11 Proposed Developer Changes To Help Homebuyers: A Breakdown + How It Affects You

January 12, 2022

URA is proposing some amendments to the venerable Housing Developers Rules. This set of laws covers a whole range of topics, from the way properties, are marketed, to the way you book a new launch unit. We will be going through each of the proposals and how they will affect you as a buyer, should they come into play:

Note on public consultation

The following amendments are only being proposed, they’re not implemented yet. From now till 5th February, the public is invited to give feedback on these, on the URA website.

Proposed rules changes

Some of the most notable proposals are:

- Obtaining approval for some exterior features, before advertising them

- Definitive TOP or CSC date when available

- Disclosure on some BCA certifications and track record

- Storey layout plans as well as floor plans

- Additional floor plan information

- Scaled floor plans for landed units

- Disclosure of reversionary owner, when carving leasehold land out of freehold

- Simplified Progressive Payment Scheme

- Later commencement of DLP and maintenance fees

- Reduced requirements for shortfall claims

- Buyer compliance required for some changes after OTP, and enhanced refunds

1. Obtaining approval for some exterior features, before advertising them

Some of the exterior features include landscaped areas, pick-up and drop-off points, and water features. Developers must also indicate the placement of refuse chutes and chambers, water tanks, power generators, pedestrian side-entrances, etc.

You may notice that some developers omit these in earlier marketing brochures, as they may not be certain of the exact placement yet. It’s also possible, under the current system, that the placement of these features may not match the brochures – this usually happens when the developer has to change its plans, to accommodate building regulations.

Under the proposed change, developers must obtain permission for these external features first, before using them in advertisements.

Significance to buyers:

This is especially helpful if you’re considering a ground-floor or lower-floor unit.

Under the current system, lower-floor units do carry a bit more risk, if the layout gets shuffled. For example, if you’re on the ground floor unit, and an unexpected side entrance gets placed near your home, you may experience some loss of privacy.

Overall, this is a change that would make it easier to pick the best stack and provide more assurance.

2. Definitive TOP or CSC date when available

Even when a development is completed, developers right now may not display the exact Temporary Occupancy Permit (TOP) or Certificate of Statutory Completion (CSC) date. The proposed change is for developers to show the date once they have it.

Significance to buyers:

This is a boon to buyers faced with complex transaction timelines, such as HDB upgraders. They’ll appreciate knowing exactly when they can move in. That said, if you have a good property agent, they’ll probably have checked to let you know already.

3. Disclosure on some BCA certifications and track record

The most notable certification here is the Construction Quality Assessment System (CONQUAS). This is a national-level certification for quality of building, and is ranked from A to F; the same way as a school grading system. You can see the full details of this on the BCA website.

Developers will also show their Quality Mark and Green Mark certifications. These amount to voluntary disclosures for workmanship and sustainability (not that developers need much prompting to show these off anyway!)

Besides these, developers will also have to show their track record for the past five years.

Significance to buyers:

Most major property developers are eager to show these off anyway; and it’s almost expected that they get an A.

Buyers do benefit, however, because you’ll know if you’re dealing with a new or inexperienced developer (e.g., a boutique developer that hasn’t put up many projects in the past five years). As such, many realtors opined that small developers, with boutique projects, may look worse in comparison.

4. Storey layout plans as well as floor plans

While site layouts and unit floor plans are already the norm, we don’t currently have layouts for individual floors.

The new change will show the location of lifts, refuse chutes, service ducts, utility rooms, etc. on the same floor as your unit. This will have to be disclosed to buyers, before they book a unit.

Significance to buyers:

This will resolve a longstanding issue, where buyers complain that common corridors are narrower than expected; or that they have less exterior space because a utility room/emergency staircase is right next to them.

5. Additional floor plan information

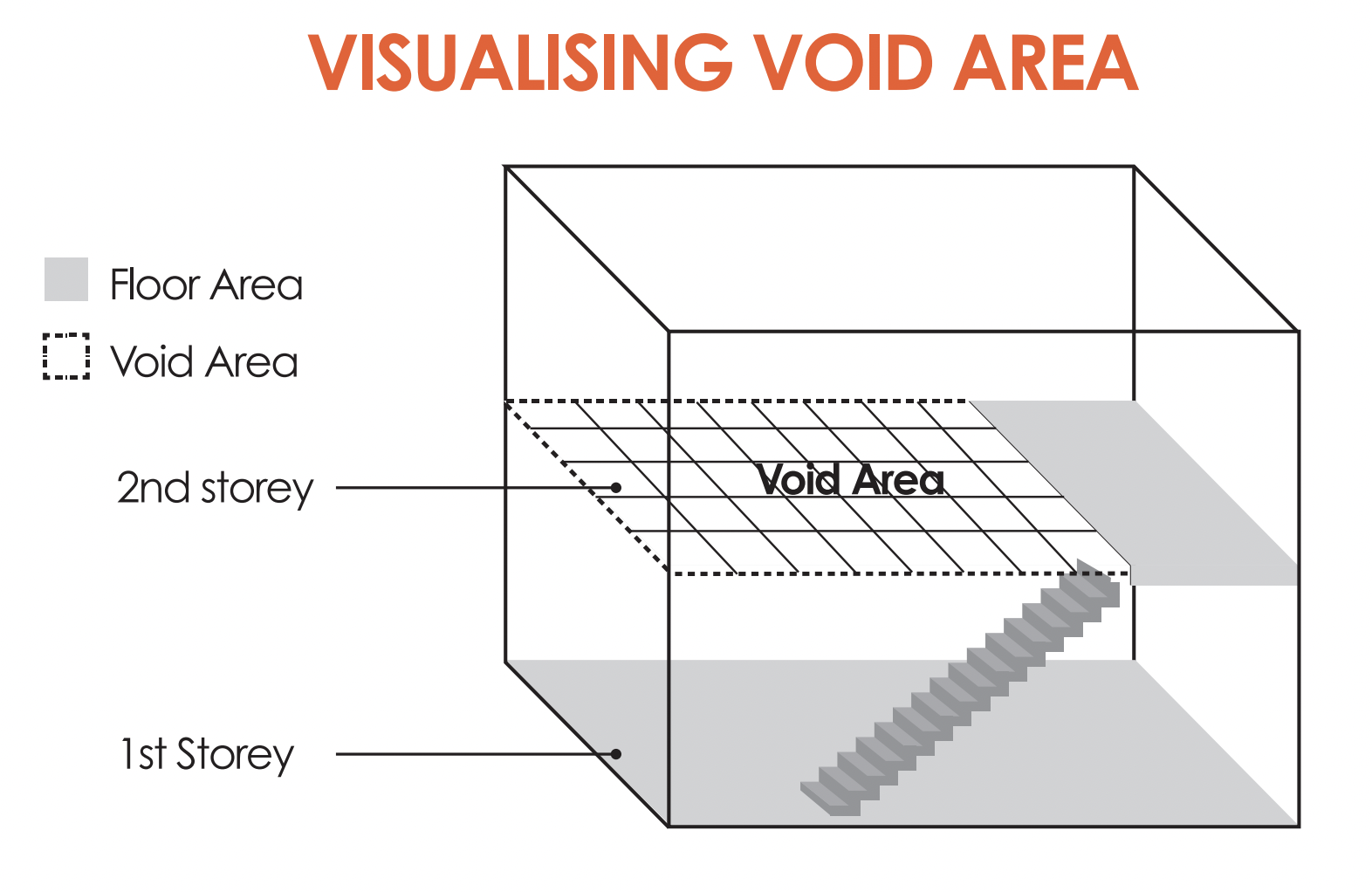

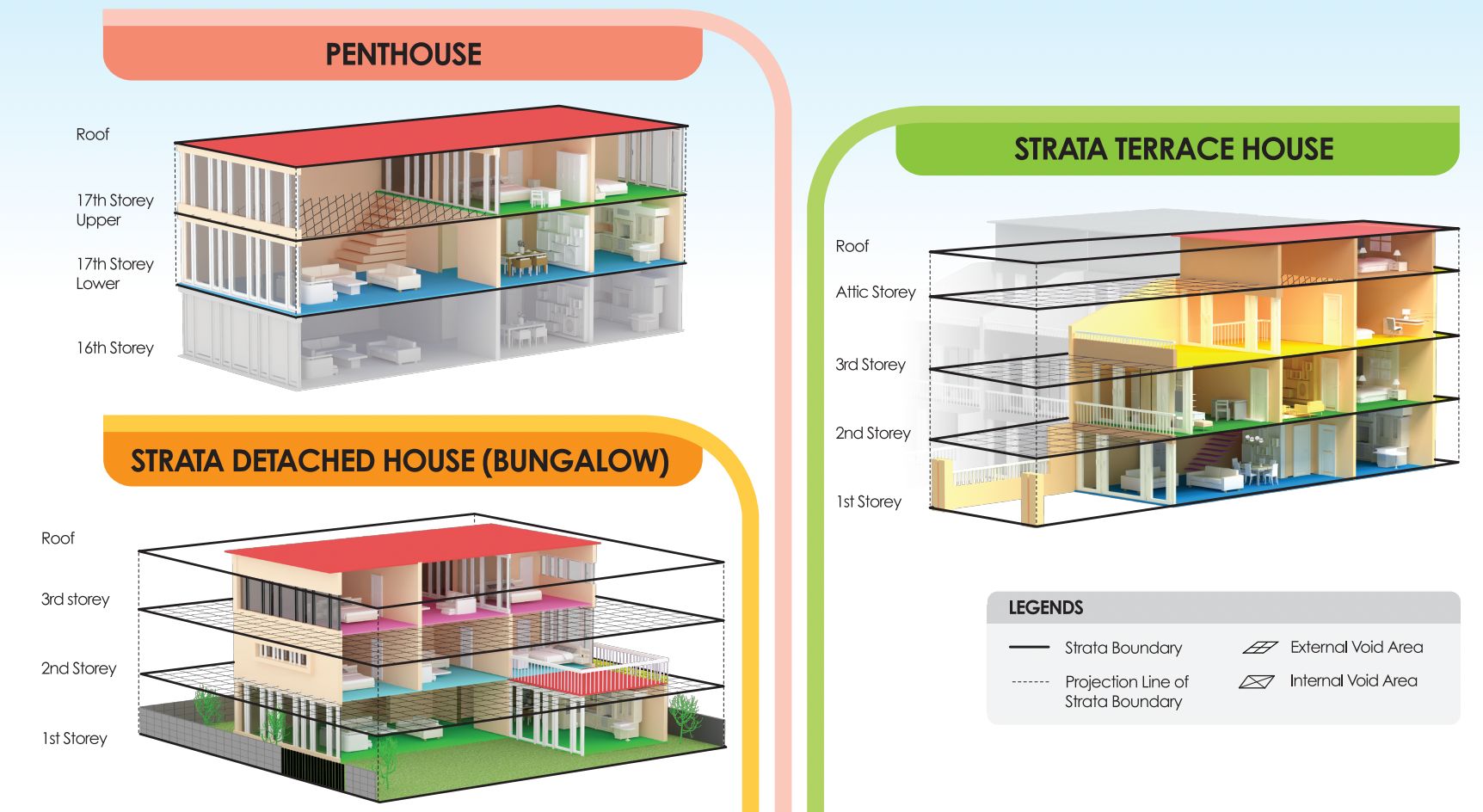

Developers will be required to mark and label void areas in the unit. We previously covered the significance of this, with regard to strata void spaces (i.e., the space between the floor and the ceiling, for which buyers can be charged).

Developers will also have to state the location and number of air-con units, on each air-con ledge.

The types of walls (load-bearing or non-load bearing), types of doors (swing or slide), service pipes, and refuse chutes must all be indicated as well; and developers must note which areas are excluded from the square footage.

Significance to buyers:

This helps to ensure you don’t waste money on void spaces, or huge air-con ledges, or at least, are aware of what you are paying for before you make the commitment.

That aside, it’s a significant help when considering renovations. You will, for example, know exactly which walls can be hacked and which ones can’t; and your interior designer/contractor will probably have an easier time drawing up plans.

6. Scaled floor plans for landed units

This is similar to point 5 above, but it also extends to landed properties. There will have to be plans for each floor, with information on types of walls, doors, placement of refuse chutes, etc. (as in point 5 above).

Significance to buyers:

Realtors told us that many landed developers, in recent years, already provide such scaled plans of their own volition; buyers tend to demand it anyway. Other than that, this will help landed property buyers the same way as in point 5 (you can better visualise renovations and possible themes).

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

We Downgraded From A 5 Bedroom Landed Home To An HDB: Here’s Why I Was Happier Than Ever

Sometimes, life’s unexpected turns require us to surrender certain luxuries; but sometimes, those luxuries aren’t all that great in hindsight.…

7. Disclosure of reversionary owner, when carving leasehold land out of freehold

It’s possible for a 99-year leasehold property to be sitting on land that’s freehold (or on a 999-year lease). In this case, the owner of the actual land – called the reversionary owner – effectively “rents out” part or all of the land plot for 99-years.

Note that in some cases, home buyers also have to pay “ground rent” to the reversionary owner; although this is quite rare.

Buyers of the property don’t get to know the identity of the reversionary owner, or much about the nature of the deal with the developers; not unless it’s voluntarily disclosed. Under the new rules, these details will be known.

Significance to buyers:

This is significant because it impacts en-bloc potential. If the reversionary owner is another property developer, for example, there’s a real risk they may not want to renew the 99-year lease for an en-bloc sale; the reversionary owner may have plans to develop a condo of their own.

In general, leasehold land carved out of freehold land is disadvantageous, compared to “normal” leasehold properties. It’s good that home buyers are made more aware of this (check the OTP, it should describe such arrangements). We won’t be surprised that there are some owners out there who have bought a property with hopes of an en-bloc sale in the future, not knowing that the property is actually “rented out” on a 99-year lease instead.

8. Simplified Progressive Payment Scheme

The old Progressive Payment Scheme (PPS) is described here.

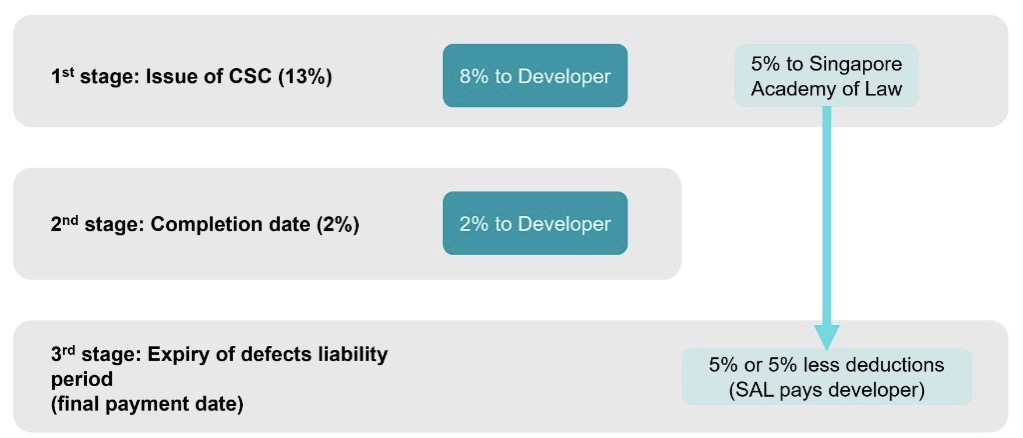

URA is proposing a simplified version that changes the payment of the final 15 per cent (The rest of the PPS is unchanged):

So instead of paying 15 per cent upon CSC, home buyers will instead pay 13 per cent: eight per cent to developers, and five per cent held by the Singapore Academy of Law (SAL)

Upon full completion, homebuyers pay the final two per cent.

After the end of the Defects Liability Period (DLP), the time in which developers are obliged to fix defects at their cost, money held by SAL is disbursed to developers, minus any deductions for defects.

Significance to buyers:

This helps a bit in financial planning, as you’ll know when your loan repayments are about to rise (the bank will handle disbursements to the developer – you’ll just get a letter telling stating your home loan repayments are about to rise accordingly).

Previously, the payment for the final 15 per cent was variable, depending on whether the completion date or CSC would occur first.

9. Later commencement of DLP and maintenance fees

The Defects Liability Period (DLP) is usually 12 months, during which the developer must fix defects at cost. This currently begins right after the date of vacant possession, or the 15th day after the notice of TOP payment (whichever comes first). The same applies to the start of maintenance fees.

Under the proposed change, the 15-day rule will be extended to 35 days.

Significance to buyers:

This is fairer to home buyers, as you have only 14 days to pay after the notice of TOP payment; but the developer has 21 days to hand over the unit. Under the current rules, this would mean the DLP and maintenance fees start before you actually get the keys.

The extension also gives you more time to check the unit for defects.

10. Reduced requirements for shortfall claims

A shortfall claim happens when your unit turns out to be smaller than the developer stated.

To make such a claim, your unit must be at least three per cent smaller than the area stated in the Sale & Purchase Agreement. Under the new rule, this will be reduced to two per cent.

Significance to buyers:

It’s been a long time since we’ve heard of any buyers making shortfall claims. Developers today are very careful in their documentation and are unlikely to make such mistakes.

Nonetheless, it’s added assurance that you won’t be cheated out of precious space (remember: one square foot could be costing you around $1,500).

11. Buyer compliance is required for some changes after OTP, and enhanced refunds

If the developer wants to change the unit’s floor plan, or make any changes to the site layout (e.g., repositioning a common facility like the gym), the new rule would require the buyers’ consent.

The only exception is if there are new building rules that emerge after the OTP, which mandate the changes.

In the event that developers have to make refunds, developers may be required to refund interest paid on loans, loan cancellation fees, and legal fees if a transaction is annulled (capped at 15 per cent of the purchase price, on top of refunding the usual instalment payments and stamp duties).

Significance to buyers:

Most developers don’t make big changes after buyers have signed the OTP anyway, as buyers have recourse to the authorities even now. Most realtors we asked couldn’t come up with a single example of changed floor plans, repositioned facilities, etc. after the OTP.

So rule or no rule, we’re sure developers are acutely aware of the risks of being sued, should they make drastic last-minute changes.

We see this proposal as more of a way to maintain the current high standards, rather than as a way to rectify any specific issue.

Don’t forget to submit your feedback to URA if you have any opinions, and let us know what you think as well. For more updates on this, follow us on Stacked. We also provide in-depth reviews of new and resale condos alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the proposed changes to how exterior features are approved before marketing a property?

How will the new rules affect the disclosure of project completion dates?

What information about developers will now be disclosed to buyers?

How will the new rules improve transparency about property layouts?

What is the significance of disclosing reversionary owners in leasehold properties?

How do the proposed changes impact the payment schedule and defect liability period for new homes?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

2 Comments

I think it is great that the government is stepping in to increase transparency. Even though we may have a showroom to walk through today, the extensive ID touches still makes it hard to visualise the actual space we will eventually be receiving.

However I also worry about the developers ever shrinking margins with the latest ABSD updates coupled with the sky high commissions they have been giving to Agents. If developers eventually resort to cutting corners to maintain their profit margins, the new owners will be the ones left with the short straw.