Why More Singaporeans May Soon Trade Condos For Resale HDBs

August 24, 2025

We may be setting the property market up for a wave of downsizing into the resale flat segment.

For most people, the focus in real estate is climbing the ladder: from BTO to resale, then condo, and possibly even landed property. It’s what agents often used to call property wealth progression, and it was heard all throughout the past two decades (albeit sometimes in variant forms). But with recent policy moves and the relentless march of demographics, the next chapter may look very different. Instead of upgraders, the market may see a wave of downsizers; and much of it is likely to spill into the resale flat segment.

There are two effects working in conjunction here now: the first is the end of SERS, and its replacement with the as-yet unpracticed VERS. The second, as covered in the National Day Rally Speech, is that Singapore is heading into super-aged territory next year; about 21 per cent of our population will be 65 or older. These two things occurring at once will do a lot for the HDB resale market, but mainly in the favour of older folks.

Without SERS, and the uncertainty of VERS, the continued appreciation of older flats may be at an end

I still remember back in 2018, when the government confidently declared that even 50-year old flats could still appreciate – a fact that was true in the day. That appreciation was driven, among other things, by the hope premium.

Even after we were told SERS wouldn’t always be available, and then that it would be available just for around four to five per cent of HDB estates, there was still hope for certain flats. For areas like Tiong Bahru and Queenstown, for example, many believed that such high-demand areas still had a chance at SERS. There may also have been some willful denial at play:

We’ve never actually seen an HDB flat reach the end of its lease. So for some, there’s still a refusal to believe that a mature neighbourhood, plus walking access to an MRT station, must still carry high value; even if half the lease is over. As such, even these older flats could continue to appreciate, and could still see a high quantum (possibly in the million-dollar range) when sold.

But now that it’s clear SERS isn’t going to happen – and that VERS will be much less generous if it does happen – the door is well and truly shut.

But with more Singaporeans getting older, the falling prices of the oldest resale flats can be a boon

Rather than see lease decay as a dead-end of wealth, we could see it as a safety valve for a greying nation. Now I’m repeating some of what I said in this article, where I argue there is a reason to pay $1 million for a 50+ year old flat; but the point is made stronger if the flats start declining in price.

Buying an ageing flat can make sense when you’re no longer thinking about resale gains, but about comfort, location, and dignity in later years. At that stage of life, a shorter lease matters less than spaciousness, amenities, and a familiar community.

In effect, the lease decay becomes a benefit instead, helping to lower housing prices for older Singaporeans. If you’re already 70 years old, then buying a flat with 50 years on the lease is more than sufficient – and it could mean a lower price for living somewhere developed, plus a bigger retirement fund when you downgrade.

More from Stacked

Land ownership in Singapore – here is everything you need to know

It is no secret that Singapore is a very small country. In case you did not know, the total land…

Put these together, and you see why a downsizing wave might be on the horizon.

It will probably occur as a natural rebalancing of priorities. Rising healthcare costs, as well as declining need for many condo-facilities*, just make HDB flats a commonsense choice. This is also complemented by a 90 per cent home ownership rate – odds are, if you have children, they will have their own home by the time you retire; they won’t need yours.

In a weird sort of way though, what could become a drawback is VERS. Because if you’ve downgraded to a comfy flat and paid for renovations, the last thing you want to hear, a decade down the road, is that you need to move again! That might be more inconvenience than salvation, when it comes to the expiring lease.

*I realise not everyone fits the assumption, but I’m confident enough to say most people won’t pay for a pickleball court and gym as they cross the age of 70.

Meanwhile in other property news…

- Why 30 to 35, or at least before 40, is a good point at which to plan your HDB-to-condo upgrade

- These are the key takeaways from NDP Rally Speech 2025, on the real estate front.

- From SERS to VERS, be forewarned about the big coming changes.

- Can a one-bedder condo unit beat a two-bedder? Sometimes it’s possible; find out with our Stacked Pro readers.

Weekly Sales Roundup (11 – 17 August)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| 21 ANDERSON | $52,250,000 | 10452 | $4,999 | FH |

| UPPERHOUSE AT ORCHARD BOULEVARD | $7,881,000 | 2056 | $3,833 | 99 yrs (2024) |

| ONE MARINA GARDENS | $5,144,355 | 1647 | $3,124 | 99 yrs (2023) |

| CANNINGHILL PIERS | $4,880,000 | 1959 | $2,491 | 99 yrs (2021) |

| LYNDENWOODS | $4,180,000 | 1647 | $2,538 | 99 yrs (1982) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SPRINGLEAF RESIDENCE | $860,000 | 388 | $2,219 | 99 years |

| CANBERRA CRESCENT RESIDENCES | $1,092,000 | 570 | $1,914 | 99 years |

| OTTO PLACE | $1,495,000 | 872 | $1,715 | 99 yrs (2024) |

| RIVER GREEN | $1,452,000 | 452 | $3,212 | 99 yrs (2024) |

| PROMENADE PEAK | $1,543,300 | 527 | $2,926 | 99 yrs (2024) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| 111 EMERALD HILL | $5,650,000 | 2411 | $2,343 | FH |

| REGENCY PARK | $5,138,000 | 2250 | $2,284 | FH |

| WATTEN HILL | $4,700,000 | 2669 | $1,761 | FH |

| MEIER SUITES | $4,660,000 | 2207 | $2,112 | FH |

| PEPYS HILL CONDOMINIUM | $4,500,000 | 4316 | $1,043 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE HILLFORD | $580,000 | 398 | $1,456 | 60 yrs (2013) |

| SUNNY LODGE | $650,000 | 398 | $1,632 | FH |

| KOVAN GRANDEUR | $663,800 | 431 | $1,542 | 99 yrs (2010) |

| SEASTRAND | $725,000 | 570 | $1,271 | 99 yrs (2011) |

| THE TAPESTRY | $737,777 | 441 | $1,672 | 99 yrs (2017) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| PEPYS HILL CONDOMINIUM | $4,500,000 | 4316 | $1,043 | $2,320,000 | 19 Years |

| THE EQUATORIAL | $4,388,000 | 1690 | $2,597 | $2,261,040 | 25 Years |

| MEIER SUITES | $4,660,000 | 2207 | $2,112 | $1,707,000 | 15 Years |

| PARK INFINIA AT WEE NAM | $3,750,000 | 1421 | $2,639 | $1,634,000 | 16 Years |

| SOLEIL @ SINARAN | $3,258,000 | 1475 | $2,209 | $1,565,000 | 18 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| 111 EMERALD HILL | $5,650,000 | 2411 | $2,343 | -$573,000 | 15 Years |

| MARINA ONE RESIDENCES | $1,300,000 | 689 | $1,887 | -$462,200 | 7 Years |

| CORALS AT KEPPEL BAY | $1,988,000 | 969 | $2,052 | -$232,390 | 12 Years |

| THE BOUTIQ | $1,900,000 | 883 | $2,153 | -$208,880 | 14 Years |

| MARTIN MODERN | $3,030,000 | 1087 | $2,787 | $18,000 | 8 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| FERNWOOD TOWERS | $2,080,000 | 1195 | $1,741 | 258.6% | 21 Years |

| BAYSHORE PARK | $1,450,000 | 1076 | $1,347 | 255.4% | 20 Years |

| MAPLE WOODS | $2,128,000 | 990 | $2,149 | 235.1% | 22 Years |

| ALESSANDREA | $2,180,000 | 1098 | $1,986 | 189.1% | 22 Years |

| NORTHOAKS | $1,670,000 | 1948 | $857 | 186.4% | 18 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| MARINA ONE RESIDENCES | $1,300,000 | 689 | $1,887 | -26.2% | 7 Years |

