Will Increased Housing Grants End Up Making HDB Resale Flats Pricier?

February 21, 2023

Budget 2023 increased the possible grants for resale flats, by another $30,000. This may benefit over 10,000 first-time homebuyers in the first year. But even on the day itself, commentators from Reddit to the local coffee shop were already saying “Gahmen push up the resale price by $30,000!” And to be fair, we did speculate on that as well, saying we (assume) authorities would take action if that’s an observable effect. But is this a fair assumption, and what are your thoughts on the issue?

Table Of Contents

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Opinions on the ground about the higher grants

Most realtors we spoke to felt that the grants would push up prices, particularly for 4-room or smaller flats (as this is where the grant increase is most significant, going up by $30,000. For 5-room flats the grant only increased by $10,000).

However, they also agreed it wouldn’t be a sweeping change across the board. One of the key reasons is Cash Over Valuation (COV). Realtor KJ, who specialises in HDB flats in mature locations, said:

“It’s not a case whereby everyone can add $30,000 to the price, and think the buyers will get the $30,000 ‘for free’ from the government. Grants are never given in cash. So if the seller ups the COV by $30,000, the buyer still has to find a way to pay out of pocket.”

KJ says that the main issue faced by buyers today is in fact the COV, as fewer are willing to commit so much cash in the current volatile economy. So despite the grant, it may not be entirely feasible for sellers to just push the price up immediately because of it.

Another realtor, however, had a contrary opinion:

“We know that the supply of HDB flats has increased, and soon more will join the pool of resale flats. For sellers, they will see this as a short window of opportunity; the mindset is that they better sell higher now, as they will have no chance later.

It’s likely they will raise their prices, now that the grant is higher.”

This seems to be the dominant opinion on some social media sites like Reddit, where we see comments like:

Another comment said that:

It was also pointed out that only households with a gross monthly income below $14,000 will benefit from the grant increases (you can look here for grant eligibility details). Those who cross this threshold won’t benefit from recent changes. One realtor noted that buyers of 5-room or larger resale flats are often more affluent, and fall into just such a category; so if prices for these properties go up, it would more likely be due to other factors (e.g., simple lack of supply).

How are buyers and sellers responding?

Speaking to some buyers, we also got mixed responses – but the majority seemed to be in “cross your fingers” territory.

Sharon T, who has her heart set on a flat in Bukit Batok this year, said: “I think it’s a good move because the flats are just too expensive right now. At the same time, this is better than just controlling resale prices, which sets an even worse precedent. I hope buyers are willing to walk away if sellers bring up the new grant, and teach them a lesson for gouging us.”

One homeowner, who currently has a 4-room flat listed, said that she and her husband are not intending to raise the price despite the announcement. She says:

More from Stacked

Should We Get A BTO At 55 As Our Retirement Home?

Hi,

“We all have our own urgencies as well, I don’t think every seller can wait and drag things out just for another $30,000”. As an example, she points out that sellers also have issues such as ABSD remission deadlines, which will take priority over haggling for a slight increase in price.

Another flat buyer, G, is simply unimpressed by the grant increase:

“These grants are not free money. When you sell you have to pay it back to the government*. Give with the left and take with the right. And when even 4-room flats can reach $600,000+, I am supposed to be impressed with an extra $30,000. I don’t see this as truly helping with affordability.”

*See here for details

The government does say it will monitor the situation

MND has said it remains “mindful of the potential impact”, and is keeping an eye on the resale market. However, this doesn’t give any clue of what they’ll do if resale flat prices start rising.

While the solution is unlikely to be an outright retraction of the grant (not so soon after it’s been implemented at least), we can see the screws being tightened in the form of even more loan curbs, such as a lower Mortgage Servicing Ratio (MSR), or an even lower cap on the loan quantum.

Why not just check the market impact, from the last time housing grants were raised?

That’s what most people would think of immediately, and it’s probable other news outlets considered it too – but there are problems in doing so.

The last time the grants were raised, was when the Special Housing Grant (SHG) and Additional Housing Grant (AHG) were combined into the Enhanced Housing Grant.

This was a substantial change, as it meant buyers of resale flats could get the new EHG of up to $80,000, whereas previously they only had access to AHG (up to $40,000). It may also be worth noting that the income ceiling was raised during this same change, from $12,000 to $14,000.

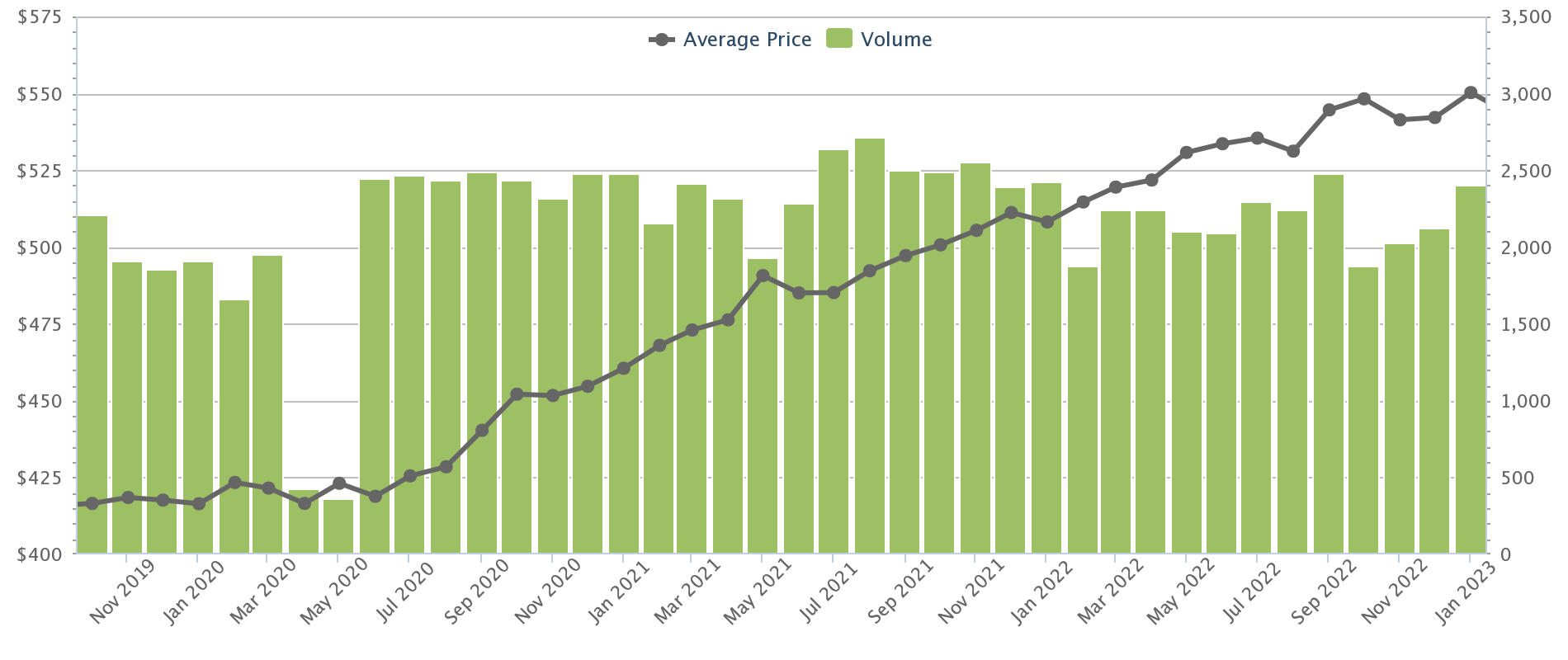

This was back in September 2019, and we can show you the prices from the following month onward:

But here’s the problem: shortly after September 2019, the Covid-19 pandemic started. It was after the pandemic, when arrangements such as Work For Home drove up housing demand, that we saw resale flat prices climb sharply.

So now, we can’t isolate the factors: we don’t know how much of the price increase is fuelled by more generous housing grants, and how much is caused by the post-Covid demand surge.

All we can say is that from October 2019 to April 2020 (when the Circuit Breaker was implemented), resale flat prices stayed largely the same at $417 psf. But a mere six months of transactions frankly doesn’t say much.

What are your thoughts on the raised CPF grant for resale flats?

We’re curious to know if you think this is just going to push up prices, or if you feel it’s a much-needed reprieve. What would you do in place of the higher grants? Comment below and let us know your thoughts.

Meanwhile, you can follow us on Stacked, and we’ll keep you updated as the situation unfolds. You can also check out our in-depth look at new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Will the increased housing grants make resale flats more expensive?

How are buyers and sellers reacting to the increase in housing grants?

Will the government do anything if resale flat prices start rising because of the grants?

Can we determine the impact of the grant increase on prices by looking at past market data?

Does the grant increase benefit all homebuyers equally?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments