When ‘Fringe’ Homes Cross $2,000 PSF, Has Singapore’s Idea of ‘Prime’ Changed for Good?

October 19, 2025

You know a big change is coming, when longstanding classifications and definitions come to a close.

For example, back in 2024, when HDB decided to abandon the “mature” versus “non-mature” classification for flats. A move that makes sense because for years now, “developed” has been a concept that’s much more localised; something you’d understand if you live right next to a mall and an MRT station, but your neighbourhood keeps getting called “ulu.”

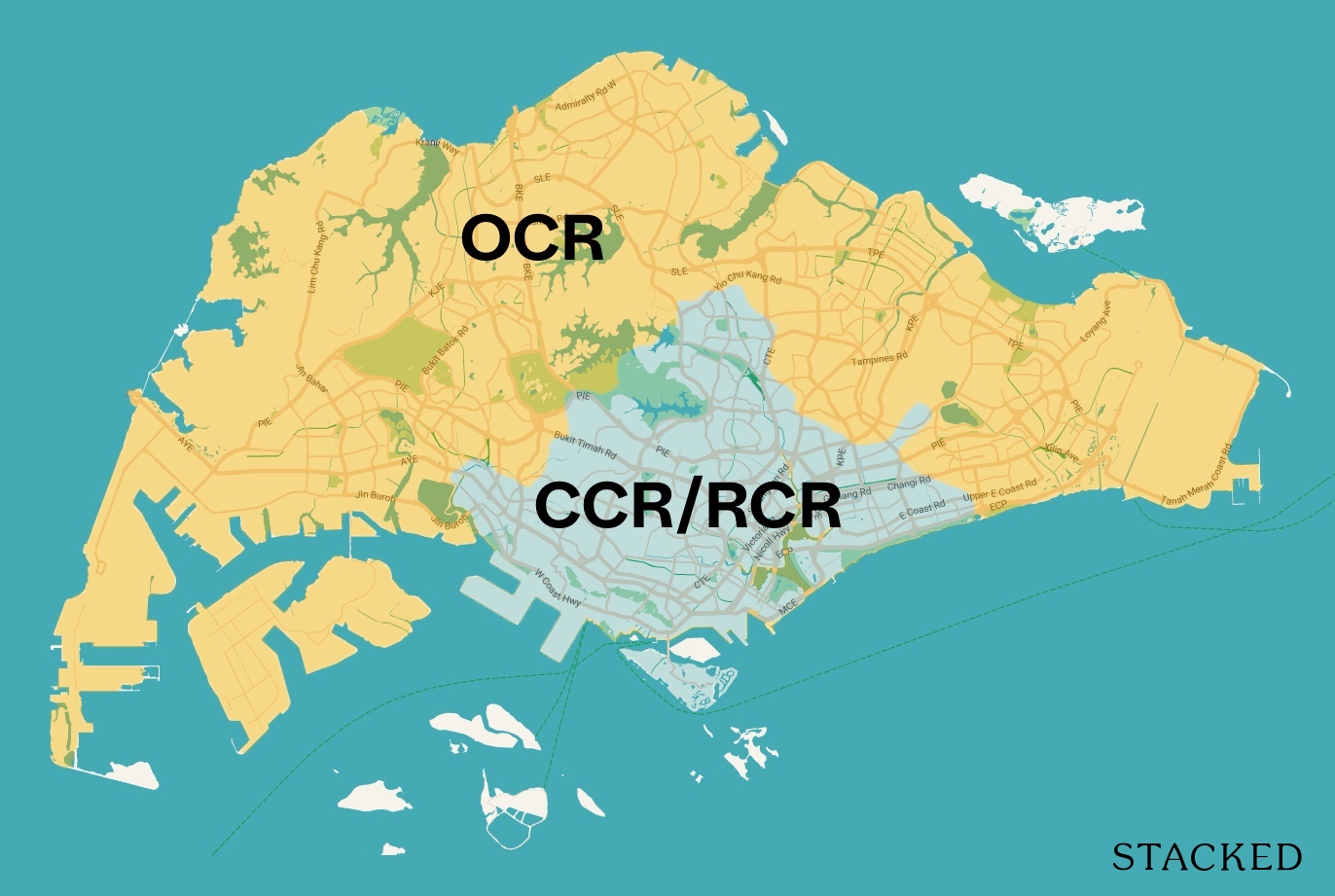

So the change in the classification system reflected changes on the ground; and as we enter 2025, I feel the same thing might be happening to another old concept: regions. By this, I mean the Core Central Region (CCR), Rest of Central Region (RCR), and Outside of Central Region (OCR).

Now I’m not so bold as to assert these mean nothing – for now, they definitely carry weight. But there are some creeping changes that hint that, at some point in the future, the notion of OCR, RCR, and CCR may be as obsolete as “mature versus non-mature.”

Observable behaviour is a good place to start. I know this is anecdotal, but it’s hard to ignore: ask around and see how many Singaporeans still “go to town” (by which I mean an area like Orchard) for their weekend retail therapy, or just to hang out. I suspect that, more often these days, you hear names like Tampines Mall, Waterway Point, NEX, etc., rather than ION Orchard or Ngee Ann City.

I’ve met Singaporeans who haven’t “gone to town” for so long, their eyes glaze over when I mention Orchard Central or Wheelock; and they need to think really hard to remember what would make them travel all the way there.

These days, most people have everything they need within a short bus ride or walk from their front door. Whether it’s groceries, restaurants, clinics, or entertainment, chances are it’s a few blocks from you, or about two to three stops by bus. Maybe back in the ‘90s or before, the nearby amenities were just minimarts and hair salons. But today? I’m willing to bet a huge number of you reading this, right now, could get to a Din Tai Fung, Starbucks, Lululemon, Uniqlo, etc., in 15 minutes or under.

And this is not even the end-point of our decentralisation: it’s still a work in progress, so it will be more pronounced in future. When you consider all the separate hubs and nodes, is the OCR really “fringe” anymore?

Then there’s the way prices have changed

Earlier this year, the median PSF for OCR condos clocked in at $2,554 psf. This was a mere sliver away from the RCR, which registered S$2,386 psf (you can find a little more detail on that here.) CCR condos, meanwhile, are at around $2,800 to $3,300 psf – this happens to be below the 2024 CCR average of $3,305 psf.

Meanwhile, in the OCR, we see condos like Springleaf Residence reach around $2,064 psf, while Canberra Crescent Residences went for around $1,974 psf. Now, of course, I’m aware that the actual total price (the quantum) is lower as the units are built to be affordable; but it doesn’t change the fact that these are numbers we’d never have associated with the “most affordable” region in the previous decade.

More to the point, we’re seeing CCR prices flattening, while RCR and especially OCR prices rise. Now, combine that with the reality on the ground: residents in most parts of the OCR no longer have significantly worse amenities compared to those in the RCR or CCR. In fact, some parts of the CCR are even arguably worse off, like Marina Bay with its lack of school access.

This shift is further supported by an ageing population.

Older residents are less inclined to travel far for errands, meals, or entertainment. I’m not even 50, and already I dread the thought of taking the train all the way to Bugis for late-night hot pot. And more to the point, why would I when there’s probably a Haidilao closer to me.

More from Stacked

The Allure Of Integrated Developments: Are They Worth The Price Premium?

Singaporeans love convenience. And nothing shows this better than the sales trend of new launch integrated developments, which have been…

*Note: I just Googled it and yes, there’s one two bus stops away. I’m in a very new neighbourhood, and I could still predict that even before I had to Google it.

And to their credit, URA’s push to decentralise anticipated this very trend. The convenience of having a clinic, supermarket, and food court nearby isn’t just a lifestyle perk – someone in charge knew it would be a necessity for an ageing society.

It’s just a happy coincidence that it would also make access to amenities more equal; and in that process, gradually erode the price difference by region.

So where do we go from here? I think we’ll have a new way to define things – but in future, we’ll probably be assessing and pricing convenience by how far things are from their given neighbourhood hub; and less so by which general district or region they’re in.

It’s worth thinking about, if you end up weighing your choices between an RCR or CCR condo, or an OCR and RCR condo. That technical distinction may matter less a long time from now, at the point of resale – so maybe focus on ground-level things like which one is a shorter walk to the nearest mall.

Meanwhile, in other property news…

- The October 2025 BTO launch review is one of the biggest to date, with 9,144 flats and 10 projects. Here’s the lowdown on each one to consider.

- If resale flats are your preference instead, check out these huge (1,700+ sq ft) units on our list.

- W Residences Marina View is a unique project, with a hospitality component run by the famed W hotel brand. Check out this upcoming new launch.

- Zyon Grand comes hot on the heels of Promenade Peak: join our Stacked Pro readers in determining whether the price point is fair.

Weekly Sales Roundup (06 – 12 October)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| 21 ANDERSON | $22,700,000 | 4489 | $5,057 | FH |

| SKYWATERS RESIDENCES | $11,687,000 | 1798 | $6,501 | 99 years |

| UPPERHOUSE AT ORCHARD BOULEVARD | $7,209,000 | 2056 | $3,506 | 99 yrs (2024) |

| THE AVENIR | $7,155,000 | 2056 | $3,480 | FH |

| SKYE AT HOLLAND | $5,840,000 | 1765 | $3,308 | 99 years |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SPRINGLEAF RESIDENCE | $1,202,000 | 527 | $2,279 | 99 yrs (2024) |

| HILL HOUSE | $1,298,000 | 431 | $3,015 | 999 yrs (1841) |

| RIVER GREEN | $1,474,000 | 452 | $3,260 | 99 yrs (2024) |

| UPPERHOUSE AT ORCHARD BOULEVARD | $1,509,000 | 474 | $3,186 | 99 yrs (2024) |

| SKYE AT HOLLAND | $1,510,000 | 581 | $2,598 | 99 years |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| NASSIM LODGE | $14,500,000 | 4176 | $3,472 | FH |

| CLIVEDEN AT GRANGE | $9,000,000 | 2842 | $3,167 | FH |

| REGENCY PARK | $8,450,000 | 3649 | $2,316 | FH |

| SOUTH BEACH RESIDENCES | $7,500,000 | 2121 | $3,537 | 99 yrs (2007) |

| EDEN RESIDENCES CAPITOL | $7,441,000 | 2304 | $3,230 | 99 yrs (2011) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SUITES @ SIMS | $653,000 | 344 | $1,896 | FH |

| THE INFLORA | $680,000 | 484 | $1,404 | 99 yrs (2012) |

| PARC ELEGANCE | $686,000 | 398 | $1,722 | FH |

| CARDIFF RESIDENCE | $725,000 | 431 | $1,684 | 99 yrs (2011) |

| THE ALPS RESIDENCES | $728,000 | 506 | $1,439 | 99 yrs (2015) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| DAKOTA RESIDENCES | $4,150,000 | 1894 | $2,191 | $2,146,600 | 17 Years |

| SOUTHBANK | $2,700,000 | 1313 | $2,056 | $1,919,920 | 19 Years |

| AALTO | $5,150,000 | 1959 | $2,629 | $1,819,700 | 15 Years |

| THE SPRINGBLOOM | $2,800,000 | 1647 | $1,700 | $1,740,000 | 18 Years |

| REGENCY PARK | $8,450,000 | 3649 | $2,316 | $1,650,000 | 3 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| CLIVEDEN AT GRANGE | $9,000,000 | 2842 | $3,167 | -$1,380,000 | 18 Years |

| THE SCOTTS TOWER | $1,200,000 | 657 | $1,828 | -$1,317,000 | 13 Years |

| THE BERTH BY THE COVE | $2,015,000 | 1453 | $1,387 | -$789,290 | 15 Years |

| HALLMARK RESIDENCES | $4,860,000 | 2960 | $1,642 | -$450,000 | 11 Years |

| THE COAST AT SENTOSA COVE | $3,068,000 | 2024 | $1,516 | -$369,280 | 19 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| SOUTHBANK | $2,700,000 | 1313 | $2,056 | 246% | 19 Years |

| BALESTIER POINT | $1,900,000 | 1636 | $1,161 | 245% | 21 Years |

| THE TROPICA | $2,200,000 | 1507 | $1,460 | 198% | 27 Years |

| ICON | $1,180,000 | 700 | $1,687 | 170% | 22 Years |

| THE TROPICA | $1,620,000 | 1238 | $1,309 | 170% | 18 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| THE SCOTTS TOWER | $1,200,000 | 657 | $1,828 | -52% | 13 Years |

| THE BERTH BY THE COVE | $2,015,000 | 1453 | $1,387 | -28% | 15 Years |

| CLIVEDEN AT GRANGE | $9,000,000 | 2842 | $3,167 | -13% | 18 Years |

| THE COAST AT SENTOSA COVE | $3,068,000 | 2024 | $1,516 | -11% | 19 Years |

| THE SAIL @ MARINA BAY | $1,068,000 | 657 | $1,627 | -10% | 15 Years |

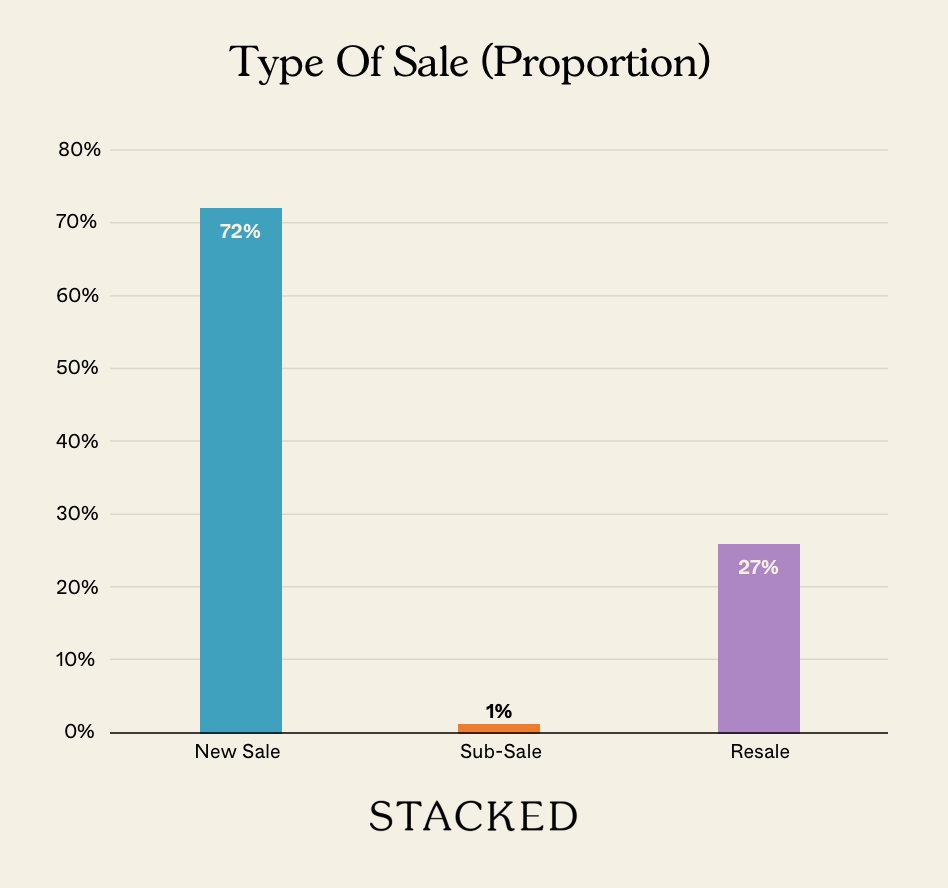

Transaction Breakdown

Follow us on Stacked for news and updates on the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Has the idea of prime districts in Singapore changed recently?

Are property prices in the outside of central region (OCR) getting more expensive?

Is the concept of fringe or outskirts areas still valid for property buyers?

How are property prices in central regions compared to other regions in Singapore?

What factors are influencing the changing perception of prime property areas in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments