The US Just Changed How Property Agents Get Paid: Will Singapore Be Next?

September 1, 2024

Every now and then, it’s good to take a page from how other countries regulate their property agents

Because everywhere in the world, there’s a general similarity in their profession: it’s a shark-eat-shark world out there, and the administrative work would traumatise a whole department of secretaries (you think I’m joking, but wait till you have to sort through 50+ calls for the serious inquiries – per day, during a rental rush).

Unfortunately, this sort of high-pressure job does lead some (but not all) agents to find any way they can to earn more, at lower costs. That beast is hungry, and it will be fed; sometimes at the cost of buyers and sellers. Case in point: seller agents who refuse to answer buyers’ agents because they don’t want to co-broke (they don’t want to split the commissions). These issues aren’t unique to Singapore; buy a property anywhere in the world, and you’ll run into some variants of such issues.

This makes two recent changes in the US quite interesting, and perhaps something we could consider with some variance:

First, seller’s agents in the US can no longer advertise the commissions paid to buyer’s agents. Now in Singapore, we don’t typically have this issue, as they aren’t advertised on a platform like the MLS in the US. As such, buyer agents there could effectively choose which listings to go for, a practice called “steering”. This means that they may not act in their client’s best interest, something similar to how certain unscrupulous agents would behave when it comes to new launches in Singapore.

In the US, buyers didn’t have to pay their real estate broker directly. It’s similar to Singapore where the commission fees to the buyers’ agent and the sellers’ agent were paid by a home seller.

As in Singapore, the norm is a two per cent commission paid by the seller and split between the buyer and seller. However, this isn’t set in stone – and there can be variations, such as the buyers being asked to pay their own agent’s commissions. We’ve also heard of some seller’s agents wanting a bigger share (e.g., a three per cent commission where they take two per cent), due to bigger marketing spend.

In essence, what’s needed is more transparency in the way agents deal with each other; and perhaps regulations on whether agents can dodge listings due to co-broking issues. This matters a lot to buyers and sellers, as it could mean the right property being taken off the radar, simply because of the way agents split their fees.

Second, for buyers’ agents in the US, there’s now a legally binding representation agreement, between buyers and their agents. This spells out a number of things in black and white – such as clarifying that if the seller isn’t going to pay their agent’s commission, then they have to. It also ensures every buyer is clear on their agent’s interests, and how that agent earns a commission.

It’s also a plus for the agent concerned, as it prevents potential legal disputes later. Buyers have less leeway to say they were misled, or that the terms weren’t made clear to them. There’s the added bonus that buyers can’t try to go behind the agent’s back, concluding the deal for cheaper after cutting the agent out of the loop.

(Whilst agents can take legal action for that right now, it’s often expensive and time-consuming, and may be a cost to them even if they win).

More from Stacked

When Renting In Singapore Is The Smarter Move — And Buying Can Wait

There’s a certain taboo in Singapore toward renting, though a good deal of it is self-inflicted. I’ve never actually heard…

In any case, such changes will be beneficial for the homebuyers in the long run, as not-so-good agents can weeded out.

Meanwhile, CCR condo prices are giving hints of a pick-up

It’s best not to read too much into monthly price movements, but it’s interesting to see that CCR condo prices were up 2.8 per cent in July. This is after around a straight quarter of declining prices.

The CCR took the heaviest hit from revised ABSD rates, as foreigners and entities now pay 60 per cent ABSD. This is significant for the CCR, as this demographic is a significant buyer group for the region. One of the reasons given was the number of million-dollar flats we’re seeing, which could be the case – it’s plausible that some HDB upgraders might seize this recent opportunity, to snap up lower-priced resale units in the CCR.

But another possible reason is the narrower price gap between CCR and RCR properties, which we detailed here. With the market’s reaction to the new ABSD rates, now might be an ideal time for some to upgrade from RCR to CCR homes. Another part of the allure could be that many CCR condos are freehold – so even some fringe region condo owners, who dislike leasehold status, may be jumping on the chance to upgrade.

We’ll be keeping an eye on the region going forward; but for now, we wouldn’t be surprised if more upgraders move on the CCR, given the dip in prices. It will be interesting to see how quickly the prices bounce back from recent cooling measures.

In other property news this week:

- We found some 1700+ sq.ft. condos that you can buy for under $2 million

- There’s grumbling on the ground that our middle-class homeowners are being marginalised. But how true is this, exactly?

- An affordable rental asset, with good yields at just $545,000 or so. Impossible to find today? Not quite, here are a few (and no, it’s not just a bunch of cheap properties in Geylang!)

- Check out how to min-max your space and budget, and see how much can really be done with the ubiquitous 4-room flat.

Weekly Sales Roundup (19 August – 25 August)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| WATTEN HOUSE | $4,956,000 | 1539 | $3,220 | FH |

| TEMBUSU GRAND | $4,244,000 | 1711 | $2,480 | 99 yrs (2022) |

| THE RESERVE RESIDENCES | $4,223,900 | 1625 | $2,599 | 99 yrs (2021) |

| THE CONTINUUM | $3,098,000 | 1087 | $2,850 | FH |

| THE BOTANY AT DAIRY FARM | $3,073,000 | 1539 | $1,996 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| KASSIA | $992,000 | 474 | $2,095 | FH |

| ONE BERNAM | $1,500,000 | 463 | $3,241 | 99 yrs (2019) |

| HILLHAVEN | $1,582,142 | 700 | $2,261 | 99 yrs (2023) |

| LENTORIA | $1,595,000 | 732 | $2,179 | 99 yrs (2022) |

| THE CONTINUUM | $1,951,000 | 667 | $2,923 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| LEEDON RESIDENCE | $5,850,000 | 2131 | $2,745 | FH |

