4 Condo Layouts And Features Buyers Are Moving Away From in 2025

August 6, 2025

In all frankness, there are trends in the Singapore property market, and they do sometimes contradict each other. In the words of a seasoned architect I spoke to earlier this year: “Every new trend is a reaction to the last one.” Balconies that were once considered luxuries are increasingly regarded as inefficient; open kitchens that were the rage are now seeing less favour than enclosed ones. I do think it drives developers a little crazy sometimes; it runs the risk of designing with features that have been popular up to a point, but then become off-putting at the actual launch. Here are some of the things we’ve noticed buyers dislike today:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Dual-key layouts

In theory, dual-key layouts should make sense in 2025. They count as one home but are subdivided into two: that means you can “own” two units, but only pay ABSD like you bought one. They also allow for intergenerational living or rental, while maintaining privacy; both solid traits in a time when private home prices are high.

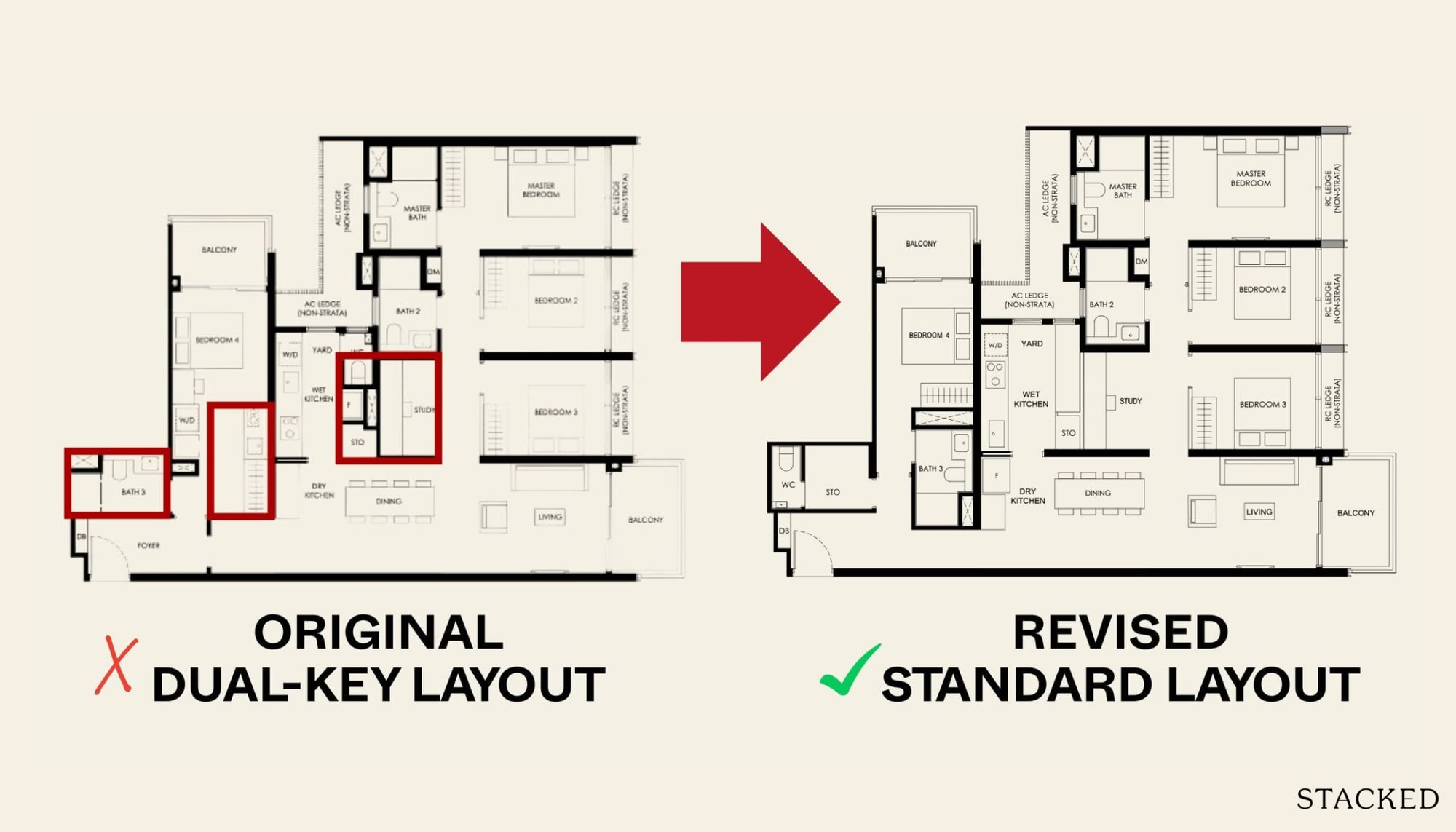

However, dual-key units in some recent new launches haven’t been selling well. At the time I’m writing this, for instance, Nava Grove has just transformed its dual-key four-bedders into standard four-bedders. This was after none of its 23 dual-key four-bedders sold, despite some 80 per cent of the overall units having already moved.

