$700K to $300 Million: What You Can Learn From This Sports Gambling Expert As An Investor

June 6, 2021

You may have heard recently that Brentford FC was recently promoted to the Premier League.

And if you aren’t a football fan, let me clue you in – that’s like hitting the en bloc lottery multiplied by 100,000.

Every year, the top 2 teams in the league (the one below the Premier League) will get promoted.

But what’s crazy is their rise from the fourth tier of English football to the top league for the first time in 74 years.

While that is an amazing feat in its own right, what’s truly incredible about this is just how they managed to do it.

It’s not a stroke of luck, but a very, very calculated “gamble”.

This is the little known story of the man behind the scenes – Matthew Benham.

Let’s start from the beginning.

Matthew Benham graduated from the University of Oxford with a degree in Physics.

As with many others, he didn’t actually use his degree, opting for a career in finance instead.

In 2001, he decided to do a complete u-turn from his position as VP at Bank of America to joining sports gambling company Premier Bet.

His new role?

To help develop predictive gambling models based on analytics.

And he was under the tutelage of one of the most renowned gamblers in the world – Tony Bloom.

Sadly, it wasn’t a fairytale ending for the two, as Matthew Benham and Tony Bloom had a fall out big time and Benham left just 2 years after.

He took what he learnt and went on winning millions gambling on sports on his own.

In 2004, he set up his own betting company called Smartodds – where he offered consultancy services using the same data and analytics that helped him become successful at sports betting.

Following that, he took control of betting exchange website, Matchbook.

At this stage, Benham had acquired a near unstoppable knowledge on prediction models from statistical data.

And while his winnings at that time is unknown, there’s no doubt that he was financially very successful as well.

So now that you know his history, let’s talk about his story with Brentford football club.

Benham had been a childhood fan since he was 11.

It was in 2005 when he heard that the club was in a financial crisis.

And obviously as a passionate fan with deep pockets, it was a no brainer decision to provide the $700,000 loan to keep the club afloat.

This became known as London’s first club that was owned by the fans.

But because Benham was the one that funded the buy-out, he was given the opportunity to purchase the club should the fans choose not to repay the loan.

Surprise, surprise.

It was an overwhelming decision not to repay the loan by the fans.

And thus in 2012, Benham became the sole owner of Brentford football club.

Here’s where it gets interesting.

He wasn’t going to be like most stereotypical football owners that you’d see today that just pumped in money.

Benham believed that by crunching the numbers, that methodical approach to analysing the data could be hugely impactful.

A radical expected goals and points per game system would be used to assess performance.

Nothing would be left to chance.

Successful corner kicks.

Number of passes in the middle third.

Number of chances.

Everything would be carefully evaluated so that the manager would be able to progressively determine what is working, and what isn’t working.

Instead, the club is run by logic and an analytical strategy that guides all their decisions.

To give you an idea of just how much Benham analyses things – when asked what Brentford’s chances are of getting promoted in 2015, Benham answered:

“There is a 42.3% chance that we will go up”

He was absolutely dedicated to his numbers as well.

One of the more astounding things he did was to fire the manager, assistant manager, and sporting director in one swoop.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

I Reviewed A New Launch 4-Bedroom Penthouse At Beauty World

Bukit Timah recorded a 53% take-up rate during its first sales weekend. It was an impressive showing and placed the…

This, despite the fact that Brentford was in 5th place in the league.

Mind you, they had only just earned promotion to the league that year itself – so in normal terms this is no small feat.

So why did he make such a drastic move?

To Benham, his mathematical model showed the club was actually the 11th best team in the league.

This made it a simple decision for him to pull the trigger.

And that’s not all.

Perhaps one of the most shrewd things that Benham has implemented was to mix traditional scouting with the use of statistics and analytics.

If you’ve watched the film Moneyball, you’d know exactly what I’m referring to.

Again, with the focus on numbers, Benham believed that scouts were looking at players the wrong way.

Where other clubs were shunning players that were deemed not to be fit by traditional standards, the numbers proved otherwise for him.

He believed that every young player needed at least 35 games before you could actually cast judgement on the player.

Not many clubs had the time to experiment, but Brentford did.

So because of this numerical focus, they were able to exploit the inefficiencies in the transfer market.

It’s a long story to list all the different things they looked at, but here’s a table of the players they were able to bring in for cheap that others weren’t paying attention to – and how much of a profit they were able to be sold for after.

Absolutely incredible, isn’t it?

To be clear, let me say that all this wasn’t the story of an overnight success.

It has been nearly 10 years in the making since Benham took over.

And if Brentford survives the first season in the EPL, Deloitte LLP estimates that they would be able to generate about $397 million in revenue over five years.

For a club that had revenues of 13.9 million pounds in 2020, that is staggering.

A huge payoff indeed.

So what are the takeaways from this story?

Yes, while the entire story is football centric, there is much to learn for those looking to invest in real estate.

In the wise words of Warren Buffett:

Risk comes from not knowing what you’re doing

Benham didn’t believe in luck.

He believed that you have to work hard at your strategy, and focus on your aim to make your own success.

And it’s really the same for investing in real estate.

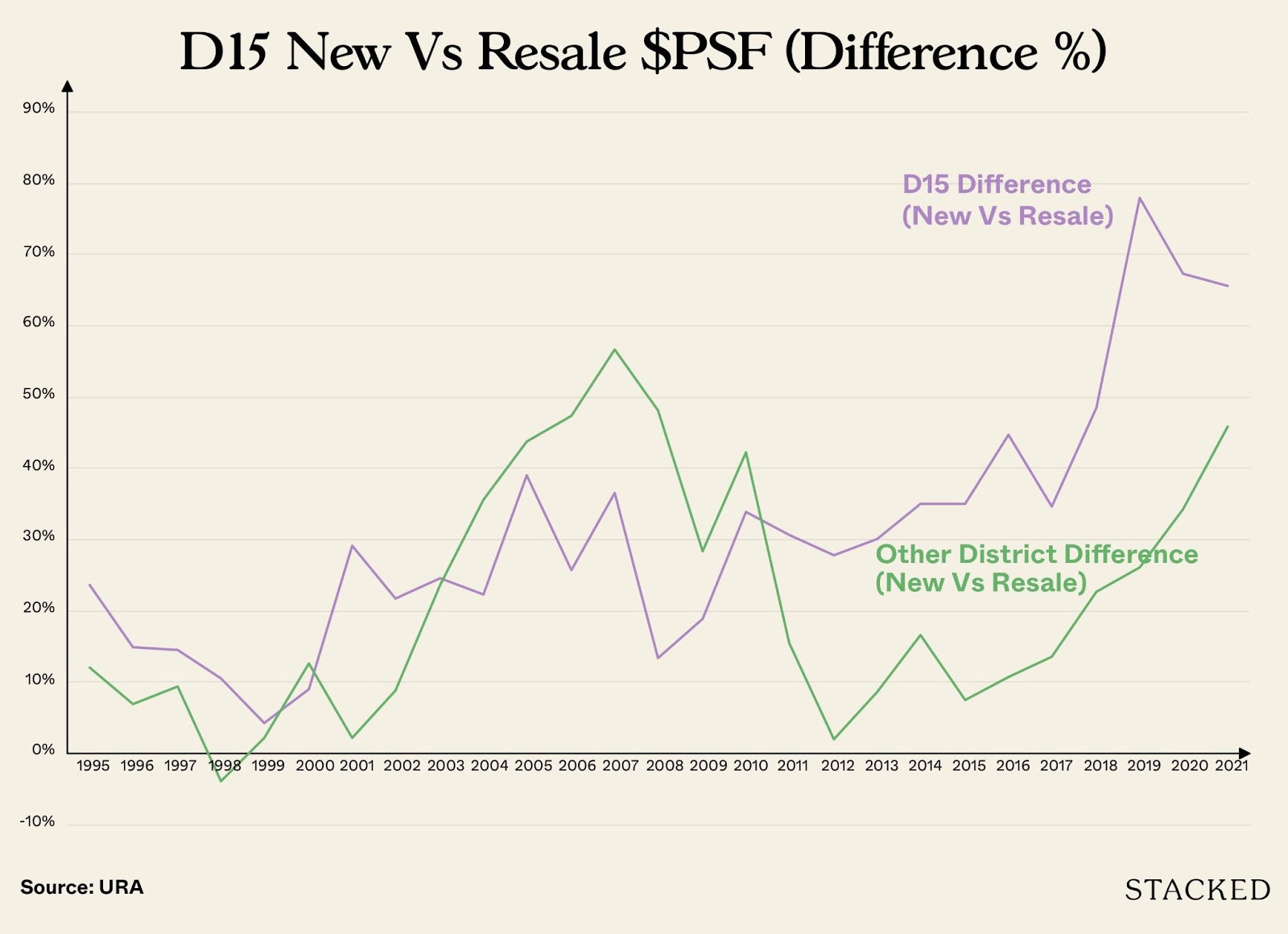

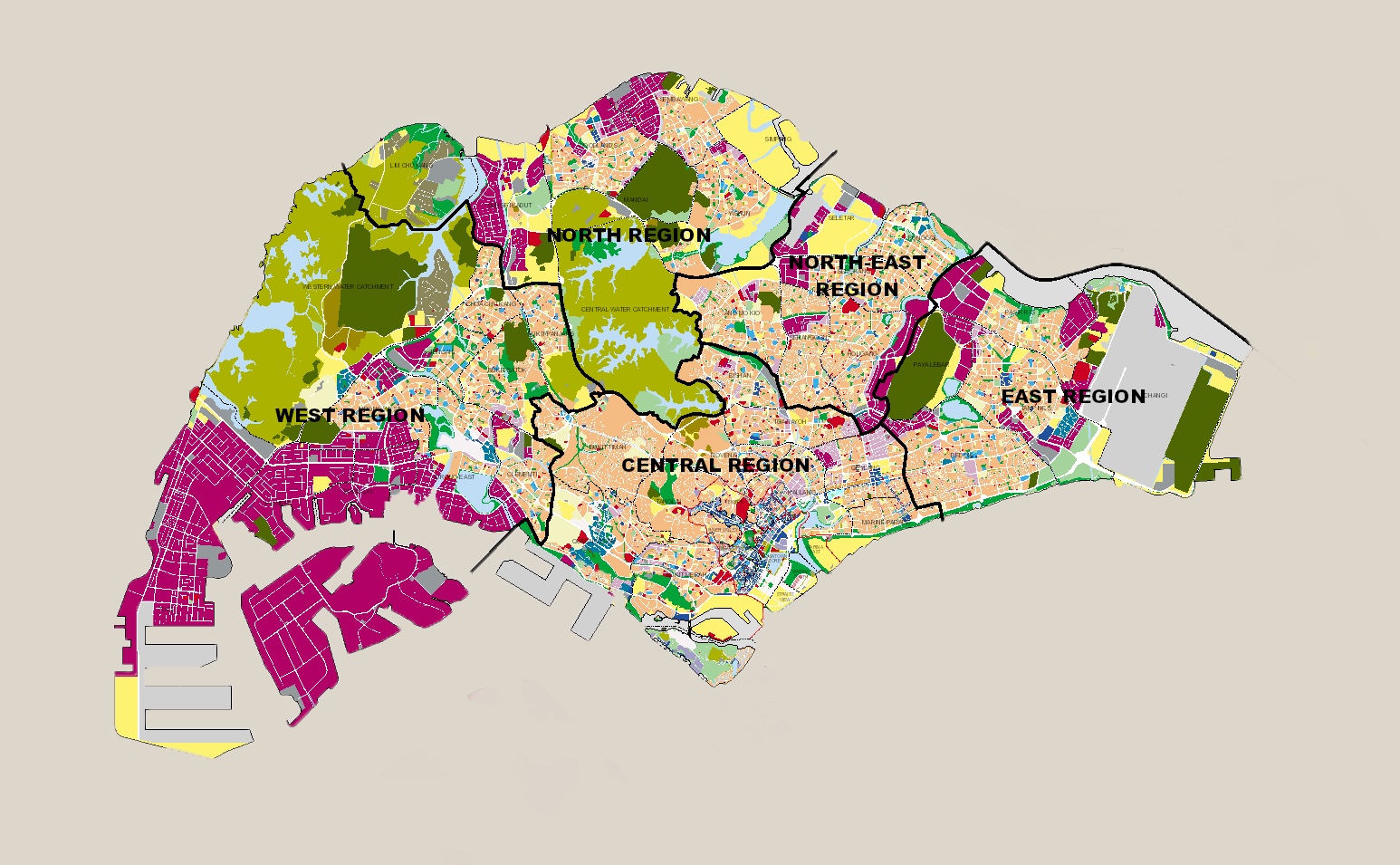

Today, you have access to so much more data, that you can use to analyse current and past trends to assess the situation.

Before diving in, make sure you understand how to compare and understand the numbers.

Because of all the information that you have access to, it is possible to be able to paint a more vivid picture of a location’s future risks or opportunities.

Ultimately, by being analytical about your decisions you will be able to minimise your risk as much as possible.

A good strategy, and focus on the numbers will pay dividends in the long run.

I hope that this story has gone some way to help in your journey.

For more on issues affecting property investment, or in-depth reviews of new and resale properties, follow us on Stacked. If you’d rather not go it alone and require help, do reach out to us for a proper consultation.

Sources:

https://www.dailystar.co.uk/sport/football/brentford-matthew-benham-premier-league-24251175.amp

https://towardsdatascience.com/brentford-fc-the-moneyball-story-in-football-9726619d0d1a

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

Property Investment Insights This Singapore Condo Has Bigger Units Near The MRT — But Timing Decided Who Made Money

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments