These Singapore Condos Had Good Locations But Modest Gains — Here’s Why They Still Underperformed the Market

November 18, 2025

While losing money is a rarity in the Singapore property market, that doesn’t mean every property investment is a sure-win. Underperformance is an issue as well; and for investors, it can be painful to realise the rest of the district has property gains surging ahead of yours. In this list, we took a look at the condos with the weakest performance over the past decade, and we’ll also go further into investigating the causes for each one:

And as this list shows, even in a strong market, some projects simply don’t keep pace, a reality many readers only realise after buying. If you want help assessing whether a unit you’re eyeing is more likely to outperform or underperform over time, tell us your criteria and we’ll connect you with one of our trusted partner agents who can break down the indicators to watch for. You can contact us here.

Caveat: For this piece, we will focus on units that were purchased from 2014 onwards and subsequently sold in 2025.

Do note that this analysis was completed at the end of Q3 2025, and some transactions from October and November are not yet reflected in the data.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

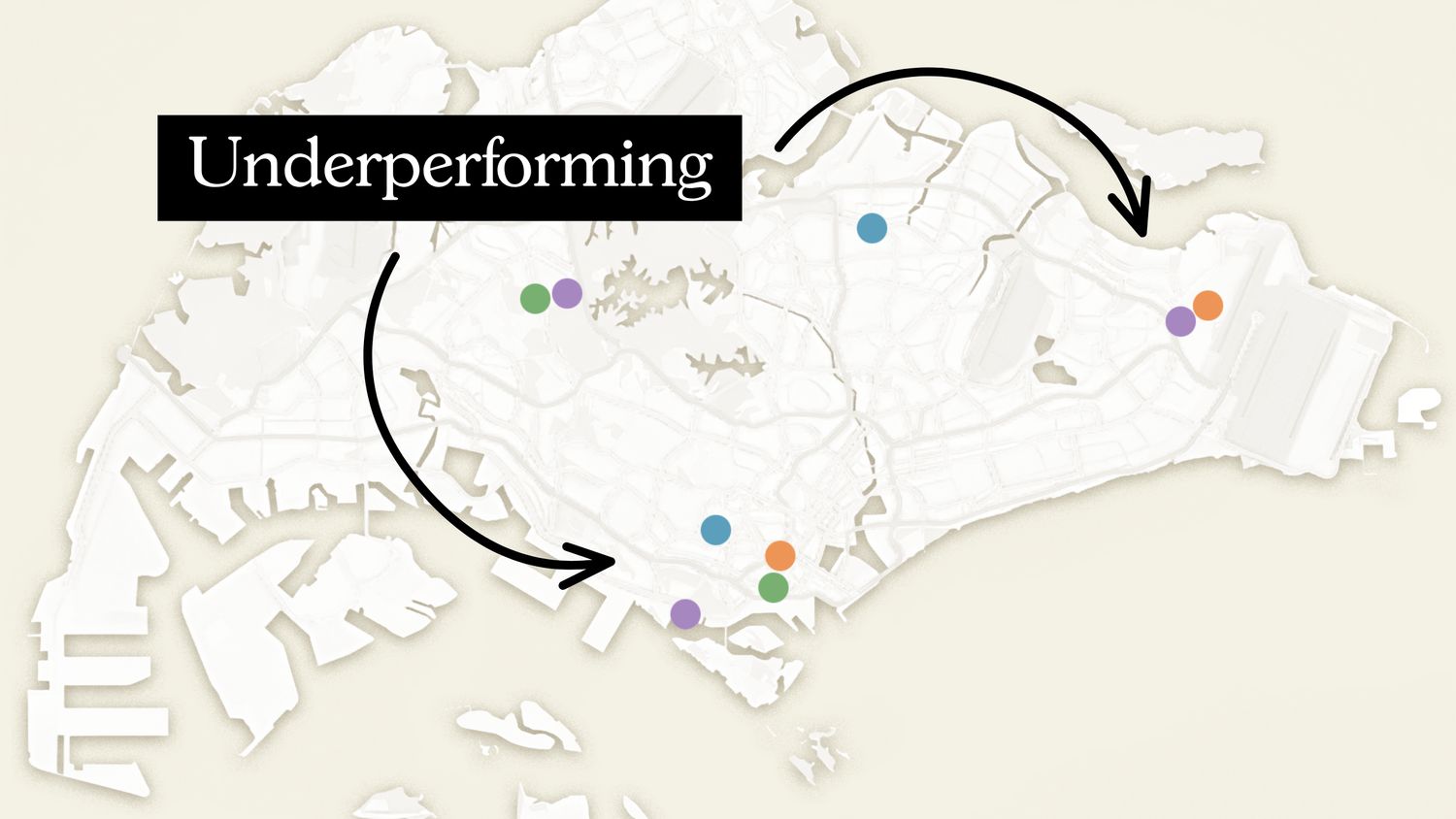

Underperforming projects in the OCR

To identify the weakest performers, we focused on the bottom 10 projects in the region. Next, we filtered out the projects that only saw one or two sales this year, which would skew the data. We included only projects with at least five recorded transactions in 2025.

| Project | Average gains | No. of units sold |

| SEAHILL | 10.59% | 7 |

| DAIRY FARM RESIDENCES | 11.83% | 23 |

| PARC KOMO | 11.85% | 13 |

| URBAN VISTA | 12.46% | 10 |

| KINGSFORD HILLVIEW PEAK | 12.97% | 13 |

| SELETAR PARK RESIDENCE | 13.33% | 8 |

| NINE RESIDENCES | 13.51% | 7 |

| THE HILLIER | 13.77% | 6 |

| THE JOVELL | 14.49% | 18 |

| E MAISON | 15.23% | 6 |

These developments all posted average gains of roughly 10 to 15 per cent, placing them well below the OCR average of 37 per cent.

That said, when we looked more closely at the individual transactions, every single one was still profitable; they’re not losing money, they’re just not appreciating as fast as many projects in the same region.

Now let’s look at the RCR

As before, we’ll look at the bottom 10 and filter out the ones with fewer than five transactions this year.

| Project | Average gains | No. of units sold |

| CORALS AT KEPPEL BAY | -3.21% | 5 |

| THE CREST | 2.28% | 17 |

| CANNINGHILL PIERS* | 6.88% | 6 |

| MAYFAIR MODERN | 7.03% | 8 |

| UPTOWN @ FARRER | 7.31% | 5 |

| REFLECTIONS AT KEPPEL BAY | 7.58% | 29 |

| ONE PEARL BANK | 7.60% | 23 |

| RIVIERE | 8.09% | 9 |

| SKY EVERTON | 8.98% | 11 |

| THE VERANDAH RESIDENCES | 9.33% | 6 |

*We note that CanningHill Piers (below) saw a substantial number of repeated units sold in 2025; however, these were classified as new-sale transactions and were therefore excluded from our calculations.

Based on all transactions completed in 2025, the average gains in the RCR are about 28 per cent. This is quite far ahead of the projects above, which saw relatively modest gains – mostly in the low to mid single-digit range.

Only one project, Corals at Keppel Bay, actually posted a negative return.

Let’s take a closer look at the transactions for these projects:

| Project | No. of profitable tnx | No. of unprofitable tnx | No. of tnx that brokeven | Percentage of unprofitable transactions |

| CORALS AT KEPPEL BAY | 3 | 2 | 40% | |

| THE CREST | 8 | 8 | 1 | 47% |

| CANNINGHILL PIERS | 5 | 1 | 17% | |

| MAYFAIR MODERN | 8 | |||

| UPTOWN @ FARRER | 5 | |||

| REFLECTIONS AT KEPPEL BAY | 19 | 10 | 34% | |

| ONE PEARL BANK | 19 | 3 | 1 | 13% |

| RIVIERE | 8 | 1 | 11% | |

| SKY EVERTON | 11 | |||

| THE VERANDAH RESIDENCES | 6 |

The Crest seems to have had the most struggles, with eight profitable sales, eight unprofitable sales, and one breakeven case – that’s an unprofitable rate of 47 per cent, the highest on this list.

More from Stacked

How I Lost $5,400 In A Rental Scam In Singapore: Here’s My Story And How These Scammers Work

The property rental market is booming in 2022, and tenants are fighting tooth and nail for affordable accommodation. This sort…

CanningHill Piers may also come as a surprise, as it was a notable headliner. This was the former Liang Court, and it was probably the most prominent integrated project of its launch cohort. It recorded one loss out of six transactions, or about 17 per cent.

Reflections at Keppel Bay also had a notable number of negative outcomes, with 10 unprofitable sales out of 29, translating to roughly 34 per cent. However, Reflections has an established reputation for volatility, seeing record high profits as well as losses. We have an extensive rundown of the issues at Reflections here.

One Pearl Bank and Rivière, whilst not stellar, also do comparatively well against these higher-end condos; their unprofitable transactions accounted for just 13 per cent and 11 per cent respectively.

Several projects did not record any losses at all. Mayfair Modern, Uptown at Farrer, Sky Everton, and The Verandah Residences may have underperformed their region, but all had fully profitable sales in 2025.

Some observable trends from the performers

From the above, we can see that – even among underperformers in the bottom 10 – losses are relatively rare. Most transactions were profitable, and some of the bottom performers, like Mayfair Modern and Sky Everton, still have perfect track records with no losses.

From word on the ground, however, agents noted that this may be a matter of timing. Two factors softened the blow for underperformers, in our 2014 to 2025 timeline:

First, 2013 was the height of the last property boom, which invited a slew of cooling measures. This pulled down prices, and the market bottomed out in around 2016/17, before rising again – so buyers who purchased during this time may have secured their units at a low point and benefited from the subsequent recovery.

Second, the immediate aftermath of COVID, in particular 2022 and 2023, saw sharp rises in private home prices due to a supply crunch. Those holding on to properties during this period – even the underperformers – are likely to have seen good appreciation. As such, timing may have helped to prop up these underperforming projects.

One reason we see so many high-end projects here is that a high initial price leaves less room for gains

An increase in the absolute price (quantum) can translate to a lower percentage return, just because of the bigger initial price tag. This is why some of the centrally located or premium developments on the list look weaker on paper, even if their owners walked away with decent absolute profits.

That said, we can also see that some projects were simply priced so high, it was much tougher for them to see significant profits. A good example of this effect is Sky Everton. At launch in 2019, Sky Everton entered the market at roughly $2.55 million for a two-bedder; enough to make many buyers baulk. Now this did still appreciate to around $2.82 million by 2025. But because the starting point was already high, the percentage gains came to a very low 1.68 per cent. You can see the full details on Sky Everton’s performance here on Stacked Pro.

Finally, the experiences of individual investors in these condos can vary, also based on timing. For example, buyers who bought earlier in the sales phases (at lower prices) may experience better returns than those who bought at resale later; so some first-hand experiences may not match the data.

Given the variables, it’s important to take a closer look at the specific projects involved. We’ll be doing this over the coming weeks on Stacked Pro, looking at projects ranging from the aforementioned Sky Everton to headliners like One Pearl Bank; so do follow us for more detailed updates.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Market Commentary Singapore’s Tallest HDB Yet: A 60-Storey Project Is Coming To Pearl’s Hill

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Latest Posts

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

0 Comments