| SILVERSEA | $5,050,000 | 2519 | $2,005 | 99 yrs (2007) |

| ST THOMAS SUITES | $4,350,000 | 1819 | $2,391 | FH |

| MARINA BAY RESIDENCES | $3,800,000 | 1636 | $2,323 | 99 yrs (2005) |

ST REGIS RESIDENCES SINGAPORE | $3,800,000 | 1507 | $2,522 | 999 yrs (1995) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE HILLFORD | $615,000 | 398 | $1,544 | 60 yrs (2013) |

| MILLAGE | $710,000 | 420 | $1,691 | FH |

| THE ALPS RESIDENCES | $710,000 | 441 | $1,609 | 99 yrs (2015) |

| URBAN VISTA | $723,800 | 441 | $1,640 | 99 yrs (2012) |

| PARC RIVIERA | $760,000 | 463 | $1,642 | 99 yrs (2015) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE TREVOSE | $3,360,000 | 1894 | $1,774 | $2,020,000 | 22 Years |

| HIGHGATE | $2,588,000 | 1636 | $1,582 | $1,848,000 | 21 Years |

| THE WATERINA | $2,630,000 | 1302 | $2,019 | $1,810,391 | 22 Years |

| SANCTUARY GREEN | $2,950,000 | 1808 | $1,631 | $1,765,200 | 25 Years |

| LEEDON RESIDENCE | $5,850,000 | 2131 | $2,745 | $1,463,040 | 9 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MARINA BAY RESIDENCES | $1,500,000 | 721 | $2,080 | -$200,000 | 14 Years |

| LUMIERE | $1,110,000 | 678 | $1,637 | -$180,000 | 14 Years |

| 76 SHENTON | $1,900,000 | 980 | $1,940 | -$68,400 | 14 Years |

| REZI 35 | $1,398,000 | 926 | $1,510 | -$14,700 | 6 Years |

| KINGSFORD WATERBAY | $1,150,000 | 850 | $1,352 | -$4,000 | 6 Years |

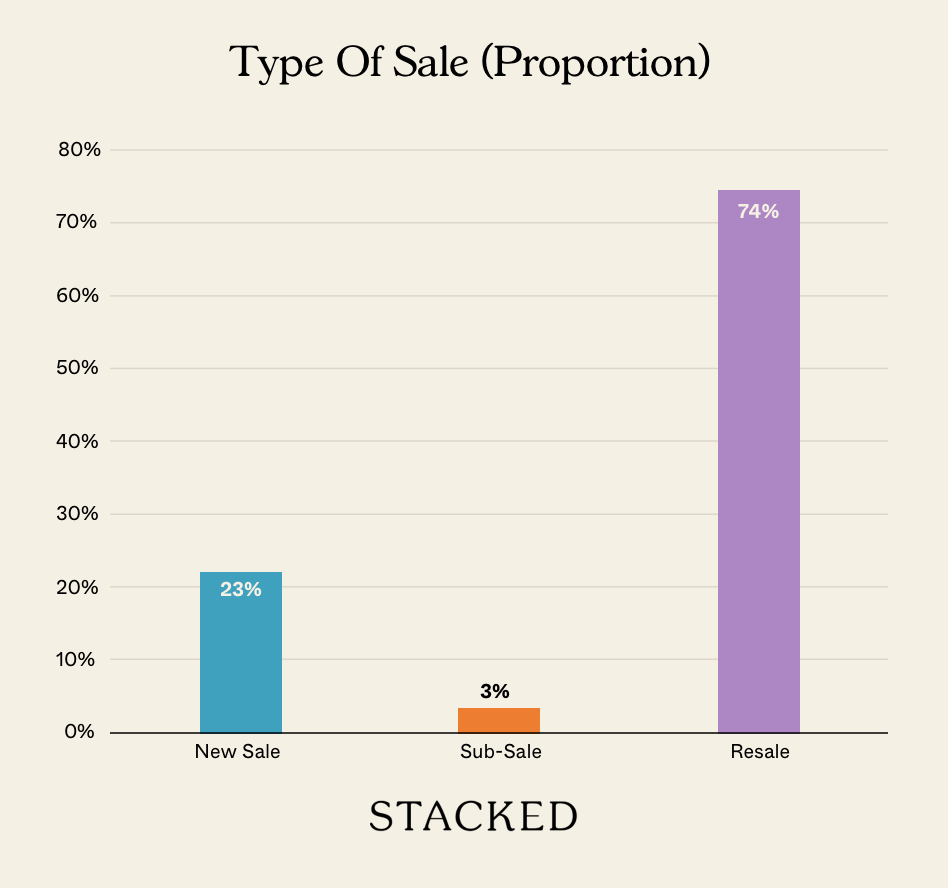

Transaction Breakdown

For more news on the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How has the US changed the way property agents get paid, and could Singapore adopt similar rules?

What is the purpose of the new legally binding agreement between buyers and their agents in the US?

Are property prices in the CCR area showing signs of recovery after recent declines?

How affordable are some condos in Singapore currently, and what are the options for buyers on a budget?

What are the recent top sales and resale property trends in Singapore’s property market?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News An Older HDB Executive Maisonette Just Sold For $1.07M — And It Wasn’t In A Mature Estate

Singapore Property News Why The Feb 2026 BTO Launch Saw Muted Demand — Except In One Town

Singapore Property News One Of The Last Riverfront Condos In River Valley Is Launching — From $2,877 PSF

Singapore Property News When A “Common” Property Strategy Becomes A $180K Problem

Latest Posts

Editor's Pick We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Pro This Singapore Condo Skipped 1-Bedders And Focused On Space — Here’s What Happened 8 Years Later

Editor's Pick Why Some Old HDB Flats Hold Value Longer Than Others

0 Comments