.

A small subset of buyers are also keeping one eye on the development, and may act when the ABSD encroaches.

Developers face 30 per cent ABSD on the land price, if the whole development isn’t finished and sold off within five years. As such, some buyers are keeping an eye on huge developments like Treasure at Tampines; 2,203 units is a lot to complete and sell in the time limit.

It’s not an impossible occurrence, as the recent fire sale at 38 Jervois proves.

Fact sheet:

Address: Tampines Lane, District 18

Developer: Sim Lian (Treasure) Pte. Ltd.

Tenure: 99-years

Expected TOP date: Est. Dec. 2023

Units: 2,203

Land size: Approx. 650,000 sq. ft.

2. Parc Clematis

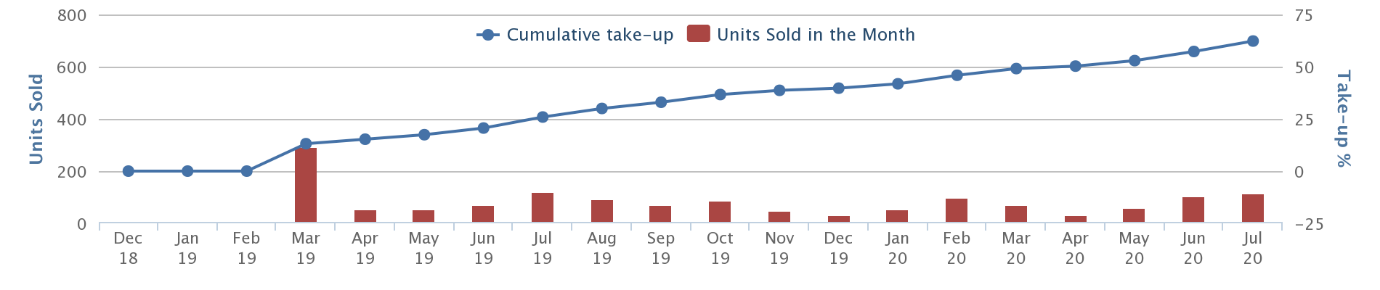

At present, the median developer’s price for Parc Clematis averages $1,649 psf. The current highest price is $1,739 psf, while the current lowest price is $1,044 psf.

The average recorded transaction price is $1,633 psf.

The cumulative take-up rate stands at 57.2 per cent – so it has sold 840 units thus far.

Key factors to note:

- Primary draw comes from being between well-located in Clementi, which is between Jurong and One-North

- Close to a lot of educational institutions

- Many of the same size mega-project issues as Treasure at Tampines

New Launch Condo ReviewsParc Clematis Review: An Astounding 400,000 sqft of Facilities At Your Doorstep

by Reuben DhanarajClementi already recorded a strong number of transactions (1,160) between 2019 and 2020, and these were already being driven by Parc Clematis and Whistler Grand. In fact in July, Parc Clematis was also a top selling condo, with 605 transactions.

Clementi benefits from being in between Jurong (Singapore’s “second CBD”) and One-North (a major tech and media hub). This makes it of interest to landlords, who see easy rentability for foreign workers.

But as a double-whammy, Clementi also has strong appeal to homeowners. Besides being a mature district, Clementi provides quick access to institutions like NUS, Singapore Polytechnic, and Nan Hua.

As such, it’s not a surprise that new condo launches in this area – such as Parc Clematis – are bound to draw attention.

That said, there are many of the same mega-project issues as Treasure at Tampines (see above). The large number of units can be a challenge to resale and rental prospects, even in a desirable location like Clementi.

And while Parc Clematis is not as huge as Treasure at Tampines, we shouldn’t forget it’s got 1,468 units; and it’s also within 10 minutes of Clementi Mall and the MRT station. That’s a potential for major noise pollution, so be careful of the unit you pick (we have a more in-depth guide for Parc Clematis on Stacked).

Fact sheet:

Address: Jalan Lempeng, District 05

Developer: Sing- Haiyi Gold Pte. Ltd.

Tenure: 99-years

Expected TOP date: Est. 2023

Units: 1,468

Land size: Approx. 633,644 sq. ft.

