Why More HDB Owners Are Suddenly Refinancing Again in 2025

November 16, 2025

It’s time for the refinancing Public Service Announcement again. Whenever interest rates are on the decline, some HDB owners will refinance into cheaper bank loans. I sort of felt this was coming, when a broker mentioned floating rates could be sub-two per cent again. And true enough, a few days ago, the Straits Times reported more flat owners refinancing as rates reached a three-year low.

Over the years, there have been a number of Stacked articles covering HDB versus bank loans; and for our long-time readers, I know it seems repetitive. But it’s worth bringing up for the newer homeowners, or those facing this issue for the first time. It’s also a rather common question, before one gets directed to a mortgage broker or banker somewhere. So without rehashing too much, do remember that:

1. No, this isn’t some sort of a con, and it might really pay off to switch to a bank loan

The last time interest rates plummeted was after the Global Financial Crisis, back in ‘08. For a long time, interest rates were rock bottom to stimulate recovery, and bank loans were usually below the HDB loan rate of 2.6 per cent*.

If you’d been an HDB owner at the time, and you refinanced from an HDB loan to a bank loan, you would likely have seen lower interest rates for roughly a decade. That’s quite a bit of accumulated savings.

*HDB loan rates are pegged at 0.1 per cent above the prevailing CPF rate, but we just always assume it’s 2.6 per cent, because it hasn’t changed in over 20 years now.

2. It’s still a bit of a risk though, as there’s no “undo” button

Once you refinance from an HDB loan into a bank loan, there’s no way to switch it back to an HDB loan (and, just in case it matters later, you only get two HDB Concessionary Loans in your lifetime.)

So if the rates start climbing past 2.6 per cent in future, you’ll just have to find the lowest you can among the private banks.

It’s also about more than just a higher or lower rate here: HDB’s main objective is to keep as many people housed as possible. So, in the off chance you can’t make your mortgage payments, you might get a bit more leeway from them. Banks, however, tend to be quicker to foreclose.

Would I switch from an HDB loan to a bank loan today?

Well, the first consideration would be whether the savings make a difference. Here’s an article from 2024 that’s still quite relevant. There’s often a fee involved in refinancing as well, so remember to deduct all that from what you’re saving. If the end result is still tangible to you, or you have a really good use for those savings right now, it might be worth considering.

Otherwise, I don’t know if it’s worth giving up the predictable, almost-fixed rate of HDB loans just to chase a percentage point or less of savings.

I would also think plans to upgrade have an indirect effect. If I’m planning to upgrade to a condo, for instance, then I’m more likely to be paying my flat loan in cash or partially in cash (to prevent being wiped out after refunding my CPF, when the flat is sold).

And if I’m paying in cash, there’s a little more psychological (read: not necessarily correct) incentive to chase lower rates.

After all, the savings directly mean more cash in my wallet. It would hit differently than if I were paying the entire home loan using CPF, without touching my own bank account*.

Ultimately, this is something that should involve a conversation with both a mortgage broker and a financial expert before you go ahead with it. Don’t reduce it to something as simplistic as “number go lower = I switch.”

*I am not advocating wiping out your CPF or ignoring it.

More from Stacked

The Allure Of Older Properties: Who Are Buying These Places?

“LEASE DECAY”, the ad screams, “DID YOU KNOW YOUR HDB VALUE IS $0 IN THE END, OMG”. It’s probably one…

Another interesting issue came up this week, regarding the famous Hillford. If you don’t know it, this is a 60-year leasehold condo that was originally meant for retirees – but thanks to its location near Beauty World and lower costs, it managed to draw even younger buyers.

While the concept of a 60-year lease drew a lot of fire at the time, I notice tones have changed. Consider that, as of August this year, the small 398 sq ft. single bedders at Hillford transacted for $580,000 to $610,000. A larger 657 sq ft unit transacted at $945,000 in February this year.

Now Hillford has 48 years of lease remaining; but you’ll notice the quantum of these transactions is below that of many resale HDB flats. For retirees whose children already own property* and won’t need to inherit one, this may not look like a bad deal. The lower cost can mean a more comfortable retirement, and a 48-year lease means someone who buys at age 60 could live there till 108.

