Selling your home? Here’s why you should never price your home too high

December 19, 2017

When it comes to any kind of transaction, price is often the most important thing that you will have to consider. Many books and courses have been created just to teach people about how to price goods and services. In fact, poorly thought out price strategies can be a huge detriment to any business. This absolutely applies to your own home as well! If you are serious about selling your home, consider this: If you were buying a property and there are many listings for sale at a particular location. What would attract you to click on a listing? A higher price than normal? Or a lower price than the average?

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

So why should I not price my home too high?

It is only human nature to want to sell your home for as high as you possibly can. Many sellers assume that they should start with a high price, as they can always lower it if they do not get the right offers. This is also influenced by the agent pamphlets that are placed in your letterbox, where they advertise attractive prices that neighbouring units have been sold at. One way to counter this is to check recent sale prices on URA for private property and HDB for public housing.

Buyers might not get to see your listing

Usually when buyers are shopping around for a home, they will have a certain budget that they are looking at. Let’s say that a particular buyer has a budget of $500,000. You happen to value your home at that price but decide to value it higher at $550,000 to allow yourself room for negotiation.

However, this often backfires because of the way people search for homes. Most buyers would think of only searching up to a maximum of their budget. So, by pricing your home higher, many buyers might never come across your listing because it is out of their price range.

Time on the market

Another issue for you as the seller is the length of time your home has been on the market. Again, let’s use the earlier example of your home price being overpriced at $550,000. You decide that you can easily lower your price at any time. So after holding out for a month and having received no offers or enquiries you decide to lower your price to $500,000. In this time, you have been missing out on buyers that have found homes that were priced appropriately.

Property AdviceSell HDB buy Condo: Can you actually upgrade to a CONDO and have a SECOND PROPERTY?

by Ryan OngNow those buyers that have their budget set to $500,000 are able to see your listing. However, during this time, there have been new properties that have come on board and have had viewings or been sold. So when buyers see your property they will probably wonder whether there are any issues with it. It seems to be of good value, so how come it has not been sold yet? The problem for you is buyers may not have seen that the price has been adjusted, and will automatically stay away because they assume there are unseen problems.

So why does listing for a lower price help?

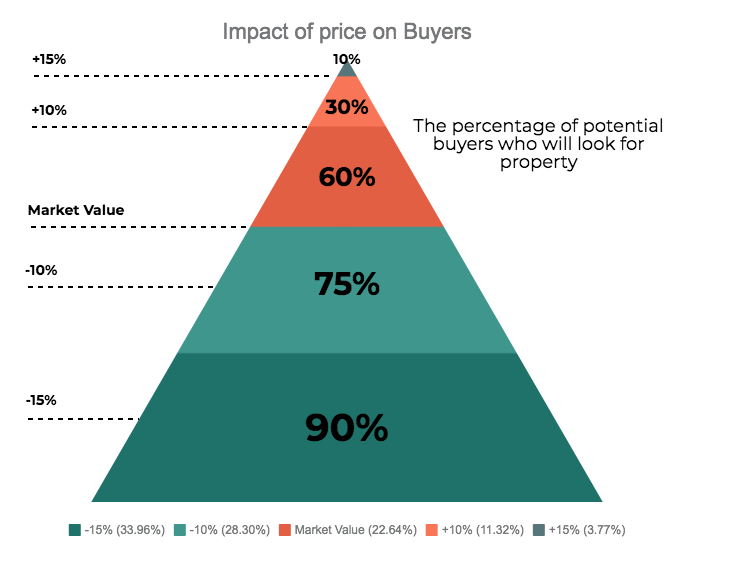

Now, if you had listed it at a lower price from the beginning there would have been more people viewing your listing. More people viewing means more enquiries and more offers that would eventually drive up the price to what is considered market value. So the reality is there is little danger to pricing your home at a lower price.

True value of your home

The bottom line here is that you can get overly attached to your home. You might have very fond memories of your time there and this can often artificially inflate how you would price your home. The hard truth is that it really does not matter how much you think the value of your home is. The only person whose view matters is the buyer that is interested in your home. Most buyers are not out there to try and lowball and might feel that an offer too low is insulting. If you do happen to be working with agents as well most experienced agents would not want to work with an overpriced listing because more often than not, the seller will tend to have unrealistic expectations. They would very much rather work with sellers that want to sell quickly and are reasonable.

As always, feel free to comment or if you have any questions you can always reach us at stories@stackedhomes.com. If you want to find out more about how to get the best price for your home you can do so here!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Druce Teo

Druce is one of the co-founders at the Stacked Editorial. He was first interested in property since university but never had any aspiration to become an agent, so this is probably the next best thing.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

0 Comments