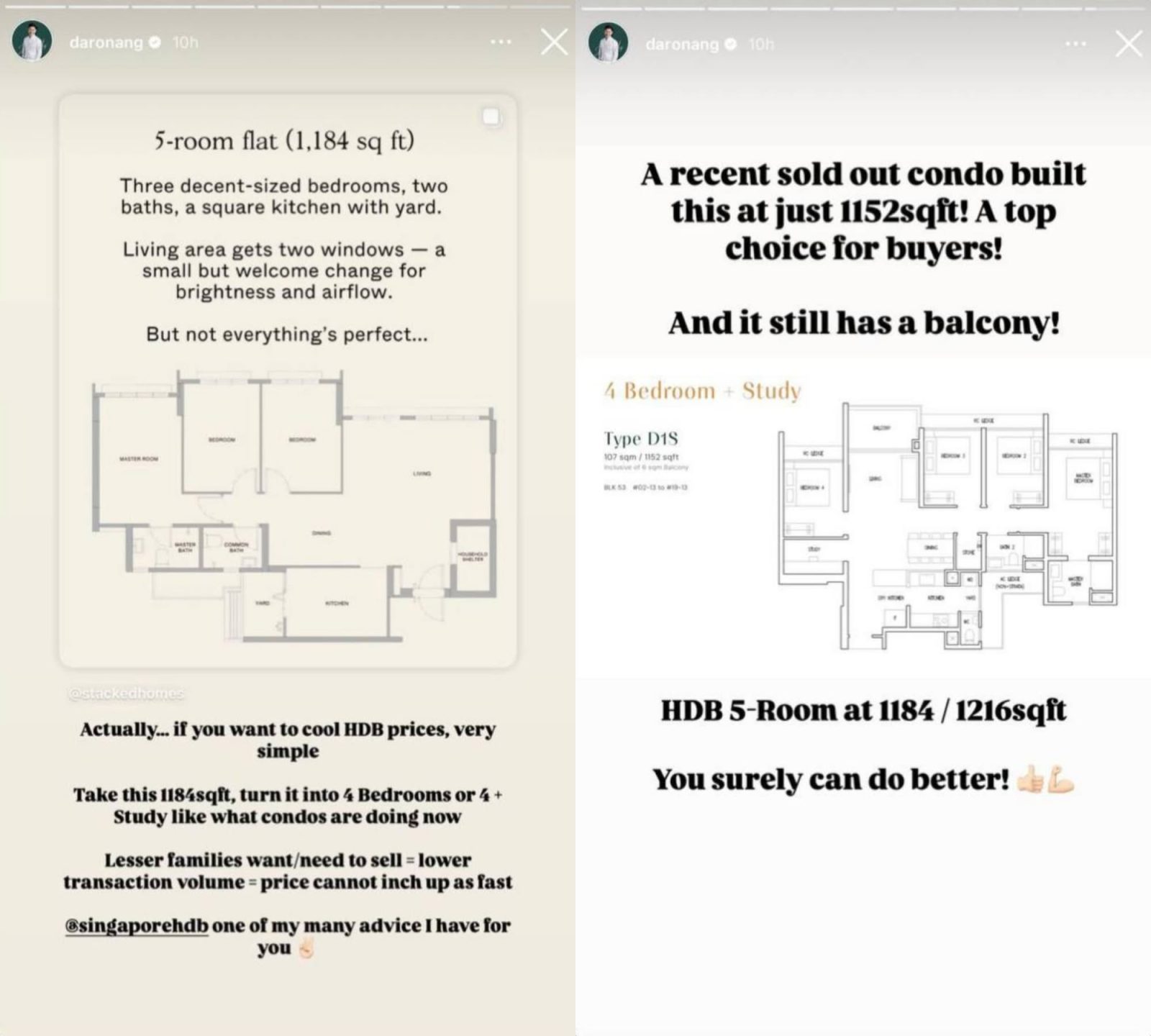

1,200 sq ft and only three bedrooms? I’ve been robbed!

At least, that’s the kind of reaction I’m seeing out of some HDB flat buyers today. Which leads me to reference these two posts:

In case you don’t see what he means, imagine this:

A condo designer looks at 1,152 square feet – which anywhere outside of Singapore is barely a large sneeze in real estate terms – and gets told by the developer: “I need to make someone pay over $2 million for this, so bend the fabric of space and time to make this a decent family home.”

Luckily, anyone who lasts in real estate development has mastered the art of conjuring three to four miracles per week, usually before Thursday lunch. Hence the bold decision:

“Let’s shove four bedrooms and a study into it, slap a balcony on the end, and then boss can charge six digits per wall.”

AND THEY DID. AND PEOPLE BOUGHT IT.

You know why?

1. Rooms = Function

It’s not just about square footage, it’s about what you can do with the space. More rooms means:

- Office for Work From Home

- Study for your kid

- Room to cry privately over ChatGPT getting you retrenched (AI-powered)

- Room for the in-laws you didn’t ask for

- A Warhammer dungeon because, like me, you’ve given up having hobbies other people can understand

I’ve also had one person explain it to me in these somewhat disturbing terms:

“If you’re spending $2 million and you only get three bedrooms, that’s $666,666 per room. If you get 4 bedrooms for the same space and price, now it’s only $500,000 per room.”

I’m not saying he’s right, and I definitely looked at him funny afterwards.

But I’m putting that anecdote here to show you how much it means to some people, just to have that extra room. If someone performs that level of mental gymnastics, you know it’s a big deal.

2. Low room count is the trigger for “upgrade syndrome”

Most families aren’t moving from HDB to condo because they want marble countertops and a gym full of sweaty strangers. Mostly.

They’re moving for other reasons, chief among these being being able to separate barking fur babies, siblings fighting for the Nintendo Switch, and space for emotional breakdowns between Zoom meetings.

Sometimes it’s not about pools, it’s not Chinese New Year status comparisons, it’s about walls. With doors. And enough room for a queen size bed in there. THAT’S ALL.

3. Supply and demand are at least a bit affected by layouts

We’ve seen how our developer designer has bent reality to make things work. But meanwhile, in HDB-land, someone is working with a beefy 1,184 to 1,216 sq ft… and what does he come up with?

Three bedrooms and a corridor to stare down while I question my life choices. Come on. Condos are out here squeezing every square inch of space for utility, like an anaconda on Red Bull. No space is safe. Kitchens become partial dining rooms. Awkward corners become studies. And yet – they deliver the room count modern families need.

More from Stacked

6 Developer Pricing Strategies For New Launch Condos

One of the great mysteries in Singapore’s private property market is developer pricing for new launches. We’ve encountered few events…

Those HDB flat layouts, on the other hand, are like: “Here’s a kitchen and a service yard big enough to host a Zumba class. But sleep there or something, because no fourth bedroom. Good luck.”

So that’s why Daron may have a cool idea.

If you take your average 1,184 sq ft HDB flat and design it like a condo – 4 bedrooms, or 3 + study – what might happen?

- Fewer families feel pressured to buy condos just to get that sweet extra room.

- Lower upgrade demand = fewer transactions = prices cool

- Homeowners can still afford to go to a nice bakery or the local clinic, even as their landlords slowly raise their rents to rival aircraft hangars.

So let’s see HDB start adding an extra room and making more effective use of what little space we have.

Meanwhile in other property news…

- You don’t need to buy an integrated development, you just need to buy NEAR an integrated development. Clever right? Here are affordable one-bedder options for that ultimate cheap bachelor convenience.

- It’s said that you feel truly complete soon after owning your first home. I agree, because I recall thinking “Now I am really finished” when I saw the bill. Here’s the sharp reality from Gail.

- Time for Norman’s update on the new launch round-up for Q2, and some reminiscing on how Singapore’s property landscape is changing.

- Join Stacked Pro readers in finding undiscovered gems; in this case, Loyang Valley, which seems intent on beating the Egyptian pyramids at long-term appreciation.

Weekly Sales Roundup (02 June – 08 June)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| 32 GILSTEAD | $15,000,000 | 4219 | $3,555 | FH |

| AUREA | $12,000,000 | 3251 | $3,691 | 99 yrs (2024) |

| CANNINGHILL PIERS | $7,531,000 | 2788 | $2,701 | 99 yrs (2021) |

| IRWELL HILL RESIDENCES | $5,550,000 | 2228 | $2,491 | 99 yrs (2020) |

| UNION SQUARE RESIDENCES | $5,249,000 | 1518 | $3,458 | 99 yrs (2024) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ONE MARINA GARDENS | $1,217,415 | 420 | $2,900 | 99 yrs (2023) |

| LUMINA GRAND | $1,410,000 | 936 | $1,506 | 99 yrs (2022) |

| BLOOMSBURY RESIDENCES | $1,427,000 | 570 | $2,501 | 99 yrs (2024) |

| SORA | $1,572,000 | 732 | $2,148 | 99 yrs (2023) |

| KASSIA | $1,871,000 | 904 | $2,069 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| FOUR SEASONS PARK | $7,500,000 | 2260 | $3,318 | FH |

| VOLARI | $6,080,000 | 2174 | $2,796 | FH |

| THE GRANGE | $6,080,000 | 2293 | $2,652 | FH |

| THE SEAFRONT ON MEYER | $4,800,000 | 2088 | $2,299 | FH |

| AMBER PARK | $4,725,000 | 1582 | $2,986 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SUITES @ EASTCOAST | $720,000 | 366 | $1,967 | FH |

