Are Middle-Class HDB Homebuyers Losing Out After The Latest HDB Loan Restrictions?

August 28, 2024

The latest cooling measures on 20th August 2024 had a target: to slow the rising prices of HDB flats. To this end, the maximum Loan To Value (LTV) ratio for HDB loans has now decreased to 75 per cent, down from 80 per cent previously.

But how much of a difference does five percentage points really make? And from the word on the ground, there were some suggestions that the middle class is being marginalised in more ways than one: with lower-income brackets getting more generous grants while the loans they can take will fall, essentially being the most affected. How true is all of this?

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Are middle-class buyers being ignored?

The most common argument is that the lower-income groups get bigger subsidies, and the higher-income groups have no problems paying existing prices – but the sandwiched people in the middle, especially the *lower-*middle, feel they’re getting little to no help.

But how dire is their situation?

Let’s look at a range of earnings up to $14,000 per month (if you earn more than that you can’t get an HDB loan anyway, so this would be irrelevant to you).

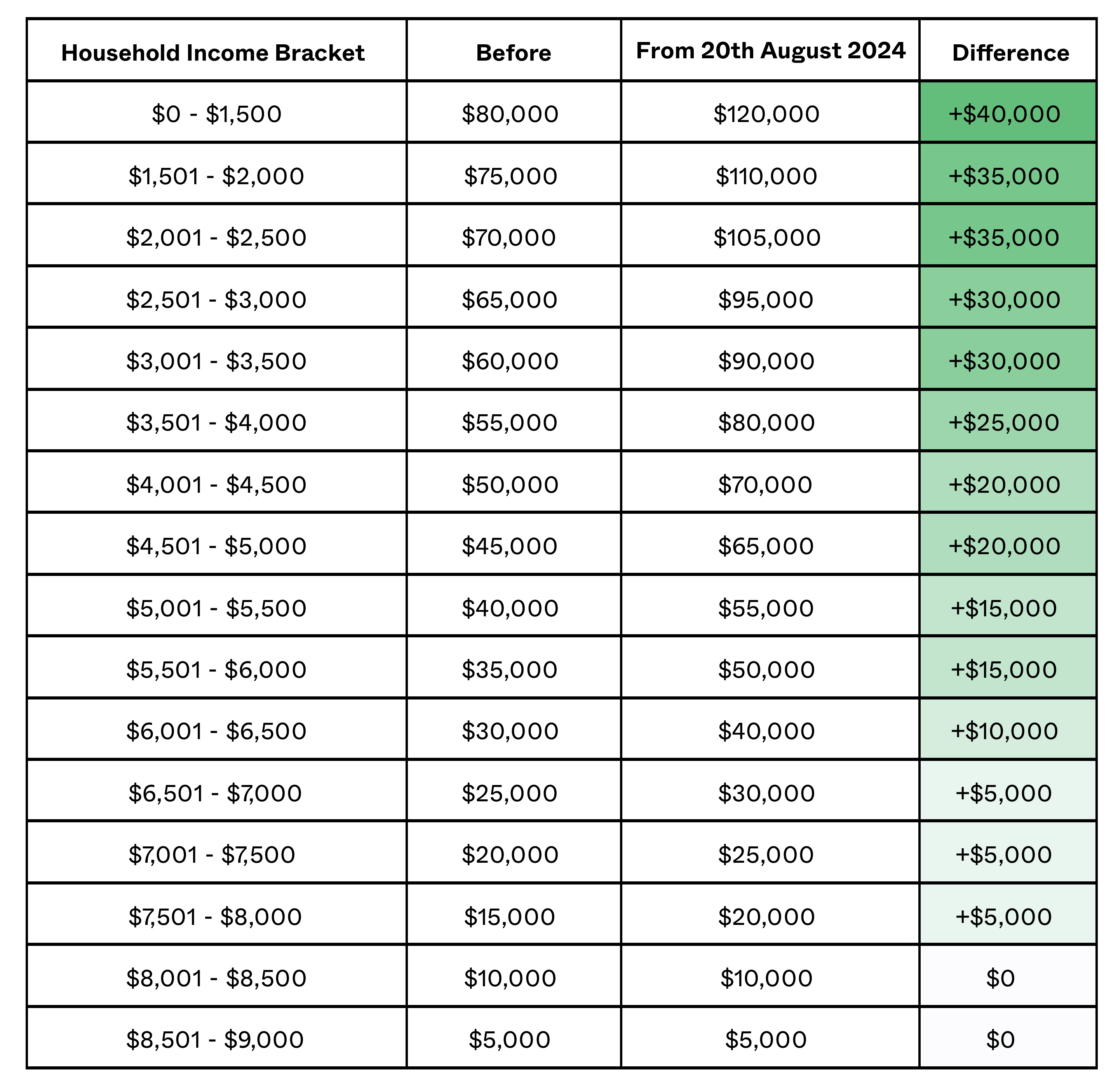

The first thing to consider is the increased Enhanced Housing Grant (EHG) which has been ramped up to a maximum potential of $120,000 (up from $80,000). The amount of the EHG you get is based on income, among other factors:

Note that for those who are in the earnings range of $8,000+ per month, the recent changes don’t provide any benefits to them.

Who is the middle class?

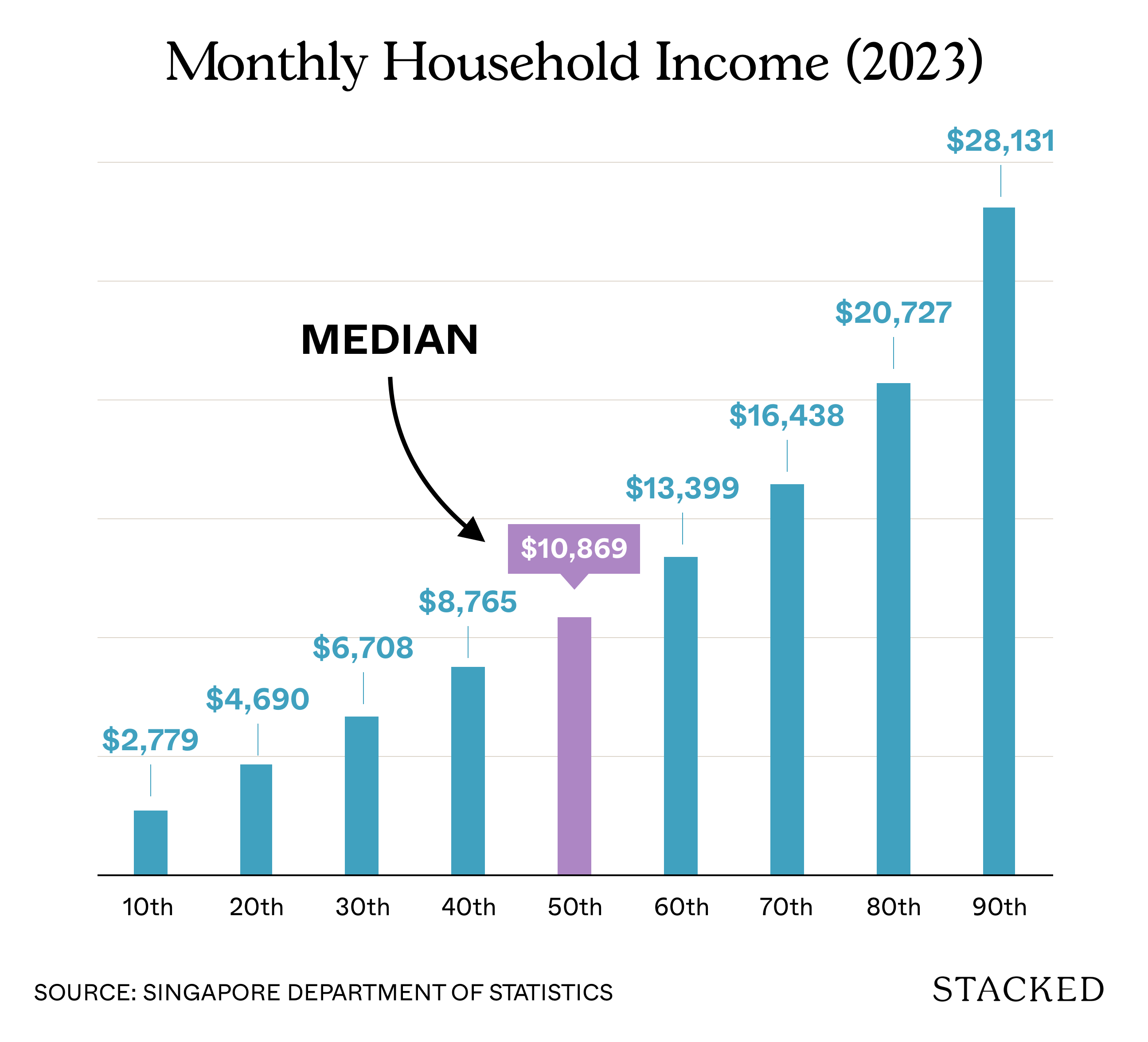

Middle-class is admittedly a vague term; and it gets tougher when you want to define a lower and upper middle. But to be as fair as possible, let’s try to quantify it a bit:

So who should we exclude from our study?

- Those above the 60th percentile. The 60th percentile is near the HDB loan limit ($14,000), so we’ll consider affordability up to $13,399.

- Those below the 30th percentile. The numbers show that below this household income, there aren’t that many options when it comes to HDBs. The middle class are those who have options. For example, at the 20th percentile, the budget is only at $300k+ which leaves very few 3-room flat options to begin with.

As such, the middle class we’re looking at have a household income of around $6,708 to $13,399.

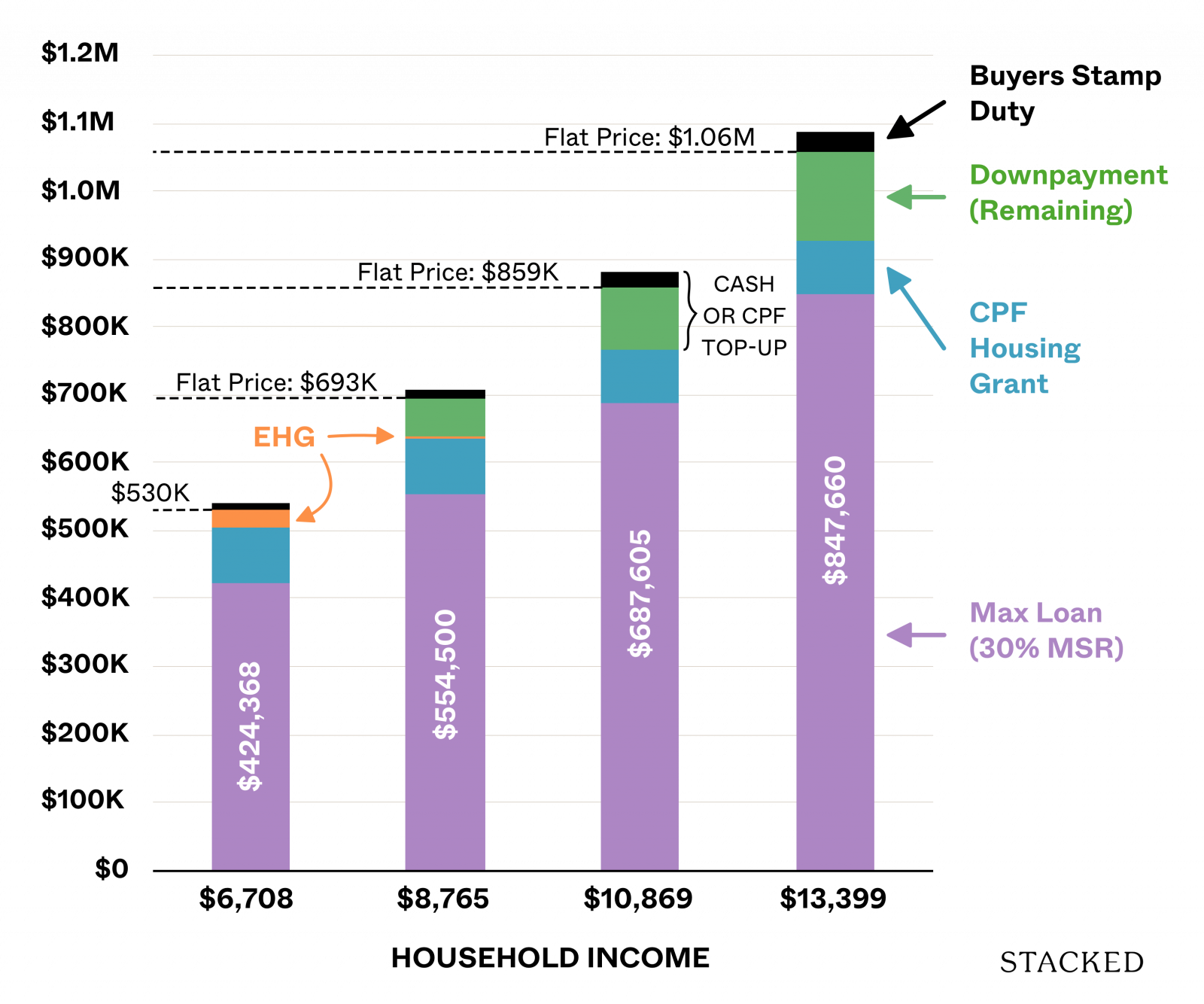

Next, let’s look at how much each of these income groups can afford. Affordability varies greatly among different households as different people wish to take up different loan amounts or have varying levels of cash/CPF. So we’ll have to make a few assumptions:

- The household will maximise their Mortgage Servicing Ratio (MSR). For HDBs, this is 30%.

- The household will take a full loan if possible. Prior to 20th August 2024, this was 80%.

- The HDB price is determined by the above 2 assumptions. If the loan plus the grants they have is not more than the flat price, the shortfall will be topped up with cash/CPF.

On 19th August, before the reduced LTV, this is what their situation looked like:

| Before 20th August 2024 | Household Income | |||

| Type | $6,708 | $8,765 | $10,869 | $13,399 |

| Enhanced CPF Housing Grant | $25,000 | $5,000 | $0 | $0 |

| CPF Housing Grant (Families) | $80,000 | $80,000 | $80,000 | $80,000 |

| Max Loan (Based on 30% MSR) | $424,368 | $554,500 | $687,605 | $847,660 |

| Max Loan + Grants | $529,368 | $639,500 | $767,605 | $927,660 |

| HDB Flat Price (Loan + 20%) | $530,460 | $693,125 | $859,506 | $1,059,575 |

| LTV Ratio | 80% | 80% | 80% | 80% |

| Buyers Stamp Duty | $10,514 | $15,394 | $20,385 | $26,387 |

| Top-Up Required | $11,606 | $69,019 | $112,286 | $158,302 |

Here’s a chart to paint a clearer picture:

Here we looked at the maximum loan that can be taken based on the household income. Then we look at the remaining downpayment and how much can be helped with the CPF Housing Grant and Enhanced Housing Grant.

Next, we added the Buyer Stamp Duty (BSD). The remaining downpayment that cannot be covered by grants and the BSD makes up the “top-up” that each household has saved and is willing to commit to the purchase.

This top-up is important because the new LTV affects how much more the household has to put up to purchase an HDB of the same price. If they cannot do the top-up, then their affordability is drastically reduced.

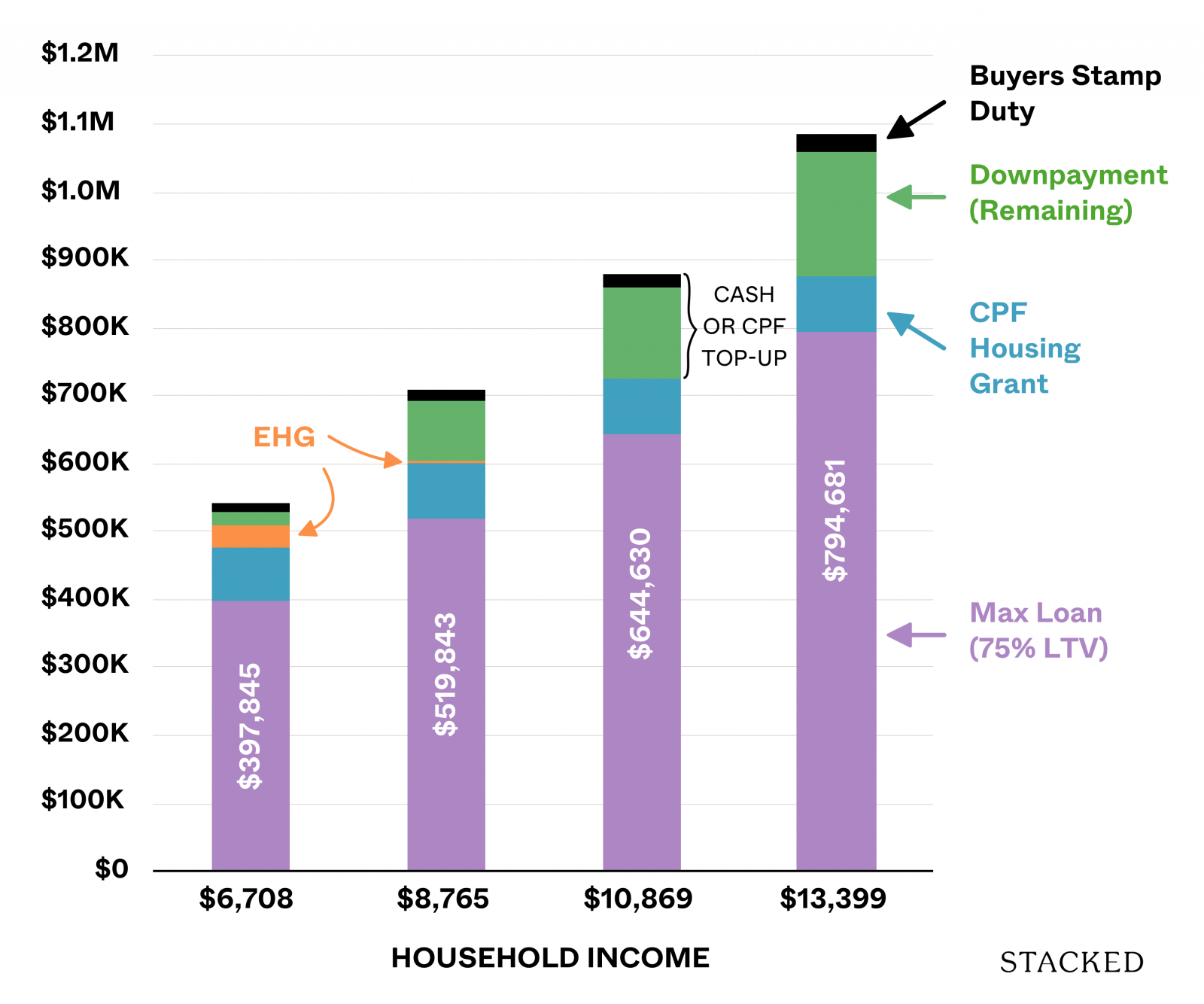

Here’s a look at how their situation changes on 20th August or later, when the LTV is reduced:

More from Stacked

Tour An Old 1987 HDB Transformation: How A Couple Achieved A Japandi Look With A $90k Reno Budget

If there’s anything that Singaporeans have a common love for, it’s anything Japanese. Even when it comes to a home,…

| From 20th August 2024 | Household Income | |||

| Type | $6,708 | $8,765 | $10,869 | $13,399 |

| HDB Flat Price (From Previous Example) | $530,460 | $693,125 | $859,506 | $1,059,575 |

| Enhanced CPF Housing Grant | $30,000 | $5,000 | $0 | $0 |

| CPF Housing Grant (Families) | $80,000 | $80,000 | $80,000 | $80,000 |

| Max Allowable Loan Based On 75% Of Purchase Price* | $397,845 | $519,843 | $644,630 | $794,681 |

| Loan + Grant | $507,845 | $604,843 | $724,630 | $874,681 |

| Buyers Stamp Duty | $10,514 | $15,394 | $20,385 | $26,387 |

| Top-Up Required | $33,129 | $103,675 | $155,262 | $211,281 |

| Difference in top-up | $21,523 | $34,656 | $42,975 | $52,979 |

As we’ve shown in “difference in top up”, some groups will need to raise the top up amount after the lower LTV. You can see that this is quite proportional, with the upper end of the spectrum having to top up more.

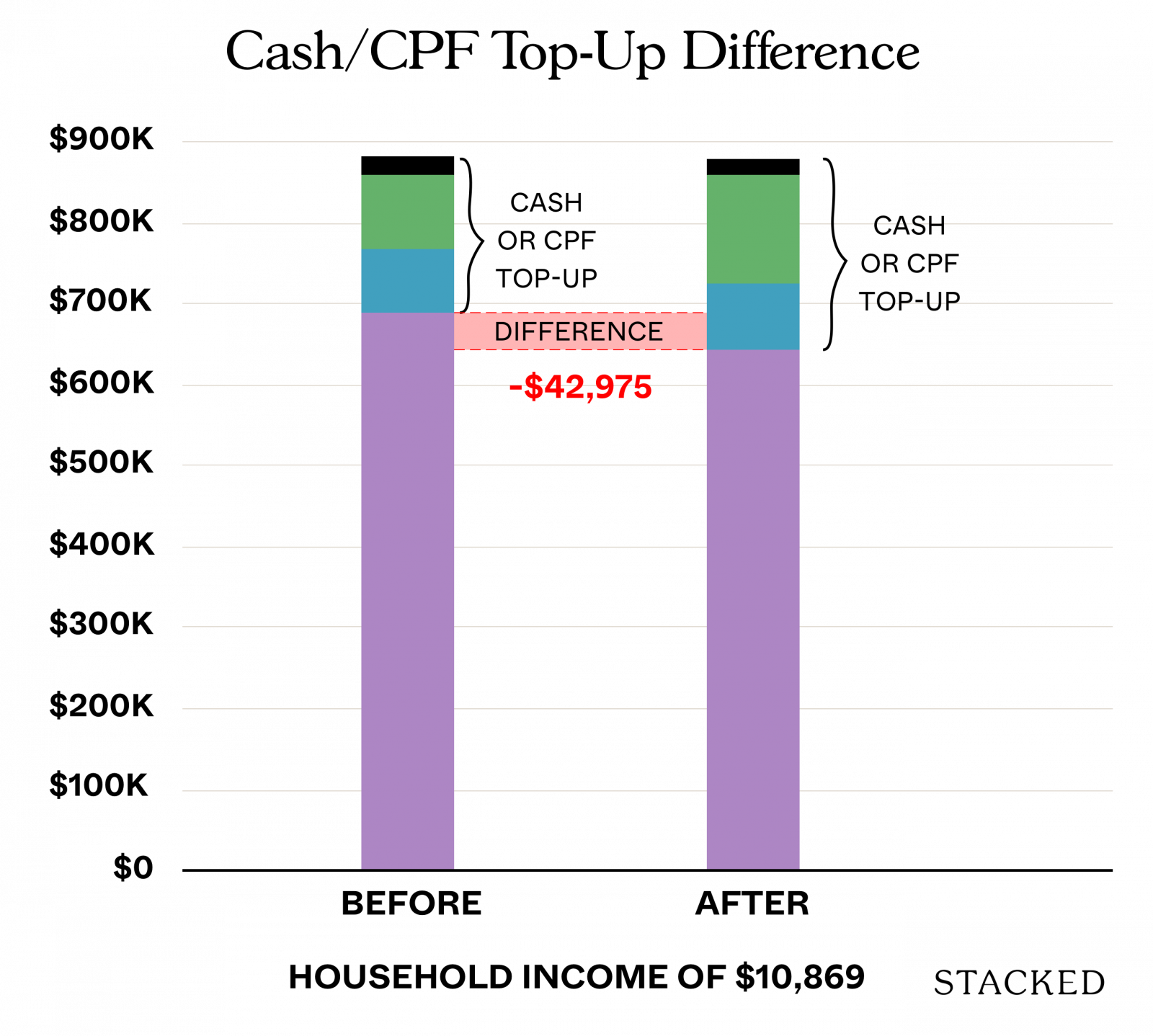

Here’s what it looks like visualised:

You can’t see the difference here as the flat price is the same, however, the top-up amount is now different. Due to the lower LTV, households across the board now have to cough up more cash/CPF to buy the same home. Here’s a side-by-side comparison of those earning a median income of $10,869:

Before 20th August 2024, those earning the median household income had to top up $112,286 to afford an HDB costing $859,506.

Since the new LTV ruling, this is now $155,262, a difference of $42,975.

For those who have $42,975 squirrelled away in fixed deposits or investments that can be readily liquidated to meet this new change, bravo! Nothing has changed for you as you’ve merely reallocated your cash/investment into real estate.

But not everyone is able to do so. If you are in urgent need of housing and have already saved up just enough to afford that dream home worth $800k+, this could spell a setback of a couple more months of saving to meet this requirement or buying something cheaper.

How much lower would you have to go though? On the surface, you may think your affordability has dropped by just $42,975. This isn’t quite true.

Why? Here’s what happened:

With the old LTV of 80%, each dollar you put up from your cash/CPF gets you 4x more leverage. Putting up $200K gets you $800K. This means you can buy a $1 million flat.

But with the new LTV of 75%, each dollar you put up only gets you only 3x more leverage. This means the same $200K only gets you $600K in loans. Your max affordability is $800k now – a reduction of 20%.

This happens because you’re restricted by your downpayment, not by your income.

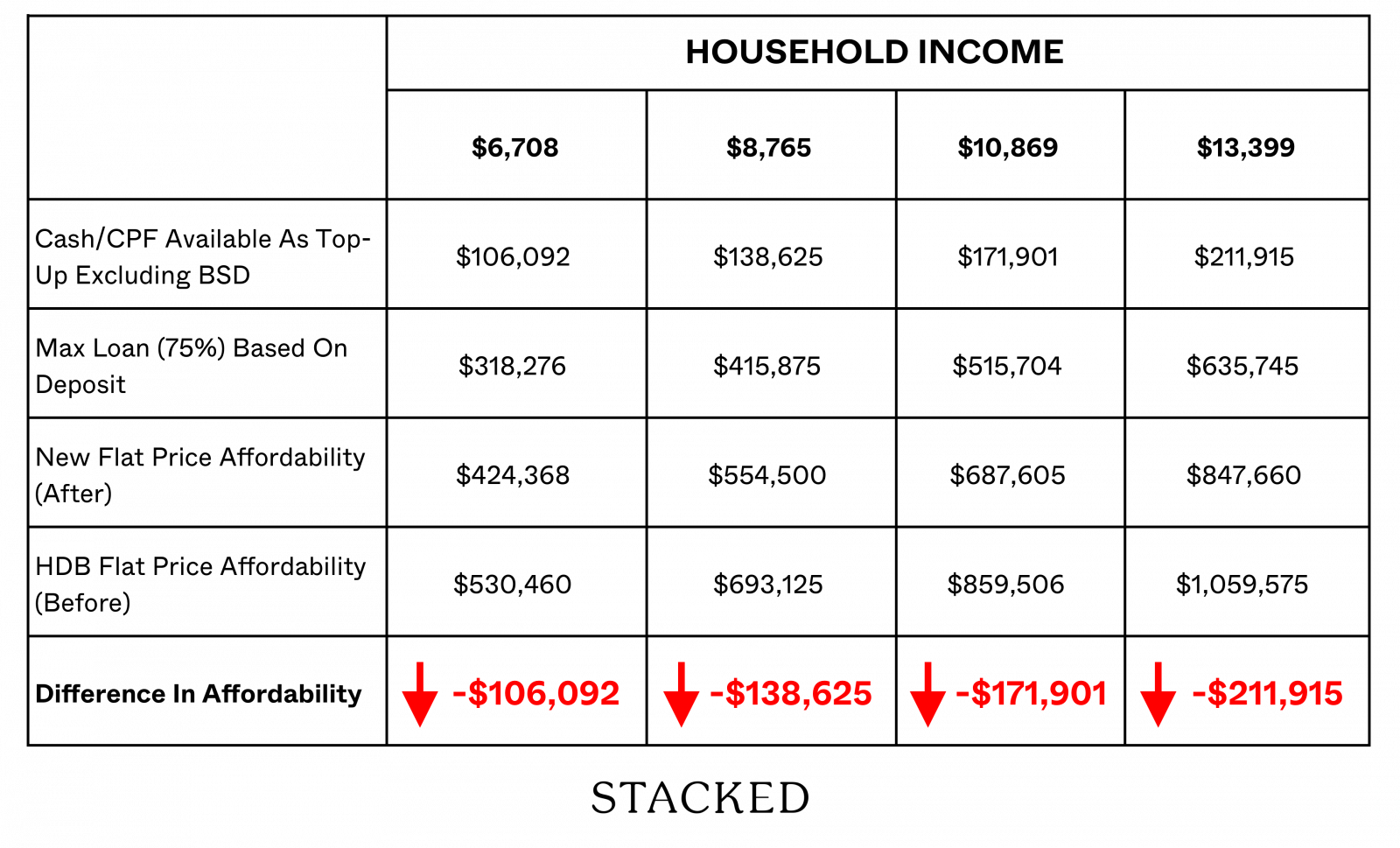

So what does the drop in affordability look like across our middle-income groups? In this case, we’ll use the cash/CPF available as a top-up plus the grants available to form the deposit. For simplicity, we’ve excluded the BSD as some of it would still be needed to pay down the new HDB price anyway.

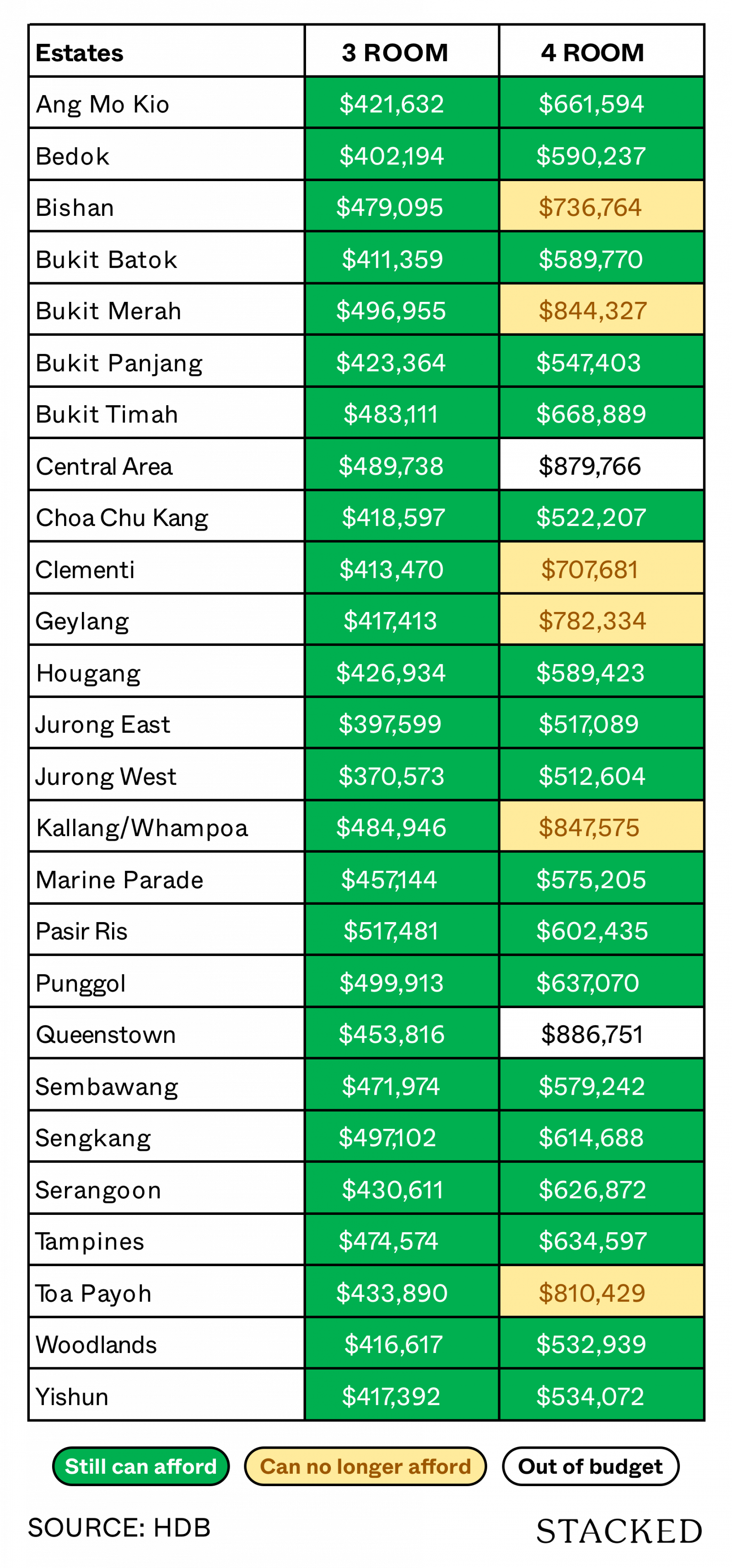

Those earning the median income of $10,869 now see a drop of around $170k in affordability. This is a big difference. To see what this change means in reality, here’s a look at the average HDB flat prices in the past 6 months as well as what you could previously afford (in yellow):

Disclaimer: Note that 5-room flats are not included as the $80,000 CPF Housing Grant only applies to 4-room flats or smaller.

Considering this change, households with a median income now have to make some sacrifices. It could mean a much lower floor, an older HDB development or another estate. Either way, some kind of compromise has to be made.

In this sense, those who want to chase after higher-priced resale flats (e.g., an $850,000 flat in Bishan or Toa Payoh) but had to scrimp for it are definitely going to feel the pain if they cannot meet the top-up requirements.

Those who settle for BTO flats or cheaper resale flats likely won’t feel the sting, as you can see from the numbers above – a $500,000 to $600,000 flat is still attainable, even with a five per cent drop in LTV.

The policy would apply mostly to those who have to squeeze a lot to purchase a highly-priced flat. The only question is – just how many Singaporeans would be affected by this? Judging from the past few regulatory changes, it seems like the answer is not so much given the steady increase in prices we’ve seen.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How do the latest HDB loan restrictions affect middle-class homebuyers?

Are middle-income HDB buyers getting less help after the new loan rules?

What is the impact of the reduced LTV ratio on the affordability of HDB flats for median-income households?

Does the new HDB loan policy favor lower-income or higher-income groups more?

How does the change in LTV ratio influence the amount of leverage homebuyers can get?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

4 Comments

Excellent article and analysis – thanks Ryan.

Midlle-class singles who plan to buy resale are also highly affected.

Maybe your team should write an article on singles buying resale. It’s so difficult given the lower loan % and lower MSR %, it adds up.