Does Buying The Best Stack Always Mean The Highest Appreciation?

July 17, 2020

If you’ve ever bought a Mac before, you’d know that speccing one out can be a slippery slope to a big hole in your wallet.

32gb ram? Check.

2TB SSD hard drive? Check.

Final price? $6,549 SGD.

The only consolation is – you can kinda recoup back a part of it when you eventually sell it on the second hand market.

And it’s rather straightforward too. A highly specced mac will always command a better resale price than a stock, bare bones unit.

It’s the same story for most consumer products – cars included.

So naturally, most people would think the same principles apply to property.

The best and most premium stack should attain the better price in the resale market, right?

Well, what if I tell you that this doesn’t always happen in reality – would you be surprised?

Let me show you an example.

Commonwealth Towers New Launch Premium Gap

Commonwealth Towers is a relatively new condo located just opposite Queenstown MRT that was launched in 2014.

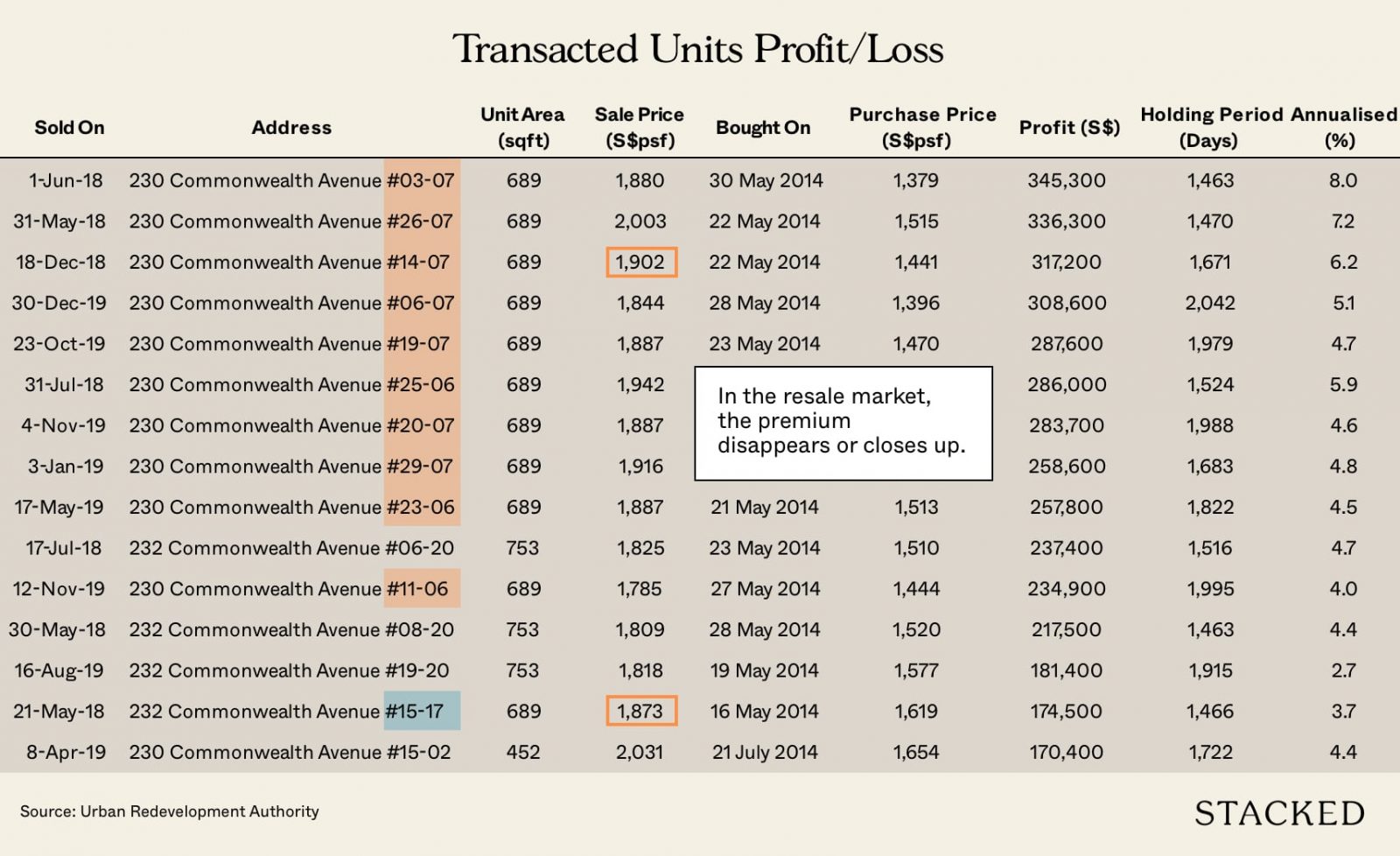

For a fairer comparison, I will have to take into account a similar purchase period, floor level, and unit size as well.

Now, look closely at the buy-in price difference during the new launch phase for a similar floor level, but different facing.

As you can see from the launch prices, Stack 17 was seen to be the premium stack, and was consistently registering higher $psf prices as compared to Stack 07 ($1,619 vs $1,442 psf).

But see what happens to these same two stacks in comparison when it hits the secondary market – the gap that one would have paid for a premium is gone.

It’s not just a higher profit overall ($317,200 vs $174,500), the cheaper unit actually achieved an even higher psf upon sale ($1,902 vs $1,873).

Some people may say it could be down to a higher level of renovation, but at a unit size of only 689 sqft – it is tough to see how one would be paying a $142,700 premium just for that.

In any case, let’s look at another example.

High Park Residences New Launch Premium Gap

Here’s one at High Park Residences, a new condo that recently was completed in 2019 in Sengkang.

Looking at almost the same purchase dates in July 2015, units on a low floor at Stack 57 were sold at a higher premium of $952 psf.

In contrast, a similar low floor unit at Stack 6 facing Fernvale Road was sold at $906 psf.

Now, see what happens when both units were sold on the secondary market?

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

In our previous analysis of HDB flats and lease decay, we found that some flats are unusually resistant to the…

The premium gap that was originally there has now been eradicated, and both units were sold for the same $1,090 psf.

Now for our third and last example – Archipelago.

Archipelago New Launch Premium Gap

Archipelago is a leasehold condo in Bedok that was completed in 2015.

Very obviously, the best stacks here are those that face outwards towards Bedok Reservoir.

At its launch in 2012, prices for Stack 112 in 2012 was at $1,264 psf.

| Date | Unit | Type of sale | Size | PSF | Price |

| 22 Feb 2012 | 531 BEDOK RESERVOIR ROAD #03-112 | NEW SALE | 829 | $1,264 | $1,048,000 |

| 20 Apr 2018 | 531 BEDOK RESERVOIR ROAD #03-112 | RESALE | 829 | $1,351 | $1,120,000 |

In April 2018, this same unit was sold at $1,351 psf for a profit of $72,000 – an appreciation of 6.87%.

But what about those that would traditionally be considered as not so ideal stacks: inward facing, no reservoir view, and facing other blocks?

| Date | Unit | Type of sale | Size | PSF | Price |

| 6 May 2012 | 507 BEDOK RESERVOIR ROAD #04-26 | NEW SALE | 829 | $1,207 | $1,000,000 |

| 10 Apr 2012 | 523 BEDOK RESERVOIR ROAD #03-79 | NEW SALE | 829 | $1,132 | $938,000 |

| 6 Feb 2012 | 527 BEDOK RESERVOIR ROAD #03-95 | NEW SALE | 829 | $1,132 | $938,000 |

| 29 May 2012 | 531 BEDOK RESERVOIR ROAD #05-109 | NEW SALE | 829 | $1,170 | $970,000 |

In 2012, these units were going for $1,207, $1,132, $1,132, and $1,170 respectively. Clearly, these were all sold at a lower price as compared to the premium stack price of $1,264.

Now, here’s what happened once they reached the resale market.

| Date | Unit | Type of sale | Size | PSF | Price |

| 26 Sep 2018 | 507 BEDOK RESERVOIR ROAD #04-26 | RESALE | 829 | $1,313 | $1,088,000 |

| 11 Jul 2018 | 523 BEDOK RESERVOIR ROAD #03-79 | RESALE | 829 | $1,327 | $1,100,000 |

| 19 Jun 2018 | 527 BEDOK RESERVOIR ROAD #03-95 | RESALE | 829 | $1,303 | $1,080,000 |

| 10 Apr 2018 | 531 BEDOK RESERVOIR ROAD #05-109 | RESALE | 829 | $1,327 | $1,100,000 |

All these units that were bought at a cheaper psf on launch have now sold very comparatively to the premium stack psf.

Final Words

So after seeing these 3 examples, does this mean that you should now not be looking at premium stacks if you are looking for a good appreciation in the future?

Not at all.

As with anything to do with real estate in Singapore, there are always caveats to every transaction.

Here’s what is important to takeaway – don’t go into a showflat blindly – best stacks doesn’t always mean it’ll be the best performer in the resale market. If you do have further questions on this, feel free to reach out to us at stories@stackedhomes.com

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Does buying the most premium property stack always guarantee higher resale value?

Can cheaper units in a condo sometimes sell for higher prices later on?

Is it better to buy a property with the best views or facing the main road?

Should I avoid investing in premium stacks if I want good appreciation?

What should I consider besides the stack when buying a property for investment?

Ryan Ong

Ryan is part property consultant, part wordsmith, and a true numbers aficionado. Ryan's balanced approach to every transaction is as diverse as it is effective. Since starting his real estate journey in 2016, he has personally brokered over $250 million of properties. Beyond the professional sphere, you'll often find him cherishing moments with his beloved cats: Mia, Holly, Percy and Toto.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

Property Investment Insights This Singapore Condo Has Bigger Units Near The MRT — But Timing Decided Who Made Money

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments