If your property investment plan ends with “…and then my children will own 10 condos”, you probably grasp the idea of wealth progression in property assets (and if you don’t, there are several hundred YouTube ads that will force-feed it to you).

The concept seems simple enough: start with one home, then sell it for more and upgrade. Then you let that home appreciate, sell it for more, and buy a bigger or more homes, rinse and repeat.

But here’s the thing: the later part of the plan (choosing which two condos, landed property, etc. to buy) is the easier part. The tough part is the very first property. After all, if your first home doesn’t appreciate well, then the rest of the plan is just a pipe dream.

This leads a lot of first-time home buyers to ask: is the bog-standard Built-To-Order (BTO) flat the right choice of a first property?

If you have other options – such as starting with a resale flat, Executive Condominium (EC), or small private condo – should you “waste time” starting with a BTO flat?

Here are some considered opinions:

Opinion 1: BTO flats are a waste of time, and should be avoided if possible

- You waste more than just five years on a BTO flat

- BTO flats tend to be in less desirable locations

1. You waste more than just five years on a BTO flat

One of the main concerns about the “BTO route” is the amount of time you spend waiting.

Most of us know about the five-year Minimum Occupation Period (MOP). You can only sell the flat on the open market, or rent out the whole flat*, after the MOP has been reached.

However, don’t forget that a BTO flat takes time to build. It can be anywhere from three to four years, before the flat is complete. The MOP period only commences after the construction is done, and you collect the keys. So if you total up the time, it’s possible that you’ll waste eight years (three years construction + five years MOP) before you can hopefully set foot in the private property market.

Now consider if you’re 35 years old at the time you buy a BTO flat.

Assuming it takes three years to build, you would be 43 by the time you’re ready to buy a condo. And when you take a bank loan for a private property, there are restrictions on the loan tenure: if your age plus the loan tenure exceeds 65, you may only get as little as 45 per cent financing for your condo.

So if you’re 43 when you buy a private property, your maximum loan tenure is just 22 years. Also, do see point 3, where we address how much you could have lost out in those eight years.

*If you are a Singapore Citizen. Note that Permanent Residents cannot rent out their entire flat, although they can still rent out rooms.

2. BTO flats tend to be in less desirable locations

New flats are not often in mature areas (and when they are, they’re almost invariably oversubscribed). It’s likely that a BTO flat is going to be in a less mature area, with limited retail options, an MRT station that won’t be up for years, fewer schools nearby, etc.

Just look at the recent August BTO launch for example – the last time a new BTO was up for sale in Bishan was all the way back in 2006.

From a home owner’s perspective, this may not be an appealing place to live in. From an investment perspective, this is double-edged. On the one hand, there’s theoretically room for more appreciation, if you buy in less developed areas.

Opinion 2: BTO flats are an ideal starting point for most home buyers

- BTO flats have a smaller cash outlay

- It’s easier to go from flat to condo, than to reverse the decision

- You can end up owning both a private property and a flat

1. BTO flats have a smaller cash outlay

Buyers who are of this opinion are more conservative; and there’s no denying that a BTO flat ties up less capital. This is about both the price, and the nature of the HDB loan (which doesn’t exist for private properties and ECs).

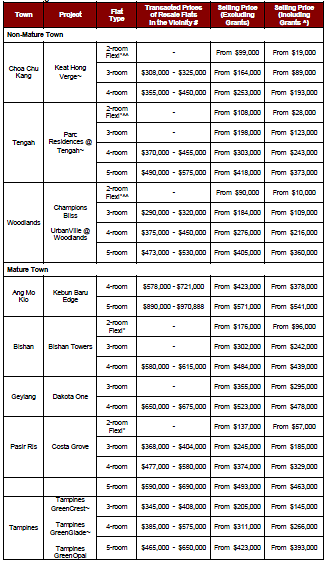

The typical cost of a four-room BTO flat, at the time of writing, is about $350,000 (for most non-mature areas).

Using an HDB Concessionary Loan, it’s possible to get financing for up to 90 per cent of the flat. This means a down payment of just $35,000. On top of that, the remaining 10 per cent down can come entirely from CPF.

This means that many Singaporeans can, in fact, buy an HDB flat without spending a single dollar from their bank account (this is also true for resale flats by the way, unless the seller of the resale flat is asking for more than the flat’s market value).

If you were to buy an EC or condo, the minimum down payment is 25 per cent. The first five per cent is always in cash, and the next 20 per cent can come from CPF.

So even for a small $1.2 million condo, you’d need $60,000 in cash. After that you’d need to pay an additional $240,000 from your CPF – if you don’t have enough in your CPF, you need to top that up in cash as well.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

10 Key Things You Can’t Overlook In Your Condo Floor Plan Before Buying

What makes a good condo layout? Well, the answer is, truthfully, quite subjective - but there are some common features…

Now, we mentioned above that the annualised return on a condo, over the past eight years excluding rent, averages 4.6 per cent.

But a financially savvy home buyer may be able to do a lot better than 4.6 per cent, with the capital freed up by buying a BTO flat instead.

Property AdviceHDB resale price: How much can you make selling your BTO after MOP?

by Sean Goh2. It’s easier to go from a flat to a condo, than to reverse the decision

If you buy a flat and want a condo, the only issue is that you need to wait for the MOP to be up.

But if you buy a condo first and later decide you need a flat, things can get more complicated. For example, you need to wait 30 months after disposing of a private property, before you can apply for a flat.

Here’s a typical “problem scenario” to consider:

Say you buy a compact unit as your first home. But a few years down the road, you decide to settle down; then you realise your condo unit is too small to raise a family.

Well you can’t apply for an HDB flat now, as you already own a private property. This leaves you with no choice but to sell the property (risking a loss if the market is bad), and then waiting for your 30 months to be up before you can apply for a flat.

3. You can end up owning both a private property and a flat

This only applies to Singapore Citizens.

If you wait till the MOP is up, you have the option of purchasing a private property, while still retaining your flat. In fact, there’s no limit to the number of private properties you can buy while still retaining your flat, so long as you wait till the MOP is up. You cannot, however, do this the other way around – if you buy a private property first, you can’t get a flat until you dispose of the private property.

As such, some home buyers choose to start with a BTO flat, and invest the savings they make from not buying a condo. After their MOP, they aim to buy a private property while still retaining the flat (they can live in one and rent out the other).

Opinion 3: Buy a resale flat instead of a BTO flat, and then upgrade to a condo

Some home buyers still believe in starting with an HDB flat; they just prefer to start with a resale flat instead. The reasons are:

- You don’t have to wait for the flat to be built

- A resale flat in a desirable location can still appreciate well

1. You don’t have to wait for the flat to be built

This one is self-explanatory. You only have to wait for the MOP, and not the construction time. You can also move into the flat right away if you have to, so there’s potential savings on temporary accommodation.

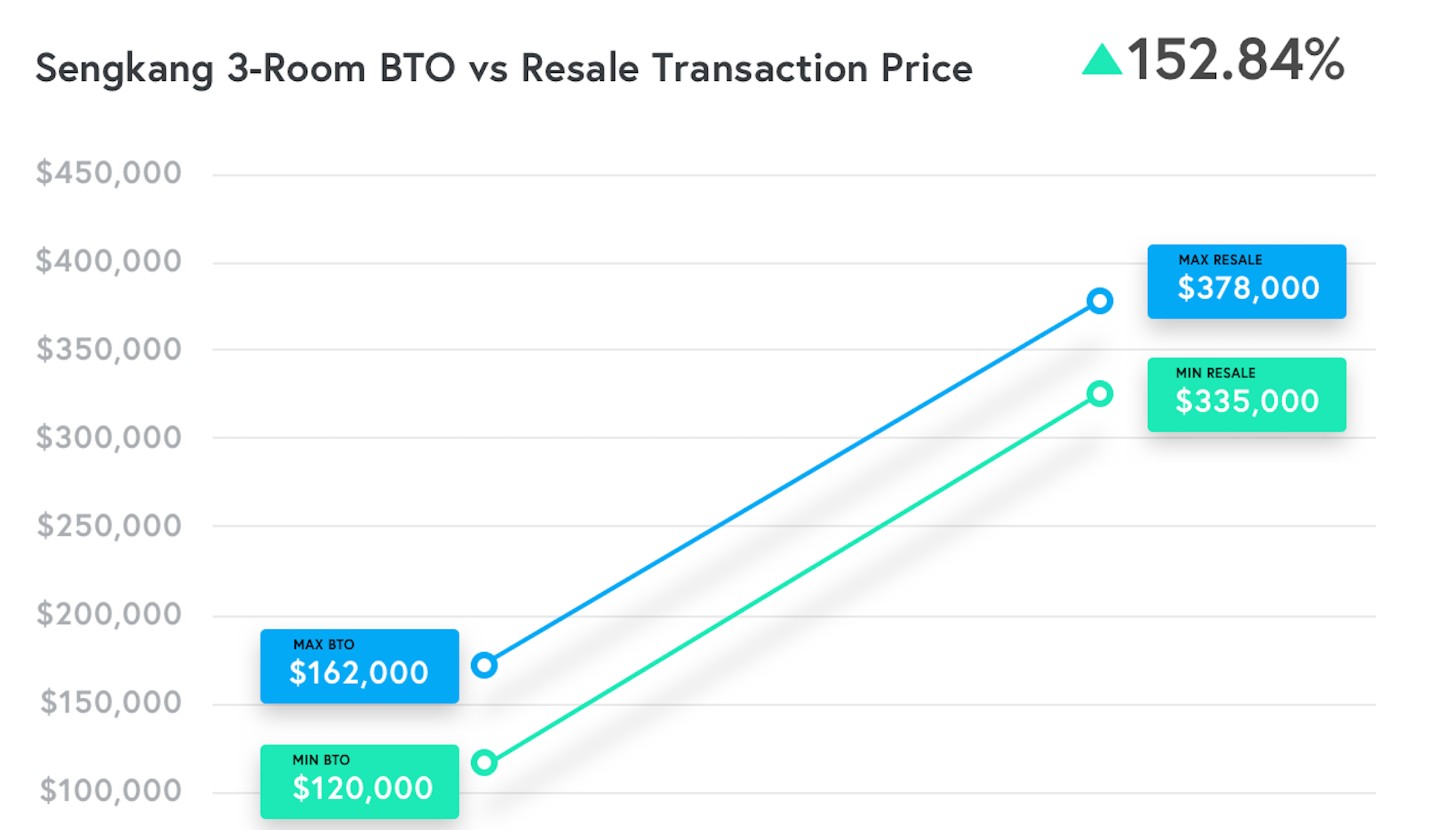

2. A resale flat in a desirable location can still appreciate well

Above, we’ve shown you that on average flats don’t appreciate as well, and have been on a downward trend for the past few years. However, this reflects on the overall market.

If a flat can sell for over a million dollars during Covid-19, then it’s clear some (key word is some) flats can buck the trend. As such, some home buyers prefer to start off with a resale flat in a good location – such as Bishan, Clementi, Marine Parade, etc. – rather than a BTO flat in a new and unproven location.

So, is starting with a BTO flat a “waste of time”?

The simple answer is no.

If you know what to do with the savings from buying a flat versus a condo, the lower cash outlay can make a big difference in your wealth accumulation. There’s also an argument in favour of financial prudence – in difficult situations, like the Covid-19 downturn – it may be better off to start with a cheaper home, even if it means losing out a little bit in capital appreciation.

There are some buyers for whom it makes more sense to start with a condo (namely those in stronger financial positions) but that isn’t universally true.

If you’re uncertain whether you have the means to start with a condo, contact us on Stacked. We can put you in touch with an expert to review your situation. In the meantime, make sure your first condo (whenever you buy it) is the right one. Check out our in-depth reviews of Singapore private properties.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is buying a BTO flat a good first property for wealth building?

How long does it typically take to buy a BTO flat and then upgrade to a private property?

Are resale flats a better option than BTO flats for first-time buyers?

What are the main disadvantages of starting with a BTO flat?

Can I own both a flat and a private property at the same time?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

0 Comments