With A $1.9 Million Budget Is Ki Residences or Fourth Avenue Residences A Better Choice?

February 4, 2022

Hello, Stacked homes,

We truly enjoyed your articles, sharing, and analysis. We’d like to seek your opinion on the following:

We have shortlisted Ki Residences and Fourth Avenue Residences.

For the price point and 999yrs leasehold – Ki Residences.

Meet our budget a maximum of 1.9 Mil for a 3 bedroom unit, but the TOP is only in 2024.

Fourth Ave, 99 years leasehold and will TOP in 2022. But only can work on a 2 bedroom unit within the budget of 1.9 million.

Location-wise, Ki Residences is a distance away from the MRT station, although there’s a new potential line that will be built between Clementi and Kent Ridge.

Fourth Avenue Residences is just next to the MRT station which is key for transport convenience, but the concern will be the 2 bedroom unit, and it is also surrounded by freehold developments which might face competition; like Royal Green, etc.

We would like to seek your advice if we plan to stay for 8 to 12 years and then exit by selling the unit. Which development will be recommended?

Thank you!

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hey there,

Thank you for writing to us and thank you for the kind words!

Regarding your decision between Ki Residences and Fourth Avenue Residences – it’s a tough one as both have their strong plus points as well as downsides, and are pretty different developments overall.

Both districts have seen also seen quite a number of new launches in recent years hence potential buyers are spoilt for choice.

We have done a full review on both projects: Ki Residences & Fourth Avenue Residences highlighting each potential and stack analysis as well. However, do note that the market may have changed since then with regards to pricing.

Let us share more on the developments you’ve shortlisted. We actually did a comparison on Fourth Avenue just the week before, which you can take a look at here.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Ki Residences

