Why Did This Bayshore GLS Site Sell For A Record $1,388 PSF: We Break It Down

April 11, 2025

One of the most talked-about sites recently is the Bayshore GLS site. Already, we’re seeing pre-emptive websites set up to sell the “new Bayshore integrated condo.” But what is it about this site that makes it so hot when, up until recently, Bayshore was considered a rather inaccessible and sparse area in Singapore? Also, are the changes to Bayshore transformative enough to justify the location to homeowners first, and investors second? Let’s take a look:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The Bayshore GLS site

This is the first private housing site for the planned Bayshore precinct, a new residential zone that’s still being developed. It’s situated next to Costa del Sol, an existing condominium, and is also next to the new Bayshore MRT station (TEL). This is a leasehold, 112,992 sq. ft. site expected to yield around 515 homes.

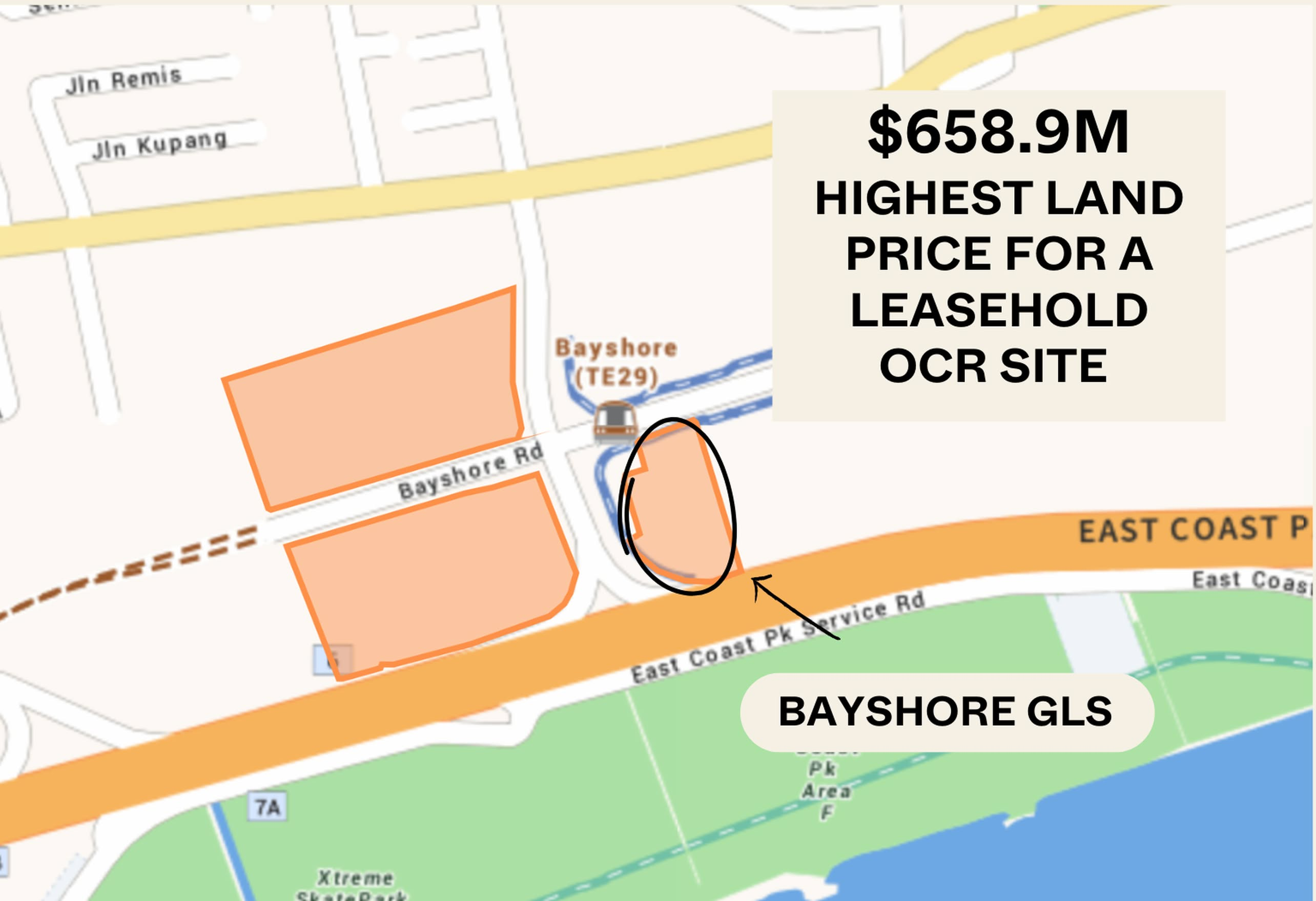

The Bayshore Road site attracted eight bidders and a top bid of $1,388 psf ($658.9 million) from Sing-Haiyi. The competition between developers was significant, as the second highest bid was very slightly lower at $1,377 psf from Sing Holdings. CDL came third, with a bid of $1,308 psf.

This is the highest land price we’ve seen for a leasehold, OCR condo so far

This surpasses the previous record of $1,250 psf for Clementi Ave 1 (currently ELTA). It notably exceeds the bids for the Zion Road parcels ($1,202 and $1,304 psf) in terms of price psf, despite those parcels being in the CCR.

Why the high bids, and what are the pros and cons of this area?

The main reasons for the high bids would be a first mover advantage, and the age of surrounding private properties.

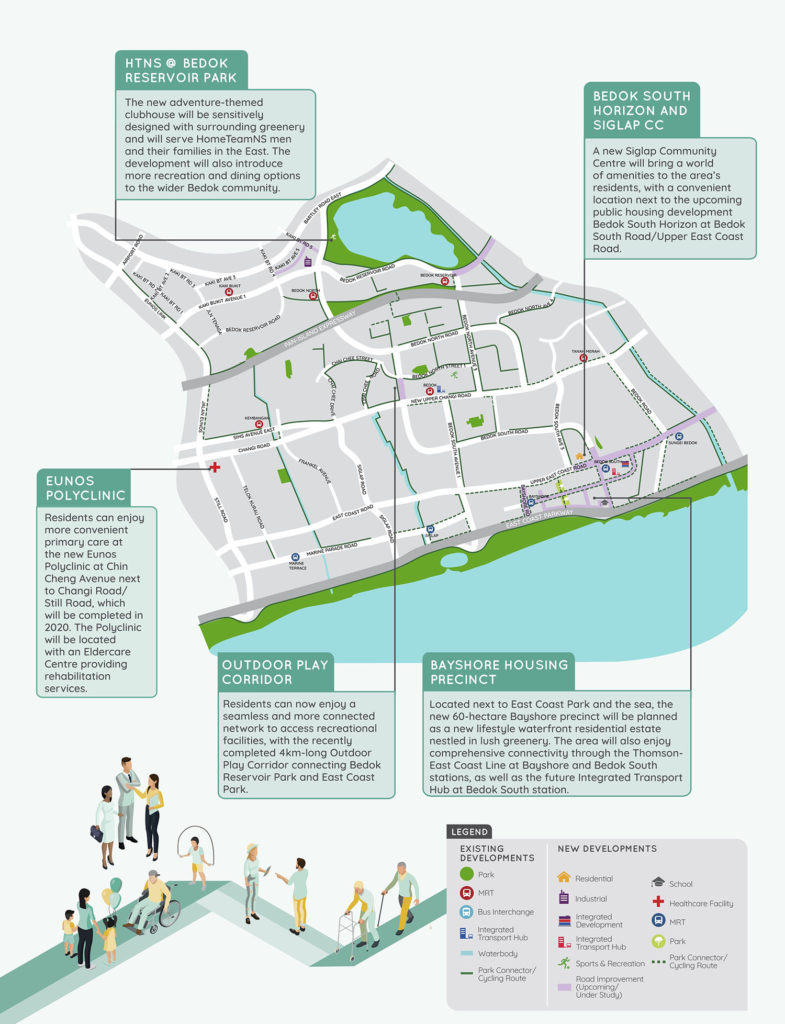

The new Bayshore precinct is intended to see around 10,000 new homes (of which about 30 per cent are private), although construction has only just begun. The first BTO project here was also the first Plus model housing launch, in the form of Bayshore Palms from the October 2024 exercise.

We’re told the project here will be integrated and connected to the Bayshore MRT station; this would also imply a commercial element. However, all we’ve heard of the integrated element is speculation and word on the ground so far, so we aren’t clear on details like how much commercial space is available or what amenities may appear – we’ll provide an update as soon as we can.

This alone, however, seems sufficient to persuade developers. There’s a clear first-mover advantage here; and realtors have drawn parallels to successful projects like Watertown. In the words of one realtor:

“If you look at integrated projects that were the first in their area, like Watertown, they tend to do very well early on because there’s no nearby amenities. So for Watertown, last time Punggol had limited amenities before Waterway Point, which is the shopping centre downstairs. This is the same as what we can see for Bayshore, where right now there’s no mall in the area.

One other advantage is that it’s different from very big and noisy shopping centres, this is probably a self-contained mall that’s mainly for local residents; a lot of buyers nowadays tend to prefer this, rather than a big shopping centre like in Paya Lebar.”

