The World’s Real Estate Is Now Worth US$393 Trillion In 2025. Here’s Where Singapore Fits In

September 30, 2025

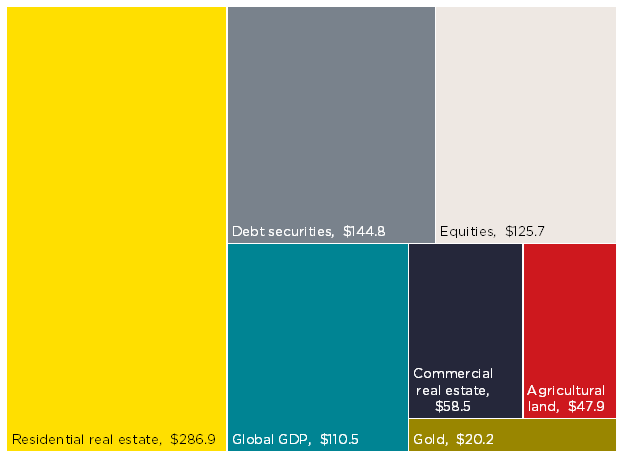

Every so often, the numbers remind us of real estate’s sheer weight in the global economy. According to Savills, the total value of all real estate, residential, commercial, and agricultural land stood at US$393.3 trillion at the start of 2025. Even with a slight 0.5% dip year-on-year, property remains the world’s largest store of wealth by a long margin. To put this in perspective: the value of all the gold ever mined comes in at US$20.2 trillion. That’s just about five per cent of what real estate is worth. In fact, the asset class outstrips global equities and debt combined.

Residential Stalls, Commercial Holds Up

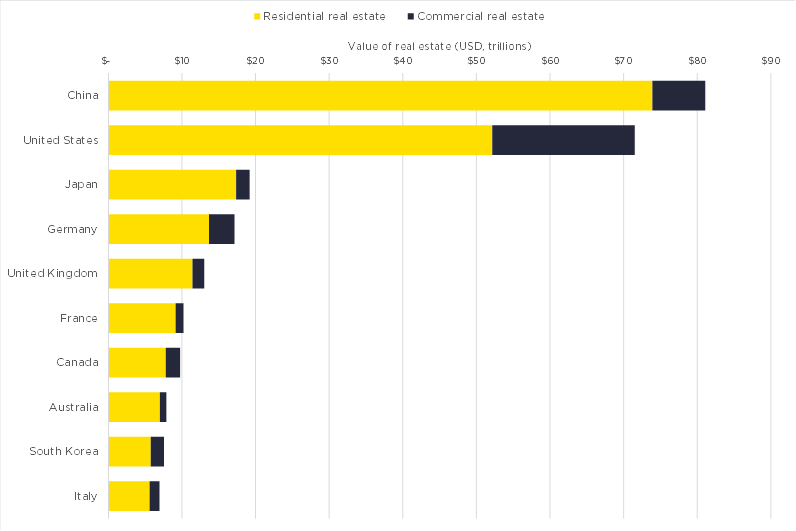

By the end of 2024, the world’s residential real estate stock was valued at US$286.9 trillion, a 2.7% annual decline in US dollar terms, but still 19% higher than in 2019, underscoring the pandemic-era boom in housing values. As of 2025, residential remains at the same level: US$286.9 trillion. In other words, the sector has stalled after years of strong growth. While most countries continued to see rising prices and expanding stock, the sharp decline in China (which is home to roughly a quarter of global housing value) was enough to offset gains elsewhere and drag the global total sideways.

Commercial property, meanwhile, proved more resilient. Total value climbed 4.1% to US$58.5 trillion, supported by stabilising prices and new stock. In markets like the US, the drive toward reshoring and investment in manufacturing gave the sector additional lift. Much of the world’s property wealth, however, remains concentrated in just two countries: China at 23.5% and the US at 20.7%. Together, they control nearly half the global market, while the top 10 countries account for 71% overall.

More from Stacked

This Rare Condo Has Both 99-Year And 993-Year Leases: We Explore Unusual Mixed-Lease Properties In Singapore

For most properties these days, it’s a clear-cut case of them being freehold or leasehold. But head back into the…

Why This Matters for Singapore

For those of us following the local market, it’s worth noting where Singapore lands in the bigger picture. Savills’ 2024 analysis places us at 26th in the world by total residential real estate value, even though we’re only the 109th most populous country. That climb of four places since 2019 highlights what many already sense on the ground: steady price growth and constant redevelopment have made our small market globally significant.

Even with recent softness, global real estate has expanded by 21.3% since 2019, broadly in line with world GDP growth of 25.6%. As Paul Tostevin of Savills notes, shorter-term factors such as interest rates and market cycles will always shape values in the moment. But over time, housing, land, and the built environment remain essential: “a store of wealth, a driver of economic growth and development, and a mirror of global economic shifts.”

Interested to get an in-depth consultation for your real estate needs? You can do so here.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How much is the total value of global real estate in 2025?

How does the value of real estate compare to gold and stocks?

What is the status of residential and commercial real estate in 2025?

Where does Singapore rank in global real estate value?

Which countries hold the largest share of global real estate wealth?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Latest Posts

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

0 Comments