So if anything, the “short lease” becomes an advantage here by reducing the cost: retirees won’t pay for lease years they will never use. It’s a rational, financially efficient choice for many older Singaporeans.

As Singapore reaches super-aged status in 2026, it may be time to consider properties catered more to the elderly. That doesn’t just mean layouts that avoid stairs, accessibility in toilets, etc. One dimension to consider is shorter lease projects like The Hillford, which provide affordable private options to ageing Singaporeans.

We have seen this year that Singaporeans have begun to lose the hang-up on freehold properties, during sell-out launches like Skye at Holland, River Green, etc. Perhaps as the realities of ageing catch on, we’ll also learn to focus on practical remaining lease, rather than overpaying for a lease period we don’t need.

*That’s the huge majority, given our 90 per cent home ownership rate

Meanwhile in other property news…

- Which new condo launches still have units remaining? Here’s a rundown of the properties to look for.

- What are the most profitable condos so far in 2025? Here’s a look at the top winners.

- There are six more GLS sites to be released in 2025, and here’s the rundown on what stands out for each one.

- Why is Sky Everton underperforming despite its prime Tanjong Pagar location? Join us on Stacked Pro to find out.

Weekly Sales Roundup (03 – 09 November)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| W RESIDENCES MARINA VIEW – SINGAPORE | $10,899,350 | 2809 | $3,880 | 99 years |

| CANNINGHILL PIERS | $6,280,000 | 1755 | $3,579 | 99 yrs (2021) |

| SCENECA RESIDENCE | $4,900,000 | 2756 | $1,778 | 99 yrs (2021) |

| ZYON GRAND | $4,604,000 | 1518 | $3,033 | 99 years |

| GRAND DUNMAN | $4,597,000 | 1787 | $2,573 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ZYON GRAND | $1,412,000 | 474 | $2,981 | 99 years |

| OTTO PLACE | $1,477,000 | 872 | $1,694 | 99 yrs (2024) |

| PROMENADE PEAK | $1,486,100 | 527 | $2,818 | 99 yrs (2024) |

| RIVER GREEN | $1,494,000 | 452 | $3,305 | 99 yrs (2024) |

| KASSIA | $1,584,000 | 753 | $2,102 | 99 yrs (2024) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| NASSIM JADE | $8,108,000 | 3455 | $2,347 | FH |

| RIVERGATE | $5,350,000 | 1733 | $3,087 | FH |

| ELIZABETH HEIGHTS | $5,100,000 | 2497 | $2,042 | FH |

| RESIDENCES @ KILLINEY | $5,000,000 | 2368 | $2,111 | FH |

| THE ARCADIA | $4,920,000 | 4618 | $1,065 | 99 yrs (1979) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SUNNY LODGE | $670,000 | 388 | $1,729 | FH |

| SYCAMORE TREE | $705,000 | 388 | $1,819 | FH |

| VIVA VISTA | $720,000 | 420 | $1,715 | FH |

| MILLAGE | $780,000 | 549 | $1,421 | FH |

| OKIO | $790,000 | 431 | $1,835 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| NASSIM JADE | $8,108,000 | 3455 | $2,347 | $3,608,000 | 19 Years |

| RIVERGATE | $5,350,000 | 1733 | $3,087 | $3,270,400 | 17 Years |

| BOTANIC GARDENS VIEW | $3,700,000 | 1410 | $2,624 | $2,775,000 | 21 Years |

| MAPLE WOODS | $3,500,666 | 1507 | $2,323 | $2,390,666 | 31 Years |

| PARK INFINIA AT WEE NAM | $3,550,000 | 1464 | $2,425 | $2,229,294 | 20 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE OCEANFRONT @ SENTOSA COVE | $3,670,000 | 2045 | $1,794 | -$430,000 | 13 Years |

| LEEDON GREEN | $2,000,000 | 710 | $2,815 | -$89,000 | 3 Years |

| THE JOVELL | $910,000 | 646 | $1,409 | -$73,200 | 4 Years |

| MILLAGE | $780,000 | 549 | $1,421 | -$40,000 | 2 Years |

| SKYSUITES@ANSON | $1,500,000 | 667 | $2,248 | $4,000 | 8 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| BOTANIC GARDENS VIEW | $3,700,000 | 1410 | $2,624 | 300% | 21 Years |

| MAPLE WOODS | $3,500,666 | 1507 | $2,323 | 215% | 31 Years |

| NORTHOAKS | $1,488,000 | 1475 | $1,009 | 209% | 20 Years |

| GRANDEUR 8 | $2,050,000 | 1313 | $1,561 | 203% | 22 Years |

| ONE ST MICHAEL’S | $2,238,000 | 1184 | $1,890 | 194% | 19 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| THE OCEANFRONT @ SENTOSA COVE | $3,670,000 | 2045 | $1,794 | -10% | 13 Years |

| THE JOVELL | $910,000 | 646 | $1,409 | -7% | 4 Years |

| MILLAGE | $780,000 | 549 | $1,421 | -5% | 2 Years |

| LEEDON GREEN | $2,000,000 | 710 | $2,815 | -4% | 3 Years |

| SKYSUITES@ANSON | $1,500,000 | 667 | $2,248 | 0% | 8 Years |

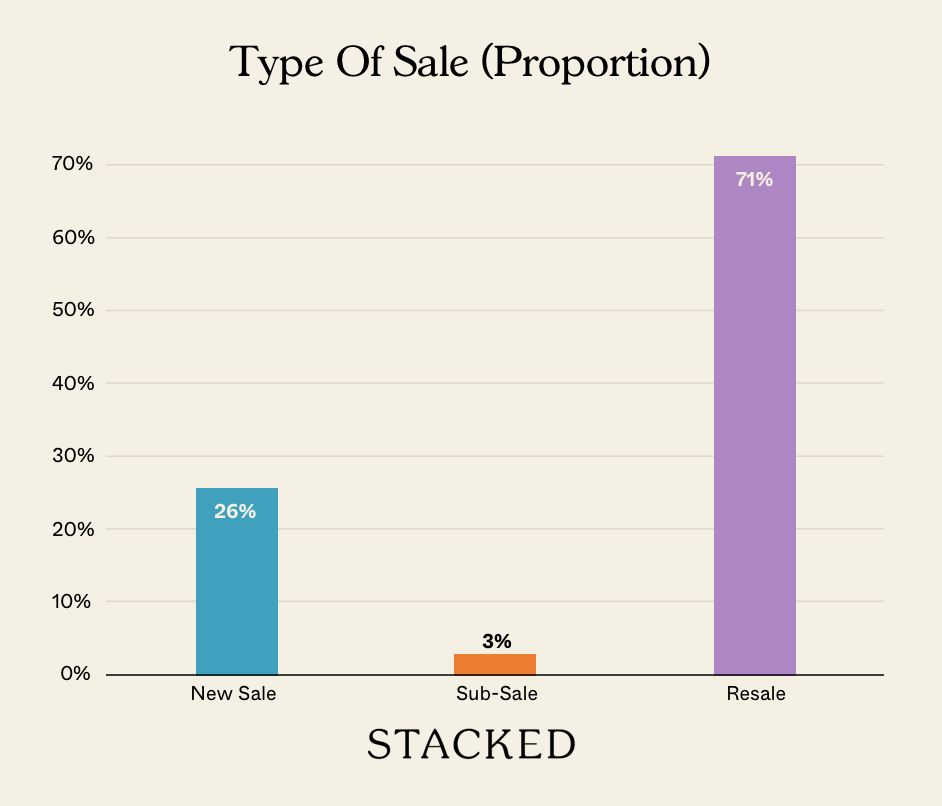

Transaction Breakdown

Follow us on Stacked for news and events in the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are more HDB owners refinancing in 2025?

Should I switch from an HDB loan to a bank loan now?

What happens if interest rates go up after refinancing?

How old is the Hillford condo with 48 years left on the lease?

Are shorter lease properties like Hillford good for retirees?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Singapore Property News You Can Now Buy Part Of A $300M Singapore Bungalow — But You Can’t Live In It

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Latest Posts

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

0 Comments