Buying A Property With A Foreign Spouse In Singapore? Here’s All You Need To Know

May 7, 2021

One of the most overlooked groups of buyers is Singaporeans with foreign spouses. From stamp duty rates to housing type restrictions, this group faces more headaches than the typical home buyer.

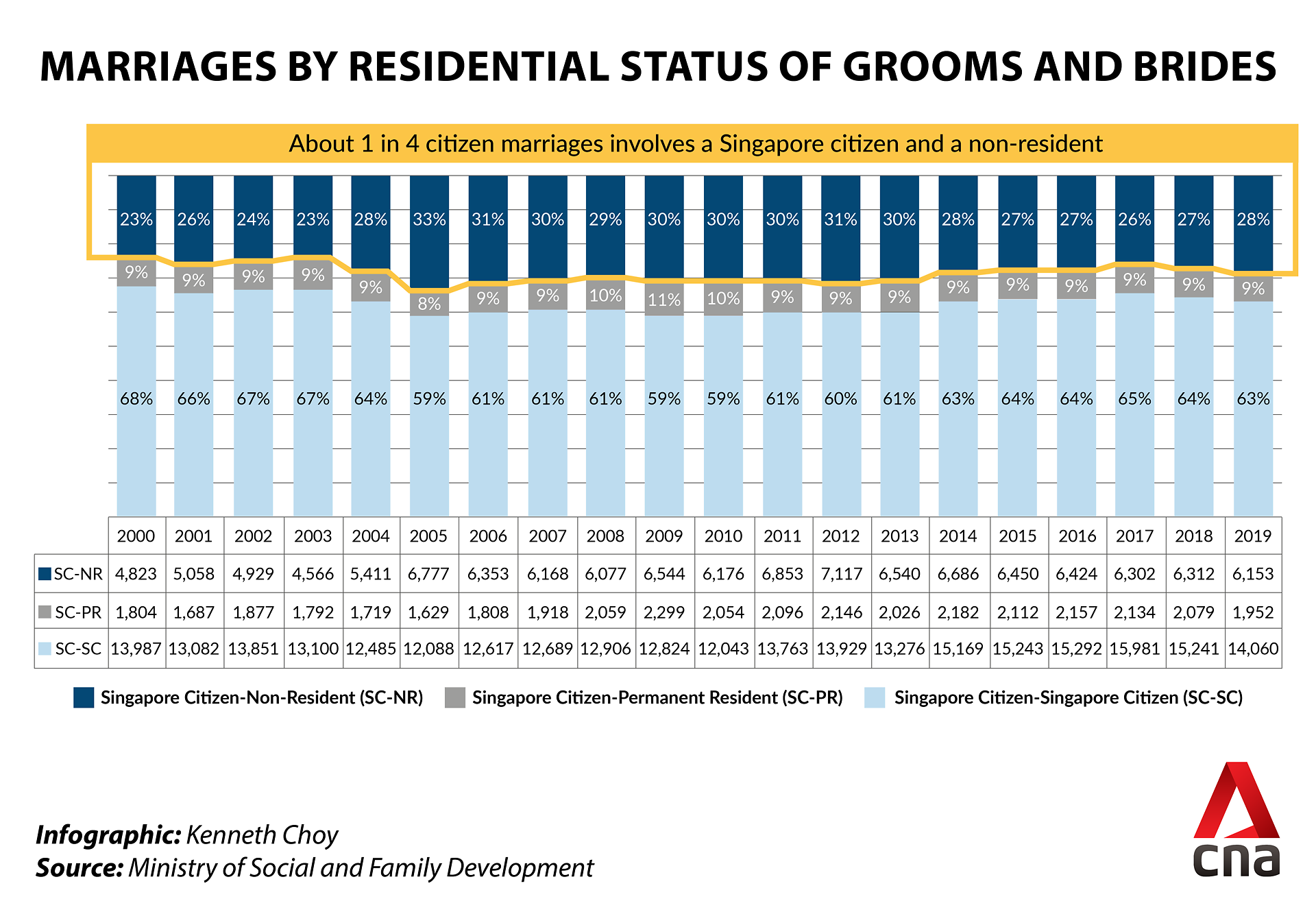

Did you know that as of 2019, nearly 1 in 4 citizen marriages in Singapore involved a foreign spouse? While we aren’t saying that it is a recent trend (the peak was in fact at 33% in 2005), it is surprising to see that it isn’t as widely written on as it should be.