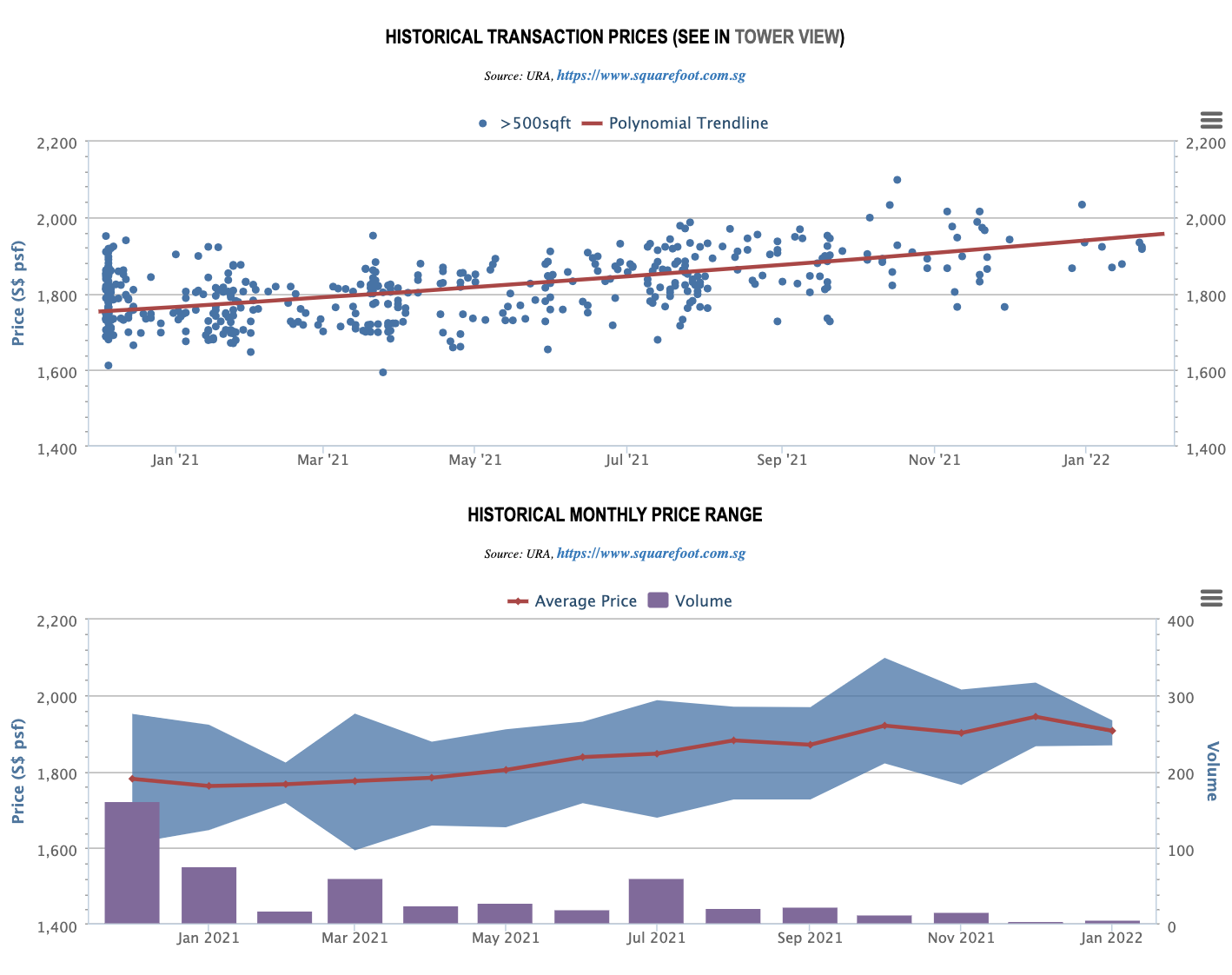

Ki Residences offer tranquil living, away from the hustle and bustle, and it’s probably one of the biggest draws of the development. It is located in the deep end of Brookvale Drive, it is quite a distance to the main Clementi Road, even with a new road under construction. It is also located away from amenities, hence, you can consider it to be inconvenient, especially for those without a car. Prices have risen to $18xx PSF on average since its launch back in December 2020. Considering today’s prices, you can think of it as a decent PSF$ for a 999-year leasehold development – which is of course as good as freehold.

As for the Cross Island Line, it is mainly speculative at this point as the exact station remains unknown to the public. But based on reasonable guesses, there is some merit to the speculation. Undoubtedly, if it does materialise, there is a big upside as the area does currently suffer from a lack of transportation links – so it will provide convenience for the area in the future.

Do also take note that there aren’t many schools located within a 1 km range from Ki Residences. Hence, future buyers especially family profiles may look at other resale options if proximity to schools is one of their main criteria. That being said, the single primary school within 1 km is Bukit Timah Primary School.

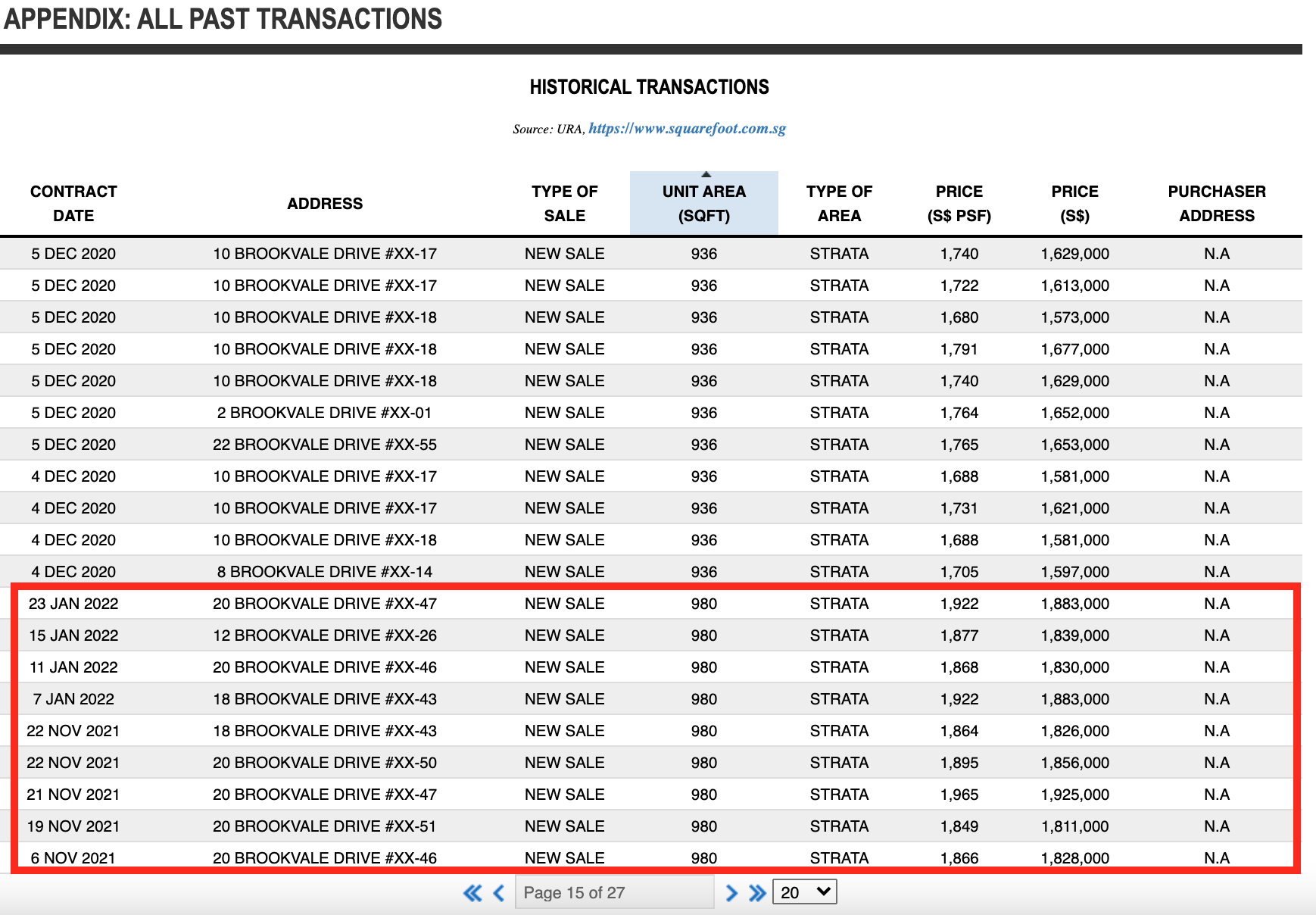

Recent 3-Bedroom Transaction: $1,883,000 (980sqft)

Pros:

- 999-year leasehold development, value retention

- Tranquil living and close to nature

Cons:

- Only 1 primary school within 1 km – Bukit Timah Primary School

- Located in the deep end of Brookvale Drive; away from amenities and bus stop.

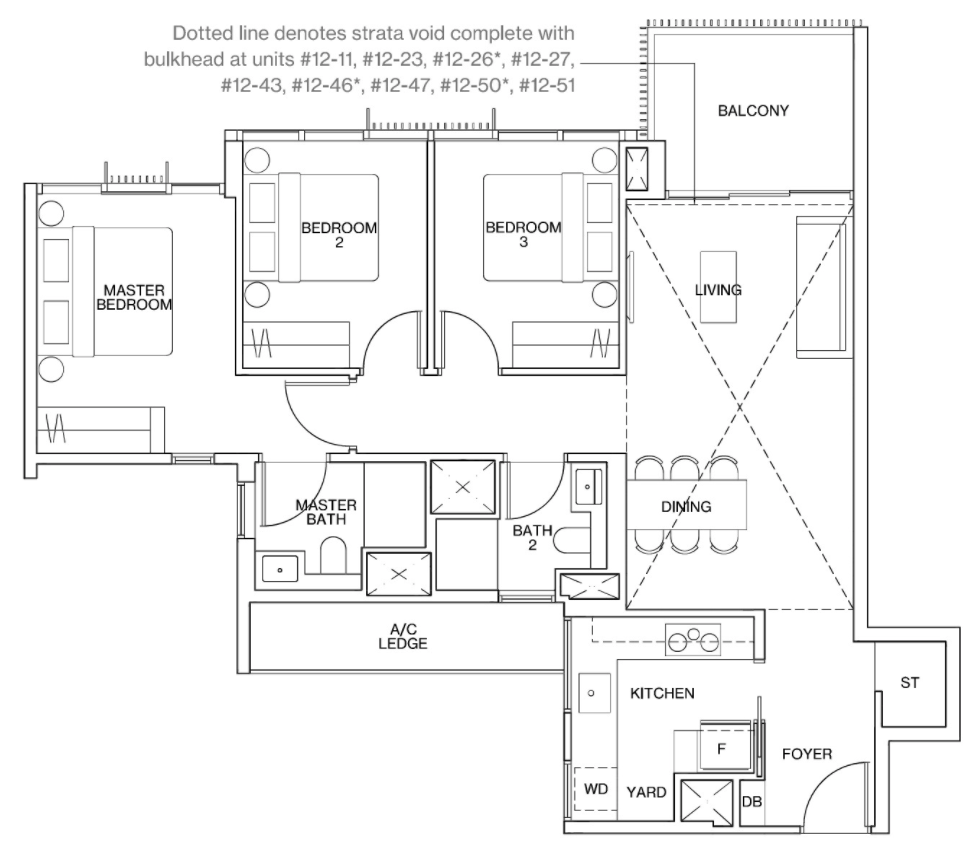

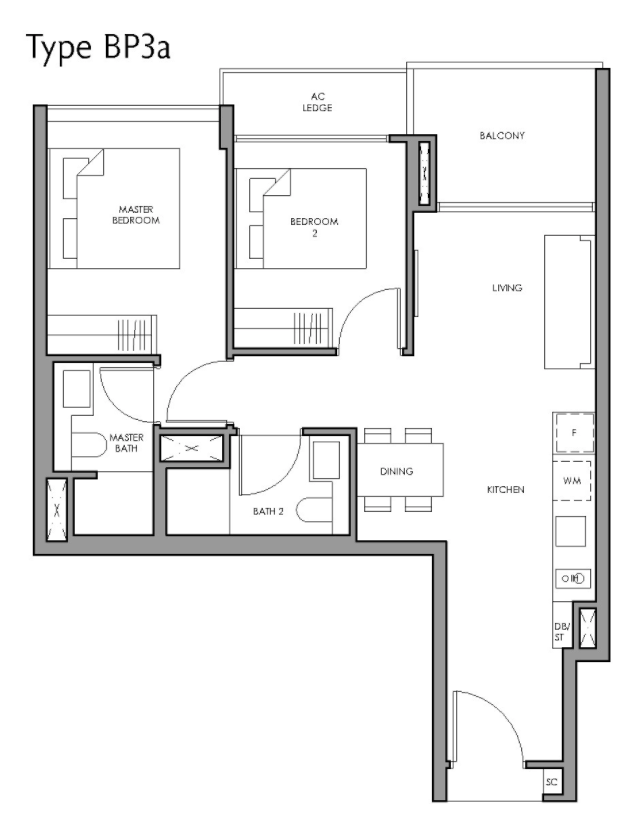

Layout Analysis

At 980 sqft, the unit layout is squarish and efficient but compact, for a 3 bedroom unit. The unit comes with an enclosed kitchen and storage space in the foyer area. Both the bathrooms and the kitchen come with ventilation windows which is very useful. However, the unit lacks a proper yard area for laundry. So aside from a proper yard and helper’s room, it is reasonably laid out for a family’s own stay option.

Fourth Avenue Residences

It is located in the prestigious address of Bukit Timah with doorstep connectivity to DTL Sixth Avenue station and basic amenities all within walking distance. Fourth Avenue Residences is great especially for buyers that are looking for convenience to transportation and amenities.

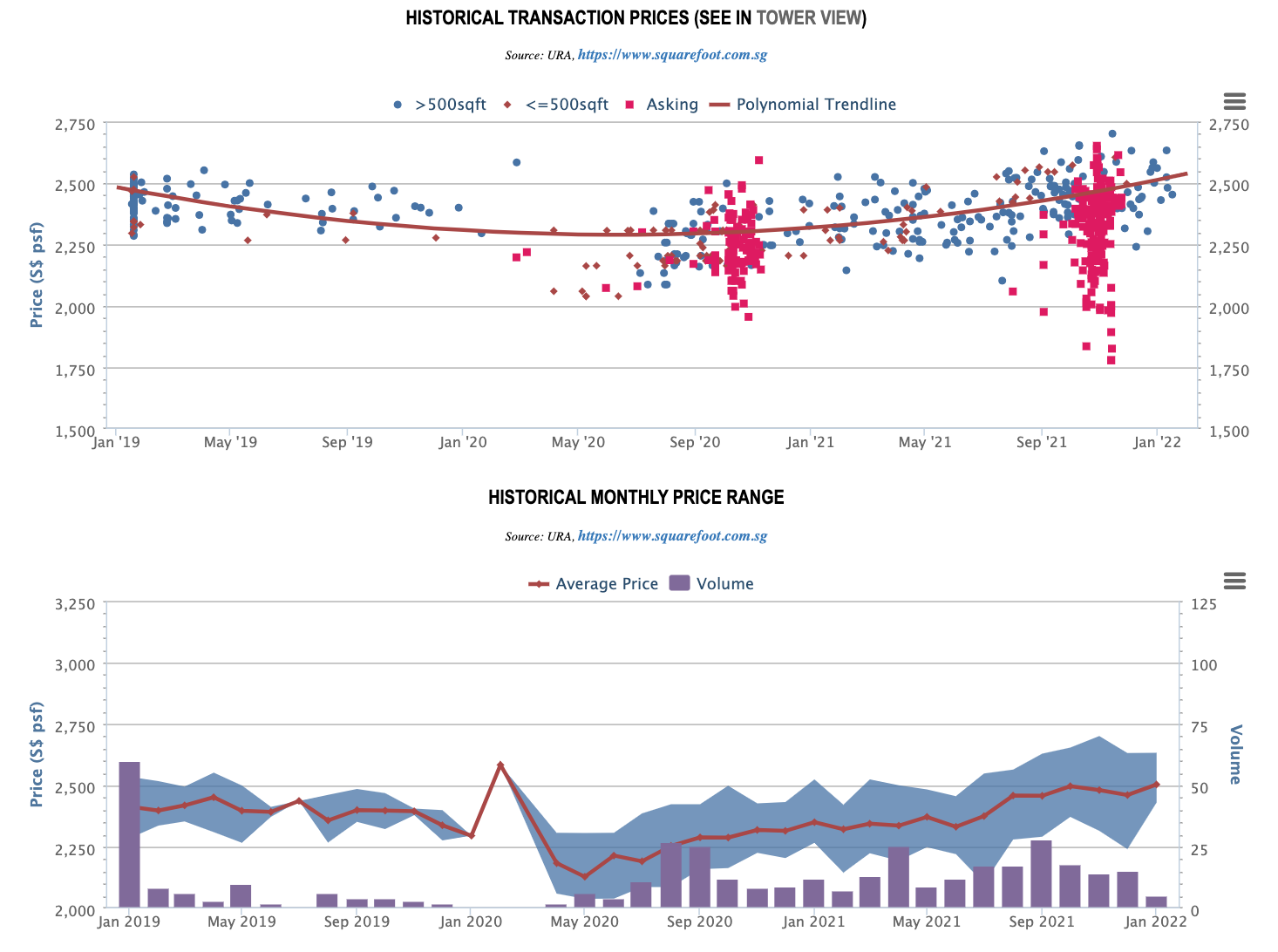

There is good road connectivity with access to major roads and nearby expressways. The unit mix is decent and the facilities are pretty good for a mid-size condominium development. At an average of $24xx PSF, it is a reasonable entry price for new development in the locality.

Do also take note that there aren’t many schools located within a 1 km range from Fourth Avenue Residences. Hence future buyers especially family profiles may look at other resale options if proximity to schools is one of their main criteria. That being said, the 1 primary school within 1KM is Raffles Girls Primary School.

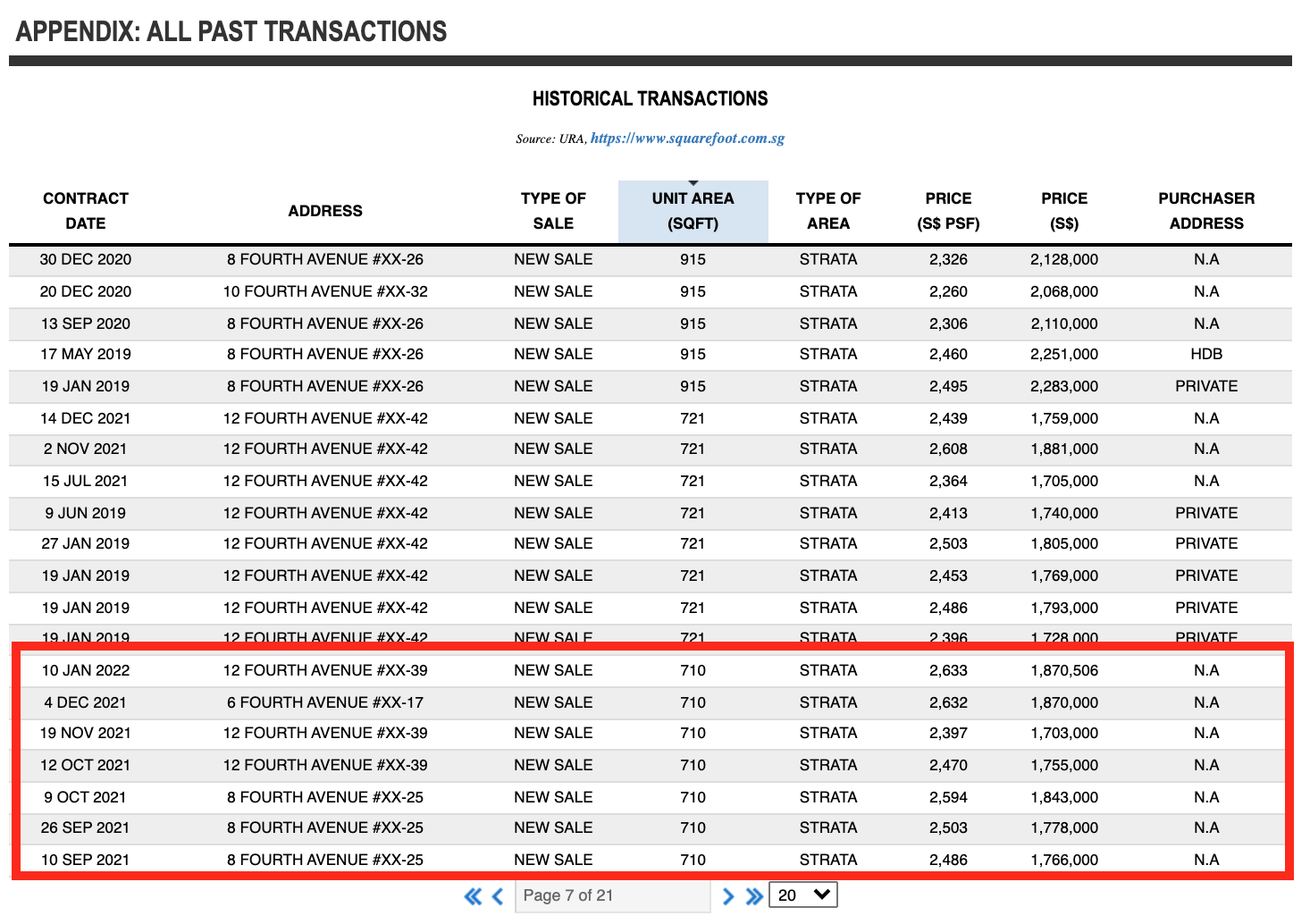

Recent 3-Bedroom Transaction: $1,870,506 (710sqft)

Pros:

- Direct access to MRT station

- Future green corridor expected to be beside, which leads to Botanic Gardens

- Good variety of amenities (coffee shops, supermarket, MRT) within 5 min walking distance

Cons:

- Inner stacks are too close to the opposite block

- Only 1 primary school within 1KM, but it is popular – Raffles Girls Primary School

Layout Analysis

At 710 sqft, the layout is squarish and just okay in terms of layout. The unit opens up to a long kitchen area with a decent size living and dining area, although the entryway is a bit of a waste. The common bedroom area is also adequate, as it can accommodate a queen-size bed minimally. However, the unit lacks ventilation windows in both the bathrooms and kitchen area, which again is a downside if you are one that does heavy cooking. That said, if you are looking at a new launch unit in the 2 bedroom department, an enclosed kitchen with natural ventilation is hard to come by.

Future Outlook

Now that we’ve covered the developments and unit layouts, let’s look at the investment prospects in greater detail.

Fourth Avenue Residences is located in a sea of freehold and a landed-dominant area, and so Fourth Avenue Residences would position itself at an affordable entry for a new full-facility condominium connected to the Sixth Avenue MRT. These traits would contribute greatly as the value-retention factor for it despite its leasehold tenure.

Fourth Avenue Residence’s units are the lowest priced full-facility condo in the vicinity due to the fact that it is the only leasehold condo in the area. We don’t expect a skyrocketing appreciation from the 2BR but instead, you should be relying on the varying stacks premiums as a safety-net/appreciation gap.

The area that FAR is in, is dominated by landed homes, so when resale buyers are looking for an affordable home in Bukit Timah (D10), FAR would come up as one option which would also appear in the search results for those looking at convenience to public transportation.

To top it off, FAR will TOP some time this year which is a huge plus if you are looking to move in early.

Moreover, I understand that you’re concerned about freehold projects such as RoyalGreen being just next door. In this regard, we think that buyers of this development will actually enjoy good rentability due to the positioning of RoyalGreen next door. Because that is a freehold project, owners there will be wanting to protect their rental yields with a higher asking rental price. This gives owners at Fourth Avenue Residences a buffer in pricing and the rental demand in this aspect would continue to keep the prices stable. In fact, direct access to the MRT will be an even more compelling option for tenants as compared to RoyalGreen.

Ki Residences on the other hand would cater to those that value tranquil living, away from the bustle. The area lacks amenities and is located on the deeper side of Brookvale, even with the new road, it is quite a walk down to the main Clementi Road so it can be inconvenient, especially without a car. For the budget of $1.9m, you are able to get a decent size 3 bedroom unit in Ki Residences, which is especially great if starting a family is in the plan. With its long leasehold status, we do foresee value retention in the long term for Ki Residence.

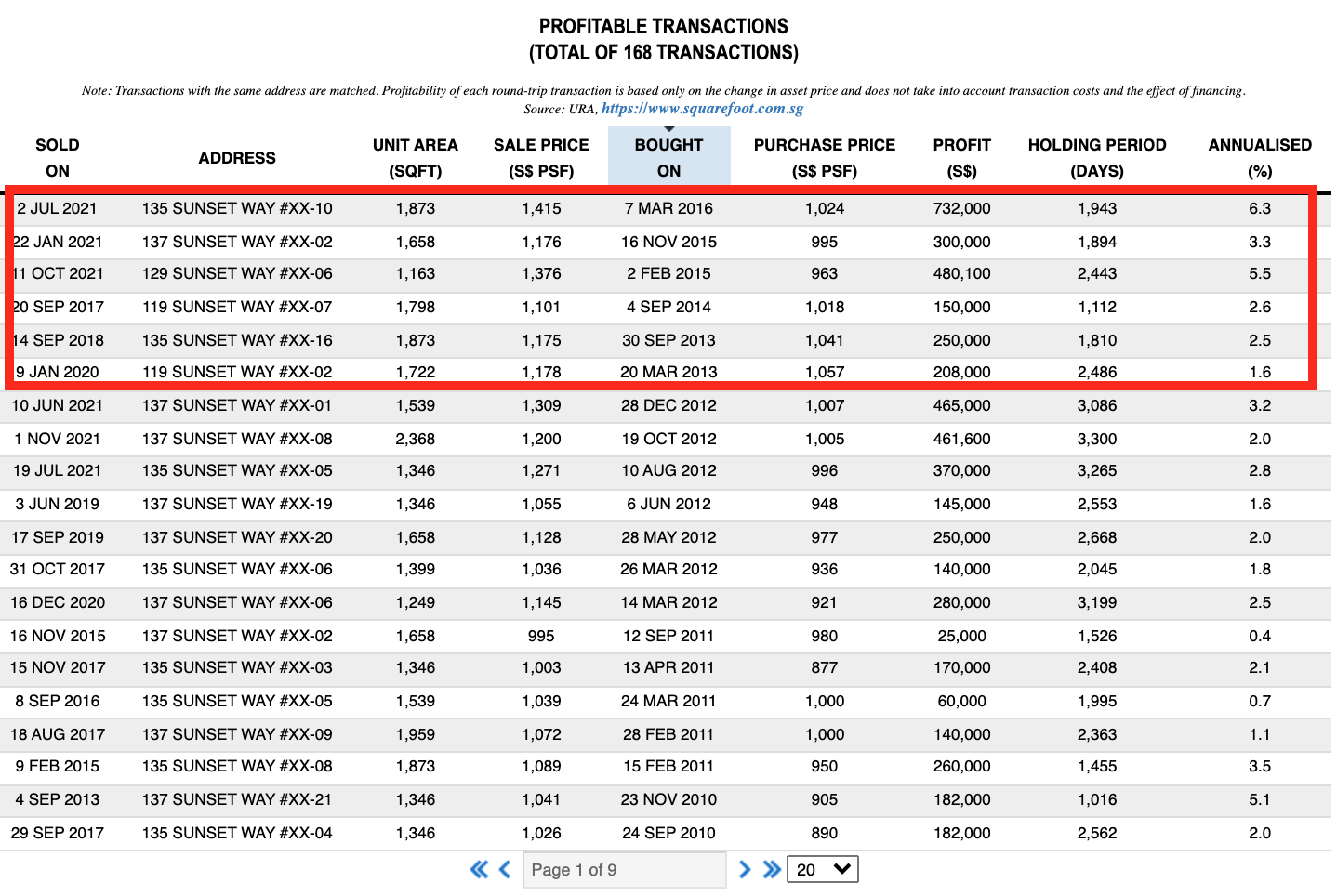

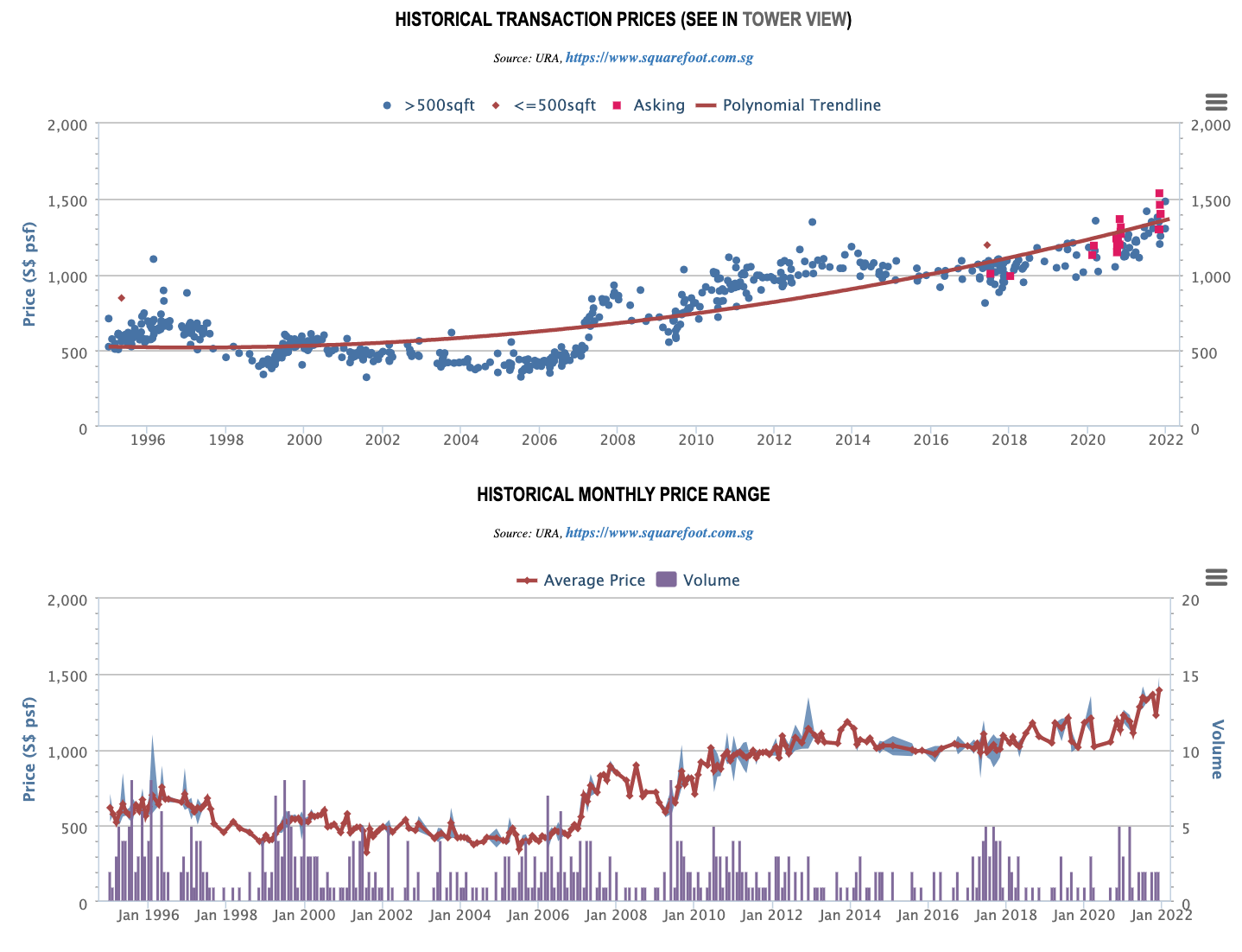

We can cross-reference to nearby resale condominium, Clementi Park, a freehold development that sees great price appreciation over the years even for those that bought a resale in the 2013-2016 period.

On another note, Ki Residences will only TOP in 2024, so that might be a possible issue if you are looking to move in soon.

Conclusion

As we’ve laid out above, both developments are very different in nature.

Fourth Avenue Residences is good if you prioritise convenience over everything else. With a Cold Storage within close walking distance, quite a wide variety of food options in the immediate area (plus you can take a longer stroll to Turf City), and direct access to the Sixth Avenue MRT – it is about as good as it gets in terms of convenience. You could even see Fourth Avenue Residences as a way to “save” money, as you could survive very well even without a car.

All that said, with the budget you have in mind, it is still a 2 bedroom unit after all. While comfortable enough for a pair, if you are planning on having children (or already have one), this may be a real downside despite its convenience.

Ki Residences is an entirely different proposition. Where Fourth Avenue Residences is convenient, Ki Residences is really not in the same league. While the Sunset Way enclave does have quite a number of food options, it really isn’t close by enough to walk daily. And until there’s confirmation of the MRT station nearby, it’s one of those developments that will require you to have a car.

So if you are a big fan of nature, and a more quiet and tranquil way of living (and have a car), then Ki Residences will be our pick between the 2. We do like the fact that for the same amount of money, you get a more useable 3 bedroom unit and nearly as good as freehold tenure – which is really good in terms of future planning. Sometimes you never know where life might take you. And so while selling Fourth Avenue Residences in the future may be an option to upgrade to a bigger space – sometimes people do discount the hassle, stress, and cost of moving house.

Thank you and we hope this helped!

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

0 Comments