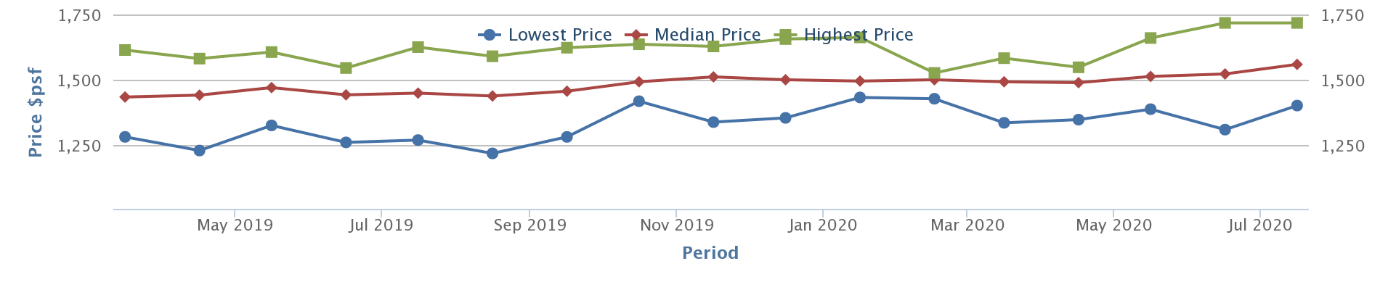

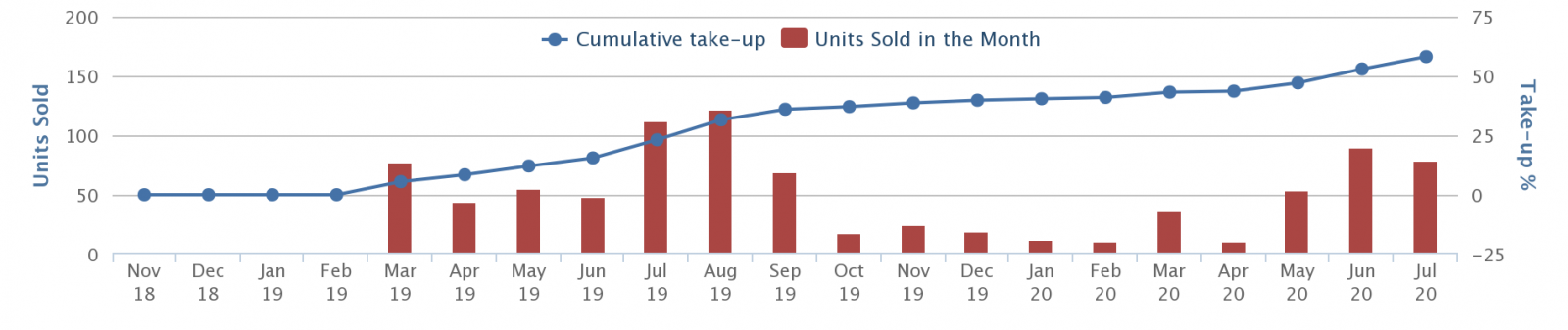

3. The Florence Residences

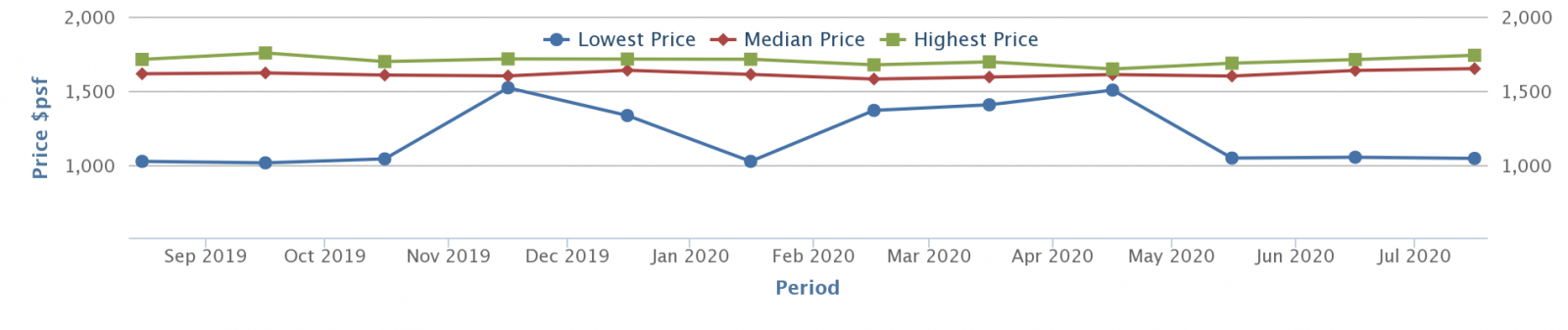

At present, the median developer’s price for The Florence Residences averages $1,559 psf. The current highest price is $1,718 psf, while the current lowest price is $1,401 psf.

The average recorded transaction price is $1,526 psf.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Units Of The Week Issue #17

Ever heard of the phrase, "old is gold"? Well, this week in our Units Of The Week issue, we've decided…

The cumulative take-up rate now stands at 58.1 per cent, this means it has sold a total of 819 units so far.

Key factors to note:

- Good rentability, due to proximity to Defu Industrial Park

- A surprising turnaround for this development, which struggled a bit at launch

- A lot of competition in the area

Florence Residences has defied some initial hand-waving by investors. At the time of launch in 2019, this development saw a lukewarm response; 54 out of 200 available units were sold, with pricing in the range of $1,450 psf.

This was due to a fact that hasn’t changed – the surrounding area includes condos like Affinity at Serangoon and Riverfront Residences, which can provide some competition (we explore this in greater detail in our full review). This isn’t helped by the size of The Florence Residences (1,410 units).

It may also have taken investors a while to get used to the overall idea of a luxury property in Hougang.

So it’s a bit of a surprise to see The Florence Residences make a turnaround, and become one of the best selling properties throughout the Circuit Breaker period.

There are two factors that could be working in its favour here:

First, a price of $1,559 psf is very palatable compared to a lot of new launches at present. Most buyers would expect to pay in the range of $1,600 psf for a new condo, even in a fringe region.

Second, it’s close to Defu Industrial Park (this isn’t the noisy type of industrial park; company types include infocomm and media, clean energy companies, and biomedical research). This provides solid rentability, as well as amenities like eateries.

Fact sheet:

Address: Hougang Ave. 2, District 19

Developer: Florence Development Pte. Ltd.

Tenure: 99-years

Expected TOP date: Est. 2023

Units: 1,410

Land size: Approx. 389,239 sq. ft.

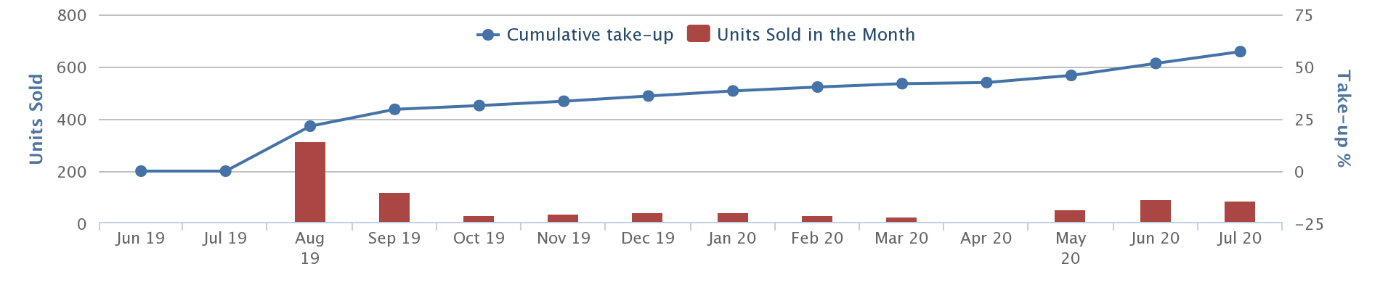

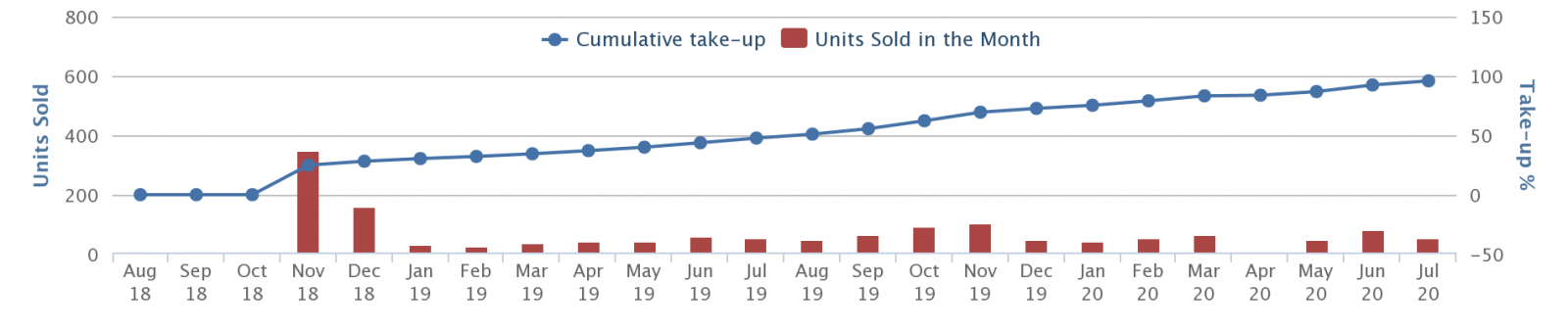

4. Parc Esta

At present, the median developer’s price for Parc Esta averages $1,710 psf. The current highest price is $2,006 psf, while the current lowest price is $1,584 psf.

The average recorded transaction price is $1,696 psf.

The cumulative take-up rate now stands at 95.9 per cent, this means it has sold a total of 1,342 units in total.

