Could Your East-Side Condo Be Worth More Now? Singapore Just Raised Height Limits Near Changi

August 17, 2025

If you live near the airport, congratulations: your condo might have just become more interesting to developers.

The Civil Aviation Authority of Singapore (CAAS) recently raised building height limits near airports, allowing residential projects to go up to 15 storeys higher than before. For industrial and commercial projects, the cap rises by nine storeys. It isn’t entirely a homegrown move though – this is due to the International Civil Aviation Organization (ICAO) revising its rules, for the first time since around the 1950s.

As you might expect, half a century of advancement in air travel has dramatically improved navigation and safety. For reference, back when the current set of rules was devised, we thought it was okay to smoke on planes, have stewardesses carve steaks with sharp knives, and safety measures were positive thinking.

So it was time for a change, and Singapore did chair the task force that pushed some changes through.

This is good news for many east-side condos near the airport

If you’re sitting in an older condo near Changi, your en bloc prospects just got brighter.

Many east-side developments – think parts of Tampines, Loyang, and Upper Changi – were previously hampered by low height limits. That lowered developer interest, since lower height limits meant fewer units. When an en-bloc did happen in affected areas, it was mainly for boutique or small condos, on equally small plots.

Take Loyang Valley, for example. This 1980s leasehold project has been attempting an en-bloc sale for some time now, and one of the elements to improve its attraction is an easing of height restrictions. Till now, it seemed that any redevelopment would yield too few units to justify the asking price. The project has tried collective sales more than once, and just this year, it made a third attempt, lowering its reserve price to S$880 million. The timing wasn’t coincidental: with airspace limits finally being loosened, what was once “never going to happen” suddenly seems quite viable.

And Loyang isn’t alone. Low-rise clusters in Bedok, Simei, and Pasir Ris, where many old condos are trapped under height restrictions, may now be back in the redevelopment conversation.

But before anyone celebrates, let’s remember: taller doesn’t solve every issue.

Aircraft noise doesn’t vanish just because you’re 15 floors higher; in fact, some might argue it gets louder. Infrastructure is another constraint: for many decades, these were areas meant to handle lighter population densities – so some of these areas (such as the area around Loyang Valley) may be light on amenities like bigger malls and public transport.

Developers will also factor these into their considerations. In fact, from word on the ground, developers are more concerned about issues like school access and the presence of upgraders (or right-sizers from landed homes) being in the area; these make up the main pool of buyers. Right now, some areas near the airport, from Upper Changi to Loyang, still lack some of these traits.

As for adding to our housing supply, not all land near the airport is zoned for private residential redevelopment. Much of it is still state land, so it’s mainly the government that will be the main beneficiary of higher height allowances. Big condos may now be plausible in those areas, but we still need to wait for URA zoning to make it all happen.

There’s also still some mystery here as to which condos are going to benefit. It’s not yet clear which projects were, or still are, restricted by aviation height limits. The updated framework will presumably introduce new standards; but until the URA and CAAS spell out precise details, we can’t be certain which developments stand to benefit.

More from Stacked

New Condos That Saw Prices Fall Soon After Completion: What Went Wrong?

We all say we want a running start to our home values; but we don’t mean a running start off…

It’s good news overall, but I’d temper my enthusiasm.

There’s still a perception that projects near the airport are more for renting to aviation workers, and some spots are considered to be very “kampung” in feel. Carissa Court, Changi Court, and Azalea Park all come to mind here, and developers who move into this area will need a big marketing push to shift those perceptions (although the freehold Kassia did manage to sell 52 per cent of its 276 units on launch weekend).

For investors, though, this now makes some older condos, as well as the land parcels near the airport, worth watching. The odds of a few en-bloc events here have improved, even if they’re still far from guaranteed.

Meanwhile, in other property news:

- What’s the ideal size of a kitchen? A bedroom? A living room? We’ve got you covered on this, so you can work out the right sizes for each part of your home.

- Comparing condo prices is both an art and a science; but start with avoiding these common mistakes.

- Everyone seems to want to buy a property in Malaysia these days; but look out for these issues before you go ahead.

- Check out our review of new launch Springleaf Residence, one of the most affordable projects near an MRT station in 2025.

- Can a boutique condo in District 15 still perform? Here’s a deep dive for Stacked Pro readers, that looks at several thousand transactions over 10 years.

Weekly Sales Roundup (04 – 10 August)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| TERRA HILL | $5,250,000 | 1894 | $2,771 | FH |

| TEMBUSU GRAND | $4,136,000 | 1711 | $2,417 | 99 yrs (2022) |

| NAVA GROVE | $3,938,600 | 1550 | $2,541 | 99 yrs (2024) |

| THE CONTINUUM | $3,853,000 | 1270 | $3,033 | FH |

| THE LAKEGARDEN RESIDENCES | $3,601,600 | 1550 | $2,324 | 99 yrs (2023) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CANBERRA CRESCENT RESIDENCES | $1,106,100 | 570 | $1,939 | 99 years |

| RIVER GREEN | $1,253,000 | 420 | $2,985 | 99 years |

| ONE MARINA GARDENS | $1,257,768 | 431 | $2,921 | 99 yrs (2023) |

| THE COLLECTIVE AT ONE SOPHIA | $1,278,000 | 452 | $2,827 | 99 yrs (2023) |

| LENTOR HILLS RESIDENCES | $1,280,000 | 581 | $2,202 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SCOTTS HIGHPARK | $7,400,000 | 3466 | $2,135 | FH |

| THE LADYHILL | $6,800,000 | 2325 | $2,925 | FH |

| ST REGIS RESIDENCES SINGAPORE | $5,382,500 | 2153 | $2,500 | FH |

| THE INTERLACE | $5,180,000 | 3154 | $1,642 | 999 yrs (1995) |

| THE TRIZON | $4,700,000 | 2185 | $2,151 | 99 yrs (2009) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PARC ROSEWOOD | $663,000 | 431 | $1,540 | 99 yrs (2011) |

| VIVA VISTA | $705,000 | 377 | $1,871 | FH |

| NEWEST | $745,000 | 463 | $1,610 | 956 yrs (1928) |

| THE WISTERIA | $745,888 | 441 | $1,690 | 99 yrs (2015) |

| THE AXIS | $755,000 | 398 | $1,896 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| GALLOP GABLES | $4,108,000 | 1744 | $2,356 | $2,868,000 | 20 Years |

| MAPLE WOODS | $3,258,000 | 1539 | $2,117 | $2,257,650 | 27 Years |

| CLEMENTI PARK | $3,120,000 | 2271 | $1,374 | $2,220,000 | 21 Years |

| THE METROPOLITAN CONDOMINIUM | $3,368,000 | 1744 | $1,931 | $2,001,800 | 19 Years |

| VALLEY PARK | $3,038,000 | 1356 | $2,240 | $1,948,000 | 30 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| TURQUOISE | $3,100,000 | 2088 | $1,485 | -$2,357,270 | 18 Years |

| EON SHENTON | $1,160,000 | 538 | $2,155 | -$291,000 | 13 Years |

| CONCOURSE SKYLINE | $2,320,000 | 1119 | $2,072 | -$140,000 | 5 Years |

| THE CREST | $2,358,000 | 1324 | $1,781 | -$68,000 | 8 Years |

| THE ORIENT | $1,350,000 | 721 | $1,872 | -$44,200 | 8 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| CLEMENTI PARK | $3,120,000 | 2271 | $1,374 | 246.7% | 21 Years |

| HERITAGE VIEW | $2,280,000 | 1313 | $1,736 | 239.3% | 27 Years |

| DORMER PARK | $2,650,000 | 1249 | $2,122 | 235.4% | 21 Years |

| GALLOP GABLES | $4,108,000 | 1744 | $2,356 | 231.3% | 20 Years |

| MAPLE WOODS | $3,258,000 | 1539 | $2,117 | 225.7% | 27 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| TURQUOISE | $3,100,000 | 2088 | $1,485 | -43.2% | 18 Years |

| EON SHENTON | $1,160,000 | 538 | $2,155 | -20.1% | 13 Years |

| CONCOURSE SKYLINE | $2,320,000 | 1119 | $2,072 | -5.7% | 5 Years |

| 18 WOODSVILLE | $895,000 | 495 | $1,808 | -3.6% | 13 Years |

| THE ORIENT | $1,350,000 | 721 | $1,872 | -3.2% | 8 Years |

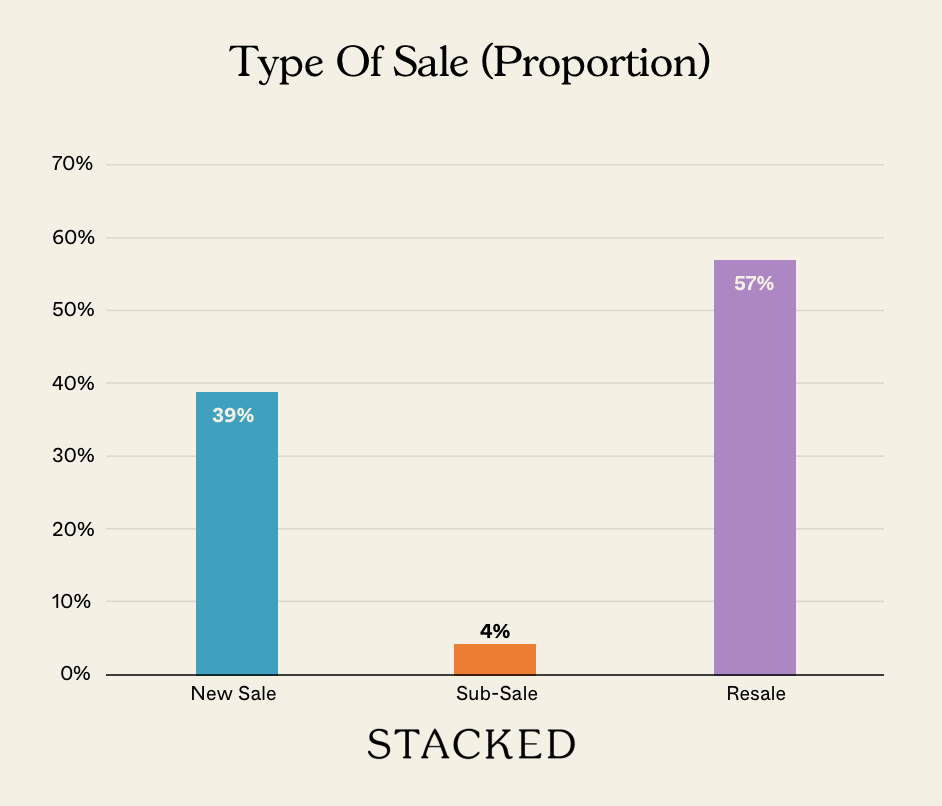

Transaction Breakdown

Follow us on Stacked for the news and insights into Singapore’s property scene.

Featured Image: Photo by Shawn on Unsplash

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How has Singapore's new height limit policy near Changi Airport affected condo development?

Which areas near Changi Airport might benefit from the increased height limits?

Will taller buildings near the airport eliminate aircraft noise concerns?

Are all land near the airport now available for private residential development?

What should residents near Changi Airport consider before expecting redevelopment?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Singapore Property News You Can Now Buy Part Of A $300M Singapore Bungalow — But You Can’t Live In It

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Latest Posts

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

0 Comments