We also saw this at The Orie, where only about half of the 39 three-bedder dual-key units have sold. The Orie’s standard three-bedders though? Sold out already. At Grand Dunman, initial sales for the two-bedroom dual-key units were promising (22 out of 34 sold). But once the launch-day excitement wore off, these units started dragging their feet. Roughly one to three dual-key units moved every quarter after that. And the three-bedroom dual-key types? Only five sold out of 36; even as standard three-bedders reached 90 per cent take-up.

One of the reasons is how forcibly dual-key concepts have been squeezed in.

From word on the ground, realtors have expressed concerns that recent dual-key layouts are almost just a “sealed off, separate room” rather than a “full” dual-key unit. Many don’t even have separate kitchenettes, for example, but rather just a tiny pantry area. A common remark among showflat viewers is that they wouldn’t feel comfortable telling their parents/children to squeeze into this sub-unit, which is just too small.

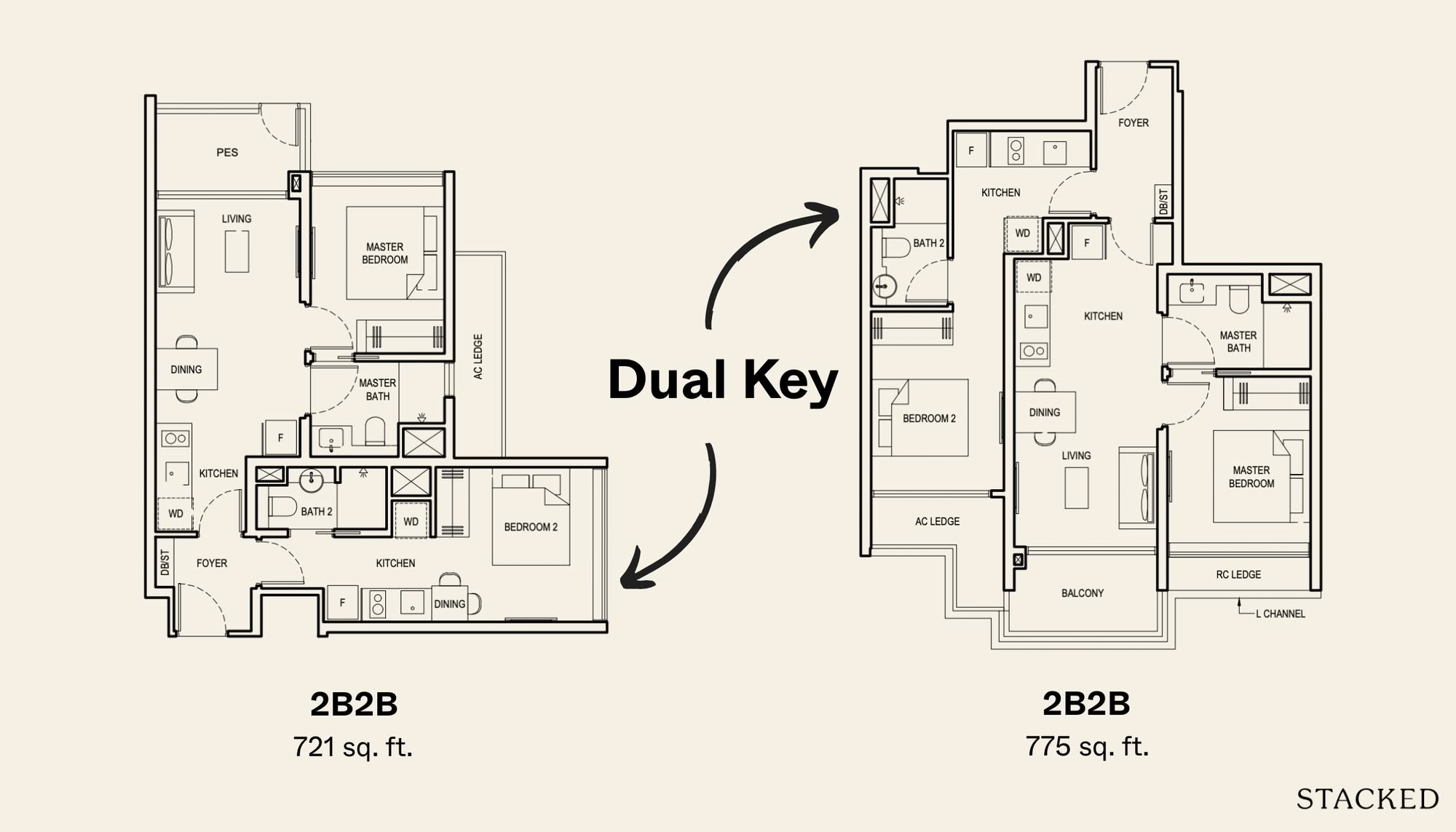

One of the examples pointed out to us was the two-bedder dual-key units at Grand Dunman. It is quite surprising that a developer would try a dual-key format for a unit that’s already so small (721 – 775 sq ft), and it results in the dining area having to be merged with the kitchen in the main unit.

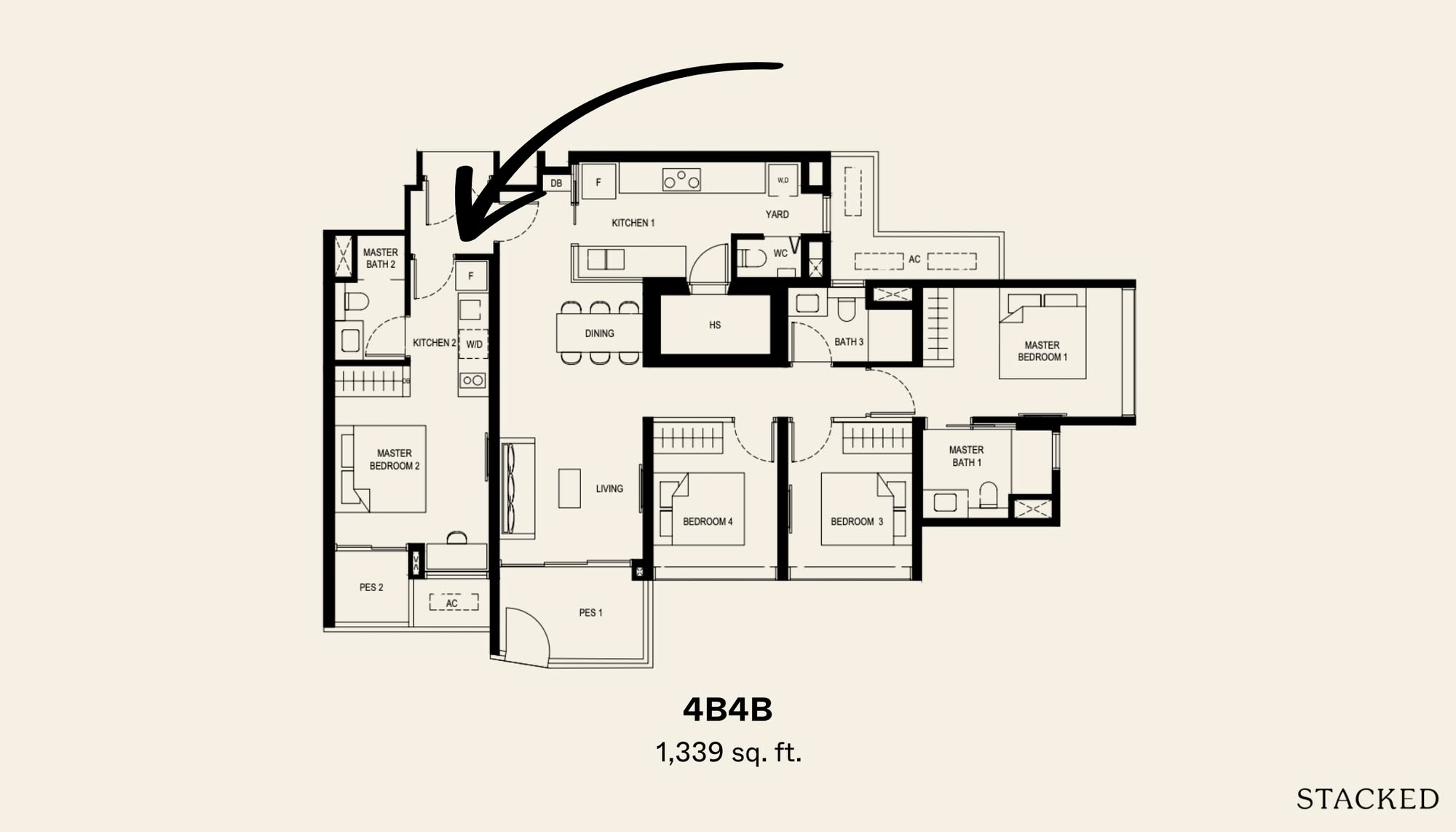

Even larger dual-key formats aren’t immune. At Lentor Hills Residences, the 1,399 sq ft four-bedder should be sizeable enough for a sub-unit, but the kitchenette is really more of a pantry, and the outdoor patio shares space with an air-con ledge.

As an aside, dual-key layouts can be tougher to resell, as most regular buyers have better use for a bigger living room, bedroom, etc. than a sub-unit.

2. We seem to be going back to enclosed kitchens as the preference

Once upon a time, open kitchens were all the rage; and back in 2018, HDB even began using them as the standard kitchen layout. Besides looking more spacious, this was believed to be advantageous to parents; an open kitchen lets them monitor children in the living room whilst still working in the kitchen, or vice versa.

But somewhere between the inescapable odours and the film of grease that could go all the way into the living room, the trend started dying out. We’ve noticed that popular units in recent reviews have an enclosed /wet kitchen.

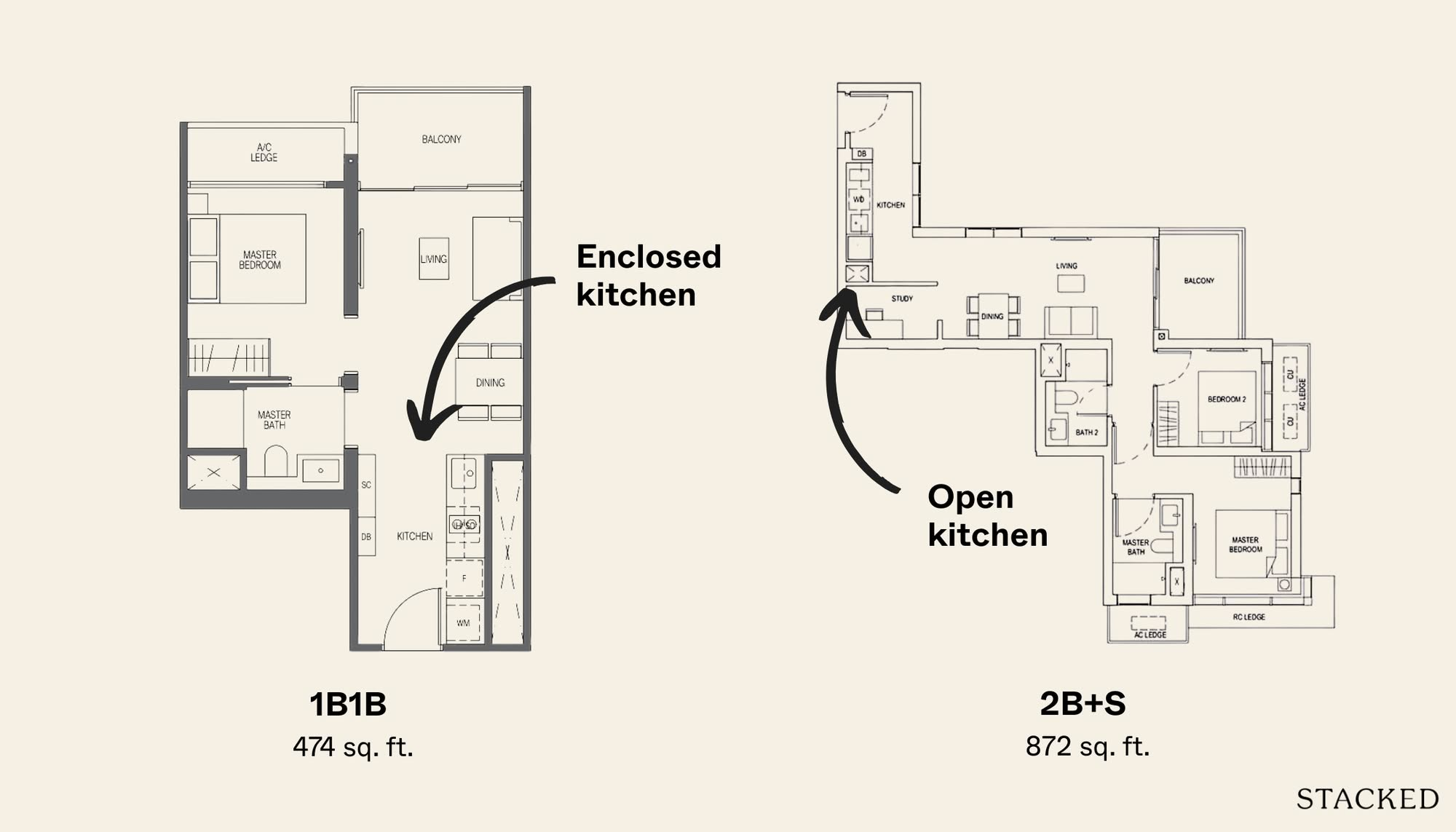

Midtown Modern, for example, has a 474 sq ft one-bedder; and one-bedders are far less popular these days (see below). But Midtown Modern’s one-bedder sold very well, and one impressive trait was that you could enclose the kitchen despite its small size.

In contrast, check out the 2+Study units at One Bernam, which saw slower sales. One criticism of the 872 sq ft was the open kitchen that only ran along one wall, thus losing the option of cabinetry and another countertop on the opposite side. To be clear, there were other problems with this layout, such as a less practical study nook and winding entrance – but the kitchen can be seen as a contributor.

More from Stacked

8 Different 5-Room HDB Layout Ideas To Make The Most Use Of Space

Some people have the impression that HDBs in Singapore is boring. It all looks the same on the outside, and…

From word on the ground, realtors have noticed that enclosed kitchens are preferred by the older generation, and hence also by multigenerational buyers. And with more Singaporeans working and eating from home these days, kitchens see heavier use than before. That means having a door you can shut while stir-frying.

3. Non-versatile, PPVC construction with fixed walls

Prefabricated Prefinished Volumetric Construction (PPVC) involves stacking factory-made room modules together to form the unit. The upside is faster, more controlled construction; but it comes at a cost.

For one, unit dimensions are more rigid. Most PPVC condos have a standard module width of around 2.8 meters and a ceiling height of about 2.75 metres, whereas conventionally built projects often had higher ceilings (2.9 – 3.3 metres) and more flexibility in room sizing (see here for full details.)

This leads to more uniform, cookie-cutter layouts. Developers have less freedom to vary floor plans, and buyers are more constrained during renovations. For example, structural walls in PPVC modules cannot be hacked during renovations (they’re load-bearing by design), so you lack options like resizing or merging rooms.

Some developers have already begun to leverage non-PPVC construction as a selling point, as we’ve seen in Canberra Crescent Residences and River Green.

Even if buyers may not know the term PPVC per se, there are definitely more of them who are asking for more versatility these days. For example, HDB uses PPVC construction; but during one of the Kallang-Whampoa BTO launches, they still made an effort to offer open-concept “white flats” to allow for versatility.

4. We’ve seen a complete turnaround of the former shoebox craze

Remember the early 2010s? When everyone was flipping tiny 450 sq ft units for profit or aiming to have rental income? Those days are gone. Buyers have become far more critical of what one-bedroom layouts actually offer.

If there’s one development that tried to reinvent the one-bedder, it’s TMW Maxwell. The project’s highly marketed “Flip/Switch” layout – where your bedroom morphs into a living room with some folding and sliding – did strike us as very innovative. But only about seven of the 324 units were sold during the first launch phase, and nothing’s moved much since then.

To be clear, we still appreciate that the developer tried something different; but perhaps the high number of one-bedders set it on an uphill challenge regardless. At Parksuites, for example, there was a notable presence of one-bedder and one-bedder + study units. Yet only 40 per cent of the regular one‑bedder units were sold by 2024, and just 32.1 per cent of the one-bedder + study units.

Perhaps another sign of this is the recent launch of Canberra Crescent Residences, where the developer only bothered to build three single-bedder units; it was practically just an afterthought.

The reason behind this is quite clear: the majority of condo buyers are HDB upgraders, selling their flats to buy private property. The majority of these HDB upgraders are family units who simply cannot fit into units that are 500 sq ft or below. It doesn’t matter how creative the layout is or how strong the location is.

So What Do Buyers Want in 2025?

When even mass-market condos routinely near or cross the $2 million mark, buyers are more emphatic than ever about how space is used. Every square foot counts, and they’re much less forgiving than before.

It has resulted in a more mature, more discerning market. Buyers notice when a long corridor eats into a usable area. They question how a kitchen can be enclosed, if it isn’t already. And some other elements – such as having a mall downstairs, or having very large balconies, are also starting to be questioned (although for now, there are still a good number of proponents on both sides.)

This might be a challenge in the resale market, too, for sellers who have condos built along older trends and preferences.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are buyers moving away from dual-key condo layouts in 2025?

Are open kitchens still popular among condo buyers in 2025?

What construction method is less favored by buyers due to limited flexibility?

Have tiny one-bedroom units lost popularity in 2025?

What features are buyers questioning in condos as space becomes more valuable?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments