6 Reasons Why Lentor Modern Sold 84% Of Its 605 Units During Launch

September 19, 2022

Despite rising interest rates and cooling measures, Lentor Modern had a phenomenal showing during its launch weekend: 508 units were sold, out of 605 units total (around 84 per cent sold out). It’s quite the reception for what some buyers might have considered to be a pricey condo, given its OCR location – but there are good reasons why buyers have flocked to this.

Table Of Contents

- High demand, despite the high price

- Reasons why Lentor Modern has still sold well:

- 1) Lentor Central may be one of the more aggressively advertised projects to date

- 2) Integrated development status, and the GuocoLand brand, may help to justify the costs

- 3) It’s a tried and tested model

- 4) Ongoing scarcity issues and peak prices may have dulled the sticker shock

- 5) Age advantage against nearby alternatives

- 6) Accessible and convenient, while still being in a quiet area

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

High demand, despite the high price

The typical price range for an HDB upgrader is between $1.6 million to $1.8 million, and they make up the bulk of buyers right now. So Lentor Modern’s fast sales are surprising when you note that its family-sized units (three and four-bedders) are well outside this price range:

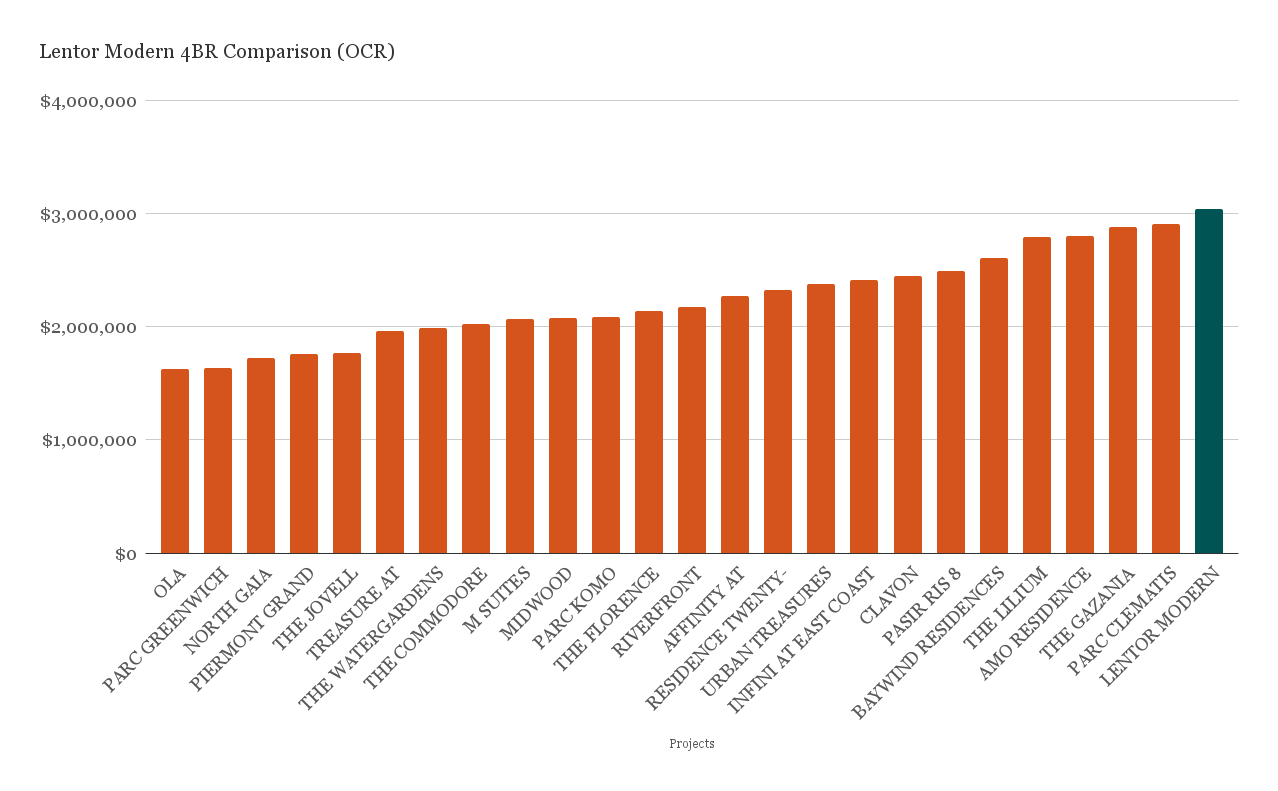

Lentor Modern is one of the priciest OCR condos that we’ve seen to date. The four-bedder units, at around 1,528 sq. ft., transact at an average of $3,036,409.

The high quantum unsurprisingly makes these the slowest to move, but just over half of the 63 available four-bedders have been sold.

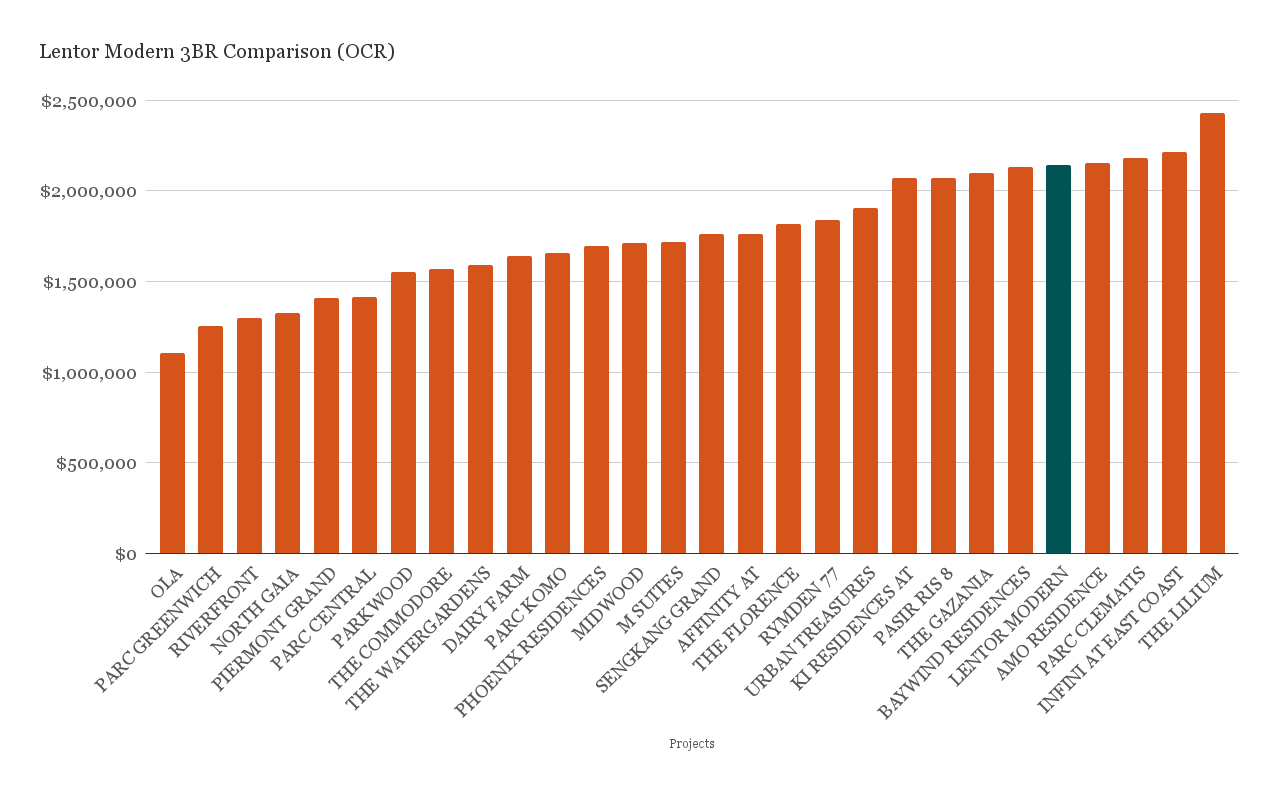

The three-bedder units, at around 969 to 1,130 sq. ft., are usually the minimum size an HDB upgrader would accept (1,000 sq. ft. is about the size of a four-room flat). At an average of $2,143,558 though, it’s a stretch for many upgraders; and it’s definitely one of the pricier projects by comparison.

Even so, 182 of the 248 available three-bedders have been sold.

For those eyeing smaller units, such as for rental, the cost is not exactly cheap either:

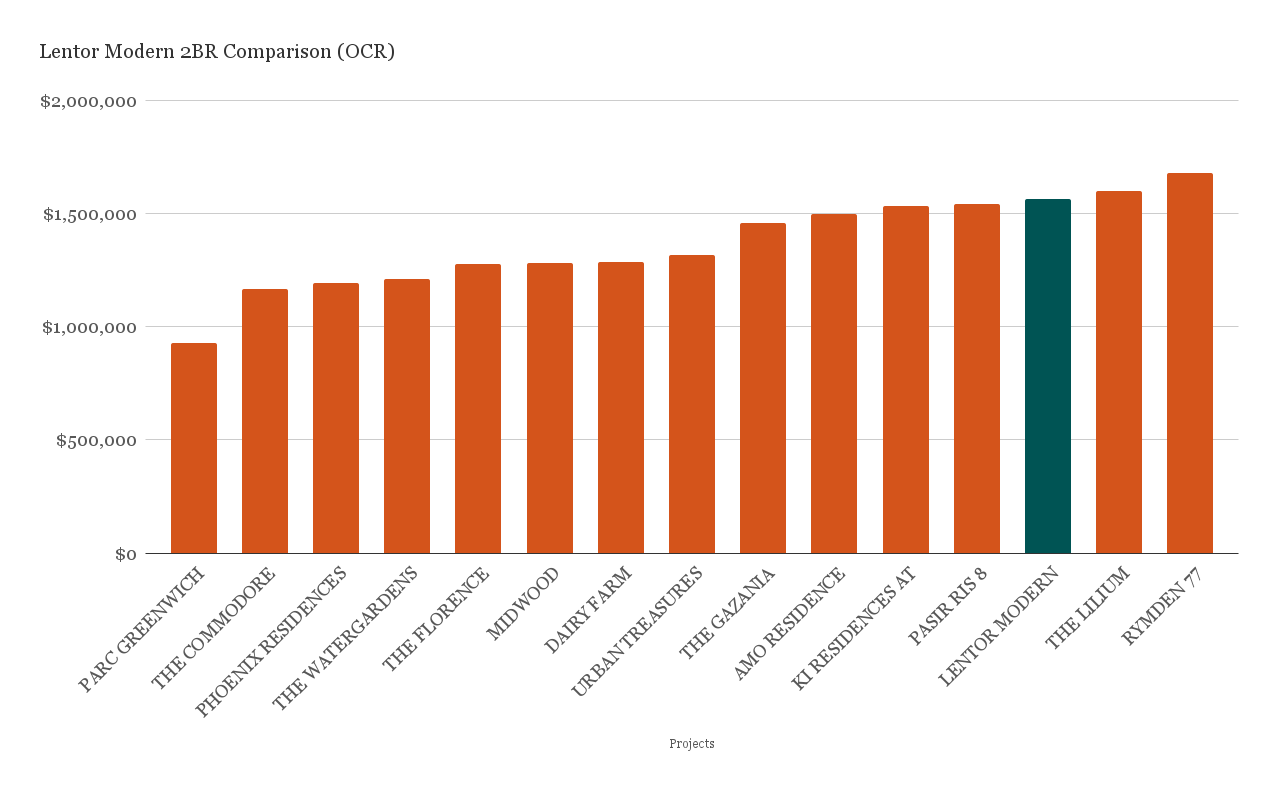

The two-bedders, at around 678 to 732 sq. ft., transact at around $1.56 million. This is sufficient to get a full, family-sized unit in the resale condo market right now.

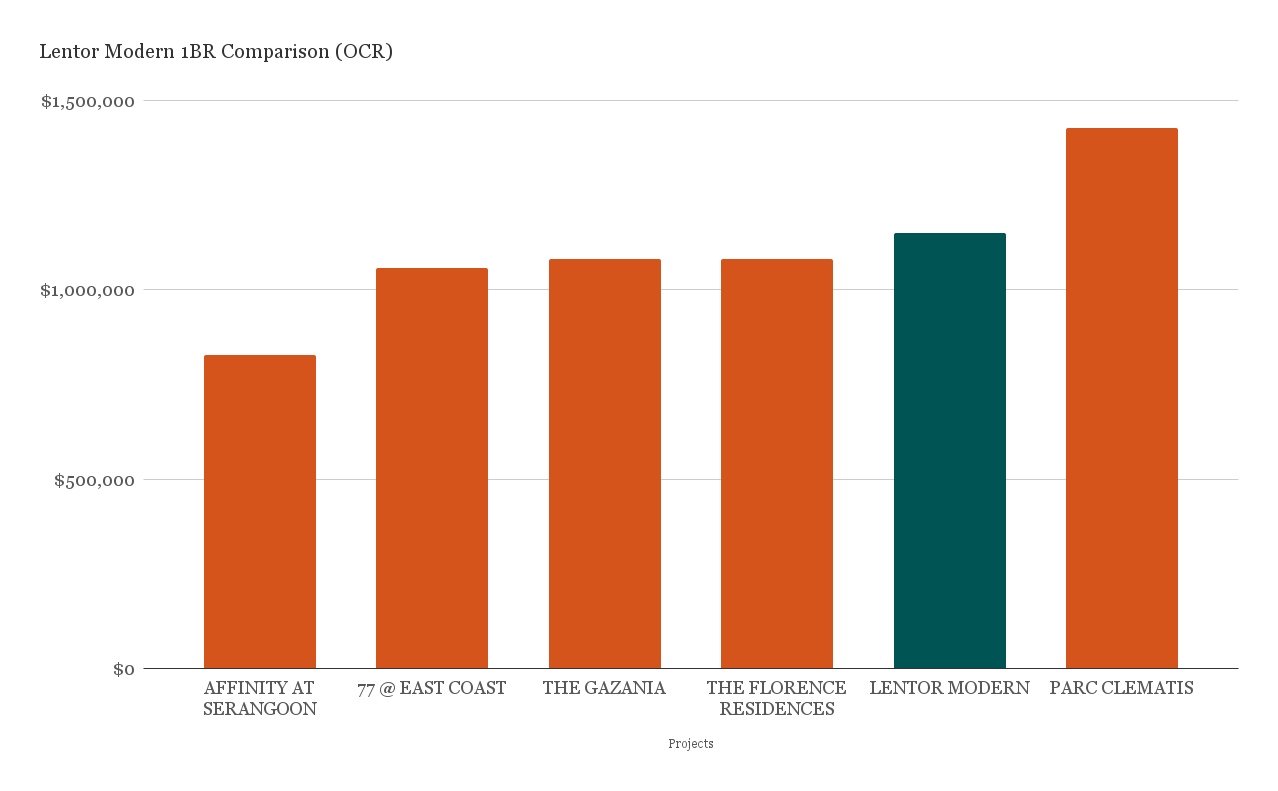

The shoebox units, at 527 sq. ft., average $1,150,459. Coupled with recent hikes to ABSD, it would be a very confident first-time investor that would fork out for such a unit. Note that by this average, even a monthly rental rate of $2,500 (a stretch for a one-bedder in those areas) would have a gross rental yield falling below three per cent.

And yet, we understand that all the one and two-bedder units have been sold!

Prices aside, here are some of the reasons why Lentor Modern has still sold well:

1) Lentor Central may be one of the more aggressively advertised projects to date

If you’ve been online in the past few months, you’ve probably seen at least a couple of ads for Lentor Central. They’ve been everywhere, from the usual Facebook and Instagram ads, and we’ve seen some on TikTok as well. There has also been a slew of early videos, and we notice major property portals have devoted quite a lot of space to Lentor Modern.

There was even a post on the food that you can get in the surrounding areas from one of the pioneering food bloggers, ieatishootipost. The more observant among you would have seen that this post was written in collaboration with GuocoLand.

They were also the first developer to get on board our new launch portal, in which we showcased a number of 3D tours that were not built in the show flat.

The aggressive push is quite smart and timely: those who missed out on the recent AMO Residence, which almost sold out entirely at launch, were probably on the prowl for an OCR condo. It wouldn’t surprise us if many Lentor Modern buyers were previously from the AMO crowd.

It also probably really helped that there are just fewer launches to compete with. Imagine if it was launched in 2019 instead, with about 60 new launches for that year – buyers were spoilt for choice then. As a new development, you had a lot of competition to jostle with for attention, it was just much harder to stand out.

Well-timed marketing is as vital for a condo as it is for any other product.

New Launch Condo ReviewsLentor Modern Review: A Well-Executed Integrated Development That’ll Be The First And Only One In Lentor

by Matthew Kwan2) Integrated development status, and the GuocoLand brand, may help to justify the costs

The price of an integrated development is generally higher than a pure residential counterpart (historically, the premium is somewhere around 20 per cent).

For Lentor Modern, the commercial segment consists of over 96,000 sq. ft.; this is planned to include eateries, a 10,000 sq. ft. childcare centre, and a 12,000 sq. ft. supermarket, among other conveniences.

Now if you scout out the location of Lentor Modern right now, the area is devoid of retail amenities; this is typical of private residential enclaves like the one Lentor Modern is in. So this means that, once it’s developed, Lentor Modern will be the retail hub of the area; there’s no competing alternative nearby. GuocoLand has quite specifically marketed Lentor Central as a “retail and social village” for the neighbourhood.

Lentor Modern also has an MRT station as part of the deal – that’s Lentor MRT on the Thomson-East Coast Line.

One realtor opined that, when it comes to integrated developments, home buyers may price in the savings of not needing a car. She said that “Because all the amenities are right downstairs, and there is also MRT access, the buyer saves on having to own a car, or even having to use ride-share, if their office is near the train.”

More from Stacked

Blossoms by the Park Review: Seamless Park Access + 3-Minutes To MRT Station

To the casual observer, One-North and Buona Vista will not typically be one of the first few places that pop…

(Mind you, in our experience, those who can afford to buy new launch, integrated projects tend to have no issues affording cars!)

Also, with regards to the mall, a very important aspect is the managed component of it. While Guoco Tower isn’t the biggest mall around, the tenant mix has been pretty decent so far. Buyers can be certain the mall will have a proper tenant mix, as opposed to a hodge-podge of unrelated shops.

3) It’s a tried and tested model

Another notable factor here is the GuocoLand brand. If it sounds familiar, that’s because they’re the same people behind the very successful Midtown Bay and Midtown Modern projects, as well as Wallich Residence.

If you’ve been to Midtown Modern or even Martin Modern, you’ll see that the designs are very much similar. As the saying goes, if it ain’t broke don’t fix it. The previous launches have worked and sold well, and given that blueprint has proven successful – Lentor Modern offers much of the same formula.

Facilities engulfed in greenery – doesn’t that look familiar?

As their recent work in the Bugis/Beach Road area shows, GuocoLand has shown that they are well versed in helping with the transformation of an area. Lentor Modern is probably going to be no different.

4) Ongoing scarcity issues and peak prices may have dulled the sticker shock

2022 is seeing fewer new launches (you can read the details here); and unlike the past few years, we have no 1,000+ unit mega-developments to soak up demand. In fact, Lentor Modern is the biggest private, non-landed residential project for this year so far.

Buyers are simply short on choice right now; and with home prices relentlessly climbing, Lentor Modern’s $2.1 million quantum (for a three-bedder) doesn’t seem too far out of the norm. One realtor noted that AMO Residence, which also sold out fast, also saw three-bedder units transacting above the $2 million mark.

As such, it’s likely that these two recent projects – AMO Residence and Lentor Modern – have set a higher benchmark for the overall market.

5) Age advantage against nearby alternatives

We have more on this in our full review; but to quickly recap, one of the reasons for Lentor Modern’s attractiveness is its age advantage. The two closest resale alternatives, Thomson Grove (1984) and The Calrose (2007), are significantly older: while they are freehold units, the facilities are not par with Lentor Modern – and, of course, neither of those can boast a mall, childcare centre, etc. downstairs.

(That aside, Lentor Modern may actually be a boon to the Thomson Grove and The Calrose, as it adds much-needed retail amenities to the neighbourhood).

6) Accessible and convenient, while still being in a quiet area

For most private residential enclaves, it’s a trade-off between exclusivity and convenience. As we pointed out above, this part of Lentor Hills was peaceful but rather inconvenient, before Lentor Modern.

The first residents at Lentor Modern will have the advantage of MRT access and shops, while still being in a fairly low-density area. Now, this might change going forward, as Lentor Modern is one of six GLS sites in the area – but we note that the next upcoming site is also under GuocoLand, so it’s likely built with the aim of complementing both projects.

(Also, Lentor Modern is the only one of the six sites that allow for integrated development, so buyers get first-mover advantage here).

Barring future projects doing rude things – like blocking the view, or introducing heavy traffic – Lentor Modern is currently in a “best of both worlds” situation.

To conclude, Lentor Modern is a pricey condo; and under normal times, HDB upgraders would probably baulk at the price (integrated or not). But in the context of 2022, its $2,000+ psf range manages to look like a norm.

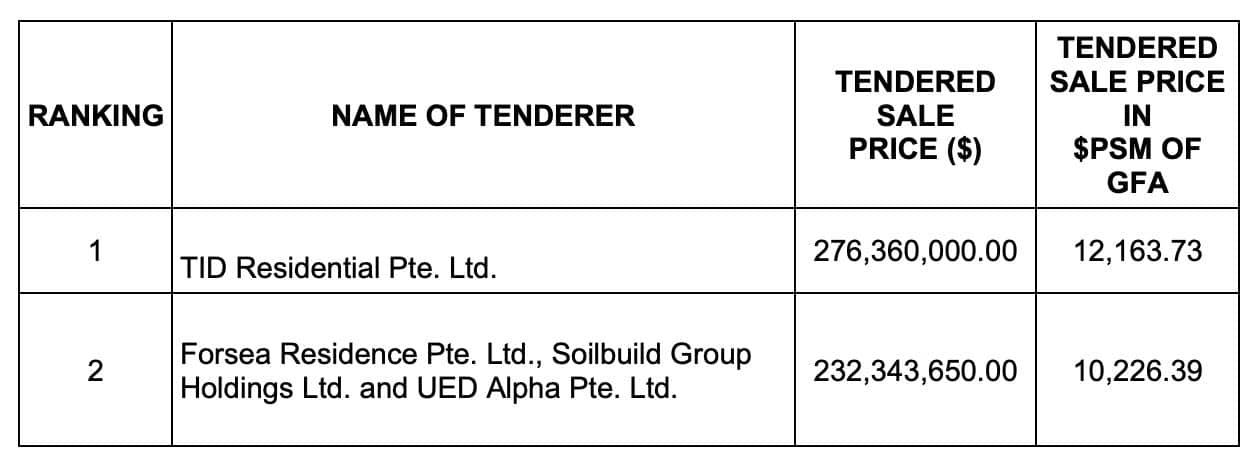

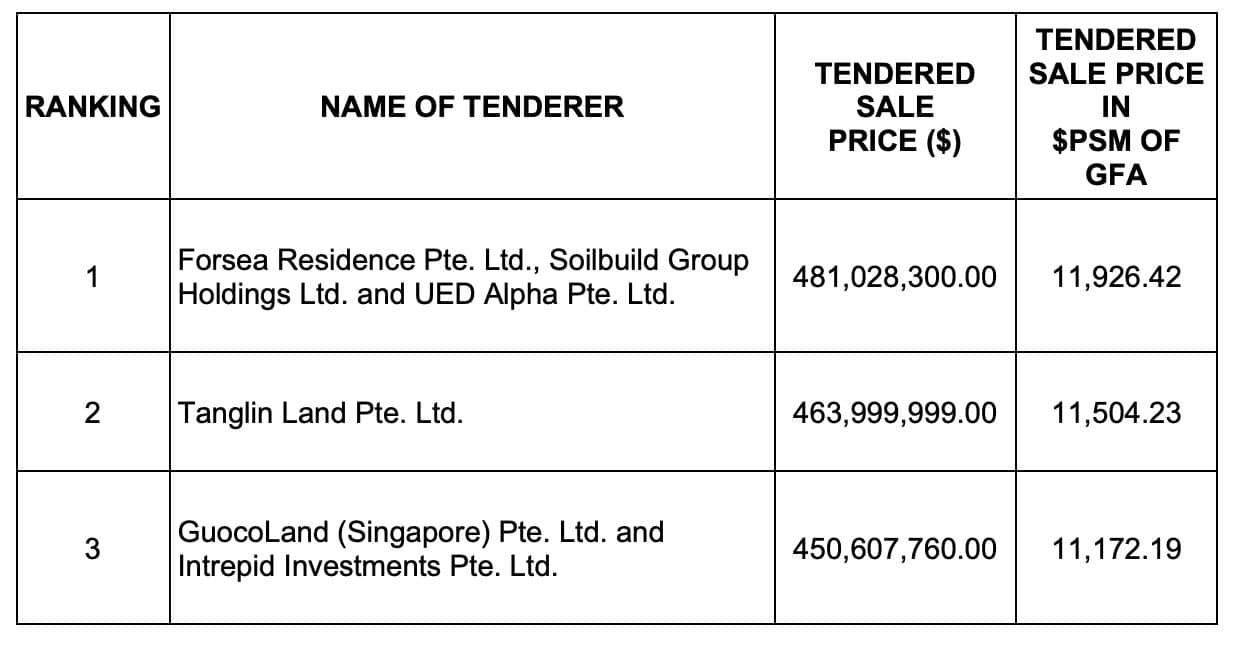

All that said, it is worth noting that the 2 subsequent Lentor GLS sites were closed with a more muted number of bids than expected. Each parcel received just 2 to 3 bids each when some analysts were expecting 7 to 10.

With the closing land bids at S$1,108 psf ppr and S$1,130 psf ppr for Lentor Central and Lentor Hills Road (Parcel B), which is still higher than Lentor Hills Road (Parcel A) at $1,060 psf ppr. This is still lower than the $1,204 psf ppr of the Lentor Modern site – which some buyers were concerned with.

Not that it matters too much now anyway, given the prices that Lentor Modern has sold at. Future buyers will definitely be watching this space more closely.

For more news on the Singapore property market, follow us on Stacked. We’ll also provide you with in-depth reviews of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did Lentor Modern sell so many units during its launch despite high prices?

How does the location of Lentor Modern influence its popularity?

What role does the GuocoLand brand play in the success of Lentor Modern?

Are the prices of Lentor Modern units justified by its features?

How does Lentor Modern compare to older nearby residential options?

Will future developments affect Lentor Modern’s appeal?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from New Launch Condo Analysis

New Launch Condo Analysis This New Dairy Farm Condo Starts From $998K — How the Pricing Compares

New Launch Condo Analysis This New Freehold CBD Condo Starts From $1.29M — Here’s How the Pricing Compares

New Launch Condo Analysis This Freehold New Launch Condo In The CBD Is Launching From Just $1.29M

New Launch Condo Analysis I Reviewed A New Launch 4-Bedroom Penthouse At Beauty World

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

2 Comments

Went for a viewing, no way am I paying the prices they are asking for this bird no lay egg place, lol! Even Sky Eden looks like a bargain by comparison.