Biggest Winners And Losers Of The Latest Cooling Measures In 2022: How Does This Affect You?

October 10, 2022

With tighter loan limits and a 15-month wait for some for resale flats, the latest round of cooling measures is poised to shake up the property market. In these volatile and uncertain times, we’d say the changes are prudent – and simple enough that they won’t overly panic the market. Still though, with every set of cooling measures, some people bear more of the brunt than others. Here’s a quick update on that:

Table Of Contents

- Winners of the latest round of cooling measures

- 1. Home buyers in the resale flat market

- 2. Right-sizers who are seniors

- 3. Sellers of smaller HDB flats

- 4. Sellers of smaller condo units

- Losers of the latest round of cooling measures

- 1. Those who can’t qualify for HDB loans

- 2. Some borrowers who are refinancing after a long period

- 3. Those who just sold their private property and are now in a jam

Winners of the latest round of cooling measures

- Home buyers in the resale flat market

- Right-sizers who are seniors

- Sellers of smaller HDB flats

- Sellers of smaller condo units

1. Home buyers in the resale flat market

The 15-month wait-out period is specifically aimed at helping this group of buyers, so they come out as the top winners.

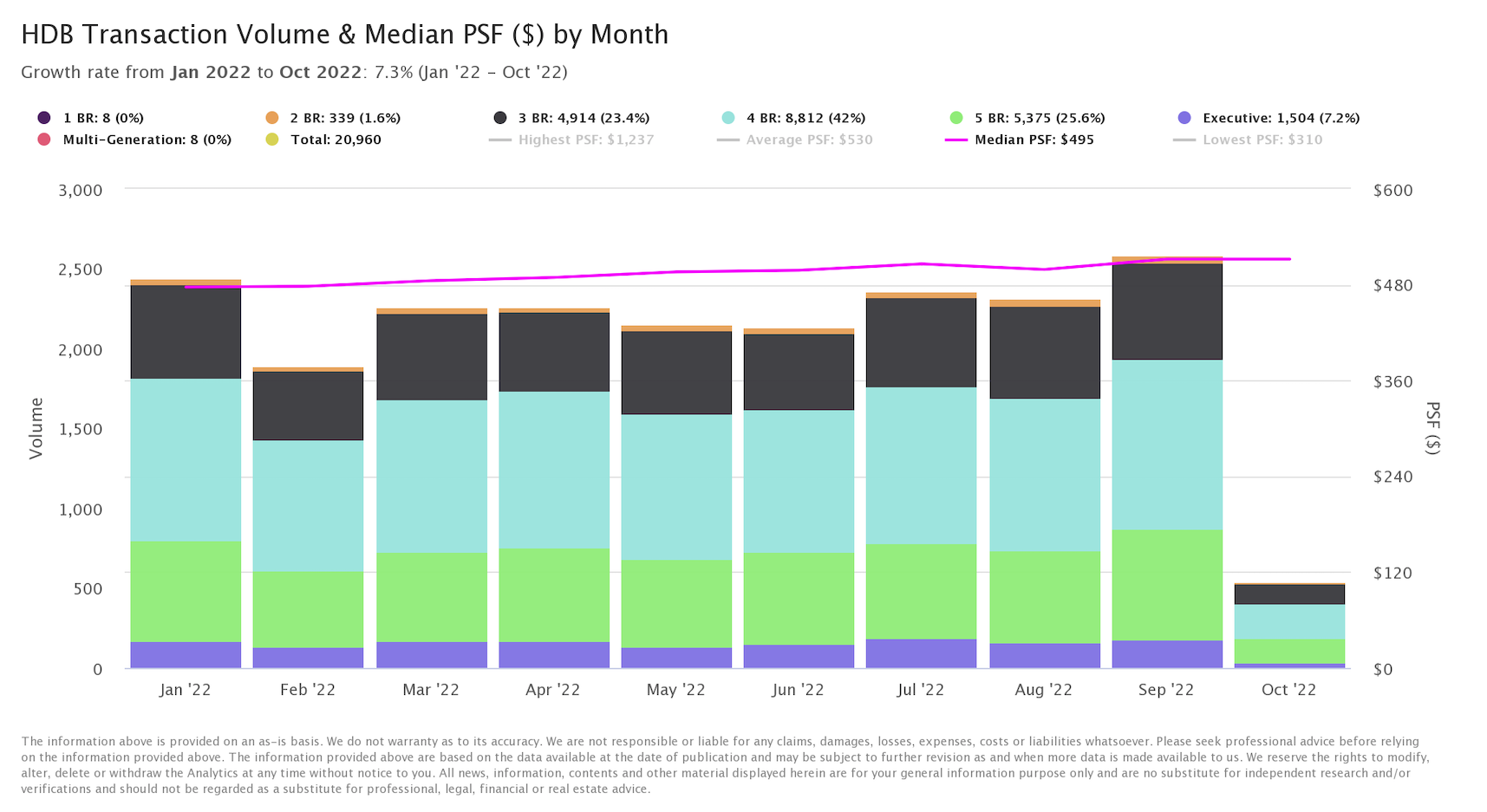

The rising number of million-dollar flats, as well as prices soaring to a median $512 psf islandwide, may be due to more than simple demand. This represents a 7.3 per cent increase from the start of the year.

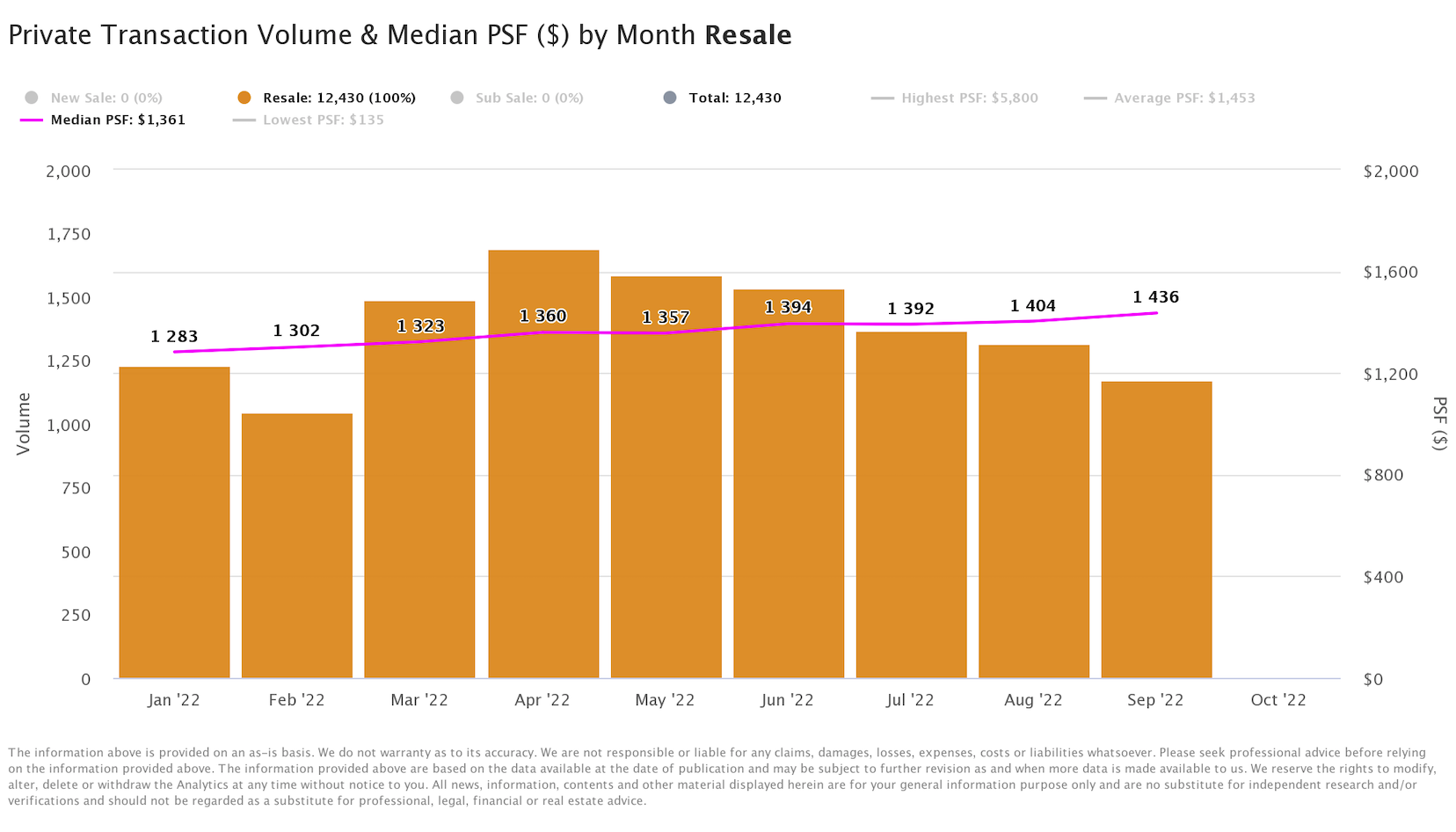

With private home prices at a peak, we may be witnessing the effects of buyers cashing out their private homes, and right-sizing to a resale flat to enjoy the profits. According to SRI research, the median for resale condo prices currently is at $1,436 psf island-wide (that’s an 11.9 per cent increase since Jan 2022). This is an all-time high, and the sale of even a 700 sq. ft. two-bedder (average of over $1.005 million) can cover the cost of practically any resale flat, even with Cash Over Valuation (COV). Condo owners who sell larger four or five-bedder units could potentially pay for their flat without even needing a loan (of course, as long as the home is fully paid up).

This particular demographic has caused issues for first-time home buyers who desperately need a resale flat, as well as for those families who cannot buy BTO units (e.g., the whole family consists of Permanent Residents).

Hopefully, for this group, the 15-month wait-out will make some difference, or at least slow the rate of price increases.

2. Right-sizers who are seniors

The 15-month wait-out for resale flats doesn’t apply if you’re aged 55 or older, and are buying a 4-room flat or smaller.

This is a nice boost for seniors who are right-sizing: not only are they spared the wait, they may see the prices of their new flats cool off a bit.

We do expect some savvy seniors to hold off on their right-sizing for a few months, as they’ll want to see if resale flat prices dip before they make their move.

3. Sellers of smaller HDB flats

There is no 15-month wait for seniors (55 years or older) buying 4-room flats or smaller, so sellers of these units may see a smaller reduction in the buyer pool. Unlike those who are selling 5-room flats, executive flats, maisonettes, etc., there shouldn’t be any shortage of buyers.

Another benefit is the tweak in Loan To Value (LTV) ratios and loan curbs. Buyers can now borrow only 80 per cent, instead of 85 per cent, of the flat’s price or valuation (whichever is lower).

Coupled with the higher floor rate for calculating MSR, some buyers may consider 4-room or smaller flats as being more affordable, with a lower cash outlay; and these flats may still be viable for family units, despite being smaller.

More from Stacked

We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Way back in 2012, Singapore saw its first-ever million-dollar HDB flat transaction: a rare a flat at 149 Mei Ling…

4. Sellers of smaller condo units

There is now a group of “stuck” home buyers, who sold their private property just before the new cooling measure was announced; and they’re now stuck as they can’t find a replacement resale flat.

Their options are either to rent (in the most expensive rental market in around six years), or to right-size into a smaller condo unit instead. This may be an attractive proposition for couples whose children have just moved out, and who don’t foresee themselves needing as much space in the future.

This could increase the buyer pool for smaller 700 to 800+ sq. ft. condo units, if right-sizers decide they can’t wait 15 months.

Singapore Property News“I’m Essentially Homeless For 15 Months Now”: New Cooling Measures Leaving Some Homeowners In A Difficult Situation

by Sean GohLosers of the latest round of cooling measures

- Those who can’t qualify for HDB loans

- Some borrowers who are refinancing after a long period

- Those who just sold their private property and are now in a jam

1. Those who can’t qualify for HDB loans

Not everyone buying an HDB property gets an HDB loan. Resale flats have no income ceiling, and some buyers with high incomes do get told to use private bank loans. Likewise, some properties, such as Executive Condominiums (ECs), have no HDB loans.

These buyers are purchasing HDB properties, and yet using bank loans. This means they need to pass both the MSR and TDSR, which have been tightened over more than one round of cooling measures.

Loan curbs aside, it also hurts to be locked out of HDB’s low 2.6 per cent interest rate right now.

2. Some borrowers who are refinancing after a long period

Given the soaring interest rates, it’s not surprising that many homeowners are eager to refinance into cheaper options (if they even exist right now).

Unfortunately, the 2021 cooling measures reduced the TDSR to 55 per cent, while the latest cooling measures rose the floor rate to four per cent.

Note that prior to the last two cooling measures, the TDSR was at 60 per cent, and the floor rate used to calculate TDSR was just 3.5 per cent.

This can result in some borrowers being in for a shock – they may find their loan applications being rejected, despite having qualified a few years back. For these homeowners, it’s time to seek the help of a mortgage broker.

3. Those who just sold their private property and are now in a jam

The buyers who are probably most infuriated right now are the ones who have sold their private property already, but haven’t yet bought a flat. Now they’re pretty much stuck renting or finding other temporary accommodation, unless they want to give up and buy a resale condo.

Unfortunately, there really is no other solution for this batch of home buyers; not unless HDB has any plans to show leniency in some cases. HDB has said that they have received about 450 appeals about the 15-month wait-out period, and may waive this for some on a case-by-case basis.

Just like how we had a reader in to us write about their situation, everyone has a different situation, and some genuine homebuyers are being left in a difficult situation right now.

For more news on the situation as it unfolds, follow us on Stacked. We’ll also provide you with in-depth reviews of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Who benefits most from the latest cooling measures in the property market?

How do the new cooling measures affect seniors looking to buy smaller flats?

Which groups are most negatively impacted by the recent cooling measures?

What challenges do homeowners refinancing their loans face with the new cooling rules?

What options do buyers who sold private property but can't buy a resale flat have now?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

2 Comments

Zero sympathy for these private home sellers, they can either buy a 1-2 bedder condo to right-size, or just pay 15 months of rent and give back their profits to the market.

Let the HDBs go to those who truly need them.

Likewise same thought process