Key factors to note:

- A direct beneficiary of the nearby Paya Lebar Quarter business hub

- Across the road from Eunos MRT station

The price for Parc Esta caused some buyers to balk at first; but buyers probably came around after prices at Park Place Residences – in the heart of Paya Lebar Quarter – began to average $2,050 psf.

At that point, Parc Esta became a real contender: it’s just one train stop from PLQ, but is significantly more affordable.

(PLQ, by the way, is a business hub that contains major malls and grade A office space. This greatly improves the rentability of properties like Parc Esta, which are in an adjoining neighbourhood).

Eunos is also a mature neighbourhood etc., but – to be blunt – for $1,696 psf the draw is being near the MRT station, and PLQ. If you’re not interested in either of those, you should shop around a bit more.

Parc Esta is right along a main road, so do keep in mind the unit facing. We have a full review that covers this in more detail.

Fact sheet:

Address: Sims Avenue, District 14

Developer: Florence Development Pte. Ltd.

Tenure: 99-years

Expected TOP date: Est. 2022

Units: 1,399

Land size: Approx. 376,716 sq. ft.

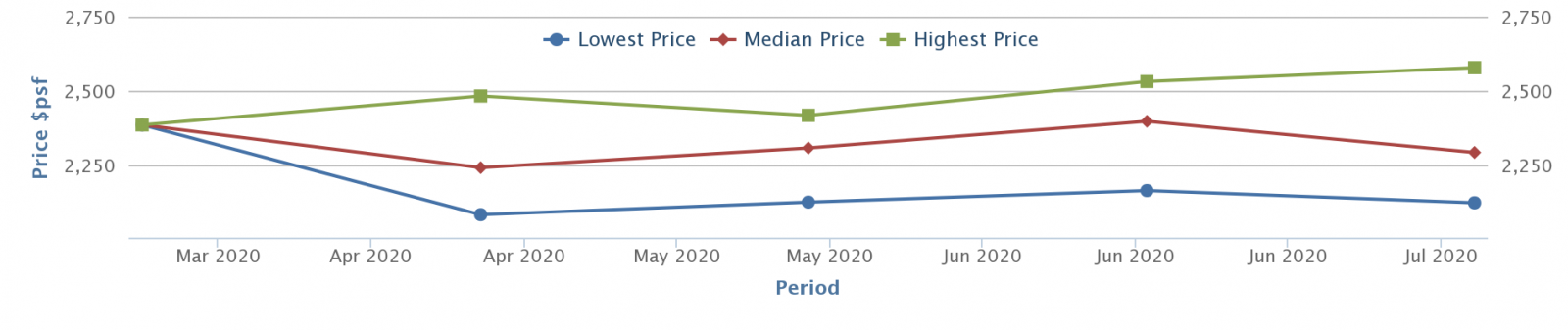

5. Kopar at Newton

At present, the median developer’s price for Kopar at Newton averages $2,292 psf. The current highest price is $2,578 psf, while the current lowest price is $2,123 psf.

The average recorded transaction price is $2,298 psf.

The cumulative take-up rate now stands at 39.2 per cent, which means it has sold a total of 148 units so far.

Key factors to note:

- Located right next to Newton MRT

- Only 30 per cent of land space is used for the condo units

- High price point, and surrounded by freehold properties

It’s a big surprise to see Kopar at Newton on this list, considering the price. At an average of $2,298 psf, and three-bedders reaching around $2 million, you wouldn’t think it wouldn’t be this easy to move units.

And yet, here it is in the top five, despite that luxury price tag and the Covid-19 downturn.

The draw of Kopar at Newton is quite straightforward – it’s right at the foot of the Newton MRT station. While there are other condos nearby (e.g. Newton Edge and Parc Centennial), none are as close as this project.

Also, only 30 per cent of the land space is used for units. This means just 378 units; it’s on the small end, so it does help retain some semblance of privacy.

Kopar at Newton is not the most affordable property however; and at $2,298 psf, some buyers are bound to wonder if the high rentability is offset by what’s likely to be a low yield (it has quite a high maintenance). It doesn’t help that Kopar at Newton is leasehold rather than freehold, which makes the price seem steeper.

Fact sheet:

Address: 150 Kampong Java Road, District 9

Developer: CELH Development Pte. Ltd.

Tenure: 99-years

Expected TOP date: Est. 2023

Units: 378

Land size: Approx. 125,326 sq. ft

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the top-selling new property launches in Singapore during Q2 2020?

Why did Treasure at Tampines sell so many units during the circuit breaker period?

How does Parc Clematis appeal to buyers despite its large size?

What makes The Florence Residences stand out as a top seller in 2020?

Why is Kopar at Newton included among the top-selling launches despite its high price?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Picks

Property Picks Where to Find Singapore’s Oldest HDB Flats (And What They Cost In 2025)

Property Picks Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

0 Comments