How Are Singapore Property Rental Rates Rising Despite Covid-19?

May 17, 2021

Since 2020, property prices have been rising across the board. It’s not entirely surprising given the Covid-19 situation that many investors see the Singapore private property market as a safe haven, particularly in such times. What is unexpected has been the revival of our soft rental market. Expectations were bleak since we’re dependent on foreign tenants, but the rental market continued to pick up steam even in end-April 2021. Here’s a look at what’s going on:

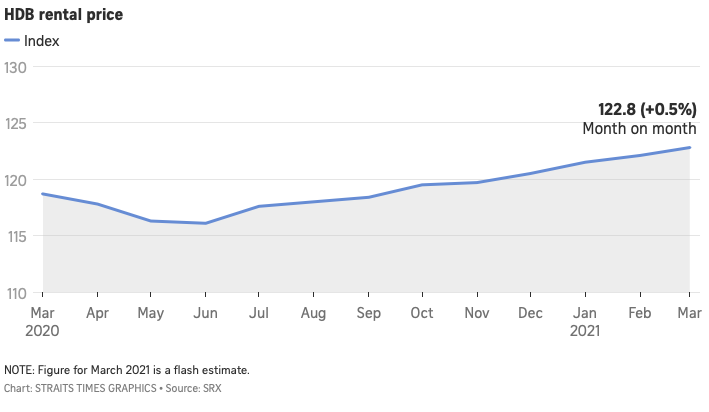

HDB rental rates have risen steadily since 2020, chalking up 10 consecutive months of rising rent across the board.

Note that rental rates for HDB flats are not available on a psf basis, so only overall monthly rates have been indicated.

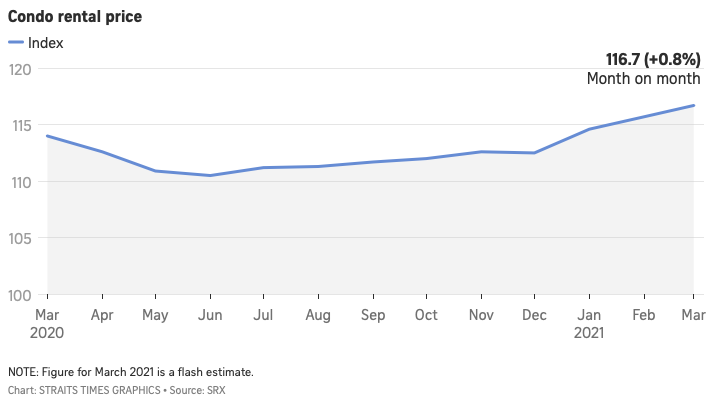

Here’s a look at the condo rental prices first.

And followed by HDB.

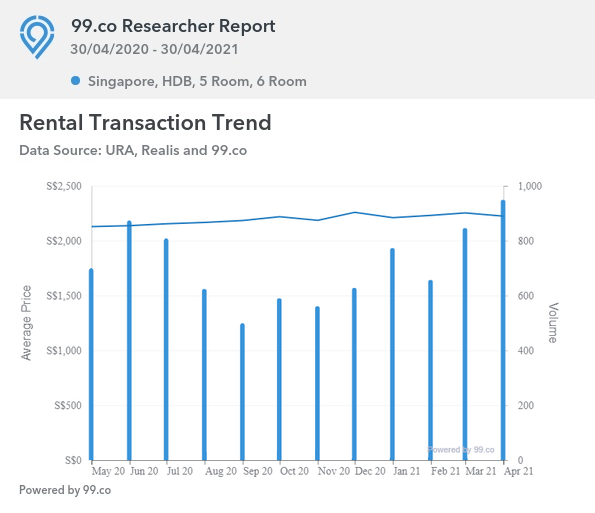

Now, here’s a breakdown of HDB rental figures by prices.

The rental rates for HDB flats, island-wide, averaged $2,064 per month as of end-April 2021. This is a 5.2 per cent increase from the same time last year. Leasing volume has also risen by 25.7 per cent over last year, reaching 3,613.

For 3-room flats, rental rates increased around 4.9 per cent, from $1,754 to $1,840.

For 4-room flats, prices rose 5.7 per cent, from $2,010 to $2,126.

For 5-room flats, prices rose 4.5 per cent, from $2,128 to $2,224.

For Executive Flats, rental rates rose 4.25 per cent, from $2,211 to $2,305.

The rising rental rates and leasing volumes have defied earlier predictions. Back in 2020, it was expected that a greater volume of resale flats reaching their Minimum Occupancy Period (MOP) would add supply to the market (flats that reach MOP can be fully rented out). At the same time, Covid-19 was expected to bring lower numbers of foreign workers, hence limiting demand.

At the moment, market watchers are waiting to see if HDB rental prices can recover to the last peak in August 2013. At the time, the average HDB rental rate was $2,332:

At present, HDB flat rents are only 11.2 per cent lower than the heyday of 2013.

Condo rental rates for end-April 2021 are pending, but SRX flash estimates show a rise of 5.2 per cent from last year. Rates currently hover around $3.57 psf. To be clear, this is still a far cry from the average of $4.07, back in the peak of 2013.

However, the flash estimates show condo rental rates have managed to rise for four straight months. Landlords will probably cheer the fact that the soft rental market is seeing a turnaround, albeit a slow and uneven one.

The big question, however, is why this is happening despite Covid-19. The cause (or collection of causes) will determine whether this is sustainable going forward, or is just a momentary upswing.

