Is Union Square Residences Worth A Look? A Detailed Pricing Review Comparison With Canninghill Piers And Riviere

February 24, 2025

Although Union Square Residences launched in November 2024, the renewed focus on the Core Central Region (CCR) in 2025 makes this an opportune time to revisit its pricing—even though it’s not technically in the CCR. This was one of the 6 new launches at that eventful bumper crop weekend and sold 20 per cent (75 units) of its 366 units – which has now increased to 31 per cent total sold. While that may not seem high with regard to where the new launch market is right now, we have to understand that this is a luxury and a higher quantum project.

Here’s what you’ll learn from this pricing review

- Prices transacted and their minimum asking price now

- Where prices stand compared to CanningHill Piers and Riviere, its closest competitors

- Where the opportunities and risks for Union Square Residences are

- How the resale condos around compare

- Where Union Square Residences stand in today’s new launch market

Transacted prices

| Bedroom Type | Average Transacted Price | Average of Unit Price ($ PSF) | Volume |

| 1 Bedroom | $1,426,444 | $3,082 | 9 |

| 1 Bedroom + Study | $1,618,217 | $3,199 | 23 |

| 2 Bedroom | $2,294,940 | $3,166 | 50 |

| 2 Bedroom + Study | $2,311,333 | $3,112 | 9 |

| 3 Bedroom Premium | $3,409,474 | $3,199 | 19 |

| 4 Bedroom Premium | $5,079,000 | $3,347 | 2 |

| Sky Suite | $9,288,000 | $3,752 | 1 |

The lowest prices on offer now

| Bedroom Type | Size | Lowest Asking Price | $PSF |

| 1 Bedroom | 463 | $1,422,000 | $3,071 |

| 1 Bedroom + Study | 506 | $1,490,000 | $2,945 |

| 2 Bedroom | 700 | $2,023,000 | $2,890 |

| 2 Bedroom + Study | 743 | $2,180,000 | $2,934 |

| 3 Bedroom | 990 | $3,176,000 | $3,208 |

| 3 Bedroom Premium | 1,066 | $3,176,000 | $2,979 |

| 4 Bedroom Premium | 1,518 | $4,620,000 | $3,043 |

| Sky Suite | 2,476 | $9,500,000 | $3,837 |

And here’s the unit mix:

| Unit Mix | Units | Proportion |

| 1 Bedroom | 102 | 27.9% |

| 2 Bedroom | 169 | 46.2% |

| 3 Bedroom | 57 | 15.6% |

| 4 Bedroom | 35 | 9.6% |

| 5 Bedroom | 2 | 0.5% |

| Penthouse | 1 | 0.3% |

| Total | 366 | 100.0% |

Prices have gone between $3,082 psf to $2,752 psf, clearly showing that at $3,000 psf, there are willing buyers available. To date, 113 units have been purchased, bringing the take-up rate to 31%, which is quite decent for a project that isn’t mass-market nor in the outskirts.

Currently, you can still purchase a unit here well below the average $PSF from $2,890 for a 2-bedder.

All this may sound high, but in the context where Norwood Grand, a Woodlands new launch condo easily hits over $2,000 psf, some people may expect a premium product like this to cost much more.

Just how do these prices compare to its nearest and direct competitors, CanningHill Piers and Riviere? We’ll focus our attention more on the 1 and 2 bedroom units given that they constitute 74% of the project.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Union Square Residences’ lowest prices are around the average prices Canninghill Piers and Riviere transacted for in 2021-22

Here’s a look at the $PSF by bedroom types for both new launches over the past few years:

| Project Name | Bedroom | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | Average |

| CANNINGHILL PIERS | 1 | $2,916 | $3,347 | $3,551 | $3,567 | $2,932 | ||

| 2 | $2,930 | $2,905 | $3,002 | $2,927 | ||||

| 3 | $2,906 | $2,828 | $2,812 | $2,882 | ||||

| 4 | $3,128 | $2,888 | $2,868 | $3,012 | ||||

| 5 | $3,022 | $3,124 | $3,122 | $3,084 | ||||

| PH | $5,360 | $4,398 | $4,718 | |||||

| Average | $2,936 | $2,968 | $3,174 | $2,960 | $2,943 | |||

| RIVIERE | 1 | $2,928 | $2,719 | $2,811 | $2,979 | $3,178 | $2,945 | |

| 2 | $2,826 | $2,563 | $2,695 | $2,949 | $3,274 | $2,859 | $2,813 | |

| 3 | $2,888 | $2,492 | $2,608 | $2,775 | $3,025 | $2,761 | ||

| 4 | $2,945 | $3,070 | $2,791 | $2,987 | $2,946 | |||

| Average | $2,894 | $2,610 | $2,665 | $2,868 | $3,066 | $2,859 | $2,819 | |

| Average | $2,894 | $2,610 | $2,893 | $2,899 | $3,078 | $2,937 | $2,893 | |

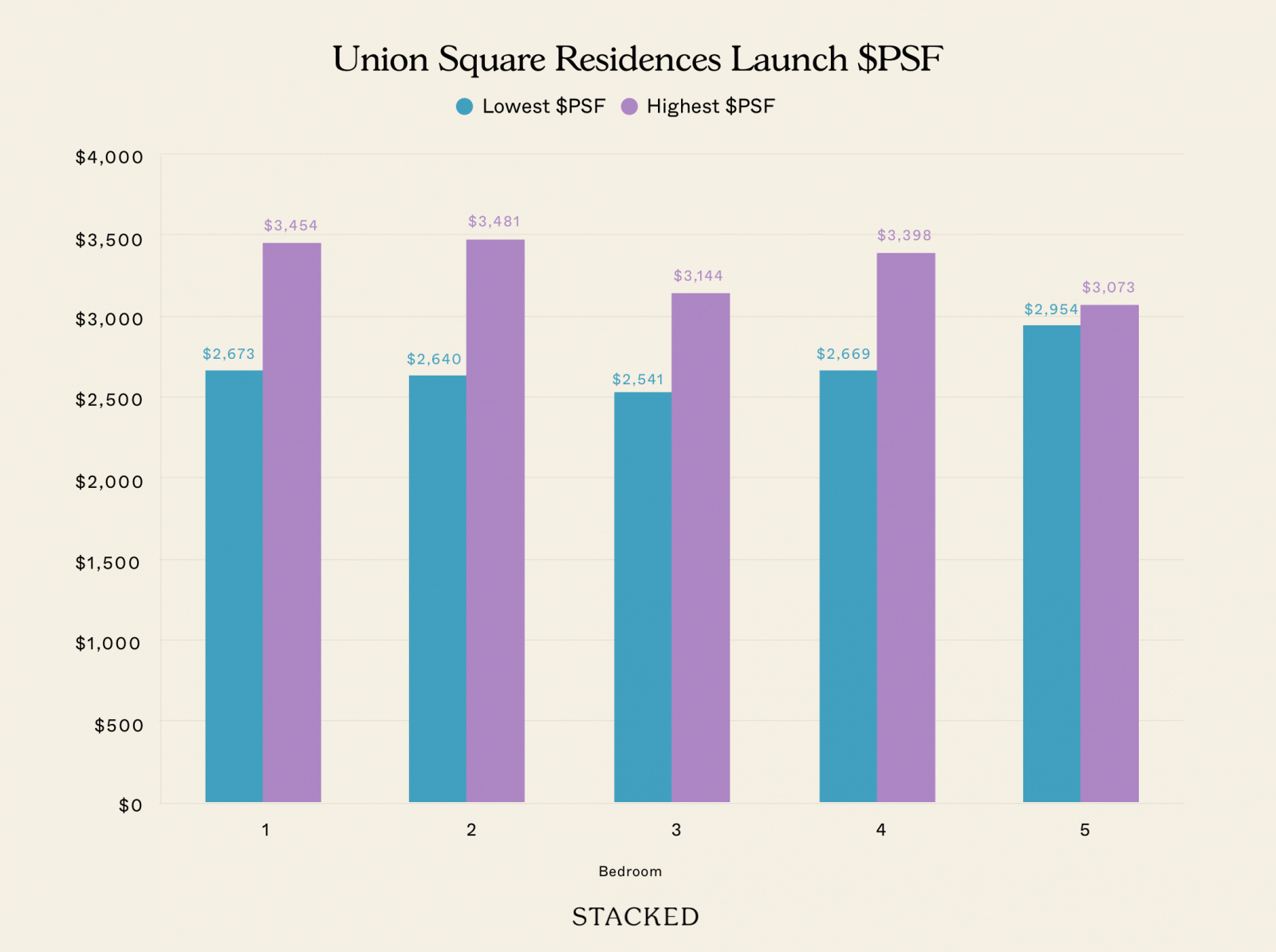

1 bedroom prices in Canninghill Piers varied greatly when it first launched in 2021 – from $2,673 PSF to $3,454:

At first glance, Union Square Residences appears to be entering the market at a price point similar to what many buyers achieved three years ago. This isn’t surprising, given how land prices trend upwards in Singapore. Nevertheless, this could create a competitive landscape, as future sellers in CanningHill Piers might still profit by listing at or around those same levels.

However, if we focus on the smaller one-bedroom units—those closer in size to what Union Square Residences offers—we see a different picture. At CanningHill Piers, units under 500 square feet were transacting at an average of $2,736 PSF. While this is higher than previous averages, it remains below the current asking price at Union Square Residences, which reflects broader market trends over the past few years.

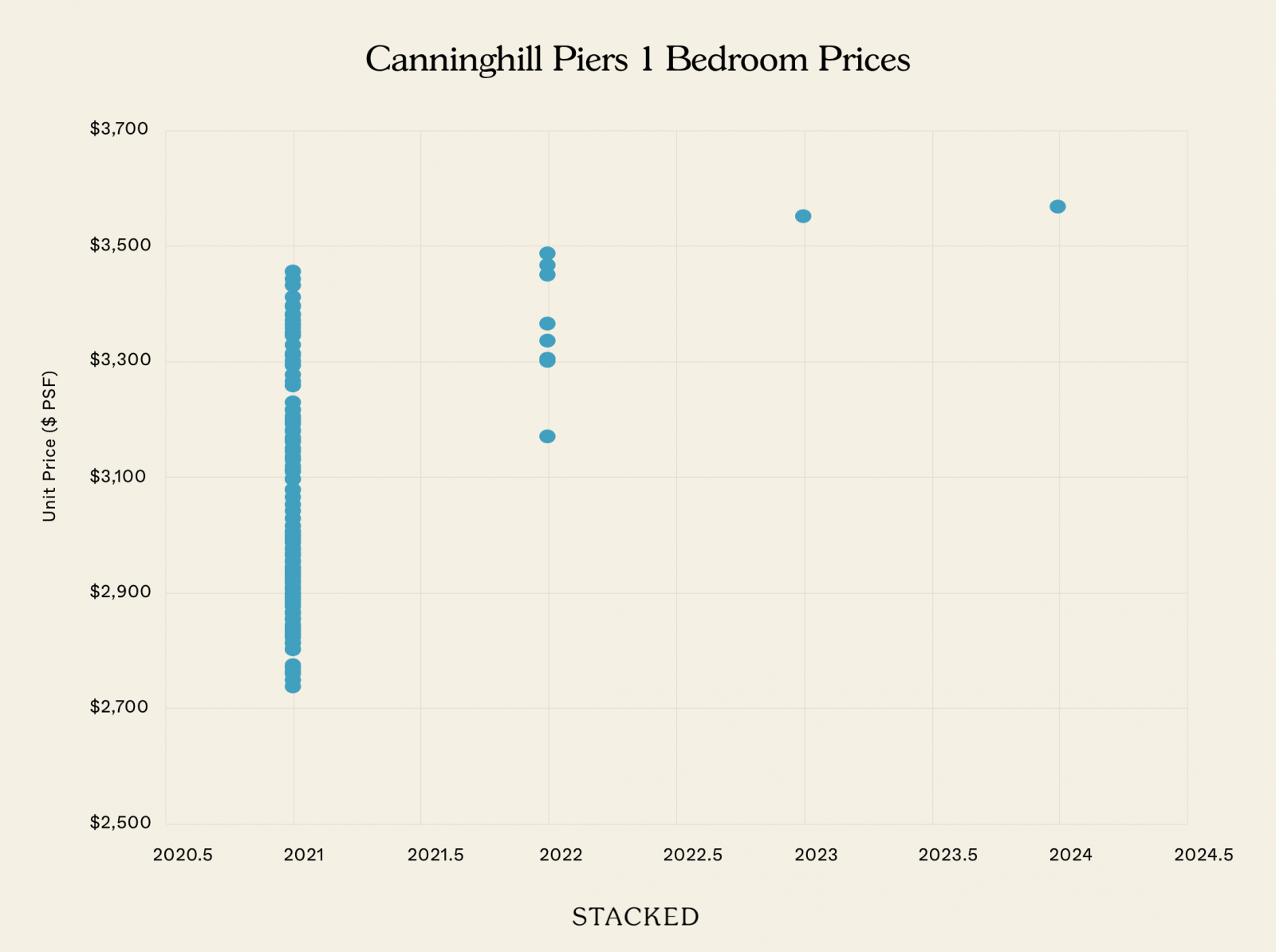

Here’s a look at the scatterplot of $PSF prices for 1 bedder units across the years at CanningHill Piers.

In 2021, there were 59 transactions out of 133 that went below the lowest $PSF of Union Square Residences for sizes below 500 sq ft. With a TOP date that’s just 1-2 years apart, buyers today would face some stiff competition if the holding period is short.

The same can be said for the 2 bedders due to the similar pattern in pricing. On average, 2 bedroom units at CanningHill Piers were sold for $2,930.

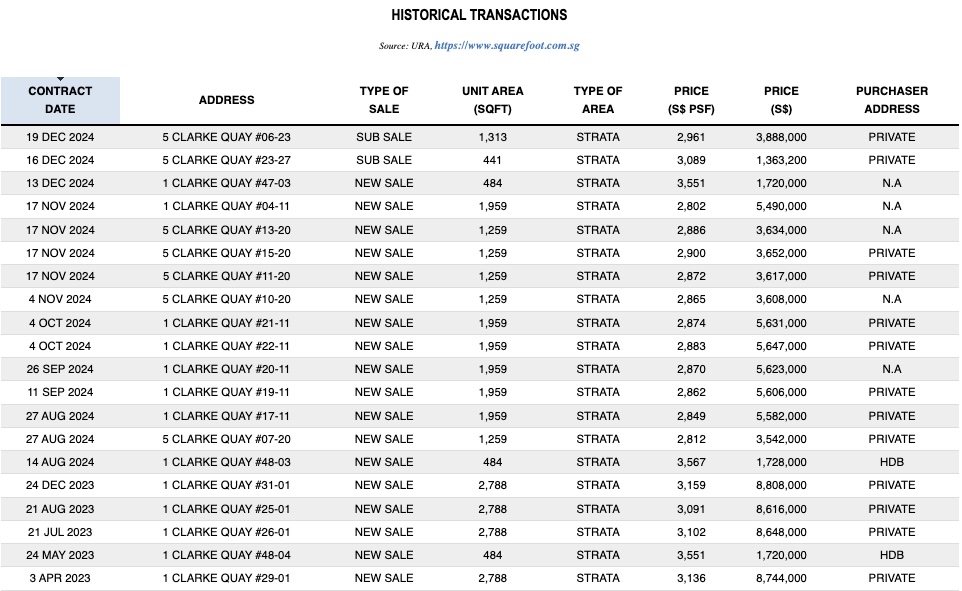

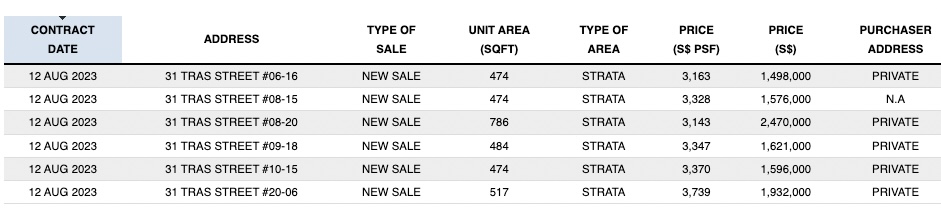

Here’s a look at some of the more recent transactions at CanningHill Piers:

These sales by the developer took place in 2024 in a relatively short period.

The most recent transactions were all $2,800 – 3,000+ $PSF which is where Union Square Residences prices start from and averages well into. While there are only 2 sub sale transactions so far, you can point to Union Square Residences pricing being quite fair if someone on the secondary market paid $3,089 psf for a 23rd storey 1 bedder.

The most recent 1-bedder at Union Square Residences which is on the 7th floor went for $3,033 psf (463 sq ft) – this isn’t too far off the $3,089 psf at CanningHill Piers, though it is 16 floors higher.

Riviere’s sub-sale and resale transactions reveal the secondary market’s opinion

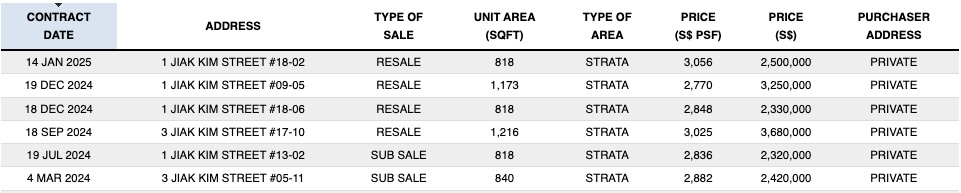

So far there have only been 4 resale transactions, though it must be noted that the bulk of Riviere’s buyers only purchased in the second half of 2022 to 2023 – so most are still some time away from fulfilling the SSD period:

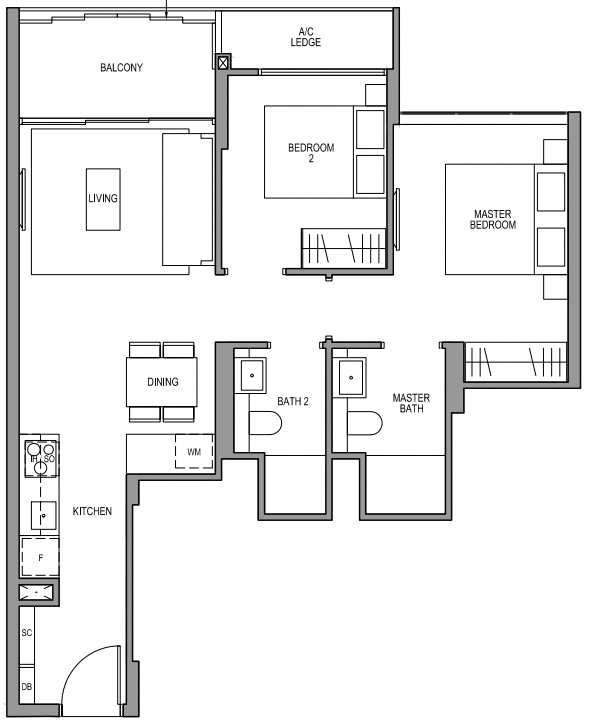

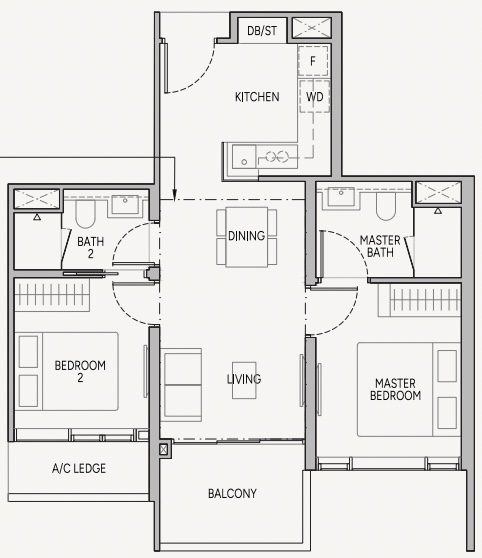

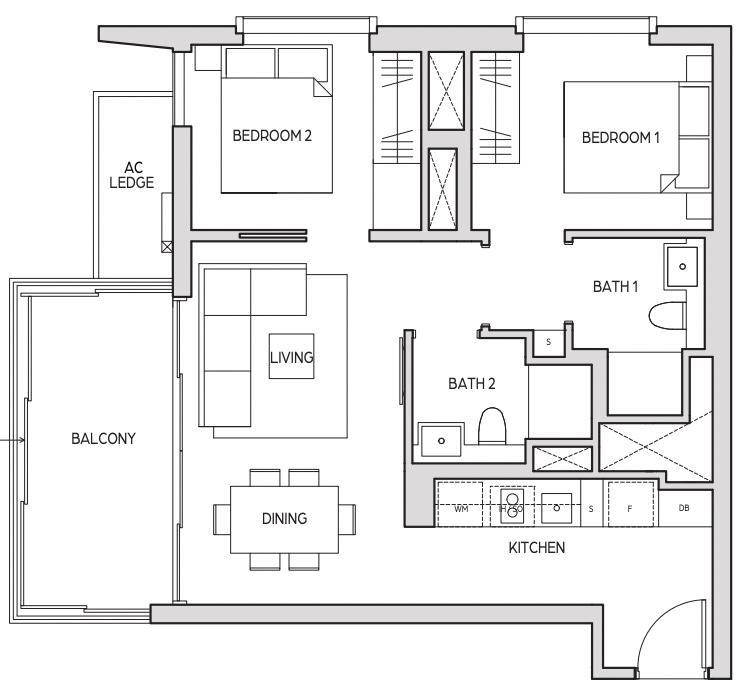

Let’s look at the two 818 sq ft 2 bedders which recorded $2,848 and $3,056 psf respectively. It has 2 bathrooms but does not have a study:

The layout is pretty typical. As you come in, there’s the kitchen on the right and a store on the left. Both bathrooms are well-sized with the common room allowing for a queen bed and 2 side tables.

Union Square Residences 700 sq ft now starts from $2,023,000 ($2,890 psf) so while it is priced around what Riviere is asking for in terms of $PSF, it does have a good edge in terms of overall price.

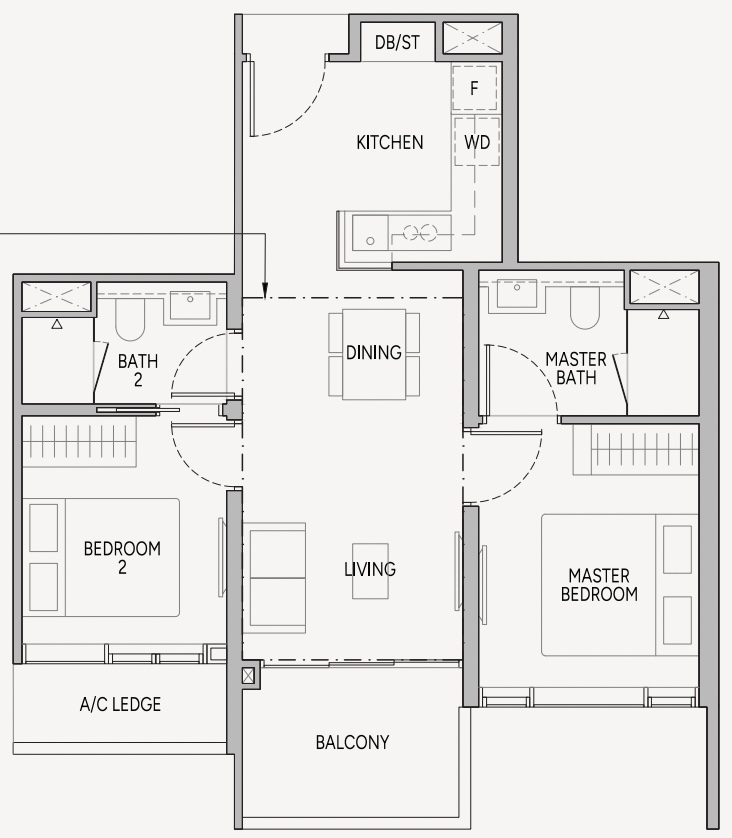

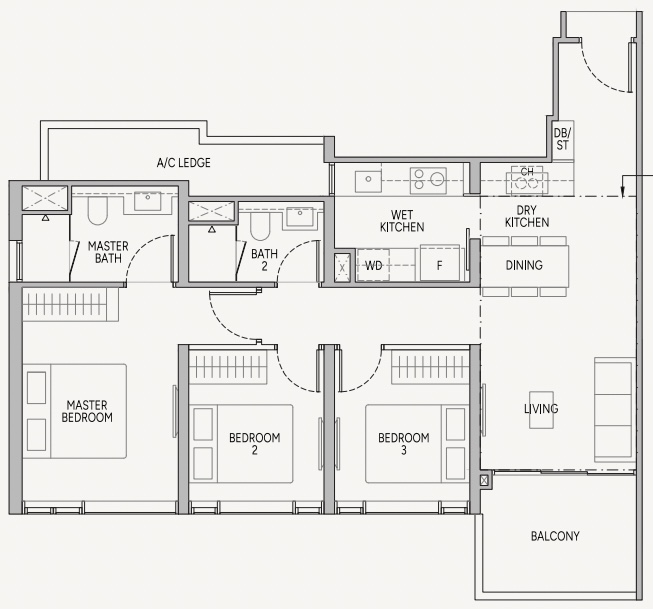

Here’s what the layout looks like:

The dumbbell layout makes it slightly more efficient and is more suited towards a tenant profile.

There are downsides to the smaller size though, such as a slightly smaller bedroom. Both bathrooms aren’t naturally ventilated, which is similar, but Union Square Residences’s layout does seem better in terms of the dining area.

Regardless, its starting $PSF is pretty much in line with what people are paying for today at Riviere. This is reinforced by the transactions of new units in CanningHill Piers too.

Old $PSFs are lower, and current $PSF hover around what Union Square Residences starts at… so what?

Nothing here is new. You cannot expect new launches in later years to charge less than others before them. Land prices go up, and if developers try to submit a bid that’s too low, it would get rejected due to the reserve price set by URA.

But what this demonstrates is that buyers of Union Square Residences would be going into the area later, but its prices are within expectations of today’s market.

What the developers is asking for is a reflection of current prices. On the more optimistic end, you can buy it at today’s price and it’ll be the newer project when it TOPs (though by only a few years).

Going into the game late doesn’t mean there’s no opportunity

CanningHill Piers only has a handful of units left – 17 as of now (and 10 of these are the 5 bedroom premium and above). Riviere is fully sold and residents have already moved in. In other words, if you want to invest in a new launch in this area at this current moment, you don’t have much of a choice. The question now is – are there any growth drivers?

Before going into them, bear in mind that any growth driver here will also lift the prices of Riviere/CanningHill Piers. It is not unique to Union Square Residences, so this does not change our opinion on the challenges of offloading it as an investor in the short-term. Growth drivers only signal that there are potential upsides beyond property inflation to realise (and some risks which we’ll get to).

Where are the growth opportunities of Union Square Residences?

There are 3 main growth drivers that work together in making places like Union Square Residences attractive to a wider audience.

They are:

- URA’s vision of turning the CBD into a more liveable place

- More HDBs will be built in prime areas

- Centrally-located properties becoming “cheaper” relative to other areas.

The confluence of these three factors means that people will start to see properties in the city as a liveable (point 1 and 2) and more affordable place (point 3).

HDB has announced plans to sell more homes in the CCR which will likely be “Prime” flats. These are flats that come with tighter restrictions (such as income restrictions and a longer MOP) as well as greater subsidy clawbacks upon selling.

Anyone who stays in an HDB cluster knows that eateries, barbershops, groceries, bakeries and clinics should be within walking distance. It’s almost like a template to ensure HDBs are liveable – and it shouldn’t be any different with Prime HDBs.

Not only will that increase liveability. Families who grow up in an area tend to want to stay nearby. There’s not just a financial incentive (the Proximity Grant), there’s also the familiarity and ties to the area that tend to keep people within an area. This is why mega launches in large HDB estates can do well – many HDB upgraders or families who wish to move close by.

All this could mean a greater desirability and relevance as a residential hotspot in the future.

