$281.2M in Singapore Shophouse Deals in 2H2025 — But That Number Doesn’t Tell the Full Story

December 18, 2025

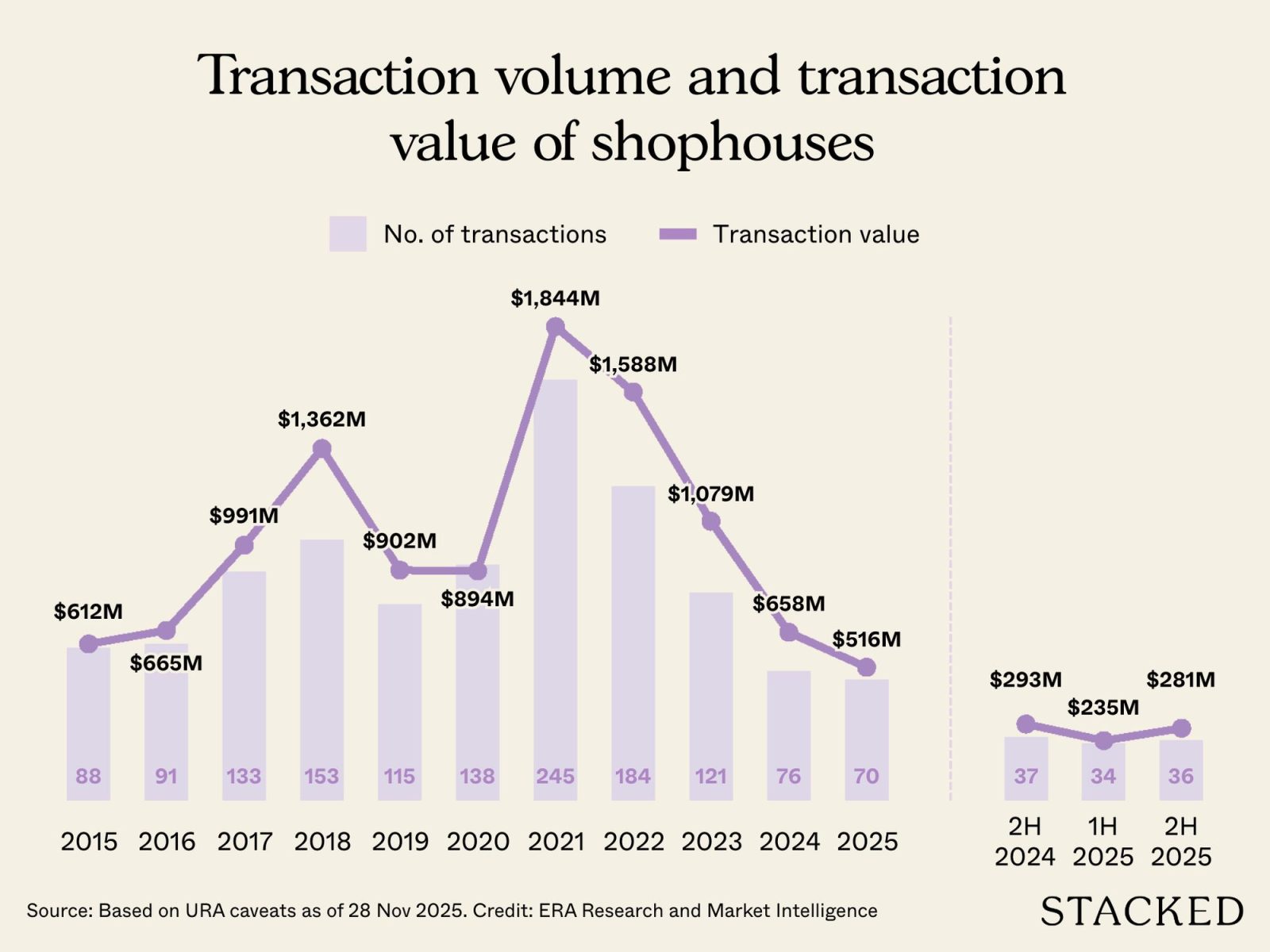

Singapore’s shophouse market recorded 36 transactions in 2H2025, with sales valued at about $281.2 million. This is a slight increase compared to the 34 deals inked in 1H2025 where the sales volume was about $235 million, according to a market report by ERA Singapore.

Overall, sales activity in the shophouse segment dropped to a 10-year low and is a sharp slowdown from the peak in 2021 when 245 shophouses worth $1.8 billion were sold.

Marcus Chu, CEO of ERA Singapore, says that elevated asset prices and increased global economic uncertainty have reduced investor appetite for shophouses in Singapore. “The subdued activity reflects a pricing standoff between buyers and sellers, rather than weak demand. Landed shophouses remain highly sought after, but price expectations continue to be the main obstacle to closing deals,” he says.

He adds that some transactions may go unreported as they were completed through special purpose vehicles, share sales, or transacted without a lodged caveat.

Most expensive shophouse deals in 2H2025

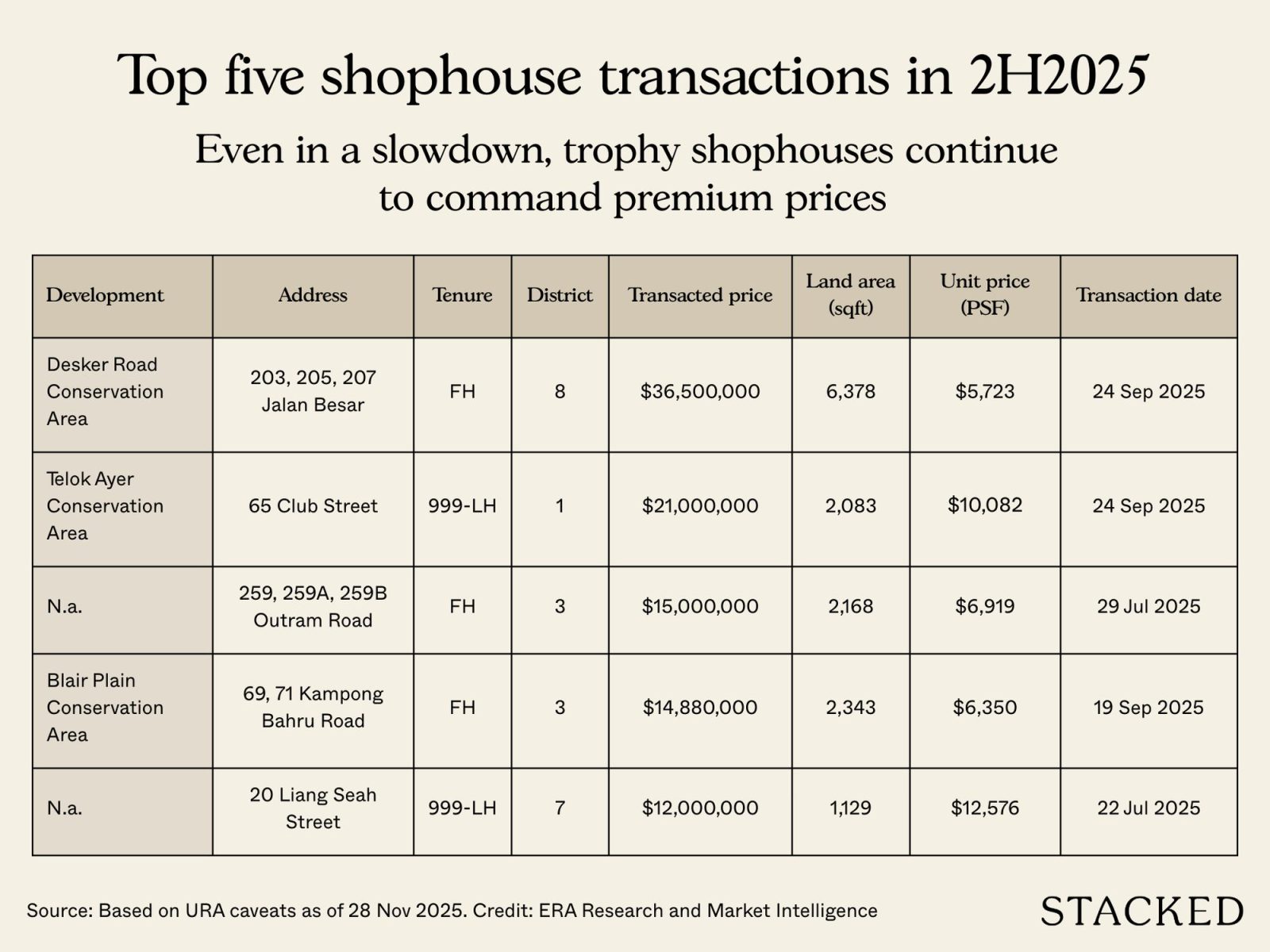

According to caveats, the most expensive shophouse transaction in 2H2025 was the sale of 203,205,207 Jalan Besar, a property in the Desker Road Conservation Area in District 8 . The freehold shophouse sits on a 6,378 sq ft site and fetched $36.5 million ($5,723 psf) when it was sold on Sept 24.

The runner-up is the sale of 65 Club Street, a 999-year leasehold shophouse in the Telok Ayer Conservation Area in District 1. The shophouse, which sits on a 2,083 sq ft site, changed hands for $21 million ($10,082 psf) and the sale was also lodged on Sept 24.

All the top five shophouse sales were freehold or 999-year leasehold properties, and more than 86.1% of the shophouse deals closed in 2H2025 were in this category. However, average prices for freehold shophouses dipped 18% in 2H2025 compared to $3,989 psf recorded in 1H2025.

Elevated freehold prices have also established a price floor for leasehold assets, with 99-year leasehold shophouses seeing a 7.1% increase in the average price to hit $4,758 psf in 2H2025 compared to the first six months of this year.

A noteworthy 99-year leasehold shophouse that changed hands in 2H2025 was the sale of 78 Pagoda Street which fetched $12 million ($10,478 psf).

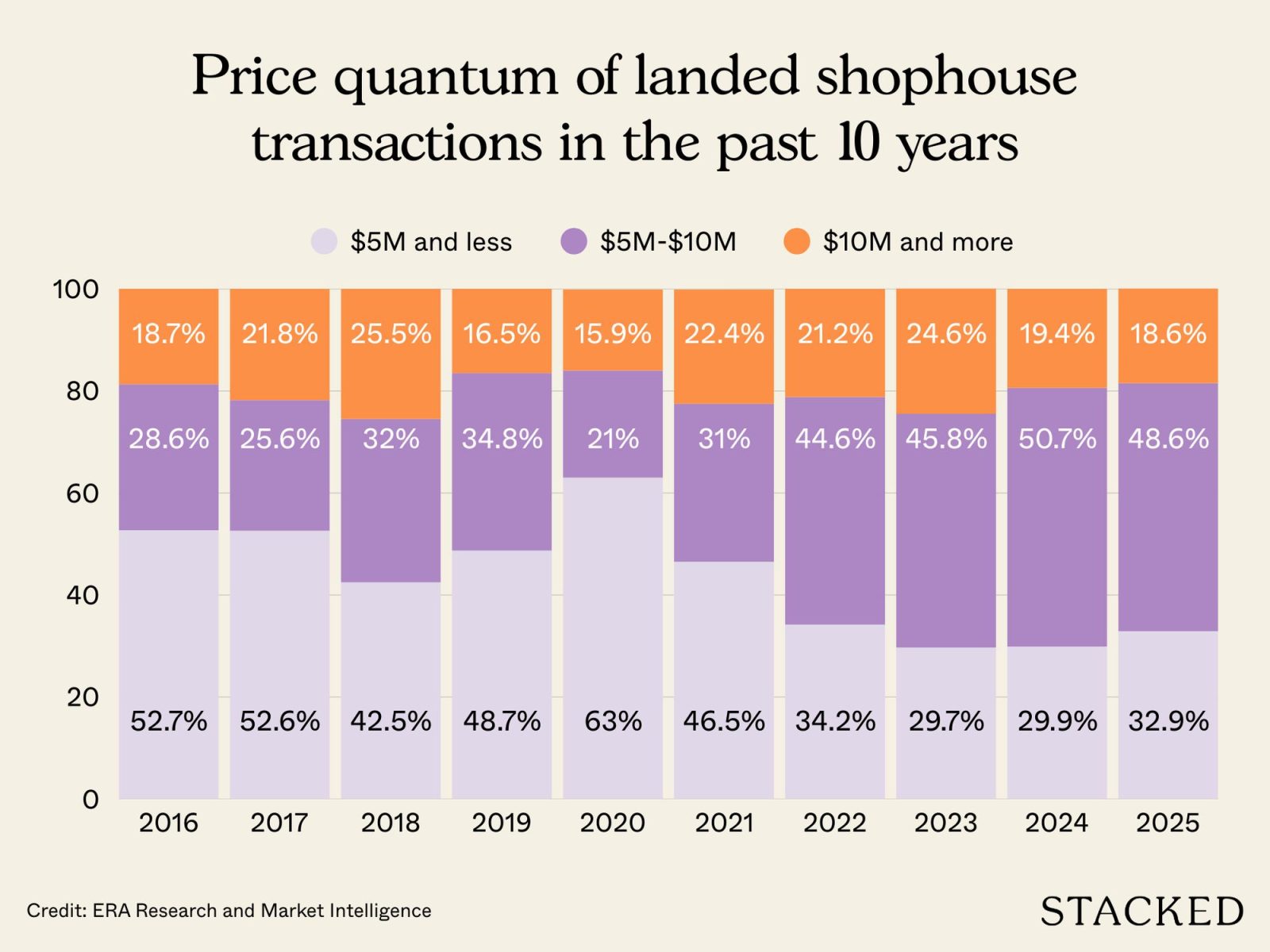

Research by ERA indicates that over the last decade, about 66.7% of all shophouse transactions in Singapore were valued between $5 to $10 million, and this underscores this as the market’s key pricing band. Transactions under $5 million were mainly 99-year leasehold properties in non-central regions or smaller units of less than 2,000 sq ft.

More from Stacked

Why This Once-Ulu Town In Singapore Is Going To Change (In A Big Way)

Expect to hear much more about Woodlands in the near future, thanks to the upcoming Johor Bahru - Singapore Rapid…

Popularity of Central Region and conservation status shophouses

Thirty of the 36 shophouse deals in 2H2025 were in the Central Region. This reflects ongoing demand for centrally located assets that offer higher rental yields from uses such as F&B, fitness, and co-living, says Chu.

There were nine transactions each in District 8 (Little India) and District 15 (East Coast/Marine Parade).

Conservation shophouses remain tightly held by owners, supported by the scarcity of such properties in Singapore. Only about 6,500 shophouse have conservation status. For example, two shophouses at 69,71 Kampong Bahru Road were sold for $14.88 million ($6,350 psf) on 19 Sept. The freehold shophouses are in the Blair Plain Conservation Area in District 3.

The lure of trophy assets

Looking ahead, family offices and institutional investors are likely to remain the key buyer groups for shophouses. Most of these buyers prefer assets in the Central Region with freehold or 999-year leasehold tenures.

Likewise, shophouses suitable for residential or co-living conversion will continue to attract the attention of operators looking to expand their portfolios in Singapore.

The absence of additional buyer stamp duties on shophouse transactions, coupled with the property’s rarity and versatility, means that these assets will be on the radar for most high net-wealth local and international buyers.

“Despite ongoing global uncertainties, Singapore remains a stable investment hub, supported by political stability, a strong Singapore dollar, a competitive tax regime, and its capacity to attract long-term capital. These factors continue to drive demand for landed shophouses as assets for capital appreciation and wealth preservation,” says Chu.

ERA forecasts that the shophouse market is poised for recovery in 2026 with 70 to 80 deals amounting to about $550 million to $650 million potentially on the table, as portfolio rebalancing and asset recycling drive big-ticket transactions.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How many shophouse deals were made in Singapore in 2H2025?

What was the most expensive shophouse sold in 2H2025?

Are freehold shophouses more expensive than leasehold ones?

Where are most shophouses sold in Singapore?

Why are conservation shophouses popular?

Timothy Tay

As Editor-in-Chief of Stacked, Timothy leads the newsroom and shapes our editorial direction, ensuring readers receive timely, thoughtful, and well-researched news and analysis. He brings over eight years of experience as a business and real estate journalist, with a strong track record across both print and digital platforms. His reporting spans luxury residential, commercial real estate, and capital markets, alongside in-depth coverage of sustainability and design.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News A Rare Freehold CBD Office Unit Is Up For Sale At $20.5M — And Foreigners Can Buy It

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Latest Posts

Property Advice Should I Pay $500K More For A New Launch — Or Buy A Resale Condo Instead?

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

0 Comments