Holland V Condo Price War (Hyll on Holland vs Leedon Green): Should You Jump In?

June 25, 2021

The Singapore private property market is on an uptrend, to the point where even new cooling measures are being considered. Despite all that, even in this supposedly strong seller’s market, some new launches are struggling. We recently talked about a possible oversupply in a prime area like Holland V when we compared between the 7 new launches in the area.

So it isn’t really a surprise to see that some have started to lower prices in later sales phases. Here’s what might be happening, and what buyers need to know:

Some new launches in Holland V have started to drop prices

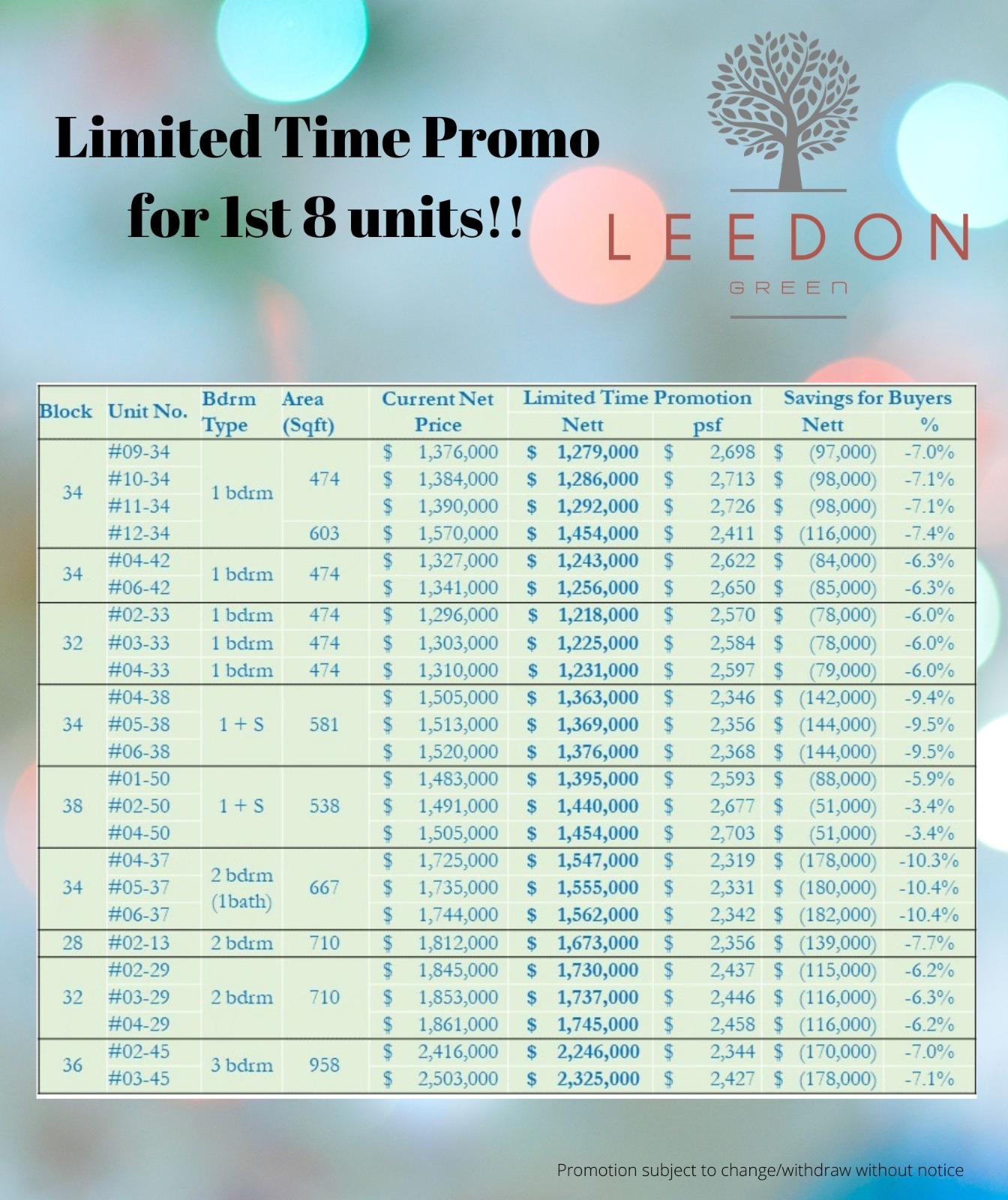

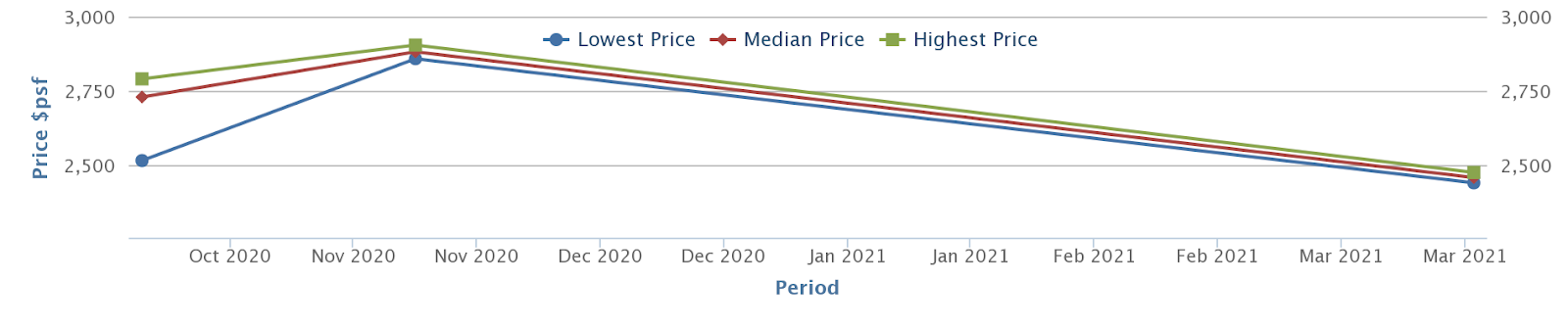

Two notable cases this week are Hyll on Holland, and Leedon Green:

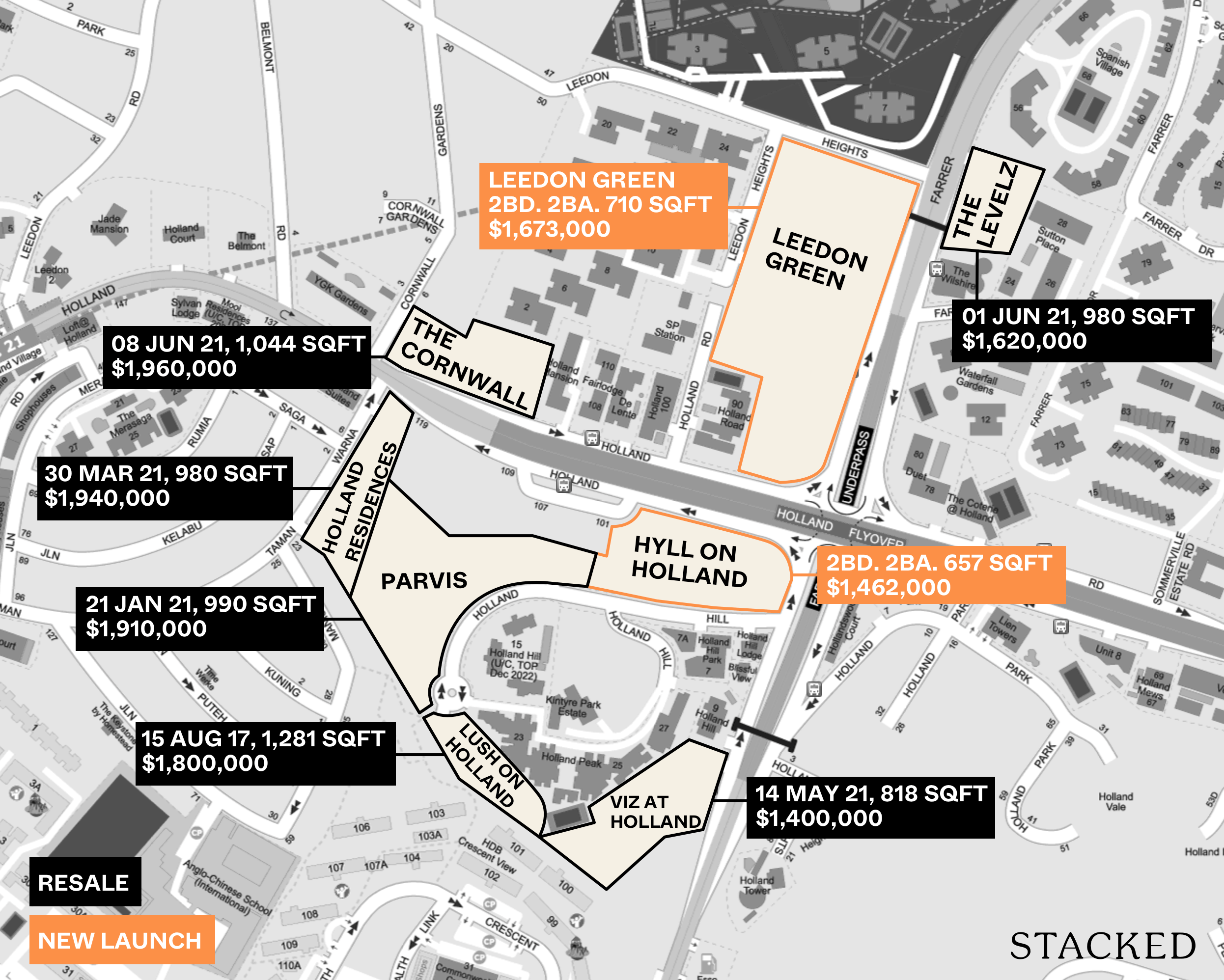

Hyll on Holland is located just 850 metres, or an 11-minute walk, from the hub of Holland V (near the MRT station). Leedon Green is a bit further out at 1.4 kilometres; but at less than an eight-minute drive, it can easily be considered “in the vicinity”.

Holland V is a major lifestyle hub. It also has a large expatriate enclave and is close to the hotspot of One-North. Plus there is the rejuvenation of One Holland Village to look forward to. These condos were expected to be an easy sell; but a look at the numbers shows slow sales:

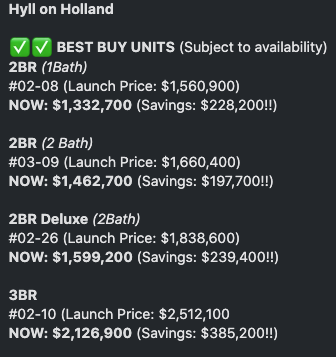

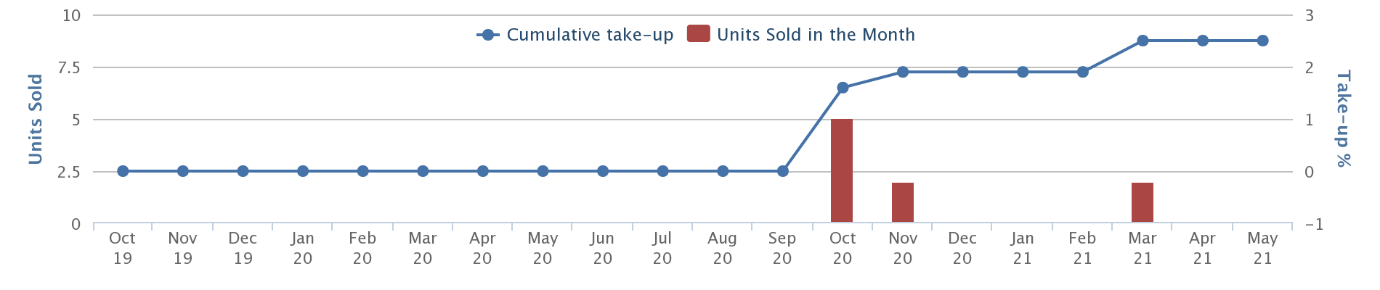

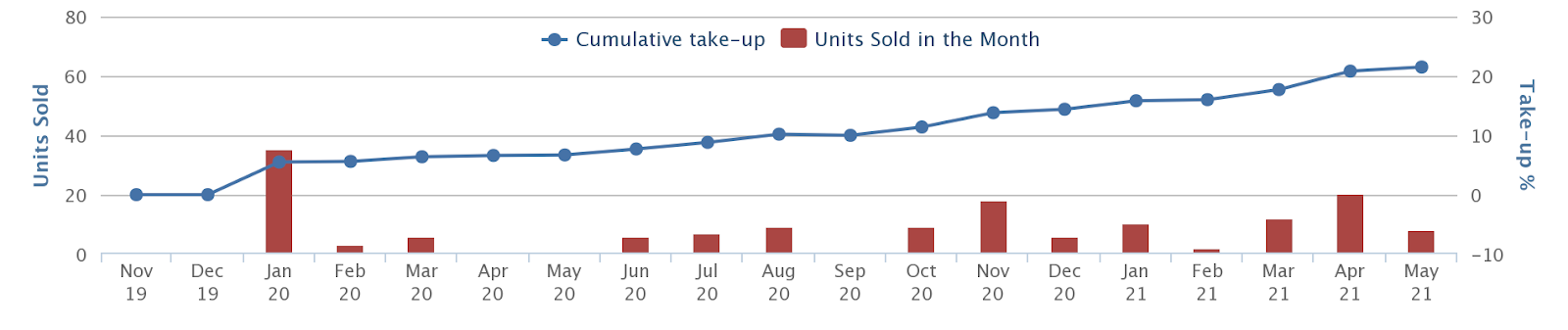

Hyll on Holland

Hyll on Holland is a freehold development, with 319 units. This development launched in October 2020, and Square Foot Research shows it has sold a mere nine units. Even then, we can see some of those later sales came after price cuts:

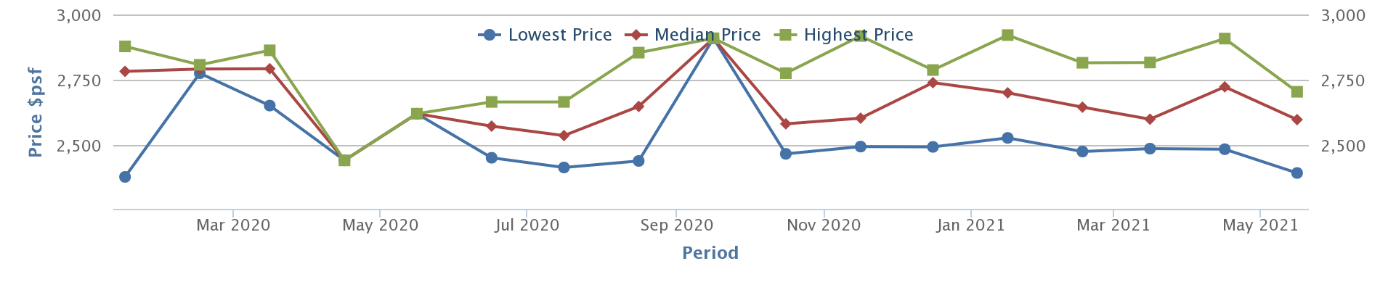

Prices have gone from a median of $2,729 psf around launch, to $2,458 psf as of March. The discounted rates, as shown above, will drive this further down.

From the demand and sales so far, we can quite clearly see that the pricing has not been set right – especially when launched in an area with ample competition.

This is even more so in an area such as Holland Village where you could say most buyers are more of the own-stay variety – and are more concerned about liveability than a smaller price point but smaller living space.

We’ve pulled up some previous asking prices to verify this:

| Date | Address | Area (Sqft) | Price (S$ PSF) | Price (S$) |

|---|---|---|---|---|

| 25 MAR 2021 | 99 HOLLAND ROAD #XX-26 | 721 | 2,475 | 1,784,800 |

| 20 MAR 2021 | 99 HOLLAND ROAD #XX-26 | 721 | 2,440 | 1,760,000 |

| 23 NOV 2020 | 93 HOLLAND ROAD #XX-15 | 1,055 | 2,858 | 3,014,900 |

| 23 NOV 2020 | 93 HOLLAND ROAD #XX-16 | 700 | 2,904 | 2,031,900 |

| 3 OCT 2020 | 89 HOLLAND ROAD #XX-09 | 657 | 2,515 | 1,651,400 |

| 2 OCT 2020 | 89 HOLLAND ROAD #XX-04 | 657 | 2,756 | 1,809,600 |

| 2 OCT 2020 | 89 HOLLAND ROAD #XX-04 | 657 | 2,729 | 1,791,600 |

| 2 OCT 2020 | 89 HOLLAND ROAD #XX-09 | 657 | 2,625 | 1,723,400 |

The former Hollandia and The Estoril were sold en bloc for $183.4 million and $223.9 million respectively. Given that the estimated breakeven for Hyll on Holland is about $2,200 psf, the current promotion that the developers are offering features prices very close to breakeven. At a lower land cost as compared to Leedon Green, it does mean that there is still some runway to play with.

New Launch Condo ReviewsHyll On Holland Review: Small Units, Road Noise, Quality Facilities

by Reuben DhanarajLeedon Green

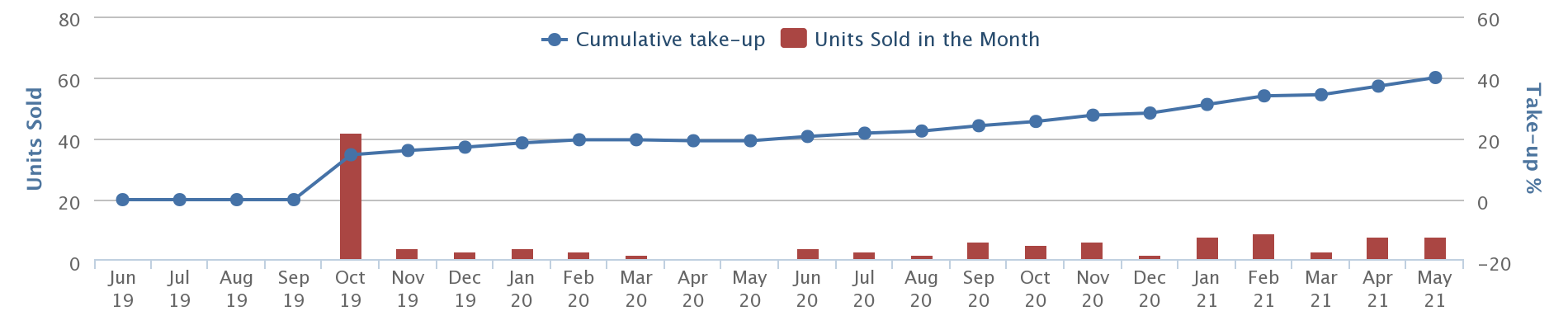

The current take-up rate is about 25.55 per cent for Leedon Green (to be fair, it has sold more in June since). This was surprising to market watchers, as Leedon Green actually got off to a strong start in January 2020. At one point, it was even reported as being the “best selling freehold project” in District 10.

When sales started to diminish, it was initially blamed on the Circuit Breaker period; but that ended in June 2020, and since then, sale volumes haven’t made it past 20 transactions in any month (with the exception of June 2021, however).

Prices have started a downward trend; from $2,782 psf, to $2,597 psf in the last transactions in May.