We also heard parallels being drawn to Parktown Residence. One realtor noted the similar traits and fast sellout of Parktown Residence, which could also apply to Bayshore:

“Parktown Residence was also the first integrated project in a new township, in Tampines North, and you can see they sold out 87 per cent on the launch weekend; so there is some parallel between what’s going on in Bayshore. It’s also a new township with no amenities, and this will be the first integrated project there.”

What are some other notable strengths?

1. The excellent views, for now

We say “for now” because in the long term, the Long Island Project could affect the seaview – not just for this new Bayshore project, but for the older cluster of condos in Bayshore Road as well.

For now, however, the Bayshore project – like the other existing condos in this area – is pushed up as close to East Coast Beach as possible. There isn’t room for more developments to crop up and impede the view; and the trio of condos in this area (Costa Del Sol, The Bayshore, and Bayshore Park) are already known for the seaview.

More from Stacked

New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

For the first time since 2021, a new government land sale (GLS) site in Lentor has attracted bids of more…

As an aside, the seaview is on one side while the other side of the project, depending on how surrounding HDB blocks get laid out, could have an equally good view of the Lucky Heights landed estate. A seaview on one side and a low-density view on the other will be a huge draw, although further development of the township will impact this.

2. Easy access to the beach

There’s an underpass to East Coast Beach next to Costa Del Sol. From this existing underpass, you’ll emerge near the Xtreme Skate Park at East Coast Beach (near one of the many BBQ areas). It’s possible to walk from here to the East Coast Lagoon Food Village.

This is also a popular family picnic and cycling track, and fishing is allowed off the nearby Bedok Jetty (within cycling distance). Bayshore, as the name implies, is a superb location for those who enjoy the beach.

This is also a very pet-friendly area by the way, with a dog run close to where you emerge from the underpass.

3. Proximity to the Katong lifestyle hub

Thanks to the new Bayshore station, it’s only three stops to Marine Parade. The Marine Parade station has Parkway Parade on one side, and i12 Katong on the other; this is more or less the heart of the Katong lifestyle hub.

Besides having multiple supermarkets and eateries, this stretch is very well known for its wide range of enrichment/tuition centres (e.g., the famed Parkway Centre), and for being an expatriate enclave. It’s also an ideal mix of affordable local food, as well as hipster diners and cafes.

We do think that, even if the Bayshore project presents more immediate amenities, the Katong area will probably be the main hub for residents here; as it has been for decades.

But are there any drawbacks?

The first issue is accessibility. Whilst the presence of the MRT station helps a lot, check out where Bayshore is on the TEL: it’s a long trip to the city centre, and many of the articles we’ve read online greatly underrate the length of the journey. Bayshore is very much a fringe, beachside enclave; and it’s probably not for those who need to live near the CBD.

Another minor annoyance is access to Changi Airport. If you’re driving, this isn’t a problem – but if you’re using the train, it gets a bit irritating. Despite how close it is on paper, you’ll have to walk all the way to the bus stop opposite The Summit, and take a bus like 14 to get to Tanah Merah station for the EWL. From here you can get the train to the airport, but you can’t get there directly from the TEL. It’s a pity, since it would be nice to use the Bayshore station to get straight to the airport, luggage and all.

From an investor’s perspective, there may be some concerns over competition from the trio of large condos nearby: Bayshore Park has 1,093 units, The Bayshore has 1,038 units, and Costa Del Sol has 906 units. Whilst these projects are much older (late ‘80s to early 00s), they are also larger, have equally good sea views, and are in good upkeep. These could provide serious competition for tenants, although less so in terms of resale due to age.

A final concern is the general lack of school access. Temasek Primary is the only Primary School within one kilometre, with the other nearby schools being Temasek Secondary and Temasek JC.

Overall though, it is rare to find a land plot with such excellent beach access and an unblocked seaview; and the hefty price paid by the developer (for an OCR parcel) reflects that. The resulting project could set the standard for private developments on the East side, for years to come.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did the Bayshore GLS site sell for a record price per square foot?

What makes the Bayshore area attractive to developers and buyers?

Are there any drawbacks to living in the Bayshore area?

How does the Bayshore project compare to other new developments in Singapore?

What are the future plans for the Bayshore precinct?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

1 Comments

Great review! I don’t fully agree with what you’re pointing out as a drawback though.

MRT at Bayshore will connect to Changi in a few years will be great for people working around that area.

https://www.straitstimes.com/singapore/transport/tel-crl-mrt-lines-to-be-extended-to-serve-changi-airport-terminal-5