Will The 846-Unit Emerald Of Katong Be Priced Cheaper? Here’s All You Need To Know About This Upcoming New Condo

October 24, 2024

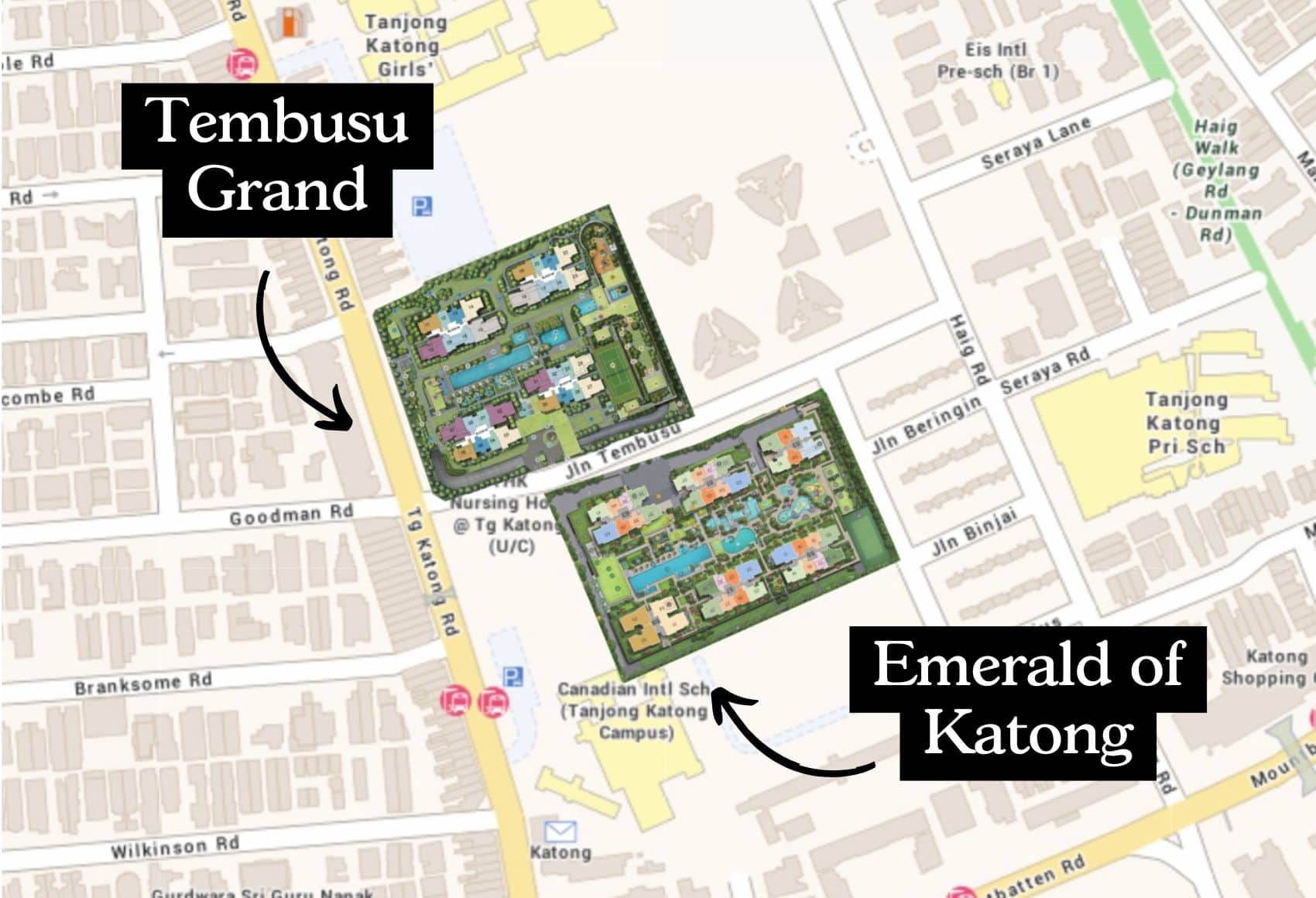

For everyone who thought District 15 was facing an oversupply of new launches (Grand Dunman, Tembusu Grand, and The Continuum), well, here’s a fourth new contender: Emerald at Katong. It’s a confident move from developer Sim Lian: with so many new launches in the same district.

There’s lots of excitement over the Emerald of Katong and Chuan Park, given that they can somewhat be considered mega-developments. Arguably, there have been more heads turned here, as this GLS plot was purchased at a cheaper rate than its competition nearby. But would that necessarily mean cheaper prices?

Here’s a look at what we know so far:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

An overview of Emerald of Katong

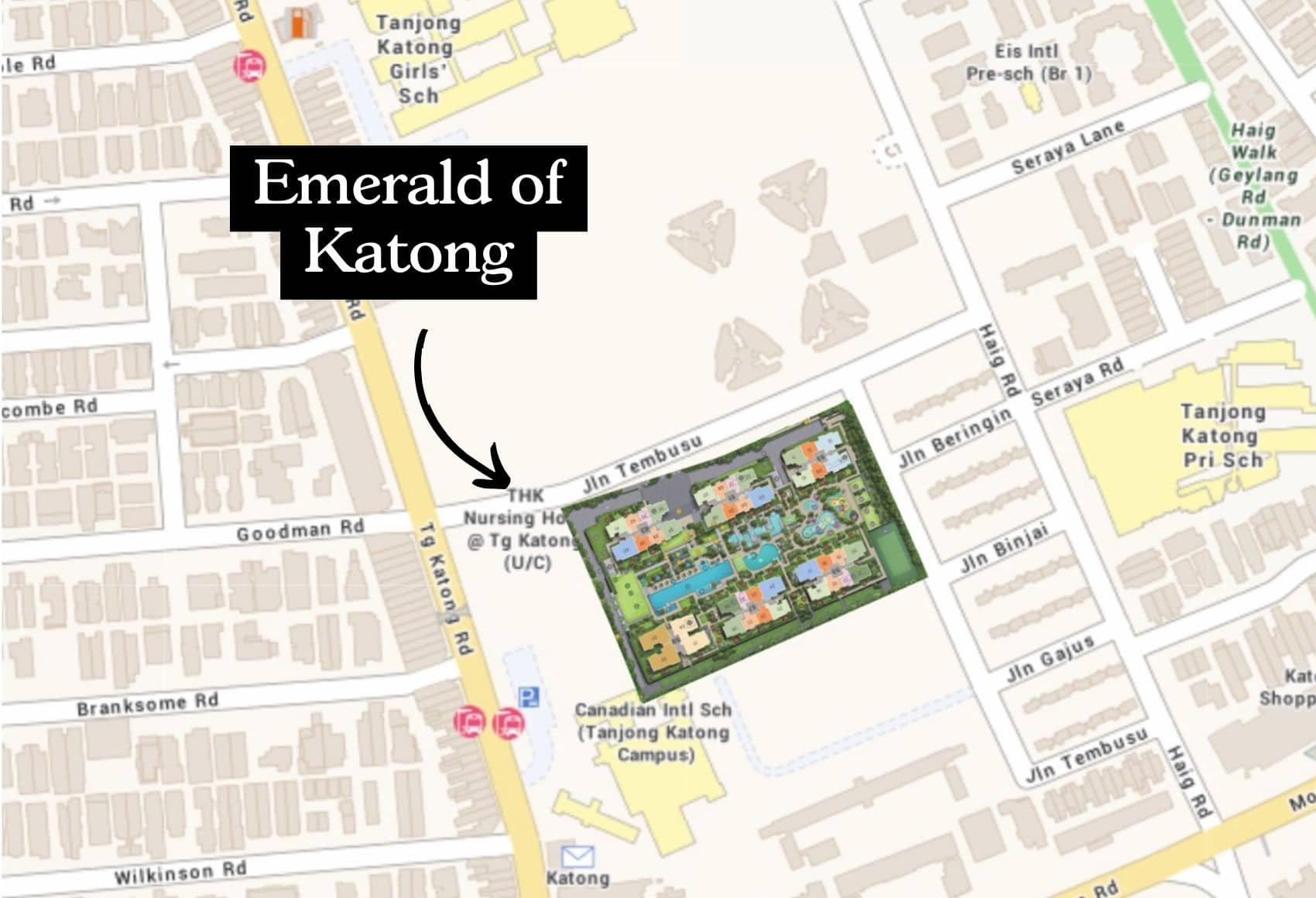

Emerald of Katong is a large development from Sim Lian, with 846 units. This is a 99-year leasehold condo located along Jalan Tembusus; and while Sim Lian is an established developer, this will be their first project in District 15. So far, most of Sim Lian’s more notable developments in the East have been in Tampines (Treasure at Tampines and Tampines Trilliant are both Sim Lian projects). As a point to note, Sim Lian’s last mega-development launch was a success, selling out 2,203 units as the largest project in Singapore. There have been 432 transactions so far (all profitable), with some of the bigger units chalking up nearly a million in profit.

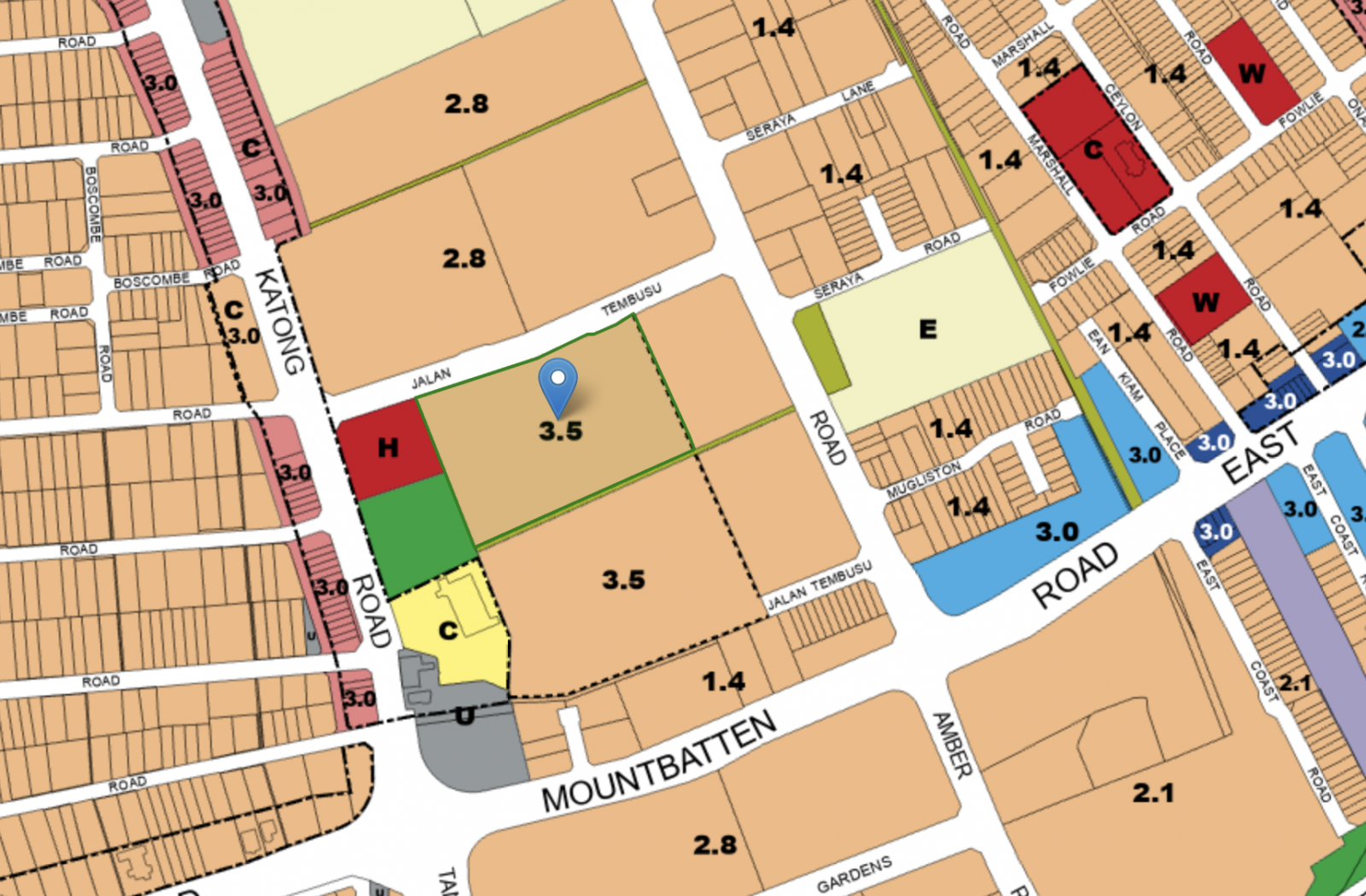

Emerald of Katong has a land size of 20,572 sqm, with a GFA of 72,003 sqm (this is a bit bigger than its neighbour Tembusu Grand, which sits on 19,567 sqm and a GFA of 54,789 sqm).

Sim Lian paid $1,069 psf for the plot, a price lower than Tembusu Grand ($1,302 psf). What’s interesting here is that Sim Lian’s bid of $828.8 million ($1,069 psf ppr) was just $800,000 (0.1%) higher than the $828 million ($1,068 psf ppr) by CDL and Frasers.

So while the price was lower, let’s not forget that it was purchased in a post-GFA harmonisation era. In a nutshell, this means that developers would not be able to charge for the square footage of air-con ledges and void spaces in units with a high ceiling. As such, typically developers would have to bid at a lower price for the land and perhaps even price at a higher psf to make up for the same margin as before. Naturally, this is a big difference between Emerald of Katong and its competition of Grand Dunman, Tembusu Grand, and The Continuum.

The location

Emerald of Katong is located in a major lifestyle hub: the nearby stretches of Haig Road and East Coast Road are well-known foodie havens, packed with a mix of local eateries, artisanal cafes, family-friendly gastropubs, etc. Both i12 Katong and Parkway Parade (the major mall for this area) have supermarkets, pharmacies, enrichment centres, etc. It also helps that the nearby Tanjong Katong MRT (TEL) is up and running, so residents can get to Parkway Parade in just one stop.

This area is oddly packed with big supermarkets by the way: Parkway Parade has a large NTUC as well as a Cold Storage, while i12 Katong has yet another Cold Storage, and Katong V has another big NTUC.

Tanjong Katong Primary School is just down the road from this project, while Haig Girls School is also within a 1 km radius. Besides that, Tanjong Katong Secondary, TKGS, and Chung Cheng are all within close distance.

Long-time East Coast residents will also know there’s a huge number of tuition and enrichment centres clustered around this area. Parkway Centre – next to Parkway Parade has long been known for its vast accumulation of tuition centres. Coupled with park access (next to Emerald of Katong), and proximity to East Coast beach, this is about as family-friendly as you can get.

Unit Types

Emerald of Katong will have a wide mix of unit sizes, ranging from 1+ Study units to five-bedders:

| Bedroom Type | Size (Sqm) | No of units |

| 1-Bedroom + Study | 45 | 82 |

| 2-Bedroom Premium | 58 / 60 | 145 |

| 2-Bedroom + Study | 62 / 63 / 64 | 143 |

| 3-Bedroom | 82 / 84 | 101 |

| 3-Bedroom + Study | 90 / 92 / 95 | 139 |

| 3-Bedroom Flexi | 92 | 42 |

| 4-Bedroom + Study | 107 | 38 |

| 4-Bedroom Premium | 117 / 118 | 84 |

| 4-Bedroom Luxe + Study | 121 / 122 | 36 |

| 5-Bedroom Luxe | 137 / 138 / 145 | 36 |

Note that the majority of units are two and three-bedders, constituting 34 and 33 per cent of the total unit count respectively.

Emerald of Katong will consist of six blocks, ranging from 18 to 21 floors.

More from Stacked

Parktown Residence Review: First Mega-Integrated Development In Tampines From $2,135 Psf

Tampines had a crucial role in the Singapore story, with the sand from its quarries fueling the construction boom in…

Four of the blocks (51, 55, 57, 63) will have eight units per floor, whilst one block (53) has just six units. The most premium block (59) will have just four units per floor and will be the only one with a private lift.

Car Park

There are 682 basement lots, with seven EV charging points. It’s an interesting differentiation here, as Tembusu Grand has a multi-storey car park instead (often considered to be less premium as it is cheaper to construct).

Facilities

| Main facilities on offer |

| Function Room |

| Lap Pool |

| Gym |

| Changing Room |

| Playroom/ Games Room |

| Reading Room |

| Playground |

| Dipping Pool |

| Aqua Gym |

| Children’s Pool |

| Tennis Court |

Another interesting addition here is that the park next to Emerald is a 3 Generation (3G) park. As such, the developer is obliged to build this part of their land tender. 3G park spaces are meant to facilitate community interaction, such as through the placement of community gardens, as well as neighbourhood events. If it catches on, this could be good for families in Emerald.

Will Emerald of Katong be priced cheaper?

Given that Emerald of Katong was purchased at a lower price point than its surrounding competition, it seems straightforward to assume that prices may be correspondingly cheaper. But again, let’s not forget that it was purchased post-harmonisation, so to compare just on a psf basis is not really fair, and we have to look at the overall quantum to decide.

Besides, we would also have to take into account the actual situation on the ground right now. The truth is that despite the talk of an oversupply of new launches in the area, most of the supply has already been absorbed (especially for the smaller units).

Here’s a quick overview of the current supply of smaller units at the time of writing.

- Tembusu Grand: 82% sold, only 19 one-bedders and 4 two-bedders left. One-bedders start at S$1.399m, and two-bedders (larger 2+ study, 883 sq. ft.) are priced from S$2.102m.

- Grand Dunman: 71% sold, with 68 one-bedders and 19 two-bedders remaining. One-bedders start at S$1.447m, and two-bedders are priced from S$1.964m.

- The Continuum: nearly 50% sold, with 60 one-bedders and 58 two-bedders left. One-bedders are priced from S$1.494m, and two-bedders from S$1.849m.

As such, while we wouldn’t rule out a few loss leaders to provide a lower quantum price/psf to promote the development at launch, the reality is that the developers don’t have to price lower given the current supply. This is especially so for the smaller units, while we may see a little more competitive prices for the 3-bedders and up given the wider availability of units.

Upcoming developments

On a much bigger scale, and much further down the road, Paya Lebar Airbase will be moving out; probably sometime in the 2030s. This will make room for a new neighbourhood, which might bring knock-on benefits to nearby areas. This will be some time after Emerald at Katong’s completion in 2028 though; you can read about the Paya Lebar relocation here.

General Outlook

Emerald is a versatile project, which can work for both own-stay use, as well as a rental asset. This particular stretch of District 15 is an established expatriate enclave, whilst also being a family area. It’s ideal for families who like self-contained enclaves, where they can stay entertained for months without having to travel further out.

In terms of accessibility, Tanjong Katong station is still quite far from most central areas; but it’s only around two minutes’ drive to the ECP from here, and about seven minutes’ drive to the next big hub (Paya Lebar Quarter). Also, there are buses and a train station within walking distance, if you can overlook the longer travel times (it would be nice if you had more than the TEL though).

The emergence of Emerald of Katong and the other new launches brings significant growth to the Katong area, which has traditionally been dominated by smaller boutique condos. Whether this change in buyer preference is driven by sales tactics (such as the common pitch that “more units equal better performance”) or a genuine shift in market demand for other reasons, the fact remains that current buyers are increasingly drawn to this trend.

For more on the project once it launches, follow us on Stacked. If you’d like an in-depth consultation on whether Emerald of Katong is right for you, you can contact us here.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Will the Emerald of Katong be cheaper than nearby condos?

Where is Emerald of Katong located and what amenities are nearby?

What types of units will Emerald of Katong offer?

What facilities will be available at Emerald of Katong?

How does the current supply of units at nearby developments affect pricing?

What is the future outlook for the area around Emerald of Katong?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from New Launch Condo Analysis

New Launch Condo Analysis This New Dairy Farm Condo Starts From $998K — How the Pricing Compares

New Launch Condo Analysis This New Freehold CBD Condo Starts From $1.29M — Here’s How the Pricing Compares

New Launch Condo Analysis This Freehold New Launch Condo In The CBD Is Launching From Just $1.29M

New Launch Condo Analysis I Reviewed A New Launch 4-Bedroom Penthouse At Beauty World

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

0 Comments