Changes to ABSD for developers are a sign of the times.

When we started seeing runaway prices after Covid, there was a sense of “not this again,” and most market watchers had flashbacks to 2009 to 2013, or the 2017 en-bloc fever. The last two times property prices skyrocketed, some of the more common scapegoats were:

- Developers being too exuberant, and

- Foreigners pushing up prices

So we saw the slew of responses, from new cooling measures to higher Land Betterment Charges (LBC). But as the post-covid phase came to a close, there was a sense that analysts and regulators were missing something.

Foreigners had been hit with the highest ABSD rate ever, with taxes doubling to 60 per cent; and we saw prices dip in the most affected areas. But still, property prices remained high.

Then the expected “second round” of en-bloc fever never materialised; and far from being exuberant, developers have been at their most muted and timid in decades. The government likely sat up and took notice when the bid for a Marina Bay white site – with what would have been a hot commodity previously – drew one lonely bid; and that bid was so low, URA rejected it and didn’t sell.

Clearly, things are different now; and the high prices aren’t easily blamed on foreigners (even the money-laundering ones), or on developers getting cocky. In fact, some realtors have commented about how few Singaporeans are willing to sell (at today’s prices, what can they buy even if they sell an $800,000 4-room flat? A two-bedder where a second toilet is a priced-out luxury? Forget it.

The changes to ABSD clawback may be a sign that things are changing

It’s not a huge change, but it is the very first time we’ve seen the government budge on it.

Under the old rules, developers had five years to complete and sell every single unit; failing to do so meant they forfeited the ABSD, which is 40 per cent of the land price. Developers could get ABSD remission of up to 35 per cent, if they completed and sold out in five years.

The government didn’t really care how many units were involved: a 1,000 unit development had the same time limit as a 50 unit development.

Now, after Budget 2024 and the Marina site bid, we have a concession: If a developer can complete the project in five years, and sell out at least 90 per cent of the units, they can get partial ABSD remission. The amount of the remission will vary based on the number of units they have left over.

Besides providing a small modicum of relief, this may (just may) have the following effects:

- Developers may be less hesitant to build larger, high-quantum units, which are typically the last ones to move

- Fire sales (i.e., developers rushing to bundle and en-bloc remaining units for sale to meet ABSD deadlines) might be a little less frequent; or may be a little less drastic, depending on the developers’ cost calculations

Depending on how the property market and land bids move, we may see further concessions in the near future. Some of the changes developers have long clamoured for is that ABSD remission be pegged to how many units are left in total, or instead of a strict 5-year timeline – it should be instead scaled accordingly to the number of units that they are undertaking.

More from Stacked

Land ownership in Singapore – here is everything you need to know

It is no secret that Singapore is a very small country. In case you did not know, the total land…

Then again, there are those in the market who will cheer the existing ABSD rules; probably out of hopes that, with the boot on developers’ necks, they’ll also be inclined to price new launches cheaper.

Meanwhile in other property news:

- FIVE Lentor projects in just two years, is this maybe getting a bit much for the area? Here’s what the newest one, Lentor Mansion, has to offer so far.

- Above 2,000 sq. ft., but under $3 million. Do good condos at this size and price range exist? We dug some up from resale records.

- It’s February, so check out the BTO launch sites, for those of you who need a flat.

- People are still asking if 2024 is the right time to upgrade to a condo; so here’s an answer, taking into account today’s prices.

Weekly Sales Roundup (12 February – 18 February)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| TERRA HILL | $5,388,430 | 1894 | $2,844 | FH |

| KLIMT CAIRNHILL | $5,230,000 | 1496 | $3,496 | FH |

| THE RESERVE RESIDENCES | $3,919,463 | 1625 | $2,411 | 99 yrs (2021) |

| PINETREE HILL | $3,646,000 | 1464 | $2,491 | 99 yrs (2022) |

| GRAND DUNMAN | $3,630,000 | 1432 | $2,536 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE LANDMARK | $1,472,640 | 517 | $2,850 | 99 yrs (2020) |

| THE MYST | $1,542,000 | 678 | $2,274 | 99 yrs |

| GRANGE 1866 | $1,584,000 | 527 | $3,003 | FH |

| IRWELL HILL RESIDENCES | $1,647,000 | 624 | $2,638 | 99 yrs (2020) |

| PINETREE HILL | $1,927,000 | 797 | $2,419 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ARDMORE PARK | $12,900,000 | 2885 | $4,472 | FH |

| CAIRNHILL PLAZA | $5,400,000 | 2852 | $1,893 | FH |

| THE SEAFRONT ON MEYER | $4,828,000 | 2088 | $2,312 | FH |

| CAPE ROYALE | $4,410,000 | 1905 | $2,315 | 99 yrs (2008) |

| CARIBBEAN AT KEPPEL BAY | $3,600,000 | 2099 | $1,715 | 99 yrs (1999) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PRESTIGE HEIGHTS | $620,000 | 344 | $1,823 | FH |

| CARDIFF RESIDENCE | $668,000 | 398 | $1,607 | 99 yrs (2011) |

| HIGH PARK RESIDENCES | $683,500 | 441 | $1,631 | 99 yrs (2014) |

| THE PROMENADE@PELIKAT | $685,000 | 484 | $1,486 | FH |

| LA FIESTA | $690,000 | 452 | $1,626 | 99 yrs (2012) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| ARDMORE PARK | $12,900,000 | 2885 | $4,472 | $7,066,041 | 28 Years |

| HILLCREST ARCADIA | $2,980,000 | 2325 | $1,282 | $1,830,000 | 28 Years |

| PARK EAST | $2,700,000 | 1755 | $1,539 | $1,815,000 | 21 Years |

| THE SEA VIEW | $3,500,000 | 1410 | $2,482 | $1,700,000 | 16 Years |

| BISHAN PARK CONDOMINIUM | $2,080,000 | 1539 | $1,351 | $1,455,000 | 17 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE LINE @ TANJONG RHU | $1,020,000 | 570 | $1,788 | -$300,000 | 10 Year |

| THE OCEANFRONT @ SENTOSA COVE | $3,550,000 | 1776 | $1,999 | -$150,000 | 13 Years |

| VISIONCREST | $2,860,000 | 1227 | $2,331 | -$110,000 | 17 Years |

| SKIES MILTONIA | $1,270,000 | 1076 | $1,180 | -$80,000 | 11 Years |

| THE ROCHESTER RESIDENCES | $1,288,000 | 1023 | $1,260 | -$78,268 | 16 Years |

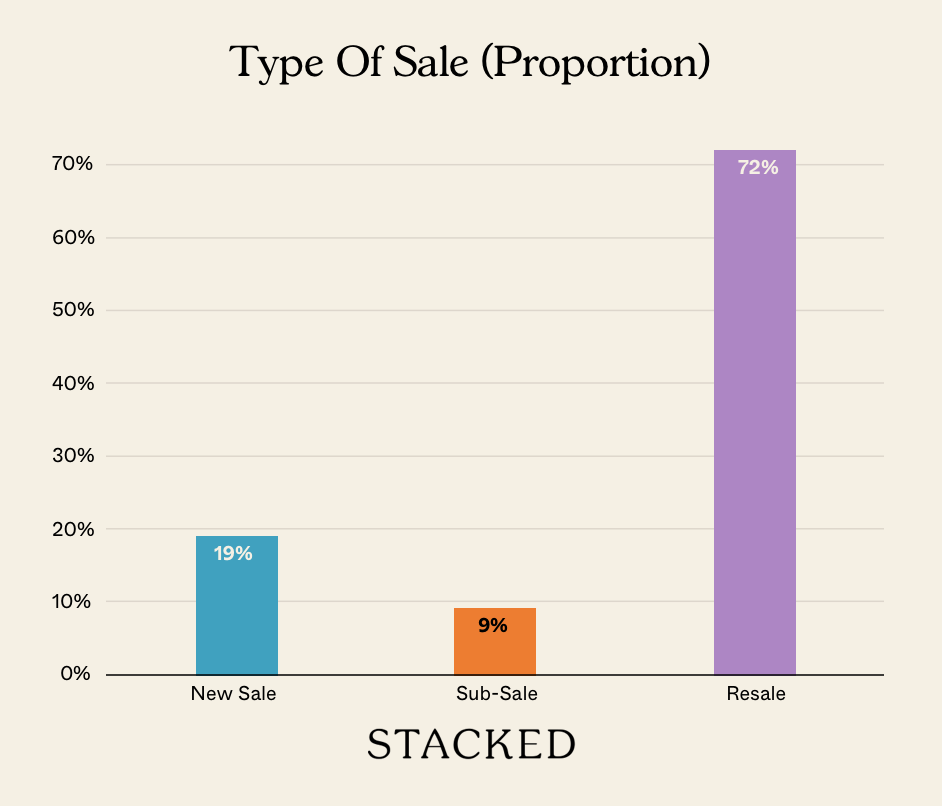

Transaction Breakdown

For more on the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the recent change to the ABSD rules for developers in Singapore?

How might the new ABSD rule affect property development in Singapore?

What does the article suggest about the current property market in Singapore?

Are there any signs that the government might introduce further concessions on ABSD in Singapore?

What is the significance of the Marina Bay site bid mentioned in the article?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Latest Posts

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Property Market Commentary Singapore’s Tallest HDB Yet: A 60-Storey Project Is Coming To Pearl’s Hill

0 Comments