As always, it’s best to be aware of these before you go house hunting to avoid disappointment. Here’s a rundown of what you need to know, as of 2021:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Buying HDB properties with a foreign spouse

For HDB resale properties, including Executive Condominiums (ECs) that are not fully privatised, you will have to buy under the Non-Citizen Spouse (NCS) scheme. The Singapore Citizen (SC) spouse must be at least 21 years old to qualify under this scheme, and the foreign spouse must have a Long-Term Visit Pass or a Work Pass.

(If a Work Pass is used, it must be valid for at least six months from the time of application).

However, if the SC spouse is 35 years or older, the foreign spouse must have one of the following:

- Work pass

- Visit pass

You can check the full range of work passes on the Ministry of Manpower website.

If you have a child who is a Singapore Citizen or Permanent Resident, you may not need to use the NCS.

You will usually be allowed to form a family nucleus with your child and foreign spouse. This allows you to buy under the Public Scheme; that means there will be no difference between you and other regular Singaporean couples.

Besides the above, there are also different restrictions based on whether you want a new (Built To Order, or BTO) flat, or a resale flat.

Buying a BTO flat

Mixed-nationality couples are only allowed to buy 2-room flexi-flats, in a non-mature estate. This will restrict you to the following HDB towns, as of 2021:

- Bukit Batok

- Bukit Panjang

- Choa Chu Kang

- Hougang

- Jurong

- Punggol

- Sembawang

- Sengkang

- Tengah

- Woodlands

- Yishun

Besides the above, note that you are subject to the usual restrictions of HDB flats that apply to everyone. This includes an income ceiling of $14,000 per month, the five-year Minimum Occupation Period (MOP), and not owning any other property locally or overseas. These usual eligibility requirements are on the HDB website, but you can also ask us directly.

However, there are no restrictions on flat size or location, if you buy a resale flat. Also, keep in mind that there’s no income ceiling for resale flats.

Available grants when buying with a foreign spouse

You can get two grants when buying under the NCS scheme: the Enhanced Housing Grant (EHG) for singles, and the Singles Grant.

The EHG is based on half your average monthly household income:

| Half of the Average Monthly Household Income | EHG (Singles) Amount |

| Not more than $750 | $40,000 |

| $751 to $1,000 | $37,500 |

| $1,001 to $1,250 | $35,000 |

| $1,251 to $1,500 | $32,500 |

| $1,501 to $1,750 | $30,000 |

| $1,751 to $2,000 | $27,500 |

| $2,001 to $2,250 | $25,000 |

| $2,251 to $2,500 | $22,500 |

| $2,501 to $2,750 | $20,000 |

| $2,751 to $3,000 | $17,500 |

| $3,001 to $3,250 | $15,000 |

| $3,251 to $3,500 | $12,500 |

| $3,501 to $3,750 | $10,000 |

| $3,751 to $4,000 | $7,500 |

| $4,001 to $4,250 | $5,000 |

| $4,251 to $4,500 | $2,500 |

You cannot get the EHG if half your monthly household income would exceed $4,500.

The Singles Grant is more straightforward. It is $25,000 if buying a 2, 3, or 4-room resale flat, and $20,000 for bigger resale flats.

In both cases, all usual restrictions for grants still apply. This means you (the SC) need to be at least 21 years old, you must be a first-timer applicant, there must be at least 20 years lease remaining on the flat, and so forth. To see the full list of grant restrictions, visit the HDB website. If it’s unclear to you, feel free to ask us directly.

Buying an EC with a foreign spouse

Unfortunately, you cannot buy an EC that is not yet privatised. You can only pick among ECs that have passed their 10th year, at which point they are considered the same as private properties (see below).

A possible exception is if you have a child with citizenship, or who is a PR. You can form a family nucleus with your child to buy an EC; or buy it under your child’s name (assuming they are old enough). However, we strongly advise that you consult a professional – such as a conveyancing lawyer – on the potential implications.

Bear in mind that if you buy an EC with your child, they cannot then buy an HDB flat later; not for as long as they co-own the EC. Your child may also have certain rights over the property as a co-owner, which your foreign spouse will lack. This gets complicated, and it’s not feasible to try and explain everything in this article. Contact us and let us know the specifics of your case, if you need help.

Your foreign spouse cannot be a co-owner of an HDB property

Your foreign spouse can only be an essential occupier, and not an actual co-owner. This has two important implications:

First, it means that they cannot be co-borrowers on the home loan. Only your income can be used, to meet requirements such as the down payment, and the Mortgage Servicing Ratio (MSR). This can mean a smaller loan quantum, or greater difficulty in loan approval. This is regardless of whether you use a bank or HDB loan. See our article on home loans for the full details.

Second, you may want to ensure your foreign spouse understands they’re not owners, and don’t have the same legal rights to the property. Even if they contribute to the loan repayments or maintenance, they will not legally own the flat.

Buying private properties with a foreign spouse

Singapore is very liberal with regard to private property ownership, and there are almost no restrictions. Unlike HDB properties, a foreigner can also be the co-owner of a private property. However, a few key points need to be highlighted:

- The higher ABSD rate applies for mixed nationalities

- Foreigners are restricted from owning certain property types

- Banks may factor income differently, if your co-owner is not employed in Singapore

1. The higher ABSD rate applies for mixed nationalities

If you’re buying your first residential property in Singapore, you don’t need to worry about this yet; but keep it in mind in case you want to buy another home in future.

When you buy a second or subsequent residential property with a foreign spouse, the higher of the Additional Buyers Stamp Duty (ABSD) rates will apply.

For example, Singaporeans usually pay 12 per cent ABSD, on their second residential property. But if they purchase a second property with a foreign spouse, the ABSD rate for foreign buyers (20 per cent) would apply instead.

(For the prevailing ABSD rates, see complete guide to all stamp duties in this article.)

In the event that you and your spouse purchase multiple properties in the same transaction (e.g., buying two or three units in the same development at once), you can choose which residences the ABSD will apply to, beyond the first.

Properties outside of Singapore do not count for the purposes of ABSD.

An exception to this is foreigners whose countries are in a Free Trade Agreement (FTA) with Singapore.

At present, these include:

- Iceland (Citizens and Permanent Residents)

- Lichtenstein (Citizens and Permanent Residents)

- Norway (Citizens and Permanent Residents)

- Switzerland (Citizens and Permanent Residents)

- United States of America (Citizens)

Foreigners from these countries will pay the same ABSD rates as Singaporeans; but do check for an update before buying, in case the status of the FTA has changed.

2. Foreigners are restricted from owning certain property types

Foreigners must obtain special permission from the Singapore Land Authority (SLA) to own (or co-own) any of the following with their SC spouse:

- Undeveloped residential land plots

- Terrace houses

- Semi-detached houses

- Bungalows

- Townhouses, cluster houses, or other strata-titled landed housing not within a condo development

- Residential shophouses

- Serviced apartments or dormitories that are not registered as hotels Special permission can be sought from SLA, and these will be evaluated on a case-by-case basis. Contact us if you need help here.

An exception to this would be the landed properties on Sentosa Cove, which can be purchased by foreigners.

3. Banks may factor income differently, if your co-owner is not employed in Singapore

If you apply for a home loan with your foreign spouse, the bank will ask if they’re currently employed in Singapore. If they’re not, banks may apply a haircut of 20 to 30 per cent to your income (e.g., if your foreign spouse earns $5,000 a month, they may count as earning only $4,000).

Banks may be willing to make an exception, such as if you’re fine to leave a certain amount as a fixed deposit with them.

When in doubt, contact the relevant government bodies or a conveyancing lawyer before buying.

The authorities will not accept misinformation by sellers as an excuse. For example, if you don’t reveal that you and your spouse own a property in their home country, and you still buy a flat, HDB can repossess it later at your cost. It won’t matter whether or not a realtor told you otherwise. It’s best to be sure before signing any cheques.

For more on the Singapore private property market or the HDB scene, follow us on Stacked. We’ll also provide you with the latest insights into new and resale developments today.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

6 Comments

Hi Ryan, interesting article. Regarding ECs, it was my understanding that for resale units between 6-10 years old you no longer need to form a family nucleus, so in this case the Singapore citizen spouse could buy in their sole name at this point, is this not possible?

Hi Ryan, thanks for writing this up. I’m an SC and husband is a foreigner. I wanted to buy my parents a larger HDB, but not live with them, and in 3 years buy a condo with husband. I’d need to take a loan on both properties. If its an EC resale, could I buy the EC under my name alone – take a loan there, and in 3 years husband buys the condo under his name alone, and take a loan there too?

(and since its privatised, don’t need the MOP?) I basically don’t want to be locked in for 5 years and just want to get my parents something larger than a 2rm HDB but cheaper than a condo.

Hi Ryan, with regards to the Singles Grant, what would be the income ceiling which is applicable? Is it a 14k combined income (including the income of the foreign spouse) or 7k just based on the Singapore citizen? Thanks.