A Complete List Of 23 Executive Apartments And Where To Find Them + Price And Size

March 6, 2021

Every decade in Singapore, our flats and condos alike seem to grow smaller. Space is at a premium; and for big families, it could be a tough call to spend over $1.6 million to fit into a sizeable three-bedroom condo. And while we’ve discussed Executive Maisonettes previously, million-dollar flats are not in everyone’s budget either. So here’s another rare-but-desirable HDB flat type to consider: the Executive Apartment (EA):

What is an Executive Apartment (EA)?

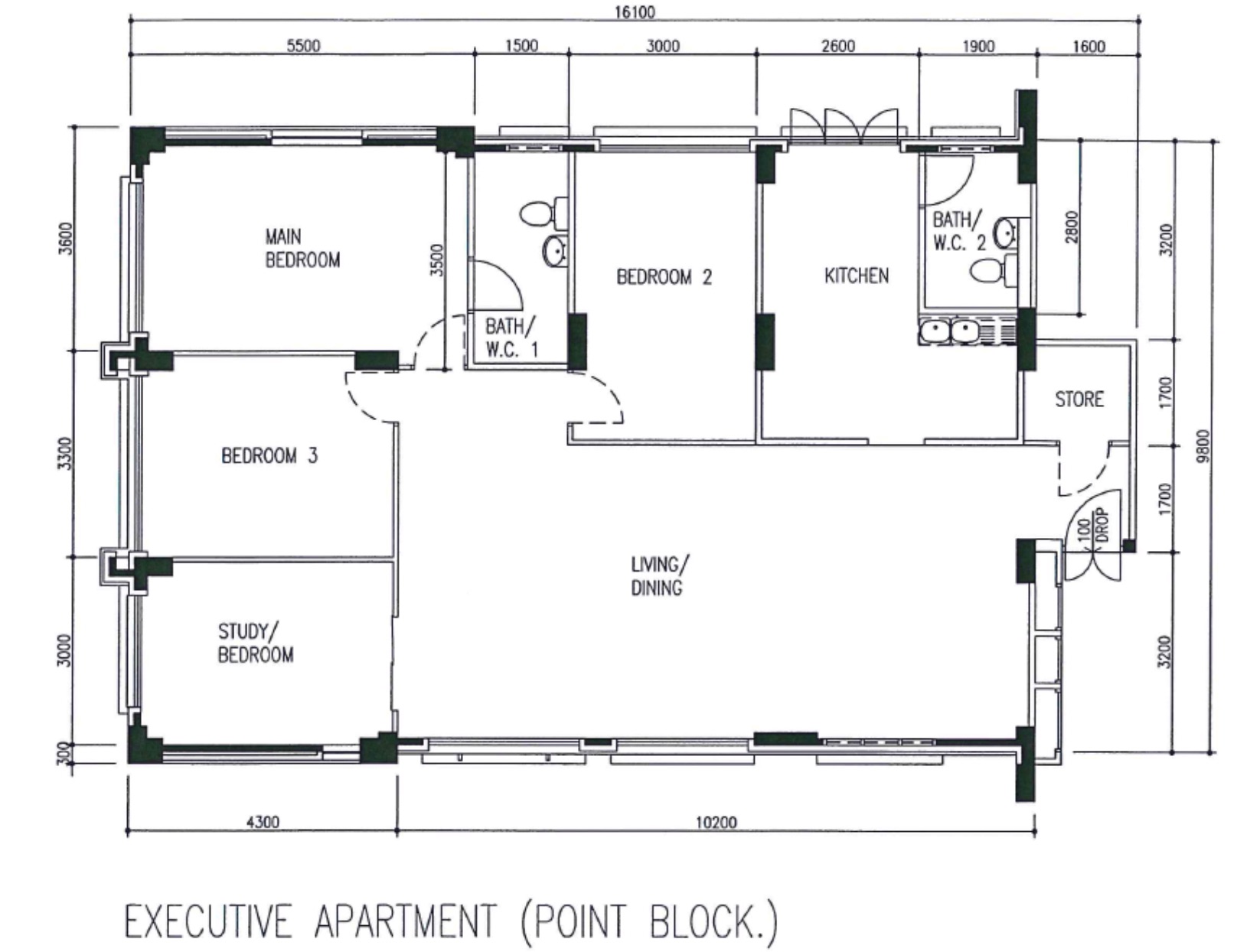

The EA first came about in 1984. While they didn’t have two storeys like their Executive Maisonette (EM) counterparts, they were still among the largest flats built by HDB. At the time, they ranged between 141 to 156 sqm.

(Note that, contrary to a popular misconception, Executive Apartments were not the predecessor to EMs. In fact, the first EMs were built in 1983, a year before the first EAs).

Executive Apartments have certain features that you won’t find in many other flats. The main ones are balconies and study rooms (which can be easily reconfigured to other purposes).

While we’re used to flats getting smaller with time, Executive Apartments strangely became bigger toward the late 1990’s. The largest EAs were built in this period, some reaching up to 221 sqm. Many of these larger units are located in Woodlands or Yishun (see below). Between EMs and EAs, public housing – prior to the year 2000 – saw some of the largest flats ever built.

After that point, however, HDB seems to have reversed course and started shrinking unit sizes. EA units were not spared: by the time the last EA units were built in 2005, their sizes ranged between just 125 to 130 sqm.

As such the older EA units – built before 2000 – are often preferred despite their more advanced lease decay.

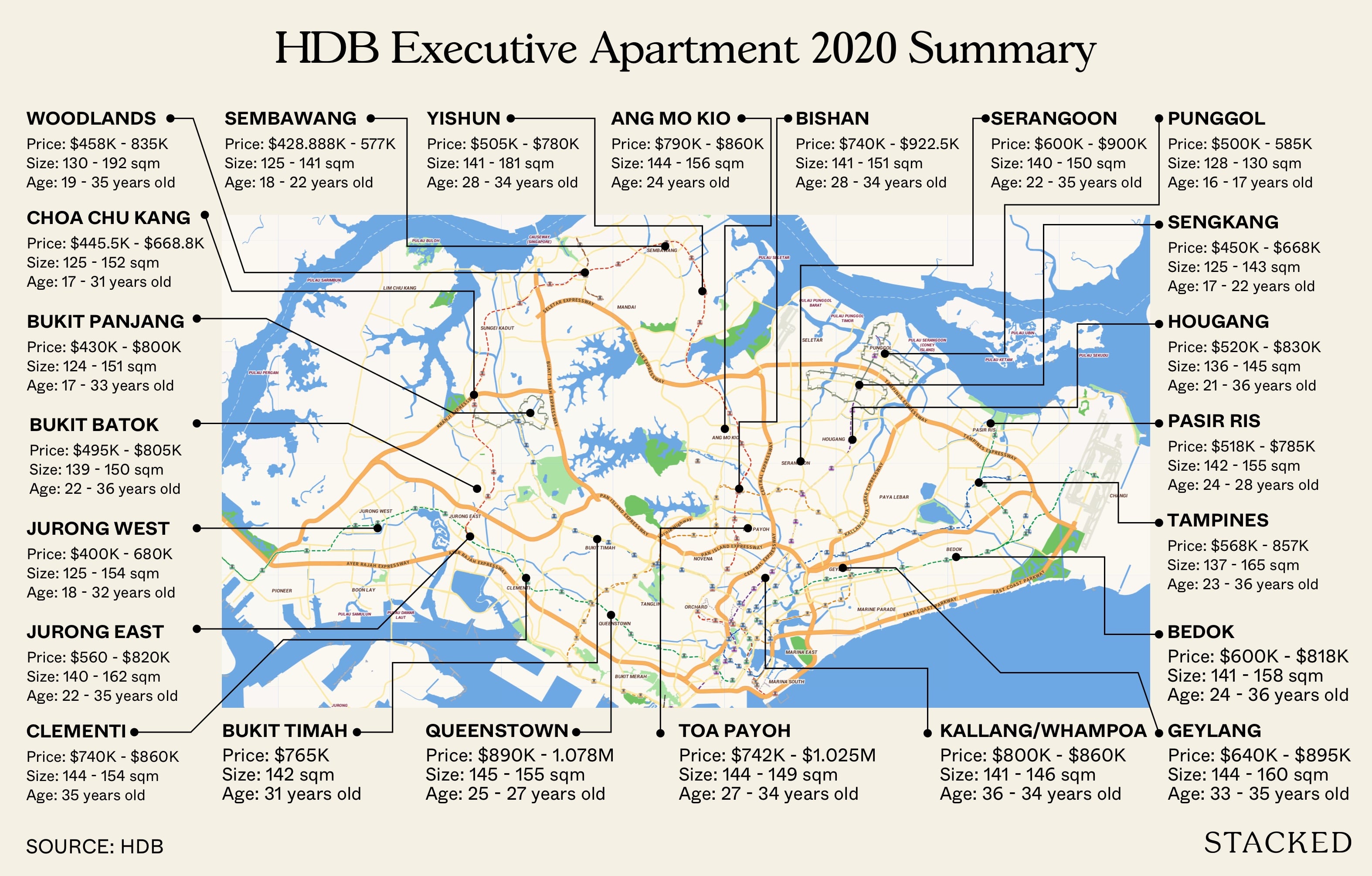

How much does an EA unit cost, and which estates are they in?

The following is shortened for brevity; for the complete list, please contact us at stories@stackedhomes.com.

| HDB town | No. of EAs found | Unit Sizes | Age range | Last Transactions Price Range |

| Ang Mo Kio | 5 | 1,550 – 1,679 sq.ft. | 24 years | $790,000 – $860,000 |

| Bedok | 34 | 1,518 – 1,701 sq.ft. | 24 – 36 years | $600,000 – $818,000 |

| Bishan | 13 | 1,518 – 1,625 sq.ft. | 28 – 34 years | $740,000 – $922,500 |

| Bukit Batok | 34 | 1,496 – 1,615 sq.ft. | 22- 36 years | $495,000 – $805,000 |

