Singaporeans Are Now Selling Coffee & Nasi Lemak From Their HDB: What You Need To Know About Running A Home-Based Business

August 24, 2022

Beyond rental, resale, and just being a home, Singaporeans are always out to stretch what they can do with their flat. In recent years, more of us have started to experiment with running a business right out of our homes (no small thanks to Covid-19). But what exactly can you do from inside your flat, and how viable is this? As it turns out, things are pretty flexible:

More Singaporeans are running businesses from their flats

One of the interesting ideas we’ve seen recently is Ground Floor Coffee. This is a Halal, take-away only coffee seller. We understand the operator, Mr. Hasif, doesn’t do this full time and has another job; but on Fridays to Sundays, you can swing by his Pasir Ris flat window to pick up a quality cup of Joe (around $5 to $6, and you do need to pre-order).

Another home business is Ms. Azlinah Toming’s $1 nasi lemak, which has been on the news of late for her affordable nasi lemak (apparently she can still make 30 cents per order!). There’s a minimum of 10 orders but, as most of you would know, $10 sometimes pays for less than two packets in some places.

Other examples we’ve seen are barber shops inside HDB flats, as well as one homeowner who runs a make-up studio in her flat. Some may be surprised to find out these businesses are completely legal in HDB flats, along with professional manicure/pedicure services; approval doesn’t even have to be sought (see below).

For many freelancers or gig workers, the HDB flat-as-office is practically a given. Self-employed photographers, writers, graphic artists, and musicians (with the right sound-proof setup of course) tend to use their flat as their place of business.

This may be the result of high rental rates

The most common answer we got, when asking why someone would operate a business from home, is rent.

Even for businesses that can use a co-working space (definitely not the Nasi Lemak or barber variety…), the cheapest options tend to start from around $180 per month; and costs of around $250+ are far more likely. In the more central areas, this can cost a whole lot more, from about $300 – $700 and up. Of course, these will come with additional perks like yoga studios, gyms, coffee, and for some, even massages.

As for opening a shop, it’s simply beyond the means for many. Realtors told us that in most places, you would pay at least $1,200 to $1,500 per month, for a small store with decent foot traffic. While there are options for $1,000 or under, they noted that these are mostly corner spaces (e.g., one corner of an existing store, like a data card seller in a clothing store), or in extremely niche areas (e.g., in an obscure corner of an industrial building).

As for setting up an actual hawker stall to sell your Nasi Lemak or other food… forget it unless you’re giving your life to it. Monthly rent is usually between $1,500 to $4,000, before you even factor in the service fees for cleaners, or the cost of hiring an assistant.

So if you want to run a business in your flat, what’s allowable?

Contrary to popular belief, you do not need approval from HDB for small-scale home businesses. Examples of “small-scale” include the usual tuition businesses, as well as hairdressing or baking.

(Do note, however, that for tuition services the maximum limit is three students at a time; and that massage services are not permitted in HDB flats).

HDB guidelines are as follows:

- The business must be operated by owners, registered occupants, or tenants of the flat (with consent from the flat owners). Third parties and non-resident employees are not allowed to work in the flat.

- There must be no advertisements, signages or posters displayed at the flat.

- No extraneous traffic should be introduced to the site nor should there be any adverse impact to the neighbourhood and the living environment, such as noise, smoke, smell, litter, effluent or dust nuisances or danger posed to surrounding residents.

- No use of heavy equipment or appliances that are not intended for domestic use.

- No large-scale storage or frequent loading and unloading of goods, especially for bulky items or use of the flat as a distribution centre.

- The activities must comply with the rules and regulations of other authorities (e.g. Singapore Food Agency, for food safety and hygiene, Fire Safety and Shelter Department, for fire safety requirements)

Take special note of point 1: third parties and non-resident employees are not allowed. This rule is one of the most commonly flouted. For example, if you run a bakery in your flat, and you hire a relative as a helper, this would technically violate the rules (as your relative is a non-resident).

More from Stacked

These Singapore Condos Had Good Locations But Modest Gains — Here’s Why They Still Underperformed the Market

While losing money is a rarity in the Singapore property market, that doesn’t mean every property investment is a sure-win.…

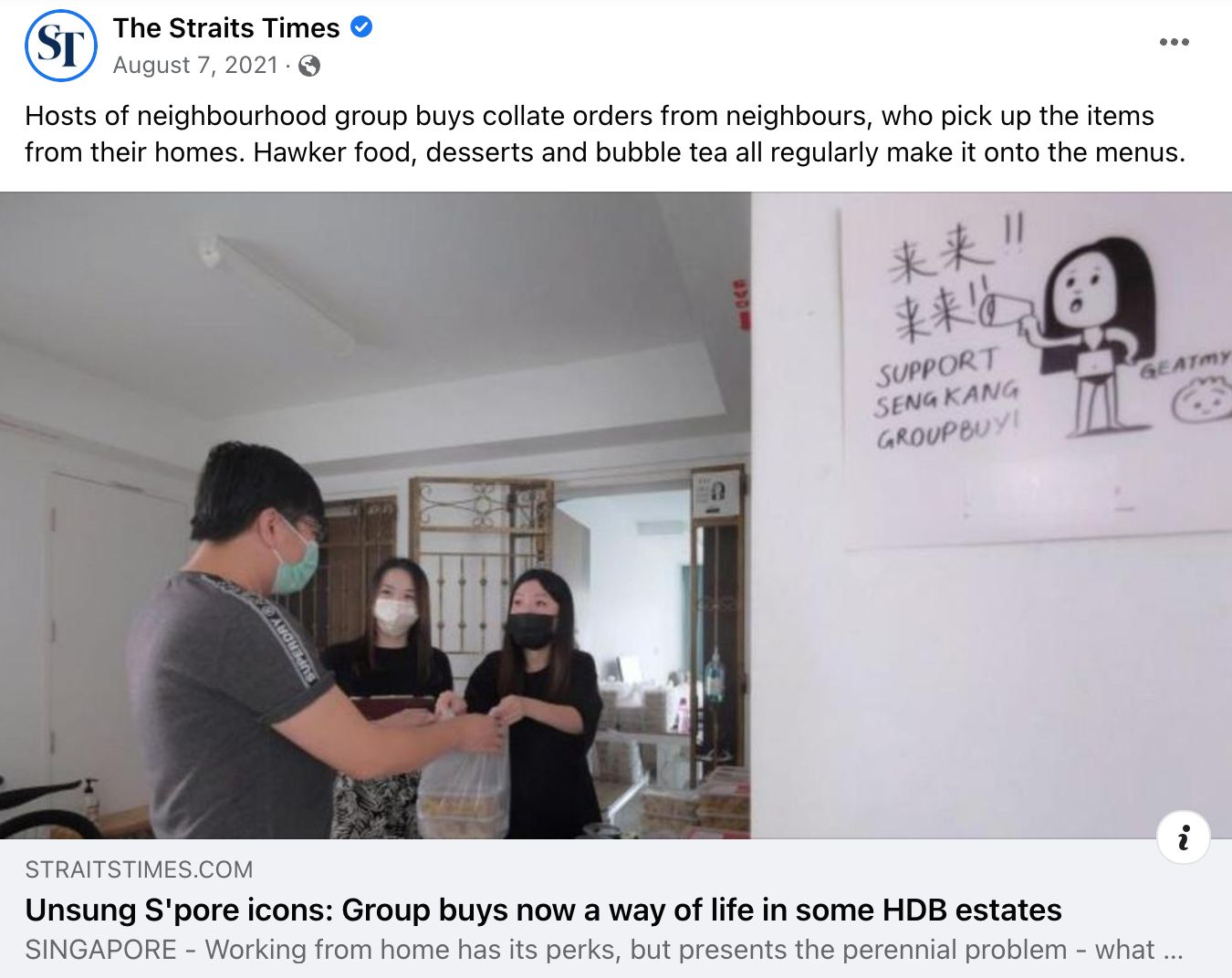

For point 6, the rules are a little fuzzy on Group Buy activities. Technically, group buy activities can turn your flat into a sort of distribution centre. Scale is a major factor here – if it gets to the point where your flat is visited by large crowds, and the neighbours complain, you could be breaking the rules. That said, group buys can actually add value to the community, and is often a way for you to get to know your neighbours – so we’d argue that this is one of those things that has good benefits.

Note that the rules differ for a Home Office

The HDB Home Office scheme is a whole different issue. This scheme does require licensing from HDB; and one crucial difference is that you can hire up to two non-resident employees.

So if your HDB flat is registered as a Home Office (HO), you can go ahead and hire your uncle, cousin, etc. to work there with your every day; as if it were a regular office. You can see the full requirements here, but we’ve highlighted some of the key points to note:

- You don’t have to be the owner of the flat to register it as an HO. You only need the written consent of the flat owner. You can use the flat even if you’re just a tenant, or registered occupier.

- Consumption of electricity and the structural loan must not exceed the normal residential load. Bear this in mind before you set up a crypto mining rig, or turn your flat into a warehouse for heavy items.

- There can’t be any selling of physical goods in and around your flat. It has to be an office, not a shop.

In the case of an HO, you can register your flat address as a business address; this is not something you can normally do. So if you need to register your entity with ACRA, getting the HO license may be a good idea.

That said, the biggest worry about a home business, or home office, is that you may be one complaint away from shutting down. HDB is very sensitive about the disruption to other residents – ultimately, if someone does complain, the fate of your business probably won’t be the priority.

Practically speaking, if you intend to run a business in the long term, using your flat should only be a temporary solution. Use it to save up, and eventually move to a real shop or office. You don’t want your business to be at the mercy of a fussy neighbour.

For more on this situation, follow us on Stacked. We’ll provide you with the latest insight and trends on the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Can I run a food business from my HDB flat in Singapore?

Do I need approval to start a home-based business in my HDB flat?

What are the rules for hiring employees in a home office in an HDB flat?

Can I use my HDB flat as a business address for my company?

What are the main restrictions for running a business from an HDB flat?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

1 Comments

$5 for angmoh coffee in the heartlands – must be dreaming! My coffee in CBD handmade by an angmoh costs the same, siao ah!