Should You Invest In A Condo’s Commercial Space? Here Are 6 Things To Note

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

With new cooling measures in place, some property investors are now considering alternatives – and one that feels close to home is commercial spaces inside condos. It’s not uncommon for many developments to have minimarts, clinics, cafés, etc. within the project itself. But are these “condo shops” a viable asset? Here’s what to check before you buy:

Table Of Contents

- Why buy a “condo shop”?

- 1. Accessibility to non-residents

- 2. Comparable amenities within walking distance

- 3. Location relative to facilities and specific stacks

- 4. Responsiveness of MCST

- 5. Resident demographics

- 6. Check the maintenance fees

- “Condo shops” are a little understood market, with limited or no data available

Why buy a “condo shop”?

The highlight of these retail spaces is that, in theory, they have a secured customer base: the residents in the condo will find the “condo shops” to be the most convenient source of amenities.

But their strength is also their drawback. Quite often, the customer base is restricted to the condo residents. This ties the fate of the property to the popularity of the condo; and unless you’re going to operate a business yourself, tenants can be tough to find.

Here’s a rundown of what to check, when you’re deciding on whether to buy:

- Accessibility to non-residents

- Comparable amenities within walking distance

- Location relative to facilities and specific stacks

- Responsiveness of MCST

- Resident demographics

- Check the maintenance fees

1. Accessibility to non-residents

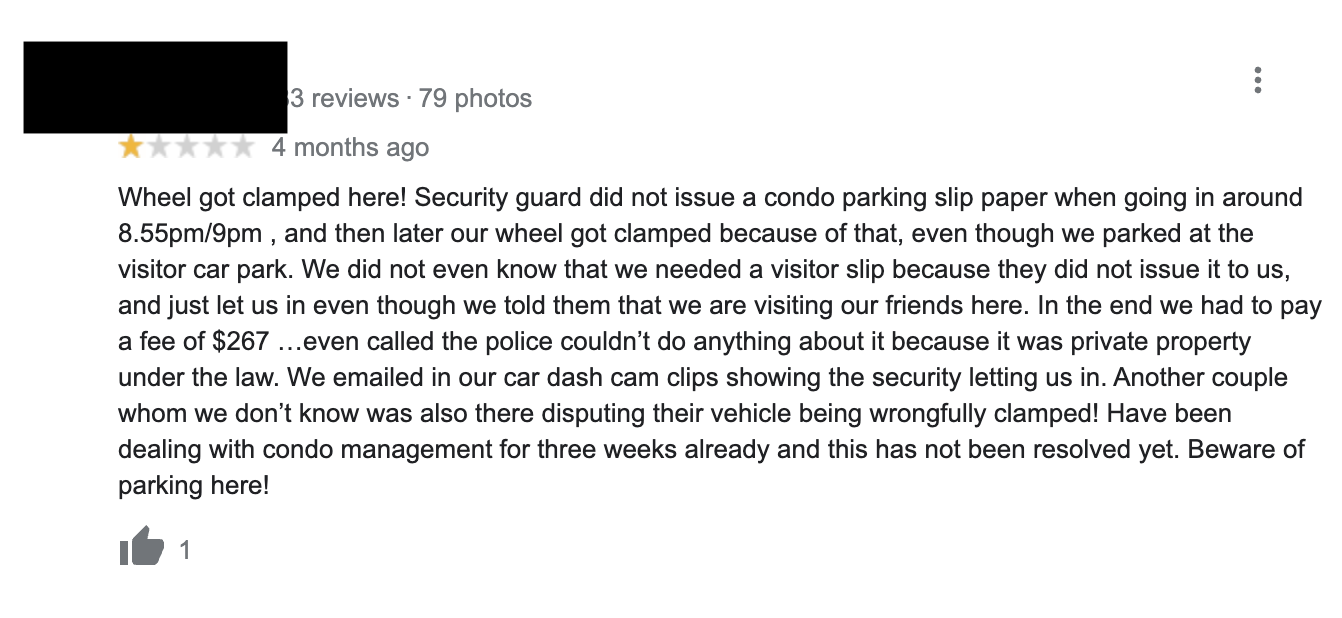

Some condos allow the public to access the project’s shops and cafes; others will bar entry from non-residents. This is probably the first question tenants will ask, so make sure you have a clear answer.

This overall situation is not as restrictive as it was in previous years. The prevalence of delivery services like Grab, Food Panda, etc. means F&B tenants can also service residents outside the condo (e.g., in HDB flats nearby, or neighbouring condo units). But just to be sure, check that the condo has no issues with allowing such delivery services to come in.

Even if they are, it is also good to check on the security of these homes. While having conscientious security is good, in some extreme cases it can be overbearing – to a point where visitors get turned off from visiting. A quick Google search should suffice for most, but do also note that security conditions can change, as some condo managements will change out the security firm they use periodically.

2. Comparable amenities within walking distance

Don’t assume a resident will go to a condo shop, because it’s more convenient than a shop that’s five minutes walk away. The relationship between condo residents and their downstairs shops is not comparable to what you find between HDB flats and their coffee shops.

For example, a good number of condo residents would rather walk to the nearby HDB coffee shop, rather than go to the café next to their own pool; and they may walk to a nearby mall even if a convenience store is right downstairs (when residents want to “get out of the house”, just walking downstairs seldom suffices).

For this reason, it’s best to avoid buying if there are already major amenities that are a short walk away. If there are childcare centres, minimarts, grocers, etc. within five minutes walk, it’s questionable if someone will open something similar in the condo; they’d just be renting a location that’s less publicly accessible.

That said, note that certain services – such as dentistry and other clinics – have an advantage over those outside the condo. In most cases, residents can wait at home, and come down when they receive a call. This is often preferable to having to sit and wait in a clinic outside.

Tenants are also spared the cost of renting a bigger waiting room.

3. Location relative to facilities and specific stacks

Some condos, such as the venerable Pandan Valley, tend to have condo shops that are widely dispersed. This can result in some spaces being clearly more accessible than others. The better ones are usually near facilities like the pool, or near the main entrance.

Other condos, like Costa Del Sol or Eastwood Centre, tend to cluster the shop spaces more efficiently; so it doesn’t make as much difference where they’re located (they’re probably all next to each other).

In the latter case, it may not make sense to pay more for a “better” location, as the frontage and placement tend to all be mostly the same anyway.

More from Stacked

Zyon Grand Pricing Review: How It Compares To Nearby Resale And New Launches In River Valley

When it comes to pricing, Zyon Grand sits in one of the most competitive positions we’ve seen this year. Unlike…

The general rule is to focus on foot traffic: look for the shops where residents pass by most often, such as near the playground or pool (assuming these are active areas), or near the more densely populated stacks.

Most spaces for F&B are located near or at the clubhouse; but don’t assume this is always the best spot; it’s often noisy and bad for conversation. Locations that offer a good view of greenery (e.g., near landscaped areas), and which are quieter, can sometimes be just as appealing for F&B.

4. Responsiveness of MCST

Business tenants need more immediate responses than residential tenants.

A residential tenant may be able to tolerate a leak coming from the neighbour’s unit for a few days, while you settle things. A business tenant won’t, because the problems can affect their storefront/appearance. They’ll want an immediate solution, not someone to “come and have a look” at 5 pm tomorrow.

While you have some control over how promptly a contractor responds, the MCST is out of your hands. If there’s some integral issue that’s affecting the shop space (e.g., electrical problems affecting the entire stretch of shops), then you’re at the mercy of the wider management’s response.

It’s a good idea to fire off a few emails or calls (ask some routine questions), to see how fast the property manager responds. If they’re the slow-moving type, that can land you in conflict with your future tenants.

5. Resident demographics

This is mainly the job of your business tenants to figure out; but it’s good to think about it yourself. If you wouldn’t open a shop there, then your prospective tenants may feel the same.

Singles, such as working expatriates or young couples without children, are less likely to need services such as childcare. This may preclude the need for a large commercial space, as business tenants will probably look at setting up convenience stores, laundromats, and other services that such residents need.

If the residents are mainly families, F&B spaces become a 50-50 bet. There’s a chance everyone mostly eats at home; and if they want to dine out, they’ll make it a family excursion to a nearby mall. On the other hand, there may be more appreciation for clinics, childcare, and other family-oriented businesses.

Finally, numbers count. In general, it’s best to stick to larger developments (in the realm of 800+ units), as tenants often assume their whole customer base consists of the condo residents*.

*Not actually true, especially with online orders these days.

6. Check the maintenance fees

In general, commercial spaces will bear more of maintenance costs than residential units. This varies between condos, but you can expect to always take on a disproportionate share of the costs.

The cost varies too widely to give any standardised figure, but it tends to be lower in older or no-frills condos/apartments. This is because maintenance fees are impacted by features like concierge services, private lifts, etc., which frankly don’t benefit the commercial spaces in the project; at least not in a direct way.

“Condo shops” are a little understood market, with limited or no data available

Don’t invest in condo shops if you’re the sort who trusts data, and proven track records.

This niche property segment is not well understood, and there’s little data on prices, rental yield per square foot, or which developments have the best performers. Real estate agents we spoke to had only one point of consensus: Finding tenants is tough, and these units are difficult to offload later.

As such, the advice is to try and buy spaces you can observe in action (e.g., buy an already tenanted space; one where you can see a current business is going well). It’s also best for first-time investors to avoid these spaces, as there’s a real risk of capital losses when you resell.

For more on the Singapore private property market, follow us on Stacked. We’ll also provide you with updates on new and resale condos alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Investment Insights

Property Investment Insights Why This 24-Year-Old Condo Outperformed Its Newer Neighbours In Singapore

Property Investment Insights How A 625-Unit Heartland Condo Launched In 2006 Became One Of 2025’s Top Performers

Property Investment Insights Does Buying A One-Bedroom Condo Still Make Sense As An Investment In 2026

Property Investment Insights This 21-Year-Old Condo Didn’t Sell Out Initially, Yet Became A Top Performer

Latest Posts

Property Market Commentary How Much You Need to Earn to Afford a One or Two-Bedder Condo In 2026 (As a Single)

Property Market Commentary This HDB Town Sold the Most Flats in 2025 — Despite Not Being the Cheapest

Singapore Property News This Former School Site May Shape A New Kind Of Lifestyle Node In Serangoon Gardens

Singapore Property News I Learned This Too Late After Buying My First Home

Overseas Property Investing I’m A Singaporean Property Agent In New York — And Most Buyers Start In The Wrong Neighbourhood

Property Market Commentary How To Decide Between A High Or Low Floor Condo Unit — And Why Most Buyers Get It Wrong

Overseas Property Investing What A $6.99 Cup of Matcha Tells Us About Liveability in Singapore

Singapore Property News This 4-Room HDB Just Crossed $1.3M — Outside the Usual Prime Hotspots

On The Market Here Are 5 Rare Newly-Renovated HDB Flats Near MRT Stations You Can Still Buy In 2026

Singapore Property News More BTO Flats Are Coming In 2026 And Why This Could Change The HDB Market

Editor's Pick We’re In Our 50s And Own An Ageing Leasehold Condo And HDB Flat: Is Keeping Both A Mistake?

Property Market Commentary Why This Once-Ulu Town In Singapore Is Going To Change (In A Big Way)

Editor's Pick This HDB Just Crossed $1.3M For The First Time — In An Unexpected Area

Singapore Property News “I Never Thought I’d Be Sued by a Tenant.” What Long-Time Landlords in Singapore Miss

Editor's Pick I Lived In Bayshore When It Was ‘Ulu’. Here’s How Much It Has Changed