| MIDTOWN RESIDENCES | $759,000 | 452 | $1,679 | 99 yrs (2013) |

| HIGH PARK RESIDENCES | $760,000 | 452 | $1,681 | 99 yrs (2014) |

| LOFT @ NATHAN | $785,000 | 388 | $2,026 | FH |

| Q BAY RESIDENCES | $820,000 | 517 | $1,587 | 99 yrs (2012) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE TESSARINA | $3,813,000 | 1615 | $2,362 | $2,395,000 | 22 Years |

| VOLARI | $6,080,000 | 2174 | $2,796 | $1,840,000 | 8 Years |

| PARC PALAIS | $4,150,000 | 2680 | $1,548 | $1,790,000 | 14 Years |

| LA MAISON | $2,550,000 | 1259 | $2,025 | $1,700,000 | 20 Years |

| THE SEAFRONT ON MEYER | $4,800,000 | 2088 | $2,299 | $1,699,000 | 18 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MARINA BAY SUITES | $4,080,000 | 2056 | $1,985 | -$2,057,200 | 12 Years |

| SCOTTS SQUARE | $1,900,000 | 635 | $2,992 | -$716,200 | 18 Years |

| DUO RESIDENCES | $3,500,000 | 1528 | $2,290 | -$309,520 | 7 Years |

| STRATUM | $2,090,000 | 2443 | $855 | -$223,800 | 7 Years |

| FOURTH AVENUE RESIDENCES | $1,700,000 | 710 | $2,393 | -$70,960 | 3 Years |

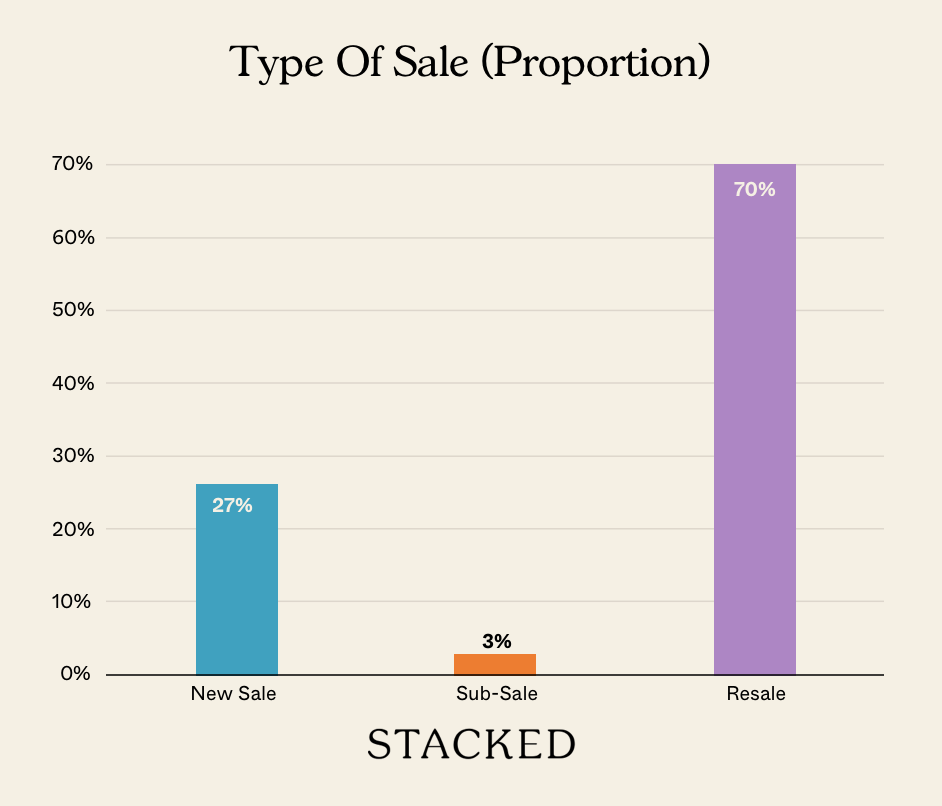

Transaction Breakdown

Follow us on Stacked for more on the Singapore property market, and deep dives into new and resale condos.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are more 4-bedroom flats important in HDB developments?

How does increasing the number of bedrooms in HDB flats affect property prices?

What are the main reasons families want larger HDB flats?

How do condo layouts influence the demand for HDB flats?

What is the potential benefit of redesigning HDB flats like condos?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

1 Comments

The one with the big living room could have just partition up the space instead of getting a 4+ 1study. It’s the upgrade mentality not just for an extra room.

It’s the rooms that are design now a days that make no sense. Why do you need a long walk way instead of making the room directly accessible from the living room. Like older point block of hdb where People who didn’t like walkway don’t have that problem.