6 Factors To Look Out For When Buying An Old 40-Year-Old Resale Flat

February 24, 2022

A few years ago, not many buyers would have been eager to buy a flat halfway through its lease. In fact, it was commonly pitched to HDB flat owners that they should quickly upgrade before depreciation took its toll. The attitude has shifted in the past few years, however, as resale flat prices surge past previous peaks because of demand from buyers due to the pandemic. Now, bigger living spaces and the ability to move in quickly take precedent. With buyers once again interested in older flats, here are some key factors to look for:

Table Of Contents

- 1. Consider the effects of lease decay

- 2. Check if you face financing restrictions, which could mean more cash down

- 3. If size is what you want, you’ll probably only see a difference in flats before 2000

- 4. For old HDB flats, be wary of the garbage chute for low floor units

- 5. Try to buy where the Home Improvement Programme (HIP) has already taken place

- 6. Before you buy a two-storey maisonette, think hard about the stairs

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Consider the effects of lease decay

The first bit of advice we want to give is to be aware of lease decay. This impacts both the price you should buy at, as well as the resale value (if that’s still a concern).

But the complication starts when trying to give you exact numbers. While lease decay should progressively lower prices, the pace at which it happens is has proven to be quite unpredictable.

To give you a general sense of lease decay on price, we looked at prices for flats that were 40-years old in 2014 and tracked their price movement through to 2019. Here’s what we found:

| 3 Room | Age | ||||

| Year | 0 – 9 | 10 – 19 | 20 – 29 | 30 – 39 | >=40 |

| 2014 | $650.16 | $595.41 | $436.99 | $462.87 | $493.26 |

| 2015 | $601.31 | $581.13 | $411.43 | $439.70 | $472.81 |

| 2016 | $597.97 | $554.51 | $404.41 | $434.74 | $456.67 |

| 2017 | $573.66 | $545.43 | $398.39 | $424.58 | $437.61 |

| 2018 | $541.10 | $538.70 | $382.37 | $405.23 | $413.10 |

| 2019 | $540.97 | $568.28 | $379.18 | $389.18 | $398.26 |

| 4 Room | Age | ||||

| Year | 0 – 9 | 10 – 19 | 20 – 29 | 30 – 39 | >=40 |

| 2014 | $564.65 | $422.21 | $397.73 | $446.90 | $505.39 |

| 2015 | $570.95 | $396.31 | $380.82 | $432.39 | $506.05 |

| 2016 | $529.48 | $392.87 | $381.65 | $432.16 | $511.35 |

| 2017 | $519.24 | $389.85 | $381.80 | $429.40 | $482.20 |

| 2018 | $521.52 | $387.64 | $369.55 | $411.14 | $465.43 |

| 2019 | $543.48 | $390.00 | $364.32 | $393.52 | $454.69 |

| 5 Room | Age | ||||

| Year | 0 – 9 | 10 – 19 | 20 – 29 | 30 – 39 | >=40 |

| 2014 | $520.03 | $405.77 | $392.55 | $478.45 | $516.45 |

| 2015 | $538.48 | $382.58 | $383.18 | $460.31 | $554.59 |

| 2016 | $569.50 | $383.49 | $385.70 | $462.33 | $558.62 |

| 2017 | $565.70 | $382.12 | $396.03 | $457.14 | $520.43 |

| 2018 | $571.52 | $380.85 | $383.78 | $447.41 | $518.41 |

| 2019 | $588.41 | $378.75 | $381.14 | $431.75 | $510.07 |

Note that this does not account for location, as that would complicate the table too much – do drop us a note if you’re interested in a specific HDB town. Also, note that the available transaction data for 5-room flats are small (about 0.35 per cent of all the transactions we found), so conclusions for this type of flat should be taken with a healthy pinch of salt. Likewise, Executive HDB data is limited, hence we excluded it here as well.

There are four overall findings, keeping in mind that available data for 5-room flats is limited:

- 3-room flats seemed to depreciate more sharply than the others. This is possibly due to buyers gravitating toward larger homes, a trend that continues till today (one of the main reasons for buying an older resale flat, for example, is that the older units tend to be larger).