| CORALS AT KEPPEL BAY | $1,988,000 | 969 | $2,052 | -10.5% | 12 Years |

| THE BOUTIQ | $1,900,000 | 883 | $2,153 | -9.9% | 14 Years |

| 111 EMERALD HILL | $5,650,000 | 2411 | $2,343 | -9.2% | 15 Years |

| MARTIN MODERN | $3,030,000 | 1087 | $2,787 | 0.6% | 8 Years |

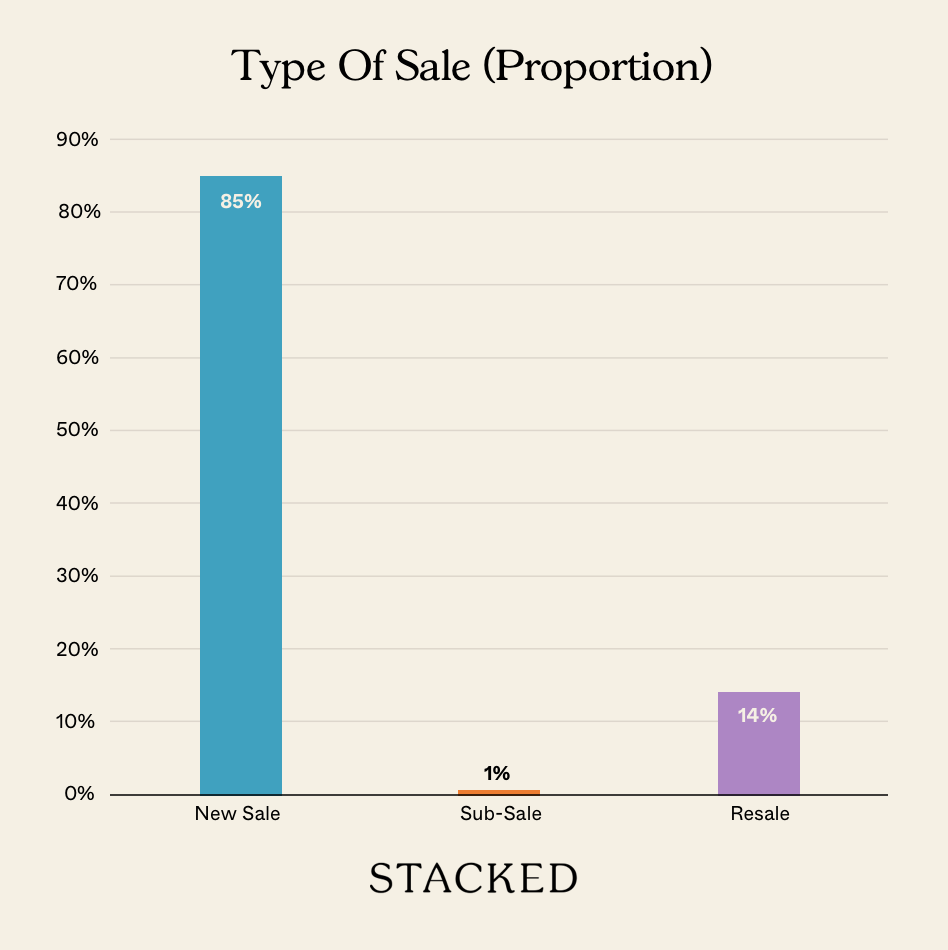

Transaction Breakdown

Follow us on Stacked for more on the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why might more Singaporeans consider downsizing to resale HDB flats in the future?

How will the aging population affect the resale flat market in Singapore?

What impact does the end of SERS and the uncertain VERS have on older flats’ value?

Why could declining prices of old resale flats benefit older Singaporeans?

What are the reasons behind a potential wave of downsizing into resale flats?

What are some considerations for seniors thinking about moving to a resale flat with a shorter lease?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

0 Comments