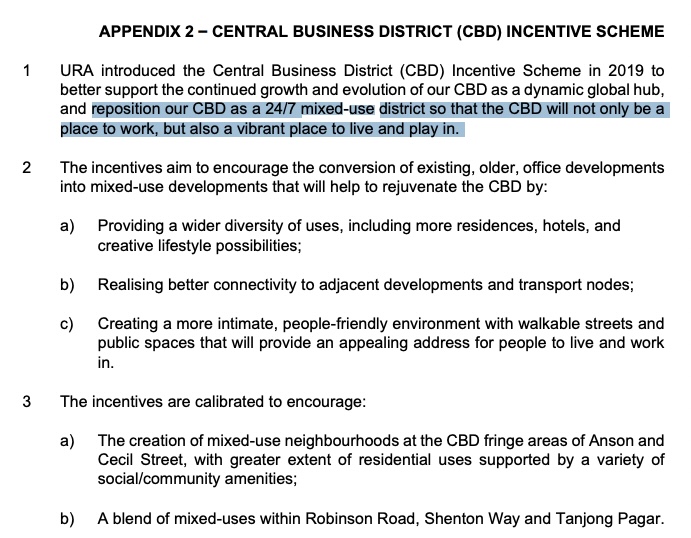

URA also has plans to liven up the city area:

It’s disheartening to go to a home where most amenities are shut because office workers are no longer around. With more mixed-use developments like Union Square Residences, as well as HDBs in the vicinity, the city area will naturally become more lively even at night, making it a lot more liveable than it is today. The caveat here is whether URA will be successful. Singapore does have a great track record of rejuvenating spaces, so it’s more likely to succeed than not, and developments like Union Square Residences contribute to this.

Finally, there’s the ongoing trend of central properties becoming “cheaper” relative to non-central ones. You may have seen news reports on how Core Central Region (CCR) properties are now not that much more pricey as compared to Outside of Central Region (OCR) ones.

However, we want to refrain from using CCR/OCR/RCR, specifically for properties like Union Square Residences. It can serve as a guide in understanding the changing dynamics of prices between the market segments, but it won’t be accurate in terms of numbers because Union Square Residences is not located in the CCR.

CCR is defined as central region properties in Districts 9, 10, 11 and those found in Downtown Core/Southern Islands (a.k.a. Sentosa).

Union Square Residences is located in district 1 outside of Downtown Core, but it’s within Central Region, thus it falls under RCR. It’s the same for Riviere and CanningHill Piers. As such, it would not be accurate to include Districts 9 – 11 in our analysis too – especially 10 and 11 given they’re much further out. After all, you wouldn’t classify staying along Sixth Avenue as equivalent to staying next to the Singapore River or CBD which is the area where Union Square Residences is.

So in our data, we’ll classify Districts 1, 2 and 6 as “within city” to be compared with OCR.

Here’s how prices have moved for resale transactions within and outside of the city:

| Year | Resale Less Than 550 Sq Ft | Resale 550 Sq Ft – 850 Sq Ft | ||||

| Within City | OCR | $PSF Gap | Within City | OCR | $PSF Gap | |

| 2013 | $2,253 | $1,444 | 56% | $2,066 | $1,161 | 78% |

| 2014 | $2,413 | $1,473 | 64% | $1,973 | $1,123 | 76% |

| 2015 | $1,866 | $1,408 | 32% | $1,915 | $1,149 | 67% |

| 2016 | $2,064 | $1,302 | 59% | $1,838 | $1,074 | 71% |

| 2017 | $2,230 | $1,294 | 72% | $1,908 | $1,125 | 69% |

| 2018 | $2,157 | $1,365 | 58% | $1,991 | $1,183 | 68% |

| 2019 | $2,025 | $1,357 | 49% | $2,095 | $1,162 | 80% |

| 2020 | $2,030 | $1,305 | 56% | $2,100 | $1,173 | 79% |

| 2021 | $2,075 | $1,382 | 50% | $2,063 | $1,242 | 66% |

| 2022 | $2,173 | $1,475 | 47% | $2,022 | $1,357 | 49% |

| 2023 | $2,261 | $1,594 | 42% | $2,004 | $1,485 | 35% |

| 2024 | $2,227 | $1,639 | 36% | $2,029 | $1,543 | 32% |

Prices have narrowed quite a bit for both categories – more so for slightly bigger units. Where resale units in OCR used to cost almost $1,000 psf less, today it’s less than a $500 psf difference. It’s still a big difference, but you can see a steady decline in the gap since 2019.

What about new sales?

| Year | New Sales Less Than 550 Sq Ft | New Sales 550 Sq Ft – 850 Sq Ft | ||||

| Within City | OCR | $PSF Gap | Within City | OCR | $PSF Gap | |

| 2013 | $2,383 | $1,367 | 74% | $2,324 | $1,251 | 86% |

| 2014 | $2,460 | $1,290 | 91% | $2,248 | $1,232 | 82% |

| 2015 | $2,662 | $1,256 | 112% | $2,315 | $1,182 | 96% |

| 2016 | $2,577 | $1,306 | 97% | $2,193 | $1,237 | 77% |

| 2017 | $2,508 | $1,414 | 77% | $2,403 | $1,289 | 86% |

| 2018 | $3,033 | $1,431 | 112% | $3,055 | $1,431 | 113% |

| 2019 | $2,521 | $1,506 | 67% | $2,564 | $1,468 | 75% |

| 2020 | $2,551 | $1,613 | 58% | $2,650 | $1,524 | 74% |

| 2021 | $2,872 | $1,726 | 66% | $2,839 | $1,621 | 75% |

| 2022 | $3,202 | $2,194 | 46% | $2,652 | $2,044 | 30% |

| 2023 | $3,319 | $2,234 | 49% | $2,695 | $2,176 | 24% |

| 2024 | $3,371 | $2,205 | 53% | $2,812 | $2,187 | 29% |

It’s the same pattern where smaller units saw a smaller reduction in the gap compared to the bigger 550 – 850 sq ft category.

Overall, the trend remains the same. Prices on a $PSF level have moved more than prices within the city area. This means that in terms of price, city condos are getting “cheaper” as news reports have mentioned. In fact, the highlight was in comparing new OCR developments versus the resale condos you can buy in CCR which is true.

In the above table, you’ll see that in 2024, OCR $PSF was $2,205 on average for a new launch condo. The average size here was 521 sq ft.

The average resale price of Districts 1, 2 and 6 in 2024 is $2,227 which is almost the same. The average size? 462 sq ft.

More from Stacked

J’den Condo Review: A Rare New Launch Near 4 MRT Lines Replacing JCube

If you told Singaporeans 20 years ago that Jurong would evolve into what it is today and stand at the…

Many of the resale units that recorded a high $PSF were 300+ sq ft in size, a size that you’ll likely not see in the OCR due to regulations that discourage developers from building too small.

This is the reason why overall, you can find cheaper resale 1 bedders in the city area as compared to new 1 bedders in the OCR. Here’s a look at the average prices for units 550 sq ft and below:

| Year | New OCR Total Price | Resale City Total Price | Price Gap |

| 2013 | $661,832 | $1,135,242 | 72% |

| 2014 | $612,685 | $1,195,000 | 95% |

| 2015 | $601,774 | $814,636 | 35% |

| 2016 | $647,503 | $941,757 | 45% |

| 2017 | $679,021 | $920,359 | 36% |

| 2018 | $683,048 | $978,643 | 43% |

| 2019 | $729,921 | $946,248 | 30% |

| 2020 | $795,696 | $902,360 | 13% |

| 2021 | $870,769 | $938,823 | 8% |

| 2022 | $1,088,103 | $981,400 | -10% |

| 2023 | $1,132,907 | $1,032,556 | -9% |

| 2024 | $1,150,358 | $1,025,129 | -11% |

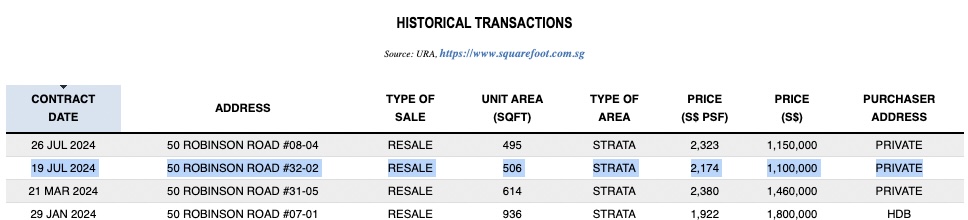

The tables have turned. Where new launches in the city used to cost 72% more for small units, now it’s 11% less. Many of the transactions in 2024 were for condos like Spottiswoode 18 and The Clift. For example, you can find a 506 sq ft 1-bedder at The Clift on a high floor asking for just above $1 million now.

This is slightly above the new launch 1 bedders in the OCR in 2024. And it’s not just because it’s an older leasehold condo. Freehold condos like Robinson Suites have clocked $1.1 million ($2,174 psf) for a 32nd floor unit that’s 506 sq ft in size.

So what does this all mean for Union Square Residences? With increased liveability in the area, there is potential for resale condo values to grow here as more and more people see the value of paying the same amount for a much more central area.

Now here’s where the risks come into play

So far, we’ve only highlighted the trends that could see why buying into a development like Union Square Residences could make sense. However, there are also opposing forces to this.

- Resale condos in the city area may be getting “cheaper” – but a $2,900+ psf is still a far cry from its resale condos

- Cooling measures are unlikely to go and add a strong inertia for foreign investors who generally look towards the central area

- The unit mix of Union Square Residences, being primarily 1 and 2-bedders, is attractive in overall price which tends to attract investors looking to tenant the property out.

- The continuing decentralisation makes the city centre less desirable.

While we’ve detailed the case where city condos could look increasingly more attractive, the prices of Union Square Residences are higher than their resale peers by around 30%. This is nothing out of the ordinary when comparing new to resale.

However, if we’re comparing OCR new launches and resale city condos, then this does matter. It means we can expect resale condos to “catch up” at a faster rate than its new launch peers as there is lesser upside potential. As such, the first beneficiaries of this are resale condos in the area with a lower price tag already. Of course, this disregards condo-specific traits such as Union Square Residences being a mixed-use development. But if we’re talking about the data and trends, then this is a valid concern.

Points 2 and 3 are quite similar in that cooling measures tend to hurt investors and foreigners who look to more central condos. Given the large unit mix of smaller bedroom types in Union Square Residences, we can also expect a larger number of investors here. Investors tend to accept a lower selling price as they not only collect rent but are willing to sell for another opportunity or aren’t beholden to a specific price to move into another home.

Finally, the whole reason why prices outside of the city area may have caught up, to begin with, could be just that the city centre is no longer that desirable after all. It may not be that central condos would now “catch up” and maintain their price gap in their heydays. It’s that OCR condos have already caught up with central condos to reflect today’s property landscape.

Resale considerations

There are plenty of resale condos to consider if you want to stay in the area:

Here’s a look at some transactions in the past year:

| Project Name | Tenure | Completed | 1 | 2 | 3 | 4 |

| Union Square Residences | 99 yrs | $1,422,000 | $2,023,000 | $3,176,000 | $4,620,000 | |

| 8 RODYK | Freehold | 2011 | $1,739,000 | $3,240,000 | ||

| MARTIN MODERN | 99 yrs from 28/09/2016 | 2021 | $1,900,000 | $2,750,000 | $4,855,000 | |

| MARTIN NO 38 | Freehold | 2011 | $2,180,000 | $3,450,000 | ||

| RIVER PLACE | 99 yrs from 07/11/1995 | 1999 | $1,240,000 | $1,540,000 | $2,070,000 | $3,550,000 |

| RIVERGATE | Freehold | 2009 | $2,950,000 | $4,185,000 | $4,800,000 | |

| RIVERSIDE 48 | Freehold | 2000 | $1,400,000 | |||

| ROBERTSON 100 | Freehold | 2004 | $2,000,000 | $2,638,888 | ||

| ROBERTSON EDGE | 999 yrs from 01/07/1841 | 2008 | $1,388,000 | |||

| RV POINT | 999 yrs from 01/07/1841 | 2015 | $855,000 | |||

| THE INSPIRA | Freehold | 2009 | $2,400,000 | |||

| THE PIER AT ROBERTSON | Freehold | 2006 | $1,450,000 | $2,100,000 | ||

| THE QUAYSIDE | 99 yrs from 03/02/1994 | 1998 | $2,220,000 | |||

| THE WHARF RESIDENCE | 999 yrs from 01/07/1841 | 2012 | $2,320,000 | $3,150,000 | $5,105,000 | |

| UE SQUARE | 929 yrs from 01/01/1953 | 1997 | $1,250,000 | $2,180,000 | $2,650,000 | |

| UP@ROBERTSON QUAY | 99 yrs from 07/06/2011 | 2015 | $1,025,000 | $1,175,000 | $2,238,000 | |

| VIVACE | 999 yrs from 01/07/1841 | 2012 | $902,888 | $1,350,000 | ||

| WATERMARK ROBERTSON QUAY | Freehold | 2008 | $2,048,000 | $3,480,000 |

The newest here is Martin Modern which was completed 3 years ago. The leasehold condo is within minutes’ walk to the Singapore River, but it’s not particularly within quick access to a mall unlike Union Square Residences (unless you consider New Bahru one).

The cheapest 2-bedroom price at Martin Modern in the past year was for a 764 sq ft unit on the 15th floor which sold for $1.9 million ($2,486). In terms of price, it’s slightly less than the lowest-asking price at Union Square Residences. On a $PSF basis though, it’s close to $404 difference in psf. If we account for floors, the gap would be larger.

The layout is regular and has the same functionalities as the one at Union Square Residences. However, Union Square Residences is more efficient given its dumbbell layout:

Overall, we think the pricing does make sense given Union Square Residences is newer and would be more convenient given its a mixed-use development. Of course, some people might prefer the more tranquil area around Martin Modern, so this is a tradeoff to note.

Martin Modern’s cheapest 3 bedder sold for $2,750,000 which is on level 4. The unit is 1,012 sq ft in size which is a compact 3 bedder:

Here’s what Union Square Residences 3 bedroom compact looks like:

Both are quite similar functionally, but Martin Modern has the bigger bedroom as it can fit a side table. It doesn’t have a dry kitchen area though, so that’s a compromise. The price between both is quite similar which does make Union Square Residences look decent here given it’s a mixed-use development.

Overall if we look at the resale table, you’ll see that the prices of Union Square Residences aren’t too high, but that’s because surrounding developments have larger units. Some of these are freehold/999-year so they have that as an advantage, however, in the short term it’s likely not to have much of an impact.

Now that we understand the positioning among direct comparables/resale condos around, opportunities and risks of Union Square Residences, let’s see how it stands among new launches today.

Union Square Residences 1 bedroom comparison

| Projects | Tenure | Area | 1BR |

| Parktown Residence | 99 yrs | Tampines | $1,070,000 |

| ELTA | 99 yrs | Clementi | $1,158,000 |

| Kassia | Freehold | Pasir Ris | $1,160,000 |

| Lentoria | 99 yrs from 19/12/2022 | Ang Mo Kio | $1,308,000 |

| Hill House | 999 yrs from 01/07/1841 | River Valley | $1,380,000 |

| Lentor Hills Residences | 99 yrs from 25/04/2022 | Ang Mo Kio | $1,406,000 |

| Tembusu Grand | 99 yrs from 25/04/2022 | Marine Parade | $1,409,000 |

| Grand Dunman | 99 yrs from 12/09/2022 | Marine Parade | $1,418,000 |

| TMW Maxwell | 99 yrs from 28/04/2023 | Outram | $1,420,000 |

| Union Square Residences | 99 yrs | Singapore River | $1,422,000 |

| 10 Evelyn | Freehold | Novena | $1,431,500 |

| The LakeGarden Residences | 99 yrs from 31/05/2023 | Jurong East | $1,470,000 |

| Claydence | Freehold | Geylang | $1,473,600 |

| 8@BT | 99 yrs | Bukit Timah | $1,495,000 |

| The Continuum | Freehold | Geylang | $1,502,000 |

| Hillock Green | 99 yrs from 19/12/2022 | Ang Mo Kio | $1,513,000 |

| Midtown Bay | 99 yrs from 02/01/2018 | Downtown Core | $1,588,000 |

| Grange 1866 | Freehold | River Valley | $1,694,000 |

| Canninghill Piers | 99 yrs from 17/09/2021 | Singapore River | $1,712,000 |

| Cuscaden Reserve | 99 yrs from 14/08/2018 | Orchard | $2,086,000 |

Union Square Residences is a vastly different product from many new launches in the table. First, it’s in the city area which tends to attract a different crowd. Next, its prices are much higher on both a quantum and $PSF basis. Those looking at Union Square Residences may also compare it to condos like TMW Maxwell, Midtown Bay, Midtown Modern, One Bernam and Canninghill Piers (the most comparable).

The current cheapest option is TMW Maxwell. The $1,420,000 unit is not technically a 1-bedroom project but what the developers call the Flip/Switch unit:

The design of the unit allows for flexibility of space depending on what you need it for. Central to this is the wardrobe which you can pull along tracks to customise the space. It is 474 sq ft in size and aside from the wardrobe, has a typical layout of a 1 bedder. At this price, it’s $2,996 psf.

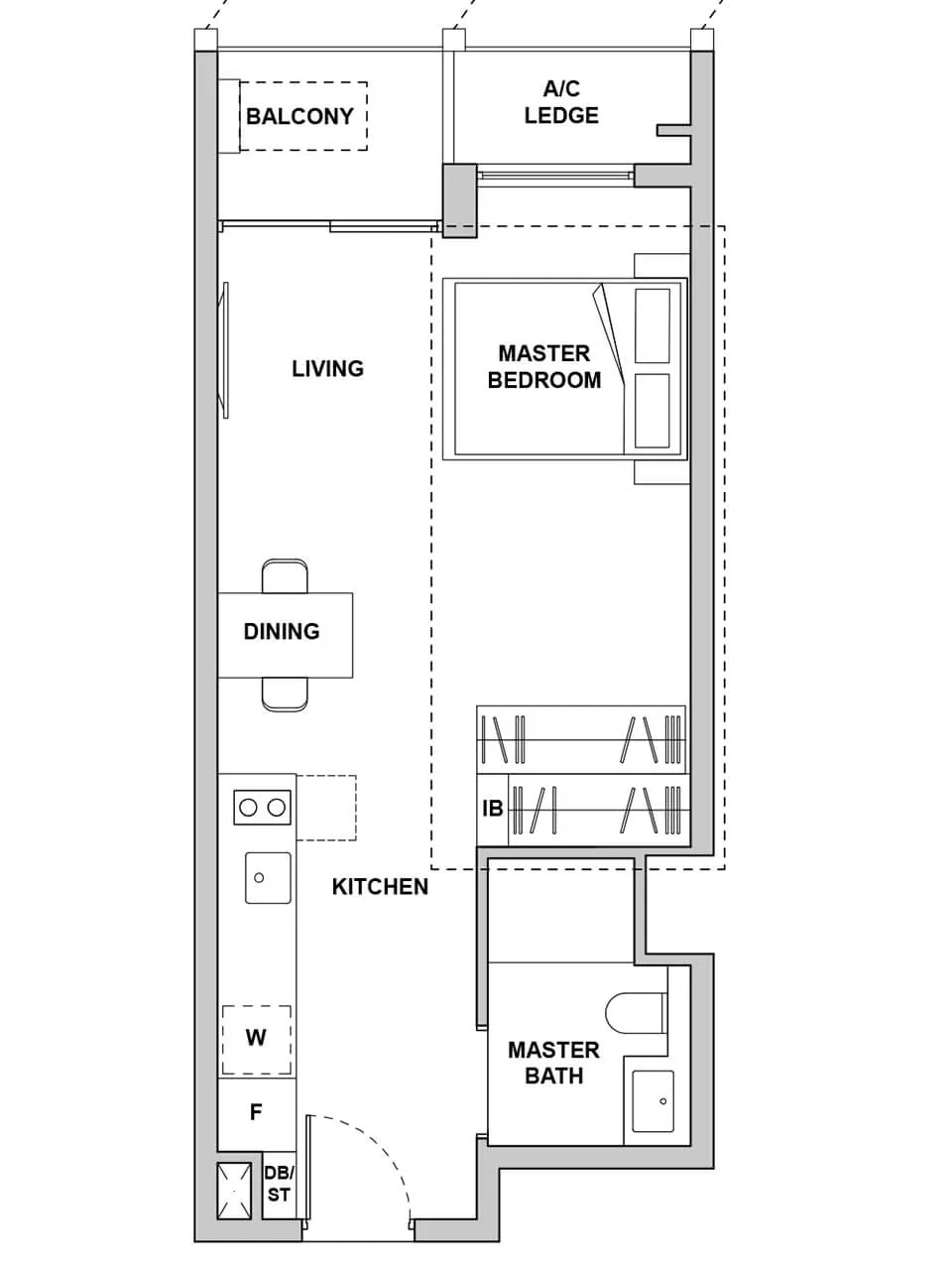

Here’s Union Square Residences’s 1 bedroom:

It goes without saying that Union Square Residences has a regular 1 bedroom layout that buyers on the market are accustomed to.

So in terms of layout, it’s down to personal preferences. To date, only 3 of these units were sold which is a poor sign of either the layout, its price or both. A bigger difference beyond the layout is its location. TMW Maxwell is truly in the heart of the city amidst the conserved shophouses of Tanjong Pagar. There’s no denying how convenient it is to stay there given these shophouses have a large variety of offerings.

At $1,422,000, Union Square Residences 1 bedroom is going for $3,071 psf which is slightly higher compared to TMW Maxwell.

Here’s a look at what TMW Maxwell prices went for at launch:

Notice how all the prices are above $3,100 psf. This is still higher than the average of $3,000+ psf achieved at Union Square Residences so far.

A more direct comparison is with CanningHill Piers. Right now, you can buy a 1 bedroom for $1,712,000. The unit is located on level 47 – the 2nd highest floor. As such, comparing it with the starting price of Union Square Residences is not a fair comparison. If we discounted it 40 storeys down at $10k per floor, that’s going to be $1.3+ already. So while on the table it looks far apart, they’re both very different offerings.

Union Square Residences 2 bedroom comparison

| Projects | Tenure | Area | 2BR |

| Parktown Residence | 99 yrs | Tampines | $1,330,000 |

| ELTA | 99 yrs | Clementi | $1,338,000 |

| The Shorefront | 999 yrs from 27/11/1937 | Pasir Ris | $1,471,000 |

| Jansen House | 999 yrs from 01/09/1876 | Hougang | $1,511,000 |

| Kassia | Freehold | Pasir Ris | $1,545,000 |

| SORA | 99 yrs from 30/08/2023 | Jurong East | $1,559,000 |

| The LakeGarden Residences | 99 yrs from 31/05/2023 | Jurong East | $1,568,100 |

| The Myst | 99 yrs from 11/05/2023 | Bukit Panjang | $1,589,000 |

| Hillock Green | 99 yrs from 19/12/2022 | Ang Mo Kio | $1,592,000 |

| Hillhaven | 99 yrs from 13/02/2023 | Bukit Batok | $1,616,560 |

| Orchard Sophia | Freehold | Rochor | $1,646,888 |

| Lentoria | 99 yrs from 19/12/2022 | Ang Mo Kio | $1,689,000 |

| Bartley Vue | 99 yrs from 13/04/2020 | Toa Payoh | $1,725,000 |

| The Hillshore | Freehold | Queenstown | $1,768,000 |

| The Arcady at Boon Keng | Freehold | Kallang | $1,785,000 |

| Koon Seng House | Freehold | Geylang | $1,807,000 |

| Hill House | 999 yrs from 01/07/1841 | River Valley | $1,838,000 |

| Terra Hill | Freehold | Queenstown | $1,884,000 |

| Claydence | Freehold | Geylang | $1,886,400 |

| Nava Grove | 99 yrs | Bukit Timah | $1,901,000 |

| 8@BT | 99 yrs | Bukit Timah | $1,920,000 |

| The Continuum | Freehold | Geylang | $1,935,000 |

| Grand Dunman | 99 yrs from 12/09/2022 | Marine Parade | $1,949,000 |

| Chuan Park | 99 yrs | Serangoon | $1,952,600 |

| Pinetree Hill | 99 yrs from 12/09/2022 | Bukit Timah | $2,006,000 |

| Union Square Residences | 99 yrs | Singapore River | $2,023,000 |

| Grange 1866 | Freehold | River Valley | $2,285,000 |

| Midtown Bay | 99 yrs from 02/01/2018 | Downtown Core | $2,308,000 |

| TMW Maxwell | 99 yrs from 28/04/2023 | Outram | $2,404,000 |

| Atlassia | Freehold | Geylang | $3,059,028 |

Union Square Residences is priced on the higher side among new launches in this category, which could raise concerns for some buyers. To put this into perspective, Chuan Park at Lorong Chuan is roughly $70,000 cheaper, but it’s also located in a less central area.

Midtown Bay is another alternative to consider, but with its focus on smaller units—primarily one- and two-bedrooms—it is arguably more suited to singles or couples without plans for children. A current listing shows a two-bedroom, 732 sq ft unit on the eighth floor going for about $2.308 million, which is relatively close to Union Square Residences’ pricing. Ultimately, each of these developments targets different lifestyles and priorities, whether it’s location, layout, or future family plans.

One unique thing about the 2 bedroom at Midtown Bay though, is the living and dining area is combined so it gets a lot more light in across both spaces since the dining is right next to the balcony:

Union Square Residences 3 bedroom comparison

| Projects | Tenure | Area | 3BR |

| North Gaia | 99 yrs from 15/02/2021 | Yishun | $1,293,000 |

| Lumina Grand | 99 yrs from 27/12/2022 | Bukit Batok | $1,364,000 |

| The Shorefront | 999 yrs from 27/11/1937 | Pasir Ris | $1,739,000 |

| Kassia | Freehold | Pasir Ris | $1,838,000 |

| The Arden | 99 yrs from 14/07/2023 | Bukit Batok | $1,854,000 |

| Jansen House | 999 yrs from 01/09/1876 | Hougang | $1,988,000 |

| Hillhaven | 99 yrs from 13/02/2023 | Bukit Batok | $2,047,632 |

| The Myst | 99 yrs from 11/05/2023 | Bukit Panjang | $2,058,000 |

| Parktown Residence | 99 yrs | Tampines | $2,070,000 |

| SORA | 99 yrs from 30/08/2023 | Jurong East | $2,094,000 |

| Lentoria | 99 yrs from 19/12/2022 | Ang Mo Kio | $2,112,000 |

| ELTA | 99 yrs | Clementi | $2,198,000 |

| The LakeGarden Residences | 99 yrs from 31/05/2023 | Jurong East | $2,240,400 |

| Hill House | 999 yrs from 01/07/1841 | River Valley | $2,250,000 |

| Terra Hill | Freehold | Queenstown | $2,361,000 |

| Sceneca Residence | 99 yrs from 10/02/2021 | Bedok | $2,378,000 |

| Koon Seng House | Freehold | Geylang | $2,387,000 |

| Hillock Green | 99 yrs from 19/12/2022 | Ang Mo Kio | $2,388,000 |

| The Arcady at Boon Keng | Freehold | Kallang | $2,414,000 |

| Nava Grove | 99 yrs | Bukit Timah | $2,432,700 |

| Grand Dunman | 99 yrs from 12/09/2022 | Marine Parade | $2,471,000 |

| Claydence | Freehold | Geylang | $2,528,600 |

| The Hillshore | Freehold | Queenstown | $2,588,000 |

| 8@BT | 99 yrs | Bukit Timah | $2,617,000 |

| Chuan Park | 99 yrs | Serangoon | $2,651,900 |

| The Botany at Dairy Farm | 99 yrs from 08/06/2022 | Bukit Panjang | $2,665,000 |

| Lentor Hills Residences | 99 yrs from 25/04/2022 | Ang Mo Kio | $2,733,000 |

| Atlassia | Freehold | Geylang | $2,804,578 |

| The Continuum | Freehold | Geylang | $2,922,000 |

| Pinetree Hill | 99 yrs from 12/09/2022 | Bukit Timah | $2,981,000 |

| J’den | 99 yrs from 30/08/2023 | Jurong East | $3,029,000 |

| Union Square Residences | 99 yrs | Singapore River | $3,176,000 |

| Enchante | Freehold | Novena | $3,298,700 |

| Ikigai | Freehold | Novena | $3,395,974 |

| 10 Evelyn | Freehold | Novena | $3,416,000 |

| Midtown Bay | 99 yrs from 02/01/2018 | Downtown Core | $4,714,000 |

| Watten House | Freehold | Bukit Timah | $5,038,000 |

| The Giverny Residences | Freehold | Bukit Timah | $5,497,000 |

At $3,176,000, Union Square Residences stands as one of the more expensive 3 bedders on the market. Slightly more expensive would be J’den which is a difficult comparison to make given that it’s in Jurong East. The integrated development’s cheapest 3 bedroom unit is on the 34th floor and it’s for the 1,184 sq ft unit. Despite the size, it’s functionally still a compact 3 bedroom as there’s no separate yard and WC. Regardless, the main reason for the high price is due to its high floor. The 3rd floor equivalent went for just $2.4+ million.

Union Square Residences 4 bedroom comparison

| Projects | Tenure | Area | 4BR |

| North Gaia | 99 yrs from 15/02/2021 | Yishun | $1,792,000 |

| Lumina Grand | 99 yrs from 27/12/2022 | Bukit Batok | $1,887,000 |

| Straits at Joo Chiat | Freehold | Bedok | $2,196,520 |

| The Arden | 99 yrs from 14/07/2023 | Bukit Batok | $2,215,000 |

| Jansen House | 999 yrs from 01/09/1876 | Hougang | $2,430,000 |

| Kassia | Freehold | Pasir Ris | $2,522,000 |

| Norwood Grand | 99 yrs | Woodlands | $2,590,000 |

| Hillock Green | 99 yrs from 19/12/2022 | Ang Mo Kio | $2,674,000 |

| Lentoria | 99 yrs from 19/12/2022 | Ang Mo Kio | $2,700,000 |

| Lentor Mansion | 99 yrs from 11/07/2023 | Ang Mo Kio | $2,717,000 |

| Hillhaven | 99 yrs from 13/02/2023 | Bukit Batok | $2,730,234 |

| The LakeGarden Residences | 99 yrs from 31/05/2023 | Jurong East | $2,755,500 |

| Koon Seng House | Freehold | Geylang | $2,780,000 |

| The Shorefront | 999 yrs from 27/11/1937 | Pasir Ris | $2,797,000 |

| ELTA | 99 yrs | Clementi | $2,798,000 |

| The Myst | 99 yrs from 11/05/2023 | Bukit Panjang | $2,841,000 |

| Parktown Residence | 99 yrs | Tampines | $2,850,000 |

| Sceneca Residence | 99 yrs from 10/02/2021 | Bedok | $3,148,000 |

| Nava Grove | 99 yrs | Bukit Timah | $3,180,200 |

| Pinetree Hill | 99 yrs from 12/09/2022 | Bukit Timah | $3,214,000 |

| SORA | 99 yrs from 30/08/2023 | Jurong East | $3,225,000 |

| Grand Dunman | 99 yrs from 12/09/2022 | Marine Parade | $3,281,000 |

| Blossoms By The Park | 99 yrs from 10/01/2022 | Queenstown | $3,336,000 |

| J’den | 99 yrs from 30/08/2023 | Jurong East | $3,371,000 |

| The Continuum | Freehold | Geylang | $3,388,000 |

| Terra Hill | Freehold | Queenstown | $3,469,000 |

| Chuan Park | 99 yrs | Serangoon | $3,557,800 |

| 8@BT | 99 yrs | Bukit Timah | $3,622,000 |

| Enchante | Freehold | Novena | $3,688,300 |

| The Arcady at Boon Keng | Freehold | Kallang | $3,701,000 |

| Tembusu Grand | 99 yrs from 25/04/2022 | Marine Parade | $3,743,000 |

| The Hillshore | Freehold | Queenstown | $3,880,000 |

| Union Square Residences | 99 yrs | Singapore River | $4,620,000 |

| Watten House | Freehold | Bukit Timah | $4,956,000 |

| Claydence | Freehold | Geylang | $5,410,000 |

| Canninghill Piers | 99 yrs from 17/09/2021 | Singapore River | $6,280,000 |

| Irwell Hill Residences | 99 yrs from 13/04/2020 | River Valley | $9,452,000 |

| The Giverny Residences | Freehold | Bukit Timah | $9,566,000 |

| 32 Gilstead | Freehold | Novena | $13,407,000 |

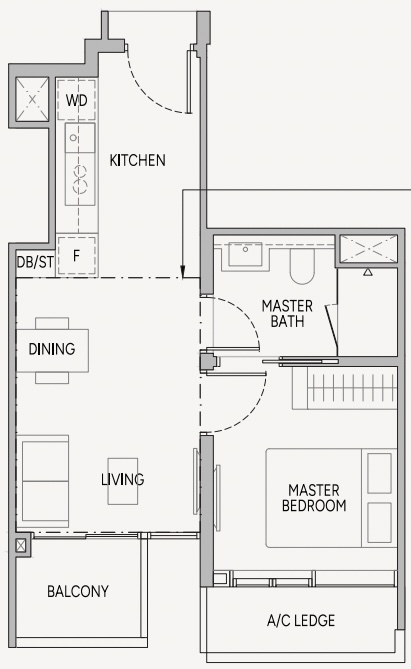

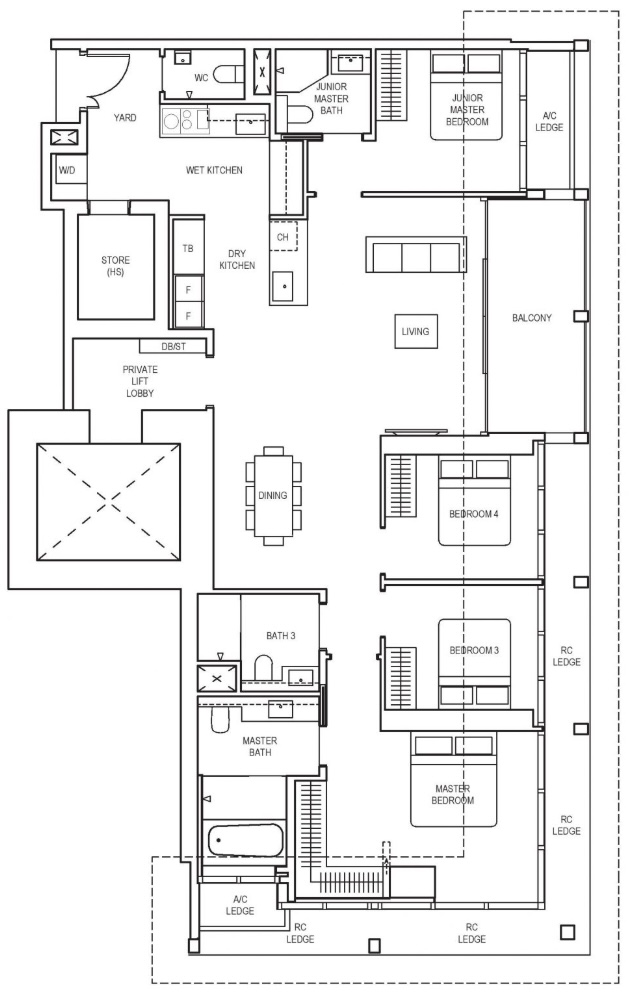

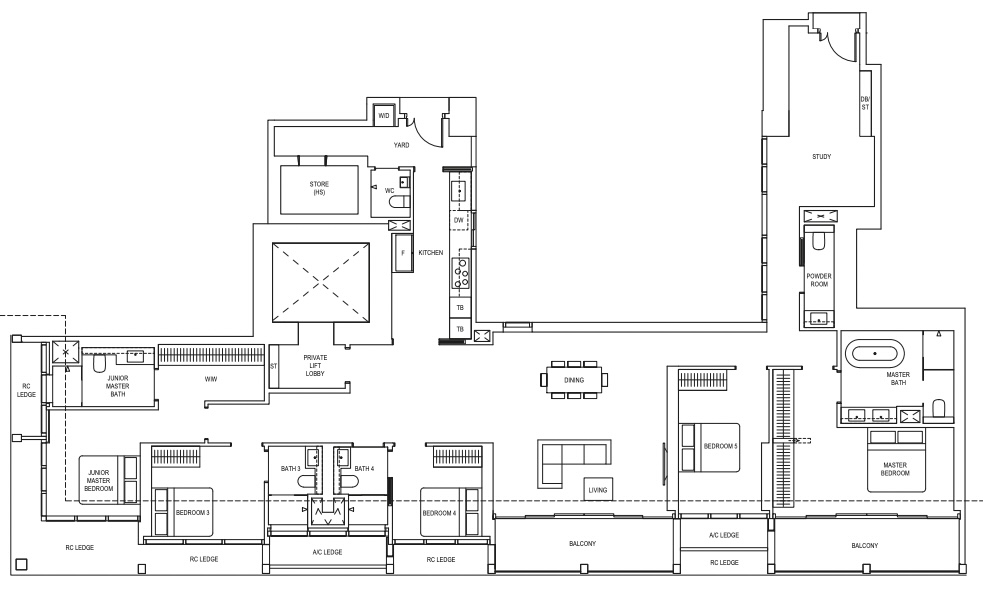

CanningHill Piers has just 1 remaining 4 bedroom at $6,280,000. It’s staged higher now due to increased prices. The unit directly above was sold for $5,732,000. The large quantum is a result of its larger space of 1,755 sq ft:

This is a full 4 bedroom unit with a private lift, yard, WC, store, wet and dry kitchen. This layout is considered to be quite functional. There’s a really wide living area which could also be combined with a dining area if need be, but there’s also a separate spot for the dining. The master bathroom has a bath tub but lacks a dual sink which we could expect of this size.

Functionally, Canninghill Piers is pretty similar to Union Square Residences – except the one at CanningHill Piers may feel more spacious given the bigger area around the living and dining as compared to Union Square Residences above.

Union Square Residences 5 bedroom comparison

| Projects | Tenure | Area | 5BR |

| Lumina Grand | 99 yrs from 27/12/2022 | Bukit Batok | $2,130,000 |

| Altura | 99 yrs from 20/06/2022 | Bukit Batok | $2,210,000 |

| Straits at Joo Chiat | Freehold | Bedok | $3,022,240 |

| The Myst | 99 yrs from 11/05/2023 | Bukit Panjang | $3,196,000 |

| Lentor Mansion | 99 yrs from 11/07/2023 | Ang Mo Kio | $3,243,000 |

| The LakeGarden Residences | 99 yrs from 31/05/2023 | Jurong East | $3,289,600 |

| SORA | 99 yrs from 30/08/2023 | Jurong East | $3,542,000 |

| Parktown Residence | 99 yrs | #N/A | $3,780,000 |

| ELTA | 99 yrs | #N/A | $3,880,000 |

| Grand Dunman | 99 yrs from 12/09/2022 | Marine Parade | $3,999,000 |

| Tembusu Grand | 99 yrs from 25/04/2022 | Marine Parade | $4,028,000 |

| Nava Grove | 99 yrs | Bukit Timah | $4,329,100 |

| Pinetree Hill | 99 yrs from 12/09/2022 | Bukit Timah | $4,364,000 |

| Terra Hill | Freehold | Queenstown | $5,511,000 |

| The Continuum | Freehold | Geylang | $5,567,000 |

| Watten House | Freehold | Bukit Timah | $7,958,000 |

| Canninghill Piers | 99 yrs from 17/09/2021 | Singapore River | $8,904,000 |

| Union Square Residences | 99 yrs | Singapore River | $9,500,000 |

| Irwell Hill Residences | 99 yrs from 13/04/2020 | River Valley | $11,080,000 |

The 5-bedroom at Union Square Residences may be a 5-bedder in name, but it’s not quite a 5-bedroom but more of the penthouse/Sky Suite. As such, it’s not comparable to many of the other units on the list. Its asking price of over $3,500+ psf may sound high, but it’s on levels 38 – 40.

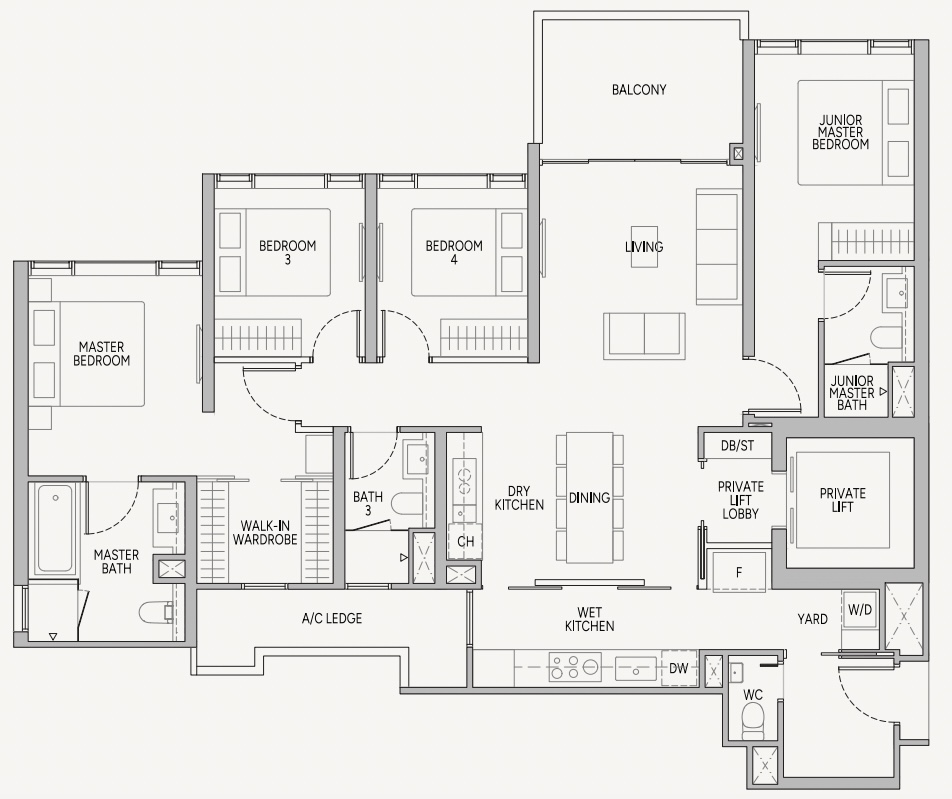

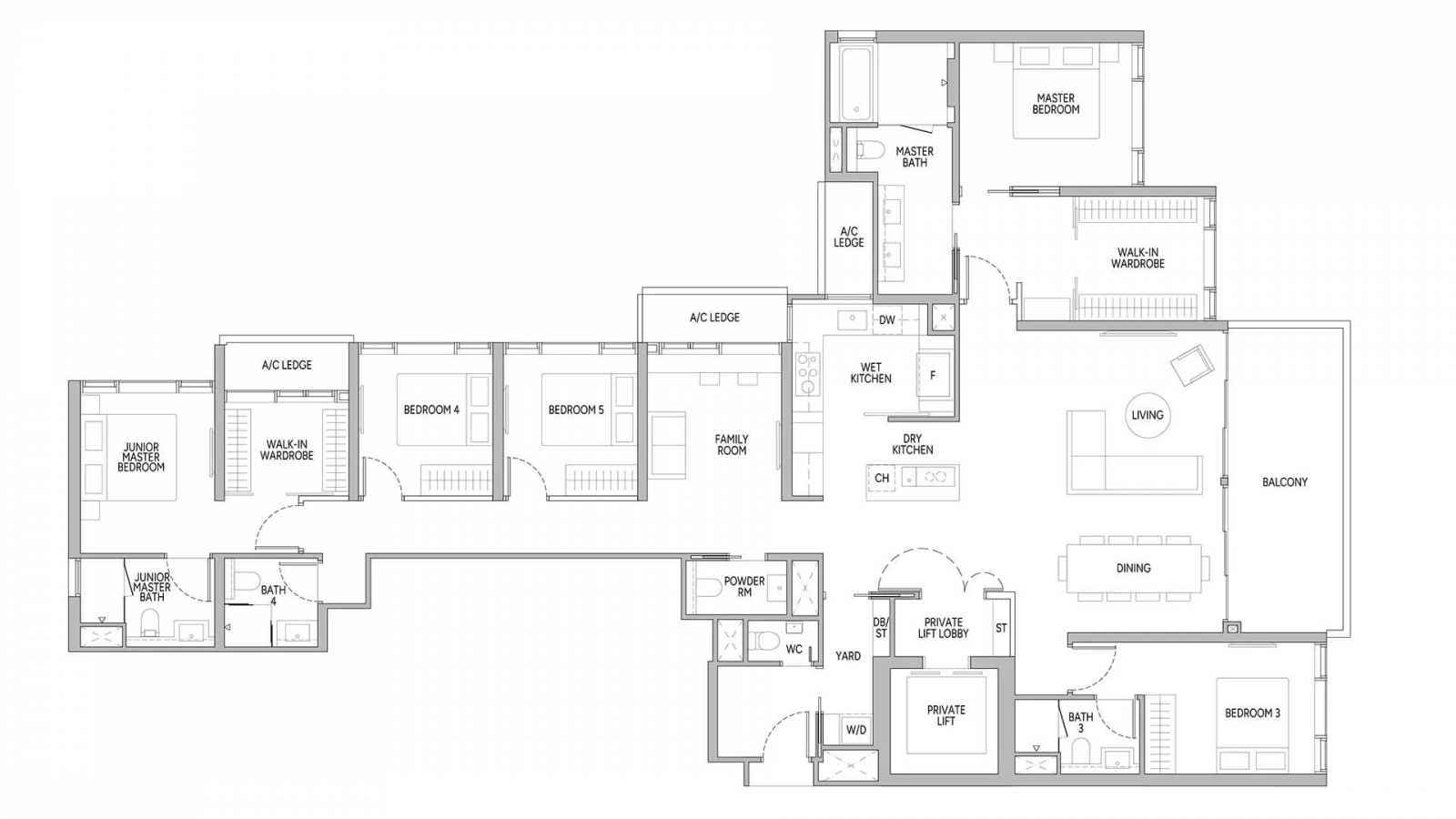

The most similar transaction to this took place in December 2022 for CanningHill Piers. It was for the 37th floor 5-bedroom premium unit which went for $9.056 million – slightly cheaper than what Union Square Residences is asking for. On a $PSF basis, Union Square Residences is asking for more though. Here’s what the 5-bedroom premium at CanningHill Piers looks like:

It’s definitely a luxurious layout. With 2 long balconies that overlooks the sweeping views of the city and a spacious interior around the living/dining space, CanningHill Piers layout seems more favourable compared to Union Square Residences one. 4 out of the 5 bedrooms also come with an attached bathroom.

Here’s what Union Square Residences’s 5 SkySuite looks like:

The main difference that Union Square Residences has is the family room. Unlike the study in CanningHill Piers’s layout, the family room can be converted to a regular bedroom, making it a 6 bedroom unit. In this sense, while it costs more, it may be more practical to a niche audience.

Where does this leave us?

In our analysis of direct competitors around, we’re cognisant to the fact that Union Square Residences is priced quite fairly for a new launch condo in the area. Compared to resale condos, we can also see how prices can make sense given it’s more convenient due to it being a mixed-use project and sizes are smaller yet functional.

What this means is that we can expect it to appreciate in line with the property market. However, as to whether greater upside can be seen, this will depend on the trends we’ve highlighted above.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Matthew Kwan

Matt read Law in university but has since traded legal statutes for the world of high finance on weekdays. On weekends, he delves into his keen interest in real estate, which has taken him to more 150 new and resale developments since the age of 16. Since first writing for Stacked, Matt has made his first home purchase and continues to appreciate the evolving trends of today's market. In his free time, Matt goes on walks and writes about (more) real estate on his personal Instagram page @propertyzaikiaNeed help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Singapore Property News You Can Now Buy Part Of A $300M Singapore Bungalow — But You Can’t Live In It

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

0 Comments