- 3-room flats that are within a decade old fared second-worse, while 3-room flats that were between 30 and 39 years old saw the worst depreciation. This could be from buyers realising that subsidies are similar for both, regardless of age, and thus preferring the newer units.

- For 4-room flats, which are probably the most common form of housing, those that were 40+ years old since 2014 fared second worse for depreciation.

- For 5-room flats (bearing in mind the smaller data set), flats that were 40+ years old in 2014 actually did quite well. They fared second-best until 2019. As with 3-room flats, this might reflect buyer preferences toward larger homes.

In any case, you can see that (if you want to buy an older flat but still expect returns) you’re better off going for a larger 5-room or at least 4-room option.

For those who expect their flats to have some legacy value (e.g., a decent price that their children can sell it for), it may not be the best idea to go for the smallest 3-room option.

2. Check if you face financing restrictions, which could mean more cash down

As of 10th May 2019, changes were implemented to CPF usage for flats.

On the upside, you can now use your CPF to buy a flat so long as just 20 years of the lease is remaining (this used to be set at 30 years).

On the downside, the remaining lease must last until the youngest buyer turns 95 years old. E.g., if the youngest buyer is 25 years old, there must be at least 70 years of lease remaining. Failing this, the available CPF monies and HDB loan will be reduced for the buyer.

Banks almost never provide loans for properties with 30 or fewer years remaining; and the loan quantum may be much lower, for properties with 40 to 60 years remaining.

As such, this issue is twofold:

First, you need to ensure that you won’t face any financing difficulties yourself when buying such an old flat. There’s a chance that you’ll face a higher cash outlay, such as if you can’t access as much of your CPF as you’d like.

Second, remember these financing restrictions will impact the buyer after you if you ever decide to sell. If you buy a flat that’s 50 years old, for example, and live in it for 10 years, any subsequent buyer will purchase it with 39 years left on the lease.

This may subject a future buyer to tighter loan restrictions, and drive down your resale value.

Property AdviceAn Ultimate Guide To Using Your CPF To Buy Property: How Much Can You Really Use?

by Ryan J. Ong3. If size is what you want, you’ll probably only see a difference in flats before 2000

