Should You Buy This Sentosa Condo At A 40% Discount?

April 14, 2024

Yet another luxury condo fire sale

You’ve probably heard: The prices at The Residences at W Singapore Sentosa Cove are being slashed by over 40 per cent. But as great as that may sound, here are a few things that haven’t made their way into some media articles:

- The 99-year lease starts from 2006, and this project was completed in 2011. It still hasn’t sold out its 228 units, which is a really long time.

- The one recorded transaction we can find here, on 7th September 2023, shows a loss of $1.46 million.

- The maintenance fee of just a two-bedder unit is $1,200+ per month. For the bigger units, this can go from $1,400 to $1,600+ per month.

- Do remember that if a lot of units sell for 40 per cent less, then the floor price is just 40 per cent less. Future buyers will use that as the reference point, which might not make the discount (which is off the original price) that big of a deal.

Now am I saying it’s bad? No, like most Sentosa Cove condos, it’s still considered a prestigious location with lifestyle benefits you can’t get elsewhere.

But some people may be considering this just because the price seems cheap. Prices that start from $1,648 in Sentosa? As even Lentor has prices that have breached the $2,000 psf mark, this may seem like a comparative bargain.

The issue is that if you’re considering this as an investment, the rental rates here may seem to be good – but the high maintenance means the net yield you get back is a lot lower. (Although, do note that the maintenance fees here also include the Sentosa Island charge).

Let’s not forget that when you want to exit you really only have a niche group to target. Sentosa may be a great place if you love the beach lifestyle, but for most Singaporeans or those who have young kids – it may be a tough ask. You would most definitely need to own a car, and travelling in and out may be a bigger nuisance than you might think.

This is the kind of property you should buy when you’re rich enough to not worry about gains, yields, etc. Nevertheless this should really only apply to those who’ve already been eyeing Sentosa for some time, and are willing/aware of the tradeoffs of living on this island – this would certainly be an attractive price.

There’s a certain odour leaving the air in our property market.

When it comes to real estate – and not just in Singapore – there’s a connection between wealth and impracticality. (Actually come to think of it, that link exists in any market, period). Once you’re gargling Bird’s Nest, a weird aversion to the general public kicks in:

Suddenly you’ll act like a dozen drug cartels have a personal interest in you, and start living in the most private and inconvenient place you can find. Some place where your landed house is blocked off by hedgerows (thus making it impossible for your food delivery to find you), or where no one bothered by a $32 Grab ride will ever care to visit you.

At some point however, this resulted in some people aping the preferences: rich people live in low-density areas where there are no HDB flats – and so, some of us reasoned, anywhere without HDB flats must be classy as hell. Having no blocks in view went hand-in-hand with $600 dinners and an overpriced watch.

More from Stacked

5 Key Features Buyers Should Expect in 2026 New Launch Condos

Is 2026 the right time to buy a new launch project? We don’t mean that in financial terms here. Rather,…

But things are finally changing

First, it’s been a long time since any property agent has used the “there are no HDB blocks in sight” angle. And if you look at the response to the upcoming Bayshore estate, it’s been mostly positive: most of the residents I’ve spoken to are actually glad they’ll have more amenities nearby. This is in stark contrast to the property market I knew from the early 2010’s, where the response was more likely to be shock and horror.

“Die already, bringing down our property value!”

In fact, in recent conversations, more buyers have started to look for an HDB enclave within walking distance. We seem to have finally come to grips with the fact that “HDB = good amenities.” There’s more likely to be a late night supper place, a coffee shop, a minimart, heck even a McDonald’s. And I think we’re approaching the time when more buyers start seeing nearby blocks of flats as a real plus point.

Meanwhile in other property news…

- Could there be HDB towns where average prices are dropping? Well, not by much but it does happen. Here’s where.

- A 4-room flat close to the MRT, and below $495,000? Here’s where we managed to find some.

- Tanah Merah is in the spotlight these days, but a lot of people are going to compare Sceneca Residence to resale options like Urban Vista – so see if it’s worth a look.

- Chuan Park Residences may be the next hottest launch to come on the radar – check out the details and see if it’s for you.

Weekly Sales Roundup (01 April – 07 April)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE RESERVE RESIDENCES | $7,945,200 | 2519 | $3,154 | 99 yrs (2021) |

| WATTEN HOUSE | $6,202,000 | 1851 | $3,350 | FH |

| DALVEY HAUS | $5,300,000 | 1561 | $3,396 | FH |

| 19 NASSIM | $3,688,000 | 1109 | $3,326 | 99 yrs (2019) |

| BLOSSOMS BY THE PARK | $3,487,264 | 1313 | $2,656 | 99 yrs (2021) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| LENTOR HILLS RESIDENCES | $1,366,000 | 581 | $2,350 | 99 yrs (2022) |

| LAVENDER RESIDENCE | $1,400,000 | 624 | $2,242 | FH |

| HILLOCK GREEN | $1,428,000 | 657 | $2,175 | 99 yrs (2022) |

| HILLHAVEN | $1,498,040 | 700 | $2,141 | 99 yrs (2023) |

| THE LANDMARK | $1,502,922 | 495 | $3,035 | 99 yrs (2020) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SIN MING CENTRE | $49,000,000 | 15425 | $3,177 | FH |

