All reviews on Stacked are editorially independent. Developers can advertise with us, but

cannot

pay

for,

edit, or preview our reviews.

New Launch Condo Reviews

Myra Condo Review: Freehold In A Convenient Location

December 21, 2020 25 min read

For those who love freehold boutiques

Despite having fewer facilities given its size, Myra is great for those seeking exclusivity with just 85 units here. Its freehold status also lures those who looking to pass on their property to the next generation.

| Project: | Myra |

|---|---|

| District: | 13 |

| Address: | Meyappa Chettiar Road |

| Tenure: | Freehold |

| No. of Units: | 85 |

| Site Area: | 30,689 sqft |

| Developer: | Selangor Dredging Berhad (SDB) |

| TOP: | 2024 |

As far as records go, Selangor Dredging Berhad (SDB) has long been a believer in the value of freehold projects.

So it really comes as no surprise that The Myra is a freehold project in itself – despite its immediacy to both the Potong Pasir MRT station and surrounding commercial spaces like the Poiz Centre.

For those wondering, the plot of land that the Myra sits upon is actually an amalgamation of 17 separate land plots – all of which were privately owned by individual landlords up till 2018 when they were collectively purchased for $60.2m.

Admittedly, the Myra’s TOP date is still a ways away (est. end-Nov 2024). So far since its launch 3 months ago, it has seen a near 20% take up rate of its 85 units.

It’s undoubtedly an attractive (read: rentable) project based on its location, exclusivity and tenure – almost to the extent of feeling like an integrated development with added benefits.

But there’s just the one concern for investors/homeowners –

It’s pricing range.

At $2,000+psf average, the project is just under $400psf more costly than it’s 99-year leasehold (integrated development) neighbour, The Poiz.

So naturally, you’ll get a number of questions about the pricing gap – and whether the Myra’s tenure/exclusivity really justifies that extra price tag.

I’ll aim to cover the topic as we get through today’s discussion on the upcoming Myra along Meyappa Chettiar Road. As always, let’s begin with our insider tour of Myra!

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Myra Condo Insider Tour

The Myra showflat is located right next to Nex Shopping Mall, and not at the actual Potong Pasir site along Meyappa Chettiar Road (Potong Pasir Precinct).

For the sake of the review, I visited the actual grounds itself as well to sniff around. In person, the land size did feel rather small, but it was well-shielded from the pollution of Upper Serangoon Road by the adjacent (high-rise) 28 Woodsville.

Taking into account its boutique condo status, the showflat is actually rather well appointed.

Not that it is a guaranteed sign of how a project would turn out, but it does to a certain extent communicate the commitment from a developer of the resources dedicated to it.

At just over 30,000 square feet of land, the Myra condo is undoubtedly a small project. In fact, there are some GCB’s in Singapore that could give it a run for its money in terms of land size.

This rectangular plot will house 85 residential units that range from 1 to 4 bedroom units.

For those curious how its small size will impact the density of the development, here’s an easy way to look at it.

30,689 sq ft / 85 units = 361 square feet of land per unit.

Compared to something on the opposite spectrum in terms of size like Treasure at Tampines (294 sq ft), it does come out on top here.

Let me touch a bit more on the exterior of the Myra first.

For those observant enough, you might notice a gradual change of building facade colour as you progress from the bottom of the development to the top.

Now I’m no colour linguist, but I’d say that the progression is from that of a champagne tinge to a relatively muted gold shade. It certainly gives off a warm vibe as opposed to a ‘you-can’t-touch-me’ feel, which you often get with most power colours (ie. black/dark brown).

Truth be told, it isn’t ultra obvious on the model itself so it would be interesting to see once the actual development is built.

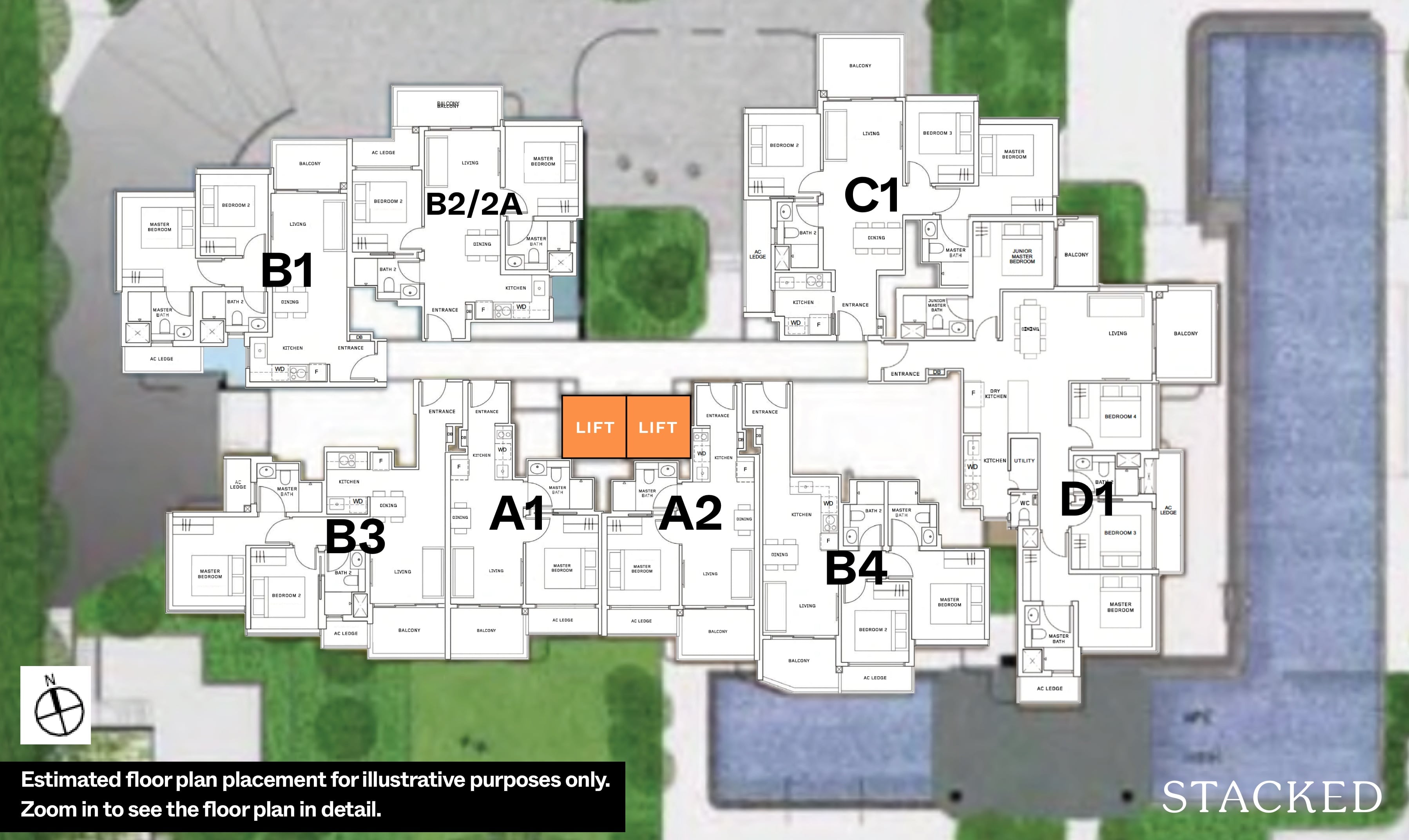

Because the land space at the Myra to work with is quite constricted, the developers have essentially combined ‘2 blocks’ into one.

