Why The Rising Number Of Property Agents In 2026 Doesn’t Tell The Full Story

January 25, 2026

There are fewer property agencies in the market today, and fewer people are signing up to be agents.

As reported by the Straits Times of late, the scene for agencies continues to consolidate. Most industry watchers already know it’s something of an oligopoly, with the market cornered by the “big three” (Propnex, ERA, Huttons). While tighter anti–money laundering rules are cited as the cause here, I have to wonder if it wouldn’t happen anyway.

Figures from the Council for Estate Agencies (CEA) show that the industry is heavily skewed toward a small number of large networks:

- PropNex Realty remains by far the largest agency, with roughly 13,945 registered agents as of January 2026.

- ERA Realty Network follows with about 8,427 agents.

- Huttons Asia comes third with around 5,760 agents.

Smaller agencies are so peripheral compared to these three that they seldom even factor into considerations.

Anti-money laundering and other compliance rules play a small part in accelerating this sort of consolidation: larger agencies can spread compliance costs and absorb regulatory overheads more easily than small, boutique agencies. But it’s not a recent impact; all it did was speed up a process that’s already well underway.

As for there being fewer property agents, this might also be a reflection of inactive players exiting the pool.

As of January 2026, there were about 36,800+ registered property agents in Singapore.

A modest rise of about 2.1 per cent over the previous year, but a much slower pace of growth compared to previous years.

There were a total of 35,251 registered property agents at the start of 2024. This was up from 34,427 agents in 2023, and 32,414 in 2022. That’s a rise of around six per cent in 2022-23, then 2.4 per cent in 2023 – 25; so the numbers are clearly dipping.

And as the Straits Times report cites, increased regulatory requirements might play a small role. But this isn’t likely to be the main issue. Consider that between 2021 and 2023, around 40 per cent of the agents didn’t close at least one deal per year (see the link above).

This level of inactivity suggests a surplus of license holders, relative to the amount of work available. It suggests several potential opportunists (there was a market boom in the aftermath of COVID) who didn’t find the easy sales they imagined, or it reflects on property agents who are really doing other jobs, but holding on to the license just “in case” the occasional opportunity comes along.

The presence of too many inactive or opportunistic agents isn’t just neutral background noise.

The Singapore property market is prone to certain heuristics or “shortcuts” in thinking. This is where you get claims like freehold always performs better, calls to buy new, buy near MRT, buy now before prices rise, etc. Or some more hazardous ones, like the notion that 99-1 loopholes are “fine” – that’s a belief that was long-held, before recent court cases.

None of it comes from a malign place, but agents who are inactive, which often leads to not paying enough attention, may concoct approaches formed in very different times, and under very different market conditions.

Just last year, for instance, we saw how the market turned toward smaller homes in the Core Central Region (CCR), and how it undermined the conventional sense of using $PSF as a way to gauge pricing. This was a very short, sharp transition away from norms we still had in 2022 or 2023.

These problems are not always filtered out by market forces either. A real estate industry with marginally participating agents tends to reward luck over competence. Even the least informed agent can sometimes end up with the occasional windfall transaction; such as when a relative happens to sell a high-quantum property.

When this happens, it sustains agents who might be, in casual terms, what we’d call “switched off.” Conversely, it results in agents who give more considered advice (e.g., telling said relative not to sell) being disincentivised.

More from Stacked

We Spoke To BCA To Clear Common Property Misconceptions In Singapore: Here Are 9 You Need To Know

Singapore has a high-quality built environment, so most of us don’t’ ponder questions like “what if my condo runs out…

In light of this, inactive agents dropping out – and a more narrow but focused pool of professional realtors – could be a net positive for all of us.

As an aside, I do think that for the fewer property agents choosing to join now, there’s a subtle benefit to the timing.

Call it anecdotal, but in my experience, there’s a generally higher regard for those who join the industry outside of a market boom. When times are good and transactions are easy, everyone wants to try their hand at the gold rush. That was certainly true in the immediate aftermath of COVID.

Joining now is different. There are tighter compliance requirements and fewer foreign buyers. New launches – should you be involved with these – no longer pay as high commissions as in the past (see the details here); and most new property agents will struggle with the long wait to get paid.

If, on the flip side, you’re dealing with the resale market, it’s a tough time to find inventory. The higher home prices could be a deterrent to upgrading, so you’ll also have work cut out for you.

Overall, the 2026 market has clearly less room for casual participation.

But – and this is important – if you’re entering the industry at this point, it’s less likely that you’ll be perceived as chasing easy wins. This distinction doesn’t just matter within your own agency; I’ve met buyers who ask when their agent joined the market, because they have an eye toward this.

Tougher times can build better agents, even if they result in fewer agents; and there are buyers and sellers who acknowledge that. If I did join the market at such a time, I’d use it as a badge of merit later.

Meanwhile in other property news…

- Are we saying goodbye to Cuppage Terrace and its memories? Let’s see if anyone takes up the $250 million valuation.

- What does $940,000 buy you in Penang? You may be surprised at how wide the price gap has become across the Causeway.

- Find out about our upcoming series where we analyse “safer” resale condos, to see if they’re worth buying in 2026.

- Here’s why 2026 may be a good year to consider an Executive Condominium (EC), as opposed to going fully private; but there’s one important consideration.

Weekly Sales Roundup (12 – 18 January)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SKYE AT HOLLAND | $5,943,000 | 1765 | $3,367 | 99 yrs (2024) |

| GRAND DUNMAN | $5,262,000 | 2131 | $2,469 | 99 yrs (2022) |

| WATTEN HOUSE | $4,985,000 | 1539 | $3,239 | FH |

| THE ORIE | $3,748,000 | 1367 | $2,742 | 99 yrs (2024) |

| THE CONTINUUM | $3,359,000 | 1087 | $3,090 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| COASTAL CABANA | $1,481,000 | 872 | $1,699 | 99 yrs |

| KASSIA | $1,566,000 | 753 | $2,078 | FH |

| THE LAKEGARDEN RESIDENCES | $1,600,000 | 678 | $2,359 | 99 yrs (2023) |

| SORA | $1,732,000 | 732 | $2,366 | 99 yrs (2023) |

| CANBERRA CRESCENT RESIDENCES | $1,732,200 | 872 | $1,987 | 99 yrs (2024) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| MAPLE WOODS | $6,200,000 | 2917 | $2,125 | FH |

| AALTO | $5,465,000 | 2024 | $2,701 | FH |

| ONE HOLLAND VILLAGE RESIDENCES | $5,058,000 | 1615 | $3,133 | 99 yrs (2018) |

| PATERSON SUITES | $5,000,000 | 1679 | $2,978 | FH |

| ISLAND VIEW | $4,350,000 | 3498 | $1,243 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| EDENZ LOFT | $630,000 | 441 | $1,428 | FH |

| SUITES @ PAYA LEBAR | $678,888 | 398 | $1,705 | FH |

| KINGSFORD WATERBAY | $713,000 | 474 | $1,505 | 99 yrs (2014) |

| EUHABITAT | $777,000 | 527 | $1,473 | 99 yrs (2010) |

| PARC RIVIERA | $781,888 | 463 | $1,689 | 99 yrs (2015) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MAPLE WOODS | $6,200,000 | 2917 | $2,125 | $3,520,000 | 19 Years |

| GLENTREES | $3,745,000 | 1711 | $2,188 | $2,535,400 | 20 Years |

| LE CRESCENDO | $2,470,100 | 1453 | $1,700 | $1,522,100 | 23 Years |

| TIERRA VUE | $3,758,000 | 2056 | $1,828 | $1,438,000 | 13 Years |

| AALTO | $5,465,000 | 2024 | $2,701 | $1,431,000 | 18 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE OCEANFRONT @ SENTOSA COVE | $3,050,000 | 1776 | $1,717 | -$1,017,040 | 19 Years |

| BELLE VUE RESIDENCES | $3,800,000 | 1841 | $2,064 | -$900,000 | 15 Years |

| THE COAST AT SENTOSA COVE | $3,228,888 | 2056 | $1,571 | -$521,112 | 13 Years |

| MARINA ONE RESIDENCES | $2,250,000 | 1163 | $1,935 | -$177,639 | 6 Years |

| PATERSON SUITES | $5,000,000 | 1679 | $2,978 | -$176,580 | 15 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| GLENTREES | $3,745,000 | 1711 | $2,188 | 210% | 20 Years |

| COSTA RHU | $2,260,000 | 1399 | $1,615 | 172% | 23 Years |

| LE CRESCENDO | $2,470,100 | 1453 | $1,700 | 161% | 23 Years |

| PAVILION 11 | $1,968,000 | 958 | $2,054 | 157% | 19 Years |

| HUNDRED PALMS RESIDENCES | $1,860,000 | 958 | $1,942 | 139% | 9 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| THE OCEANFRONT @ SENTOSA COVE | $3,050,000 | 1776 | $1,717 | -25% | 19 Years |

| BELLE VUE RESIDENCES | $3,800,000 | 1841 | $2,064 | -19% | 15 Years |

| THE COAST AT SENTOSA COVE | $3,228,888 | 2056 | $1,571 | -14% | 13 Years |

| V ON SHENTON | $900,000 | 441 | $2,039 | -12% | 13 Years |

| MARINA ONE RESIDENCES | $2,250,000 | 1163 | $1,935 | -7% | 6 Years |

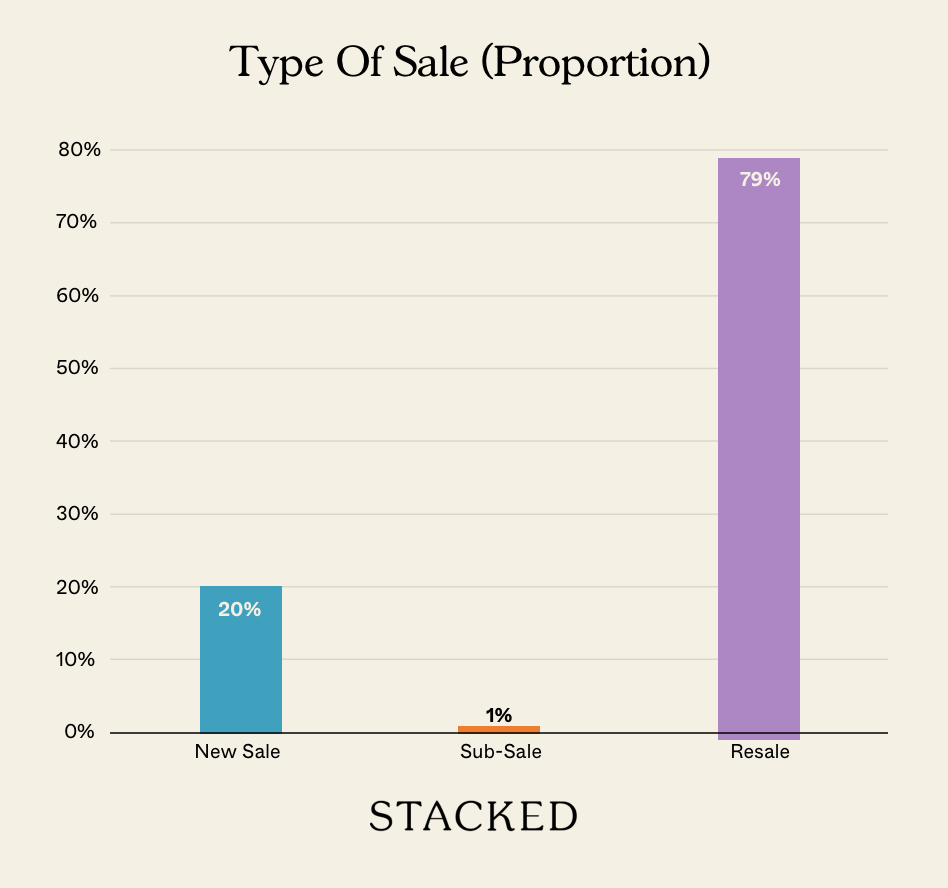

Transaction Breakdown

Follow us on Stacked for more news and on-the-ground insights into the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How many property agents are there in Singapore in 2026?

Why are there fewer property agencies now?

What does it mean if there are fewer active property agents?

How does the number of property agents affect the Singapore property market?

Is entering the property industry now a good idea?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Latest Posts

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

0 Comments