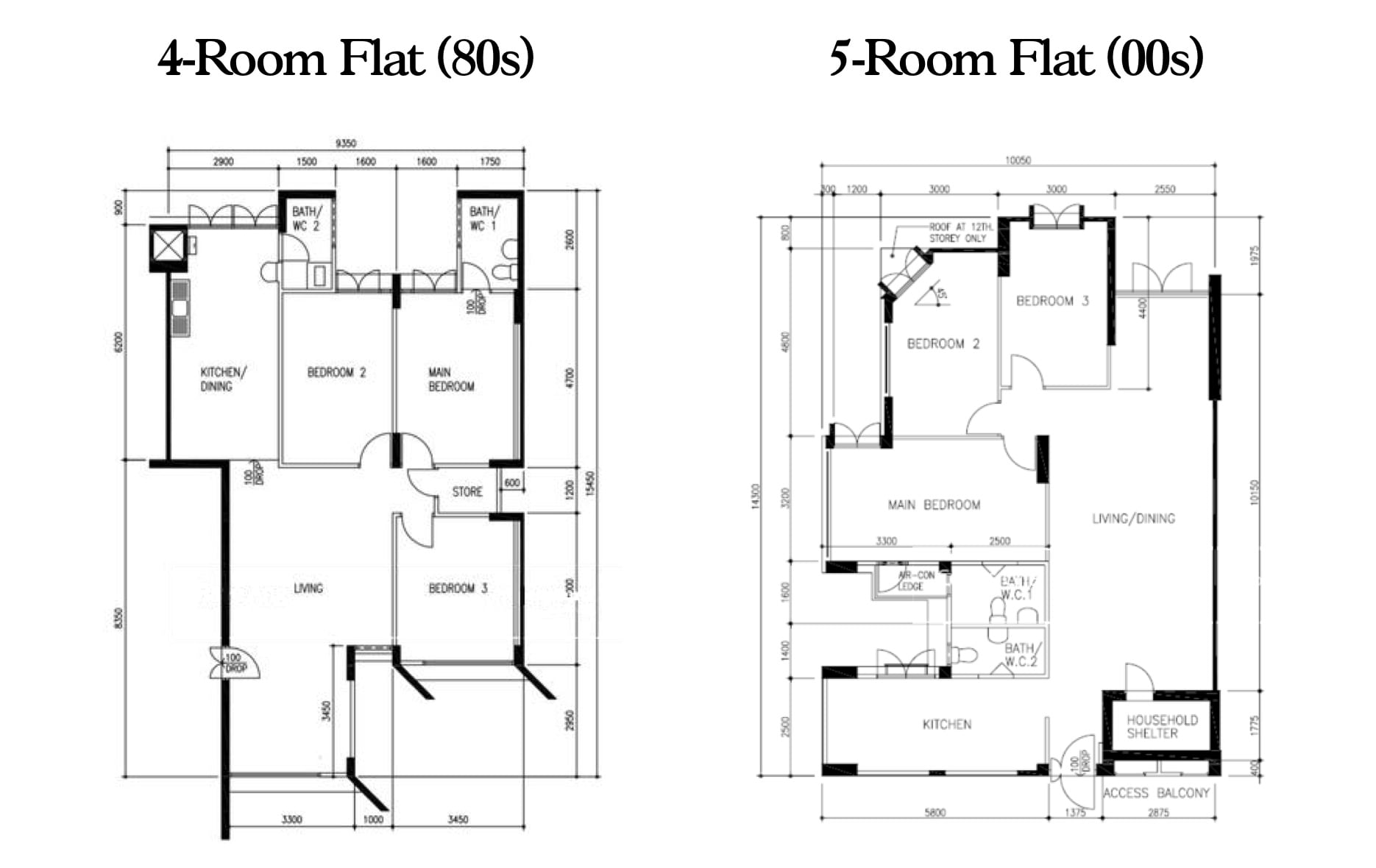

Flats between the 2000s to the present haven’t shown big differences in size. However, there is a more pronounced size difference between a 1990s flat and a current flat, and especially a 1980s flat.

Notice that a 4-room flat from the ‘80s is almost the size of a 5-room flat in the ‘00s!

Here’s an interesting trick for you, to gauge a flat’s age at a glance: just look around for a multi-storey carpark. If you don’t see one anywhere, chances are the surrounding flats were built in the ‘80s or before (because HDB didn’t build many multi-storey carpark in those early days).

4. For old HDB flats, be wary of the garbage chute for low floor units

Newer HDB flats have a communal dumping area. Older HDB flats – typically those from the early ‘90s – often had centralised chutes.

There’s a good reason why we switched to the newer system. Centralised chutes pose a greater risk of vermin issues, especially for low-floor units. Remember that everyone else’s garbage, from many floors above, is separated just by that chute in your kitchen.

We have to mention that, on the flip side, we know of some homeowners who prefer the older system; an example would be elderly folk, who don’t want to have to lug garbage bags to the communal dumping chute.

But in general, if you see the old system where the chute is right in your kitchen, it’s probably best to buy on a higher floor.

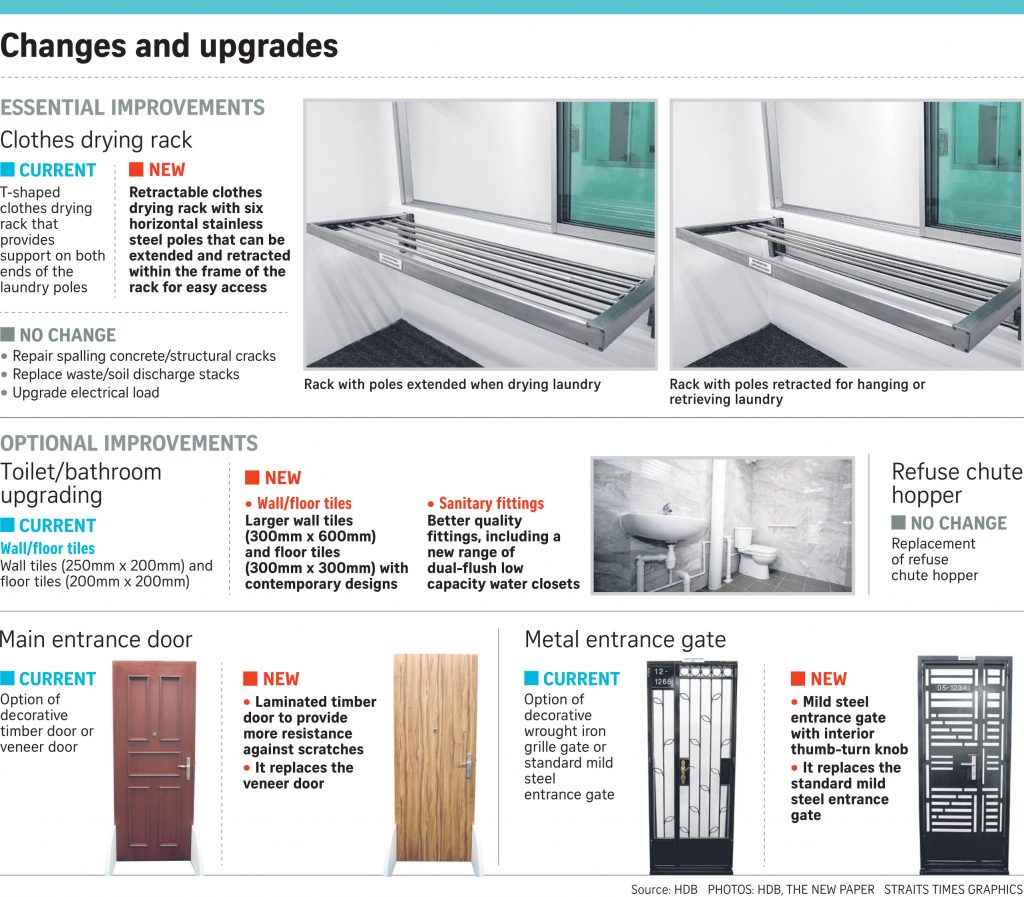

5. Try to buy where the Home Improvement Programme (HIP) has already taken place

You can read about HIP on the HDB website. In brief, this means the ageing flat has already seen a facelift; from repair of spalling concrete to upgraded toilets (if the previous owner chose such optional upgrades).

In our experience, having undergone HIP doesn’t always make a huge difference in the price; but it can make maintenance issues less likely.

For older home buyers, flats that have undergone HIP may also ease improvements, such as grab bars in toilets, and non-slip floor tiles. This can spare you the cost of paying such additions; although of course, this is a non-factor if you’re going to renovate anyway.