So far, the identifiable factors have been:

- HDB construction delays and buyer prudence

- Increased preference for “selling before buying”

- A momentary uptick from returning tenants

- Work From Home (WFH) requirements prompting a move

1. HDB construction delays and buyer prudence

The majority (85 per cent) of ongoing BTO projects face construction delays of six to nine months. This has already caused the application for interim rental flats to double, with 2,350 applications this year compared to 1,370 in 2019. In the linked report, it also states that about 40 per cent of successful applicants haven’t turned up for flat selection; this usually means they’ve found other forms of housing, such as renting a resale unit that’s bigger, or in a more desirable location.

While this is the most immediate reason, some of the realtors we spoke to also said buyers are holding off for fears of job stability. One of the realtors, speaking on condition of anonymity, said that:

“I have lost potential buyers in December and January, when they decided to rent or continue renting, instead of buying.

Their reasoning is to wait out the current volatility, as they didn’t feel ready to take on the commitment when their job security is at risk. We can say interest rates are low, resale flat prices are rising, we can say all those things…but in the end they’re probably doing what’s right for them.

A lot of these buyers are new families. They need a place to stay, but they are also dealing with their wedding costs, their first child coming along, all these things at once. So with Covid, I can understand if they don’t want another major expense on their plate.

But they still need a place for their new families, and BTO construction is slow, desirable areas are hard to get. So I think if you’re renting your flat, if you just reached your MOP this year, then your timing is very lucky.”

More from Stacked

Looking To Invest In Property In 2022? Here Are 5 Property Investment Trends That Have Changed

With a slew of policy tweaks over the past decade, the property market in 2022 is almost unrecognisable to those…

2. Increased preference for “selling before buying”

Some realtors pointed out that most HDB upgraders sell their flats first, before buying a condo. This usually requires temporary accommodation. Given that most buyers today are just such upgraders, there’s a commensurate rise in rental demand.

Buyers who purchase a new home before selling their flat are less common. These buyers must pay the Additional Buyers Stamp Duty (ABSD)* of 12 per cent for citizens or 15 per cent for Permanent Residents, on their new home. This is because they count as buying their second property, if they’re still in possession of their HDB flat.

Realtors noted that those who “buy before selling” can end up servicing two home loans – one for their new property, and one for their existing flat. They may also lack sufficient funds for the down payment of a condo (minimum of five per cent in cash) if they don’t sell the flat first.

This also coincides with the strong sales since 2019, when HDB upgraders became recognised as the main driving force. Many of these upgraders, from 2019 onward, are supporting the current rental demand.

*An exception is for the purchase of ECs. You don’t have to pay ABSD if you buy a (non-privatised) EC before selling your flat. Also, note that even upgraders who qualify for ABSD remission must sell their previous home within six months of buying a new one, to get said remission.

Property Advice6 Tips To Maximise Your Profits When Selling Your HDB Flat

by Ryan J. Ong3. A momentary uptick from returning tenants

Besides the above reasons, realtors pointed out that – before the resurgence of Covid-19 cases – there was an influx of foreign workers returning to our shores. At the time, companies were eager to replenish their limited manpower; especially in recovering sectors like F&B and construction.

At the time we’re writing this however, Singapore has rolled back to phase 2, with the number of Covid-19 cases on the rise again. As such, it’s uncertain whether returning workers will continue to support the rental market – another tightening of our borders will likely blunt the recovery.

4. Work From Home (WFH) requirements prompting a move

Working from home can be a challenge, if parents and multiple siblings are also on the same arrangements. A number of recent tenants, who were previously content to live with parents or siblings, have expressed that it’s become impractical: different family members are having to occupy different rooms for their conference calls, and some jobs simply need more room than a shared flat can provide.

One of the realtors we spoke to said that:

“Of the eight cases I encountered since the start of the year, seven of them were moving out of their parents’ flat due to work. They couldn’t make their calls with younger siblings running around, or there were just too many distractions. But they also couldn’t go to the office because the office is closed; who knows for how long. So they take the plunge into independent living.

I think for those who already considered moving out, this pandemic is the catalyst. But because property prices are high right now, they cannot afford to buy yet; so they start by renting their own place. It’s a good way to get used to living independently.”

It’s still too early to declare the rental market is recovering, despite several months of rising prices

The reason is down to the unpredictability of Covid-19. Even now, we’re receiving word of mutant strains that can affect the vaccinated, and rising numbers of local cases. The risk of a second wave of infections, which could see borders and businesses closed, is still a looming concern for property investors.

So while the current situation is good news for landlords, they’d best brace for near-term changes. There may yet be dry spells and vacancies ahead.

For more on the Singapore property market and in-depth reviews of new and resale properties alike, follow us on Stacked. We’ll update you as the situation unfolds.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are rental rates for Singapore HDB flats increasing during Covid-19?

Are condo rental prices in Singapore rising despite the pandemic?

What factors are contributing to the rise in Singapore property rentals during Covid-19?

Is the rental market in Singapore expected to stay strong during Covid-19?

How has Covid-19 affected the demand for rental properties in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Rental Market

Rental Market Is Singapore’s Rental Market Really Softening? We Break Down The 2024 Numbers By Unit Size

Editor's Pick The Cheapest Condos For Rent In 2024: Where To Find 1/2 Bedders For Rent From $1,700 Per Month

Rental Market Where To Find The Cheapest Landed Homes To Rent In 2024 (From $3,000 Per Month)

Rental Market Where To Find High Rental Yield Condos From 5.3% (In Actual Condos And Not Apartments)

Latest Posts

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

On The Market A 40-Year-Old Prime District 10 Condo Is Back On The Market — As Ultra-Luxury Prices In Singapore Hit New Highs

0 Comments