The downside to that is that you get 8 units per floor from level 2 to level 9, and 7 units per floor from level 10 to level 12.

You also get just the 2 lifts serving all floors (without the inclusion of any private lift access), so I can definitely see increased wait-times here during peak hours.

It’s also quite interesting how they’ve managed to engineer a variation of unit tiers in this small development (buyers have 10 inter-unit variations available to choose from).

For example, if you have a look at stack 3, you’ll find 3 floors of D2 (4-bedroom) units – which are essentially a combination of 2 units from the 9 floors of B1 and B2A (2-bedders) below it.

It’s also the 4-bedder variation that I much prefer as opposed to the showflat model one (I’ll cover that in a bit).

The arrival point does seem cozy, if a tad small – a drawback you’ll have to live with for the sake of more privacy.

But what catches my eye is the oculus located a little deeper in which is meant to catch the streams of sunlight by day, and the shadows by night.

It’s definitely more of an aesthetic implementation than a functional one, but it certainly adds diversity of design to the space here.

If you haven’t already noticed, the units here are elevated above ground, so the lowest residential unit is on the 2nd floor.

The result of which is added ceiling height to the ground floor which helps accentuate the space, and allows for a walkway that leads to the back of the project/facilities.

I wasn’t expecting too much on the facilities-end given the land-size to block ratio, so I wasn’t too surprised to see an inclusion of a 25m lap pool (as opposed to your full length 50m ones).

The pool will face Woodsville 28, so I can’t say you will be enjoying the most private of swimming experiences.

They’ve also managed to fit a hydro therapy pool and hydro gym adjacent to the 25m pool.

You guys know my thoughts on hydro gyms by now. And considering the lack of space, I do feel like this space could have been utilised better as opposed to plonking down these chunky metal machines inside the pool.

Still, some people like them – so as always, it ultimately boils down to personal preference.

Beyond that you get your sheltered outdoor gym (no indoor gyms here, and unfortunately none at the Poiz Center – but you do get a fully equipped Anytime Fitness an 8-min walk away close to the Sant Ritz).

The outdoor gym serves as a dissection of sorts for the subsequent shallow play pool and adjacent children’s playground and leisure lawn.

It really isn’t too much to look at, but that’s just some of the drawbacks you often face with boutique projects (like the Montana).

For those who do crave recreation, you do get the upcoming Bidadari estate (just 10-minutes walk away), which will undoubtedly inject new life and recreational amenities into the area.

Despite its small size, the Myra condo does try to cater to children as well. There is a small shallow kids swimming pool, and a kids playground.

Regarding underground parking, you’re unsurprisingly slapped with the 80% lot allocation here – something which is becoming quite the norm in most New Launch condos we see today.

(That’s a total of 68 lots with 2 extra handicaps as well as 22 bicycle bays to supplement a car-lite project).

Given its location on the city-fringe and the majority 1 and 2-bedder unit-types here (ie. mostly tenant crowd), I’m not too worried about lot competition.

For those wondering, lots are allocated on a first come first serve basis, with subsequent lot competition to be balloted for.

And according to the developers, car park usage will be monitored in the initial stages post-TOP, and depending on demand, owners with additional vehicles might be privy to lots on a season parking/monthly-fee basis.

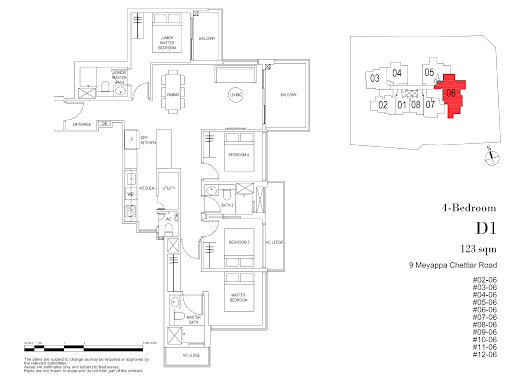

Myra Condo 4 Bedroom Review

For those wondering, this is the biggest unit available at the Myra.

It comes in at 1,324 sq ft, and unlike the other 4-bedder type (D2) that shares its stack with other 2-bedders below (floors 2-9), this 4-bedroom unit comes in a separate stack of its own. Meaning to say, you only get 4-bedders in this stack from floors 2 through 12.

Needless to say, at 1,324 sq ft for a 4 bedroom unit, this isn’t a place blessed in the size department.

Regarding the layout, a long entranceway definitely takes away some usability from the space. You also get one of the AC Ledges outside of a singular common room, which places an obstruction on the size of the windows there.

Finally, all the toilets but the junior master bath come with windows for natural ventilation.

(Just alluding to my point previously on why I preferred the D1 variation. Firstly, it’s set in our preferred dumbbell layout so you don’t get a waste of entrance space. Secondly, you get an L-shaped kitchen which affords more privacy to cooks. And thirdly, your AC Ledges are behind your toilets, which means no halved windows throughout the bedrooms).

Walking into the unit, you are greeted by a passageway into the living area with the junior master on your left and the open-concept kitchen on your right.

Let’s have a look at the junior master first before I get to the rest of the unit (its separate location does make it the outlier of the unit after all).

Just a quick side-note first, it’s important to note that all the unit ceilings in the project only go up to 2.85m at best – with no exceptions for the larger/top/bottom-floored units.

The junior master parallels all the other bedroom heights at 2.85m.

(Also take note that the B2a 2-bedroom units have their common bedroom, dining and living ceiling heights set at a 2.75m peak).

First off, I like that the junior master bedroom is set apart from the rest. It just allows for that extra bit of flexibility for multi-generation living due to the privacy that it caters for.

Some might nitpick at the inefficiency of that entranceway to the bedroom but I actually quite like the implementation of it here. Many others would have the door located directly at the dining area, which isn’t the best where privacy is concerned – so this is a better approach.

The junior master is an en-suite with additional balcony space. As a result, you’re probably only able to fit a queen-sized bed here with enough space for small side tables.

As per usual, you get engineered wood in terms of flooring. Storage space is also the standard 2-panel wardrobe.

The balcony here is fitted with wooden-board flooring which will come in the actual unit itself. As mentioned earlier, the developers did not see fit to include noise abatement measures, so you get your usual aluminium-framed glass sliding doors for the balcony.

For those wondering, the junior master will be overlooking the 25m pool and the pool-side decks. It is relatively shielded from the drop-off point by stack 5, and the kids play areas (around stacks 1,2 and 8) – so I don’t foresee too much noise disturbances even if you take a unit on a lower level.

Regarding the junior master bath however, you might observe the lack of windows (substituted by toilet vent). Of course, you do get ventilation from the balcony area, but that would involve you having to leave both (balcony and toilet) doors open after a shower if you choose not to switch on the electric vents.

On the whole, the bathroom is a decent size. It comes fitted with porcelain tiles, with the bathroom fittings itself by Grohe.

Moving back outside, the open-concept kitchen takes centrestage.

It begins with the dry kitchen, with an island on one end, and the fridge/dry area on the other.

The countertop can also be used as a place to have breakfast or even just a quick meal.

Moving on deeper into the kitchen, you find yourself in the wet kitchen. It’s a decent size, though you unfortunately do not get a double sink here. That said, you do get internal and external storage (ie. display area) just above the wet kitchen.

It is quite long lengthwise, although because the counters are only on one side, some might find the countertop space to be insufficient. That said, width wise it is quite spacious, so even if someone is cooking, moving in and out would be relatively easy.

Another positive point is the addition of a window for natural ventilation, although you do only get the choice of an induction hob here. Kitchen equipment are all supplied by Bosch – so no real surprises there.

Another thing to note is that every unit in the project comes with a singular washer/dryer given the lack of a yard.

While this will contribute to your electricity bill, it’s no doubt the more convenient option – although a singular washer/dryer for a 4-bedroom unit does seem like a tight-fit.

Beyond that you get a small utility room (which would most likely be used as a helpers room), and your WC.

For a 4-bedroom unit, the dining area doesn’t seem very spacious – which again, alludes to my preference for the D2 variation.

This is especially true when you consider that the ID hasn’t included a full-sized table, and that half of the seating areas are of the built-in variety.

It means that you either have to flush your dining area to the side (as seen here) – without the option of a full length dining table. Or you choose to go alfresco, which would leave you with a bigger living area.

The living room is rather straightforward. It fits a 3 seater sofa length-wise, and could perhaps see an inclusion of a bigger coffee table and a 2 seater breadth-wise – to provide both a partition of sorts for the dining area and extra seating space.

The balcony is quite sizeable length-wise, which is demonstrated with the inclusion of the sofa set here. It could easily fit an 8-seater dining table with just a tad room on either end to maneuver with.

Note that the wooden boards you see here will also be included in the actual unit (as mentioned earlier with the junior master).

Next up, the long hallway will lead you to the 3 other bedrooms as well as the common bathroom.

Heading on to the first of the 2 common bedrooms, you will find that the developers have opted for a single-bed/study combo. It certainly increases the usability of the space, but you don’t fully get a sense of the room size just yet.

Unlike the common bedroom next door, this one features full length windows, which is always preferred.

The second common bedroom has again been converted into a single-bed/study variation. You can fit in a queen, but it’s not going to leave much space on both sides of it.

As mentioned at the beginning, because the AC ledge is located on the outside, you can’t get full length windows here.

Although the silver lining here is that you can flush the bed all the way to the corner, thereby leaving you with a little more wiggle room for a study table.

The common bathroom comes with a frosted window, which is always good for natural ventilation and to let light in.

This one has the advantage of a jack and jill layout, which means you can enter/exit from both the hallway and the common bedroom. Effectively, this makes nearly all the bedrooms save for the first common bedroom ensuites.

Heading on to the final room for today, you get a little entranceway of sorts to the master bedroom.

The walkway is also where your wardrobes are located, which is a bit more of an unusual placement. That said, you don’t get much in way of extra storage space.

Having the wardrobes away from the bed area does allow for more space to manoeuvre with on that end, and also helps to reduce noise disturbances to either partner in the event of an early-riser/late-sleeper scenario.

The master bathroom is decently sized, but other than its porcelain tiles and Grohe bathroom fittings, there isn’t much differentiation from the other bathrooms save for the addition of a rain shower.

Finally, the master bedroom does not come with a balcony unlike your junior master, but it certainly makes up for it with a pleasant addition of the L-shaped windows.

I’m not sure about you, but I’ve also been a massive fan of full-length glass windows, and to have them on both ends – just imagine the amount of light streaming through that will add to the openness of the area.

View-wise, you will get pocket views of the landed enclaves across Upper Serangoon Road (through the opposite Woodsville 28), and on the other end, views stretching across the PIE into the Geylang Bahru/Kallang River area.

Regarding its size, well, there’s really nothing to shout about here – which is to be expected anyway given the overall size of the apartment.

Myra Condo Location Review

Potong Pasir is quite an interesting neighbourhood in itself.

While it was once notorious for gangs, it has since observed numerous transitions from the iconic sloped-roof HDBs to the construction of the massive St. Andrew’s Village and now the mixed development which is Poiz Residences (and Poiz Centre).

It’s a cozy and well-equipped neighbourhood with your community centres, hawkers, convenience stores and MRT/Bus stations to boot.

It helps that it’s located by the city fringe and the numerous highways around the area adds to private transport accessibility/convenience for residents here.

On that note, it’s also worth mentioning again that the Myra condo has the added benefit of being (mostly) shielded from the ill-effects of both highways by the subsequent high-rise developments like Woodsville 28.

Amenities

Groceries

| Grocery Shops | Distance From Condo (& Est. Walk Time) |

| Fairprice – The Poiz | 22m, 1-min walk |

| Ang Mo Supermarket | 350m, 4-min walk |

| Cold Storage – Nex | 2.5km, 7-min drive |

Shopping Malls

| Shopping Mall Cluster | Distance From Condo (& Est. Walk Time) |

| The Poiz | 22m, 1-min walk |

| Macpherson Mall | 1.9km, 7-min drive |

| Nex | 2.5km, 7-min drive |

| City Square Mall/Mustafa Centre | 2.9km, 9-min drive |

| Toa Payoh Mall/HDB Hub | 3.7km, 10-min drive |

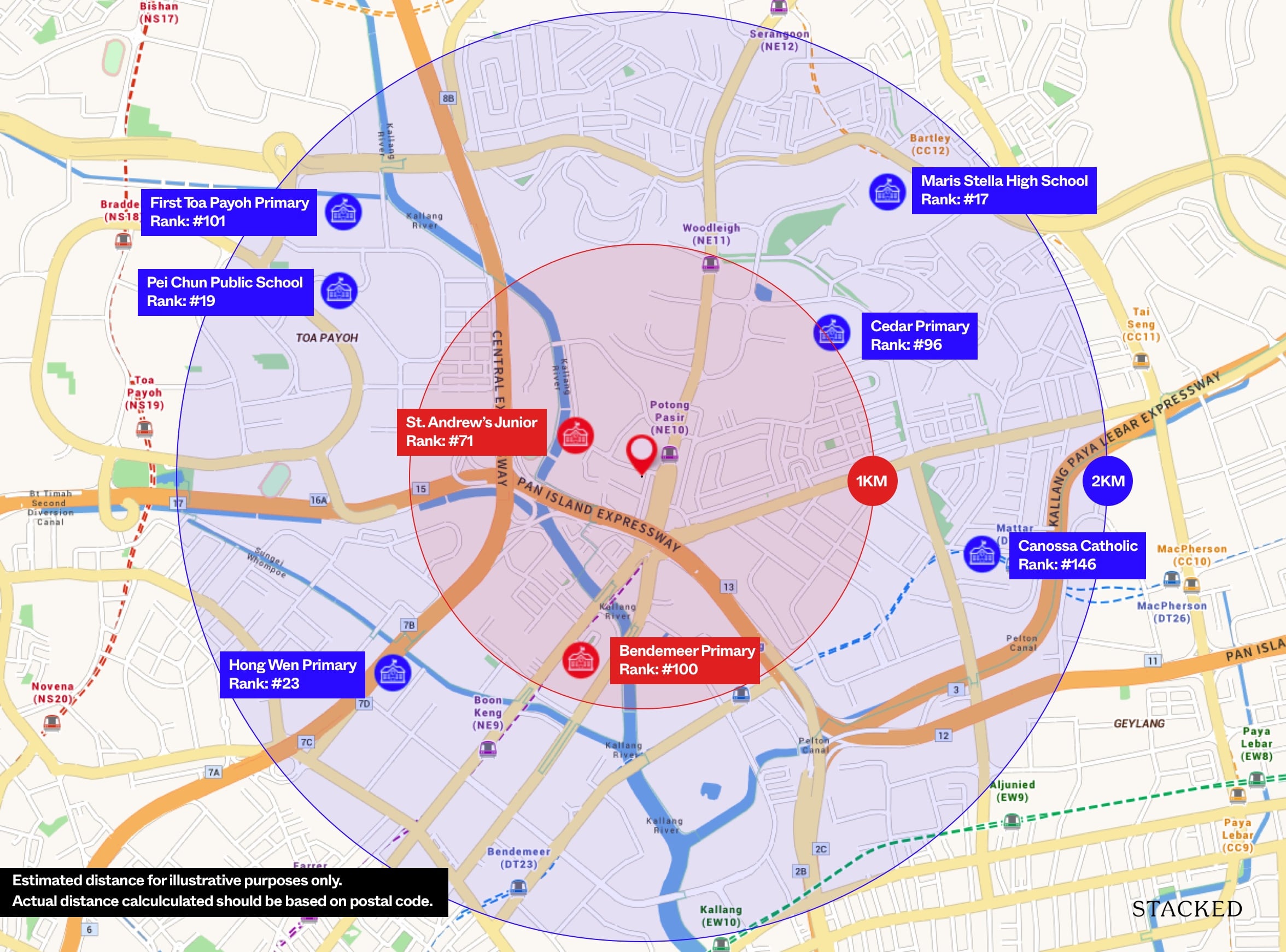

Schools

| Educational Tier | Names of Institutes |

| Preschool (within 1km walk) | Little Seeds Preschool @ Calvary Baptist ChurchAscension Kindercare – Little Seeds My First Skool @ Blk 134 Potong Pasir |

| Primary (within 3km-drive) | St. Andrew’s Junior (350m, 5-min walk)Cedar PrimaryCanossa Catholic PrimarySt. Margaret’s Primary Bendemeer PrimaryYangzheng PrimaryGeylang Methodist Primary |

| Secondary (within 3km-drive) | St. Andrew’s Secondary (400m, 5-min walk) Cedar Girls’ SecondaryMaris Stella HighSt. Gabriel’s SecondaryZhonghua SecondaryBendemeer SecondaryGeylang Methodist Secondary |

| Junior College (within 5km-drive) | St. Andrew’s Junior College (1km, 12-min walk)Nanyang Junior CollegeCatholic Junior College |

| University (within 5km-drive) | James Cook University |

| Polytechnic (within 10km-drive) | – |

Not to wax lyrical, but the St. Andrew’s Village has perhaps been one of the bigger draws of Potong Pasir in recent years.

It has a kindergarten, primary, secondary and junior college all linked together amidst a ton of facilities like running tracks, roof-top basketball courts, astro turfs, swimming pools and even rock-climbing facades.

Culture-wise, you get quite a supportive parent-teacher group with an overall emphasis on key moral values and a ton of CCAs to choose from.

It caters for boys up till the secondary school level, with the junior college serving as a mixed institute thereafter.

Public Transport

| Bus Station | Buses Serviced | Distance From Condo (& Est. Walking Time) |

| ‘Potong Pasir’ | 13, 107, 107M, 133, 142, 147, 853, 853M, NR6 | 150m, 2-min walk |

| ‘Potong Pasir Stn Exit B’ | 13, 107, 107M, 133, 142, 147, 147A, 853, 853M, | 400m, 5-min walk (Underpass) |

Closest MRT: Potong Pasir MRT – 150m, 2-min walk

Perhaps the biggest benefit (and contributor to the Myra’s psf range) – public transport accessibility.

There isn’t much else to say, apart from the fact that the brief walk to the MRT station isn’t actually sheltered, and that having the bus station located along Upper Serangoon Road (before the subsequent PIE/Upper Serangoon Viaduct) means really good accessibility to most parts of Singapore.

A trip to Orchard is a 35-min ride spanning from Potong Pasir MRT to Dhoby Ghaut MRT (4 stops) – and thereafter, a switch to the North-South line toward Orchard MRT (2 stops).

In the same vein, a trip to the CBD (Raffles Place MRT) is a 33-min ride spanning from Potong Pasir MRT to Dhoby Ghaut MRT (4 stops) – and thereafter, a switch to the North-South line toward Raffles Place MRT (2 stops).

Private Transport

| Key Destinations | Distance From Condo (& Est. Peak Hour Drive Time) |

| CBD (Raffles Place) | 8.4km, 18-min drive |

| Orchard Road | 6.5km, 16-min drive |

| Suntec City | 5.2km, 15-min drive |

| Changi Airport | 14.4km, 16-min drive |

| Tuas Port (By 2040) | 42.5km, 52-min drive |

| Paya Lebar Quarters/Airbase (By 2030) | 4.8km, 16-min drive |

| Mediapolis (and surroundings) | 12.8km, 20-min drive |

| Mapletree Business City | 15.1km, 30-min drive |

| Tuas Checkpoint | 33.2km, 37-min drive |

| Woodlands Checkpoint | 21.5km, 25-min drive |

| Jurong Cluster (JCube) | 17.7km, 24-min drive |

| Woodlands Cluster (Causeway Point) | 20.4km, 26-min drive |

| HarbourFront Cluster (Vivo City) | 11.5km, 22-min drive |

| Punggol Cluster (Waterway Point) | 14.9km, 22-min drive |

*Note that Drive Times are calculated during Peak Hours

Immediate Road Exit(s): 1 exit along Meyyappa Chettiar Road

The Developer Team

Developer

To date, SDN (Selangor Dredging Berhad) has completed just 5 residential projects here in Singapore, with 3 more projects in the pipeline (JUI Residences, Myra and One Draycott Park).

They have also engineered a total of 16 office, service apartment and residential projects combined back in Malaysia.

So in that regard, this isn’t a developer that has its limbs dipped in every other part of the world, unlike some of the past companies we’ve reviewed.

It also means that while there is a certain level of uncertainty about their work, they are required to put in the extra effort to make their projects stand out.

Looking at their past projects in Singapore – SDN has only delved into freehold projects, mostly of the boutique development range. So it’s clearly a niche that they are well-versed in.

As such, you wouldn’t expect too much from their facilities-offerings, but when you observe certain factors like upkeep and attention-to-theme (ie. communal-centric in projects like Village @ Pasir Panjang or city-living at Gilstead Two), it feels like they’ve done a good job overall.

It’s definitely a leap of faith in this instance, so let’s keep a keen eye for other factors that might ascertain the project’s quality.

Architect

The architecture team consists of JGP & Pitman Tozer (design-wise).

JPG is a Singapore-based firm with offices in Shanghai, Beijing, Ho Chi Minh City, Kuala Lumpur and Yangon.

It’s assuring to note that they have a good portfolio of residential projects including Wilshire Residences, Atra and 11 @ Holland. On the commercial end, they were also incharge of FOC Sentosa and WIS @ Changi.

What’s more interesting is that they’ve had a main architectural hand in 2 of SDN’s past residential projects as well as all of its upcoming projects (ie. JUI Residences, Myra and One Draycott Park).

As for British design architects Pitman Tozer, while they are undoubtedly award-winning architects back in the UK, it will be their first venture into Singapore, and perhaps even in the SEA region.

In that aspect, I am glad that they will be working with JPG.

If all goes well, I can see the design input by the British architects intertwining/value-adding to the deep-seated local architectural experience on JPG’s end.

Unit Mix

| Unit Type | No. Of Units | Size of Units (sqft) | Est. Maintenance Fee |

| 1-Bedroom | 22 | 474 sqft | $305 |

| 2-Bedroom | 38 | 667 – 732 sqft | $366 |

| 3-Bedroom | 11 | 872 sqft | $366 |

| 4-Bedroom | 14 | 1,313 – 1,324 sqft | $427 |

There isn’t too much to mention here that hasn’t already been said – given that it is a boutique development afterall.

But what I can perhaps share with you guys is the heatmap of units that were sold at launch back in September.

For starters, we saw a single 1-bedroom unit, twelve 2-bedroom units and two 3-bedroom units transacting during this time.

Regarding the twelve 2-bedroom units sold, 1 was of the Type B4 unit, another was of the Type B3 units, 5 were of the Type B2 unit and the other 5 were of the Type B1 units.

The developers have since sold 3 other units during the timeframe.

It’s unclear if these units were sold to homeowners or investors, though it certainly shows the appeal of the 2-bedders here as opposed to the other unit tiers.

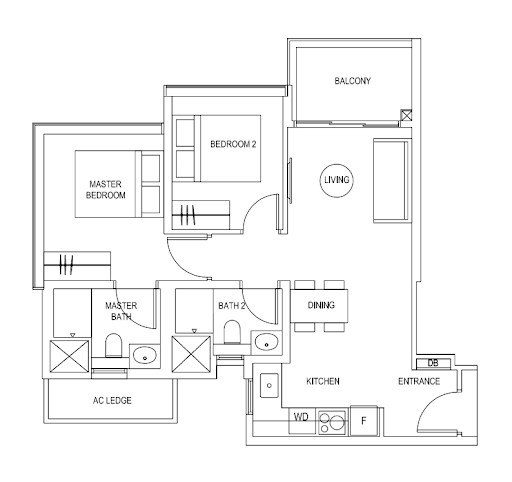

Also, given the majority of 2-bedroom units here, I’ll briefly analyse the more ‘popular’ 2-bedder types in this next section – which are essentially the B1 and B2 units.

Unit Layout Analysis

Type B1 (2-bedroom, 700 sqft) Vs Type B2 (2-bedroom, 678 sqft)

As per usual, having a dumbbell layout takes the cake as long as you are looking at it from an efficiency standpoint. In type B2, the entranceway opens up immediately into the living and dining, with the kitchen on the right. You could possibly even look at concealing the kitchen here if you wished.

Ultimately, this is usually the preferred option as you do maximise the already little amount of space available.

In addition, the common bedroom in B2 is linked with the common bath – which, by the way has a jack-and-jill format for easy access to those in the living area; very much unlike the common bath in B1 located opposite the common bedroom.

That said, those that prefer more privacy in terms of their master bedroom will no doubt be leaning towards B1 instead.

Probably the worst thing about B2 would be the AC ledge being located right outside the bedroom, which weirdly enough, extends beyond towards the AC ledge as well.

All that said, between the two I think most would go for B2 given the lower quantum due to the smaller size and the slightly more efficient layout.

Stack Analysis

Development Site Plan

| Garden | Bar Counter | Outdoor Dining |

| Lawn | Children’s Playground | Shallow Play Pool |

| Pool Deck | Outdoor Showers | Changing Room/Toilet |

| outdoor gym | hydro gym | hydrotherapy pool |

| 25m lap pool | pool sunbath lounger | alfresco barbecue dining |

| seating area |

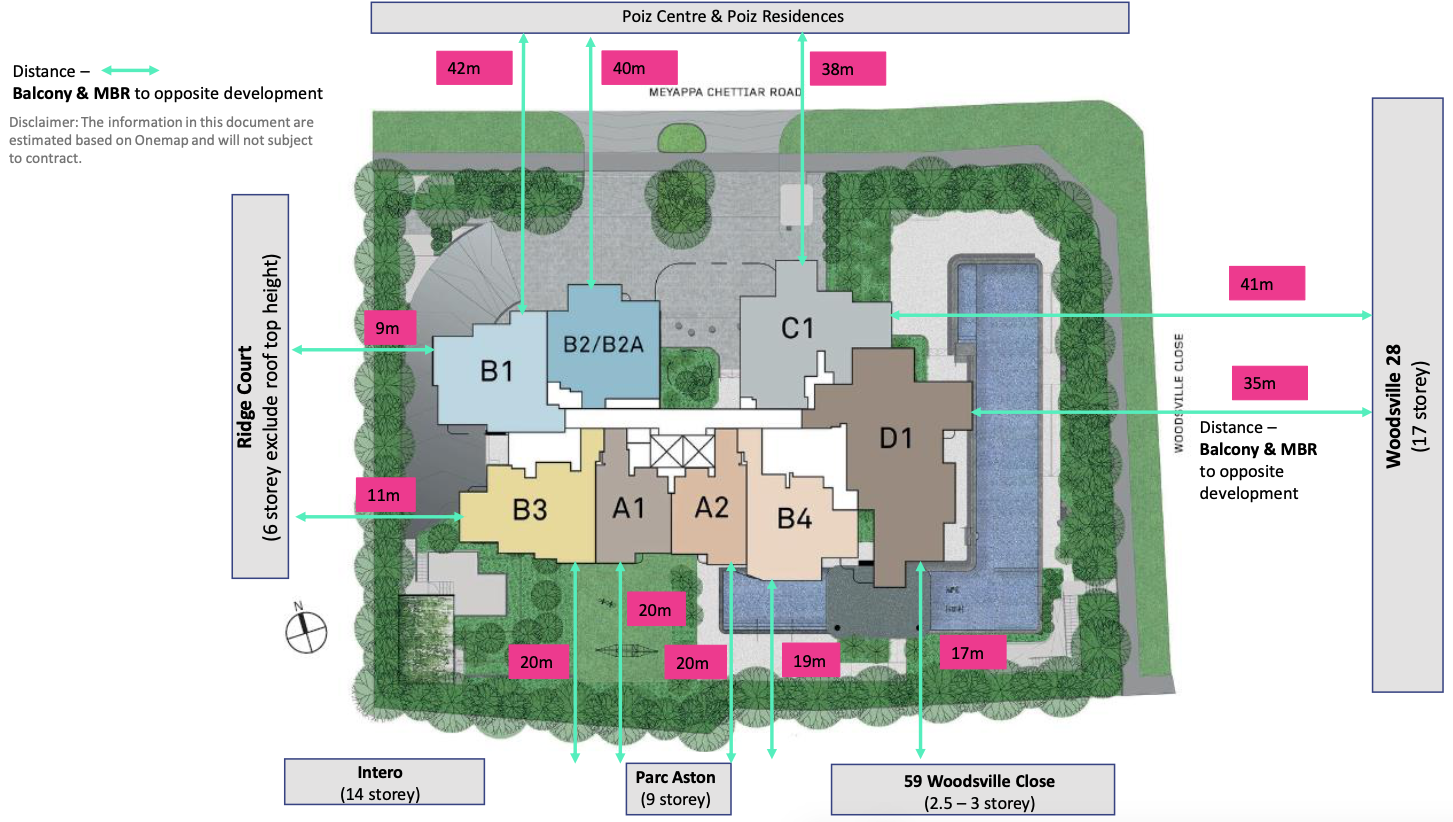

As you can see from the top-down view, the development really isn’t all that spacious, though it seems to be really well-equipped with shrubbery.

When I first heard that Myra was actually short for Palmyra (a tall fan-leaf Indian palm) on the pretext of the project being a ‘green-etched’ project, I simply shrugged it off as marketing speak.

But it’s here that I begin to see the essence of it coming into play with the numerous green-spaces intertwining with the facilities.

Most boutique developments I’ve seen have been void of greenery, and in that vein they usually feel a lot less communal/welcoming.

Again it’s down to personal preference, but props to the developer for choosing to diversify the space with greens (as opposed to forcing in other facilities in its place).

Finally, I believe that I might have missed out on the bicycle bays (27), internal bar counter/dining area (6/7), as well as the BBQ pits (21) earlier on in the tour due to the spatial tightness of the model, so you can have a clearer idea of their exact locations here.

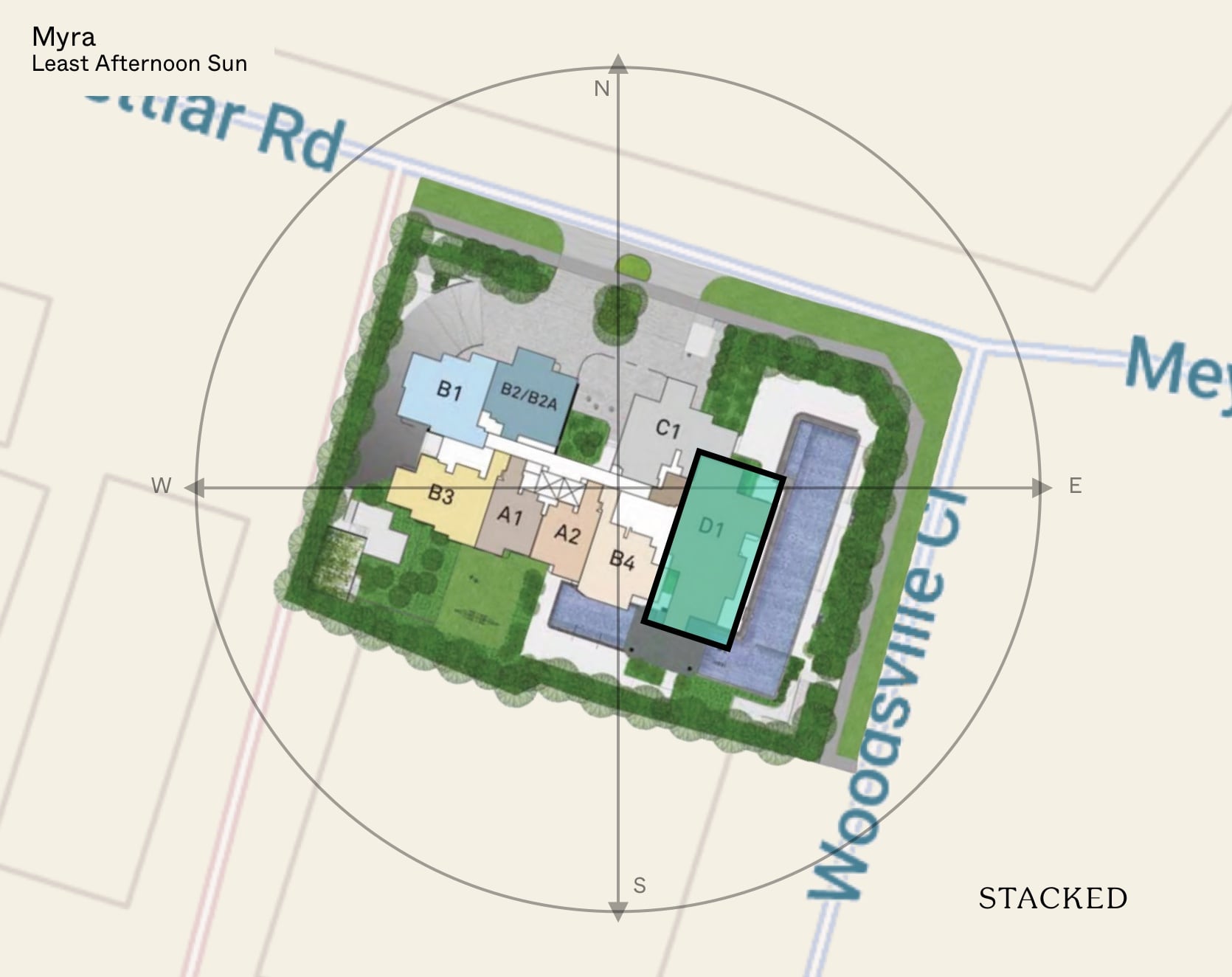

Afternoon west sun analysis

Units in Myra either have a south-west or north-east orientation, with the exception of D1 which faces the east.

Those facing the south-west orientation would experience the afternoon sun towards the October – January period, with the hottest around December-January.

Do note that while B3 and B1 look like it bears the brunt of the west sun, it’s actually a concrete wall.

From May till around September, the north-east facing units would experience some afternoon sun, though not nearly as much as the south-west facing units.

Stacks with the least afternoon sun

Stack D1 is the only east-facing stack and hence would enjoy a sunrise all-year round with no afternoon at all.

Best Overall Stacks

In terms of best stacks, you are nearly surrounded by developments all around so it’s tough to really recommend one in terms of best for each unit type. Ultimately, it’s really more of the unit size that you will need, as for a boutique development, you don’t get as many choices to choose from unlike bigger ones.

Price Review

Considering how small a town Potong Pasir actually is, the following list proves to be quite lengthy.

As such, I’ll split the comparison into sections, before comparing the total quantum figures of the smallest 1 and 2-bedroom units between Myra, the Addition (where applicable) and Poiz Residences.

Let’s get started.

| Project Name | Tenure | TOP | Average Price (PSF) |

| Myra | Freehold | 2024 | $2,096 |

| Poiz Residences | 99-year Leasehold | 2018 | $1,702 |

| The Addition | Freehold | Dec 2023 | $1,765 |

| 18 Woodsville | Freehold | 2015 | $1,427 |

| One Leicester | Freehold | 2013 | $1,512 |

| Nin Residence | 99-year Leasehold | 2014 | $1,238 |

| Sant Ritz | 99-year Leasehold | 2014 | $1,251 |

| Sennett Residence | 99-year Leasehold | 2014 | $1,462 |

| Woodleigh Residences | 99-year Leasehold | 2022 | $1,934 |

| Park Colonial | 99-year Leasehold | 2022 | $1,939 |

The biggest pull for Myra (in tandem with proximity to MRT) is its freehold tenure. It isn’t the only freehold project in the neighbourhood per se, but it’s certainly rare to get a freehold new launch situated this close to the MRT station.

It is also the most expensive freehold development on the list (note, we’ll get to its two main price competitors – The Addition and Poiz Residences at the end of this section).

18 Woodsville and One Leicester are the only other current freehold developments in the area, both of which are fronting major roads (ie. Upper Serangoon Road/PIE). They are also over $500 psf more affordable than the Myra.

For those looking for more affordable (relatively new) 99-year leasehold developments in this city fringe area, you have Nin Residence, Sant Ritz and Sennett Residence to choose from.

They are located just across the road, with Nin Residence situated closer to the upcoming Bidadari estate, while Sant Ritz is situated closer to the Upper Serangoon/PIE ‘crossover’.

Sennett Residence on the other hand has direct access to Exit B of Potong Pasir MRT and the adjacent bus stop hence it’s slightly higher psf value of $1,462.

I’ve also included both Woodleigh Residences and Park Colonial on the pretext that they’re New Launch condos located by the next closest MRT station (Woodleigh MRT).

For those familiar with these condos, they are 273,000+ sqft and 210,000+ sqft large respectively, so you definitely get much more units and facilities to choose from here. Not to mention the entire commercial space which is part of Woodleigh Residences.

Naturally that explains the much higher psf value despite their 99-year leaseholds and somewhat less city-fringe location when compared to condos in Potong Pasir.

Is the freehold tenure really worth that additional $400 psf differential from Poiz Residences?”

There’s no doubt that Myra has been priced at quite a high psf range. If you were to look at the 26-unit Addition just down the road (closer to St. Andrew’s and further from MRT), you’d observe a $331psf differential.

That said, the project’s units were fully snapped up between the space of 13 September 2018 to 30 October 2019 – which essentially attests to the demand of such developments in the area, hence giving SDB the green light to price their project higher based on the ‘freehold/boutique’ metric.

Now my general rule of thumb is 10% more for freehold projects than leasehold ones. But in this case, we see a 20%+ differential from Poiz Residences based on Myra’s new launch prices alone.

Some might argue in favour of Myra’s pricing given the rarity of this MRT-adjacent freehold project, and the gradual leasehold decay of its neighbours which it is less immune to.

To give you a clearer picture of what they mean, here are the number of LH vs FH launches in the vicinity over the past years:

| Project | Number of Units | Tenure |

| E Maison | 130 | Freehold |

| R Maison | 45 | Freehold |

| Sant Ritz | 214 | Leasehold |

| Sennett Residence | 332 | Leasehold |

| The Venue Residences | 266 | Leasehold |

| The Poiz Residences | 685 | Leasehold |

| Park Colonial | 805 | Leasehold |

| The Tre Ver | 729 | Leasehold |

| The Addition | 26 | Freehold |

As you can see, there are just the 201 freehold units compared to 3,301 leasehold units that have been built here over the past 8 years.

It certainly feels like a scarcity, which would explain why the Myra is priced so steeply – despite its relative lack of facilities.

If you were to ask me however, here’s my personal take on the issue.

While some might upsell the rarity of freehold units, alongside the fact that they are usually easier to ‘exit’ from, I wouldn’t be too quick to buy into the sentiment.

For one, affordability plays a huge role. If most potential buyers of the area do not have the financial strength to purchase these ‘more expensive’ units (think HDB upgraders from Bidadari in the near future), you could end up finding it harder to market your unit out.

Secondly, looking at the convenience/pull of the area, there will certainly still be demand for the leasehold properties here over a period of years – which in my opinion, would greatly slow the decay process (99 years is a long time after all) and reduce the pull/significant quantum increase of freehold projects in the space.

To end off the price review, here are the latest 1/2-bedder average quantum prices for the 3 newest projects in the immediate area.

| Project: | Size of Smallest 1-Bedder: | PSF of Smallest 1-Bedder (recent sale): | Quantum of Smallest 1-Bedder (recent sale): | Size of Smallest 2-Bedder: | PSF of Smallest 2-Bedder (recent sale): | Quantum of Smallest 2-Bedder (recent sale): |

| Myra | 474 sqft | $2,273 psf | $1.076m | 667 sqft | $2,197 psf | $1.466m |

| Poiz Residences | 420 sqft | $1,768 psf | $742,000 | 581 sqft | $1,621 psf | $942,000 |

| The Addition | NIL | NIL | NIL | 592 sqft | $1,895 psf | $1.122m |

Appreciation Analysis

Over the past years, we’ve seen marked increases of private housing prices in the Potong Pasir area with the more recent price swings coming in at approximately 20% from $1,500 psf back in 2017 to $1,800 psf now in 2020.

No doubt, this is because of the launch of new projects in the area, which has also contributed to a hike in private resale prices here in D13 as well.

As we know by now, any increase/decrease in pricings often hinges on neighbouring condo price moments – so it would take something significant to boost prices here (excluding the general property market pricing sentiments over the years).

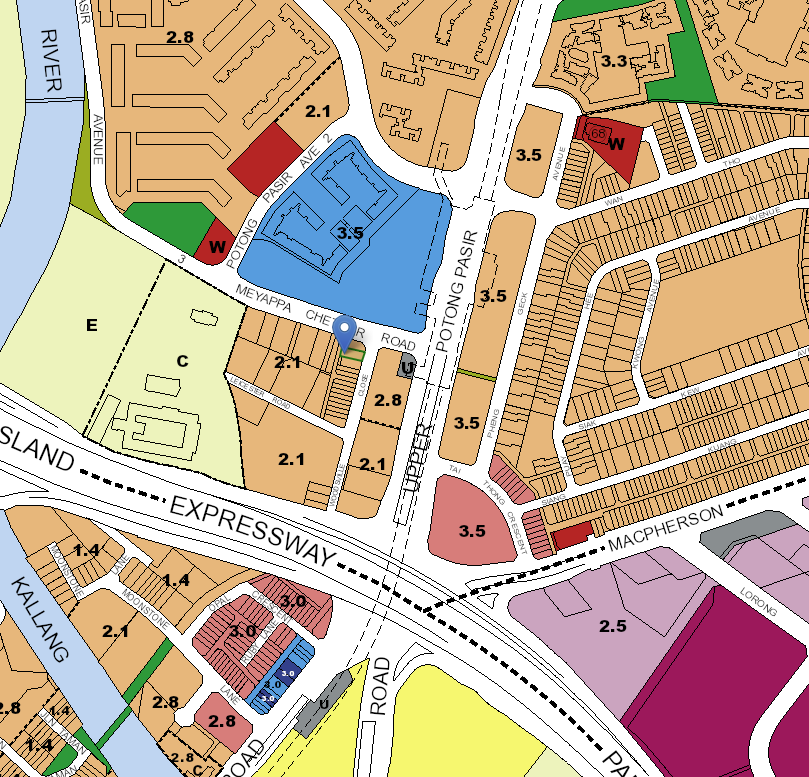

Based on the masterplan, we see numerous reserved land plots around the Potong Pasir Region, but none in the actual area itself.

In that regard, any impending price hikes from immediate land redevelopments have likely been taken out of the equation – save perhaps for en bloc takeovers of older condos here down the road or a potential SERS exercise for the aging population that live in Potong Pasir’s age-old HDB enclaves.

That said, we could still see trickle-down effects from the (re-)development of two key areas both north and south of Potong Pasir.

The first would be the upcoming Bidadari estate (located a 10-min walk/single station ride from the condo), which will bring in 10,000 HDB units by 2022 – and likely contain potential HDB upgraders keen on the region’s offerings.

It also brings in recreational bonuses like the park and green spaces, amongst a number of other commercial amenities.

There is also the question of the Kallang River rejuvenation down south.

It was slated in both the 2014 and 2019 Master Plan that we would see key adjustments to the land spaces along the River.

For now, any potential commercial/residential developments here do remain speculative, but these would be the two to look out for.

Our Take

What we like

- Near MRT & Amenities

- Exclusive

- Freehold

What we don’t like

- –Lots of competitors

- –Other than 2 bedroom, small units

Personally, I feel that the Myra will face pushback on its pricing, even though there is no doubt it is hinging on the entire freehold pretext to justify its pricing.

Considering that an integrated development (complete with commercials, more facilities and MRT accessibility) is going at $300+ psf more affordable next door, it does mean that competition is quite fierce in the area.

In my eyes, the one way Myra really shines is if you were to hang onto a unit here for a long term – at least till the point that we observe the lease decay for some 99-year leasehold projects in Potong Pasir beginning to creep in.

If we ignore the prices for a second and look at the general project, I’m certainly a fan of the facade design, even if the facilities are not as varied as I would like (as is to be expected).

Ultimately, its draw is really its more exclusive status, freehold land, and convenient location.

It isn’t necessarily my ideal home from both a homeowner or investor’s perspective, but when you look at the amenities around, you certainly get everything you need, save for entertainment amenities like cinemas or bowling alleys.

What this means for you

You might like Myra if you:

-

• Appreciate the Charm of Boutique Developments:

It’s certainly more exclusive than bigger projects despite an obvious shrinkage in the variety of facilities.

-

• Are a Firm Believer in Freehold Projects:

After all is said and done, there’s a certain sentimental pull to having a property that you could possibly ‘own’ forever (ie. pass down to future generations) – even if the odds of that happening are rare.

You might not like Myra if you:

-

• Are not a Fan of the Potong Pasir Location:

At $2,000+ psf, you certainly have numerous other options available in other parts of Singapore – even if you crave a new launch project.

-

• Need A Lot Of Space:

As with most boutique projects, land sizes are never big hence it would naturally feel more constrained. It also doesn’t help that the immediate area is already quite built-up so for those that want a sense of space should look elsewhere.

End of Review

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the main appeal of Myra condo for buyers interested in freehold properties?

Myra condo offers exclusivity with only 85 units, its freehold status, and a location near MRT and commercial spaces, making it attractive for those seeking long-term property ownership and investment.

How does the size and layout of Myra condo impact its living experience?

The small land size (30,689 sqft) results in a boutique development with 85 units, limited facilities, and a cozy, private atmosphere. The units have varied layouts, and the elevation provides added ceiling height and privacy.

What are the key facilities available at Myra condo?

Myra features a 25m lap pool, hydrotherapy pool, hydro gym, outdoor gym, children's pool, playground, and leisure lawn. It also has underground parking with 80% lot allocation, bicycle bays, and nearby amenities.

How does the pricing of Myra compare to nearby developments?

Myra's units average over $2,000 psf, which is about $400 psf more expensive than the nearby 99-year leasehold development, The Poiz, raising questions about whether its exclusivity and freehold status justify the higher price.

What are the options and features of the largest 4-bedroom unit at Myra?

The largest 4-bedroom unit is 1,324 sqft, located in a separate stack, with a long entrance, junior master bedroom with balcony, open-concept kitchen, and standard amenities. It has a ceiling height of 2.85m and includes a utility room and washer/dryer.

Our Verdict

69%

Overall Rating

Join our Telegram group for instant notifications

Join Now

0 Comments