| Date | Address | Area (Sqft) | Price (S$ PSF) | Price (S$) |

|---|---|---|---|---|

| 19 JUN 2021 | 26 LEEDON HEIGHTS #XX-03 | 1,044 | 2,681 | 2,799,000 |

| 19 JUN 2021 | 36 LEEDON HEIGHTS #XX-44 | 1,356 | 2,749 | 3,728,000 |

| 19 JUN 2021 | 38 LEEDON HEIGHTS #XX-58 | 538 | 2,681 | 1,443,000 |

| 15 JUN 2021 | 28 LEEDON HEIGHTS #XX-11 | 1,496 | 2,562 | 3,833,300 |

| 15 JUN 2021 | 28 LEEDON HEIGHTS #XX-11 | 1,496 | 2,569 | 3,843,300 |

| 14 JUN 2021 | 26 LEEDON HEIGHTS #XX-03 | 1,044 | 2,720 | 2,840,000 |

| 13 JUN 2021 | 26 LEEDON HEIGHTS #XX-03 | 1,044 | 2,715 | 2,835,000 |

| 13 JUN 2021 | 30 LEEDON HEIGHTS #XX-18 | 700 | 2,729 | 1,909,200 |

| 13 JUN 2021 | 36 LEEDON HEIGHTS #XX-47 | 710 | 2,393 | 1,699,700 |

| 13 JUN 2021 | 36 LEEDON HEIGHTS #XX-48 | 1,496 | 2,484 | 3,715,900 |

| 13 JUN 2021 | 36 LEEDON HEIGHTS #XX-49 | 1,356 | 2,811 | 3,812,500 |

| 12 JUN 2021 | 38 LEEDON HEIGHTS #XX-53 | 1,496 | 2,624 | 3,926,000 |

| 12 JUN 2021 | 38 LEEDON HEIGHTS #XX-57 | 1,496 | 2,766 | 4,138,000 |

| 11 JUN 2021 | 26 LEEDON HEIGHTS #XX-07 | 1,044 | 2,893 | 3,021,000 |

| 11 JUN 2021 | 32 LEEDON HEIGHTS #XX-27 | 700 | 2,642 | 1,848,300 |

| 10 JUN 2021 | 30 LEEDON HEIGHTS #XX-22 | 1,076 | 2,502 | 2,693,500 |

| 10 JUN 2021 | 32 LEEDON HEIGHTS #XX-30 | 818 | 2,680 | 2,192,800 |

| 10 JUN 2021 | 38 LEEDON HEIGHTS #XX-53 | 1,496 | 2,631 | 3,936,000 |

| 9 JUN 2021 | 26 LEEDON HEIGHTS #XX-02 | 1,496 | 2,740 | 4,100,000 |

| 8 JUN 2021 | 38 LEEDON HEIGHTS #XX-53 | 1,496 | 2,526 | 3,780,000 |

Leedon Green has been selling rather well in June lately, so with the current promotion (although only 8 units as of time of writing), it looks like they are pushing to be competitive in this arena.

The former Tulip Garden was bought at a high of $907 million in a collective sale. With the estimated breakeven for Leedon Green at $2,500 psf, it does seem like the developer is keen to let go some of the units at a seeming loss to push the needle to the needed 30 per cent take up rate.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

$281.2M in Singapore Shophouse Deals in 2H2025 — But That Number Doesn’t Tell the Full Story

Singapore’s shophouse market recorded 36 transactions in 2H2025, with sales valued at about $281.2 million. This is a slight increase…

Why is this happening?

The general consensus among realtors is “too much, too soon”. There are currently seven new launches in Holland V fighting for attention:

| Projects | Take-Up Rate | Units |

| One Holland Village Residences | 45.6% | 296 |

| Van Holland | 26.09% | 69 |

| Leedon Green | 25.55% | 638 |

| Mooi Residences | 16.67% | 24 |

| Hyll on Holland | 2.51% | 319 |

| 15 Holland Hill | 16.95% | 59 |

| Wilshire Residences | 30.59% | 85 |

With just 302 units sold out of 1,490 units available, there is clearly a lot of options for buyers in the area.

Note that all of these, except for One Holland Village, are freehold properties.

We also shouldn’t forget that there are many older, resale condos in the same vicinity. Warner Court, Willyn Ville, Loft at Holland, Holland Court…all of these condos are within Holland V as well. They’re all also freehold and provide alternatives for buyers and tenants.

It’s a little surprising that developers didn’t see this coming. During the 2017 en-bloc fever, Holland V was one of the hotspots – six collective sales took place in close proximity: Tulip Garden (second-highest en-bloc transaction of 2017, at $907 million), The Wilshire, Hollandia, Toho Mansion, The Estoril, and Olinda Lodge.

It was quite bold of developers to price high regardless; perhaps on confidence regarding the location. It hasn’t played out well for many of them though, and we expect slow sales to push prices down further.

Elsewhere in District 10, we may see other condos follow suit

RoyalGreen, a freehold condo along Sixth Avenue hasn’t been performing as well as expected.

While as of May it has sold 40 per cent of its 285 units, it is considered to be slow for a development that was launched in 2019. A site visit will tell you that the developers are in a rush to complete the project, as that can be a helping hand to get more buyers through the door.

Slim margins, plus the ABSD, are putting pressure on developers

For properties that come from the 2017 en-bloc fever, margins are already low. This was due to aggressive land bids from foreign developers, most of whom had deep pockets.

Now the Additional Buyers Stamp Duty (ABSD) for developers is 30 per cent of the land price. However, if a developer can complete and sell the entire project in five years, they can obtain ABSD remission (25 per cent of the land price, with five per cent not being remissible).

Given the already low margins on some of these projects, developers can’t afford to absorb ABSD losses as well. This could result in fire sales, such as what we saw with 38 Jervois in June 2020.

Will the new, lower prices be enough?

With the lowered prices, there is some case to be made for buyers looking at the Holland vicinity. Especially for Hyll on Holland, where if you eyeing a 2 bed 2 bathroom option, the entry price will be one of the lowest in the area.

But, there are three important factors at note too:

First, buyers have started to gravitate toward larger units. This is because the bulk of buyers today are HDB upgraders. These are family buyers, who seldom have an interest in units below 900 sq. ft. As such, prime region condos, which often trade space to get a lower quantum, don’t capture this demographic’s attention.

Second, buyers of small, prime region condos – such as shoebox units in District 10 – are typically investors looking to rent out. But many of these investors are wary of buying amidst the pandemic; they’re uncertain whether the flow of foreign tenants will be maintained, or if subsequent issues (e.g., mutant strains and a second outbreak) could derail their investment.

Lastly, it’s been shown that buyers in the immediate area still prize bigger units, and are willing to pay for them despite the fact that they are older (in some cases, much older).

Coupled with the oversaturation of some areas like Holland V, even the recent drop in prices doesn’t guarantee good sales.

But sure, the prices are attractive enough that you will see units being snapped up. You may even see spillover from buyers that were initially priced out of the area, and have missed the early sales of developments that have launched and sold well (Irwell Hill Residences, One-North Eden come to mind).

There is one factor that could also help move units, however

That’s the fear of new cooling measures, as home prices continue to rise. Buyers who are “on the fence” could finally make their move if prices drop – before stamp duty rates still make the properties unaffordable.

This is a double-edge sword though, as actual new cooling measures would worsen the situation for developers.

A key lesson here is to be wary of “early phase” discounts

Buyers who purchased in the earlier phases, perhaps for VVIP preview discounts, are probably disappointed by this.

If you buy at a supposed 20 per cent discount early on, you should see an “instant 20 per cent profit” when the prices normalise. If the prices drop however, you simply end up being the person who bought at a premium.

This is reminiscent of last year when the developer of Enclave Holland lowered its remaining units to an extreme low. Yes, it’s a boutique project but at $18xx in 2020 which was move-in ready: it was good especially for investors looking to rent out immediately – but not so much for the initial buyers.

Developers certainly aren’t inclined to do this (who wants to sell for less, right?) But buyers should always keep in mind the five-year ABSD. Sometimes, developers don’t have any choice; and it’s the units sold at the very last minute that grab the discounts. It’s a strategy they have to undertake to capture market share to move units, no one wants to be caught with their pants down if the tide turns.

For more as the situation unfolds, follow us on Stacked. We’ll update you should prices drop further; and do check out our Holland V condo reviews (both new and resale).

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are some new condos in Holland V lowering their prices?

What is the current state of sales for Hyll on Holland and Leedon Green?

Are developers in Holland V facing difficulties with property sales?

How does the oversupply in Holland V affect property prices?

What factors should buyers consider when looking at discounted units in Holland V?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

2 Comments

https://www.todayonline.com/tulip-garden-sold-s9069-million-second-largest-en-bloc-deal-year

The above article seems to claim the Tulip Garden sale happened in 2018. Can we clarify this? The above article seems to say that the sale happened in 2017.