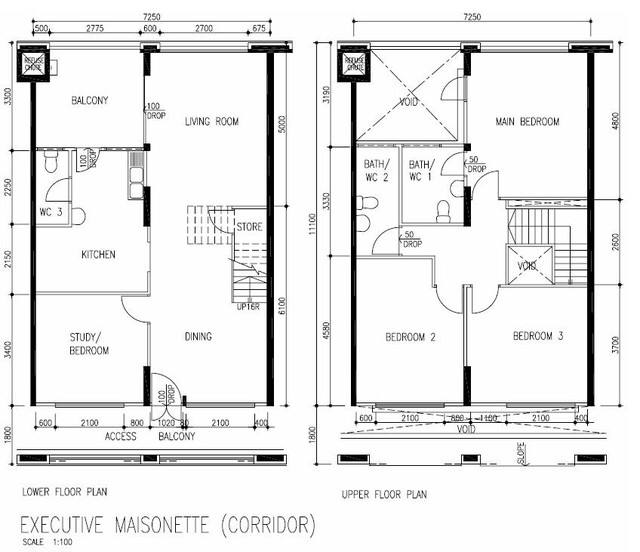

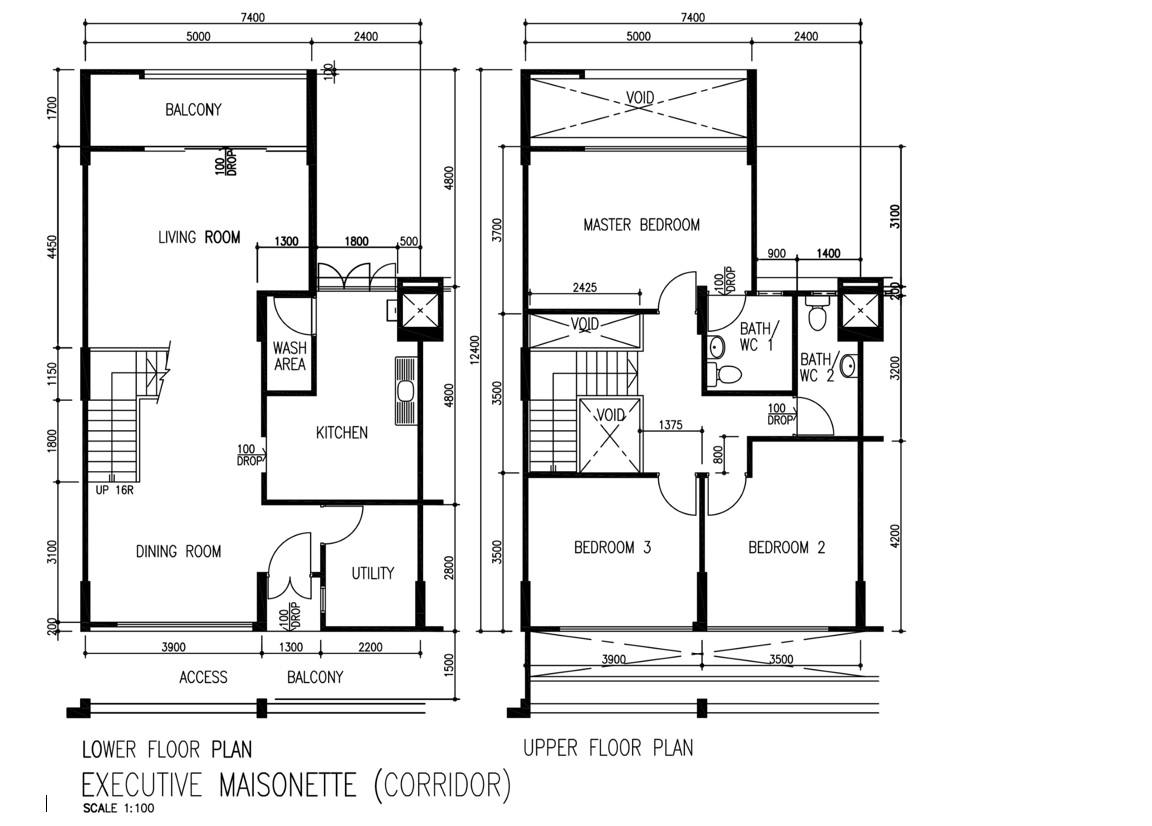

6. Before you buy a two-storey maisonette, think hard about the stairs

If your intent is to age in place, bear in mind that going up and down the stairs can be hazardous when you’re older.

A common response to this is that “oh, when I’m older I’ll just live downstairs”. This statement assumes somebody else – such as a child or helper – is around to clean the second floor.

Do also take note that it isn’t as common to find a maisonette with enough space on the first floor as the bedrooms are usually on the second floor. For the first floor, it’d usually be either a study or utility. If you want to fit a queen-size bed, you’ll need to look for the one with the study instead, as this is a bigger space.

For elderly couples or those who live alone, it’s can be more trouble than it is worth; and it may not justify the hefty Cash Over Valuation (COV) that almost invariably comes with these rare flats.

For more on buying older flats or direct consultation with an expert, do talk to us at Stacked. We can put you in touch with the right professionals, to help you with an informed choice. You can also follow us for news and updates on the Singapore private property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

0 Comments