Where Condo Prices Rose Fastest (and Slowest) in Singapore’s Outside Central Regions

September 7, 2025

The OCR has been the ultimate property tycoon speed-run for the past 10 years.

Maybe it was some uncle or auntie who couldn’t stand the loud neighbour in block 117. Or maybe some couple wanted to stay closer to the CBD and thought “$1 million? For that price I may as well have a pool.” Quite possibly, the thought of serious property investment never even registered in their mind. But fast forward to today, and their property asset performance makes them look like genius tycoons.

Oh, and possibly on a more serious note, this is all really bad news for upgraders in the OCR who waited too long.

My point is, the OCR (and incidentally the RCR but that’s not my focus here) may not be a “budget substitute” for the CCR in future

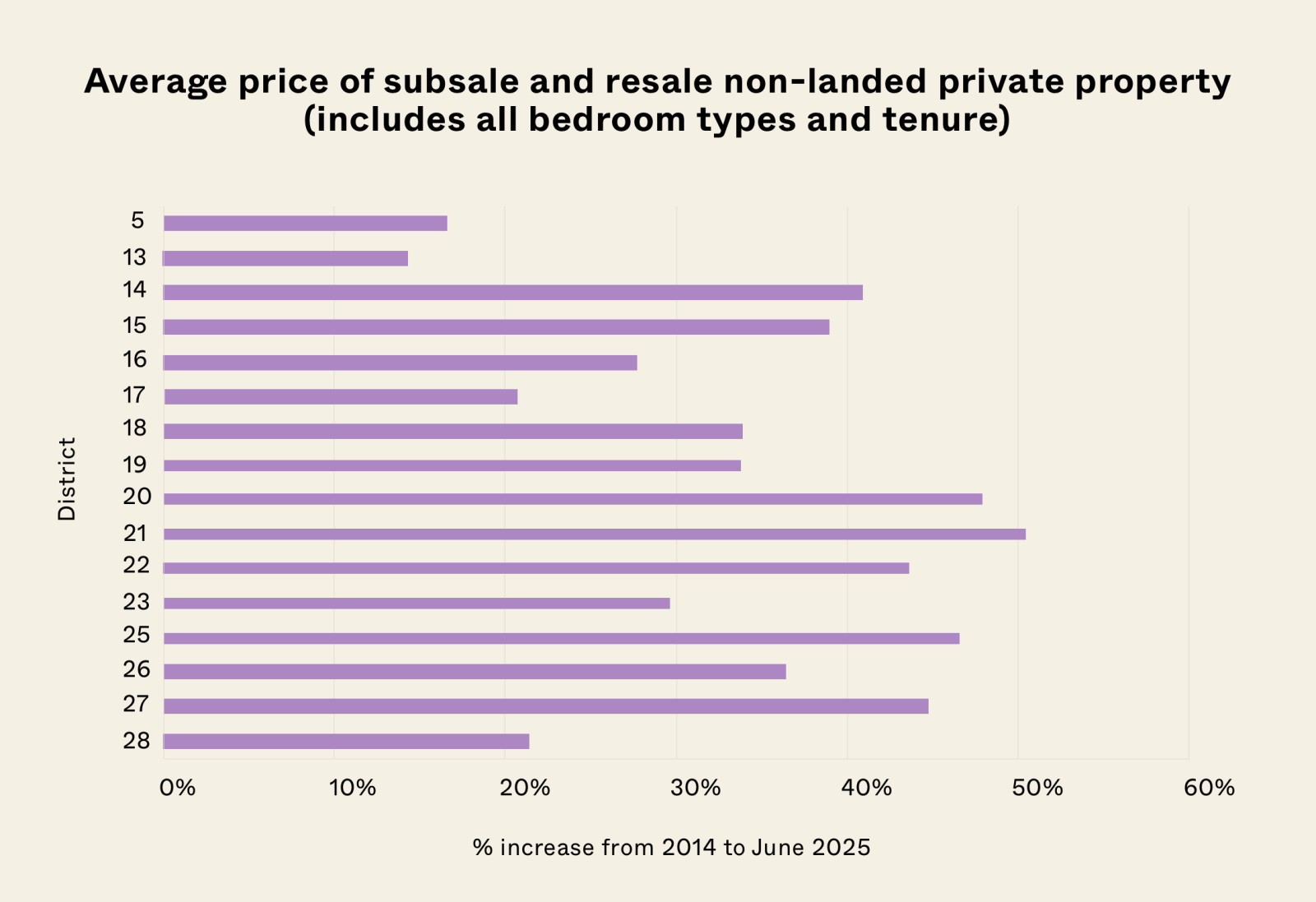

Here’s a look at the prices, and how they’ve risen over the past decade:

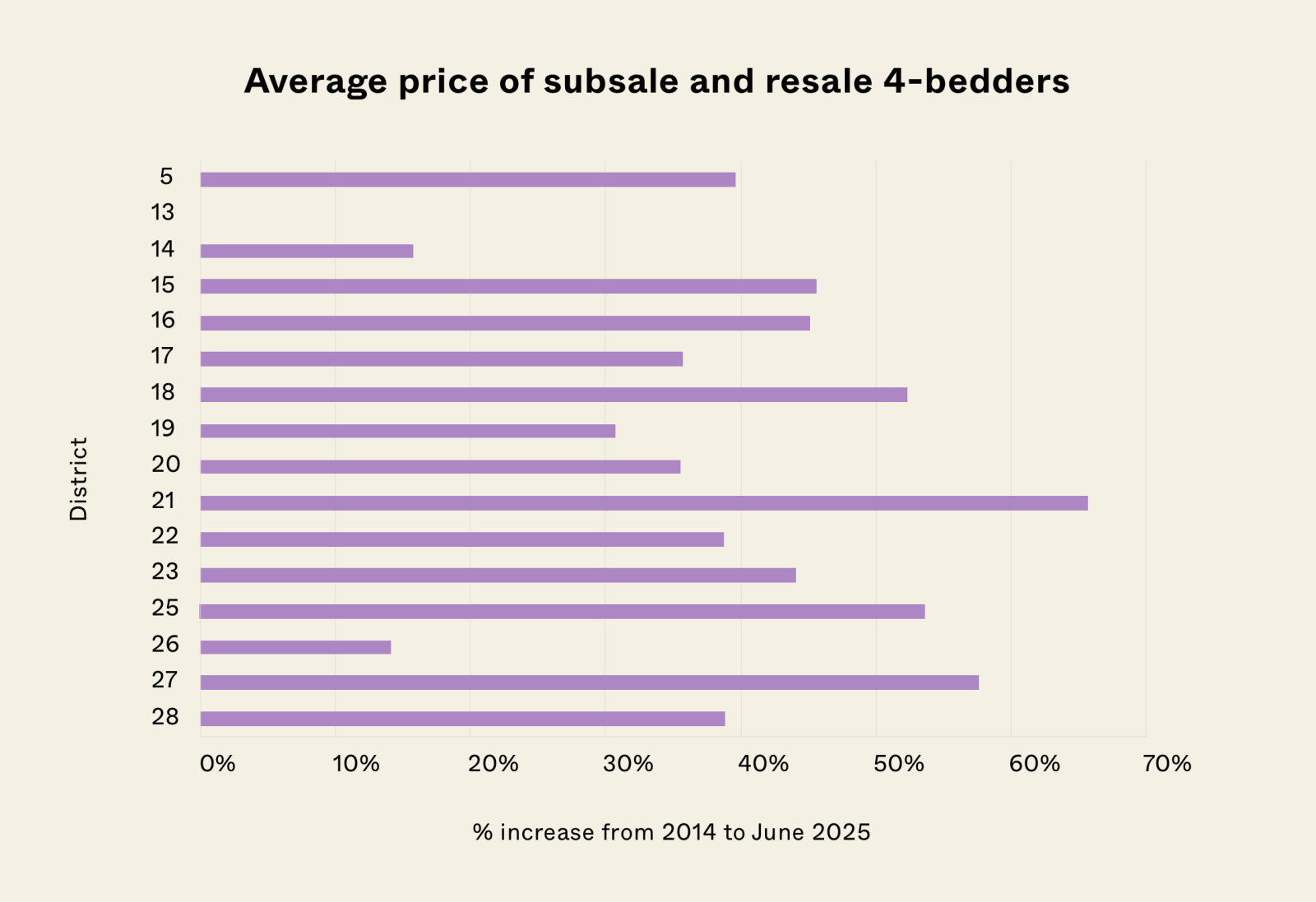

Only those in D21 doubled, but afew are pretty close to doubling

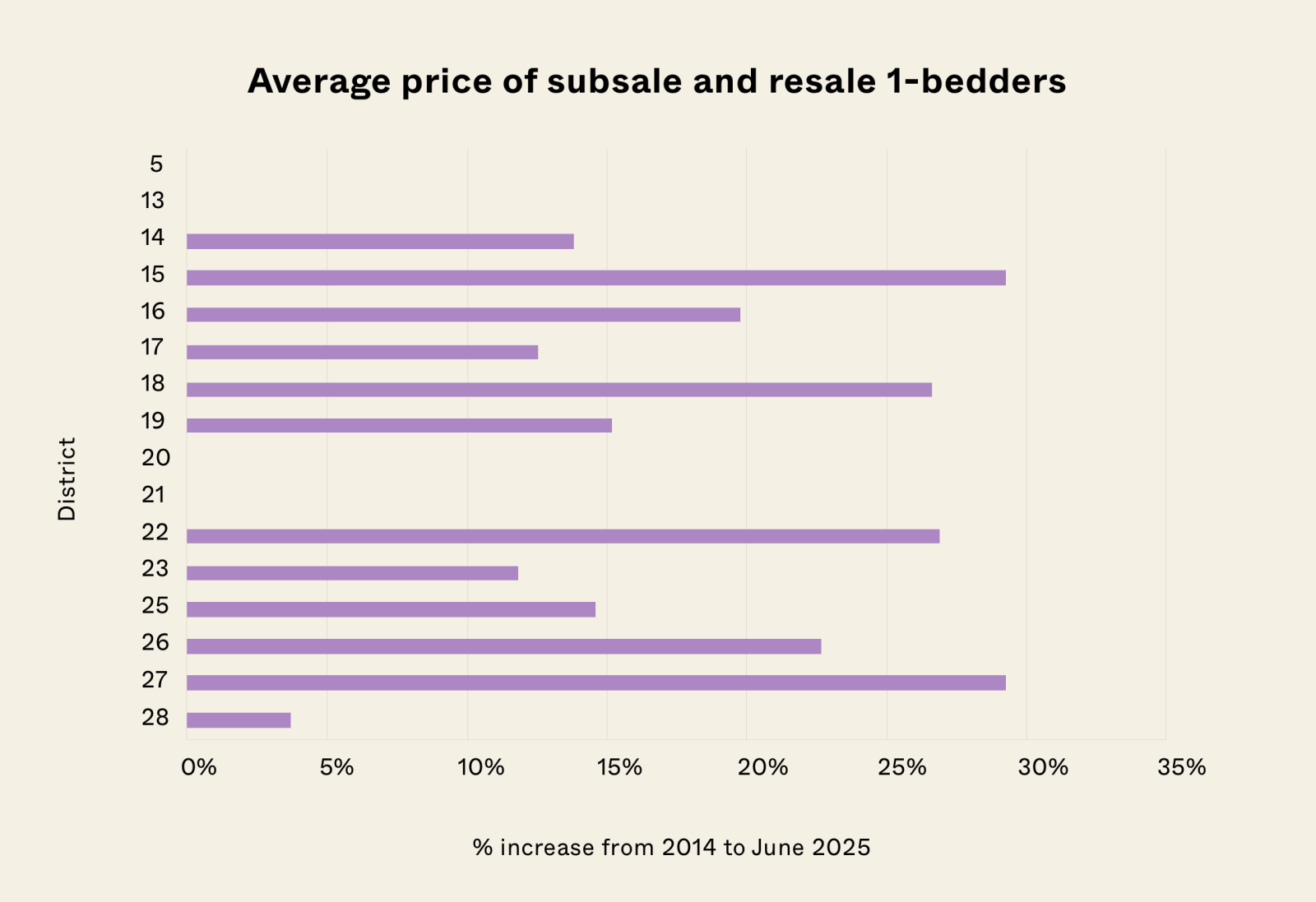

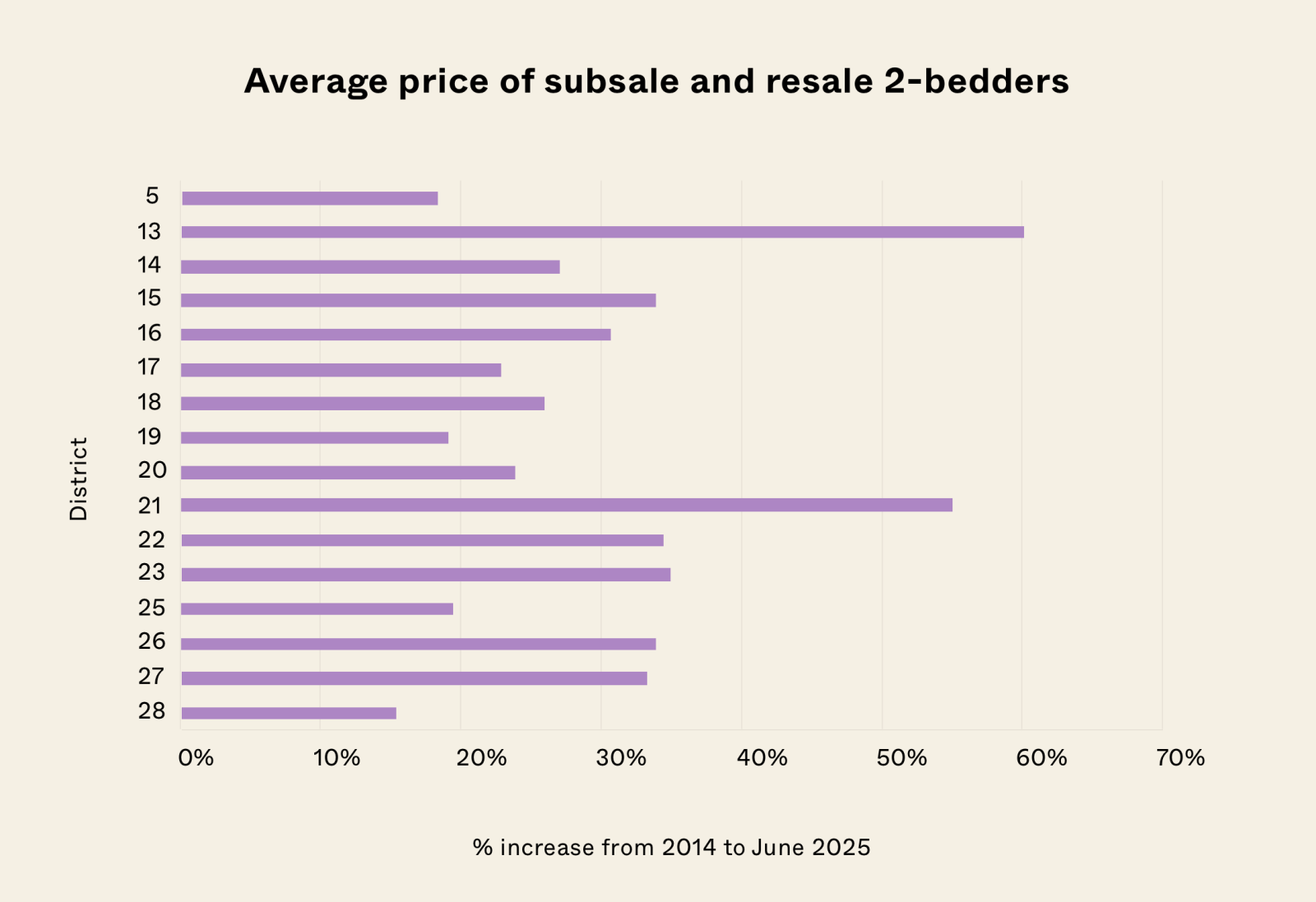

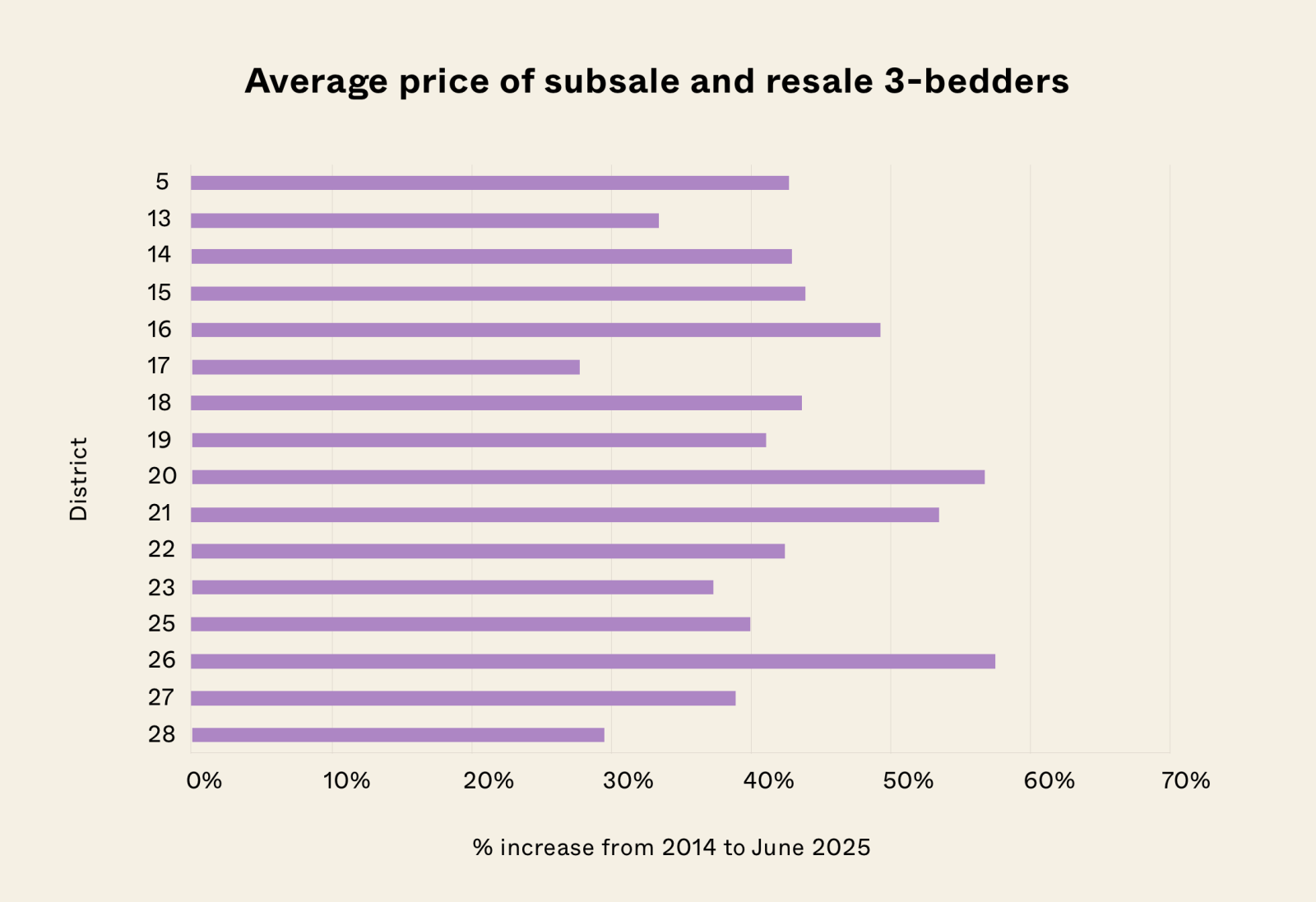

We’ll also break it down into the different bedroom types

Some districts may have missing data in 2014 or 2025 so we can’t check the % increase for those

The biggest price leaps have come from the western heartland areas, which we tend to think of as the “affordable escape” to high property prices.

District 21, covering Upper Bukit Timah and Clementi Park, has nearly doubled in average condo prices over the past decade by 50.42 per cent. Close behind is District 20 (Bishan/AMK), with gains of 47.9 per cent; this has turned what used to be “easy upgrader territory” into a growing cluster of million-dollar condos.

What’s especially concerning is that family-sized units are leading the rise. In D21, three-bedders surged by 53.49 per cent, while four-bedders jumped a staggering 65.64 per cent. This isn’t investor money chasing shoebox rentals; it’s upgraders and families fuelling demand for more space; and it’s resulted in heartland prices reaching levels we considered unthinkable in 2014. It’s not just a few outliers either:

Even “ulu” districts like D23 (Bukit Panjang/Choa Chu Kang) and D25 (Woodlands) have seen dramatic climbs of 43.56 per cent and 46.52 per cent, so almost no corner of the OCR has been spared.

Smaller units like one-bedders haven’t kept pace, but that’s hardly anything to be relieved about: the bread-and-butter family units, like the three-bedders, are the main concern for most regular Singaporeans.

And here’s the part that stings: Singapore isn’t a big country.

In larger markets, when one neighbourhood overheats, there’s always somewhere else you can still run to – the equivalent of moving one train stop further and shaving $150,000 off your loan or something.

But here in small Singapore, the escape routes are disappearing.

The OCR used to be the fallback option. Can’t afford Orchard? Go to the RCR. Can’t afford the RCR? Your last shot is in the heartlands.

Well that ladder may not exist for long. When even Bukit Panjang and Woodlands have clocked 40+ per cent price jumps, heartland upgraders now find themselves staring at $1.6 million to $1.8 million+ entry points across the board. Some aren’t choosing between CCR, RCR, and OCR anymore; they’re simply choosing the quantum that won’t break them. This is part of the reason why we see even families picking up lower-quantum two-bedder units.

Also, I don’t know if this is a clear win for every OCR condo owner either

As the old saying goes, if you can sell high, you’re going to buy high. Great, their property went up by $600,000 to $800,000. But unless they’re planning to sell and retire in Batam, they’re also going to have to buy back in at today’s high prices. Which means:

More from Stacked

How Do We Deal With The “Unfairness” Of Prime Region HDB Flats?

Before you fork out $20,000 or $30,000 in Cash Over Valuation (COV), you should pay close attention to what National…

- Some upgraders are stuck. Cashing out doesn’t get you ahead if your replacement condo has also jumped 40–60 per cent. You’re trading up in quantum, but not in lifestyle.

- Downgraders lose their edge. Even if you sell OCR and move to another OCR project, you’re still coughing up at today’s inflated entry prices. The gain is mostly theoretical unless you quit private property altogether.

The only plausible winners are the ones who are downgrading back to HDB flats, in which case their resale gains could pad a retirement account by a hefty margin – but not everyone considers moving back to HDB to be a desirable milestone.

Another possible consequence is that – with further decentralisation – the notions of districts and regions may become less important.

URA’s Master Plan has been slowly carving out self-contained hubs all over the island. Tampines, Jurong, Punggol, Woodlands – each was once considered fringe, but each now have their own mall cluster, offices, hawker centres, transport nodes, etc.

With continued decentralisation, your “property premium” in future may not hinge on whether you’re in D20 vs D21, but whether you’re within a short walk of your neighbourhood’s hub. Even today, you’ll find Singaporeans who roll their eyes at the mention of Orchard or Marina, and tell you whatever they can buy there they can buy in their local heartland mall.

The lesson is that – in a land-scarce city where decentralisation is creating mini-CBDs – the waiting game isn’t always the wisest choice. The longer you wait to make your move, the tougher it can get; and this is true even in traditionally cheaper zones.

Meanwhile in other property news…

- Do Primary schools really affect condo prices? From what this study shows, the answer may not be what you expect.

- These are the five most common property questions everyone asks, and why you can never get a straight answer.

- These are the six new upcoming condo launches to brace for, in the latter half of 2025

- Join our Stacked Pro readers, in finding out which boutique condos in District 12 have managed to stand out for gains.

Weekly Sales Roundup (25 – 31 August)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CANNINGHILL PIERS | $8,120,000 | 2874 | $2,825 | 99 yrs (2021) |

| PROMENADE PEAK | $5,313,100 | 1582 | $3,358 | 99 yrs (2024) |

| AMBER HOUSE | $5,305,608 | 1744 | $3,043 | FH |

| PINETREE HILL | $4,454,000 | 1733 | $2,570 | 99 yrs (2022) |

| TEMBUSU GRAND | $4,208,000 | 1711 | $2,459 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ARTISAN 8 | $1,058,000 | 398 | $2,657 | FH |

| CANBERRA CRESCENT RESIDENCES | $1,340,100 | 667 | $2,008 | 99 yrs (2024) |

| BAGNALL HAUS | $1,371,000 | 495 | $2,769 | FH |

| BLOOMSBURY RESIDENCES | $1,397,000 | 570 | $2,449 | 99 yrs (2024) |

| PROMENADE PEAK | $1,548,000 | 527 | $2,935 | 99 yrs (2024) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| TOMLINSON HEIGHTS | $10,900,000 | 2745 | $3,971 | FH |

| HILLTOPS | $5,420,000 | 1593 | $3,402 | FH |

| FLORIDIAN | $4,955,000 | 1862 | $2,661 | FH |

| PARVIS | $4,550,000 | 1701 | $2,675 | FH |

| THE SEA VIEW | $4,428,000 | 1647 | $2,689 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CITY LOFT | $690,000 | 355 | $1,943 | FH |

| EUHABITAT | $700,000 | 527 | $1,327 | 99 yrs (2010) |

| 91 MARSHALL | $705,000 | 377 | $1,871 | FH |

| PRESTO@UPPER SERANGOON | $748,000 | 431 | $1,737 | FH |

| PALMERA EAST | $750,000 | 431 | $1,742 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| HAIG COURT | $3,300,000 | 1550 | $2,129 | $2,372,406 | 21 Years |

| PARVIS | $4,550,000 | 1701 | $2,675 | $1,948,240 | 16 Years |

| TANGLIN PARK | $2,650,000 | 1033 | $2,564 | $1,720,000 | 23 Years |

| FLORIDIAN | $4,955,000 | 1862 | $2,661 | $1,687,190 | 14 Years |

| THE SEA VIEW | $4,428,000 | 1647 | $2,689 | $1,678,000 | 7 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MARINA ONE RESIDENCES | $3,220,000 | 1539 | $2,092 | -$506,994 | 7 Years |

| OUE TWIN PEAKS | $1,255,000 | 570 | $2,200 | -$275,000 | 6 Years |

| EON SHENTON | $1,550,000 | 883 | $1,756 | -$55,000 | 9 Years |

| RV ALTITUDE | $1,270,000 | 441 | $2,878 | $1,000 | 5 Years |

| NORMANTON PARK | $994,000 | 527 | $1,885 | $1,170 | 4 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| HAIG COURT | $3,300,000 | 1550 | $2,129 | 256.0% | 21 Years |

| GRANDEUR 8 | $2,250,000 | 1421 | $1,584 | 215.0% | 22 Years |

| TANGLIN PARK | $2,650,000 | 1033 | $2,564 | 185.0% | 23 Years |

| LAKEHOLMZ | $1,700,000 | 1313 | $1,295 | 173.0% | 22 Years |

| PARC EMILY | $2,088,888 | 1001 | $2,087 | 169.0% | 19 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| OUE TWIN PEAKS | $1,255,000 | 570 | $2,200 | -18.0% | 6 Years |

| MARINA ONE RESIDENCES | $3,220,000 | 1539 | $2,092 | -14.0% | 7 Years |

| EON SHENTON | $1,550,000 | 883 | $1,756 | -3.0% | 9 Years |

| RV ALTITUDE | $1,270,000 | 441 | $2,878 | 0.0% | 5 Years |

| NORMANTON PARK | $994,000 | 527 | $1,885 | 0.0% | 4 Years |

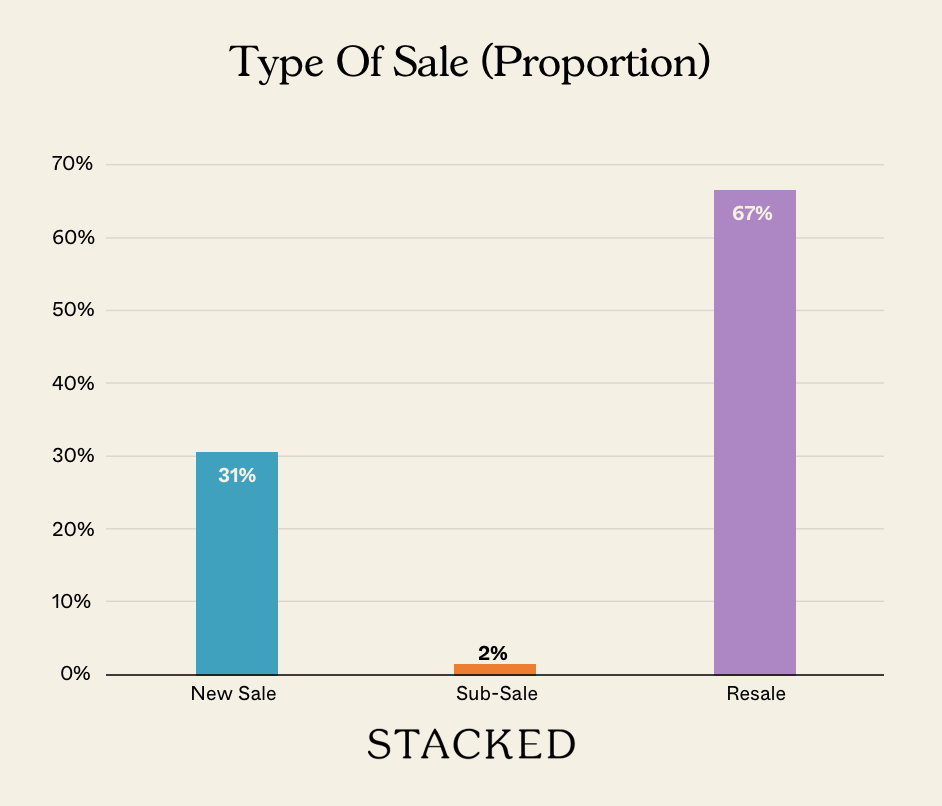

Transaction Breakdown

Follow us on Stacked for more on the Singapore property market

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Which districts in Singapore have seen the highest condo price increases over the past decade?

How have property prices changed in Singapore's heartland districts like Bukit Panjang and Woodlands?

Are smaller units like one-bedroom condos keeping up with the price growth in Singapore?

What impact does decentralisation have on property values in Singapore?

What are the risks for condo owners who have seen property prices rise significantly?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Latest Posts

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

1 Comments

duplicate images