Are We In A Property Buyer’s Or Seller’s Market?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

The theme for the 2024 property market is “good news, bad news”

It’s almost as if the universe wants to perfectly balance the forces that push property prices up, as well as down; so I’m not surprised that 2024 has been called both a buyer’s market and a seller’s market, depending on where you’re standing.

First, Core Central Region (CCR) prices are coming down, due to recent cooling measures. Look at recent discounts offered at developments like Cuscaden Reserve, where units are going for $2,900 psf, down from a range of $3,400 to $3,800 psf of units that were previously sold. This is the big chance for you to grab one at a lower price. On the other hand, sky-high interest rates, a high quantum, and economic headwinds mean most of us get to sit on our hands and watch this opportunity fly by.

Second, HDB prices grew at double-digit rates in the aftermath of Covid. Comparing the price difference between the 2013 peak and today is like comparing a partially trampled anthill to Mount Everest. However, private property prices grew even faster, thus widening the gap despite the resale flats’ performance.

Now bear in mind the double-digit price growth for resale flats can’t be sustained; and it’s already starting to level off. So it’s likely that aspiring upgraders will have to struggle even harder to bridge that gap in the coming years.

Third, the creation of the Plus and Prime schemes have kicked in: now the people who don’t want to upgrade won’t be competing with the people who do (because if you do want to upgrade, you won’t buy a flat that you can only resell in around 14 years. At the rate we’re going, the price of a two-bedder might be enough to fund a small colony on Mars by then.)

Fourth, you probably heard there’s something of an apocalypse happening in the tech industry. Layoffs, combined with growing concerns of the wider economy, may finally lead to a slowdown in private housing prices – and we may even see some of that demand channeled into a more affordable market, like Malaysia. Under normal circumstances, the unaffected Singaporeans might hail this as an opportunity.

But then again, the affected workers, thanks to their now-lower income, may shift their gaze toward the cheaper resale condo market. (As we explain in this article, the gap between new launch and resale condos has become quite large). Rising demand in the resale segment may not bode well for the median-income upgrader, who is also largely priced out of new launch family units.

And while job losses or pay cuts could mean some are forced to sell, this is also counterbalanced by our debt ratios and savings. Limits like the Total Debt Servicing Ratio (TDSR), coupled with CPF savings that can be used to service housing loans, could mean that even recently retrenched are not desperate to sell. And psychologically, we’re just not wired to accept losing money on property as a “thing.” So there’s no guarantee that we’ll see fire sales and discounts; especially not if they can turn to rental to offset the costs.

More from Stacked

How Well Do Regional Centre Properties Compare Against The CBD?

A short while back, we put out an article explaining how the Bugis – Beach Road area (district 7) has…

Which leads us to the final issue: rental income has improved, not least due to the government allowing up to eight unrelated tenants (up from six). But while rental income has risen (but recent accounts point to a weakening market), so have interest rates and property taxes; so yet another scenario with bad news counterbalancing good news (for landlords in this case).

Everything looks like it’s precariously balanced on a see-saw* right now, so I refuse to rush into deciding whether this is really a buyer’s or seller’s market just yet.

*Bonus tip: You can look for see-saws on a playground to guess the age of a development. They were more popular in the ‘00s and earlier. In more recent decades, playground designers have become convinced that see-saws, like swings, are basically machines designed to concuss children. Maybe that’s why our ghost stories keep involving them.

Meanwhile in other property news…

- If you are looking to buy a second property but want to avoid paying for ABSD, here’s what you need to know about decoupling.

- Conversely, there are some people out there willing to pay for the ABSD to own 2 properties. Here’s the story of one such individual.

- No one wants to pay a million dollars for an HDB, but if you have the budget, here are some that are nicely renovated and near an MRT.

- Here’s a common scenario when it comes to buying a new launch today – is a 2b2b better than a 2b1b unit? Here’s what the data tells us.

Weekly Sales Roundup (26 February – 03 March)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| WATTEN HOUSE | $11,828,000 | 3412 | $3,457 | FH |

| ENCHANT� | $5,520,000 | 1701 | $3,246 | FH |

| KOVAN JEWEL | $4,206,000 | 2153 | $1,954 | FH |

| THE RESERVE RESIDENCES | $3,826,295 | 1625 | $2,354 | 99 yrs (2021) |

| GRAND DUNMAN | $3,515,000 | 1432 | $2,455 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| LENTORIA | $1,185,000 | 538 | $2,202 | 99 yrs |

| THE MYST | $1,221,000 | 517 | $2,363 | 99 yrs (2023) |

| PINETREE HILL | $1,267,000 | 538 | $2,354 | 99 yrs (2022) |

| THE ARDEN | $1,327,000 | 721 | $1,840 | 99 yrs (2023) |

| GRAND DUNMAN | $1,405,000 | 549 | $2,559 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE ORCHARD RESIDENCES | $6,900,000 | 2174 | $3,173 | 99 yrs (2006) |

| ST MARTIN RESIDENCE | $5,000,000 | 2982 | $1,677 | FH |

| LEONIE GARDENS | $4,608,888 | 2540 | $1,814 | 99 yrs (1990) |

| YONG AN PARK | $4,200,000 | 1765 | $2,379 | FH |

| CHANCERY PARK | $4,100,000 | 2379 | $1,724 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE HILLFORD | $713,000 | 506 | $1,409 | 60 yrs (2013) |

| CENTRA SUITES | $722,000 | 452 | $1,597 | FH |

| RIVERBANK @ FERNVALE | $730,000 | 495 | $1,474 | 99 yrs (2013) |

| TRE RESIDENCES | $780,000 | 420 | $1,858 | 99 yrs (2014) |

| RIPPLE BAY | $800,000 | 538 | $1,486 | 99 yrs (2011) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| LEONIE GARDENS | $4,608,888 | 2540 | $1,814 | $2,408,888 | 17 Years |

| CHANCERY PARK | $4,100,000 | 2379 | $1,724 | $2,300,000 | 18 Years |

| THE SEA VIEW | $3,600,000 | 1410 | $2,553 | $1,978,500 | 16 Years |

| EDELWEISS PARK CONDOMINIUM | $2,138,000 | 2465 | $867 | $1,383,000 | 17 Years |

| VALLEY PARK | $3,070,000 | 1356 | $2,264 | $1,370,000 | 17 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| LUMIERE | $1,150,000 | 678 | $1,696 | -$260,240 | 11 Year |

| VIDA | $1,100,000 | 527 | $2,086 | -$68,000 | 9 Years |

| THE FORESTA @ MOUNT FABER | $1,360,000 | 667 | $2,038 | $30,000 | 8 Years |

| BUKIT 828 | $880,000 | 506 | $1,739 | $72,000 | 4 Years |

| TRE RESIDENCES | $780,000 | 420 | $1,858 | $72,900 | 9 Years |

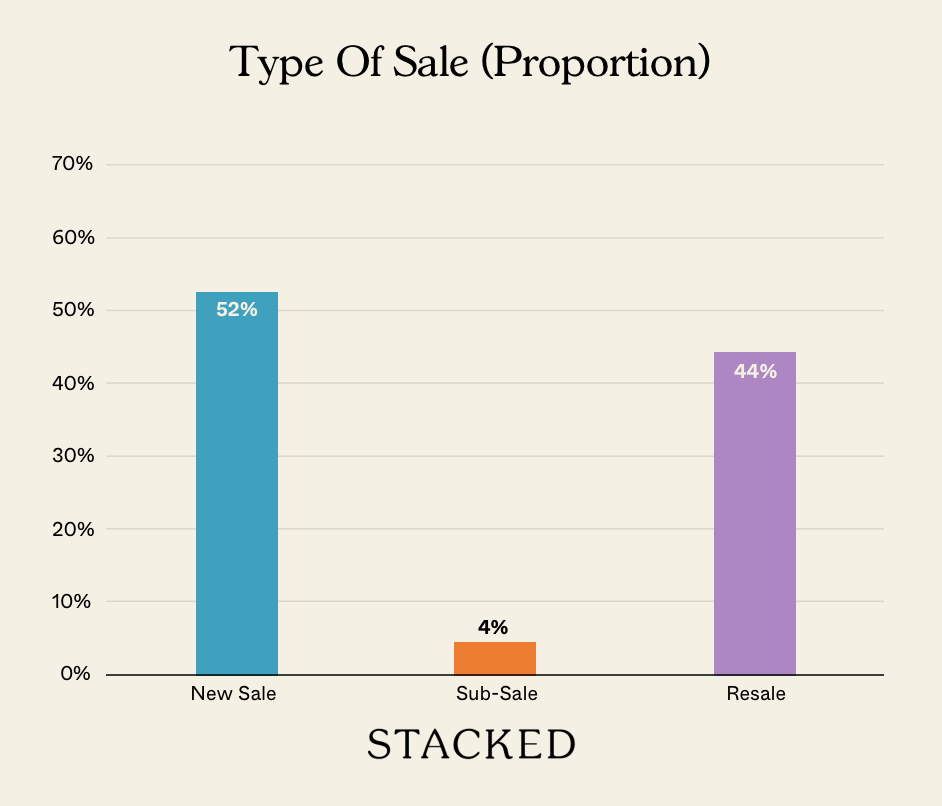

Transaction Breakdown

For more Singapore property news, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Singapore Property News

Singapore Property News Why ‘Accurate’ Property Listings Still Mislead Buyers In Singapore

Singapore Property News Narra Residences Sets a New Price Benchmark for Dairy Farm at $2,180 PSF — and the sales breakdown offers

Singapore Property News Newport Residences Sells 57% at Launch Weekend — But the Real Surprise Came From the Large Units

Singapore Property News A Rare Freehold Mall Is Up for Sale At $295 Million: Why the Market Is Paying Attention

Latest Posts

Property Market Commentary Why Early Buyers In New Housing Estates May See Less Upside In 2026

Overseas Property Investing This Overlooked Property Market Could Deliver 12–20% Growth — But There’s a Catch

Property Market Commentary Landed Home Sales Hit a Four-Year High — Here’s What That Could Mean for Prices in 2026

On The Market Here Are The Rare HDB Flats With Unblocked Views That Hardly Come Up for Sale

Pro Where HDB Flats Continue to Hold Value Despite Ageing Leases

Property Market Commentary What A Little-Noticed URA Rule Means For Future Neighbourhoods In Singapore

Editor's Pick We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Pro What Happens When a “Well-Priced” Condo Hits the Resale Market

New Launch Condo Analysis This New Dairy Farm Condo Starts From $998K — How the Pricing Compares

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

On The Market Here Are The Cheapest Newer 3-Bedroom Condos You Can Still Buy Under $1.7M

New Launch Condo Reviews Narra Residences Review: A New Condo in Dairy Farm Priced Close To An EC From $1,930 PSF

Property Market Commentary Why Looking at Average HDB Prices No Longer Tells the Full Story: A New Series

On The Market Orchard Road’s Most Unlikely $250 Million Property Is Finally Up for Sale — After 20 Years

Editor's Pick We Analyse “Safer” Resale Condos in Singapore to See If They’re Actually Worth Buying: A New Series