7 Key Requirements To Make Your Property A Retirement Asset

November 5, 2021

Home prices are at a peak in 2021, and the Additional Buyers Stamp Duty (ABSD) has raised questions on whether a property is a great investment. Whether you’re a landlord or owner-investor, it’s clear that the property market today is not what it was in the build-up from 2009 to 2013; or like the “golden era” of Singapore’s transition to a first-world country. Instead, here are some of the main factors to ensure your property can still work as a retirement asset:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. You must know the role your property plays after retirement

Not all properties can perform the same function.

For example, say you buy an old walk-up apartment with 60 years left on the lease, for $800,000 (lower prices are possible for older, leasehold properties).

You’re able to rent it out for $3,000 a month, generating an above-average gross rental yield of 4.5 per cent. This is way above the average of two to three percent for most residential properties; but is this a great retirement asset?

If the rental money isn’t going toward your retirement, and you’re counting on resale gains, it’s not a great idea. By the time you resell in 20 years, buyers are unlikely to get financing for your property (see below).

Alternatively, what if you were to buy a new launch at $1.4 million, but still only generate a rental income of $3,000 per month?

The rental yield is less attractive at just 2.5 per cent; but being new, there’s a better chance of resale gains, as it will not be too old even if you sell 20 years down the road.

We can also posit a third scenario: you could use accumulated savings to buy the very old-walk up in full (no loan), as you near retirement. Assuming you’re around 65, you could then collect an income of $3,000 a month, all the way to the end of your life. You may not care about eventual resale gains.

You need to have a clear idea of what your property is meant to do, before you can decide if it’s a retirement asset.

2. You know how you’re going to monetise the property if you won’t be downgrading/selling

For many Singaporeans, retirement involves selling their property and downgrading to a smaller one. However, this isn’t viable for everyone.

In these cases, you need to ensure there’s some way to monetise your property after retirement. It’s painful to own a million-dollar condo, but still have no income.

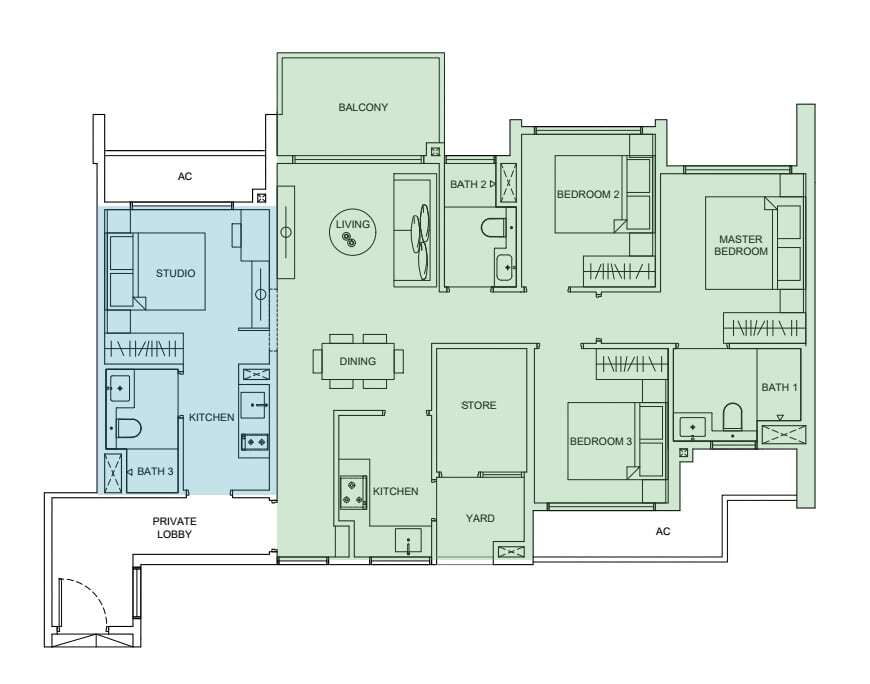

In some cases, buyers will plan to have tenants after retirement. These buyers may seek dual-key units, which are split into two sub-units. This allows them to rent out part of the property, with no loss of privacy.

Another possibility – for those doing well financially – could be to keep their flat after the five-year Minimum Occupancy Period (MOP), and then buy a second property.

This will incur the Additional Buyers Stamp Duty (ABSD), but it does mean they can rent out their whole flat while staying in your condo. They can also live in their flat while renting out the condo, if they want more rental income.

Besides this, there are other financing schemes and options – such as a reverse mortgage to top up your CPF (only available from DBS right now), to Lease Buyback Schemes (LBS) from HDB.

If you plan to use these schemes, make sure they meet quantified retirement goals. For example, if you rent out the other half of your dual-key unit, would that be sufficient to meet your desired Income Replacement Rate (IRR)?

This should be discussed with a financial professional, in conjunction with data or projections from real estate professionals.

3. Lease decay is not too advanced

For long-term property investments – such as a home you’ll be holding for 20 or 30 years – freehold may be worth the premium.

Once there are 60 or fewer years left on the lease, future buyers may not be able to secure full financing. Once there’s 30 or fewer years on the lease, bank loans are no longer possible.

For HDB properties, CPF cannot be used to purchase flats with 20 or fewer years on the lease.

As future buyers can’t get proper financing, they’ll have to pay for most of your unit in cash. At this point, there’s a high chance you’ll sell your property for little to no gains.

As an aside, keep in mind there’s less incentive to upgrade or maintain a property nearing the end of its lease; you can see this effect in run-down, strata-titled malls. When there are just a few decades left, many residents don’t want to hike maintenance fees to restore old facilities, upgrade landscaped areas, etc.

4. The property is not too niche, with narrow appeal

A good example of niche properties is one-bedder units, below 500 sq. ft. (also called shoebox units).

These are great for specific purposes, such as a start point for new investors, or landlords chasing rental yields from specific groups of tenants (e.g., students in a nearby university, or single expat workers staying for the short term).

But if you’re thinking of resale gains – such as eventually selling your shoebox unit to pad your retirement fund – these properties can be riskier. Keep in mind that one-bedders are too small for family units, so some of the most typical buyers – such as HDB upgraders – probably won’t be interested.

Likewise, properties such as walk-up apartments, or boutique condos in landed enclaves (usually far from amenities) may be tougher to resell. These properties may be trending at the time you buy, but maybe out of favour decades down the road.

This is not true of all such units; but in general, if you’re counting on later resale gains, it’s best to stick to properties with wider appeal. This means keeping to fundamentals, such as being conveniently located and schools.

5. You should be able to pay off the home loan by the age of 55

If you’re still burdened with a home loan after the age of 55, there’s a chance that your property may end up being a liability and not an asset.

Besides, it’s quite depressing to reach your CPF draw-down age, and realise you can only get $5,000 because most of your CPF has been emptied into your still ongoing home loan.

Property AdviceAn Ultimate Guide To Using Your CPF To Buy Property: How Much Can You Really Use?

by Ryan J. OngAs most financial advisors will point out, age brings the risk of decreased income. Retrenchment, or re-employment at lower wages, are real possibilities. You risk serious financial loss if, near the time of retirement, you’re forced to sell your property in a bad market.

It can also be difficult to refinance to get lower interest rates, as you grow older; you may not qualify for a cheaper loan package.

So, while you can maintain your CPF OA beyond 55 and keep using it to repay the home loan, it’s prudent to try and wrap things up by that point.

6. If you have other co-owners, they’re on board with the plan for the property

It’s not uncommon in Singapore to have co-owners, such as a spouse, a child, a son or daughter-in-law, etc.

If you’re planning to use the property for retirement, it’s important to make sure your co-owners understand your intent. Otherwise, there could be conflict among owners on whether to sell.

For example, say you plan to sell your condo at 65, to fund your retirement. However, you didn’t properly communicate this to your child, who is a co-owner.

This causes a problem at the time you’re ready to sell. If your child agrees to the sale, for instance, they would be disposing of a private property; and they’re then unable to apply for a BTO flat for 30 months. This could leave them stuck with buying a pricier resale flat, or renting for over two years.

There may also be disagreements about whether it’s “the right time” to sell. You may not be concerned with higher returns, so long as you can meet your retirement targets. However, your co-owners may be aiming higher than you.

All this can lead to your “retirement property” being held on long after it’s meant to be sold; or sometimes being sold before you intend (sometimes your co-owner may push you to sell, because they have their own financial targets).

7. The property is part of your retirement plan, not the entirety of it

If the property costs so much that you can’t afford to invest in anything else, it’s probably not a great retirement asset.

If you have nothing except the one property (e.g., CPF savings all wiped out, no equities or bonds, no endowment plans, and so forth), you are making an all-in bet on the future property value, or its rentability. This isn’t really a “retirement asset” so much as it is a risky real-estate gamble.

It’s better to ensure that, as a retirement asset, your property makes up one part of your financial plan; it should not be the financial plan.

Ultimately, investing in property at the wrong time can be a costly decision. The fact is you may retire at the most untimely spot in the property cycle – it’s always hard to time it. If that were your only investment for retirement, you may be forced to sell it during the down market and possibly even incur a loss. Of course, you could wait for the upswing in prices to sell at some profit. But as with everything, that might be a long wait, and the timing is one you cannot afford when it comes to retirement.

While we believe real estate is a great asset class, a degree of balance and diversification is still important. It’s definitely prudent to buy within your means, giving you sufficient holding power to ride out downturns.

For reviews of new and resale properties that could match your needs, or to speak to an expert, reach out to us at Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

2 Comments

i thought you can’t live in condo and rent out your entire flat?