A $100 Billion Dollar City Turned Into A Ghost Town

April 30, 2023

The world’s most expensive monument to overconfidence is nearer than you think…

I’m talking about Forest City, a massive ghost town right across the causeway. This development is around 1,740 hectares (17.4 square kilometres), which is almost the entirety of Jurong East or apparently 4 times the size of Monaco.

It was built by Country Garden (China’s largest developer) supposedly to the tune of $100 billion. But as of 2019, only 500 out of the expected 700,000+ residents were living there.

I’ve had a chance to briefly visit the place, and while we can crack any number of jokes about it – the world’s most expensive horror movie set, world’s biggest bar*, condo with 100,000 sq. ft. yard – it’s also a massive problem waiting to happen.

An entire almost empty neighbourhood is a ripe set-up for squatters, crime, fires, and hygiene issues. It’s a matter of time before mother nature beats the scant maintenance staff, and the vermin start to move in…and given Malaysia’s reputation for build quality, I don’t have high hopes for how it’s going to turn out.

All of this due to speculation and overconfidence: the certainty that the High-Speed Rail would have been operational by the time of completion, the surety that businesses would be rushing into Iskandar, and even the boldness of demolishing a local village to build a 700,000+ resident condo (an insane number by any reckoning).

There are other problems too. According to an Insider piece, Forest City is built on reclaimed land, and given how fast they tried to build it, that didn’t give the reclaimed land fast enough time to settle. So cracks have appeared in areas, and sections of the road have sunk.

Herein lies a risk that many condo buyers don’t consider since it almost never happens locally: the risk that, even if your project is completed, it can end up a total disaster.

When a project the size of Forest City fails, it’s not something the government can just leave there (for the aforementioned reasons). Once the hazard of vermin, crime, and other issues take root, and it needs to be torn down, there’s no telling what the condo owners will get in return.

But it’s likely that, when the buyers bought their units, their main worries were about quality and non-completion. Who would have thought that even with the project finished, there could be a risk of it being a ghost town?

It’s worth thinking about, before committing to giant-scale, speculative projects overseas.

*Forest City is in a special economic zone without alcohol tax, so you’ll find shops selling alcohol, and their customers, still hanging around there.

In the meantime, we have ABSD issues to contend with locally.

There’s a bit less reaction this time because Singaporeans have become a bit jaded by ABSD increases (but also the big jumps have really been for foreigners). In the property industry sure, it’s always exciting news – but after reaching out, I’ve begun to sense a rather “meh” reaction. Realistically, how many can afford a second property in Singapore anyway?

My cousin’s reaction, I think, has become the norm; and it goes along the lines of:

“Please, as if I can afford to own two houses in one lifetime. Even if I am going to buy privately, I still have no ABSD. 17 per cent, 20 per cent, 100 per cent, all also no difference to me.”

Now I don’t think this is right, as raising the ABSD does have an effect even on upgraders. Fewer people buying a second or third home, for instance, ensures that prices don’t rise so far that the average Singaporean can’t afford it.

However, ABSD has developed what I call the “spleen effect.”

Do you know what your spleen does? I bet not. You likely wouldn’t know or care, until the day it stops working – then it’s a nightmare and you’ll realise how badly you need one.

The same goes for ABSD. I think it’s one of those policies that works well and does its job – but no one really notices, precisely because it’s working. If we were to remove ABSD overnight, then we’d feel the impact…and I think there would be blood in the streets.

More from Stacked

We Ranked The Bottom 10 Singapore Districts By Appreciation (2021)

2021 has been rough on first time home buyers, as well as new investors. With property prices rising across the…

Bear in mind, the ABSD amount alone (typically upward of $270,000 at least) would make it possible for many more Singaporeans to keep their HDB flat, and also buy a second property.

While we first saw ABSD as a hindrance – and more recently as another “meh” policy gesture – it is an instrument that has kept private homes within reasonable reach for upgraders.

You can read about it in this article.

In other property news this week…

- Check out these 4-room flats that recently became available, and that are still under $590,000.

- Here’s a list of mega-developments that have finally been completed. Mega-developments tend to have more generous facilities and (usually) lower prices; so if you want a unit that you can move into right away, check these out.

- The rental market is up, so more landlords have pondered adding an extra room. More rooms = more tenants right? Maybe, but know the concerns first.

- Finally, check out some freehold landed homes in Orchard, that may not be as insanely pricey as we often assume.

Weekly Sales Roundup (17 – 23 Apr)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| KLIMT CAIRNHILL | $7,370,000 | 2056 | $3,585 | FH |

| THE GAZANIA | $3,700,000 | 1970 | $1,878 | FH |

| PULLMAN RESIDENCES NEWTON | $3,679,830 | 1163 | $3,165 | FH |

| JERVOIS PRIVE | $3,570,000 | 1109 | $3,220 | FH |

| RIVIERE | $3,510,000 | 1141 | $3,076 | 99 yrs (2018) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| NORTH GAIA | $1,253,000 | 1001 | $1,252 | 99 yrs (2022) |

| THE LANDMARK | $1,335,312 | 495 | $2,697 | 99 yrs (2020) |

| THE ATELIER | $1,417,320 | 549 | $2,582 | FH |

| PULLMAN RESIDENCES NEWTON | $1,424,610 | 463 | $3,078 | FH |

| THE BOTANY AT DAIRY FARM | $1,433,000 | 743 | $1,929 | 99 yrs (2020) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ALBA | $7,600,000 | 1905 | $3,989 | FH |

| WATTEN HILL | $4,800,000 | 2669 | $1,798 | FH |

| THE IMPERIAL | $4,650,000 | 1916 | $2,427 | FH |

| BOTANIC GARDENS VIEW | $3,680,000 | 1259 | $2,922 | FH |

| THE CASCADIA | $3,260,000 | 1582 | $2,060 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| LE REGAL | $550,000 | 366 | $1,503 | 99 yrs (2010) |

| OCEAN FRONT SUITES | $625,000 | 409 | $1,528 | FH |

| SHIRO | $640,000 | 452 | $1,416 | 99 yrs (2014) |

| CARDIFF RESIDENCE | $655,000 | 420 | $1,560 | FH |

| THE WATER EDGE | $683,000 | 441 | $1,548 | 99 yrs (2012) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE TREVOSE | $3,100,000 | 1765 | $1,756 | $2,070,000 | 19 Years |

| TWIN REGENCY | $2,900,000 | 1442 | $2,011 | $1,910,000 | 19 Years |

| OXLEY GARDEN | $3,100,000 | 1647 | $1,882 | $1,850,000 | 17 Years |

| BALMORAL GATE | $2,750,000 | 1259 | $2,184 | $1,700,000 | 17 Years |

| BOTANIC GARDENS VIEW | $3,680,000 | 1259 | $2,922 | $1,680,000 | 6 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| HELIOS RESIDENCES | $3,150,000 | 1281 | $2,459 | -$1,833,000 | 10 Years |

| THE TENNERY | $1,060,000 | 861 | $1,231 | -$33,235 | 12 Years |

| THE TENNERY | $820,000 | 614 | $1,336 | -$17,000 | 12 Years |

| SHIRO | $640,000 | 452 | $1,416 | -$6,563 | 11 Years |

| NEWEST | $990,000 | 635 | $1,559 | $5,500 | 10 Years |

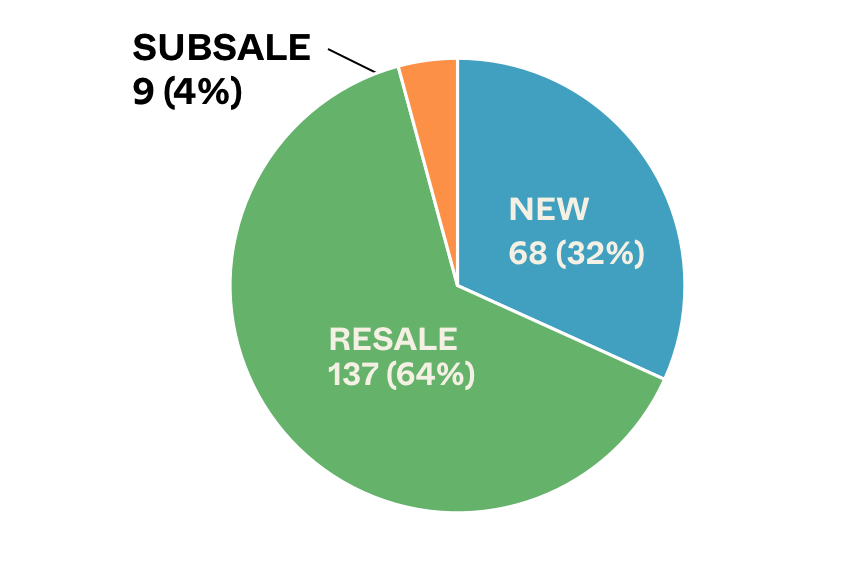

Transaction Breakdown

My interesting links of the week

- A one-road village

It was just this week that I found out about a Polish village called Suloszowa, which has 6,000 of its residents living along a single 9 km long street. It sounds unbelievable until you actually see the photos for yourself:

I do have a lot of questions as to how such an arrangement came about. Did they have so little land that everyone had to live in a row? How does driving work, if everyone goes to work at the same time, does that cause traffic jams? How do they decide which part of the town is worth more? Would it be the houses at the end or in the middle?

Nevertheless, while this could never work in Singapore, what are your thoughts on living on such a street?

- $190,000 for an island off Scotland

Just like Forest City, the allure would always be there for foreign property given how pricey our local market has gotten. This headline definitely caught my attention, as $190,000 for an island off the coast of Scotland certainly sounds reasonable given you can just about buy 2 Cat A COE’s in Singapore right now.

There are currently no buildings on the island, so you will have to allocate additional costs for building infrastructure (building, etc).

What do you think, any interest in buying such an island?

It will be an interesting week ahead, as we observe how the market reacts to cooling measures. While we’re expecting the usual “wait and see” approach from buyers, it could mean a big change for CCR properties that are most affected. Follow us on Stacked Homes as we observe the situation.

Featured Image Credit: Journal of Territorial and Maritime Studies

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is Forest City and why is it considered a ghost town?

What caused Forest City to become so underpopulated and problematic?

What are the risks for buyers of properties in large, speculative developments like Forest City?

How does the article describe the impact of ABSD (Additional Buyer’s Stamp Duty) on Singapore property buyers?

What recent property market trends are mentioned in the article?

What are some interesting property-related examples from other countries mentioned in the article?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

3 Comments

Forest city is not a ghost town. It was the pandemic that put a halt to all activities and business there. Its now thriving back to its potential. Every weekend people are coming and bustling there. Occupancy is also increasing steadily. Don’t believe all the biased reports about forest city. Come down yourself and see it to believe. The place is very well mantained. So much better than most other places in johor. In fact I’ve never even seen any rats before at all after living here for a year…

I wonder how Forest City will affect the other building projects in JB. Also, when the rails completed, do you think demand will go up if geopolitical issues don’t continue to worsen?

Johor is by far a better place to live than the congested over crowded and over price little red dot.