13 Top Rental-Yielding Condos Near Grade A Office Hubs

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Remember when being “near the office” almost always meant living near the CBD? That’s less of a certainty these days; and the Circuit Breaker in 2020 could be the final catalyst. The plans to decentralise the CBD were made as far back as the 1990’s, and today there are grade A office / commercial hubs in almost every part of the island. For landlords seeking to capture this demographic, we’ve picked out the top condo options near prime office spaces:

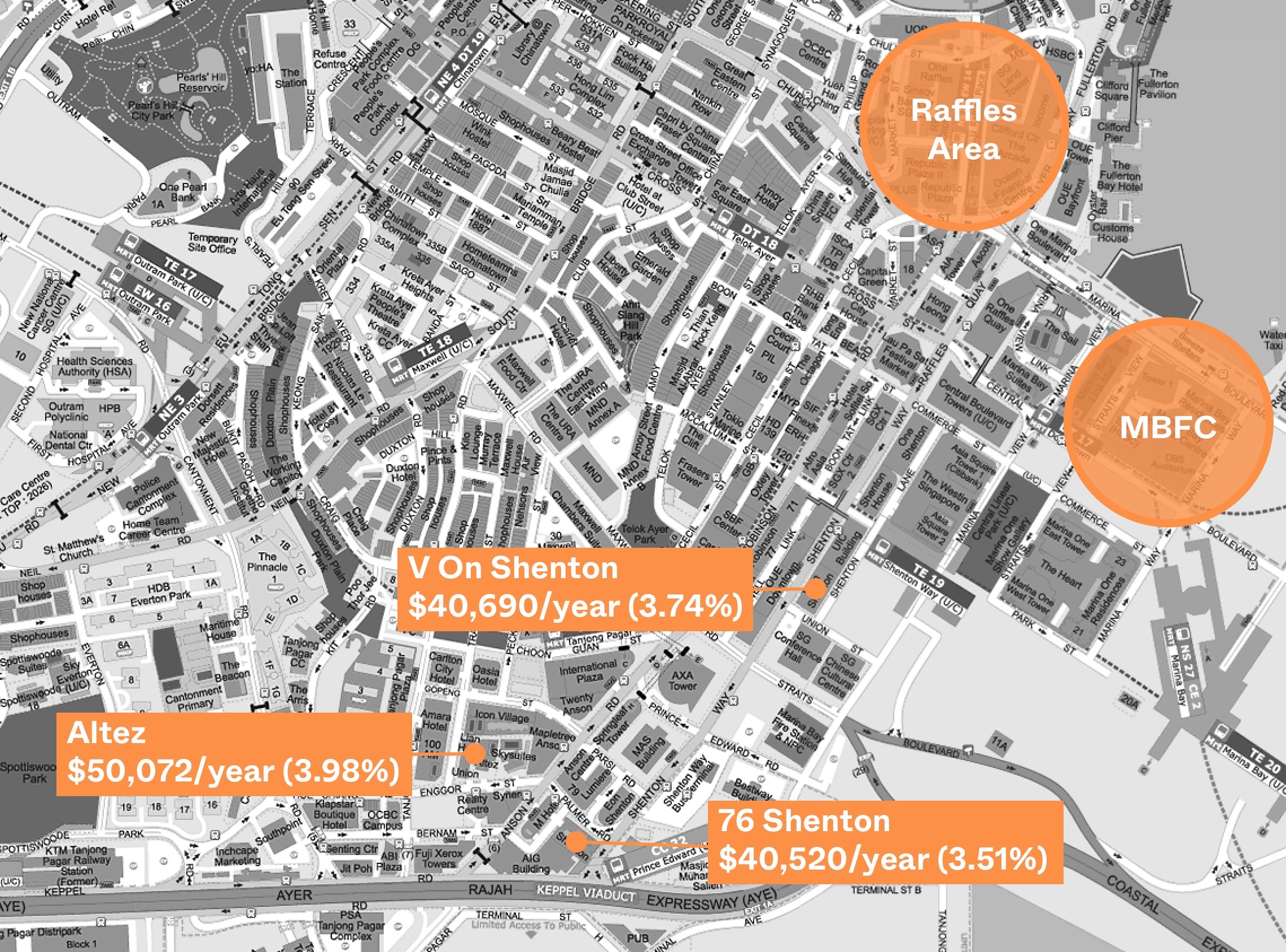

Top yielding condos near the traditional CBD

1. Altez (1-bedders)

| Average Price | Average Rental | Est. Gross Yield |

| $1,259,333 | $50,072 | 3.98% |

Location: Enggor Street (District 02)

Developer: Bishan Properties Pte. Ltd.

Lease: 99-years

Completion: 2014

Number of units: 280

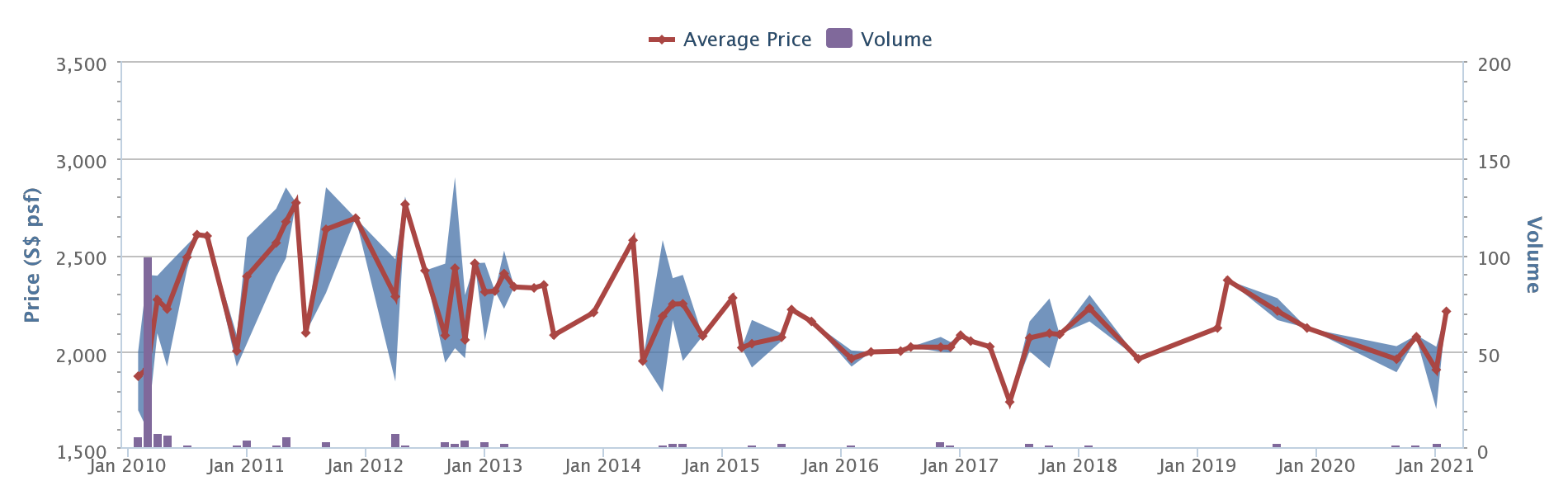

Square Foot Research indicates a price range of $1,705 to $2,209 psf, with an average price of $2,015 psf. To date, there have been 31 profitable transactions, and 13 unprofitable transactions.

