Buying Singapore Property In A Downturn: Can You Still Lose Money?

October 26, 2023

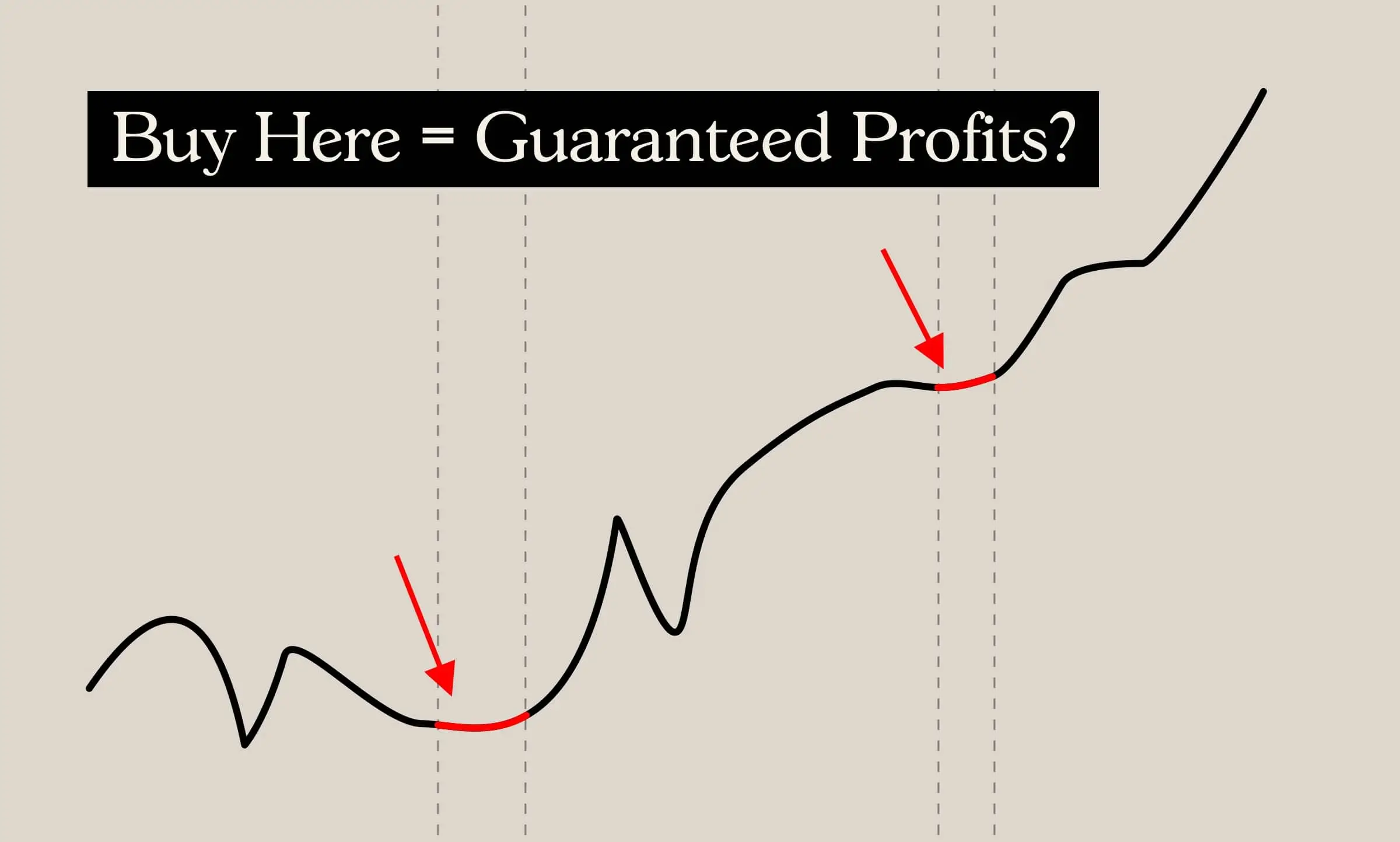

We’re often warned to avoid “buying at the peak” as if it’s possible to identify when exactly that is (you never truly know except in hindsight, right?). But this tends to distract from a very important fact: timing the property market requires two right decisions, and not just one. Buying at the right time is only half the process – you also need to know the right time to sell. If you can get one right and the other wrong, you could still end up losing money. In the following analysis, we delve into properties that, on paper, were acquired at seemingly “ideal” times. Let’s explore how their outcomes unfolded.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

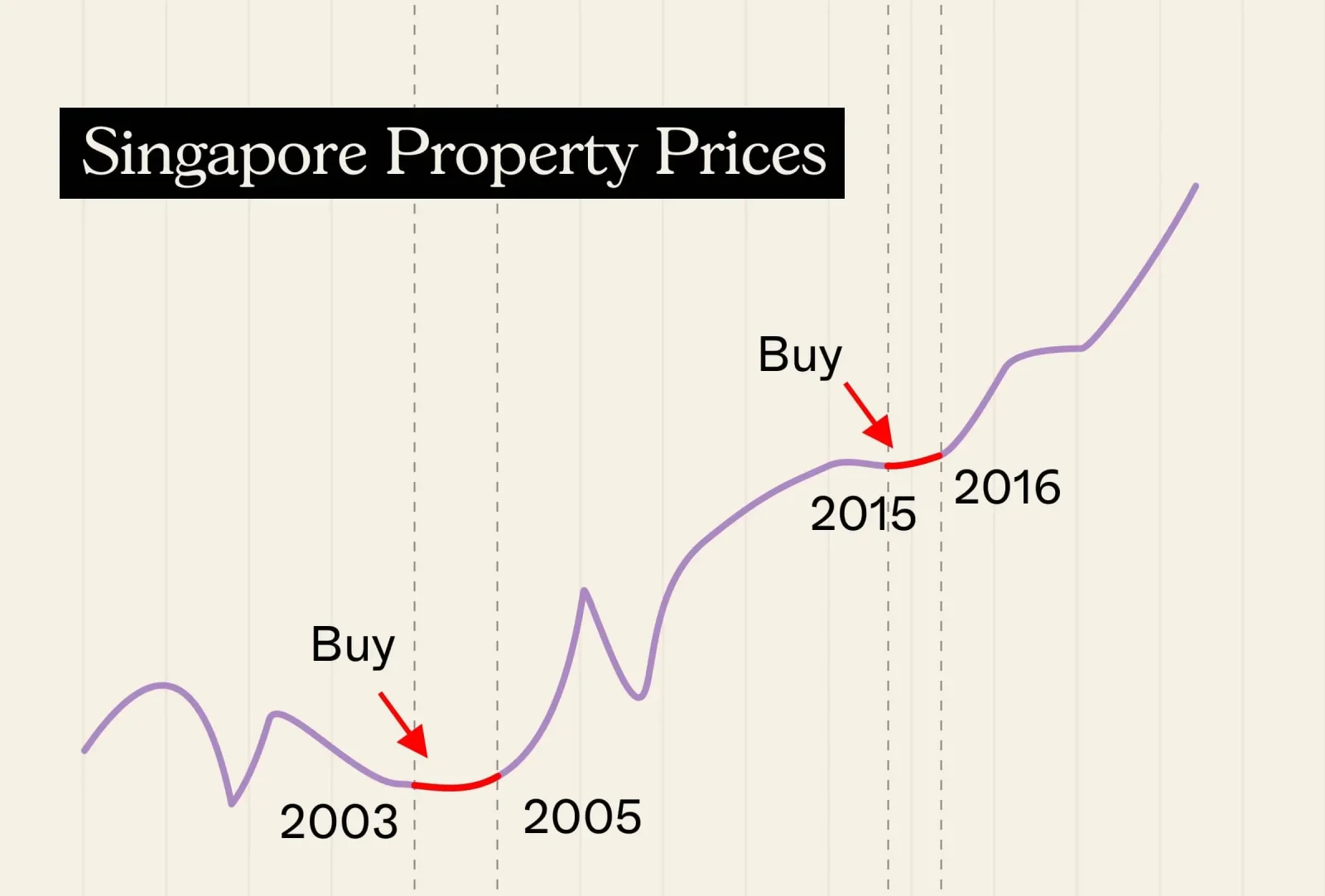

A quick note on the dates used:

First, you’ll notice we used two different sets of dates: one for condos bought between 2003 to 2005, and the other for condos bought between 2015 to 2016. We did this because the Sellers Stamp Duty (SSD) was introduced in February 2010. SSD is a tax on properties sold within three years of the initial purchase, and this would have impacted the resale prices.

Second, in choosing the dates below, we focused on the lowest points of the property market. These units were bought at what you might call the “ideal” time when prices were at the bottom.

More from Stacked

This Homeowner Made $4.3m In Profit In 5 Years: The Best Performing New Launches Since 2018

Five years and one world-shaking epidemic later, the property market is like nothing we’ve ever seen. Realtors back then may…

Top 30 projects that recorded at least 1 loss when buying in the 2003 – 2005 era

| Project | Loss (%) | Volume |

| CHNG MANSIONS | -50.0% | 1 |

| VALLEY PARK | -43.4% | 1 |

| JANSEN SPRING | -41.6% | 1 |

| WING FONG MANSIONS | -35.0% | 1 |

| CLEMENTI PARK | -31.7% | 1 |

| AZALEA PARK CONDOMINIUM | -31.4% | 1 |

| KEMBANGAN PLAZA | -30.8% | 1 |

| FOH PIN MANSION | -30.6% | 1 |

| AVA TOWERS | -29.8% | 1 |

| YONG AN PARK | -27.1% | 1 |

| JALAN BESAR PLAZA | -25.8% | 1 |

| ELIAS GREEN | -25.4% | 1 |

| REGENTVILLE | -25.0% | 2 |

| PALM GROVE CONDOMINIUM | -24.6% | 2 |

| CANBERLIN APARTMENTS | -23.9% | 1 |

| BULLION PARK | -22.4% | 1 |

| DUNMAN VIEW | -22.4% | 1 |

| THE BLOSSOMVALE | -20.8% | 1 |

| ASTORIA PARK | -20.8% | 2 |

| REGENT GROVE | -20.6% | 5 |

| LANGSTON VILLE | -20.6% | 1 |

| CASA SARINA | -19.6% | 2 |

| HIGHGATE | -19.2% | 1 |

| SPRINGDALE CONDOMINIUM | -19.1% | 1 |

| TOHO GREEN | -18.6% | 1 |

| CHELSEA LODGE | -18.5% | 1 |

| COSTA RHU | -18.3% | 1 |

| SHERWOOD TOWER | -17.6% | 1 |

| ESCADA VIEW | -17.5% | 1 |

| THE ANCHORAGE | -16.7% | 1 |

Top 30 projects that recorded at least 1 loss when buying in the 2015 – 2016 era

| Project | Loss (%) | Volume |

| MUTIARA CREST | -41.3% | 1 |

| HILLVIEW REGENCY | -38.6% | 1 |

| D’CHATEAU @ SHELFORD | -36.9% | 1 |

| THE SCOTTS TOWER | -35.1% | 1 |

| SEASCAPE | -22.4% | 1 |

| THE OCEANFRONT @ SENTOSA COVE | -21.8% | 1 |

| THE COAST AT SENTOSA COVE | -21.1% | 1 |

| CITIGATE RESIDENCE | -19.3% | 2 |

| SUN PLAZA | -18.9% | 1 |

| THE PEAK @ CAIRNHILL I | -18.7% | 1 |

| REIGNWOOD HAMILTON SCOTTS | -16.7% | 1 |

| SKY HABITAT | -16.6% | 1 |

| ALEXIS | -16.4% | 2 |

| H2O RESIDENCES | -14.8% | 1 |

| CUBE 8 | -14.6% | 1 |

| RITZ @ FARRER | -13.7% | 1 |

| PARC SOMME | -13.7% | 1 |

| OKIO | -13.5% | 1 |

| H RESIDENCES | -13.5% | 1 |

| ARDMORE THREE | -12.8% | 1 |

| PALM ISLES | -12.7% | 1 |

| AALTO | -12.5% | 1 |

| THE CRISTALLO | -12.4% | 1 |

| THREE BALMORAL | -12.2% | 2 |

| OASIS @ ELIAS | -12.2% | 1 |

| TREASURES @ G20 | -11.5% | 2 |

| OUE TWIN PEAKS | -11.5% | 17 |

| ASTOR GREEN | -11.4% | 1 |

| LIV ON WILKIE | -11.3% | 1 |

| BLUE HORIZON | -11.2% | 1 |

Average Holding Period

| Era | Holding Period (Years) |

| 2003 – 2005 | 2.4 |

| 2015 – 2016 | 5.2 |

Some observations from the above:

1. The SSD has met the intended goal of preventing flipping

Although it’s not the original intent, we can see from the data that the SSD meets its purpose rather well. The point of SSD is to prevent house-flipping, as rapid buying and reselling of homes pushes property prices up and can create a property bubble.

We can see that, for units bought between 2003 to 2005, the average holding period was just 2.4 years. For those bought after the SSD (2015 to 2016), the average holding period was 5.2 years.

On a related note, consider that policy measures such as the SSD can significantly impact exit strategies. If you bought low in 2009 with the expectation of turning a quick profit in 2010, the sudden implementation of SSD (in February 2010) could have forced you to stay invested longer than you thought. This is another consideration of why just buying at the right time isn’t enough – policy measures can affect you at the point of resale.

That said, the short holding periods may also play a role

Among these losing transactions, we notice that holding periods are very short. Even for those who bought after SSD (2015 – 2016), the holding period of 5.2 years is not considered to be very long. And if you were to average the holding period of all the buyers, from both eras, the median holding period is just 3.5 years.

This might suggest that the buyers were deliberately aiming for a quicker profit. E.g., buying during early phases, and then trying to sell immediately after the SSD period when the price has gone up. This could also be due to buyers buying the wrong property, and having to sell due to certain major changes in life.

(As one example of how this is done, check out how new launches are priced).

Property Market Commentary6 Developer Pricing Strategies For New Launch Condos

by Ryan J. OngIf these buyers had held on for longer, however, their chances of seeing losses could have been reduced. So once again, the buyers bought at the right time, but were foiled by selling at the wrong time.

2. Luxury properties tend to fare worse

As we gathered the data, we noticed it had some overlap with an earlier article. Here, we explained why luxury homes tend to fare so poorly.

Many of the properties on the list, such as The Oceanfront @ Sentosa Cove, Aalto, or The Scotts Tower, fall into the luxury category (although not necessarily freehold). Their losses tend to be steeper than mass-market properties, even though they were purchased at a market ebb.

This would suggest it’s not simply the timing of the buyers, but factors inherent in the luxury segment that make bigger losses possible. As in the linked article, it seems to be more about room for appreciation, and the limited buyer pool for high quantum properties. When cooling measures or worldwide black swan events happen, they tend to impact the luxury market more heavily. Also, most of the local market would typically prefer to buy a landed home, at the higher price points.

These other factors may still impact your resale gains, even if you snagged a luxury property at the market bottom.

3. For non-luxury properties, steep losses are still unlikely

So far we’ve sounded quite critical of attempts to time the market. But to look on the flip side, the vast majority of losses are in single-digit percentages, and we doubt they were ruinous for the sellers.

This does illustrate the upside of timing the property purchase, assuming you can get it right. Outside of luxury properties, it seems that – even if you were to sell at the wrong time or under urgent circumstances – your lower initial price would act to limit your losses.

Policy interventions make it hard to time the Singapore market

Every realtor we spoke to had the same conclusion: when you buy a home, make sure it’s one you’re comfortable staying in, even if it’s just a stepping-stone.

The Singapore government is interventionist when it comes to residential property, and measures like SSD, ABSD, and so forth can happen overnight. One realtor highlighted the May 2023 cooling measures as an example: the government doubled ABSD rates for foreign buyers by 30 to 60 per cent, whereas previous rounds had raised the tax by just five to 10 per cent.

The realtor said the sudden increase caused a foreign buyer to rethink their purchase, and his client was forced to accept a lower offer a few months later.

Simply put, flipping a property for profit requires two consecutive correct decisions: when to buy and when to sell; and this makes it a much harder guessing game than many assume. It’s better to focus on holding power: if you’re okay to wait out market fluctuations, you might see a good return regardless of your timing.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Investment Insights This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Latest Posts

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

0 Comments