| THE PEAK | $8,300,000 | 5522 | $1,503 | FH |

| SKY@ELEVEN | $6,480,000 | 2713 | $2,389 | FH |

| ST REGIS RESIDENCES SINGAPORE | $6,050,000 | 2594 | $2,332 | 999 yrs (1995) |

| CAPE ROYALE | $5,825,000 | 2508 | $2,323 | 99 yrs (2008) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PRESTIGE HEIGHTS | $624,000 | 344 | $1,812 | FH |

| PARC ROSEWOOD | $642,888 | 431 | $1,493 | 99 yrs (2011) |

| THE COTZ | $668,000 | 398 | $1,677 | FH |

| VIVA VISTA | $700,000 | 377 | $1,858 | FH |

| VIBES @ EAST COAST | $708,000 | 420 | $1,687 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PRESTIGE HEIGHTS | $624,000 | 344 | $1,812 | FH |

| PARC ROSEWOOD | $642,888 | 431 | $1,493 | 99 yrs (2011) |

| THE COTZ | $668,000 | 398 | $1,677 | FH |

| VIVA VISTA | $700,000 | 377 | $1,858 | FH |

| VIBES @ EAST COAST | $708,000 | 420 | $1,687 | FH |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MARINA BAY SUITES | $3,938,000 | 2067 | $1,905 | -$450,000 | 14 Years |

| LUMIERE | $1,800,000 | 990 | $1,818 | -$255,000 | 14 Years |

| ST REGIS RESIDENCES SINGAPORE | $6,050,000 | 2594 | $2,332 | -$57,000 | 17 Years |

| SKYLINE RESIDENCES | $1,060,000 | 484 | $2,188 | -$43,040 | 12 Years |

| WATERSCAPE AT CAVENAGH | $1,280,000 | 592 | $2,162 | -$25,000 | 11 Years |

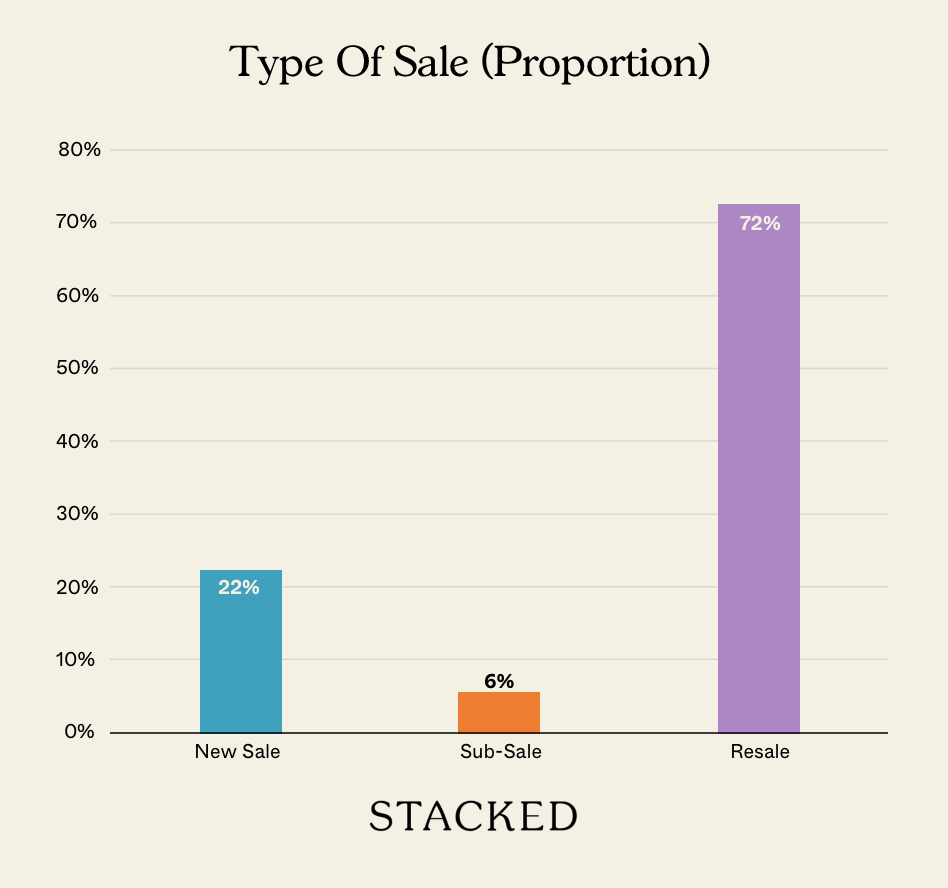

Transaction Breakdown

Follow us on Stacked Homes for news and updates on the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is buying the Sentosa condo at a 40% discount a good investment?

What should I consider before buying the Sentosa condo at a discount?

Are prices at Sentosa condos really that low compared to other areas?

What are the drawbacks of living in a Sentosa condo?

Has the perception of luxury living without HDB flats changed?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

0 Comments