The indicative rental range is $4.47 to $7.27 psf, with an average of $5.91 psf.

Key highlights

Altez tends to be overshadowed, because it’s near two famous developments: Pinnacle @ Duxton (HDB) and the venerable Everton Park. But Altez boasts many of the same benefits as its two famous counterparts:

It’s 310 metres from Tanjong Pagar MRT station, just a seven-minute walk. When Maxwell MRT station opens later this year, it will just be around 680 metres, or about 10 minutes’ walk; this means residents can access the Thomson-East Coast Line as well.

Altez is also immediately across from 100 AM mall, and on the other side of that is Tanjong Pagar Plaza with the market and food centre; this area is the focal point of the neighbourhood’s amenities.

The only downside is that family tenants are less likely to choose Altez, as there’s little in the way of green spaces, childcare, or family recreation. This condo is really for singles or couples, who don’t mind the noise and bustle of the CBD.

Altez is just across from 76 Shenton (see below).

2. V on Shenton (1-bedders)

| Average Price | Average Rental | Est. Gross Yield |

| $1,088,000 | $40,690 | 3.74% |

Location: Shenton Way (District 01)

Developer: UIC Investments (Properties) Pte. Ltd.

Lease: 99-years

Completion: 2017

Number of units: 510

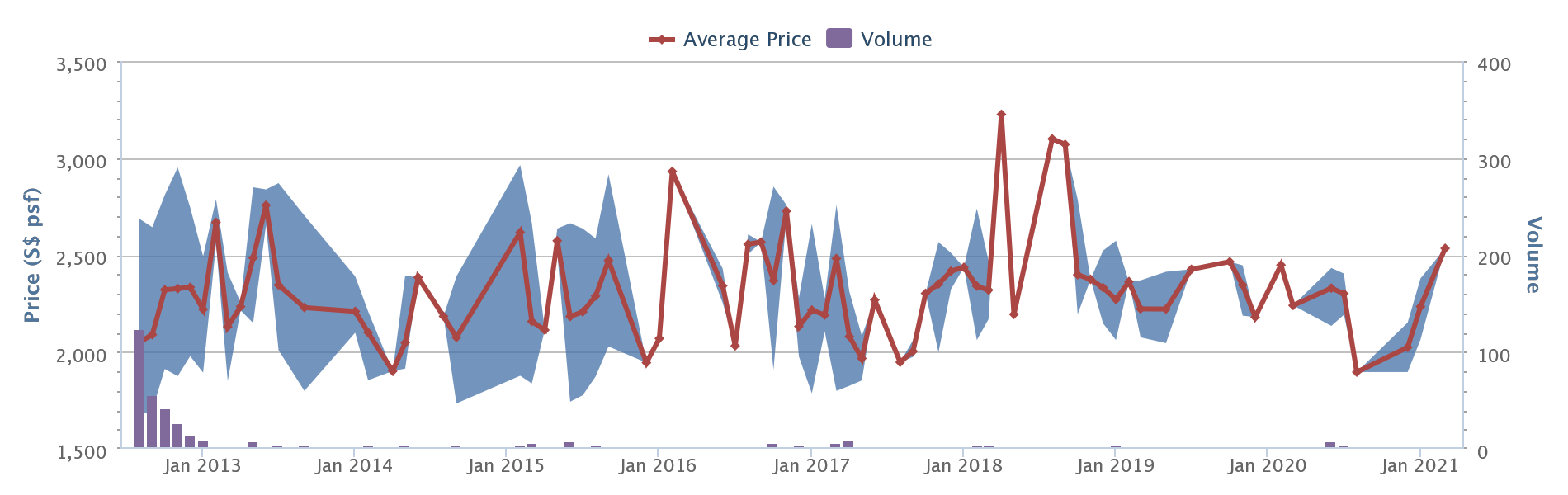

Square Foot Research indicates a price range of $1,896 to $2,534 psf, with an average price of $2,214 psf. To date, there have been 7 profitable transactions, and 12 unprofitable transactions.

The indicative rental range is $3.67 to $7.78 psf, with an average of $5.16 psf.

Key highlights

V on Shenton is one of the most accessible CBD area condos, given its price point. It’s actually within walking distance of three MRT stations: Tanjong Pagar MRT is 330 metres away, Downtown MRT is 490 metres away, and the upcoming Shenton Way MRT will be the closest (150 metres).

Note that all three stations give access to different lines: The East-West Line (EWL) from Tanjong Pagar, the Downtown Line (DTL) from Downtown, and the TEL from Shenton Way.

The downside is that there isn’t much in terms of “across the road” amenities, so tenants will have to make the walk to Tanjong Pagar MRT for better food and retail options.

3. 76 Shenton (1-bedders)

Average Price | Average Rental | Est. Gross Yield |

| $1,154,167 | $40,520 | 3.51% |

Location: Shenton Way (District 02)

Developer: Hong Leong House Pte. Ltd.

Lease: 99-years

Completion: 2014

Number of units: 202

Square Foot Research indicates a price range of $1,786 to $1,985 psf, with an average price of $1,847 psf. To date, there have been 34 profitable transactions, and 15 unprofitable transactions.

The indicative rental range is $4.37 to $7.27 psf, with an average of $5.25 psf.

Key highlights:

This development is neck-and-neck with Altez, being just 160 metres away. It shares the same location issues as Altez, and even the same age and general size (76 Shenton has 202 units, versus the 280 in Altez; both are considered small developments).

This honestly makes it a toss-up; for tenants it will come down to individual unit qualities to be the deciding factor (facing, renovations, furnishing, etc.) For landlords, Altez may have a slight edge, with a lower overall quantum on its one-bedders.

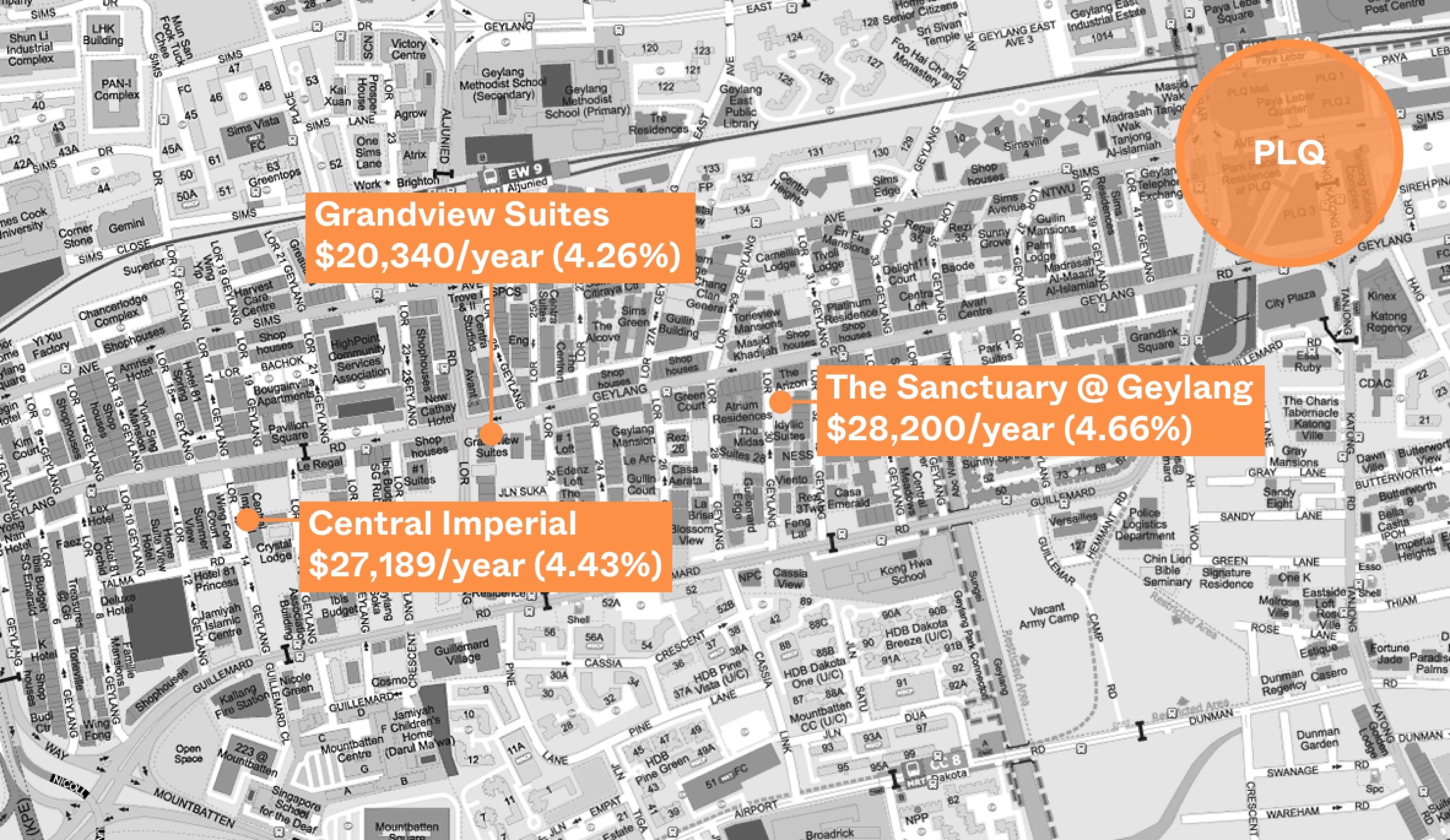

Top yielding condos near Paya Lebar Quarter (PLQ)

- The Sanctuary @ Geylang

- Central Imperial

- Grandview Suites

Note that, by virtue of pricing and the newness of PLQ, the highest yielding condos near this area are invariably closer to the Geylang than Paya Lebar side of the area. Aljunied MRT station is one stop away from PLQ.

1. The Sanctuary @ Geylang

| Average Price | Average Rental | Est. Gross Yield |

| $605,000 | $28,200 | 4.66% |

Location: Lorong 30 Geylang (District 14)

Developer: Bishan Properties Pte. Ltd.

Lease: Freehold

Completion: 2014

Number of units: 21

Square Foot Research indicates an average price of $1,171 psf. To date, there have been six profitable transactions, with no losing sales.

The indicative rental range is $3.82 to $4.55 psf, with an average of $4.18 psf.

Key highlights:

The Sanctuary @ Geylang is an apartment, not a condo. It’s noteworthy for one unusual quality: it’s single-bedders range from 517 sq.ft., to 1,324 sq. ft. (that’s not a typo, and the larger sizes are due to it being a penthouse – so expect more outdoor space with it).

The Sanctuary is for tenants who favour function over form. It’s no-frills, and not pretty: it’s hemmed in on all sides by other buildings, so it’s pure road and concrete all around. What tenants do get are:

(1) a lot of living space with a big unit, and

(2) access to both Aljunied MRT (540 metres) and Dakota MRT (610 metres). This means foot access to both the EWL, and the Circle Line (CC).

As it’s closer to Geylang than Paya Lebar, it’s also closer to the foodie hotspots; although there isn’t much in the way of retail.

2. Central Imperial (2-bedders)

| Average Price | Average Rental | Est. Gross Yield |

| $614,000 | $27,189 | 4.43% |

Location: Lorong 14 (District 14)

Developer: G28 Development Pte. Ltd.

Lease: Freehold

Completion: 2014

Number of units: 63

Square Foot Research indicates an average price of $1,217 psf. To date, there have been 10 profitable transactions, and 12 unprofitable transactions.

The indicative rental range is $3.08 to $5.27 psf, with an average of $4.02 psf.

Key highlights:

This property falls within the red-light area, but we include it because it is one of the highest-yielding developments.

This development isn’t as close to the MRT station as its counterparts on this list; its 640 metres to Aljunied MRT, which is about 10 minutes away on foot; some tenants may not consider it walkable. It’s also one of the noisiest properties we’ve seen, being along a busy road, next to a budget hotel, and with a coffee shop right next to that.

Nonetheless, rentability remains solid. This is mostly by way of convenience (you can walk out the door and find coffee shops, minimarts, and grocers quickly). For landlords, the low cost inevitably translates to a high rental yield. But this high risk, high reward investment is not for beginners; it’s very difficult to sell units in this location (there may also be financing issues from the red-light location).

3. Grandview Suites (1-bedders)

| Average Price | Average Rental | Est. Gross Yield |

| $477,667 | $20,340 | 4.26% |

Location: Lorong 22 (District 14)

Developer: Grandview (Geylang) Pte. Ltd.

Lease: Freehold

Completion: 2016

Number of units: 52

Square Foot Research indicates a price range of $1,234 to $1,408 psf, with an average price of $1,321 psf. To date, there have been four unprofitable transactions.

The indicative rental range is $3.18 to $5.14 psf, with an average of $4 psf.

Key highlights:

Grandview Suite is the closest to Aljunied MRT, at 450 metres (about a six-minute walk). It’s not in the most comfortable location, being situated near the intersection of Lorong 22, Geylang Road, and Aljunied Road. However, at an average price below $480,000, this may be the cheapest freehold property in Singapore.

More from Stacked

5 Unique High-Ceiling HDB Flats Priced From $650k

There's always jokes that HDB flats are "hamster cages," and complaints about how small they've gotten. But in reality, HDB…

It’s easily rentable to singles, due to the proximity to the MRT station, and abundance of minimarts and coffee shops. However, we wouldn’t suggest it for new investors, as it’s close to the red-light area and difficult to sell. This is a property for landlords pursuing a long term cash-flow positive strategy, with less emphasis on resale gains.

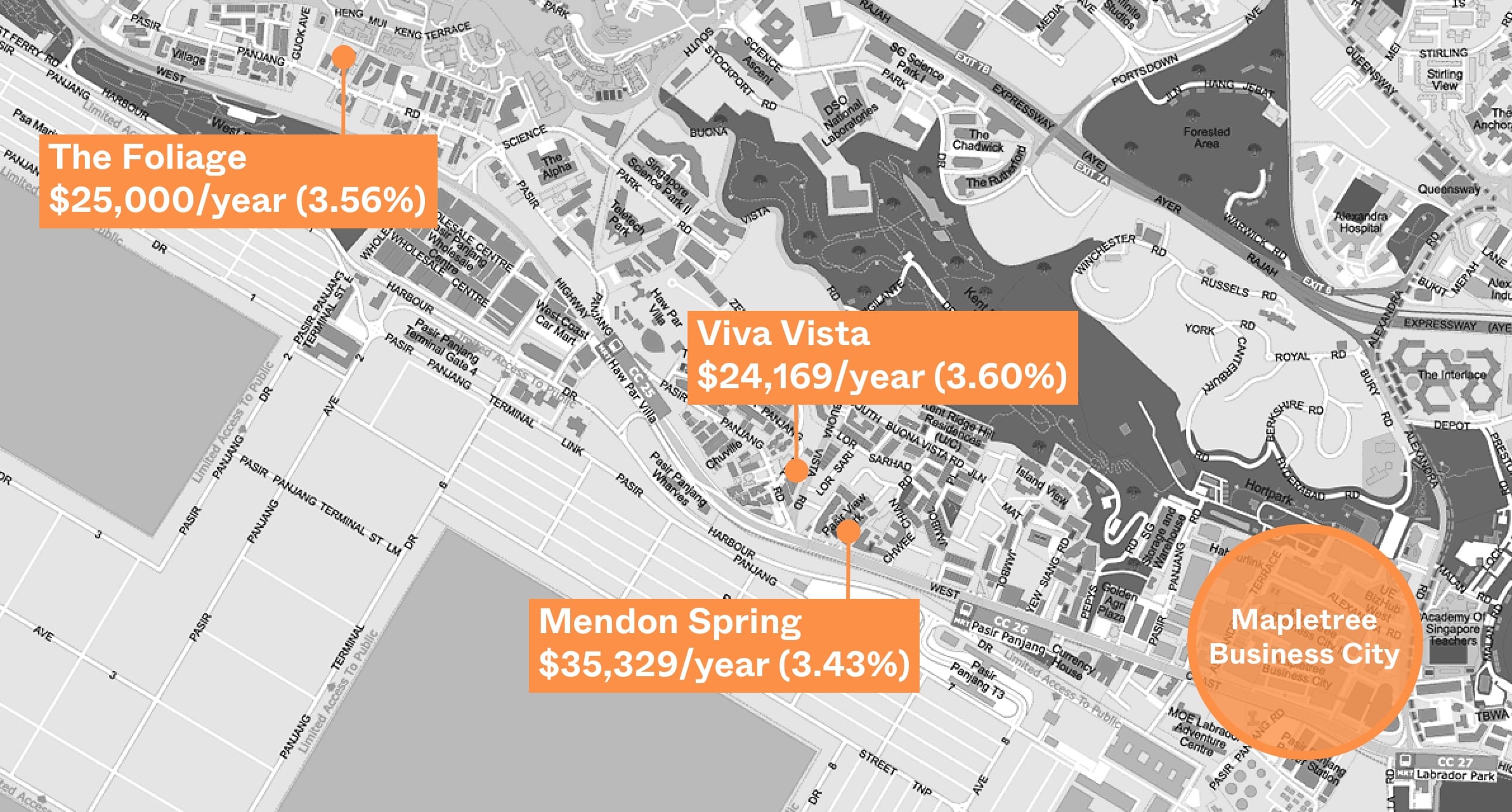

Top yielding condos near Mapletree Business City

- Viva Vista

- The Foliage

- Mendon Spring

1. Viva Vista (1-bedders)

| Average Price | Average Rental | Est. Gross Yield |

| $672,200 | $24,169.09 | 3.6% |

Location: South Buona Vista Road (District 05)

Developer: Hume Homes Pte. Ltd.

Lease: Freehold

Completion: 2014

Number of units: 144

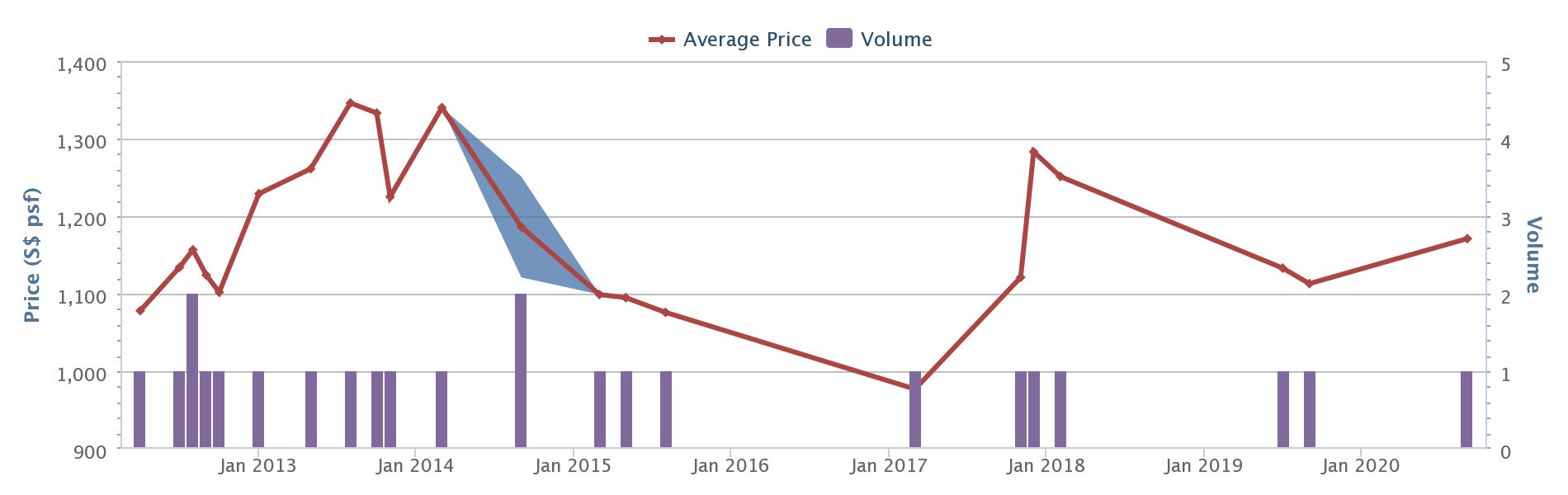

Square Foot Research indicates a price range of $1,145 to $1,561 psf, with an average price of $1,406 psf. To date, there have been 34 profitable transactions, and 7 unprofitable transactions.

The indicative rental range is $2.87 to $6.69 psf, with an average of $5.17 psf.

Key highlights:

Viva Vista is mixed use; it isn’t a huge mall (106 commercial units), but it’s nice to have access to a minimart and day-to-day services, like tailoring, in quick reach. This development is just a two-minute drive to Mapletree Business City, and about an eight-minute walk to Haw Par Villa MRT station.

The main drawback is that, apart from the mall downstairs, the immediate area is quite lacking in amenities. This will appeal to tenants who just want to live near work, and don’t mind having to travel out of the neighbourhood for fun.

2. The Foliage (1-bedder)

| Average Price | Average Rental | Est. Gross Yield |

| $701,944 | $25,000 | 3.56% |

Location: Pasir Panjang Road (District 05)

Developer: Hoi Hup JV Development Pte. Ltd.

Lease: Freehold

Completion: 2008

Number of units: 88

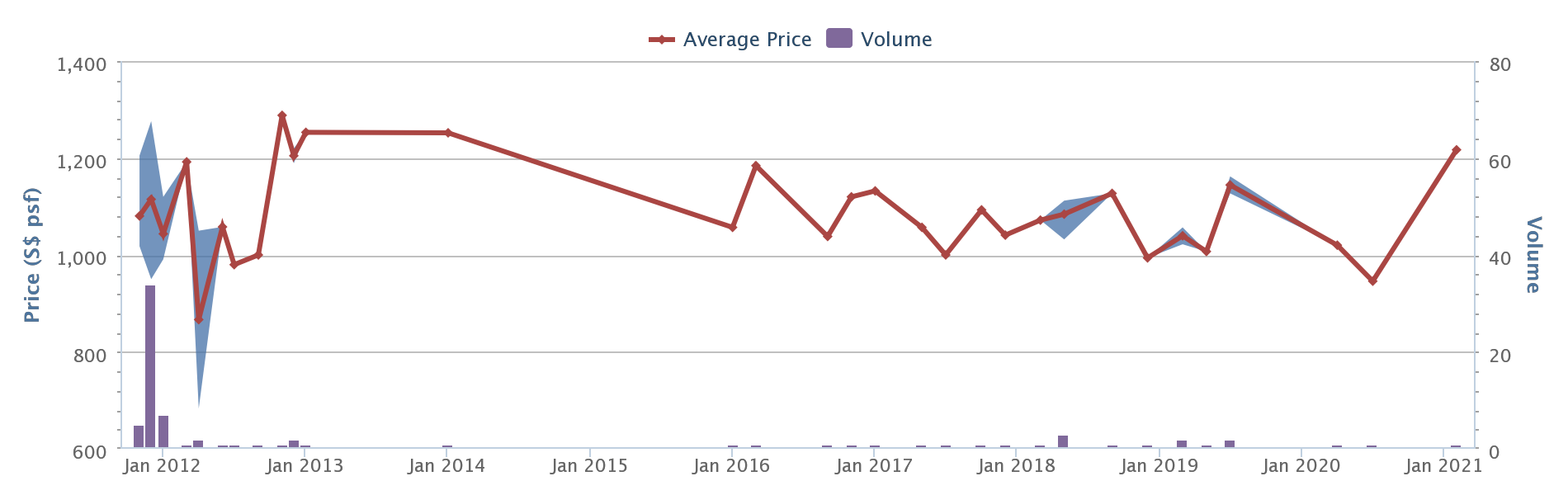

Square Foot Research indicates a price range of $1,168 to $1,470 psf, with an average price of $1,301 psf. To date, there have been 76 profitable transactions, and only 1 unprofitable transaction.

The indicative rental range is $2.57 to $4.18 psf, with an average of $3.39 psf.

Key highlights:

Besides those working at Mapletree Business City, tenants who pick The Foliage may include staff or students at the National University of Singapore (NUS). The University is under a 400-metre drive from The Foliage, so they’d be there in minutes. Mapletree Business City itself is about a 4.7 kilometre, six-minute drive.

Despite the age of this property, it remains attractive due to the lower overall quantum (around $700,000 for a freehold condo is hard to find these days). This comes with the catch that The Foliage has low accessibility; tenants who don’t drive or use PHVs are likely to rule it out.

3. Mendon Spring (2-bedders)

| Average Price | Average Rental | Est. Gross Yield |

| $1,030,000 | $35,329 | 3.43% |

Location: Pasir Panjang Road (District 05)

Developer: Not stated

Lease: Freehold

Completion: 2002

Number of units: 48

Square Foot Research indicates an average price of $976 psf. To date, there have been 14 profitable transactions, and 1 unprofitable transaction.

The indicative rental range is $1.40 to $3.24 psf, with an average of $2.63 psf.

Key highlights:

Mendon Spring is a two-minute drive to Mapletree Business City, but it has wider appeal than that. It’s one of the more accessible condos in Mapletree’s vicinity, via public transport. This development is 410 metres, or five minutes’ walk, from Pasir Panjang MRT station. It also has a bus stop right outside, with a good range of service routes (188, 143, 175, 176, 10, 51, and 30).

The downside is that the immediate surroundings are sparse, with little in the way of food, retail, or recreation. Mendon Spring is also getting along in years, so the facilities aren’t as grand as what you’d find in newer condos. Nonetheless, rentability is good among more practical tenants.

5 Expat Enclaves And Their Rental Rates + All-Inclusive Rental Rates List

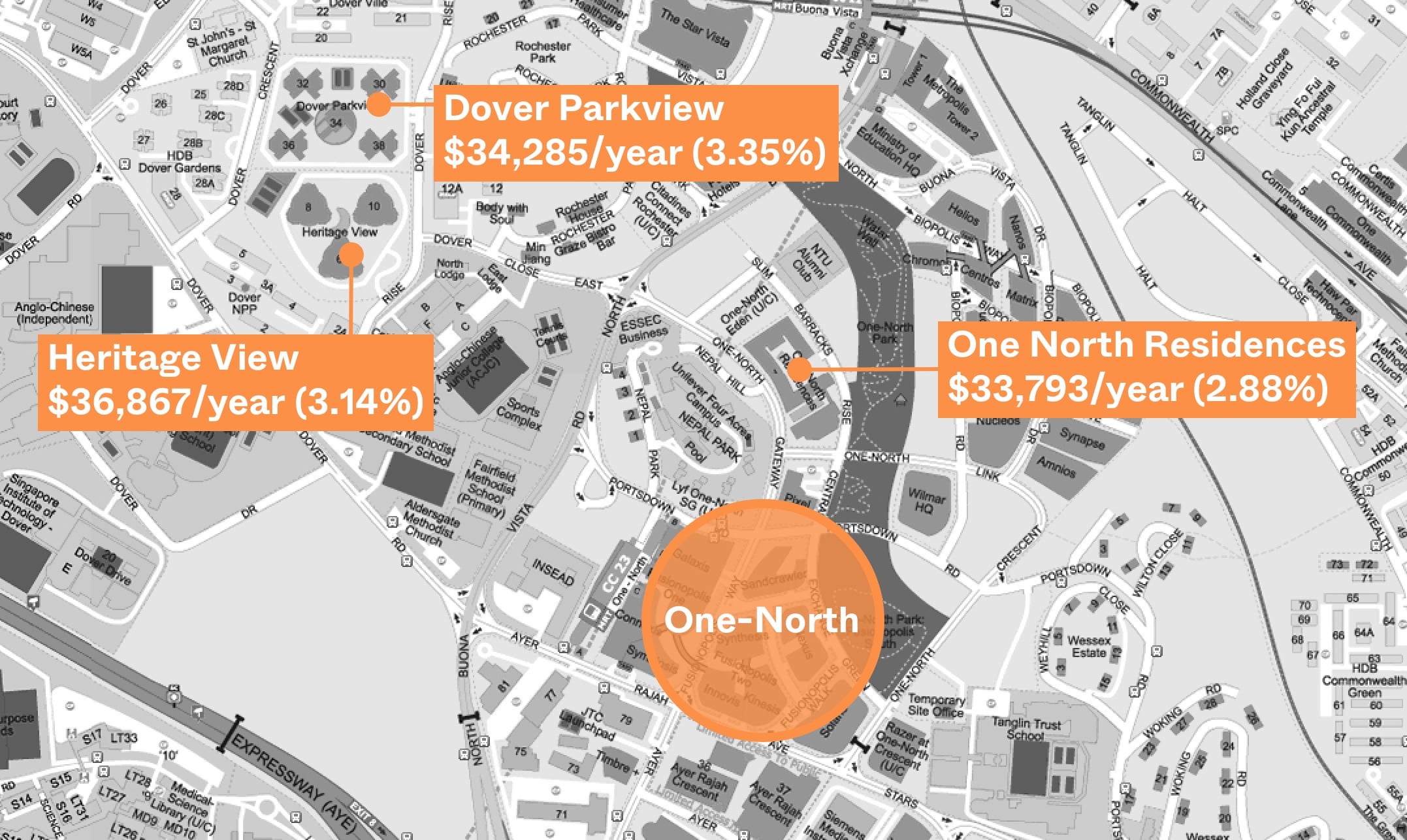

by Ryan J. OngTop yielding properties near One-North

- Dover Parkview

- Heritage View

- One-North Residences

1. Dover Parkview (2-bedder)

| Average Price | Average Rental | Est. Gross Yield |

| $1,022,782 | $34.285 | 3.35% |

Location: Dover Rise (District 05)

Developer: Far East Organization

Lease: 99-years

Completion: 1997

Number of units: 686

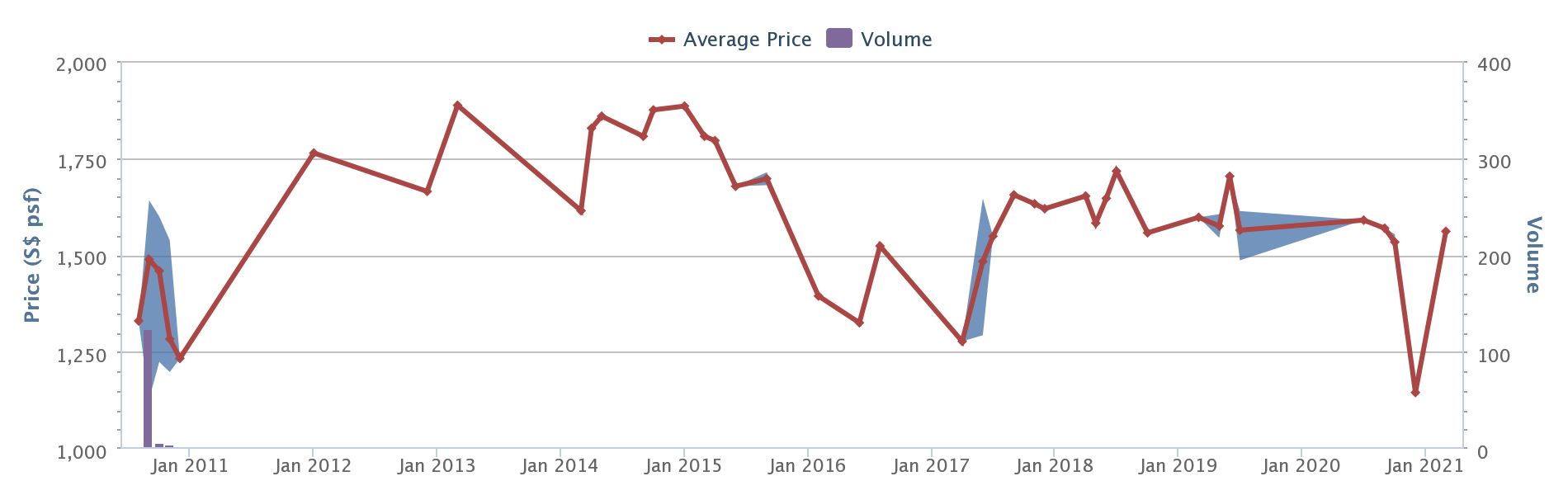

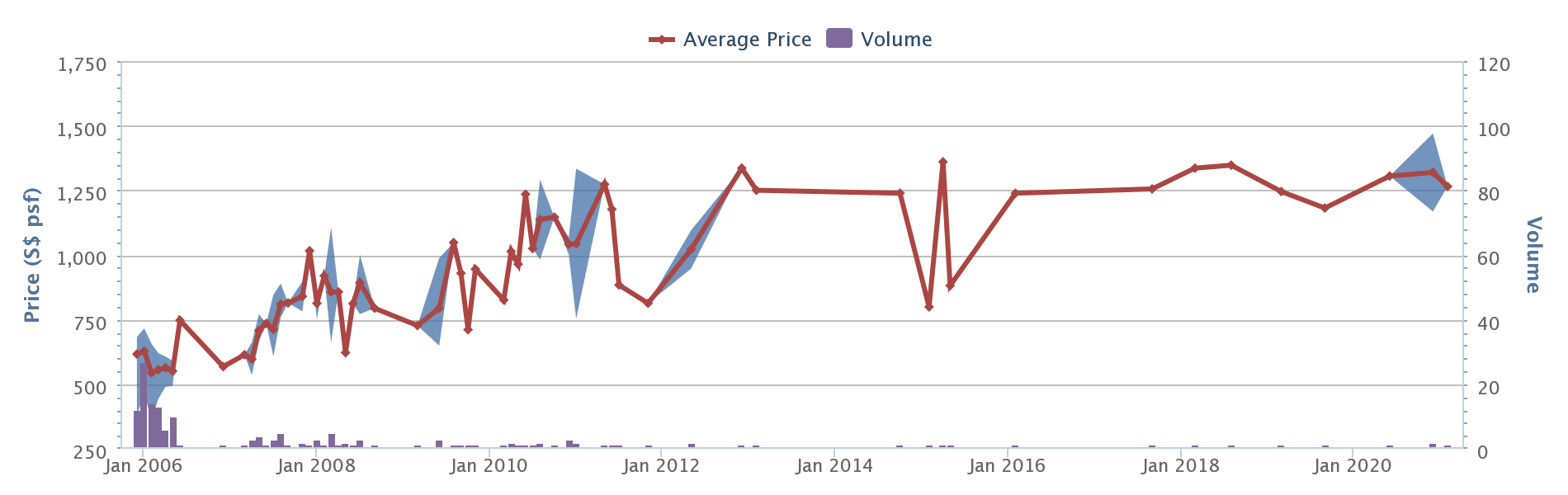

Square Foot Research indicates a price range of $823 to $1,149 psf, with an average price of $1,060 psf. To date, there have been 471 profitable transactions, and 183 unprofitable transactions.

The indicative rental range is $1.96 to $3.68 psf, with an average of $2.98 psf.

Key highlights:

We’re a little surprised to see Dover Parkview has such a high rental yield, as it’s mainly known as a family condo. It’s mainly known for being close to Fairfield Methodist Primary and Secondary schools, as well as Anglo-Chinese School.

Nonetheless, the popularity among tenants could be explained by proximity to the Star Vista mall in Buona Vista; it’s only 490 metres away, or a 10-minute walk. ESSEC business school may also be contributing to the tenant pool, being just 600 metres (seven-minute walk) away.

That said, Dover Parkview is not actually that close to One-North in the walking sense; it would take around 14 minutes to cover the 720-metre distance on foot. Still, that’s not far, and a four-minute drive may be appealing to tenants with a car.

Investors should take note of the age factor, as this is a leasehold condo that was built in 1997.

2. Heritage View (two-bedders)

| Average Price | Average Rental | Est. Gross Yield |

| $1,173,400 | $36,866 | 3.14% |

Location: Dover Rise (District 05)

Developer: Dover Rise Ltd.

Lease: 99-years

Completion: 2000

Number of units: 618

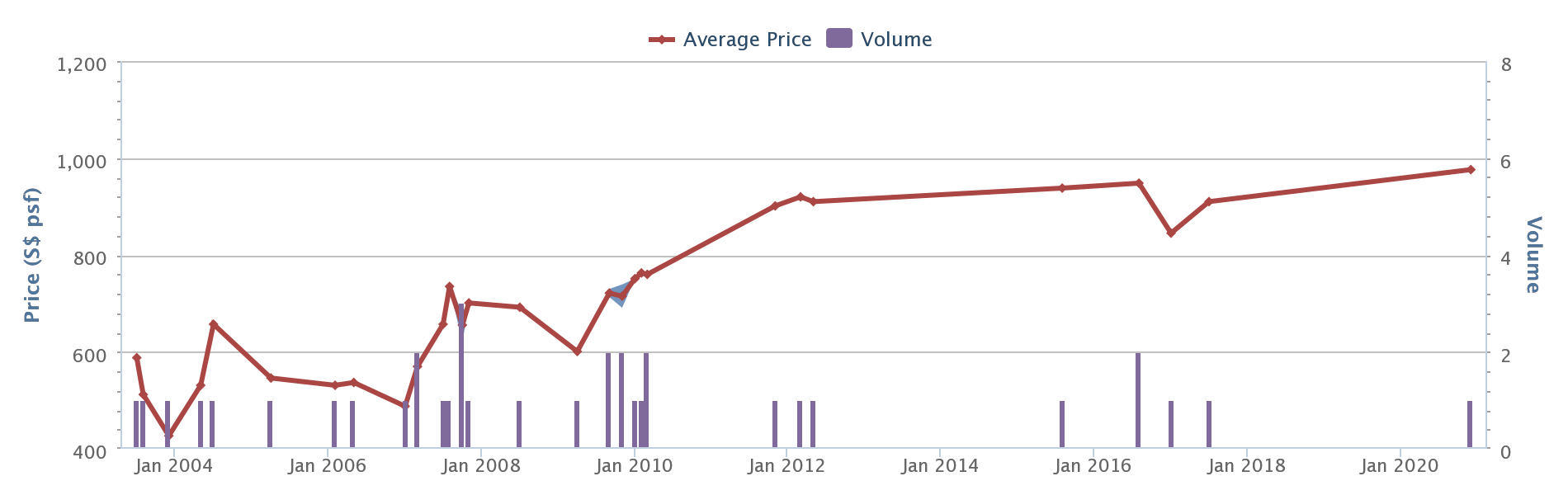

Square Foot Research indicates a price range of $1,099 to $1,243 psf, with an average price of $1,179 psf. To date, there have been 502 profitable transactions, and 113 unprofitable transactions.

The indicative rental range is $2.52 to $4.61 psf, with an average of $3.29 psf.

Key highlights:

Heritage View is quite close to Dover Parkview (see above), so the location has the same general benefits. However, Heritage View is slightly closer to One-North, at 600 metres; this could shave down the walking time to about 11 minutes. Conversely, this makes it further from The Star Vista and Buona Vista (about 15 minutes’ walk).

Other than that, Heritage View and Dover Parkview are quite similar, even in terms of age; they’re only three years apart. Choosing between them will come down to individual unit differences.

3. One-North Residences

| Average Price | Average Rental | Est. Gross Yield |

| $1,174,657 | $33,793 | 2.88% |

Location: One-North Gateway (District 05)

Developer: Vista Development Pte. Ltd.

Lease: 99-years

Completion: 2009

Number of units: 405

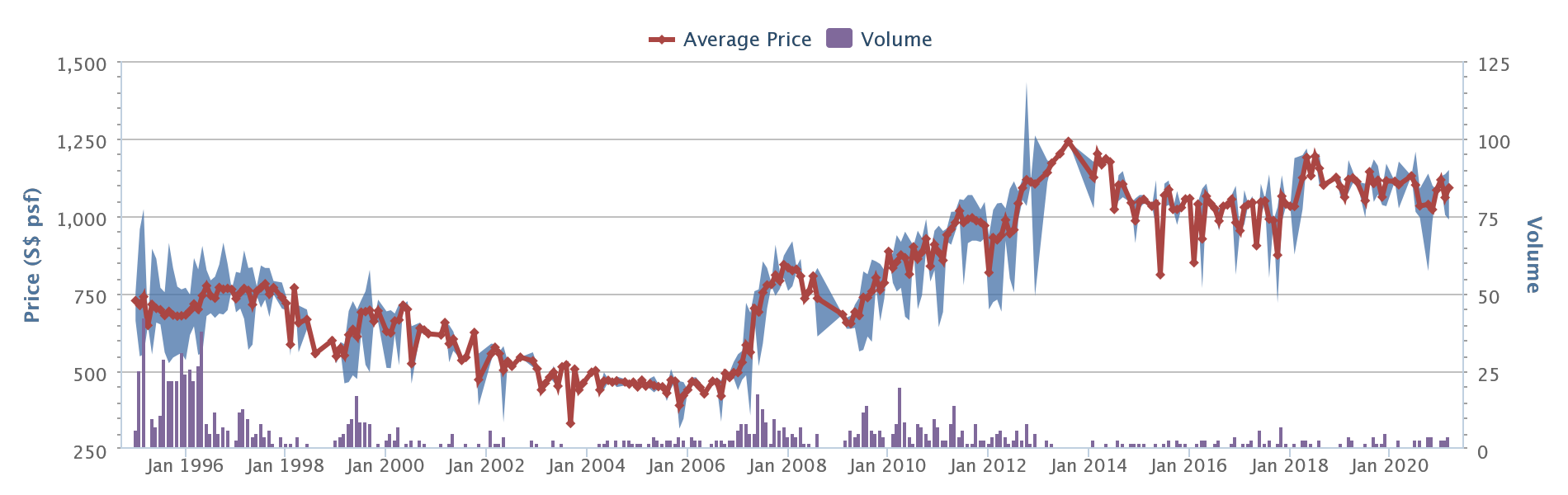

Square Foot Research indicates a price range of $1,124 to $1,520 psf, with an average price of $1,399 psf. To date, there have been 330 profitable transactions, and 29 unprofitable transactions.

The indicative rental range is $2.52 to $6.36 psf, with an average of $4.29 psf.

Key highlights:

One-North Residences will shortly be challenged as a prime rental property. Since its completion in 2009 it’s been the leading choice among tenants, as there were few other options. However, the recent launch of Normanton Park, as well as smaller condos like One-North Eden, now provide more alternatives.

That said, One-North Residences is still one of the best located condos for those who work in the area. It’s just 390 metres, or about a six-minute walk, to Fusionopolis and the One-North MRT station (Fusionopolis doesn’t have much retail, but it’s loaded with eateries and has a Cold Storage and Guardian).

There’s high rentability in this property and it’s well-priced for what it offers; just be aware that fresh competition is moving in.

There are more office hubs, which we’ll cover in time

You can follow us on Stacked, as we track more top-yielding condos near offices. In the meantime, do remember to buy rental properties only if you’re sufficiently capitalised; the three-year Sellers Stamp Duty (SSD) period means you should be prepared to sell only in the fourth year at the earliest. If you’re uncertain, contact us directly so we can help.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Picks

Property Picks Where to Find Singapore’s Oldest HDB Flats (And What They Cost In 2025)

Property Picks Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025

Latest Posts

Pro Where HDB Flats Continue to Hold Value Despite Ageing Leases

Property Market Commentary What A Little-Noticed URA Rule Means For Future Neighbourhoods In Singapore

Editor's Pick We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Pro What Happens When a “Well-Priced” Condo Hits the Resale Market

Editor's Pick We Review The February 2026 BTO Launch Sites (Bukit Merah, Toa Payoh, Tampines, Sembawang)

Editor's Pick One Segment of the Singapore Property Market Is Still Climbing — Even as the Rest Slowed in 2025

Singapore Property News Why The Rising Number Of Property Agents In 2026 Doesn’t Tell The Full Story

New Launch Condo Analysis This New Dairy Farm Condo Starts From $998K — How the Pricing Compares

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

On The Market Here Are The Cheapest Newer 3-Bedroom Condos You Can Still Buy Under $1.7M

Editor's Pick Why Buying Or Refinancing Your Home Makes More Sense In 2026

New Launch Condo Reviews Narra Residences Review: A New Condo in Dairy Farm Priced Close To An EC From $1,930 PSF

Property Market Commentary Why Looking at Average HDB Prices No Longer Tells the Full Story: A New Series

Singapore Property News This Latest $962 PSF Land Bid May Push Dairy Farm Homes Past $2,300 PSF — Here’s Why

On The Market Orchard Road’s Most Unlikely $250 Million Property Is Finally Up for Sale — After 20 Years

Hi Ryan nice article here. It will be good if mcst fees are mention as it will directly impact nett yield. Some condos may have high rental rates but comes with high mcst fees which equates to much lower yield than lower rental rates condo.