A HDB DBSS Flat Just Sold For $1.6 Million: Why Is This Happening?

January 13, 2025

In July 2024, the record holder for the most expensive flat in Singapore was a $1.73 million Dawson unit. At the time, we thought it was an anomaly—something we wouldn’t see again for a long while. But here we are in January 2025, and already, a 13-year-old DBSS flat has nearly matched it, selling for $1.6 million. So, where are these prices headed, and what’s driving this surge?

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A 13-year-old flat for $1.6 million

The flat in question is at The Peak @ Toa Payoh, a DBSS project. Located at Block 138A Lorong 1A, it’s a 1,259 sq.ft. unit situated on the 19th to 21st floor. At $1.6 million, that works out to about $1,270 psf.

We can already hear the obvious question: “What are nearby resale flat prices like?” Fair point—the area has seen several flats selling for $1.5 million or more, with some even making our list of the priciest resale flats of 2024.

But here’s a comparison to put things in perspective: Just 210 meters away from The Peak is Trevista, a leasehold private condo, with an average price of about $1,848 psf. In September 2024, a 1,012 sq. ft. unit there sold for $1.87 million.

Granted, the flat’s proximity to Toa Payoh Hub— a major retail and dining centre with an MRT station (NSL)—certainly justifies a higher price. But for an HDB project to be so close to private property prices is remarkable and underscores just how far prices have surged since the end of COVID.

Is it about DBSS being a cut above the rest?

Some news reports have cited industry experts claiming that DBSS flats are of superior quality. These flats were built by private developers, similar to Executive Condominiums (ECs), though they lack amenities like pools and gyms. However, it’s odd to hear such praise now, as many DBSS flats weren’t well-regarded for their quality when they were first launched.

That also goes for The Peak. Around 20 to 30 per cent of the initial buyers raised complaints about the flat’s quality. This suggests that the soaring prices today are likely more about the location than the actual quality/workmanship of the flats.

More from Stacked

Why Some Central 2 Bedroom Homeowners In Singapore Are Stuck

I’m talking about the number of homebuyers who are interested in living within the Core Central Region (CCR), where prices…

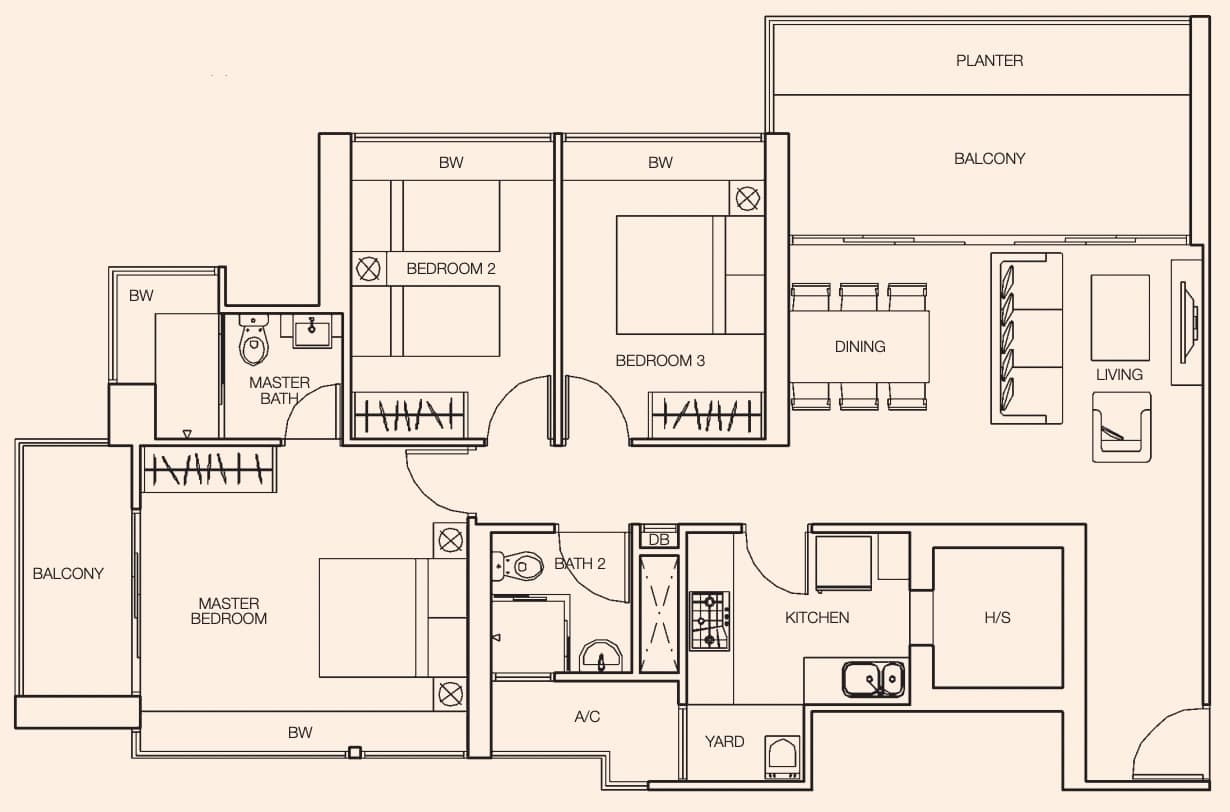

Some realtors have also suggested that it’s not so much quality, but the unique layouts that make DBSS flats appealing. Features like a third bathroom, double-volume ceilings, and floor-to-ceiling windows—elements not commonly found in HDB flats—set these units apart. While the quality of finishes may have left much to be desired at the time, these distinctive features retain their appeal. And many of the initial complaints, such as peeling laminates or cracked shower glass, could be addressed with the right contractor anyway.

We expected that demand for DBSS flats would continue, but prices have risen quicker than we imagined

A while ago, we asked when it is that we might see a $2 million flat. At the time as a fun piece, we “predicted” it would be around 2034 or 2035. But given that we’re already seeing prices above $1.5 million in 2024/25, we’ve clearly underestimated the rise in resale flat prices.

Also, we once pointed the finger at jumbo, maisonette, and other such special flats as the cause of million-dollar transactions. Now, it seems that DBSS flats are the most likely culprits to drive a price up to $2 million.

As far as optics go, these once-derided projects (see some old conversations) have the power to be a thorn in HDB’s side. The government did react quickly to the DBSS issue in the past: The scheme was suspended in 2011, when it became clear the pricing was out of control. Only 13 DBSS projects were ever completed, but the high initial and resale prices continue to create the impression of unaffordable housing; and we imagine it was one of the more regrettable decisions.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are some HDB flats selling for over a million dollars in Singapore?

What makes DBSS flats different from regular HDB flats?

Are the high prices of DBSS flats mainly because of their quality?

How have resale flat prices changed recently in Singapore?

Why did the government suspend the DBSS scheme in 2011?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

0 Comments