Ang Mo Kio’s Most Expensive 5-Room HDB Flat Sold For $1.5 Million: Here’s Why

May 22, 2025

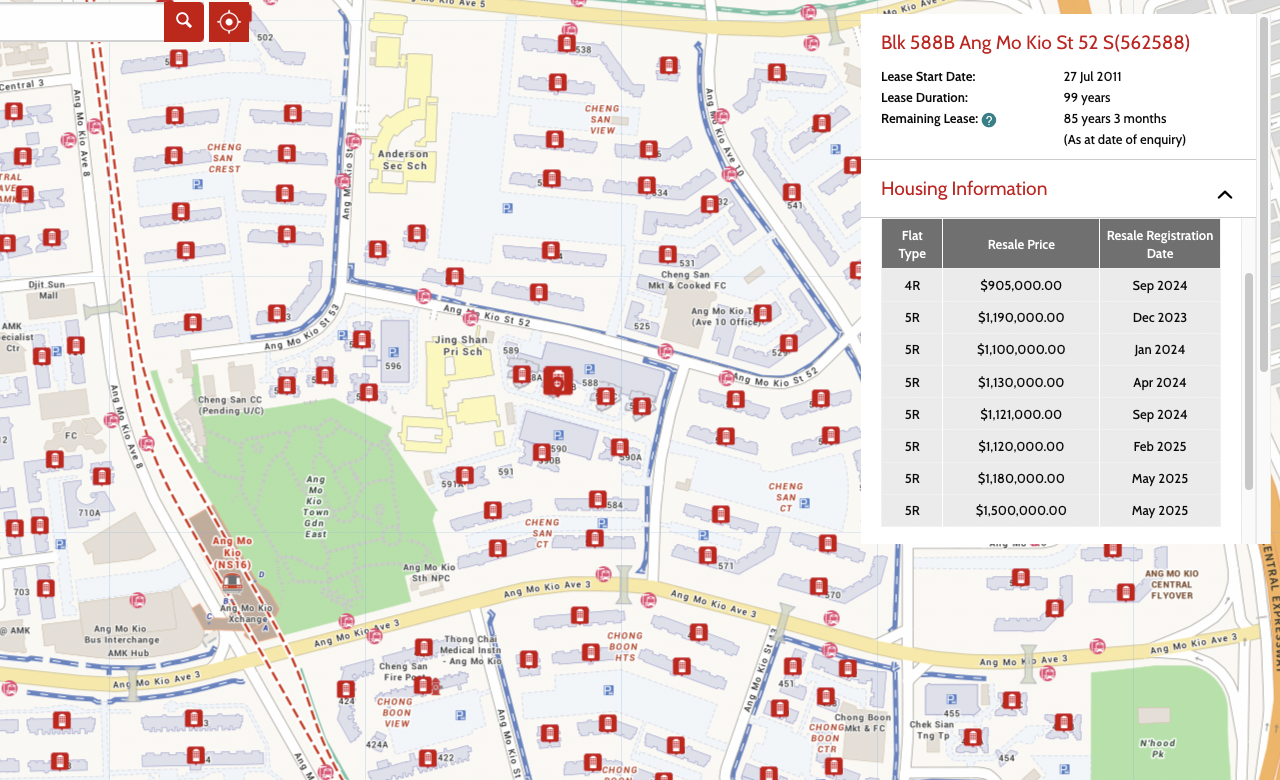

Another day, another record. In May 2025, a 5-room flat at 588B Ang Mo Kio Street 52 transacted for $1.5 million – the highest ever for a 5-room HDB flat in Ang Mo Kio.

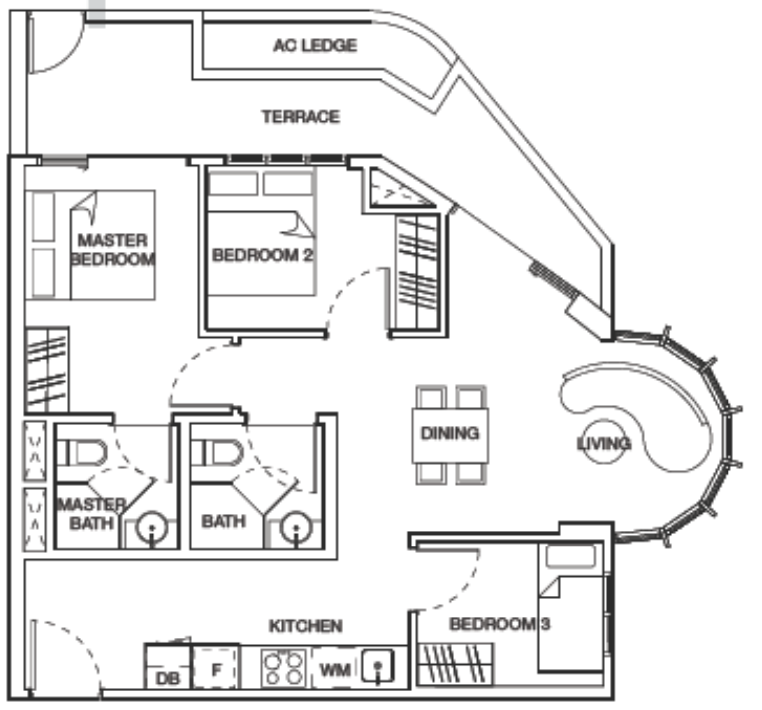

Located in Park Central @ AMK, a DBSS project completed in 2011, the unit spans 120 sqm and sits on a high floor (19 to 21). It edges out the previous record in the same development (a unit on the 28th to 30th floor at 588D) by $20,000, despite being nearly 10 floors lower.

So why are buyers still willing to pay private property prices for HDB flats here? Here’s a closer look at the factors driving this transaction.

1. A Limited Pool Of Newer Flats In A Mature Estate

The flat’s age and size are major factors. Ang Mo Kio, one of Singapore’s oldest estates, has a limited supply of large-format flats built in the last 20 years. Of the 6,291 5-room flats ever sold in the estate, just 1,887 were completed from 2000 onwards. Narrow it down to those under 20 years old, and you’re looking at around 1,200 units (Park Central @ AMK included).

Newer developments like Ang Mo Kio Court have yet to hit the resale market, and are also located closer to Mayflower MRT, which may not be as central as the core Ang Mo Kio Town Centre. For buyers looking for a large, relatively new flat near the town’s heart, Park Central becomes one of the few available options.

2. High Floor, Decent Views

While the views from 588B are not panoramic, given the surrounding low-rise blocks, the elevation does help reduce noise and offer a greater sense of privacy. In land-scarce Singapore, high-floor units have long been associated with premium pricing, particularly in HDB transactions.

3. Not Quite “Near MRT,” But Acceptable To Some

Park Central @ AMK isn’t exactly close to the MRT. Walking to Ang Mo Kio station takes about 8 to 10 minutes, even when cutting through the nearby park. That’s just outside what most would define as “convenient walking distance” in a hot property market like Singapore’s, where anything beyond 5 to 7 minutes can start to feel like a stretch, especially in the heat or rain.

That said, it’s still within a tolerable range for buyers who prioritise space and centrality over direct MRT access. For those who drive, the trade-off may not be a significant deterrent. But it’s fair to say the location isn’t likely to attract buyers with a hard requirement for doorstep MRT convenience, which makes the record price even more notable.

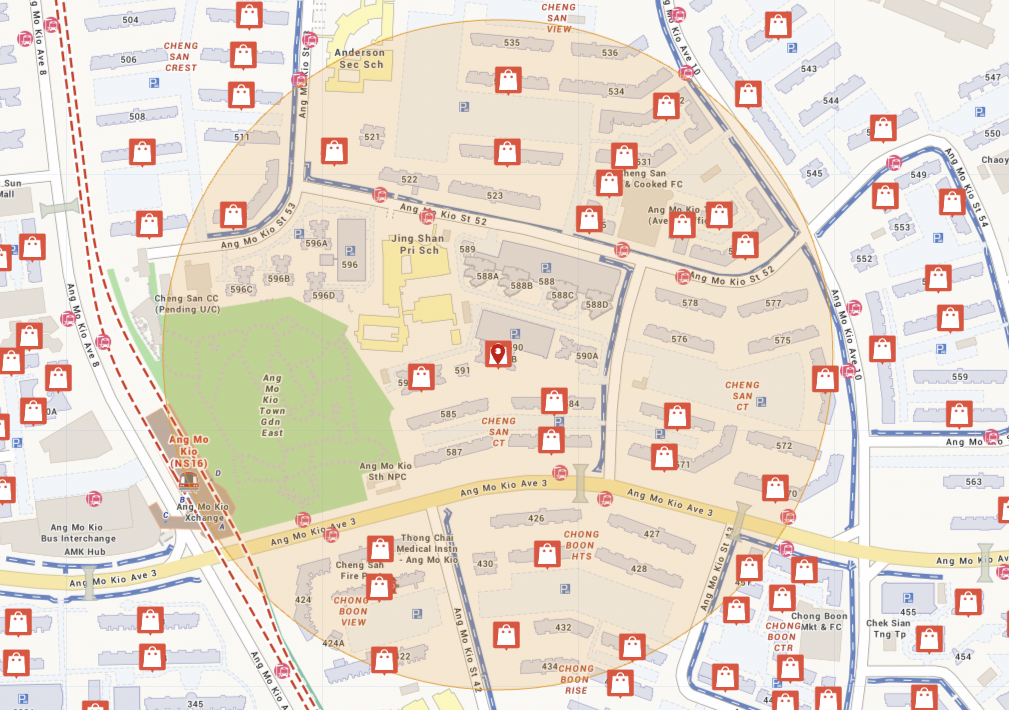

What helps is the overall connectivity and amenity access in the area. Residents can easily walk to Cheng San Market, supermarkets, and multiple eateries. Although the project itself doesn’t have HDB shophouses, being surrounded by older HDB blocks means nearby amenities are plentiful.

4. It’s Not About Schools

Interestingly, this location isn’t particularly strong when it comes to primary school proximity, with just two schools within 1km, neither of which is top-ranked. That suggests buyers here are likely driven more by lifestyle convenience, size, and the relative scarcity of such flats in Ang Mo Kio, rather than enrolment considerations.

5. How It Stacks Up Against Private Alternatives

More from Stacked

The Rise Of Million-Dollar HDB Flats In Singapore: Is This Going To Be The New Norm?

Million-dollar HDB flats are still outliers, making up some one per cent of HDB transactions; and even those that are…

At $1.5 million, this DBSS flat enters territory traditionally dominated by private condos. So, how does it compare?

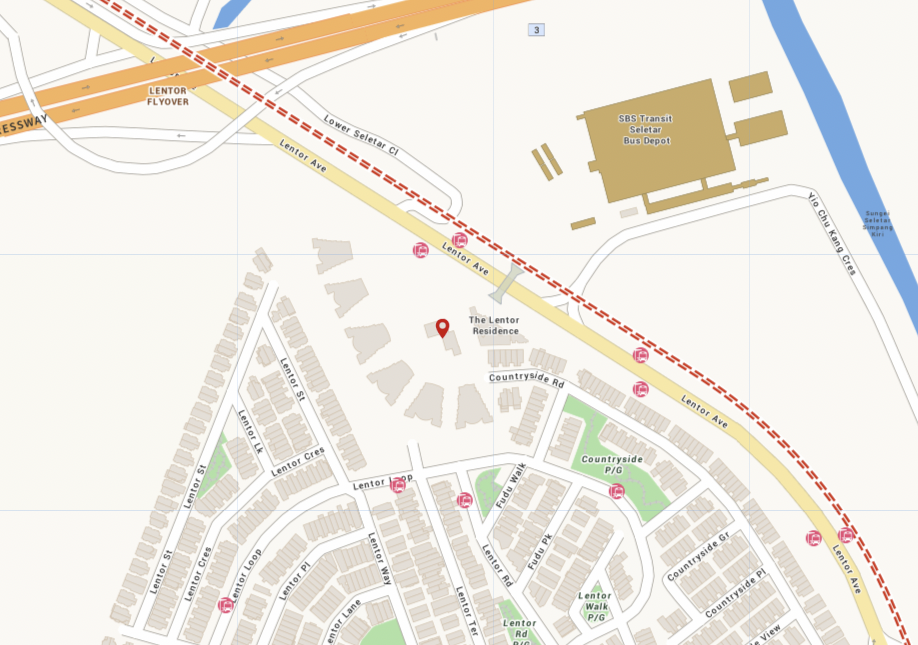

Let’s start with Floraview, a freehold condo completed in 2017. A 3-bedroom unit there sold for $1.2 million in February 2025. On paper, that’s cheaper, no doubt. But the unit was just 867 sq. ft. – 425 sq. ft. smaller than the Park Central flat. The layout was also compact: one bedroom only fit a single bed. More importantly, Floraview’s location, along Yio Chu Kang Road, is notably inconvenient. There’s no MRT station nearby, and the walkability factor is far lower.

By contrast, the 5-room flat here allows for at least a queen-sized bed in each bedroom.

Then there’s Bullion Park, a freehold development completed in 1993. The most recent sale crossed $1.88 million – a full $380,000 more than the DBSS unit. While it’s a much larger unit at approximately 1,245 sq. ft., the location again presents challenges: it’s deeper within the Seletar/Yio Chu Kang area, away from major retail centres or direct MRT access. For some buyers, the trade-off of more space but reduced convenience and an older project may not be worth the price jump.

However, the price gap between the HDB flat and some of these older, larger freehold condos isn’t that wide, and that could invite a very different interpretation. From another angle, the $1.5 million flat may seem overpriced, particularly if you value size and tenure. Some might argue that for just 20 to 25 per cent more, you could get a bigger private unit with freehold status, and far fewer restrictions down the line. If you don’t mind the age or location of these condos, they could present better long-term value.

There are also other condos like Castle Green or Grandeur 8 that sit closer to the $1.5 million mark, but they come with further compromises. Castle Green, for instance, is nearing 30 years old and has larger grounds but fewer modern fittings. Grandeur 8 is closer to AMK Hub, but prices are trending higher — recent sales averaged above $1.67 million for 1,204 sq. ft. units.

Final Thoughts

This latest record is less about overreach and more about scarcity. Park Central @ AMK occupies a unique niche in Ang Mo Kio, it’s one of the few newer HDB options in a highly central and amenity-rich estate. Combine that with its size, DBSS finishings, and elevated floor, and it becomes clear why some buyers see value at this price point – even if it’s one that creeps into private territory.

Whether $1.5 million becomes the new normal remains to be seen. But in estates like Ang Mo Kio, where new and spacious HDB flats are increasingly rare, it’s unlikely this will be the last record we see.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did the 5-room HDB flat in Ang Mo Kio sell for a record price of $1.5 million?

What makes this Ang Mo Kio flat more valuable than other similar flats?

How does the price of this HDB flat compare to private condos nearby?

Why are buyers willing to pay private property prices for this HDB flat?

Is proximity to the MRT a key factor in the flat’s high price?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

1 Comments

Crazy! In Batam can buy 10 landed houses of it:):):). Greetings from Batam. Emile Leus TVworkshop Asia Pte Ltd