| Bukit Panjang | 67 | 1,335 – 1,625 sq.ft. | 17 – 33 years | $430,000 – $800,000 |

| Bukit Timah | 1 | 1,528 – 1,528 sq.ft. | 31 years | $765,000 |

| Choa Chu Kang | 91 | 1,345 – 1,636 sq.ft. | 17 – 31 years | $445,500 – $668,800 |

| Clementi | 2 | 1,550 – 1,658 sq.ft. | 35 years | $740,000 – $860,000 |

| Geylang | 5 | 1,550 – 1,722 sq.ft. | 33 – 35 years | $640,000 – $895,000 |

| Hougang | 44 | 1,464 – 1,561 sq.ft. | 21 – 36 years | $520,000 – $830,000 |

| Jurong East | 17 | 1,507 – 1,744 sq.ft. | 22 – 35 years | $560,000 – $820,000 |

| Jurong West | 93 | 1,345 – 1,658 sq.ft. | 18 – 32 years | $400,000 – $680,000 |

| Kallang / Whampoa | 5 | 1,518 – 1,572 sq.ft. | 26 – 34 years | $800,000 – $860,000 |

| Pasir Ris | 132 | 1,528 – 1,668 sq.ft. | 24 – 28 years | $518,000 – $785,000 |

| Punggol | 18 | 1,378 – 1,399 sq.ft. | 16 – 17 years | $500,000 – $585,000 |

| Queenstown | 4 | 1,561 – 1,668 sq.ft. | 25 – 27 years | $890,000 – $1,078,000 |

| Sembawang | 54 | 1,345 – 1,518 sq.ft. | 18 – 22 years | $428,888 – $577,000 |

| Sengkang | 68 | 1,345 – 1,539 sq.ft. | 17 – 22 years | $450,000 – $668,000 |

| Serangoon | 23 | 1,507 – 1,615 sq.ft. | 22 – 35 years | $600,000 – $900,000 |

| Tampines | 92 | 1,475 – 1,776 sq.ft. | 23 – 36 years | $568,000 – $857,000 |

| Toa Payoh | 9 | 1,550 – 1,604 sq.ft. | 27 – 34 years | $740,000 – $1,025,000 |

| Woodlands | 150 | 1,399 – 2,067 sq.ft. | 19 – 35 years | $458,000 – $835,000 |

| Yishun | 53 | 1,518 – 1,948 sq.ft. | 28 – 34 years | $505,000 – $780,000 |

Property PicksUltimate List Of 23 HDB Executive Maisonettes: Location, Price, Size, And Are They Worth Buying?

by Ryan J. OngIs it worth buying an Executive Apartment today?

Whether it’s worth buying an EA depends on your objectives for the property. The key considerations are:

- Owner-occupancy versus investment

- An alternative downgrading / retirement option

- Financing considerations

- EAs versus EMs for big families

1. Owner-occupancy versus investment

The first consideration is whether you’re purely buying a home, or whether you want an investment asset. EAs are a strong alternative for the former, and mostly a bad idea for the latter.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Touring A $2.48m Artsy Apartment In A Quiet Corner Off Orchard Road

This week, we tour a charming 4-bedroom unit at Orchard Court.

At current condo prices (approx. $1,341 psf), a non-landed, private home the size of the typical EA would reach about $2 million; well outside the price range of most Singaporeans. As such, EAs may be the most realistic way for big families to get sufficient living space.

However, Executive Apartments are not great as investment assets. In terms of asset progression (e.g., if you plan to sell and upgrade to a condo later), the lease decay is often a problem. Most EAs are already between 25 to 30 years old; your subsequent buyer is not likely to offer a substantial sum, given the limited time remaining.

As such, those intending to upgrade would do better to consider a newer 5-room flat. Note that a resale 5-room flat had an average quantum of about $537,247 island-wide, as of end-2020.

However, you’re more likely to see gains in a newer 5-room flat, than in an EA that’s already pushing 30; especially if you’re planning to stay in the unit for another decade.

2. An alternative downgrading / retirement option

If you already own a private property, you may be considering a resale flat for retirement. The sale proceeds from a private home are likely to cover the entire cost of the typical flat.

However, some retirees may have grown used to a certain amount of space; especially if you’re downgrading from larger condo units or even a landed home. In these instances, you may want to try and get an EA instead of a resale 5-room flat. As we mentioned in point 1, the price difference between the two is often justifiable for genuine home buyers.

3. Financing considerations

The advanced age of most EAs could restrict available financing. Note that, for CPF usage, the remaining least of the flat must be at least 20 years, and must last till the youngest buyer reaches 95 years of age. Failing that, the amount of CPF you can use will be restricted.

The maximum amount you can borrow for the flat will also be reduced, if the lease won’t last till you’re at least 95. This applies to both bank and HDB loans.

4. EAs versus EMs for big families

A common question is whether EAs or EMs are better for big families. On a price per-square-foot basis, the two are fairly comparable; but in terms of overall quantum, an EM can be as much as twice the price (see our previous article for reference).

Also, are you ready to pay Cash Over Valuation (COV)? COV prices are no longer published by HDB; but you should know that EMs are largely considered to be more prestigious (the “penthouses of HDB”), rarer, and are more likely to come with high COV. This could mean a much bigger cash outlay.

Remember that it’s ultimately the quantum which decides affordability – not price psf.

Price aside, there are a few other living considerations:

- Do you have children or elderly parents? EMs have more space as they’re double-storey units; but these also increase fall-risks, and are impractical if you have family members who need wheelchairs, walkers, etc.

- How do you feel about balconies? Some buyers absolutely love these; others find they’re a waste of money (you pay for the square footage, even if you never sit on the balcony). Balconies are also expensive and can require more work to maintain – this may not be a feature of EAs that you like.

- EMs may offer more renovation options, due to the double-storey layout and simply have more space. However, these same factors can increase the amount of maintenance required for EMs.

Finally, one advantage to consider is that most Executive Apartments are in the more developed parts of their neighbourhood

Even the newest Executive Apartments tend to be at least 17 years old. This means that, even if you’re in a non-mature neighbourhood like Sembawang, chances are your EA is in one of the more built-up areas; you’re more likely to have hawker centres, markets, malls, etc. already in the area.

This is one advantage that EAs share with old flat types like EMs; and for some buyers, it will offset the drawback of age.

For more on picking the right home, visit Stacked; we’ll update you on the current trends and strategies in the Singapore property market. We’ll also provide you with the most in-depth reviews of new and old properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is an Executive Apartment in Singapore?

Are Executive Apartments good for investment purposes?

How much do Executive Apartments typically cost in Singapore?

Are Executive Apartments suitable for big families?

What are some advantages of buying an Executive Apartment?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Picks

Property Picks Where to Find Singapore’s Oldest HDB Flats (And What They Cost In 2025)

Property Picks Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments