6 Common Things That Can Go Wrong When Buying A Property In Singapore (Without An Agent)

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Some homebuyers may feel an agent of their own is unnecessary. Some want to avoid paying commissions (though for private properties, the seller usually pays both agents). Others worry about the buyer and seller agents colluding to raise the price, for higher commissions on both sides (although the reality is most agents would rather close at a lower price than risk losing the deal). But in reality, the risk of a lost license – coupled with ease of viewings – makes a buyers’ agent worth taking on for most. Some buyers also end up facing added issues without an agent of their own, such as the following:

(To caveat the entire piece, everything here is only possible if you have a good and experienced property agent who is motivated to look after you. The reason why agents have such a bad rep is that it was relatively easy to become an agent in the earlier years (the recent agent exams have made this harder), and there are a lot of property agents out there who don’t have the necessary experience nor training to conduct themselves well).

1. Failing to notice important details in the paperwork

Here’s a common situation we come across:

When you first view the resale property, everything seems to be quite new and intact. You’re satisfied, so you put down the deposit. Right after this, the seller begins to move out some of the remaining furniture and other contents; but in the process, an appliance slams into a wall and leaves a giant crack; or perhaps some floor tiles shatter.

Who has to fix the damage?

It comes down to whether your Option To Purchase (OTP) document has the standard “condition 5.1.” This states that:

“On Completion, the Vendor must deliver the Property in the same state and condition as it was at the date of the option or the date of the contract, whichever is earlier, (save for fair wear and tear) unless otherwise agreed to by the parties.“

The tricky part is, not every seller may use the standard OTP.

There are variations involved, such as the validity period and yes, the inclusion of condition 5.1. If you’re not an experienced buyer, you might not notice if an OTP lacks this; and that could force you to accept the property in its damaged state, with no obligation by the seller to fix it.

In theory, your conveyancing firm should catch this, if you already had a lawyer check the OTP before you signed it. But it’s not uncommon for buyers to realise this only when it’s too late.

This is just one example of subtle changes to the paperwork, which can greatly benefit the sellers at your expense. A buyer’s agent is familiar with the documentation though, and is trained to notice non-standard clauses and subtle variations that could affect you.

2. You tend to end up paying additional costs

The timeline involved in a property transaction is sensitive. This is especially true if you’re trying to upgrade from a flat to a condo: you need to coordinate the time to hand over your flat, with the time when your new condo is ready to move into. A buyer’s agent can make the difference between having to move just once, and moving twice.

Inexperienced buyers are more prone to timeline errors and could end up moving twice when it’s not necessary. That leads to avoidable rental and storage costs.

Another common issue is buyers who – lacking the advice of an agent or other expert – put down deposits before securing their bank loan. If you put down a cheque before getting In Principle Approval (IPA)from a bank, you will end up with just 14 to 21 days to secure a bank loan, lest you end up forfeiting a part of the deposit.

The resulting mad scramble for a lender – any lender with fast approval – could leave you saddled with a higher interest rate. This is the sort of mistake that a good buyer’s agent can prevent if they’re around to guide you.

3. The buyer’s agent can spot illegal work done to the unit

There’s a notorious issue with the setback for landed properties: some houses are built too close to roads or other boundaries, and this may have gone unnoticed for years – until a sudden letter arrives from a government agency. A good buyer’s agent will warn you of such possible risks.

In condos and shophouses, some sellers have had features like mezzanine floors built without permission. While they may have gotten away with it, you’re the one left responsible for tearing it down, once you’ve signed the sale and purchase agreement. Misrepresentation also happens here, as sellers and their agents will sometimes claim the proper authorisation was granted.

4. You end up wasting time with sales pitches you can’t really verify

If you approach a seller without an agent of your own, be prepared to receive the full show with fireworks.

You’re going to hear the entirety of a long-winded sales pitch, replete with numbers, charts, zone maps, etc. that you probably have no way to verify (unless you’re one of the few buyers who subscribes to the relevant data sources to check – and they’re often not cheap).

View 10 listings, and you’ll go through 10 of these sales pitches. You can’t really “fast-forward” these, as they contain a mix of real details as well as persuasive ones. It’s hard to tell one from the other.

If you have a good buyer’s agent though, they can help you sieve through the details. Also, the two realtors tend to just cut to the chase; and you can quickly get all the verifiable facts and details to make comparisons.

(As an aside, this is also true for bank loans: try calling the banks without the help of a mortgage broker, and each call will waste about 15 minutes from your life, via a sales pitch about trivial home loan benefits).

5. Analysis paralysis can cause you to miss opportunities

Seeking information about developments is much easier than curating the information. Every one represents a barrage of information: unit mixes and layouts, nearby zones, quality of schools and malls, train station access, types of discounts, pricing per floor…the list goes on.

Among buyers, the common result is analysis paralysis: there are so many factors to consider, the end decision is either (1) arbitrary, because you’re burnt out from the comparisons, or (2) comes way too late, as by the time you’ve decided the sale phase has moved on (higher prices), or someone else has snapped up the unit.

An experienced buyer’s agent can help you to both verify the data you’re saying and provide clarity by picking out the important details. If they’re clear on your needs, they can help you to act faster, by shortlisting the units that best fit your criteria.

6. You overpay because you weren’t aware of a nearby alternative

The filters on property search portals, while useful, also tend to put blinkers on buyers. For example, if you filter for properties within one kilometre, the system may leave out a viable option that’s 1.01 kilometres out. If you put in a maximum price of $1.6 million, the system excludes units that are $1.61 million, etc.

There are also listings that – due to lack of exclusive deals* or inept marketing – don’t appear even if they’re appropriate. Buyer’s agents, who make it their entire job to scout out properties and compare, are far less likely to miss these deals.

There have also been cases where buyer’s agents can “jump in” on a failed transaction, to the benefit of their client. An example is when a buyer unexpectedly forfeits their OTP, causing the home to be put back on the market. A reputable buyer’s agent, with their industry contacts, may be able to get you in as a buyer even before the property is listed again.

For new launches, buyer’s agents will be kept up to date with returned units; this can mean not having to give up on your first choice.

*If a seller doesn’t have an exclusive with their agent, it means any agent who closes the deal can claim the commission. This causes agents to minimise their marketing budget for the listing, as no one wants to spend a lot to market a property which someone else sells.

Even if you’ve bought a home yourself before, do consider that the real estate market is always changing. Policy measures, architecture and interior layouts, and entire neighbourhoods change over time. So whether you’re looking for a home for the first time, or are in the market after many years, a buyer’s agent is almost always helpful.

Reach out to us on Stacked if you need assistance, and we can provide you with the information you need.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Advice

Property Advice The Ultimate Work From Home Homebuyer Checklist (That Most People Still Overlook)

Property Advice When ‘Bad’ Property Traits Can Be A Bargain For Homebuyers In Singapore

Property Advice The Hidden Risks Of Buying A Landed Home In Singapore: 6 Renovations That Could Be Illegal

Property Advice Why Being The First Seller In A Condo Can Be Risky (And How To Make It Work)

Latest Posts

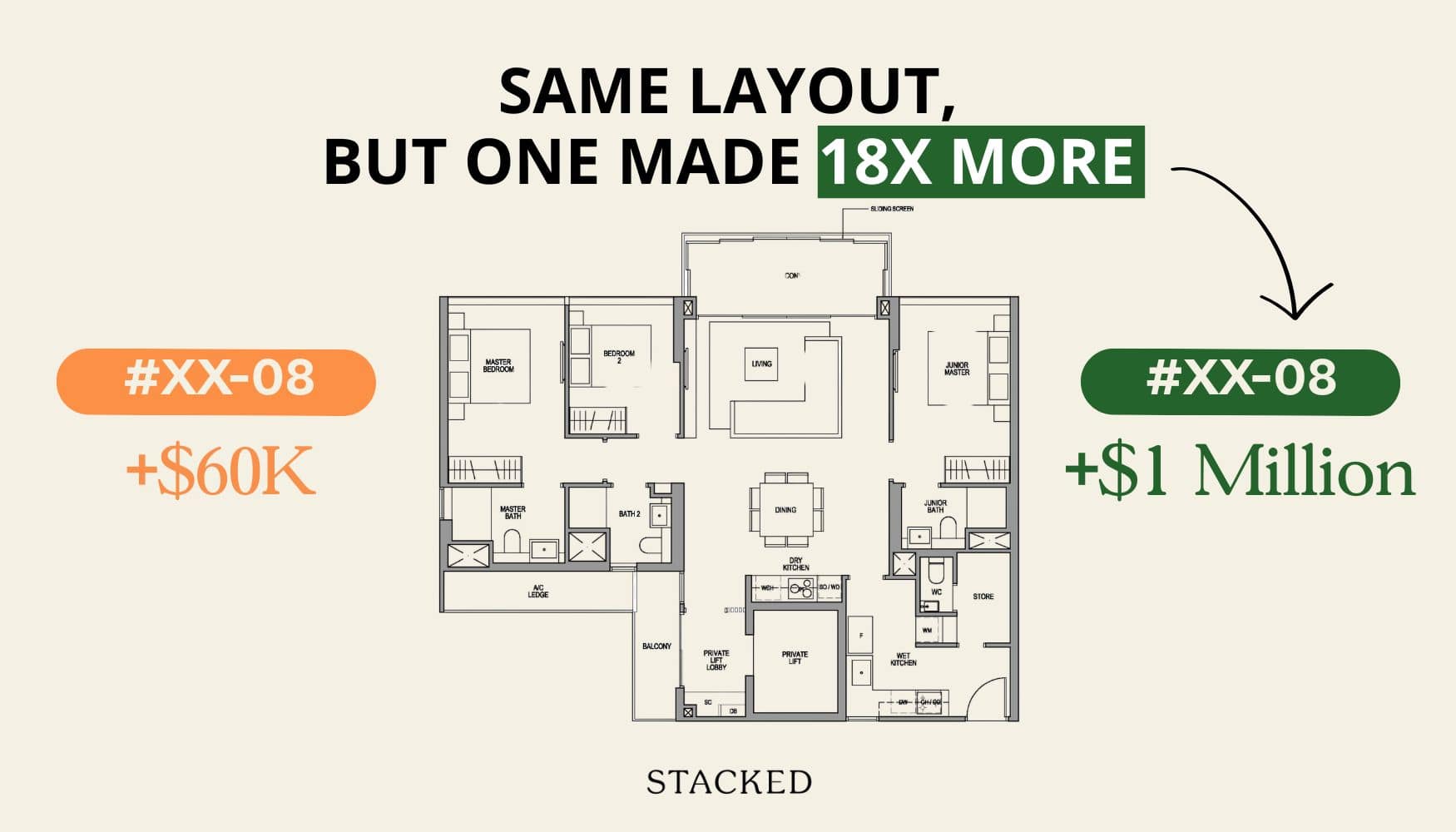

Pro How Different Condo Views Affect Returns In Singapore: A 25-Year Study Of Pebble Bay

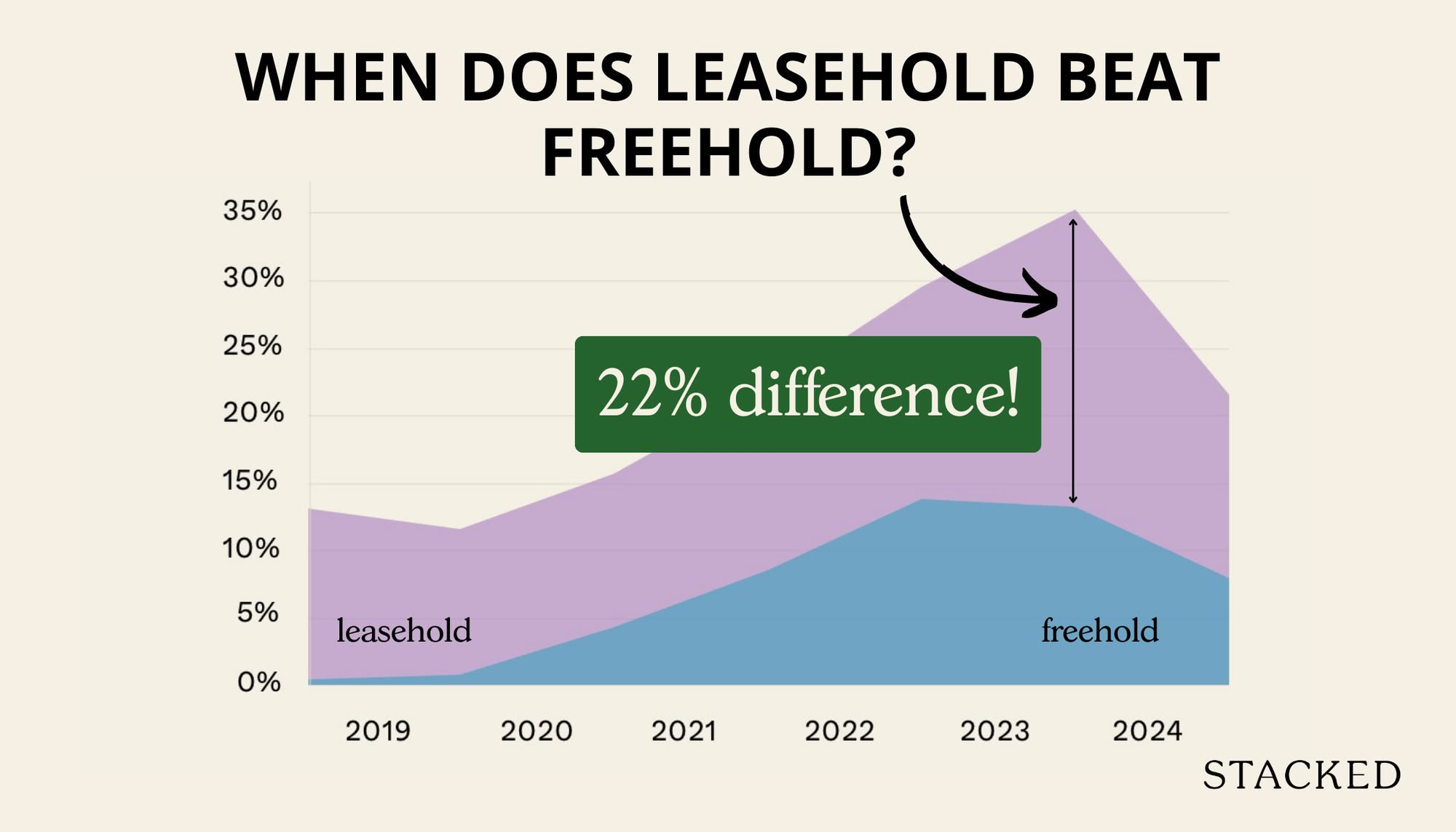

Pro Can Leasehold Condos Deliver Better Returns Than Freehold? A 10-Year Data Study Says Yes

Home Tours Inside A Minimalist’s Tiny Loft With A Stunning City View

On The Market 5 Most Affordable Newly MOP 4-Room HDB Flats From $585k

Property Market Commentary Distressed Property Sales Are Up In Singapore In 2025: But Don’t Expect Bargain Prices

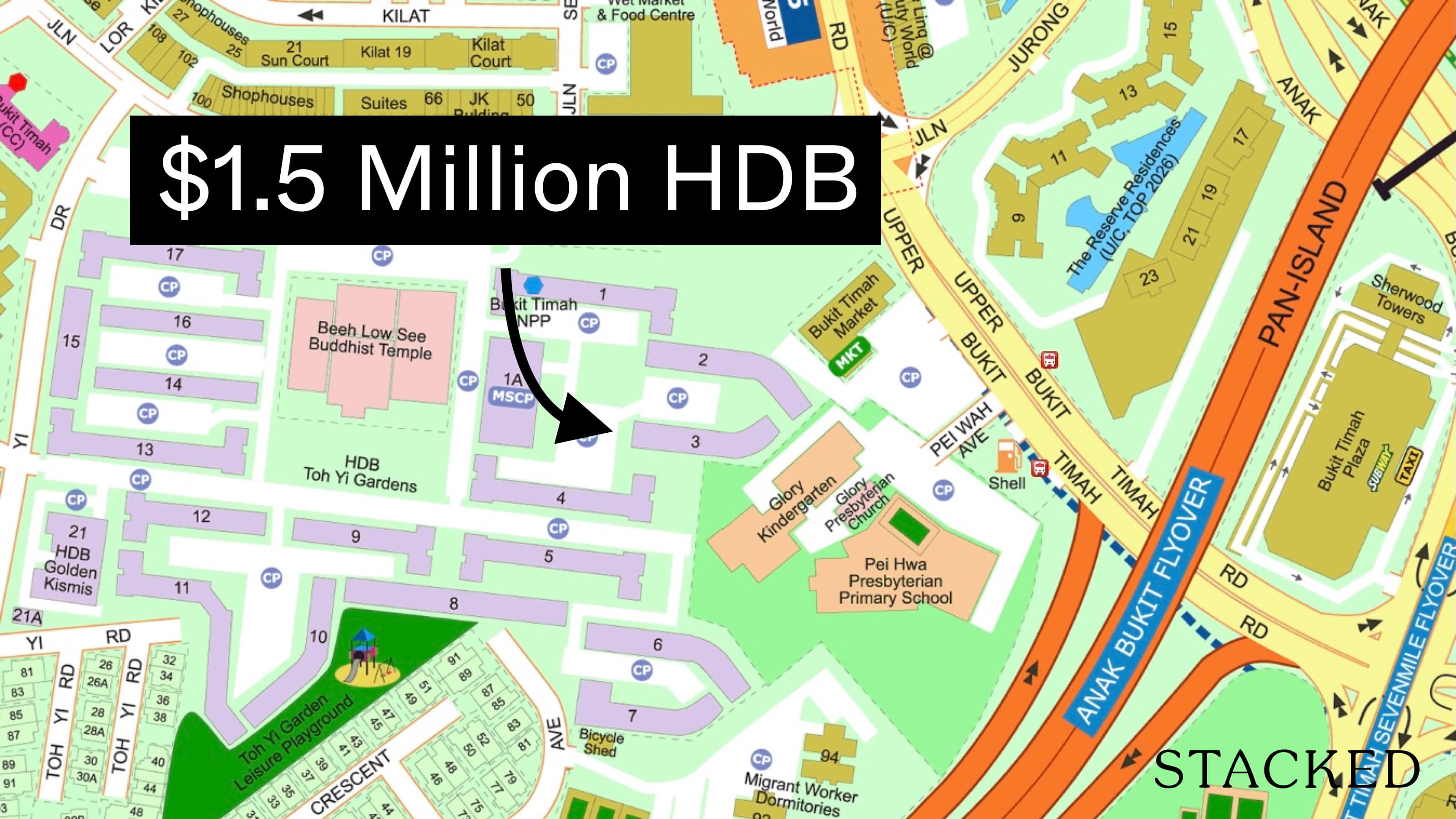

Singapore Property News This $1.5M Bukit Timah Executive HDB Flat With 62-Years Lease Left Just Set A Record: Here’s Why

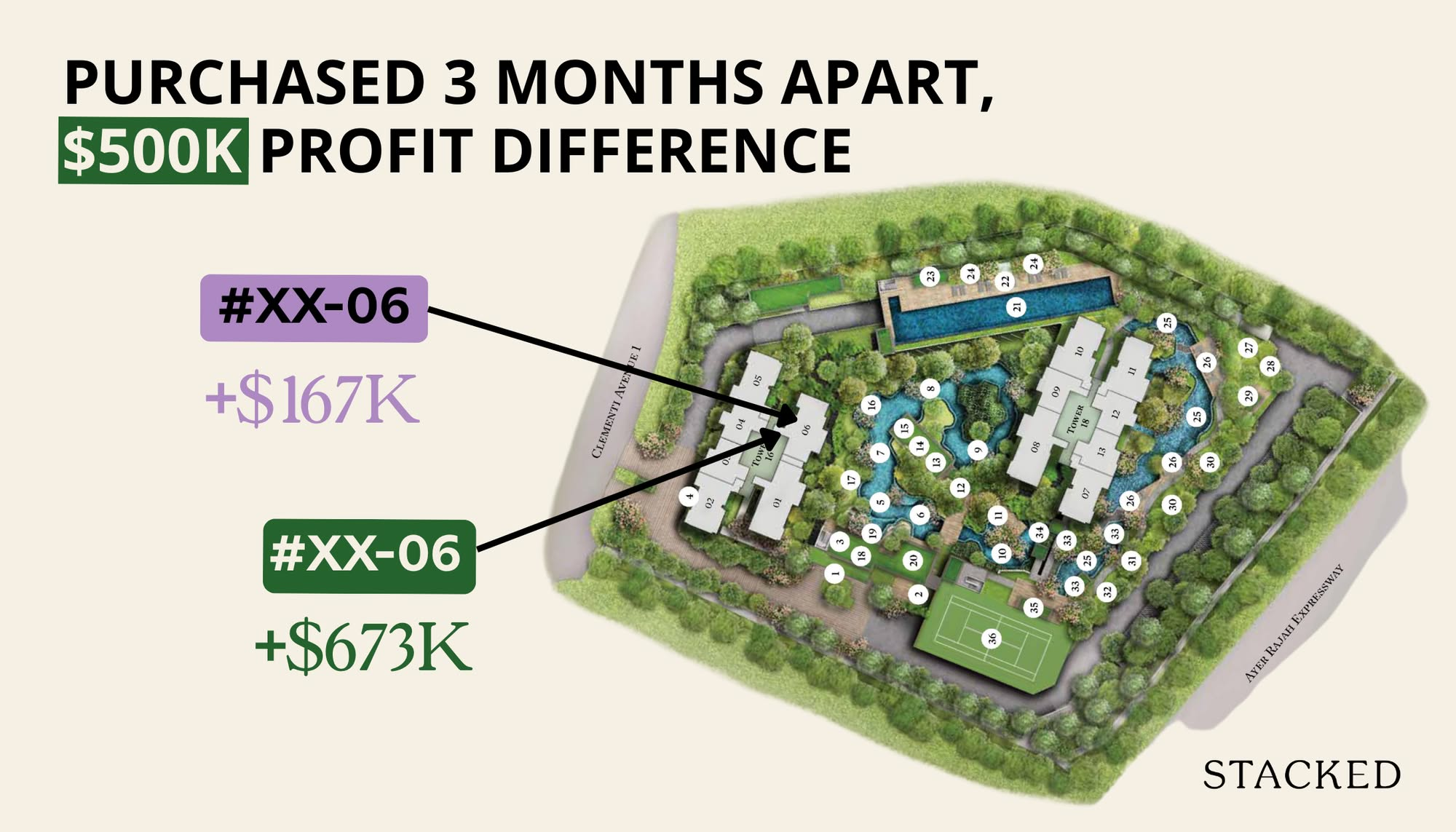

Editor's Pick How A Clement Canopy Condo Buyer Made $700K More Than Their Neighbours: A Data Breakdown On Timing

Editor's Pick Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Editor's Pick These $4m Freehold Landed Homes In Joo Chiat Have A 1.4 Plot Ratio: What Buyers Should Know

Editor's Pick Now That GE2025 Is Over, Let’s Talk About The Housing Proposals That Didn’t Get Enough Scrutiny

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025

Property Market Commentary Why Do Property Agents Always Recommend New Launch Condos? Is It Really About The Money?

On The Market 5 Affordable Condos With Unblocked Views Priced Under $1 Million

Pro Watertown Condo’s 10-Year Case Study: When Holding Period And Exit Timing Mattered More Than Buying Early