Why We Bought A $1.9xm Unit At The Continuum: A Buyer’s Case Study With Stacked

January 2, 2024

Project Case Study: The Continuum

Client Details

- Early 30s

- Works in the banking industry

Buyer’s Brief

- Initially wanted a 3BR but after looking at affordability, realised that she was capped to 2BR.

- Wanted something new and in the same vicinity as where she was currently living.

Challenges they faced

- Many of the resale units that were available and seemed attractive were built in the bay window era which restricted the space and the flexibility should she decide to knock walls to convert to a large 1BR

Many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

First consultation

Our buyer, NN, was clear about the intended location from the start. Her family has a home in Kembangan, and she was residing in Meyer Road at the time of the consult; so there was a firm attachment to the East side, particularly the Katong and Eunos areas. This was also convenient for work-related reasons, so NN was 100 per cent sure about her desired location.

NN had also settled on something within the two-bedroom size range, and the home would be for own-stay use. She had rented and lived in Balmoral and Balestier before, so her prior living experiences had helped to affirm the kind of unit she needed.

Exploring a range of options

NN’s initial choice was much more straightforward: this was to purchase a unit in the same condo she was already renting. However, this opinion changed while looking at other options. NN also considered older resale condos nearby, such as Makena, but was ultimately drawn to the newest project in the immediate vicinity: Tembusu Grand.

NN decided that, while she appreciated the larger units in older condos, she ultimately wanted something new. We discussed some of the inherent drawbacks of opting for a new launch, of which two stood out:

- New launch units were likely to be smaller

- There is a delay in moving in, due to the required construction time

However, NN said there was an emotional appeal to owning something new and fresh; and she wasn’t too concerned with factors such as price appreciation, but rather wanted something she would be “happy to come home to.” Also, there was a consideration that – however much you renovate a resale unit – the common facilities in an older condo will remain dated.

As such, the focus for the initial viewing was Tembusu Grand.

Initial and second viewings at Tembusu Grand

Upon the initial showflat visit, NN said she loved Tembusu Grand’s location, but was ambivalent about the project as a whole (quality, facilities, layout, etc.) It was on a second visit that NN noticed something she didn’t like.

NN often hosted friends and guests, who would mostly be driving to her place; but Tembusu Grand only had 71 basement car park lots, while the remaining 516 lots were within the multi-storey car park. She didn’t like the idea of her guests having to park at the multi-storey (the visitor lots are likely on the highest floor), take the lift down, and then walk to her block to take another lift.

In addition, NN didn’t like the colour palette, particularly the tiling, as seen in the show flat. While this could be changed with renovations, NN didn’t want extra costs when moving in. At least part of the attraction for a new launch is, after all, lower renovation costs than a resale.

As luck would have it though, Hoi Hup had just announced their own launch at the time, also in the east – this was The Continuum.

New Launch Condo ReviewsThe Continuum Review: A Unique Freehold Condo Set On 2 Plots Of Land That’s Linked By A Bridge

by Matthew KwanVisiting The Continuum as an alternative

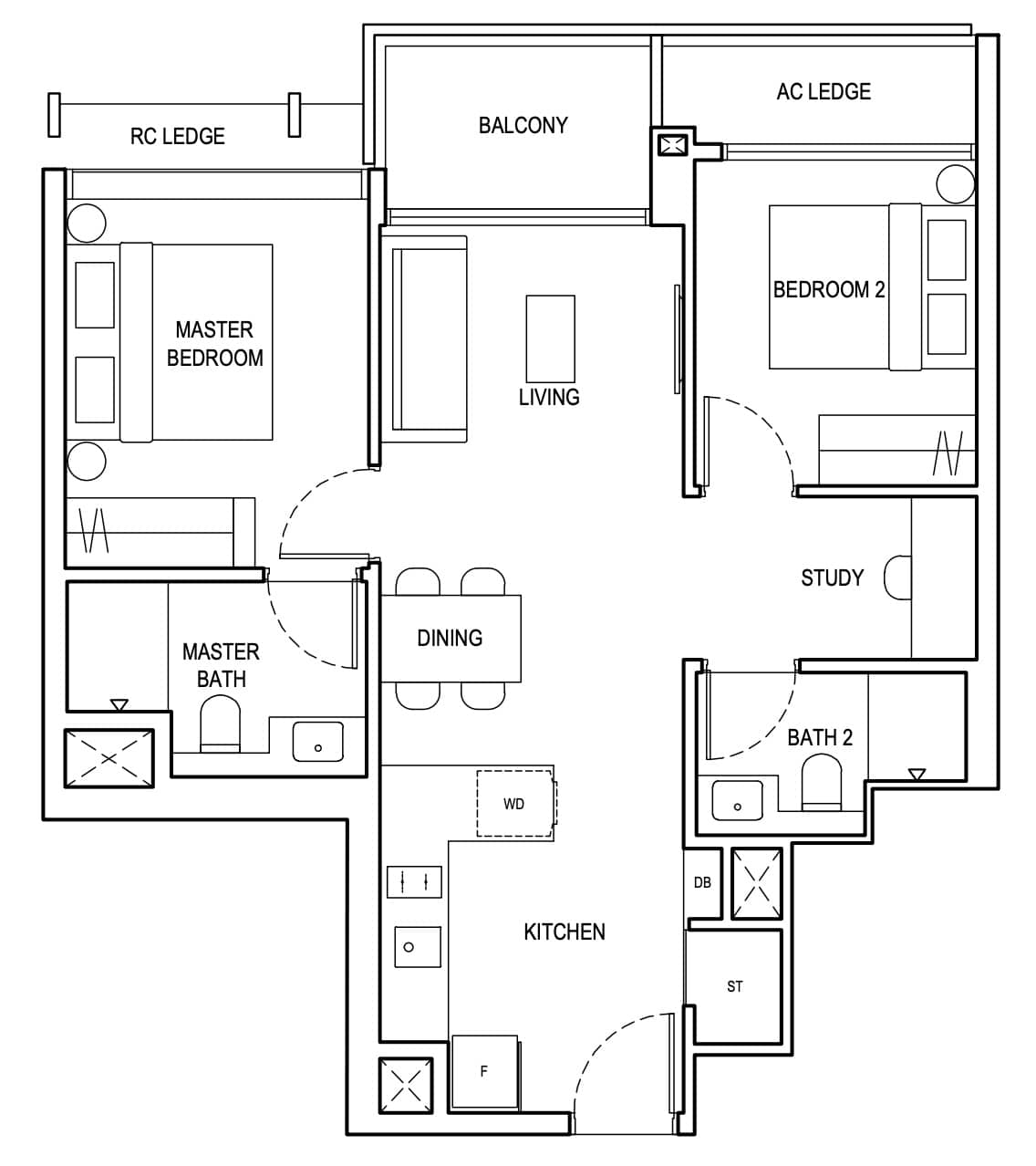

From NN’s perspective, The Continuum was less ideal than Tembusu Grand in terms of location. However, she preferred the unit layout at The Continuum. NN liked the layout of the two-bedroom + study, and the storage room next to the kitchen was also ideal; this would spare her from leaving the vacuum, mops, and other cleaning supplies in the open. It would also help with storing her luggage carriers, which NN used often as a frequent traveller.

We also noted the location of the study made it quite flexible – it could double as a work area, or be converted to a walk-in wardrobe. Plus, the colour of the tiling was much more to her taste.

As such, it boiled down to two main options: Tembusu Grand for its better location but less ideal interior, or The Continuum which was the opposite.

After much deliberation, NN decided The Continuum’s location wasn’t too big a compromise after all. While dinner and groceries would be a bit further, she decided it was ultimately possible to order what she needed online.

More from Stacked

This Freehold New Launch Condo In The CBD Is Launching From Just $1.29M

City Developments (CDL) will preview its mixed-use development Newport Plaza on Friday, Jan 16. Sales bookings for the 246 luxury…

Besides this, NN would have been buying at a later launch phase, when it came to Tembusu Grand. This limited the options, as we had only the remaining units to pick from. With The Continuum, there was still more choice and opportunity, in the ballot for the preferred units.

The final tilt in the favour of Continuum was its freehold status, in addition to the wider availability.

Balloting and crunching the numbers

For those who’ve participated in a new launch ballot, you would know that you’re only given a few minutes to make price comparisons for the varying stacks and floors. Fortunately, NN was less particular about facing, and she didn’t want a high-floor unit (due to long elevator rides and waiting times.) NN did specify she didn’t want exposure to the west sun, but this was simple to avoid as Continuum has a North-South facing anyway; most units wouldn’t have such exposure.

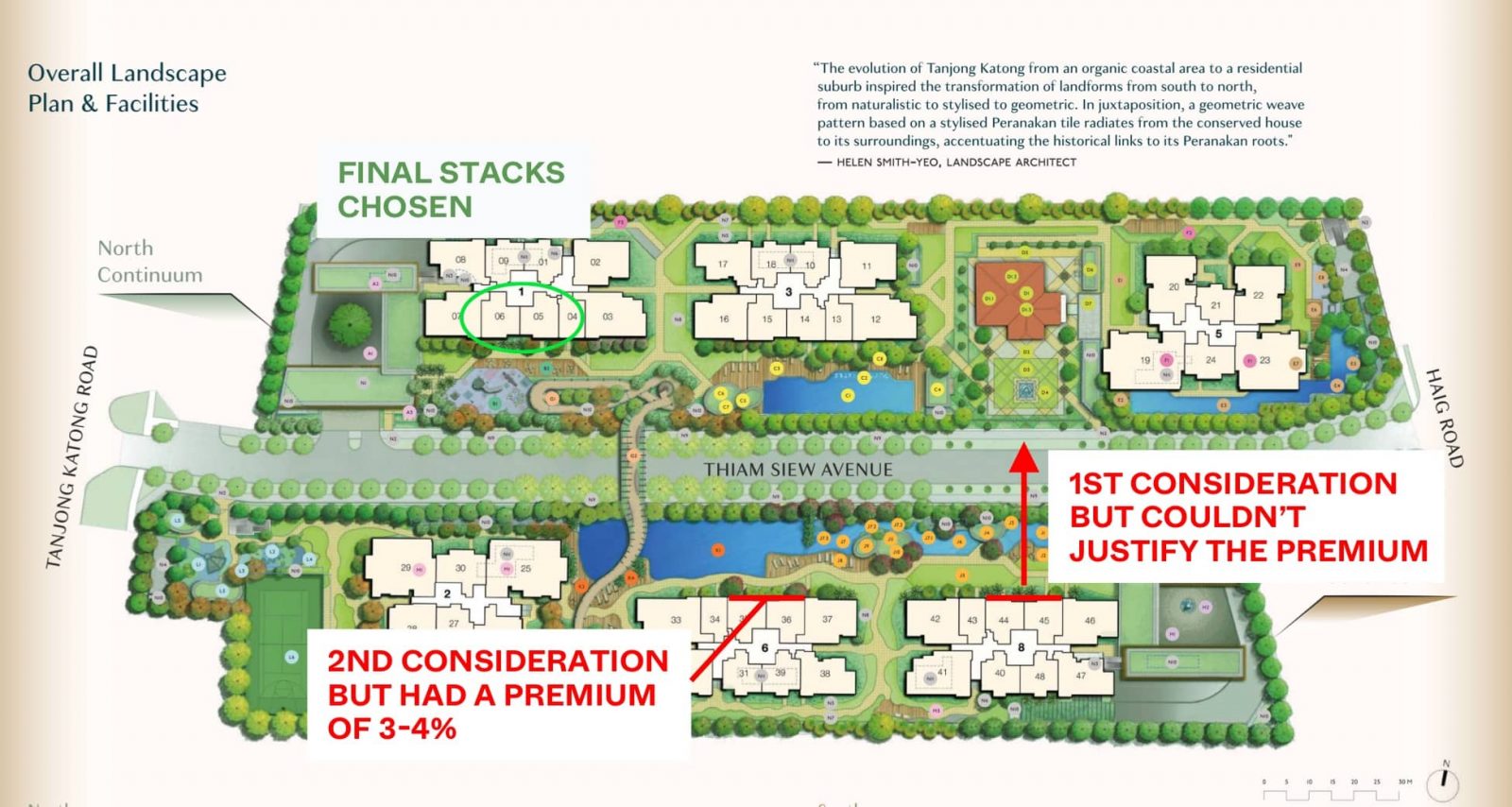

NN did have a preference for stacks 44 and 45, because these stacks have a facing that overlooks one of the clubhouses. The Continuum has two clubhouses, one of which is a preserved heritage building (21 Thiam Siew Avenue).

However, these stacks cost a premium of about five to six percent above stacks five and six. The added premium was enough to inch the pricing past a comfortable budget for NN. This led to a discussion on how much she valued the view: would she open the windows, sit on the balcony, and enjoy the view often?

NN decided that this wouldn’t be a frequent occurrence; and with four cats, she may need safety grilles as in her current home, and might rarely open the windows. This led to choosing the most affordably priced 2BR+S units.

We also looked at other stacks, clustered toward the middle of Continuum – but these were at a three to four per cent premium, which further encouraged the decision to choose stacks five or six instead. These stacks are closer to Tanjong Katong Road anyway, which is where many of the main lifestyle amenities are found.

A final consideration was the floor of choice. The developers were quite strategic in their pricing strategy: while stacks five and six were more affordable, the price jump per floor was more significant than the others. After observing and continuously checking the price, we settled on a mid-floor unit.

While NN was willing to accept lower-floor units, such units can sometimes be harder to sell later or show weaker appreciation. And whilst NN did say she was unlikely to sell, we advised a mid-floor unit just in case a sale ever becomes necessary. Even though investment wasn’t the primary goal, it made sense to leverage on internal pricing, and arbitrage future potential gains or losses.

One thing to note from this transaction is that – just because owner-occupiers can be more relaxed about the bottom line – that doesn’t mean everything should be “free and easy.”

Even if the resale gains are not a priority, there can be substantial savings if you surrender the lesser perks (e.g., a slightly better facing.) In addition, there’s no harm in grabbing what advantages you can – such as a mid-level instead of a lower floor unit – when the incremental cost is still well within budget.

In fact, in some ways, the number crunching for pure home buyers can be more complex, as there are qualitative issues involved. How do we put an exact dollar value on being closer to a certain area? For a pure investor, there are well-defined answers (look at rental rates, transaction histories, zoning etc.) But for a home buyer, there are emotional factors that are difficult to price, such as a childhood attachment to an area, or longstanding lifestyle routines. If you do struggle with these issues, reach out to us on Stacked, and we can find the professionals to lend added clarity to your decision.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan Ong

Ryan is part property consultant, part wordsmith, and a true numbers aficionado. Ryan's balanced approach to every transaction is as diverse as it is effective. Since starting his real estate journey in 2016, he has personally brokered over $250 million of properties. Beyond the professional sphere, you'll often find him cherishing moments with his beloved cats: Mia, Holly, Percy and Toto.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

11 Comments

Sales at The Continuum are undeniably slow in today’s market, and it all boils down to the subpar location. A classic example of being neither here nor there.

Continuum is a freehold project , way better than Tembusu Grand

My comment from yesterday appears to have been deleted. I wonder why so? Because I did not support your viewpoint?

Will toilets get mould? No window ventilation at all

Can I get Stakedhome’s views on whether similar analysis reflected in this article would also apply to the 3 bedders in The Continuum please?