Why Looking at Average HDB Prices No Longer Tells the Full Story: A New Series

January 22, 2026

As a real estate journalist, I’ve had to field many questions from extended family members, friends, and acquaintances about Singapore’s property market. “So, how’s the property market?” is the most common refrain.

More than half the time, they really want to talk about the HDB market – how quickly the price of Build-To-Order flats (BTOs) and resale flats has climbed, stories of people who failed multiple times to score a BTO, or how they hope to cash in a windfall when they sell their flat.

Likewise, some Stacked readers occasionally write in to ask for our take on the HDB market. These aren’t questions about news headlines; instead, the crux of their questions relates to buying risk, market expectations, and sales outcomes.

“Why did the price of my flat increase less than that of my neighbours, even though the housing market is strong?”

“If two flats are the same age, why do their pricing outcomes often look so different?”

“Is the impact of lease decay really linear, or is there a sudden turning point when it affects resale value?”

“Does the price of my home really benefit from being close to a school? Or did I pay more just to see a marginal impact?”

These are the types of questions about the HDB market we occasionally receive from Stacked readers, and it’s about time we tackle them head-on. There must be more to understanding this market than seeing prices go up, then down, and new BTOs launching.

These are questions that don’t have straightforward answers because it means taking an objective look at flats as housing assets and how they behave in the market next to other factors like housing supply, age, and neighbourhood context.

So, we’re beginning a new Pro series on the HDB market, using the same analytical depth and market research we apply to other Pro series. We hope our readers will appreciate how their understanding of the public housing market will change once they look beyond surface-level averages.

Are most of us analysing the HDB market wrongly?

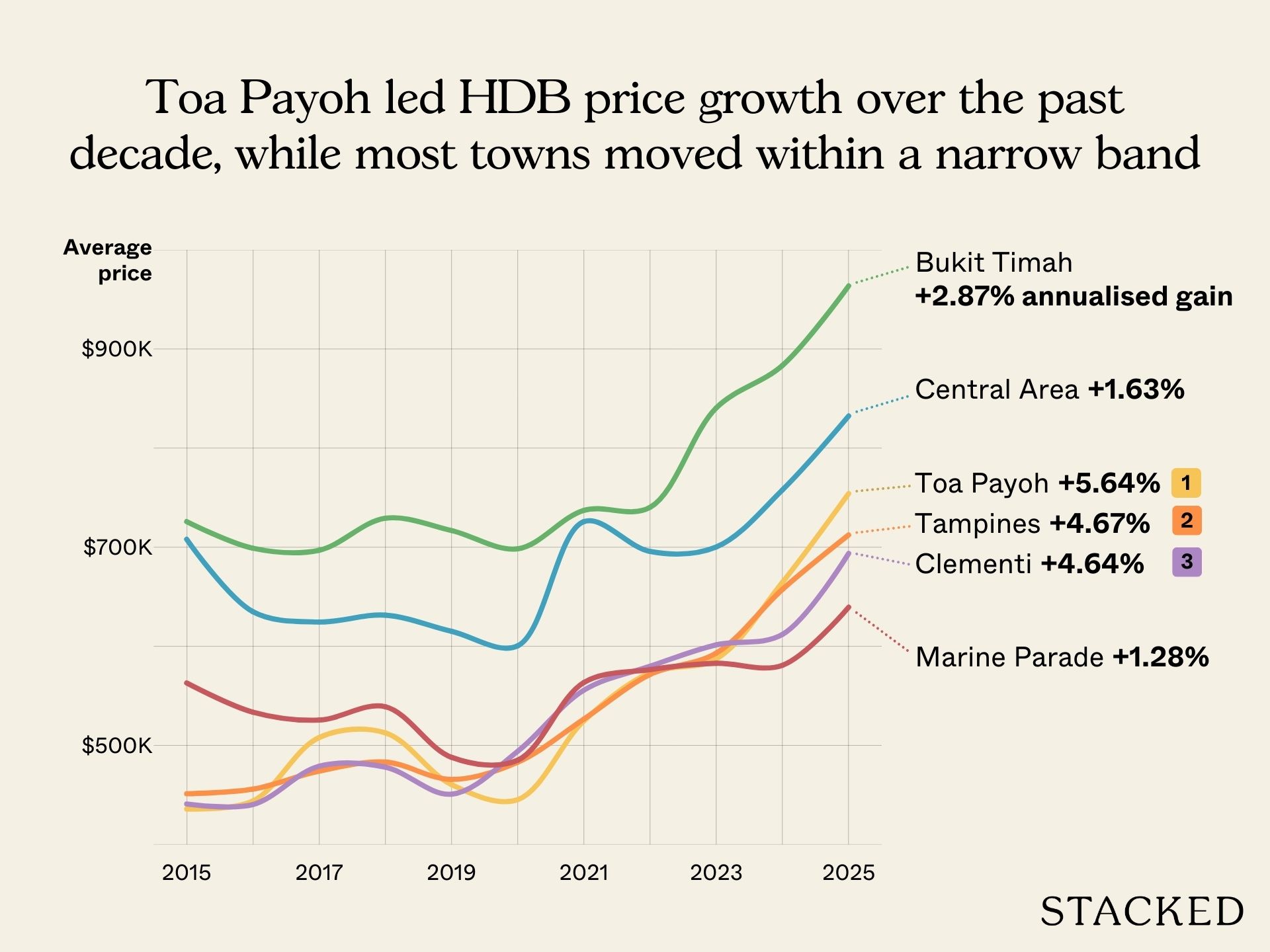

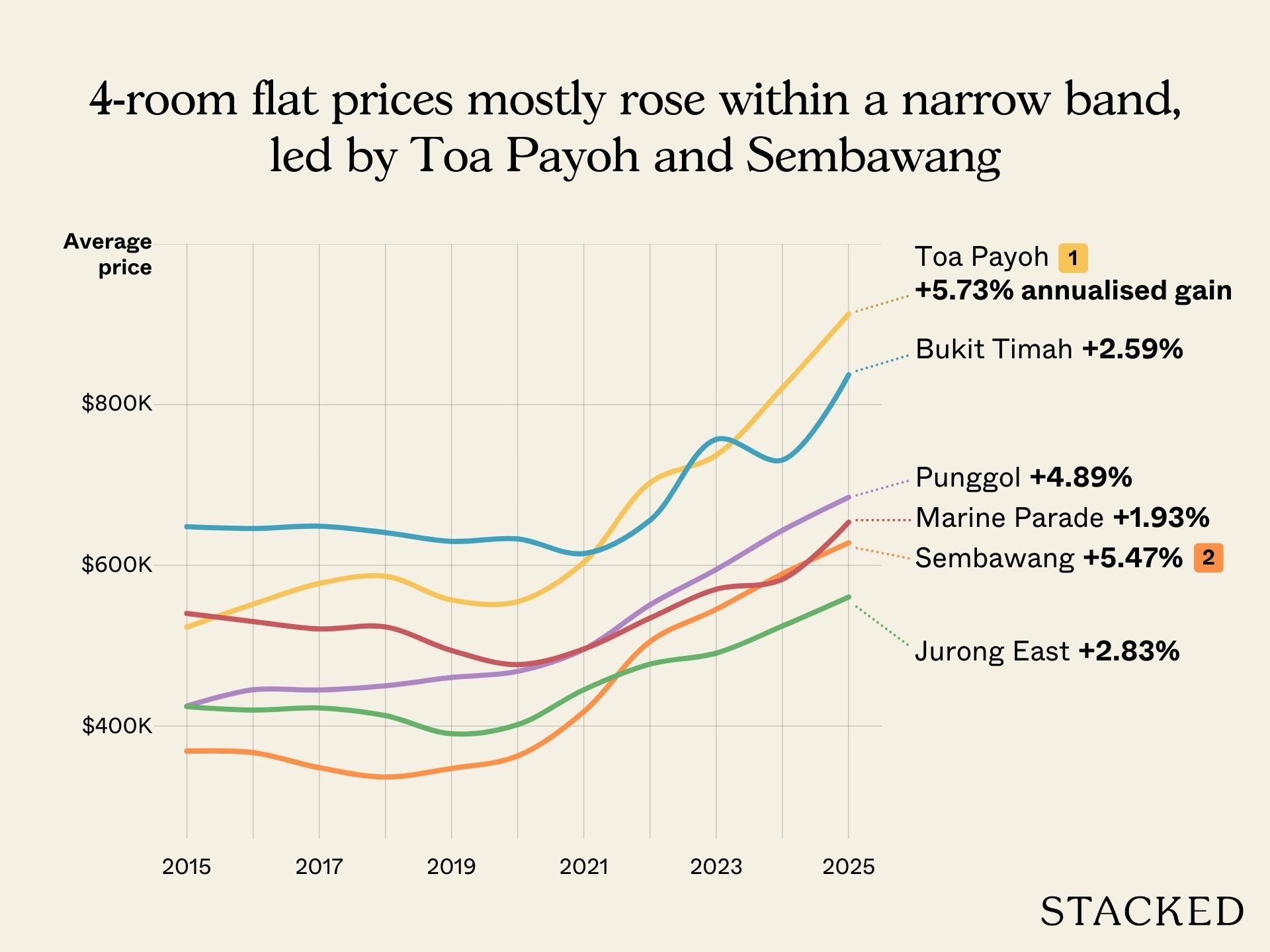

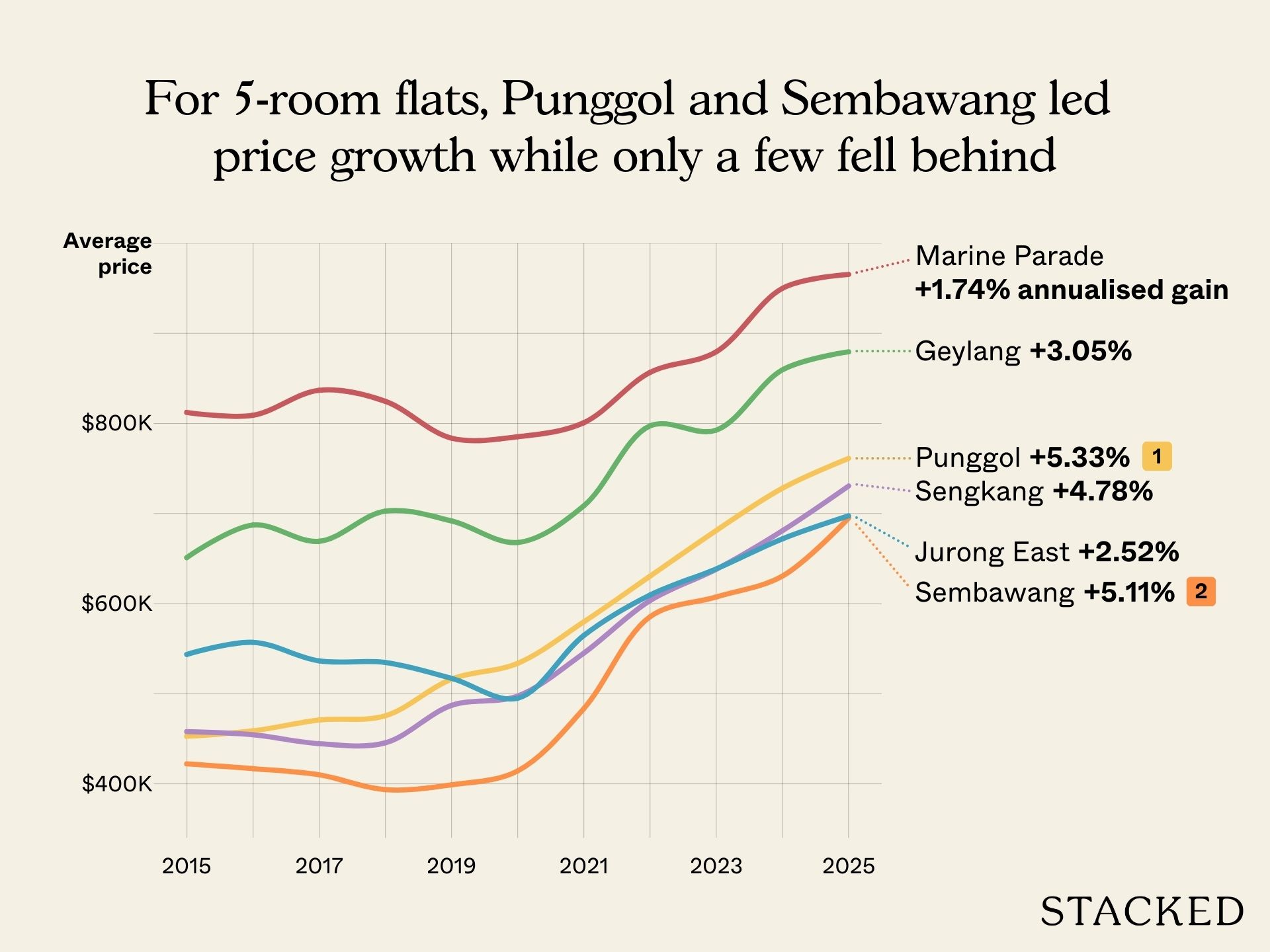

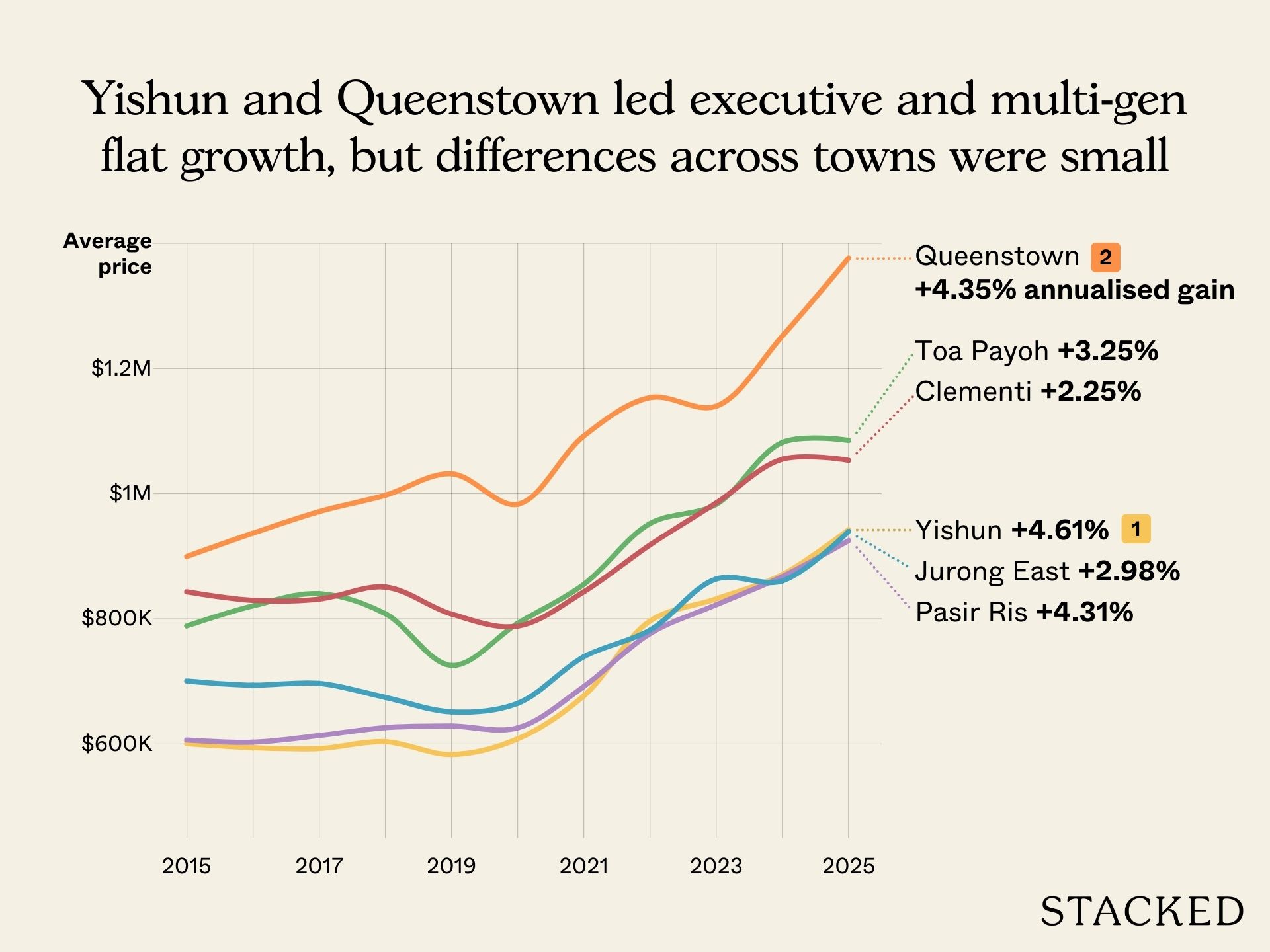

No, but there’s only so much information we can glean from overall price trends, town-level averages, or broad comparatives such as the price performance of mature versus non-mature towns.

If you need a snapshot perspective of the HDB market, these metrics are useful. But recognise that they also tend to give an incomplete picture of a dynamic and regulated market with many localised sub-market clusters.

Take the latest 4Q2025 flash estimates on the HDB market published at the start of this month. Overall, the HDB market recorded nearly flat quarterly price growth, led by declines in smaller flats like three-bedders, which fell 0.8% q-o-q and four-room flats slipping 0.9% q-o-q. This mostly wiped out the price gains of larger flats like five-rooms, which recorded a 1.3% q-o-q price growth and executive flats pulling ahead by 2.7% q-o-q.

So even though headline figures show the growth in flat prices almost plateauing, the price growth for larger flats is still on an upward trend.

Even among the various HDB towns, there was a different picture. Last quarter, 16 towns recorded declines in average resale price, but eight towns notched price gains and two towns had zero growth.

Taking the quarterly housing statistics at face value also reinforces assumptions such as all flats in an estate behave similarly, or relatively high price growth reflects broad-based gains. We also know that factors like the age of the flat, available and incoming housing supply, and buyer preferences don’t operate in neat and predictable ways.

This is why we see the resale outcome of two flats with similar remaining leases diverge, or two estates can see average prices rise over time, but each due to their own circumstances and reasons. And a rising median price across an entire estate doesn’t always mean most owners benefit from the uplift.

These nuances are usually invisible unless you look directly at the data – and look at it in the right way.

Why does this matter now?

In 2024, the government upended the decades-old town-based classification framework with a location-based classification framework for new BTO flats. This gave us the three categories of BTO flats – Standard, Plus, and Prime.

More from Stacked

Inside A $60k Bidadari BTO Makeover: How This Couple Created Their Japandi Home

Starting a renovation for your BTO flat in Singapore? The process can be as exciting as it is complex. We…

In general, this categorises flats based on their locational attributes like proximity to the city centre, transport connectivity, and surrounding amenities.

For example, the last BTO sales exercise in October 2025 saw five Standard projects, a Plus project, and four Prime projects. The prime projects were located in more desirable neighbourhoods like Ang Mo Kio, Bishan, Bukit Merah, and Toa Payoh.

These changes come as the public housing market continues to mature and evolve, and over time, the differences between estates and towns are becoming more pronounced.

As an observer, we also see that age is no longer a distance concern for many estates, and the pattern of new housing supply is relatively uneven. As a result, price growth is no longer as uniformly distributed across an entire town.

What this series is trying to do differently

For this Pro series, we want to take a step back and ask better questions about how to interpret the HDB market.

Rather than asking: “Did prices go up?”

We want to know:

- Who are the buyers that benefited, and which group of buyers didn’t?

- When does the age of a flat actually start to influence its resale value?

- Where is price-growth broad-based, and where is it narrowly concentrated?

- Where do price premiums persist, and which have eroded over time?

- Which estates see a rise in transaction volumes and price growth but still lag behind the rest of the market?

To aid our analysis, we’ll draw on HDB transaction data going as far back as the 1990s, as well as available block and estate-level property information. We’ll also draw on BTO supply data and a comparative analysis of the public housing market across multiple market cycles.

The goal of this series isn’t to rank the best-performing estates or to pinpoint where you should buy your next flat. We want to give you the know-how to understand the structure of the HDB resale market, so that you can understand why outcomes diverge even when the headline story looks the same.

Here’s what you can expect from this series

Some of the leading questions each of the upcoming articles in this series will try to address are:

- Why some HDB flats and estates continue to outperform the market average even as their leases run down – and why others don’t.

- When does the lease decay start affecting price, and how does it differ by estate

- How large BTO launches reshape their surrounding resale markets – for better or worse

- Whether scarcity at the block level still matters in public housing

- If buyers truly recover price premiums paid for higher floors or school proximity

- Whether price growth in an estate is the result of broad buyer participation, or just a handful of standout transactions

The caveat is that there are no one-size-fits-all answers, and in some cases, our findings may present uncomfortable conclusions to buyers who might be banking on a different outcome.

For the average Singaporean, most of our net wealth is tied up in our property purchases, and there are knock-on effects that influence our upgrading decisions and retirement planning.

We’ll reiterate that this is not a series about telling you where to buy. We hope that this helps our readers understand a complex and interconnected housing market. We’ll be publishing these pieces weekly as part of our Pro section.

This introductory article is free because the questions matter to anyone trying to navigate this market today, and the analysis that follows in the coming weeks will go deeper.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are average HDB prices not enough to understand the market?

How does flat age affect resale value?

Why do some flats in the same estate sell for different prices?

What does the new location-based classification for BTO flats mean?

How can I better understand the real estate market beyond headlines?

Timothy Tay

As Editor-in-Chief of Stacked, Timothy leads the newsroom and shapes our editorial direction, ensuring readers receive timely, thoughtful, and well-researched news and analysis. He brings over eight years of experience as a business and real estate journalist, with a strong track record across both print and digital platforms. His reporting spans luxury residential, commercial real estate, and capital markets, alongside in-depth coverage of sustainability and design.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

0 Comments