Around this time last year, National Development Minister Lawrence Wong cautioned resale HDB flat buyers that not all old HDB flats will automatically be eligible for the Selective En bloc Redevelopment Scheme (SERS).

<Leasehold Properties as Assets> My last blog on choosing a HDB resale flat generated some discussion and debate. Let…

Posted by Lawrence Wong on Tuesday, April 11, 2017

This sparked a huge debate online and prompted a follow up, with the National Development Minister saying that leasehold properties are still a good store of asset value. Many people are still divided over whether an HDB flat should be seen as an asset or just a home. This is partly because the “Asset Enhancement Scheme“, which was a theme of the PAP back in the 1990s. As such, many of the older generation still believe that an HDB flat is an asset that is a wise investment and in local terms in Singapore, “confirm won’t lose money!” So how does this actually affect the HDB resale price?

HDB flat an asset or liability?

Of course properties in general will always be seen as an asset. It is easy to see why many Singaporeans have such faith in the property market in Singapore, where in 1986 to 1996 there was a 440% increase in the private residential price index. Many Singaporeans also made bucket loads of cash in the 2006-2007 en bloc frenzy, with the current en bloc cycle in 2018 still riding high.

However, Singapore is no longer a developing nation and growth in the economy is not going to be as rapid as before. In fact, despite the projected increase in property price in Singapore, the resale prices actually declined by 0.8% in Q1 2018.

So what will I be looking to see in terms of my HDB resale price?

Although new flats used to be pegged to the HDB resale price, this is no longer the practice today. So since this move in 2011, the prices of a new BTO flat has become more affordable. In general, buying a BTO flat will always be an attractive option, due to the subsidised rates and many housing grants that are available. You will have to contend with certain inconveniences at the beginning, such as the wait for the flat to be built and the availability of amenities. For example, in the earlier years of Punggol’s history, BTO prices were really low to attract people to purchase flats there as there were hardly any amenities in the area at that point. But once the supply was ramped up and malls such as Waterway Point were established, the HDB resale price in Punggol has gone up.

So let us take a look at 3 areas that have been quite popular with younger Singaporeans, Bukit Panjang, Punggol and Sengkang.

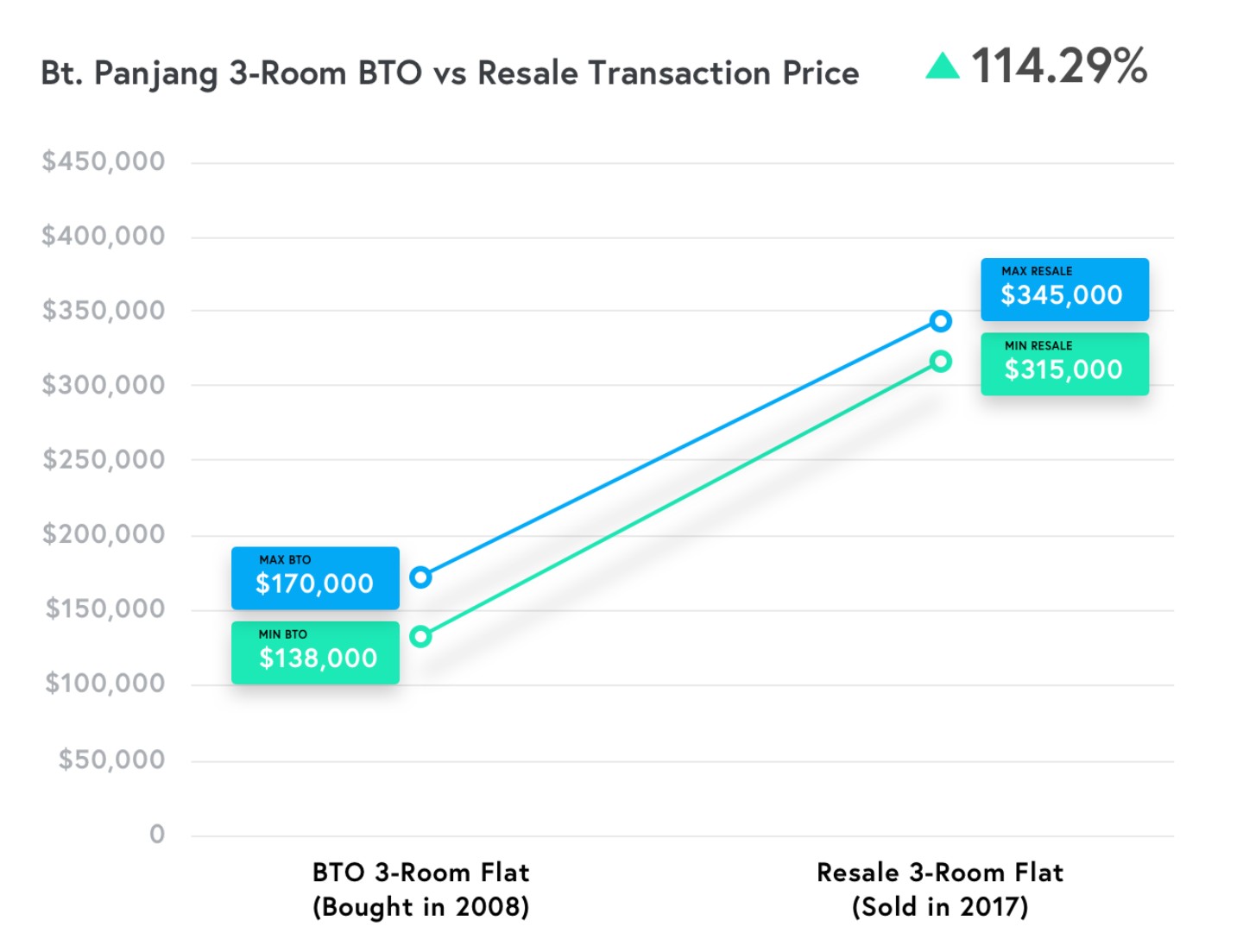

Bukit Panjang 3-room BTO

In Bukit Panjang if you had bought a BTO in 2008, the price range of a 3-room BTO was between $138,000 to $170,000. As of 2017 last year, the HDB resale price range was between $315,000 to $345,000. This is a 114% increase in less than 10 years!

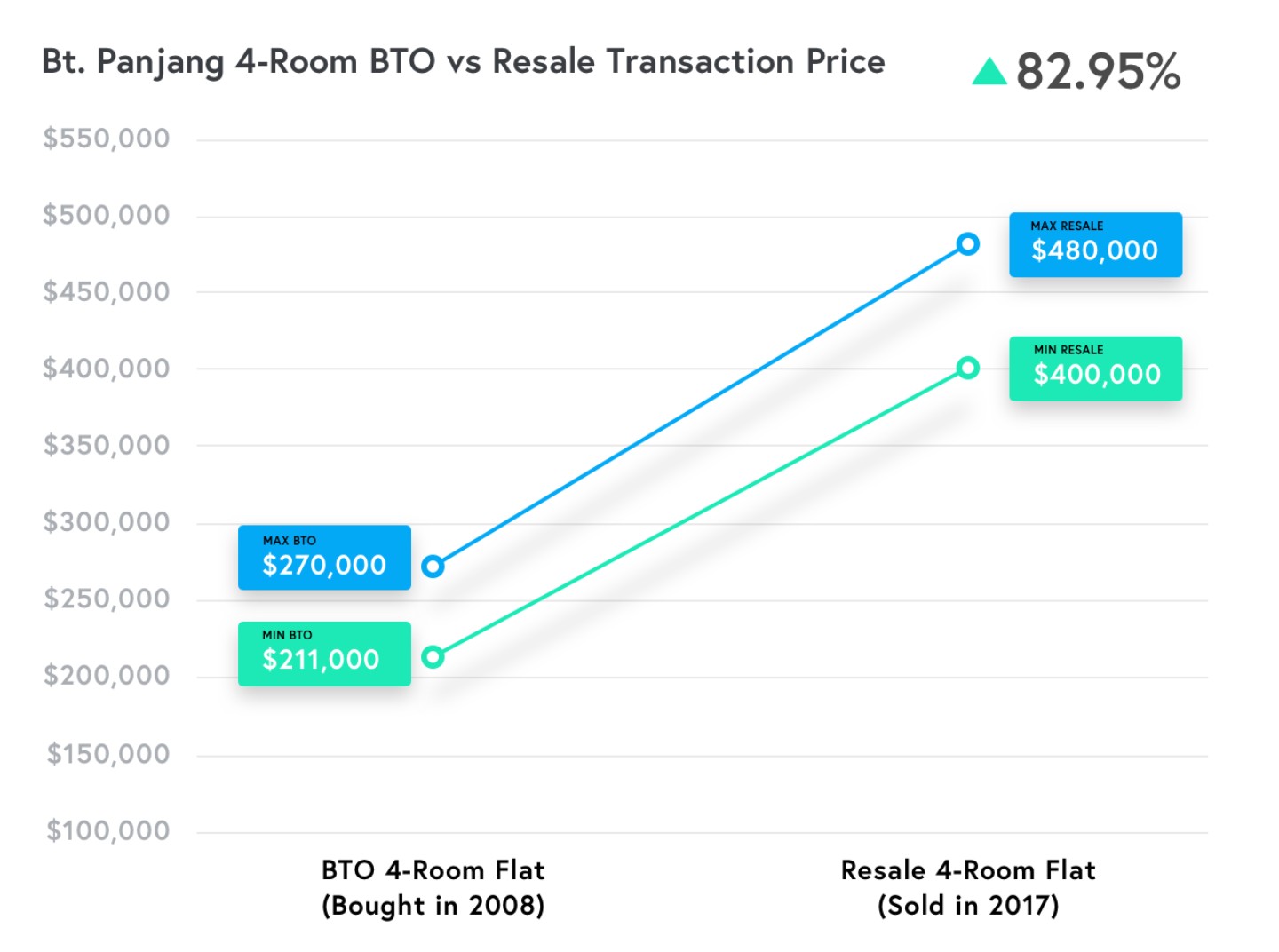

Bukit Panjang 4-room BTO

If you had bought a 4-room BTO in 2008, the price range was between $211,000 to $270,000. As of 2017 last year, the HDB resale price range was between $400,000 to $480,000. This is a 82% increase in less than 10 years!

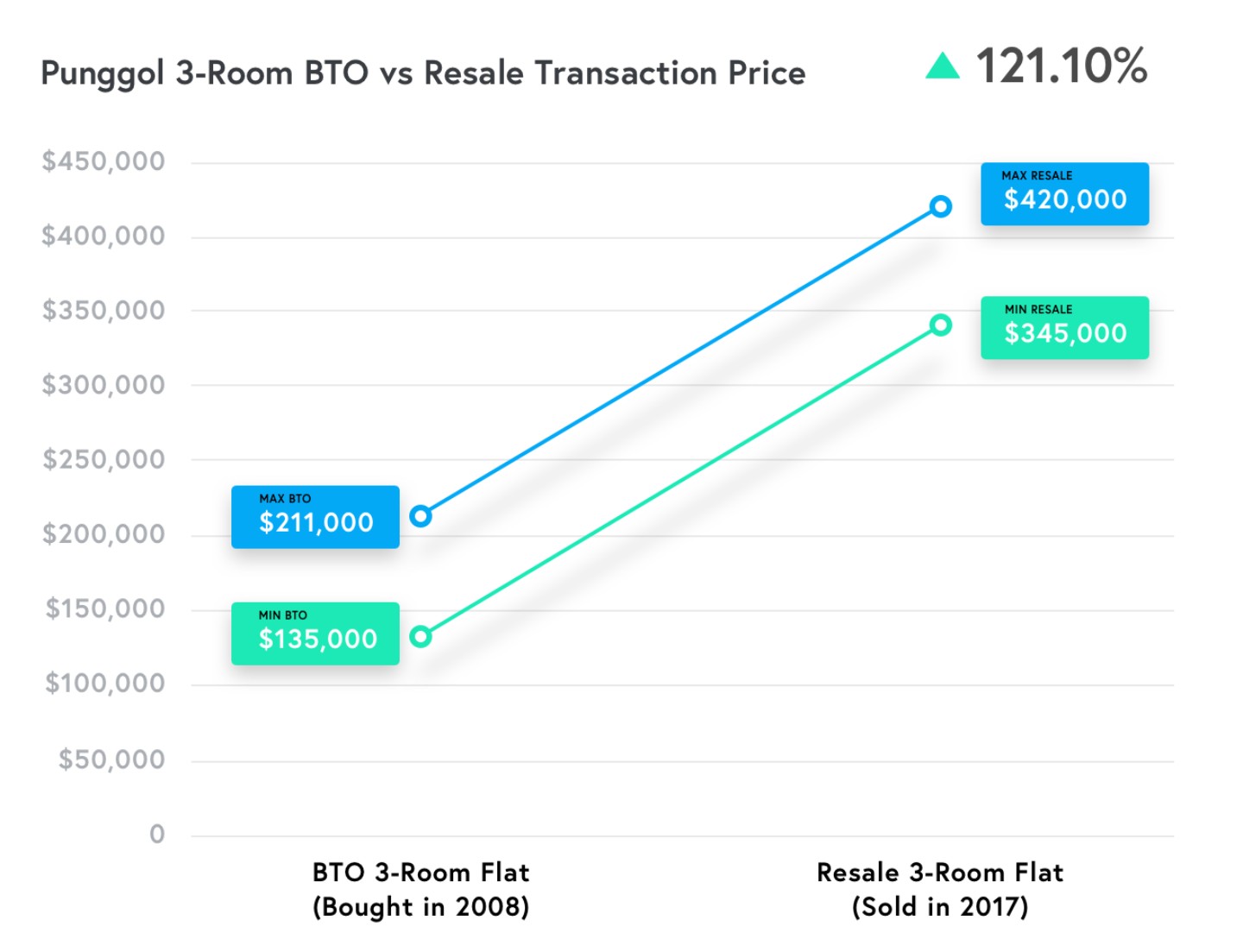

Punggol 3-room BTO

In Punggol if you had bought a BTO in 2008, the price range of a 3-room BTO was between $135,000 to $211,000. As of 2017 last year, the HDB resale price range was between $345,000 to $420,000. This is a 121% increase in less than 10 years!

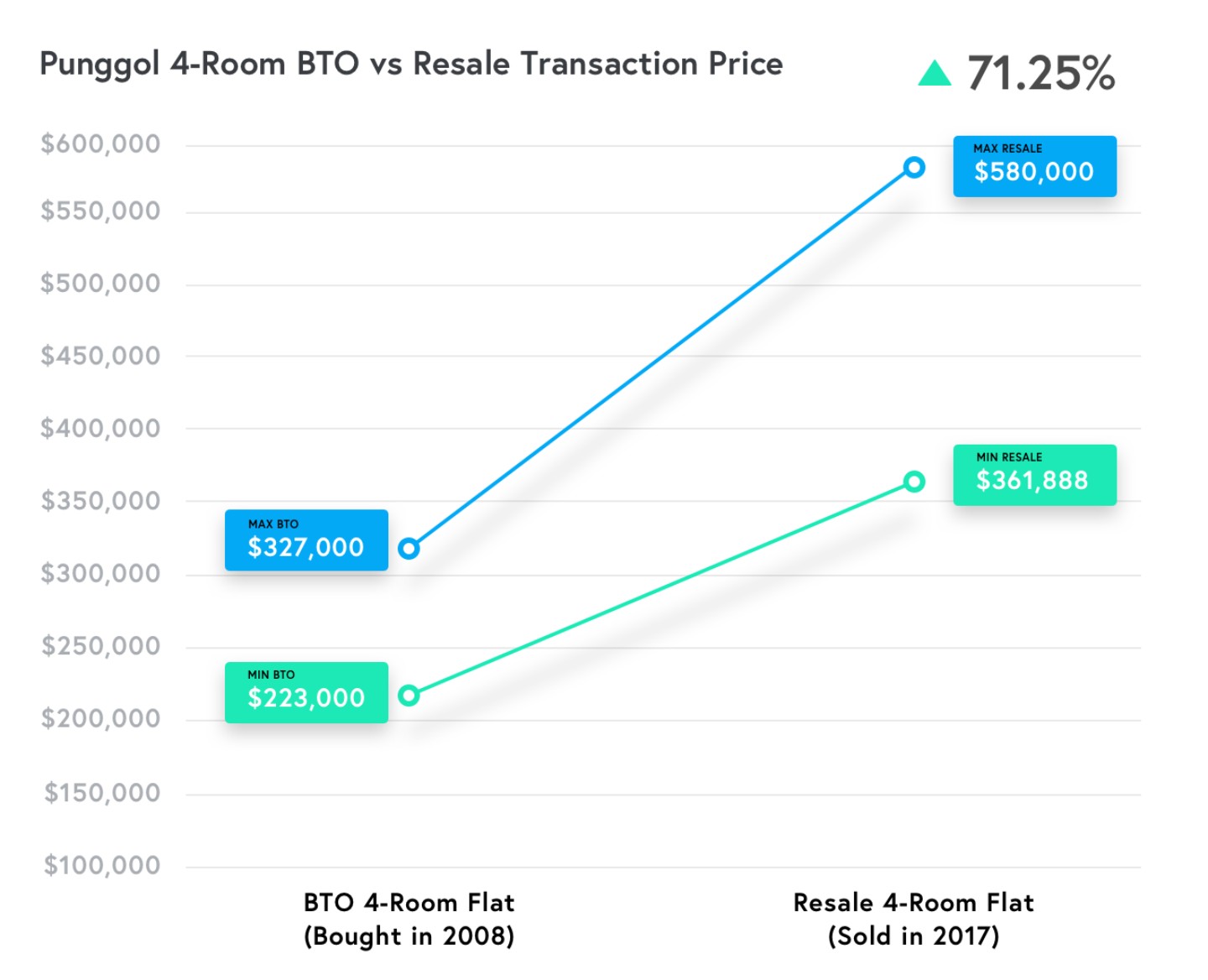

Punggol 4-room BTO

If you had bought a 4-room BTO in 2008, the price range was between $223,000 to $327,000. As of 2017 last year, the HDB resale price range was between $361,888 to $580,000. This is a 71% increase in less than 10 years!

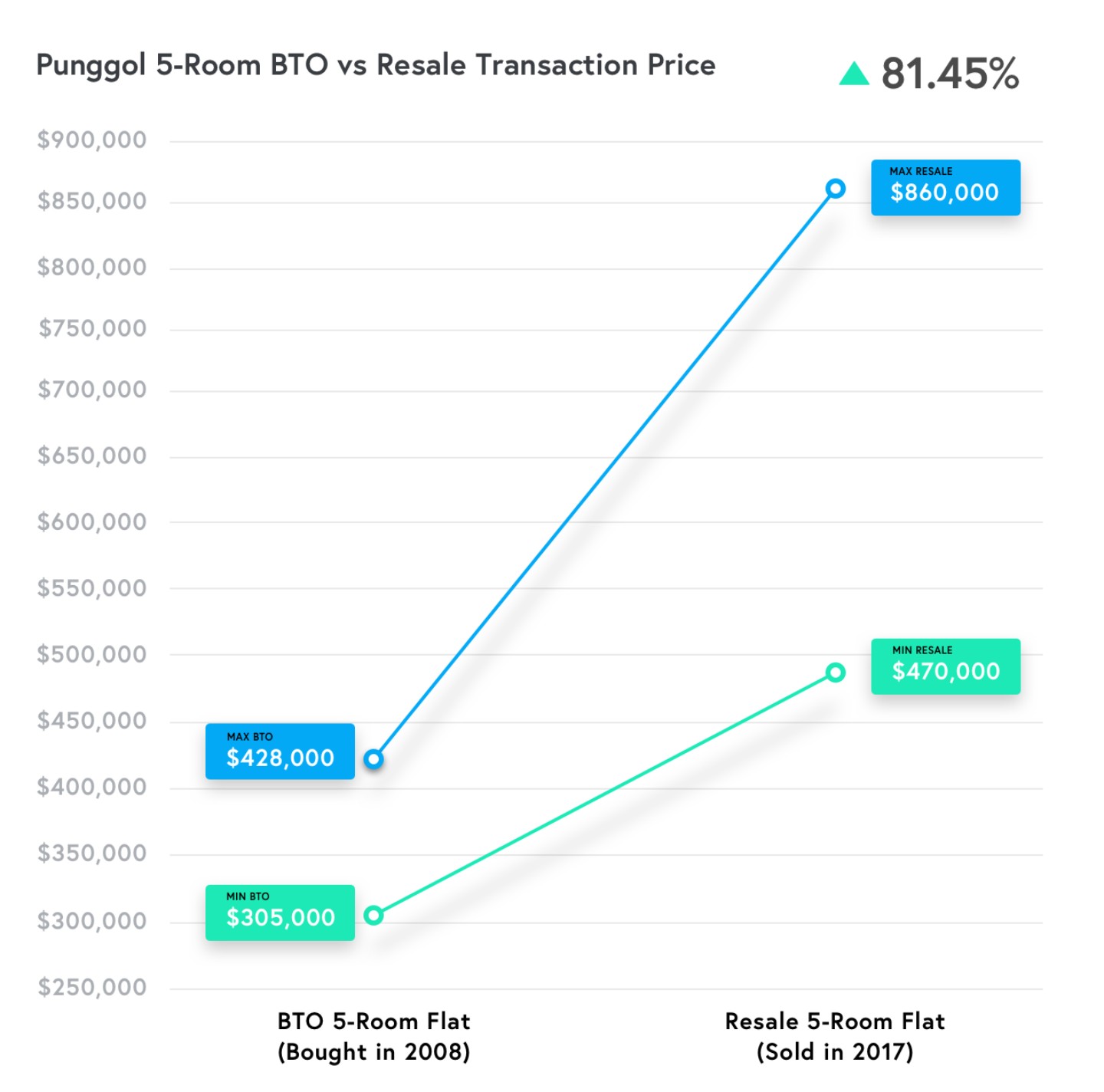

Punggol 5-room BTO

If you had bought a 5-room BTO in 2008, the price range was between $305,000 to $428,000. As of 2017 last year, the HDB resale price range was between $470,000 to $860,000. This is a 81% increase in less than 10 years!

Property TrendsWe Analysed 22 Recent HDB MOP Estates To Find Out Which Has Made The Most Money

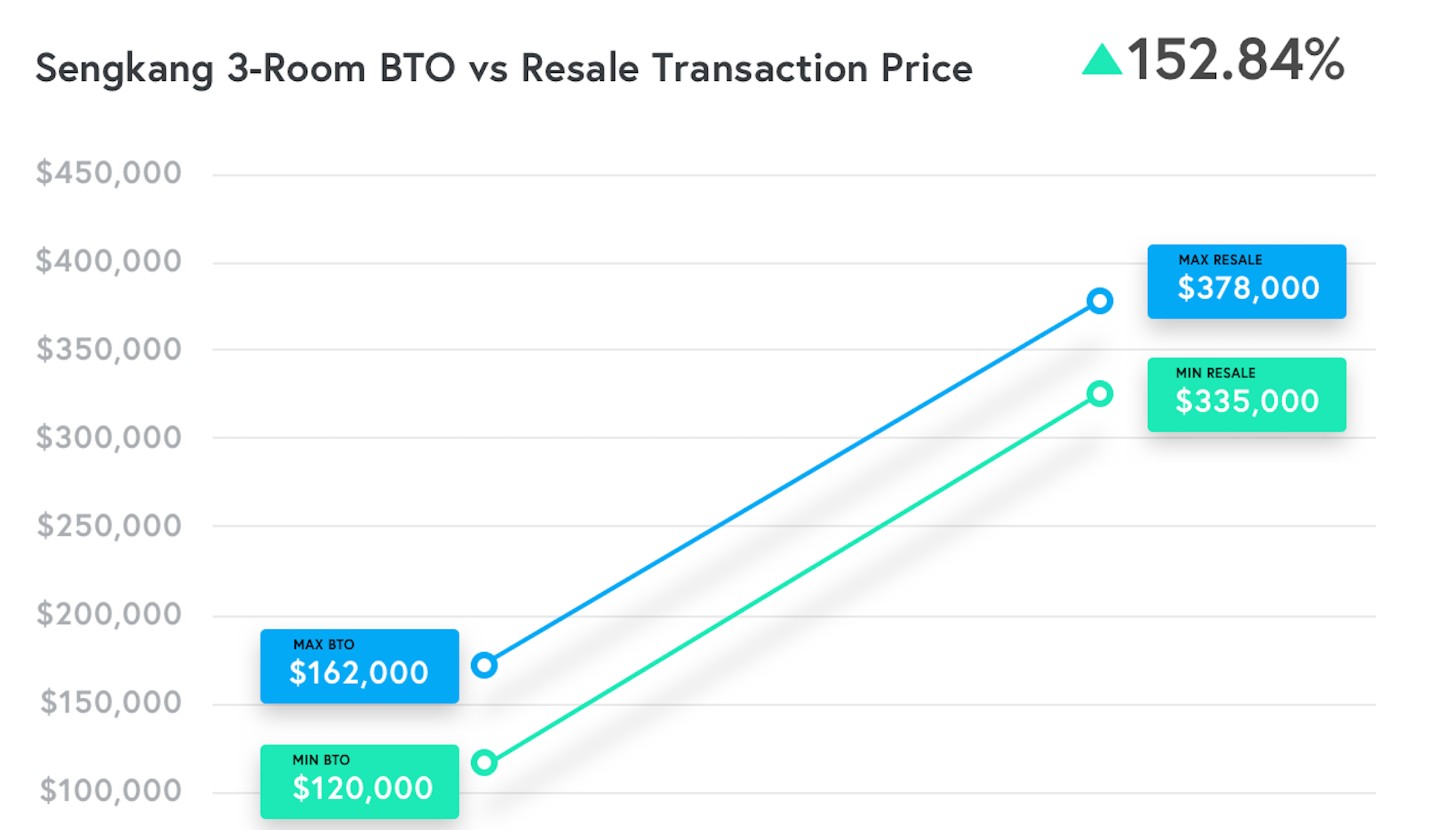

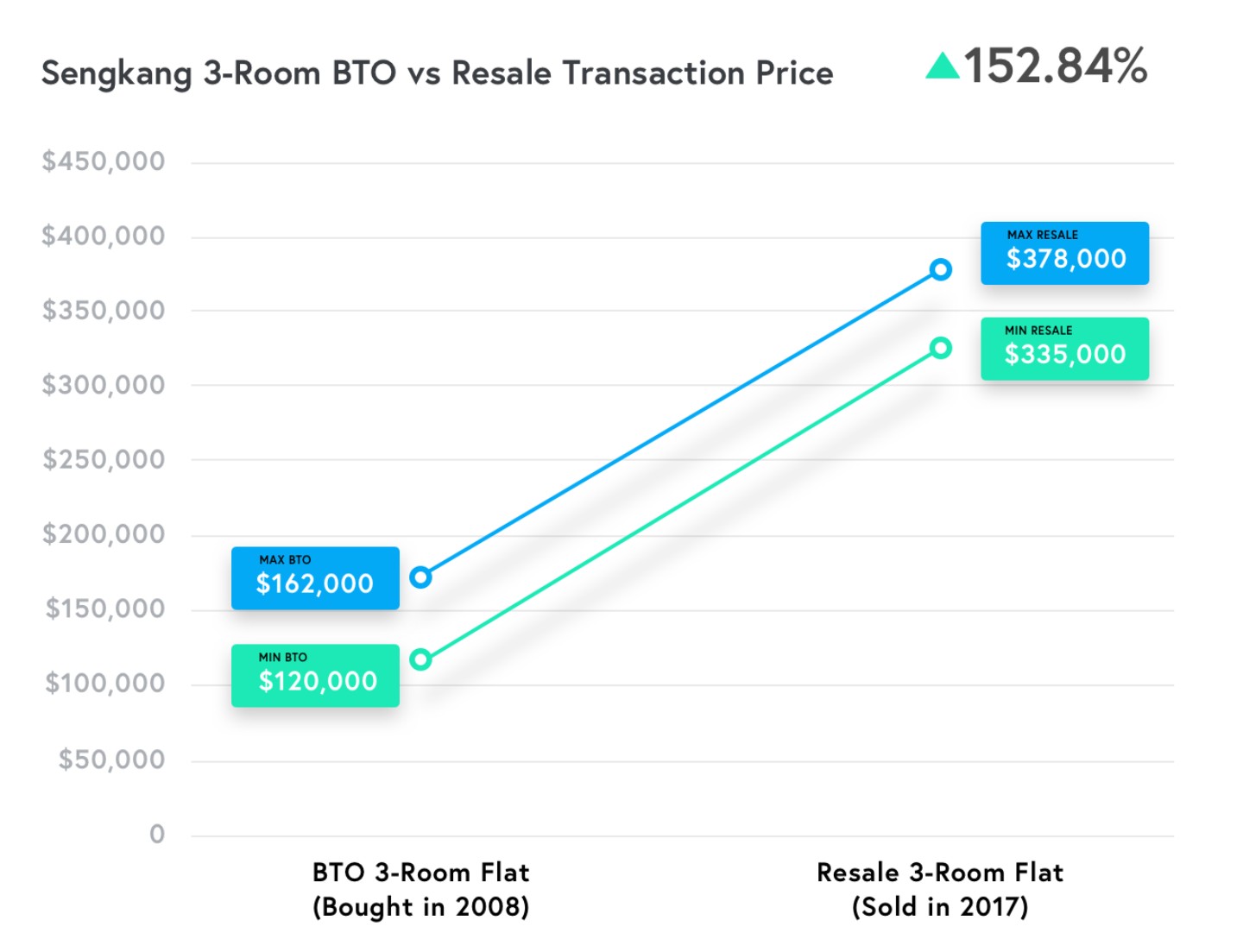

by ReubenSengkang 3-room BTO

In Sengkang if you had bought a BTO in 2008, the price range of a 3-room BTO was between $120,000 to $162,000. As of 2017 last year, the HDB resale price range was between $335,000 to $378,000. That is a whopping 152% increase in less than 10 years!

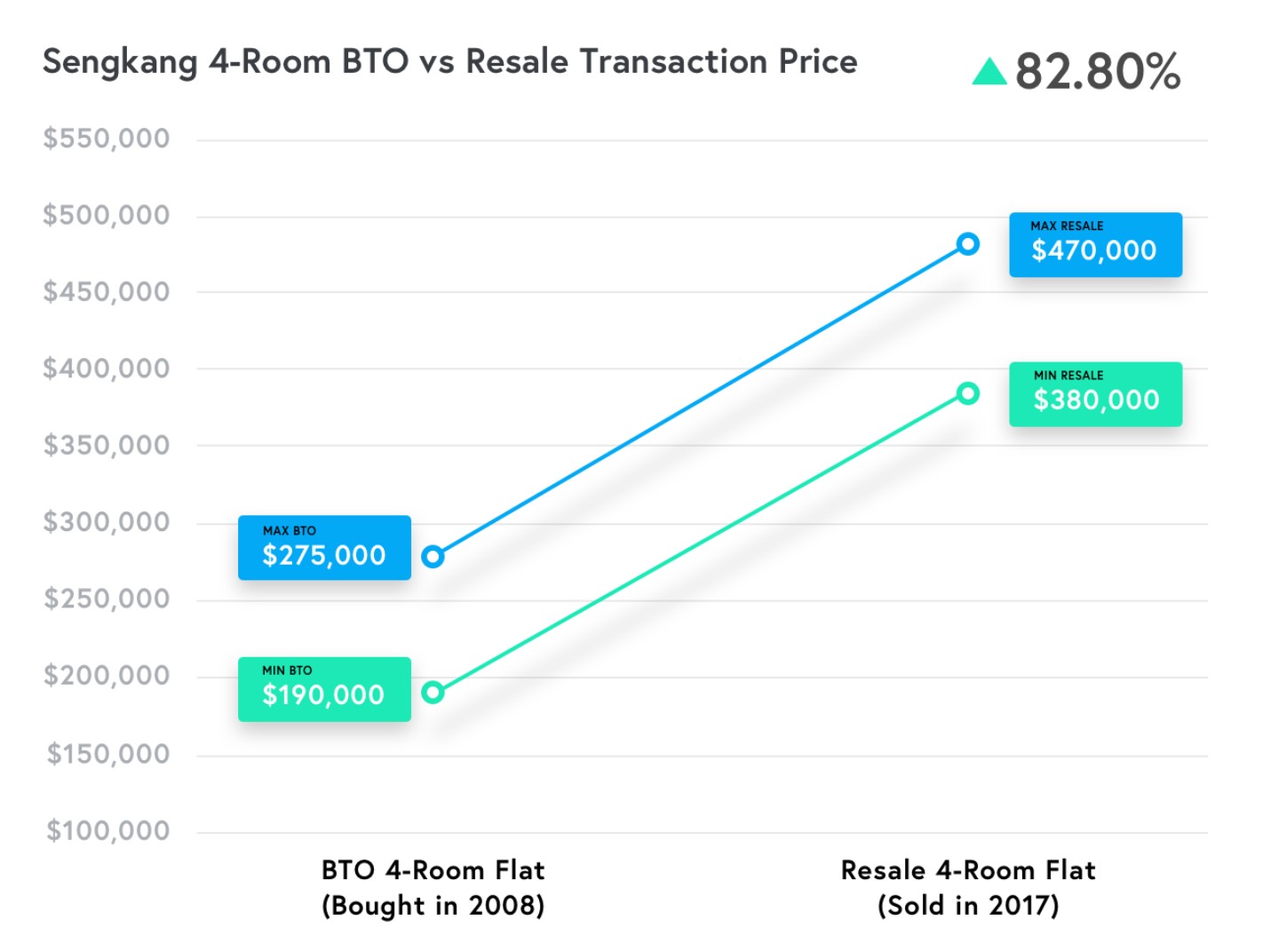

Sengkang 4-room BTO

If you had bought a 4-room BTO in 2008, the price range was between $190,000 to $275,000. As of 2017 last year, the HDB resale price range was between $380,000 to $470,000. This is a 82% increase in less than 10 years!

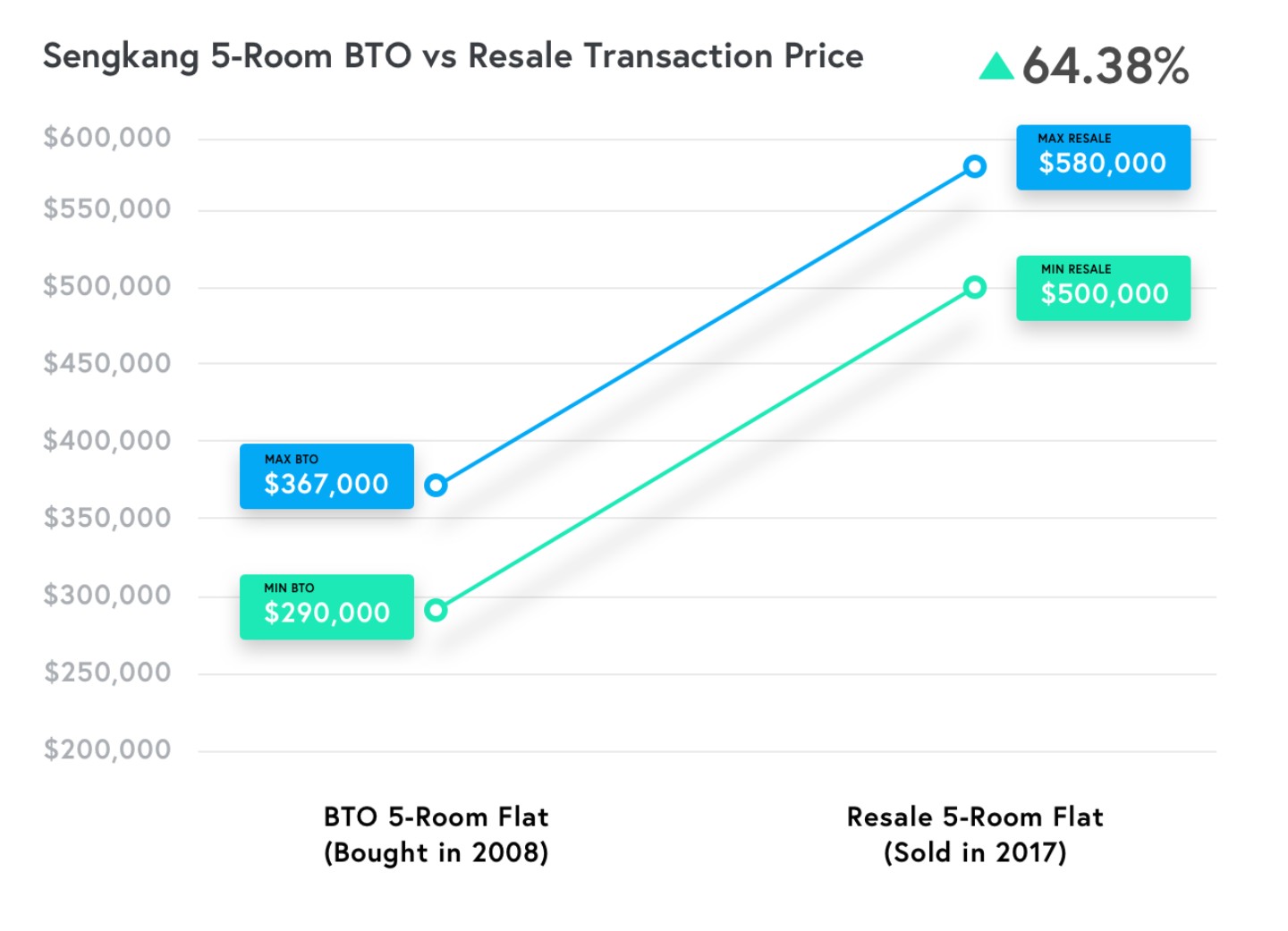

Sengkang 5-room BTO

If you had bought a 5-room BTO in 2008, the price range was between $290,000 to $367,000. As of 2017 last year, the HDB resale price range was between $500,000 to $580,000. This is a 64% increase in less than 10 years!

From these figures you can easily see that a Sengkang 3-room HDB is the biggest winner here, nearly doubling most of the returns from the other estates if you were to compare with the 4-room and 5-room. Of course, the increases are impressive for the 3-room HDBs, but it was always to be expected given the lower value of the home. Also, don’t forget that these are probably one of the higher growth HDB estates around.

If you would like us to expand on more estates, you can always contact us at hello@stackedhomes.com! Or feel free to leave a comment down below.

Sean

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Read next from Property Advice

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Property Advice Why Punggol Northshore Could Be The Next Hotspot In The HDB Resale Market

Property Advice How Much Is Your Home Really Worth? How Property Valuations Work in Singapore

Property Advice Why I Had Second Thoughts After Buying My Dream Home In Singapore

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

Editor's Pick The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

Editor's Pick This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Editor's Pick Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Editor's Pick Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?